TIDMWINK

RNS Number : 5619Q

M Winkworth Plc

13 September 2017

M Winkworth Plc

Interim Results for the Six Months ended 30 June 2017

M Winkworth Plc ("Winkworth" or the "Company") is pleased to

announce its

Interim Results for the six months ended 30 June 2017

Highlights for the period

-- Revenues down 7.6% to GBP2.54m (2016: GBP2.75m)

-- Profit before taxation down 25.2% to GBP0.54m (2016: GBP0.72m)

-- Cash generated from operations GBP0.77m (2016: GBP0.44m)

-- Cash balance as at 30 June 2017 GBP3.00m (2016: GBP2.84m)

-- Rental income increased to 45% of total revenues

-- Seven new franchisees signed

-- Dividends of 3.6p declared and paid during the period (2016: 3.5p)

Dominic Agace, Chief Executive Officer of the Company,

commented:

"With these results we are pleased to have demonstrated our

ability to adapt to challenging market conditions and maintain our

dividend payment. Although the market is likely to remain unsettled

for the remainder of the year, we expect to see franchises that

have converted to the Winkworth brand growing their market share by

plugging into our evolving platform and new franchises approaching

us to benefit from the greater rewards of equity ownership."

For further information please contact:

M Winkworth Plc Tel : 020 7355 0206

Dominic Agace (Chief Executive Officer)

Andrew Nicol (Chief Financial Officer)

Milbourne (Public Relations) Tel : 07903 802545

Tim Draper

Stockdale Securities Ltd (NOMAD and Broker) Tel : 020 7601 6100

Robert Finlay

Ed Thomas

Henry Willcocks

Chairman's Statement

We are pleased to report some success in maintaining

profitability and growing our franchises during the period under

review. Notable achievements were an increase in rental turnover

and the signing of seven new offices, which gives us a total number

of offices at the end of the reporting period of 96.

Our robust estate agency platform is attracting an increasing

number of new franchisees as well as owner upgrades in some of our

older, established franchises such as Fulham. Our patience in

waiting for a downturn before significantly expanding our number of

offices is being rewarded, and this expansion has been achieved

without diluting cash resources in the first half of the year - my

congratulations to the management team.

We continue to focus on delivering the best services for our

franchisees to enable them to maintain top service levels to

vendors, buyers, landlords and tenants, and in order to maintain

the growth and goodwill attached to the Winkworth brand. The

successful roll-out of our centralised services, which now include

an evolving internet platform and back-up office services for our

franchises, is proving to be a powerful competitive advantage.

Work has continued on building our self-developed online client

portal and customer service system which, on completion, will fully

integrate sales, rentals and management allowing our clients and

offices to conduct more of their business through our website. Our

franchisees have diverse requirements, but we have been able to

include them into the development of the system. Furthermore, by

developing this system ourselves we have provided them with

additional security and savings. I would like to thank our internal

development team and franchisees for creating what we believe will

be the leading platform for independent agencies.

Even though an uncertain outlook for sales volumes continues to

weigh on the market, we are confident that our business model will

lead to a return to growth in this sector. Meanwhile, we are

delighted with the organic growth of our rentals business.

Although markets remain slow, based on the performance in the

first half of the current financial year, and recent trading, we

expect full year results to be in line with management's

expectations. Looking forward our net cash position and established

brand puts us in a strong position to take on whatever

opportunities arise.

Simon Agace

Non-Executive Chairman

13 September 2017

CEO's Statement

Comparisons between this half year's performance and H1 2016 are

complicated by the introduction of higher stamp duty for buy-to-let

and second property owners in April 2016, which led to a spike in

transactions, distorting sales performance from the underlying

market environment. As a result, 2016 was the first year in which

our second half was weaker than the first. We expect our seasonal

performance to revert to normal in 2017 after a 18% year-on-year

fall in the number of transactions in H1.

Excluding this comparison, the sales market has remained

unsettled, with political and economic uncertainty and

affordability issues post stamp duty changes weighing on

transactions. The exception in the first half was central London,

where price depreciation of some 15% over the last two years and

international buyers attracted by a cheaper pound led to renewed

interest, underpinning prices and increasing activity. Winkworth's

gross sales income in this sector rose by 7% year-on-year.

Prices have remained steady in the more domestically-focused

outer London markets, underpinned by low interest rates and high

employment, but affordability issues continue.

Despite price reductions in central London, which accounts for

approximately 25% of our total London sales, our average fees

charged for a property sale were flat as a result of our average

property price continuing to grow on the strength of the Winkworth

brand. The average price of a Winkworth property sold increased by

2%, rising to GBP750,000 in London and GBP594,000 across the

UK.

With the sales market subdued, our investment in the lettings

and management side of the business has continued to pay dividends.

Despite an increase in supply post the buy-to-let mini boom

weighing on rental prices, lettings and management revenue grew by

4% and increased from 40% in H1 2016 to 45% of total gross revenue

for the franchised office network. Of particular note was the

strengthening of our property management business. This now

accounts for 37% of our letting revenue compared to 34% this time

last year, as increased training and our investment in improved

procedures are bolstered by a heightened focus by franchisees on

the value of this revenue stream. We see sustained growth in our

lettings and management business as rental prices level out

following the increase in supply.

In H1 2017, gross revenues of the franchised office network fell

by 9% to GBP21.4m (GBP23.6m), with sales falling 18% to GBP11.7m

(GBP14.3m), lettings down 2% to GBP6.0m (GBP6.1m) and property

management up 15% to GBP3.7m (GBP3.2m).

Whilst Winkworth's revenues fell by 8% to GBP2.54m (GBP2.75m),

and profit before taxation was 25% lower at GBP540k (GBP722k). Cash

generated from operations increased by 74% to GBP766k (GBP439k),

and the cash balance as at 30 June 2017 was GBP3.00m (2016:

GBP2.84m). The Company remains debt-free.

Dividends of 3.6p were declared for the period (3.6p) and

continue to be paid quarterly.

Against a background of a low transactional market we continue

to attract high quality new franchise applicants and convert

existing quality businesses to the Winkworth brand in markets that

are complementary to our existing network. Start-up franchisees are

typically successful managers whose earnings are depressed by

current market conditions and who are looking to own equity in

their own business, with the opportunity to secure their income

longer term and no longer be hamstrung by the corporate

requirements of larger well-known brands dragging down their

earnings potential.

Existing businesses may be lettings agencies looking to develop

into sales to offset the proposed loss of tenancy administration

fees, or estate agencies in prime locations looking to compete for

higher value properties and thus raise their profitability. In each

case, new franchisees are able to add value through an enhanced

level of service and, ultimately, the prices that their personal

skill set and the Winkworth platform can help their clients

achieve.

We have signed seven offices this year in Kingsbury, Milford On

Sea, Cheltenham, Surbiton, Sunningdale, Dartmouth and Brixham,

three of which were operational under the Winkworth brand in the

first half. This compares to two new offices this time last year.

With ongoing interest from exciting applicants, we expect this

trend to continue and already have a number of new franchised

offices lined up for launch in January 2018.

In order to attract candidates we have continued to invest in

the platform. We launched a recruitment department in June 2017 to

help franchisees find quality employees to enhance both their

businesses and the overall Winkworth profile.

Our digital plan is now well underway, with a new website having

been successfully launched in February and work in progress to

develop improved functionality for sales and lettings clients. This

will improve both the transparency of the Winkworth service and the

capability to link into it, as well as providing added support to

our franchisees as they use their skills and personal interaction

to add value to their clients' property transactions and management

requirements.

Outlook

We expect prices to be supported whilst interest rates remain

low and employment high, but for the number of transactions to

remain subdued on the back of an unpredictable economic outlook.

The exception to this is central London, where we anticipate that

transactions will continue to improve on the back of better

sentiment and that prices have bottomed out.

In the rental market we expect prices to stabilise, after having

fallen in H2 2016 and H1 2017, and activity to continue to grow as

the post stamp duty glut is absorbed.

Based on the performance in the first half of the current

financial year, and recent trading, we expect that full year

results should be in line with management's expectations.

With current market conditions set to continue for the remainder

of the year we expect to see franchises that have converted to the

Winkworth brand growing their market share by plugging into our

evolving platform, and new franchises approaching us to benefit

from the greater rewards of equity ownership. This combined with

the Company's strong financial position provides us with an ongoing

positive outlook for growth of the network.

Dominic Agace

Chief Executive Officer

13 September 2017

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

for the period 1 January 2017 to 30 June 2017

(Unaudited) (Unaudited)

Period Period

1.1.17 1.1.16 (Audited)

Year

To To ended

30.6.17 30.6.16 31.12.16

GBP000's GBP000's GBP000's

CONTINUING OPERATIONS

Revenue 2,544 2,746 5,566

Cost of sales (661) (667) (1,477)

------------ ------------ ----------

GROSS PROFIT 1,883 2,079 4,089

Administrative expenses (1,376) (1,391) (2,743)

------------ ------------ ----------

OPERATING PROFIT 507 688 1,346

Finance costs - - -

Finance income 33 34 71

------------ ------------ ----------

PROFIT BEFORE TAXATION 540 722 1,417

Taxation (99) (148) (291)

------------ ------------ ----------

PROFIT FOR THE PERIOD 441 574 1,126

OTHER COMPREHENSIVE INCOME - - -

------------ ------------ ----------

TOTAL COMPREHENSIVE INCOME

FOR THE PERIOD 441 574 1,126

============ ============ ==========

Earnings per share expressed

in pence per share: 3

Basic 3.46 4.52 8.84

Diluted 3.29 4.51 8.84

============ ============ ==========

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 June 2017

(Unaudited) (Unaudited) (Audited)

30.06.2017 30.06.2016 31.12.2016

Notes GBP000's GBP000's GBP000's

ASSETS

NON-CURRENT ASSETS

Intangible assets 4 734 897 777

Property, plant and equipment 99 140 115

Investments 7 7 7

Trade and other receivables 619 735 716

Deferred tax - - -

------------ ------------ -----------

1,459 1,779 1,615

------------ ------------ -----------

CURRENT ASSETS

Trade and other receivables 1,820 2,002 1,348

Tax receivable 212 - 69

Cash and cash equivalents 3,005 2,838 2,972

------------ ------------ -----------

5,037 4,840 4,389

TOTAL ASSETS 6,496 6,619 6,004

============ ============ ===========

EQUITY

SHAREHOLDERS' EQUITY

Share capital 64 64 64

Share premium 1,793 1,793 1,793

Share option reserve 51 51 51

Retained earnings 3,539 3,462 3,556

------------ ------------ -----------

TOTAL EQUITY 5,447 5,370 5,464

------------ ------------ -----------

LIABILITIES

NON-CURRENT LIABILITIES

Deferred tax 7 21 16

------------ ------------ -----------

CURRENT LIABILITIES

Trade and other payables 1,042 1,193 524

Tax payable - 35 -

------------ ------------ -----------

1,042 1,228 524

------------ ------------ -----------

TOTAL LIABILITIES 1,049 1,249 540

------------ ------------ -----------

TOTAL EQUITY AND LIABILITIES 6,496 6,619 6,004

============ ============ ===========

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the period 1 January 2016 to 30 June 2017

Share Retained Share Share Shareholders'

option

capital earnings reserve premium equity

GBP000's GBP000's GBP000's GBP000's GBP000's

Balance at 1

January 2016 64 3,334 51 1,793 5,242

Total comprehensive

income - 574 - - 574

Share-based payment - - - - -

Dividends paid - (446) - - (446)

--------- --------- --------- --------- --------------

Balance at 30

June 2016 64 3,462 51 1,793 5,370

--------- --------- --------- --------- --------------

Total comprehensive

income - 552 - - 552

Issue of share - - - - -

capital

Share-based payment - - - - -

Dividends paid - (458) - - (458)

--------- --------- --------- --------- --------------

Balance at 31

December 2016 64 3,556 51 1,793 5,464

--------- --------- --------- --------- --------------

Total comprehensive

income - 441 - - 441

Dividends paid - (458) - - (458)

--------- --------- --------- --------- --------------

Balance at 30

June 2017 64 3,539 51 1,793 5,447

========= ========= ========= ========= ==============

M WINKWORTH PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

for the period 1 January 2017 to 30 June 2017

(Unaudited) (Unaudited)

Period Period

1.1.17 1.1.16 (Audited)

To To Year ended

30.6.17 30.6.16 31.12.16

Notes GBP000's GBP000's GBP000's

Cash flows from operating

activities

Cash generated from

operations i 765 439 1,569

Interest paid - - -

Tax paid (250) (201) (453)

------------ ------------ -----------

Net cash from operating

activities 515 238 1,116

------------ ------------ -----------

Cash flows from investing

activities

Purchase of intangible

fixed assets (54) (32) (122)

Purchase of tangible

fixed assets (3) (124) (128)

Sale of property, plant

& equipment - - -

Interest received 33 34 71

------------ ------------ -----------

Net cash used in investing

activities (24) (122) (179)

------------ ------------ -----------

Cash flows from financing

activities

Share issue - - -

Equity dividends paid (458) (446) (1,133)

------------ ------------ -----------

Net cash used in financing

activities (458) (446) (1,133)

------------ ------------ -----------

Increase/(decrease)

in cash and cash equivalents 33 (330) (196)

Cash and cash equivalents

at beginning of period 2,972 3,168 3,168

------------ ------------ -----------

Cash and cash equivalents

at end of period ii 3,005 2,838 2,972

============ ============ ===========

M WINKWORTH PLC

NOTES TO THE CONSOLIDATED STATEMENT OF CASH FLOWS

for the period 1 January 2017 to 30 June 2017

i. RECONCILIATION OF PROFIT BEFORE TAXATION TO CASH

GENERATED FROM OPERATIONS

(Unaudited) (Unaudited)

Period Period

1.1.17 1.1.16 (Audited)

Year

To To ended

30.6.17 30.6.16 31.12.16

GBP000's GBP000's GBP000's

Profit before taxation 540 722 1,417

Depreciation and amortisation 117 130 368

Share-based payments - - -

Finance costs - - -

Finance income (33) (34) (71)

------------ ------------ ----------

624 818 1,714

(Increase) in trade and other

receivables (377) (770) (97)

Increase/(decrease) in trade

and other payables 518 391 (48)

------------ ------------ ----------

Cash generated from operations 765 439 1,569

============ ============ ==========

ii. CASH AND CASH EQUIVALENTS

The amounts disclosed in the cash flow statement in respect of

cash and cash equivalents are in respect of these balance sheet

amounts:

30.6.17 30.6.16 31.12.16

GBP000's GBP000's GBP000's

Cash and cash equivalents 3,005 2,838 2,972

========= ========= =========

M WINKWORTH PLC

NOTES TO THE CONSOLIDATED INTERIM RESULTS

for the period 1 January 2017 to 30 June 2017

1. ACCOUNTING POLICIES

Basis of preparation

The interim report for the six months ended 30 June 2017 and the

comparative information for the periods ended 30 June 2016 and 31

December 2016 do not constitute statutory accounts as defined in

section 434 of the Companies Act 2006. A copy of the most recent

statutory accounts for the year ended 31 December 2016 has been

delivered to the Registrar of Companies. The auditor's report on

these accounts was unqualified and did not contain a statement

under section 498 of the Companies Act 2006.

The financial information for the six months ended 30 June 2017

and 30 June 2016 is unaudited. The financial information for the

year ended 31 December 2016 is derived from the group's audited

annual report and accounts.

The annual financial statements are prepared in accordance with

International Financial Reporting Standards (IFRS) as adopted by

the European Union. The condensed set of financial statements

included in this interim financial report has been prepared in

accordance with International Accounting Standard 34 'Interim

Financial Reporting'.

The accounting policies and methods of computation used in this

financial information is consistent with those applied in the

group's latest annual audited financial statements, except as noted

below. The directors do not anticipate that any new standards,

applicable to the year ending 31 December 2017, will have an impact

on the results of the group.

Taxation

Income tax expense has been recognised based on the best

estimate of the weighted average annual effective income tax rate

expected for the full financial year.

Deferred tax is recognised in respect of all material temporary

differences that have originated but not reversed at the balance

sheet date.

2. SEGMENTAL REPORTING

The directors believe that the group has only one segment, that

of a franchising business. Currently, these operations principally

occur in the UK, with only limited business in other territories.

Accordingly no segmental analysis is considered necessary.

M WINKWORTH PLC

NOTES TO THE CONSOLIDATED INTERIM RESULTS

for the period 1 January 2017 to 30 June 2017

3. EARNINGS PER SHARE

Basic and diluted earnings per share is calculated by dividing

the earnings attributable to ordinary shareholders by the weighted

average number of ordinary shares in issue during the period.

Weighted

average Per-share

Earnings number amount

GBP000's of shares pence

Period ended 30.06.17

Basic EPS

Earnings/number of shares 441 12,733 3.46

Effect of dilutive securities - 659 -

--------- ---------- ----------

Diluted EPS

Adjusted earnings/number

of shares 441 13,392 3.29

--------- ---------- ----------

Period ended 30.06.16

Basic EPS

Earnings/number of shares 574 12,682 4.52

Effect of dilutive securities - 41 -

--------- ---------- ----------

Diluted EPS

Adjusted earnings/number

of shares 574 12,723 4.51

Year ended 31.12.16

Basic EPS

Earnings/number of shares 1,126 12,733 8.84

Effect of dilutive securities - - -

--------- ---------- ----------

Diluted EPS

Adjusted earnings/number

of shares 1,126 12,733 8.84

--------- ---------- ----------

M WINKWORTH PLC

NOTES TO THE CONSOLIDATED INTERIM RESULTS

for the period 1 January 2017 to 30 June 2017

4. INTANGIBLE ASSETS

GBP000's

Net book value at 1 January 2016 976

Additions 32

Amortisation (111)

---------

Net book value at 30 June 2016 897

---------

Additions 90

Disposals (164)

Amortisation (46)

---------

Net book value at 31 December 2016 777

---------

Additions 54

Amortisation (97)

---------

Net book value at 30 June 2017 734

=========

5. INTERIM RESULTS

Copies of this notice are available to the public from the

registered office at 1 Lumley Street, London, W1K 6TT, and on the

Company's website at www.winkworthplc.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UUONRBSAKAAR

(END) Dow Jones Newswires

September 13, 2017 02:00 ET (06:00 GMT)

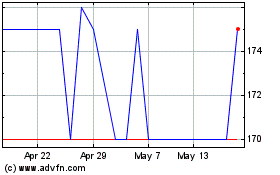

M Winkworth (LSE:WINK)

Historical Stock Chart

From Oct 2024 to Nov 2024

M Winkworth (LSE:WINK)

Historical Stock Chart

From Nov 2023 to Nov 2024