RNS Number:1315R

United Overseas Group PLC

19 September 2000

UNITED OVERSEAS GROUP PLC

Interim Results for the six months ended 30th June 2000

Strong recovery

Pre-tax profits of #1.6m; EPS of 0.54p (Basic); Turnover up 10 percent

Mr. Jeffrey Curtiss, founder, to retire in March 2001

United Overseas Group plc ("UOG"), Europe's largest group specialising in the

world-wide purchase, sale and distribution of excess inventory to retail and

wholesale customers, announces much improved results for the six months ended

30th June 2000 including a return to profitability and further strengthening

of its Balance Sheet.

Mr. Alex Watson, Chairman, said in his statement to shareholders:

"This turnaround in performance is particularly encouraging given that it is

against a background of the current retail trading conditions and justifies

the decisive management actions taken over the last twelve months".

Key points of the results and extracts from the Chairman's statement

* Turnover up 10 per cent to #63.1m (1999: #57.4m)

* Much improved performances in the UK (sales up 10 per cent) and North

America (sales up 34 per cent)

* Gross profit margin improved to 25 per cent (1999: 22 per cent)

* Pre-tax profit of #1.6 m (1999: #0.3m loss)

* Balance Sheet management a continuing priority; stock levels reduced by

#1m; creditors significantly lower; net current assets increased by

#2m year on year

* No interim dividend declared; Board will evaluate the Group's improving

position

* Further senior management appointments in North America and Europe

complete management restructuring commenced last year

* Jeffrey Curtiss to step down as Group Chief Executive to become Vice-

Chairman ahead of retirement in March 2001

Regarding prospects for the rest of the current year and beyond, Mr. Watson

added:

"We expect that the retail environment will remain challenging for the

foreseeable future. However, the Board is encouraged by the Group's

performance to date and.with our strengthened management team, we are

confident that we are well positioned for sustainable profitable growth over

the longer term."

Enquiries:

Michael Corke:- Group Chief Executive,

Phil Carr: - Group Finance Director,

United Overseas Group plc

Tel: 01733 362 300

Paul Vann: -

Binns & Co PR Limited

Tel: 020 7786 9600

CHAIRMAN'S STATEMENT

I am delighted to announce that the results for the six months to 30th June

2000 have shown a strong recovery over the corresponding six months period to

30th June 1999. The Group has achieved a pre-tax profit of #1.6 million

against a comparable loss of #0.3 million. Turnover has increased by 10% to

#63.1 million and the gross profit margin has improved from 22% to 25%. Stock

levels have been reduced by a further #1 million since 31st December making a

total reduction of #4 million over the last 12 months. In addition to the

reduction in stock levels the Group's creditors are significantly lower

resulting in a #2 million increase in net current assets over the position at

30 June 1999.

The most significant areas of improvement have been in our UK and North

American operations, both in terms of Profit performance and Balance Sheet

management. Sales in the United States have increased by 34% (now representing

17% of total Group sales) during the period as a result of strengthened buying

activity and increased sales to both national and regional chain stores. In

anticipation of future growth in the U.S. market, we are in the process of

expanding our existing showroom facilities and relocating our offices to new

premises adjacent to our warehousing facilities. United Overseas Limited, our

principal UK subsidiary, has experienced a sales growth of 10% and benefited

substantially from enhanced gross profit margins, resultant from improved

stock management, as well as greater efficiencies. Furthermore, our Dutch

operations have benefited from the operational efficiencies derived from the

new European Distribution Centre in Moerdijk, The Netherlands which became

fully functional in September 1999. This turnaround in performance is

particularly encouraging given that it is against a background of the

current retail trading conditions and justifies the decisive management actions

taken over the last twelve months.

As I announced at the Group's Annual General meeting in June, Phil Carr has

succeeded Terry Balkham as Group Financial Director. Phil has been with the

Group since 1997 and was previously Group Financial Controller. Bert Boersema

was appointed to the main Board as Managing Director, Northern Continental

Europe, assuming the responsibilities previously held by his late uncle, Eppe

Boersema. In addition, the Board appointed in April 2000 John Gordon and

Robert van den Heuvel as Non-Executive Directors, both of whom have taken up

duties on the Audit Committee and the Remuneration and Nominations Committee.

Both John and Robert bring a wealth of financial and international experience

that will benefit the Group.

Earlier this month we announced two senior appointments in The Netherlands and

the United States, which will enhance and consolidate our trading

opportunities in the important toy sector. Ries van Eijck was appointed to the

Board of Intertading Agencies Boersema BV, the Group's subsidiary based in

Moerdijk, The Netherlands and Chuck Miller was appointed Vice President of

Merchandising for UniTrade Marketing, our operating subsidiary based in the

United States. Both executives have extensive experience of the international

toy industry having worked for a number of well known toy retail chains

including Toys R US. These appointments, together with the earlier

appointments of Phil Green, who joined the Group as Managing Director, United

Overseas Limited in August 1999 and has 25 years retailing experience gained

at Woolworths plc and Michael Corke, who was appointed Group Managing Director

in November 1999, and has 28 years of senior international management

experience in marketing and distribution of branded consumer goods having

previously worked for Hutchinson Whampoa Ltd (Hong Kong) and Hagemeyer N.V.

(The Netherlands), complete the essential management restructuring, which

commenced last year.

Against the background of the Group's financial turnaround and substantially

improved trading performance, supported by a strengthened Executive and Non-

Executive management team, Jeffrey Curtiss, the Group's founder, has decided

to step down from his role of Chief Executive Officer and to take the position

of Vice Chairman, prior to retiring from the Board in March 2001. Michael

Corke, Group Managing Director, will assume Jeffrey's executive

responsibilities with immediate effect.

The Board is committed to the programme of change and the management of its

resources, and therefore, has decided not to declare an interim dividend at

this time, but will continue to monitor and evaluate the Group's improving

position with the intention of returning to dividend payments as soon as

practicable.

As previously announced the Group has appointed Williams de Broe as

stockbrokers and financial advisors, effective 1st September 2000.

We expect that the retail environment will remain challenging for the

foreseeable future. However, the Board is encouraged by the Group's

performance to date and, as Europe's leading international distributor of

excess branded consumer products, with our strengthened management team, we

are confident that we are well positioned for sustainable profit growth.

Alex Watson

Chairman

19 September 2000

Consolidated Profit and Loss Account

For the period ended 30 June 2000

6 months 6 months 12 months

ended ended ended

30/06/00 30/06/99 31/12/99

(unaudited) (unaudited) (audited)

Note #'000 #'000 #'000

---------- ---------- ---------

Turnover 2 63,060 57,406 113,192

Cost of sales (47,589) (44,840) (90,689)

---------- ---------- ---------

Gross profit 15,471 12,566 22,503

Distribution costs (5,012) (5,104) (10,576)

Administrative costs (7,526) (6,544) (13,639)

Other operating income 259 163 222

Amortisation of goodwill 3 (249) (252) (499)

---------- ---------- ---------

Operating profit/(loss) 2,943 829 (1,989)

Profit on disposal of property - - 192

Net interest payable (1,333) (1,171) (2,147)

---------- ---------- ---------

Profit/(loss) on ordinary

activities before taxation 1,610 (342) (3,944)

Taxation 4 (759) (158) (125)

---------- ---------- ---------

Profit/(loss) on ordinary

activities after taxation 851 (500) (4,069)

Minority interests (100) (118) (205)

---------- ---------- ---------

Profit/(loss) attributable to

shareholders 751 (618) (4,274)

Dividends 5 - - -

---------- ---------- ---------

Retained profit/(loss) for the

period 751 (618) (4,274)

---------- ---------- ---------

Earnings per share 6

- Basic 0.54p (0.44)p (3.07)p

- Fully diluted 0.54p (0.44)p (3.07)p

- Adjusted basic 0.72p (0.26)p (2.71)p

---------- ---------- ---------

Dividends per share 5 - - -

---------- ---------- ---------

Consolidated Balance Sheet

At 30 June 2000

At 30/06/00 At 30/06/99 At 31/12/99

(unaudited) (unaudited) (audited)

Note #'000 #'000 #'000

---------- ---------- ---------

Fixed assets

Intangible assets 9,539 9,698 9,800

Tangible assets 3,540 8,724 2,777

Investments 300 250 300

---------- ---------- ---------

13,379 18,672 12,877

---------- ---------- ---------

Current assets

Stocks 34,583 38,735 35,671

Debtors 29,218 29,486 22,544

Cash at bank and in hand 1,185 1,066 1,742

---------- ---------- ---------

64,986 69,287 59,957

Creditors: amounts falling due

within one year (41,582) (47,879) (36,777)

---------- ---------- ---------

Net current assets 23,404 21,408 23,180

---------- ---------- ---------

Total assets less current

liabilities 36,783 40,080 36,057

Creditors: amounts falling due

after more than one year (2,015) (2,386) (2,272)

---------- ---------- ---------

Net assets 34,768 37,694 33,785

---------- ---------- ---------

Capital and reserves

Called up share capital 13,990 13,990 13,990

Share premium account 55,207 55,207 55,207

Profit and loss account 3 (34,945) (31,832) (35,828)

---------- ---------- ---------

Equity shareholders' funds 34,252 37,365 33,369

Equity minority interests 516 329 416

---------- ---------- ---------

34,768 37,694 33,785

---------- ---------- ---------

Consolidated Cash Flow Statement

For the period ended 30 June 2000

6 months 6 months 12 months

ended ended ended

30/06/00 30/06/99 31/12/99

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

---------- ---------- ---------

Net cash (outflow)/inflow from

operating activities (13) (1,671) 4,170

---------- ---------- ---------

Returns on investments and servicing

of finance

Interest received 46 16 81

Interest paid and similar charges (1,215) (1,200) (2,095)

Interest element of hire purchase and

finance leases (39) (26) (60)

---------- ---------- ---------

Net cash outflow from returns on

investments and servicing of finance (1,208) (1,210) (2,074)

---------- ---------- ---------

Taxation

UK corporation tax (paid)/recovered (43) 871 323

Overseas taxation (paid)/recovered (931) 398 346

---------- ---------- ---------

Net cash (outflow)/inflow from

taxation (974) 1,269 669

---------- ---------- ---------

Capital expenditure and financial

investment

Purchase of intangible fixed assets - - (26)

Purchase of tangible fixed assets (764) (2,982) (4,132)

Purchase of fixed asset investments - (50) (100)

Sale of tangible fixed assets 23 47 7,434

---------- ---------- ---------

Net cash (outflow)/inflow from capital

expenditure and financial investment (741) (2,985) 3,176

---------- ---------- ---------

Acquisitions and disposals

Purchase of subsidiary undertakings - (22) -

---------- ---------- ---------

Net cash outflow from acquisitions and

disposals - (22) -

---------- ---------- ---------

Equity dividends paid - (182) (182)

---------- ---------- ---------

Cash (outflow)/inflow before use of

liquid resources and financing (2,936) (4,801) 5,759

---------- ---------- ---------

Financing

Loans repaid (683) - (7,600)

Capital element of finance lease

rentals (211) (214) (500)

New short term finance - 1,776 2,796

---------- ---------- ---------

Net cash (outflow)/inflow from

financing (894) 1,562 (5,304)

---------- ---------- ---------

(Decrease)/increase in cash in the

period (3,830) (3,239) 455

---------- ---------- ---------

Reconciliation of Operating Profit/(Loss) to Net Cash Flow

from Operating Activities

For the period ended 30 June 2000

6 months 6 months 12 months

ended ended ended

30/06/00 30/06/99 31/12/99

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

----------- ----------- ---------

Operating profit/(loss) 2,943 829 (1,989)

Depreciation of fixed assets 404 380 783

Amortisation of trade marks 9 11 44

Amortisation of goodwill 249 252 499

(Profit)/loss on sale of tangible

fixed assets (1) (3) 12

Decrease in stocks 1,440 3,869 6,032

(Increase)/decrease in debtors (7,187) (2,828) 4,217

Increase/(decrease) in creditors 2,097 (4,161) (5,374)

Exchange movements in respect of

foreign undertakings 33 (20) (54)

----------- ---------- ---------

Net (outflow)/inflow from operating

activities (13) (1,671) 4,170

----------- ---------- ---------

Reconciliation of Net Cash Flow to Movement in Net Debt

For the period ended 30 June 2000

6 months 6 months 12 months

ended ended ended

30/06/00 30/06/99 31/12/99

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

----------- ----------- ----------

(Decrease)/increase in cash in the

period (3,830) (3,239) 455

Cash outflow/(inflow) from decrease in

debt and finance leasing 894 (1,562) 5,304

----------- ----------- ----------

Change in net funds resulting from

cash flows (2,936) (4,801) 5,759

Foreign exchange movements (185) - 729

New finance leases (404) (21) (288)

----------- ----------- ----------

Movement in net debt (3,525) (4,822) 6,200

----------- ----------- ----------

Opening net debt (21,850) (28,050) (28,050)

Movement in net debt (3,525) (4,822) 6,200

----------- ----------- ----------

Closing net debt (25,375) (32,872) (21,850)

----------- ----------- ----------

Notes

1 Nature of the Financial Information

The Company prepares statutory accounts annually to 31 December. These are

the interim accounts covering the six months ended 30 June 2000.

The results for the six months ended 30 June 1999 and the year ended 31

December 1999, are extracted from the previous year's interim and final

accounts respectively.

The results for the six months ended 30 June 2000 and 1999 are unaudited, and

have been prepared in accordance with the accounting policies set out in the

Company's annual report.

The financial information set out above does not constitute statutory accounts

within the meaning of Section 240 of the Companies Act 1985. The results for

the year ended 31 December 1999 are an abridged version of the full statutory

accounts that have an unqualified audit report and have been delivered to the

Registrar of Companies.

2 Turnover and Profit before Tax

6 months 6 months 12 months

ended ended ended

30/06/00 30/06/99 31/12/99

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

----------- ----------- ---------

Turnover by destination:

United Kingdom 29,582 26,686 55,086

Rest of Europe 21,618 21,946 41,491

North America 11,860 8,774 16,615

----------- ----------- ---------

63,060 57,406 113,192

----------- ----------- ---------

By origin:

United Kingdom 32,416 28,671 59,391

Rest of Europe 19,982 20,576 38,559

North America 10,662 8,159 15,242

----------- ----------- ---------

63,060 57,406 113,192

----------- ----------- ---------

Profit/(loss) before tax by origin:

United Kingdom 468 (1,223) (4,019)

Rest of Europe 783 845 230

North America 359 36 (155)

----------- ----------- ---------

1,610 (342) (3,944)

----------- ----------- ---------

Figures for the rest of the world have been incorporated within the category

for North America.

3 Profit and Loss Account

In accordance with Financial Reporting Standard 10 Goodwill and Intangible

Assets, goodwill arising from acquisitions before 1 January 1998 has been

written off to reserves. For acquisitions after this date, the goodwill

arising has been capitalised and is being amortised through the profit and

loss account over the Directors' estimate of their useful economic life.

4 Taxation

The taxation charge for the six months to 30 June 2000 and 1999 is based on

the anticipated tax position for the full year.

5 Dividends

No interim dividend is proposed for the six months ended 30 June 2000 (1999:

nil).

6 Earnings per Share

Basic earnings per share for the six months ended 30 June 2000 is calculated

by dividing the profit on ordinary activities after taxation and minority

interests of #751,000 by 139,903,939 (30 June 1999: loss #618,000 by

139,496,709; 31 December 1999: loss #4,274,000 by 139,364,613) being the

weighted average number of ordinary shares of 10 pence each in issue during

the period after taking account of the purchases of ordinary shares by the

Employee Share Ownership Plan (ESOP).

The adjusted basic earnings per share for the six months ended 30 June 2000 is

calculated by dividing the profit on ordinary activities after taxation and

minority interests and before amortisation of goodwill of #1,000,000 by

139,903,939 (30 June 1999: loss #366,000 by 139,496,709: 31 December 1999:

loss #3,775,000 by 139,364,613) being the weighted average number of ordinary

shares of 10 pence in issue during the period after taking account of the

purchases of ordinary shares by the ESOP.

No dilution arises as a result of the share options in issue, as the value at

which they were granted is in excess of both the market price at 30 June 2000

and the average market price for the six months, and therefore no options

would be exercised. Accordingly the fully diluted earnings per share is

identical to the basic earnings per share as stated above.

7 Interim Statement

Copies of the Interim Statement are being sent to shareholders and are

available from the Company Secretary, United Overseas Group Plc, United House,

Shrewsbury Avenue, Woodston, Peterborough PE2 7BZ.

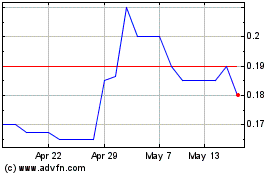

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Nov 2024 to Dec 2024

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Dec 2023 to Dec 2024