RNS Number:4164J

VASTox plc

26 September 2006

VASTox plc

("VASTox" or "the Company")

INTERIM RESULTS FOR THE SIX MONTHS ENDED 31 JULY 2006

Oxford, UK, 26 September 2006 - VASTox plc (AIM: VOX), a leading UK

biotechnology company, announces its interim results for the six months ended 31

July 2006.

Financial Highlights

* Turnover increased 133% to #468,591 (H1 2005/06: #201,156) as a result

of 15 new chemical genomics service contracts

* R&D expenditure increased in-line with expectations to #1.28 million

(H1 2005/06: #0.16 million) primarily to accelerate development of the

lead neuromuscular drug discovery programme in Duchenne muscular

dystrophy (DMD), and to fund two new programmes initiated during the

period

* In-line with expectations, pre-tax losses up to #1.31 million (H1 2005

/06: #0.13 million) with the increased investment in proprietary drug

discovery programmes

* Strengthened cash position following successful placing in February

2006 which raised #10.45 million (gross) - cash and short-term

investments up to #20.2 million at period end (H1 2005/06:

#12.9 million)

Operational Highlights

* Orphan drug designation awarded by European Medicines Agency (EMEA)

for the Company's initial compound for the treatment of DMD following

positive preclinical studies

* Fifth and sixth drug discovery programmes initiated in cancer and stem

cell therapy, respectively, the latter will be funded with a UK

Department of Trade & Industry grant

* Board of Directors and Senior Management strengthened:

o Richard Storer, DPhil appointed Chief Scientific Officer

o Darren Millington, ACMA appointed Chief Financial Officer

o James Taylor appointed Chief Commercial Officer

Today VASTox announces two further Board changes (see separate press release):

o Barry Price, PhD appointed as Non-executive Chairman to replace

Professor Stephen Davies who steps down to Non-executive Director

o Colin Wall appointed Non-executive Director to replace John

Montgomery who has resigned as Non-executive Director

Steven Lee, PhD, CEO of VASTox said: "VASTox has made excellent progress in all

areas of its business to date in 2006. Our internal drug discovery programmes

are advancing rapidly, our services business has grown significantly, and we

have added senior R&D and commercial experience to the management team and

board. Overall, our operations are now well positioned to enable us to deliver

the key elements of our corporate strategy."

Analysts' R&D day

VASTox will be hosting an R&D day for analysts and investors at the Company's

main site in Milton Science Park, Oxfordshire on 6 October 2006. Please contact

Mark Swallow or Valerie Auffray at Citigate Dewe Rogerson on 020 7638 9571 for

further details.

-ends-

For more information please contact:

VASTox

Steven Lee, PhD, Chief Executive Officer Tel: +44 (0)1235 443910

Darren Millington, ACMA, Chief Financial Officer

Citigate Dewe Rogerson

David Dible / Mark Swallow / Valerie Auffray Tel: +44 (0)207 638 9571

About VASTox plc

VASTox is a chemical genomics technology company that discovers and develops

proprietary novel drugs and provides services to the pharmaceutical industry.

The company's most advanced drug development programme is focused on developing

a new treatment for Duchenne muscular dystrophy based on the up-regulation of

utrophin. A second drug development programme for spinal muscular atrophy is

also progressing rapidly. VASTox has four additional programmes focused on

osteoarthritis, cancer, tuberculosis and stem cell therapies, which are expected

to be out-licensed prior to entering the clinic.

The company's technology platform, which uses zebrafish and fruitflies, has the

potential to dramatically decrease the time and cost of drug discovery and

development. This is because using whole organisms allows it to carry out high

volume, high content screening, which delivers data that are highly predictive

of the efficacy and toxicity of potential drug compounds in humans. VASTox is

growing revenues based on marketing its unique technology platform and its

chemistry expertise. The company listed on the AIM market of the London Stock

Exchange in October 2004.

Further information about the company is available at www.vastox.com

This document contains "forward-looking statements" within the meaning of the

U.S. Private Securities Litigation Reform Act of 1995. Forward-looking

statements can be identified by words such as "anticipates", "intends", "plans",

"seeks", "believes", "estimates", "expects" and similar references to future

periods, or by the inclusion of forecasts or projections.

Forward-looking statements are based on the Company's current expectations and

assumptions regarding our business, the economy and other future conditions.

Because forward-looking statements relate to the future, by their nature, they

are subject to inherent uncertainties, risks and changes in circumstances that

are difficult to predict. The Company's actual results may differ materially

from those contemplated by the forward-looking statements. The Company cautions

you therefore that you should not rely on any of these forward-looking

statements as statements of historical fact or as guarantees or assurances of

future performance. Important factors that could cause actual results to differ

materially from those in the forward-looking statements include (factors

included in this presentation) and regional, national, global political,

economic, business, competitive, market and regulatory conditions.

Chief Executive's statement

Introduction

In the year to date we have continued to make excellent progress in all areas of

the business. Our own drug discovery programmes are advancing rapidly, our

services business has grown significantly, and we have added senior R&D and

commercial experience to the management team and board. Overall, our operations

are now well positioned to enable us to deliver the key elements of our

corporate strategy.

Our expenditure and R&D investment for the first six months of the year is in

line with our budget and the Company's cash position remains strong having been

bolstered significantly by the successful placing undertaken in February 2006,

which raised #10.45 million in gross proceeds. This money has been ring-fenced

specifically to accelerate our lead drug discovery programme: the development of

innovative and effective new products to treat Duchenne muscular dystrophy

(DMD).

Operational Highlights

Lead programme in Duchenne Muscular Dystrophy accelerated

Considerable progress has been made in our lead drug discovery programme during

2006. The exciting progress we made in preclinical studies enabled us to raise

more than #10 million in a secondary placing with new and existing investors to

accelerate the development of this programme. The preclinical studies, announced

in January 2006, resulted in the identification of a novel lead series of

compounds that up-regulate utrophin production to reverse the effects of the

defective dystrophin production mechanism that causes DMD. Preliminary

toxicology assessment of this lead series of compounds has also been conducted

using our proprietary zebrafish models.

Both this progress and the clear medical need for an effective treatment for DMD

have supported our application for orphan drug designation for clinical

candidates that emerge from the programme. Consequently, in June 2006, VASTox

was awarded orphan drug status by the European Medicines Agency (EMEA) for the

Company's initial compound.

This designation provides an important validation of VASTox's approach to the

treatment of DMD. From a commercial perspective, orphan status provides a

quicker and cheaper route to market as the drug's development is fast-tracked

through the EU's regulatory stages.

During the first half of 2006, VASTox also became a key commercial partner in a

five-year, EU-wide network of leading researchers, clinicians and charities

involved in the development of new treatments for neuromuscular dystrophies

(NMD). The TREAT-NMD network, as it is called, involves 21 organisations from 11

countries and is funded by a Euro10 million grant from the EU.

Two new drug discovery programmes initiated

VASTox's approach for identifying new drug discovery programmes aims to

capitalise on attractive academic research programmes where a clear rationale

for the treatment of a particular disease has already been developed. To date in

2006, we have initiated two new drug discovery programmes in the areas of cancer

and stem cell therapy based on this approach. The Company now has six drug

discovery programmes in both niche neuromuscular diseases, such as DMD and

spinal muscular atrophy, as well as more common diseases such as tuberculosis,

osteoarthritis and cancer.

The fifth programme initiated in April 2006 in cancer is focused on the Wnt

signalling pathway. This pathway is active during embryonic development and

inactive in adults. It appears to be re-activated in certain types of cancer and

leads to uncontrolled cell growth. VASTox has developed a whole organism

screening programme in fruitflies in order to model the Wnt pathway and

potentially identify compounds that can affect the pathway safely and

effectively for development into therapeutics.

The sixth drug discovery programme, announced in September 2006, is focused on

stem cell therapies and, initially, is part of a #910,000 collaborative

programme that will be jointly funded by VASTox, the UK Department of Trade &

Industry and the Medical Research Council. As part of the programme, entitled

Understanding Molecular Activation of Stem Cells ('UNMASC'), VASTox will screen

small molecules in zebrafish and fruitfly models to identify compounds that

affect stem cell behaviour. Promising compounds can then be developed for use in

a wide range of regenerative therapies for diseases. Any intellectual property

generated that relates to potential drugs will reside exclusively with VASTox.

VASTox continues to deliver on its commitments to progress all of its drug

programmes using its in-house drug discovery expertise. The Company has now put

in place an enlarged team of medicinal chemists and biologists who can use

VASTox's unique chemical genomics platform to produce good quality drug

candidates.

Services business continues to grow

During the first six months of this financial year VASTox has worked with 20

life sciences organisations, 15 of which are new. Each contract is profitable,

increases our expertise in chemical genomics and makes our service offerings

more valuable both for customers and our own drug programmes. We have

pro-actively managed the services division to ensure that we can increase the

size of customer contracts that we sign as well as to increase the gross margin

that we earn.

Furthermore, our services offering, particularly in carbohydrate chemistry was

enhanced during 2006 by the appointment of Professor George Fleet as specialist

consultant. Professor Fleet is at the University of Oxford and is widely

acknowledged as one of the world's foremost experts on carbohydrate chemistry

and has consulted for many of the leading pharmaceutical and biotechnology

companies.

New appointments strengthen development and commercial capabilities

VASTox has made positive steps forward during the first half of 2006 to bring in

experienced industry professionals to its senior management team and board in

order to maximise the potential of both its drug discovery and development, and

its commercial capabilities.

Today, VASTox is very pleased to announce the appointment of Barry Price, PhD as

Non-executive Chairman. Barry brings a wealth of industry experience and is

currently Chairman of the Boards of Biowisdom Limited and Antisoma plc, and a

Non-executive Director of Shire plc, one of the UK's largest life sciences

companies. Professor Stephen Davies will step down as Chairman and remain as a

Non-executive Director. Professor Davies has been Chairman since he founded

VASTox in January 2003 and has guided the Company through a successful flotation

in October 2004 and a growth phase that sees it now employing 50 scientists and

managers. Professor Davies is stepping down as Chairman to focus more time on

his new role as Waynflete Professor and Chairman of Chemistry at the University

of Oxford, one of the most prestigious academic posts in UK science. We thank

Steve for his contribution as Chairman and look forward to his continuing

involvement as a Non-executive Director.

The Company also announces today the appointment of Colin Wall as Non-executive

Director. Colin has significant public company experience and will act as the

Company's senior independent Non-executive Director. He replaces John Montgomery

as Non-executive Director. John is a co-founder of the Company and has been a

director since its formation in 2003. We would like to thank John for his

contributions to VASTox during his time as a director and at the same time

welcome Barry and Colin to the board.

Earlier in 2006, VASTox added significant R&D and commercial experience to the

executive management team. In April, Richard Storer, DPhil joined the board as

Chief Scientific Officer. Richard has more than 30 years' R&D experience within

the pharmaceutical industry and will oversee the development of VASTox's

preclinical programmes with a key objective of advancing the most promising

candidates into clinical trials. A major focus will be to accelerate the

Company's DMD programme, from which we anticipate advancing a compound in

clinical development during early 2007.

In May, Darren Millington, ACMA was appointed to the Board as Chief Financial

Officer and Company Secretary. Darren has eight years' of financial and

consulting experience and previously worked with IP2IPO Group plc (now IP Group

plc), Arthur Andersen and Deloitte & Touche. Darren has worked with VASTox

since the Company's successful flotation in October 2004.

In July, VASTox appointed James Taylor to the board as Chief Commercial Officer

with responsibility to grow the services business and to lay the platform for

commercial progress with our own proprietary drug programmes. James has more

than 20 years' business experience in the life science industry with a track

record of delivering successful commercial deals. The majority of his career

was spent at AstraZeneca and most recently, he was Vice President of Business

Development at Cellzome, where he was responsible for commercialising its

complex drug discovery technology as well as licensing early-stage drug

programmes.

These significant appointments complete the senior management team and will

provide VASTox with the experience needed to accelerate the growth of the

business.

Financial Review

Turnover during the first half of 2006 increased 133% to #468,591 (H1 2005/06:

#201,156) as a result of 15 new chemical genomics service contracts. In

addition to revenue growth, the gross margins of the services business have

increased to 67% (H1 2005/06: 62%).

R&D expenditure increased in line with budget to #1.28 million (H1 2005/06:

#0.16 million) primarily to accelerate development of our DMD drug discovery

programme, and to fund additional programmes initiated during period in cancer

and stem cell therapy.

Pre-tax losses during the period were #1.31 million, up from #0.13 million in H1

2005/06, as we continued to increase investment in advancing our drug discovery

programmes. Recognising an R&D tax credit for the period has resulted in a

post-tax loss of #1,143,290 (loss of #128,920 for H1 2005/06).

In February 2006, the Company raised #10m after expenses by issuing a further

5,903,955 ordinary shares in a successful secondary placing. This fund-raising

was supported by existing and new investors and the money has been ring-fenced

for the DMD programme, for which it is expected to fund development until

mid-2008.

The Company continues to make careful use of investors' funds and at 31 July

2006, VASTox had a strong cash position of #20.2m, compared to #12.9m on 31 July

2005 and #12.6m on 31 January 2006).

FRS 20 Restatement

All quoted UK companies are required to implement accounting standard FRS 20 - '

Share based payment' for financial periods commencing on or after 1 January

2006. This standard requires recognition of the fair value of issued share

options and is made retrospectively, leading to a restatement in prior periods.

It is important to note that in the six month period to 31 July 2006, the charge

due to the implementation of FRS 20 is #155,588; this compares to a charge of

#7,200 for the six month period to 31 July 2005.

Summary and outlook

In the remainder of the current financial year, we expect to continue making

good progress with our in-house drug programmes and remain on track to select

our first clinical candidate from our lead DMD programme early in 2007.

In addition, we expect our services business to continue growing as our chemical

genomics capabilities improve and expand, and our reputation for high quality

and value-creating services is enhanced.

We believe that VASTox has had a strong first half of 2006/07 and through the

development of its management and business is well placed to build on its rapid

growth and deliver value for investors. None of this progress is possible

without a team of committed scientists and managers; we thank them for their

hard work and dedication.

Steven Lee, PhD

Chief Executive Officer

Consolidated profit and loss account

for the six months ended 31 July 2006

Unaudited Restated Restated

Six months unaudited Year

ended Six months ended

31 July ended 31 January

2006 31 July 2006

2005

# # #

Turnover 468,591 201,156 531,361

Cost of sales ( 154,828 ) ( 75,894 ) ( 233,444 )

Gross profit 313,763 125,262 297,917

Research and development ( 1,284,466 ) ( 159,069 ) ( 1,025,683 )

Other ( 733,539 ) ( 400,435 ) ( 1,071,992 )

Total administrative costs ( 2,018,005 ) ( 559,504 ) ( 2,097,675 )

Operating loss ( 1,704,242 ) ( 434,242 ) ( 1,799,758 )

Interest receivable 414,324 305,322 582,868

Interest payable ( 20,175 ) - -

Loss on ordinary activities before ( 1,310,093 ) ( 128,920 ) ( 1,216,890 )

taxation

Tax on loss on ordinary activities 166,803 - 155,437

Loss on ordinary activities after ( 1,143,290 ) ( 128,920 ) ( 1,061,453 )

taxation

Basic loss per ordinary share 3.21p 0.41p 3.39p

Consolidated balance sheet

at 31 July 2006

Unaudited Restated Restated

31 July unaudited 31 January

2006 31 July 2006

2005

# # #

Fixed assets

Intangible assets 57,977 35,000 28,016

Tangible assets 1,847,593 1,139,645 1,261,082

1,905,570 1,174,645 1,289,098

Current assets

Stock 29,207 - 27,000

Debtors 855,864 429,687

541,300

Cash on short term deposits 16,700,796 12,900,000 11,593,626

Cash at bank 3,512,585 19,730 1,039,690

21,098,452 13,349,417 13,201,616

Creditors: amounts falling due within one (315,269) (555,886) (704,833)

year

Net current assets 20,783,183 12,793,531 12,496,783

Creditors: amounts falling due after more (610,442) - (690,812)

than one year

Net assets 22,078,311 13,968,176 13,095,069

Capital and reserves

Called up share capital 3,721,707 3,131,311 3,131,311

Share premium account 22,327,396 12,946,848 12,946,848

Other reserves (1,942,589) (1,942,589) (1,942,589)

Profit and loss account (2,028,203) (167,394) (1,040,501)

Equity shareholders' funds 22,078,311 13,968,176 13,095,069

Consolidated cash flow statement

for the six months ended 31 July 2006

Unaudited Unaudited

Six months Six months Year

ended ended ended

31 July 31 July 31 January

2006 2005 2006

# # #

Net Cash flow from operating activities (1,934,163) (371,110) (1,447,680)

Return on investments and servicing of finance 276,410 305,322 507,652

Taxation: R&D tax credit received - - 29,041

Capital expenditure (652,964) (1,175,734 (1,373,553)

Cash outflow before management of liquid (2,310,717) (1,241,522) (2,284,540

resources and financing

Management of liquid resources

Decrease (increase) in short term deposits (5,107,170) 900,000 2,206,374

Financing

Issue of share capital 9,970,944 - -

(Repayment) increase in debt during the year (80,162) - 756,604

9,890,782 - 756,604

Increase (decrease) in cash in the period 2,472,895 (341,522) 678,438

Reconciliation of operating loss to net cash flow from operating activities

Unaudited Unaudited Restated

Six months Six months Year

ended ended ended

31 July 31 July 31 January

2006 2005 2006

# # #

Operating loss (1,704,242) (434,242) (1,799,758)

Depreciation charge 108,771 18,645 127,520

Amortisation of intangible fixed assets 4,409 3,797 7,767

FRS 20 charge for fair value of share options 155,588 7,200 66,626

Increase in debtors (30,022) (336,547) (246,547)

Increase in stock (2,207) - (27,000)

(Decrease) increase in creditors (466,460) 370,037 423,712

Net cash outflow from operation (1,934,163) (371,110) (1,447,680)

activities

Notes to the interim results

1. Basis of preparation

The results for the half-year are unaudited and do not constitute statutory

accounts within the meaning of section 240 of the Companies Act 1985. They have

been prepared on the basis of the accounting policies expected to apply for the

financial year to 31 January 2007.

The results shown for the full year ended 31 January 2006 are not the company's

full statutory accounts for that year. A copy of the statutory accounts for

that year has been delivered to the Registrar of Companies. The auditors'

report on those accounts was unqualified and did not contain a statement under

section 237 (2) - (3) of the Companies Act 1985.

FRS 20 Restatement

All quoted UK companies are required to implement accounting standard FRS 20 - '

Share based payment' for financial periods commencing on or after 1 January

2006. This standard affects all companies that issue share options and results

in a non-cash charge to the profit and loss statement to reflect the 'fair

value' of issued share options. The fair value of VASTox share options is

calculated using the Black-Scholes formula. In common with the implementation

of all accounting standards, prior year results must be restated as if the

accounting standard had always been in force. In the six month period to 31

July 2006 the charge due to the implementation of FRS 20 is #155,588 (six month

period to 31 July 2005: #7,200; year to 31 January 2006: #66,626). This

restatement has had no impact on the net assets in the periods presented in

these interim results.

2. Loss per share calculation

The loss per share has been calculated by dividing the loss for the period of

#1,143,290 (for the period ended 31 July 2005: restated loss of #128,920; for

the year ended 31 January 2006: restated loss of #1,061,453) by the weighted

average number of 35,577,079 shares in issue during the six month period to 31

July 2006 (for the six month period ended 31 July 2005: 31,313,111; for the year

ended 31 January 2006: 31,313,111).

Since the group has reported a net loss, diluted loss per share is equal to

basic loss per share.

3. Analysis of changes in net funds

Unaudited Unaudited Year

Six months Six months ended

ended ended 31 January

31 July 31 July 2006

2006 2005 #

# #

Increase (decrease) in cash in the period 2,472,895 (341,522) 678,438

Increase (decrease) in short term deposits 5,107,170 (900,000) (2,206,374)

Cash (inflow) outflow from loan finance 80,162 - (756,604)

Opening net funds 11,876,712 14,161,252 14,161,252

Closing net funds 19,536,939 12,919,730 11,876,712

4. Interim report

Copies of this interim report are being sent to all shareholders. Copies are

also available at the Registered Office of the Company: VASTox plc, 91 Milton

Park, Abingdon, Oxfordshire, OX14 4RY and at the Company's website:

www.vastox.com.

The interim results were approved by the Board of Directors on 25 September

2006.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR LELFLQKBLBBV

Vox Valor Capital (LSE:VOX)

Historical Stock Chart

From Jun 2024 to Jul 2024

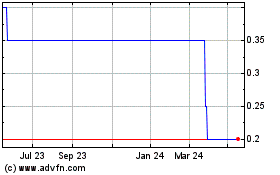

Vox Valor Capital (LSE:VOX)

Historical Stock Chart

From Jul 2023 to Jul 2024