United Utilities Group PLC United Utilities Trading Update (9680M)

September 27 2021 - 2:00AM

UK Regulatory

TIDMUU.

RNS Number : 9680M

United Utilities Group PLC

27 September 2021

United Utilities Group PLC

27 September 2021

UNITED UTILITIES TRADING UPDATE

United Utilities announces the following trading update ahead of

its half year results on 24 November 2021.

Current trading is in line with the group's expectations for the

six months ending 30 September 2021.

Supporting customers

We continue to deliver high levels of customer satisfaction and

provide services to more than 7 million customers in the North

West. Our customer facing teams work incredibly hard to help those

struggling financially, with around 200,000 customers currently

benefitting from our affordability schemes we are supporting more

customers than ever before.

We have continued to build on our long track record of

innovating to improve service and enhance the customer experience,

reflected in our C-MeX and D-MeX scores for which we have earned a

reward against both measures for 2020/21.

Leading environmental performance

In the Environment Agency's latest annual assessment of

environmental performance, we achieved the top 4 star ranking and

were assessed as "green" across all six areas that the Agency

assessed. This is the fourth time in the last 6 years we have

earned this top rating.

Securing a low carbon future

In July we became the first UK water company to have

science-based targets, including supply chain (scope 3) targets,

approved by the Science Based Targets initiative (SBTi). The SBTi

is widely accepted as providing the gold standard approval for

carbon emission reduction targets. Our new scope 3 emissions

targets, with measures including both supplier engagement and an

absolute reduction, further develop our carbon strategy and

demonstrate our ambition to net zero from 2030.

Financial performance

Our AMP7 guidance on regulatory performance remains unchanged

from that given at our full year results in May 2021.

Group revenue for the first half of 2021/22 is expected to be

higher than the first half of last year, mainly reflecting higher

consumption only partially offset by the known regulatory revenue

reduction. Household consumption remains high as many customers

continue to work from home and consumption from businesses has

started to return to pre-Covid levels as restrictions are lifted.

Overall, the net increase in revenue in the first half of the year

is expected to be around 4 per cent.

Underlying operating profit for the first half of 2021/22 is

expected to be higher than the first half of last year. This

largely reflects higher revenue and targeted efficiencies partly

offset by higher underlying operating costs, largely as a result of

inflationary increases in our core costs.

At the full year to March 2021, we simplified our approach to

alternative performance measures (APMs) such that we no longer, as

a matter of course, adjust our underlying earnings for

restructuring costs, net pension interest, capitalised borrowing

costs and routine prior years' tax matters.

We expect the underlying net finance expense for the first half

of 2021/22 to be around GBP25 million higher than the first half of

last year. Higher inflation applied to the group's index-linked

debt is expected to increase the underlying net finance expense for

the first half by around GBP55 million and is partly offset by a

GBP30 million reduction as a result of the change in APMs.

The introduction of capital allowances super deductions

announced in the Chancellor's Budget is expected to reduce the

group's current tax charge significantly in 2021/22 and result in

an underlying tax rate of around 5 per cent for the first half of

the year.

The legislation to increase the headline rate of corporation tax

to 25 per cent from 1 April 2023 was enacted in May 2021. As a

result, we expect to incur a deferred tax charge through the income

statement of around GBP380 million in the first half of 2021/22. To

provide a more representative view of business performance, this

deferred tax charge will be excluded from the underlying profit

measures.

We expect a small increase in group net debt at 30 September

2021 compared with the position as at 31 March 2021. This largely

reflects the group's ongoing investment in its asset base along

with acceleration of capital expenditure to deliver service

improvements sooner.

Our responsible approach to financial risk management continues

to deliver benefits, including a strong balance sheet, a stable

IFRS pension surplus and gearing within our target range supporting

a solid A3 credit rating for United Utilities Water with

Moody's.

United Utilities contacts:

Gaynor Kenyon, Corporate Affairs

Director +44 (0) 7753 622 282

Robert Lee, Head of Investor Relations +44 (0) 7500 087 704

Graeme Wilson, Tulchan Communications +44 (0) 2073 534 200

LEI 2138002IEYQAOC88ZJ59

Classification - Trading update

.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUSUNRASUKUAR

(END) Dow Jones Newswires

September 27, 2021 02:00 ET (06:00 GMT)

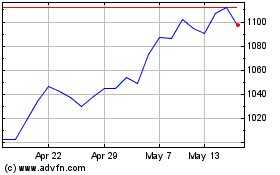

United Utilities (LSE:UU.)

Historical Stock Chart

From Jun 2024 to Jul 2024

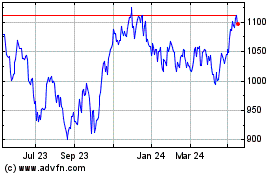

United Utilities (LSE:UU.)

Historical Stock Chart

From Jul 2023 to Jul 2024