RNS Number:6582J

United Overseas Group PLC

27 April 2000

UNITED OVERSEAS GROUP PLC

Final Results for the year ended 31 December 1999

United Overseas Group plc ("UOG"), Europe's largest group specialising in the

purchase, sale and distribution of surplus inventory to wholesale and retail

customers, announces final results for the year ended 31 December 1999. These

results were produced against a background of difficult trading conditions in

the UK retail market.

Mr. Alex Watson, Chairman, said in his statement to shareholders:

"Whilst the results for the year are in many ways very disappointing, your

Board believes that 1999 has marked the turning point for the Group's

future."

Key points and extracts from the Chairman's Statement:

(comparatives are 12 month figures to 31 December 1998)

* Turnover of #113.2m (1998: #107.6m).

* Pre-tax loss of #3.9m, after charging substantially non-recurring

costs of #5.3m, and Goodwill of #0.5m (1998: #3.7m profit).

* Directors are not recommending payment of a final dividend.

* Stock reduced by #6.9 million.

* Debt reduced by #6.2 million.

* European Distribution Centre in Moerdijk, the Netherlands, fully

operational September 1999 - record Q4 sales volumes achieved.

* Significant increase in European sales (excl. UK) - 34% of turnover

(1998: 20%).

* Board further strengthened during year with appointment of Michael

Corke as Group Managing Director, Phil Green as Managing Director,

United Overseas Limited (UK).

* Eppe Boersema, Managing Director, Northern Continental Europe,

tragically died on 16 April 2000.

* Appointment of new non-executive Directors, John Gordon and Robert

van den Heuvel.

Regarding the outlook for the remainder of 2000, Mr. Watson added:

"The building and development of strong profitable businesses in key

geographic regions remains at the heart of the Group's strategic plan. The

development of the European Distribution Centre at Moerdijk and the

subsequent record performance of our Dutch subsidiary following the facility

becoming fully operational is encouraging confirmation of progress in

fulfilling our aims in Northern Europe. Our North American business, having

improved stock efficiency significantly in 1999, is now well placed to

continue its growth plans in 2000 and beyond."

"We expect that our business in the first half of 2000, whilst continuing to

operate in an extremely competitive retail environment, will realise the

benefits of the focused management action taken in 1999. The Board is

confident that the Group is now firmly positioned for profitable growth over

the medium term."

Enquiries:

Alex Watson, Chairman

Jeffrey Curtiss, Chief Executive

Terry Balkham, Finance Director, United Overseas Group plc 01733 362300

Peter Binns/Simon Ellis/Jane Mallinson, Binns & Co PR Limited 020 7786 9600

Chairman's Statement

In the Interim Report for 1999 the Board identified major difficulties

confronting the business and confirmed its resolve to overcome them.

Consequently, whilst the results for the year are in many ways very

disappointing, your Board believes 1999 has marked the turning point for the

Group's fortunes. Overall, sales increased by 5 per cent to #113.2 million

(1998: #107.6 million), but at the pre-tax level the Group has recorded a

loss of #3.9 million, compared to a pre-tax profit of #3.7 million in 1998.

The results were adversely affected by actions taken to address key issues

which the Board believe are substantially non-recurring. In summary these

were margin reductions to below normal expectations to improve stock

efficiency, corrective actions taken to refocus the Toy Wizards business and

one-off costs of re-organisation particularly in the UK group. In the

circumstances your Board does not propose the payment of a final dividend.

Business Development

Despite these undoubted disappointments, there has been progress made in

areas vital to the Group's development. The European Distribution Centre in

Moerdijk, the Netherlands, became fully operational in September 1999 and the

fourth quarter saw record sales volumes in our Dutch subsidiary. We are

confident that our business in Northern Europe now has the firm foundation

necessary to develop consistently profitable growth.

The Board identified improved management of working capital as a key goal

during 1999. The advances made in this area resulted in an overall reduction

in stock from 1998 levels and an increased focus on cash management producing

a significant reduction of debt at year end.

Changes to the Board and Advisers

At the Annual General Meeting in May 1999 Dr John Westhead retired from the

Board upon reaching his 70th birthday. Norman Riddell, my predecessor as

Chairman, stood down from the Board in October 1999 to enable him to

concentrate on his other business interests. On behalf of the Board I would

like to thank John and Norman for their considerable contribution and wish

them well for the future.

Our Executive Management team was strengthened by two key appointments during

the second half of 1999. In August, Phil Green joined the Board from

Woolworths plc in the position of Managing Director, United Overseas Limited,

the Group's principal operating company in the UK. In November, Michael

Corke was appointed as Group Managing Director, United Overseas Group plc,

having had substantial senior management experience of developing

international marketing and distribution businesses, with Hagemeyer NV and

Hutchison Whampoa.

It is with great sadness that I must report the death of Eppe Boersema.

Eppe, a member of the Board, and Managing Director Northern Continental

Europe, died on 16 April following injuries he received in a road traffic

accident. Eppe's contribution to the group during his all too short

association with us was of major significance. Eppe will be sadly missed by

all who knew him as an exceptional trader, colleague and friend.

I am pleased to announce the appointment of John Gordon and Robert van den

Heuvel to the Board as Non-Executive Directors from 26 April 2000. In

welcoming John and Robert to the Group I am sure that the skills and

experience they bring, will greatly assist in the development of the Group's

strategic direction.

The Board agreed with Marshall Securities Limited that they would stand down

as financial advisers and stockbrokers to the Group with effect from 31 March

2000. On behalf of the Group I would like to thank Marshall for their

support and encouragement over the years of our association. I expect to be

able to announce the appointment of new financial advisers and stockbrokers

shortly.

Employees

1999 was an extremely difficult and challenging year for the Group caused by

the changes to practices which have been implemented. I would like to take

this opportunity to thank all our staff for their efforts in ensuring that

the redirection of the Group was satisfactorily achieved.

Strategy

The building and development of strong profitable businesses in key

geographic regions remains at the heart of the Group's strategic plan. The

development of the European Distribution Centre at Moerdijk and the

subsequent record performance of our Dutch subsidiary following the facility

becoming fully operational is encouraging confirmation of progress in

fulfilling our aims in Northern Europe. Our North American business, having

improved stock efficiency significantly in 1999, is now well placed to

continue its growth plans in 2000 and beyond.

Outlook

We expect that our business in the first half of 2000, whilst continuing to

operate in an extremely competitive retail environment will realise the

benefits of the focused management action taken in 1999. The Board is

confident that the Group is now firmly positioned for profitable growth over

the medium term.

Alex Watson

Chairman

Operational Review

During the course of the past twelve months the business has faced a number

of issues critical to ensuring the long term prosperity of the Group. I

believe necessary remedial actions have been taken and where appropriate

their costs are reflected in the 1999 results.

Management

We had determined that a key requirement for our business was to enhance the

quality and experience of our management to drive and sustain our business

growth. During the second half of 1999 significant gains were made by the

appointment of Phil Green and Michael Corke to the Board. Phil brings to our

Group 25 years of blue-chip retailing experience at Woolworths plc and his

contribution as Managing Director of United Overseas Limited, our principal

UK trading company, will be pivotal to the Group's development during 2000

and beyond. Michael has 28 years international experience of managing

branded consumer products trading companies and nurturing business growth in

North America, Europe and Asia Pacific. Michael's key responsibility as

Group Managing Director will be to partner with our operating company

management in each country to facilitate the development and achievement of

their business plans to ensure consistent future growth.

UK

Our UK business was adversely affected in 1999 by a series of adjustments

necessary to reposition the Toy Wizards business. This necessitated re-

aligning selling activities and distribution channels in addition to managing

down stock balances, all of which was successfully completed during the year.

Total sales in 1999 were lower at #59 million compared to #69 million in

1998, a major contributory factor being the revised strategy in 1999 of

repositioning Toy Wizards to address a smaller niche collector market. The

UK was central to the Group's drive to improve stock efficiency during 1999

and stocks were reduced substantially during the year. In order to generate

these gains, margins were reduced where appropriate to create the necessary

sales velocity to move the stock. In addition certain structural and

management changes were made to improve the effectiveness of the UK

organisation with the costs of the reorganisation reflected in the 1999

results. With these issues conclusively addressed, Phil Green is leading our

development plans in the UK with a combination of business building

initiatives and targeted cost reduction programmes. Currently there are

encouraging signs from these initiatives which we expect will start to bear

fruit in 2000.

European Stock Solutions, our specialist housewares business, continued its

growth pattern and recorded a 17 per cent increase in turnover in 1999

compared to 1998. The business has established a major presence in its core

sector and we expect further gains in 2000.

Northern Europe

Our strategy is to increase our presence in the major consumer markets of the

world and our development within Northern Europe continues on course. Our

focus over the past 12 months has been the development of a new, centralised

warehouse and distribution complex at Moerdijk, the Netherlands, capable of

servicing our expanding Northern European operation. This was achieved on

time and within budget and despite the inevitable disruption caused during

the commissioning of the new 225,000 sq ft facility. Intertrading turnover

in 1999 increased to #25 million compared to the #23 million achieved on an

annualised basis in 1998. Turnover in the fourth quarter of 1999 reached

record levels, and given the size of the project and the scale of the

undertaking, the Board regard this increase in turnover as satisfactory. We

now have in place a fully operational and technically advanced distribution

facility, thus removing a major restraint on growth. Our expanded presence in

Northern Europe will enable us to increase sales in the key consumer markets

of Germany, Scandinavia, Holland, Belgium, Switzerland and Austria, a

combined market of approximately 150 million consumers, and we continue to

regard the potential as considerable.

North America

Progress in North America was modest in 1999 partially due to a short term

but critical disruption to our buying function. However good gains were made

in the area of stock efficiency. Having re-established and strengthened both

our buying and selling organisations we are confident that 2000 will see

significant gains in our performance in the North American market place. Our

local management team are focused on achieving an aggressive growth plan

which will establish the foundation for further progress over the medium term

as we continue to consolidate our position in the world's largest consumer

market.

Asia Pacific

I commented last year that the primary aim of our development in Hong Kong

was to build on our relationships with the world's major toy manufacturers

and to assist in our sourcing capability. This is a key facet of our

strategy, and since we established a presence in Hong Kong in October 1998 we

have been pleased with the results. We have also been encouraged by the

level of sales that have been achieved by our Hong Kong operation recently in

South East Asia and Australasia. Admittedly our business in these regions is

small, but nonetheless we are making progress, and further gains are expected

in the coming year.

Summary and Prospects

As we look to the future the Group is actively considering the business

growth potential available from leveraging of Internet based technology

particularly in the area of e-commerce business to business buying and

selling. We are presently working on developing the appropriate balance

between the excitement generated from the potential opportunities and the

commercial reality likely to drive shareholder value. A cohesive e-commerce

strategy is expected to be implemented during 2000.

In my concluding remarks to shareholders last year, I commented that

management of the Balance Sheet would remain a high priority throughout 1999

and this focus has produced positive results. Our strategy for the future

profitable development of the Group remains intact, and given the changes

that we have made in 1999, we now have a firm platform from which we can

develop. In the current year we will continue to retain our focus on Balance

Sheet management whilst further developing the business initiatives commenced

in 1999. Despite our recent difficulties I remain confident in the Group's

profitable future and management's ability to deliver it.

Jeffrey Curtiss

Chief Executive

Financial Review

The statutory accounts are the consolidated results of the Group and include

the first full year's performance of Intertrading.

Turnover

Group turnover for the year to 31 December 1999 of #113.2 million represented

an increase of #5.6 million or 5% on the previous year. Intertrading sales

included for a full year in 1999 were #24.9 million compared to #8.1 million

for the period 2 September to 31 December 1998 following acquisition. The

geographical distribution of sales showed a significant increase in the

proportion of the Group's business originating in Europe, excluding the UK,

to 34% (1998: 20%), with the UK representing 52% (1998: 64%) and North

America and Asia 14% (1998: 16%).

Profit and Loss

The Group recorded an operating loss of #2.0 million (1998: #6.0 million

profit) after charging goodwill of #0.5 million (1998: #0.2 million). There

were three significant factors which adversely impacted the result as

follows. Margin reductions to consolidate improvements in efficient stock

management across the Group amounted to #3.3 million. Adjustments to the

trading methodology of Toy Wizards and the attendant carrying value of stock

impacted adversely by #1.4 million and structural reorganisation to improve

efficiency a further #0.6 million.

Interest

Interest costs reduced to #2.1 million (1998: #2.3 million) having included a

full year effect of Intertrading. Exclusive of Intertrading, interest

payable declined to #1.6 million (1998: #2.1 million) reflecting the Group's

improved use of cash and borrowing resources.

Taxation

The 1999 tax charge for the Group, #0.1 million (1998: #1.5 million) arose on

profits that were not able to be offset against losses made in other parts of

the Group. In addition there were a number of charges at Group level,

including the amortisation of goodwill, which were non-deductible for tax

purposes. The Group will obtain tax repayments where losses arose and those

which cannot be utilised will be carried forward to offset against future

profits.

Treasury Management

It is Group policy that no trading in financial instruments or speculative

trading activity be undertaken. Whilst it is not Group policy to

specifically hedge the earnings of its overseas subsidiaries this is

partially achieved by borrowing in local currencies principally US Dollars

and Dutch Guilders. Additionally the Group frequently purchases in foreign

currencies giving rise to transactional currency exposure. These exposures,

where appropriate, are hedged by forward currency transactions and by the

holding of foreign currency cash balances.

Intangible Fixed Assets

During 1999 fair value adjustments arising from the acquisition of

Intertrading have been finalised from the provisional position existing at

the 1998 Balance Sheet date in accordance with Financial Reporting Standard

(FRS)7 - "Fair Values in Acquisition Accounting". As required by FRS11 -

"Impairment of Fixed Assets and Goodwill" a review was undertaken in respect

of the Goodwill relating to the above acquisition and this confirmed the

carrying value of the asset as recorded in the financial statements.

Tangible Fixed Assets

During 1999 the development of the European Distribution Centre at Moerdijk,

the Netherlands, continued and was completed in July 1999. On 14 July the

development was sold to Vastned Industrial BV for #6.9 million (NLG 22.75

million) realising a profit of #0.2 million (NLG 0.6 million). All loans

undertaken to fund the construction were repaid in full in July 1999.

Working Capital and Debt

From the second half of 1998 a key goal of the Group has been to improve its

Balance Sheet management and in particular working capital and debt.

Progress in this area was illustrated by the Group's generation of positive

cash flow in 1999 following significant cash outflows in the preceding years.

The resultant effect from this was that net debt was reduced to #21.8 million

(1998: #28.1 million).

Sustained efforts to improve efficiency of inventory management and align

investment in stock more closely with demand resulted in stock being reduced

to #35.7 million (1998: #42.6 million). Trade debtor management was improved

generally throughout the Group resulting in a closing balance of #19.8

million (1998: #24.7 million).

Long Term Debt

Long term debt was reduced to #2.3 million in 1999 (1998: #6.7 million). On

completion of the construction, sale and leaseback of the Moerdijk facility

the loans obtained to fund its construction were repaid in full.

The draw down on these loans at the end of 1998 was #3.2 million (NLG 10

million). Repayments of the loan relating to the cash element of the

acquisition of Intertrading began in 1999 with the long term content reducing

to #2.1 million at the end of 1999 (1998: #3.2 million).

Year 2000

For much of 1998 and 1999 Group IT resources were focused on the "Y2k issue".

I am delighted to report that all Group companies negotiated the millennium

change with the minimum of disruption and IT support will now be focused on

business building and development.

uogplc.com

The Group's new website was launched on 14 April 2000. The initial focus is

on Investor Relations which will be followed by further additions enabling

news and information about the Group and its subsidiary trading companies to

be easily communicated.

Terry Balkham

Finance Director

Consolidated Profit and Loss Account

For the year ended 31 December 1999

1999 1998

#'000 #'000

---------- ----------

Turnover 113,192 107,603

Cost of sales (90,689) (82,972)

---------- ----------

Gross profit 22,503 24,631

Distribution costs (10,576) (7,541)

Administrative costs: other (13,639) (10,968)

Administrative costs: amortisation of goodwill (499) (166)

Other operating income 222 83

---------- ----------

Operating (loss)/profit (1,989) 6,039

---------- ----------

Profit on disposal of property 192 -

Net interest payable (2,147) (2,309)

---------- ----------

(Loss)/profit on ordinary activities before

taxation (3,944) 3,730

Taxation (125) (1,482)

---------- ----------

(Loss)/profit on ordinary activities after

taxation (4,069) 2,248

Minority interests (205) (126)

---------- ----------

(Loss)/profit attributable to shareholders (4,274) 2,122

Dividends - (715)

---------- ----------

Retained (loss)/profit for the year (4,274) 1,407

====== ======

(Loss)/earnings per share

- Basic (3.07p) 1.64p

- Diluted (3.07p) 1.64p

- Adjusted basic (2.71p) 1.77p

====== ======

Dividends per share 0.00p 0.56p

====== ======

All of the above relate to continuing activities.

Consolidated Statement of Total Recognised Gains and Losses

1999 1998

#'000 #'000

---------- ----------

(Loss)/profit for the year (4,274) 2,122

Net currency translation differences

on foreign currency net investments (549) 202

-------- --------

Total recognised gains and losses (4,823) 2,324

====== ======

Balance Sheets

At 31 December 1999

Group

1999 1998

#'000 #'000

---------- ----------

Fixed assets

Intangible assets 9,800 9,939

Tangible assets 2,777 6,427

Investments 300 200

---------- ----------

12,877 16,566

====== ======

Current assets

Stocks 35,671 42,604

Debtors - due within one year 22,544 27,185

Cash at bank and in hand 1,742 775

---------- ----------

59,957 70,564

Creditors: amounts falling due within one year (36,777) (42,051)

---------- ----------

Net current assets 23,180 28,513

---------- ----------

Total assets less current liabilities 36,057 45,079

Creditors: amounts falling due after more than

one year (2,272) (6,676)

---------- ----------

Net assets 33,785 38,403

====== ======

Capital and reserves

Called up share capital 13,990 13,990

Share premium account 55,207 55,207

Merger reserve - -

Profit and loss account (35,828) (31,005)

---------- ----------

Equity shareholders' funds 33,369 38,192

Equity minority interests 416 211

---------- ----------

33,785 38,403

====== ======

Approved on behalf of the Board on 26 April 2000 by:

A E Watson J Curtiss

Chairman Chief Executive

Consolidated Cash Flow Statement

For the year ended 31 December 1999

1999 1998

#000 #000

---------- ----------

Net cash inflow from operating activities 4,170 4,906

---------- ----------

Returns on investments and servicing of finance

Interest received 81 54

Interest paid and similar charges (2,095) (2,273)

Interest element of finance leases (60) (51)

---------- ----------

Net cash outflow from returns on investments

and servicing of finance (2,074) (2,270)

---------- ----------

Taxation

UK corporation tax recovered/(paid) 323 (2,376)

Overseas taxation recovered/(paid) 346 (838)

---------- ----------

Net cash inflow/(outflow) from taxation 669 (3,214)

---------- ----------

Capital expenditure and financial investment

Purchase of tangible fixed assets (4,132) (3,150)

Purchase of intangible fixed assets (26) (23)

Purchase of fixed asset investments (100) (200)

Sale of tangible fixed assets 7,434 35

---------- ----------

Net cash inflow/(outflow) from capital expenditure

and financial investment 3,176 (3,338)

---------- ----------

Acquisitions and disposals

Purchase of subsidiary undertakings - (4,459)

Net overdraft acquired with subsidiary

undertakings - (2,371)

---------- ----------

Net cash outflow from acquisitions and disposals - (6,830)

---------- ----------

Equity dividends paid (182) (1,476)

---------- ----------

Cash inflow/(outflow) before use of liquid

resources and financing 5,759 (12,222)

---------- ----------

Financing

Expenses paid in connection with share issues - (715)

Loans repaid (7,600) -

Finance lease capital payments (500) (502)

New loans 2,796 7,428

---------- ----------

Net cash (outflow)/inflow from financing (5,304) 6,211

---------- ----------

Increase/(decrease) in cash in the year 455 (6,011)

====== ======

All cash flows relate to continuing activities.

Notes to the Accounts

1 STATUTORY ACCOUNTS FOR 1999

The financial information contained in these Preliminary Results does not

constitute statutory accounts as defined in Section 240 of the Companies Act

1985. The information for the years ended 31 December 1999 and 1998 is

extracted from the audited accounts for the year ended 31 December 1999,

which will be filed with the Registrar of Companies shortly, and upon which

the Auditors have expressed an unqualified opinion.

2 TURNOVER AND PROFIT BEFORE TAX AND NET ASSETS

Segmental Information

1999 1998

#'000 #'000

---------- ----------

a) Turnover

By destination - United Kingdom 55,086 58,494

- Rest of Europe 41,491 31,005

- North America 14,775 16,922

- Rest of World 1,840 1,182

---------- ----------

113,192 107,603

====== ======

By origin - United Kingdom 59,391 69,300

- Rest of Europe 38,559 21,945

- North America and Asia 15,242 16,358

---------- ----------

113,192 107,603

====== ======

b) (Loss)/profit before tax by origin

United Kingdom (4,019) 2,629

Rest of Europe 230 610

North America and Asia (155) 491

---------- ----------

(3,944) 3,730

====== ======

c) Net assets by location

United Kingdom 20,319 23,250

Rest of Europe 11,916 13,401

North America and Asia 1,550 1,752

---------- ----------

33,785 38,403

====== ======

The Directors consider that the Group has only one class of business and

consequently no further analysis of turnover or profit is given.

3 (LOSS)/EARNINGS PER SHARE

Basic (loss)/earnings per Ordinary Share is calculated by dividing the loss

after taxation and minority interests of #4,274,000 by 139,364,613 (1998:

profit of #2,122,000 by 129,199,267) being the weighted average number of

Ordinary Shares of 10 pence each in issue during the year after taking

account of the purchase of Ordinary Shares by the Employee Share Ownership

Plan (ESOP).

In view of the significant impact of the amorisation of goodwill on earnings

per share calculated in accordance with Financial Reporting Standard 14 -

Earnings per Share, an adjusted earnings per share figure has been provided.

The adjusted basic (loss)/earnings per Ordinary Share is calculated by

dividing the loss after taxation and minority interests (#4,274,000) and

before amortisation of goodwill (#499,000) by 139,364,613 (1998: #2,288,000

by 129,199,267) being the weighted average number of Ordinary Shares of 10

pence each in issue during the year.

A reconciliation of basic (loss)/earnings per share with adjusted basic

(loss)/earnings per share is as follows:

1999 Number Pence 1998 Number Pence

#'000 of shares per #'000 of shares per

share share

-------- -------- ------ -------- -------- -----

Basic (loss)/earnings

per Ordinary Share (4,274) 139,364,613 (3.07p) 2,122 129,199,267 1.64p

Eliminate amortisation

of goodwill 499 - 0.36p 166 - 0.13p

-------- -------- ------ -------- -------- -----

Adjusted basic

(loss)/earnings per

Ordinary Share (3,775) 139,364,613 (2.71p) 2,288 129,199,267 1.77p

======== ======== ====== ======= ======== =====

No dilution arises as a result of the share options in issue, as the value at

which they were granted is in excess of both the market price at 31 December

1999 and the average market price for the year, and therefore no options

would be exercised. Accordingly the diluted (loss)/earnings per share is

identical to the basic earnings per share as stated above.

4 TAXATION ON (LOSS)/PROFIT ON ORDINARY ACTIVITIES

1999 1998

#'000 #'000

---------- ----------

United Kingdom corporation tax on

(loss)/profit on ordinary activities at 30% (520) 853

Overseas taxation 645 629

---------- ----------

125 1,482

====== ======

The Group has taxable losses of #1,400,000 (1998: #nil) available for offset

against future UK taxable profits.

5 RECONCILIATION OF OPERATING (LOSS)/PROFIT TO NET CASH FLOW FROM

OPERATING ACTIVITIES

1999 1998

#'000 #'000

---------- ----------

Operating (loss)/profit (1,989) 6,039

Depreciation of fixed assets 783 637

Amortisation of trademarks 44 15

Amortisation of goodwill 499 166

Loss/(profit) on sale of tangible fixed assets 12 (2)

Decrease in stocks 6,032 2,550

Decrease/(increase) in debtors 4,217 (1,391)

Decrease in creditors (5,374) (2,951)

Exchange movements in respect of

foreign undertakings (54) (157)

---------- ----------

Net cash inflow from operating activities 4,170 4,906

====== ======

6 RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET

DEBT

1999 1998

#'000 #'000

---------- ----------

Increase/(decrease) in cash in the year 455 (6,011)

Cash outflow/(inflow) from decrease in debt

and lease financing 5,304 (6,926)

---------- ----------

Changes in net funds resulting from cash flows 5,759 (12,937)

Loans and finance leases acquired with

subsidiaries - (898)

Foreign exchange movements 729 -

New finance leases (288) (693)

---------- ----------

Movement in net debt 6,200 (14,528)

---------- ----------

Net debt at 1 January 1999 (28,050) (13,522)

Movement in net debt 6,200 (14,528)

---------- ----------

Net debt at 31 December 1999 (21,850) (28,050)

====== ======

7 ANALYSIS OF CHANGES IN NET DEBT

At Foreign Other At

1 January Exchange non-cash 31 December

1999 Cash flows movements movements 1999

#'000 #'000 #'000 #'000 #'000

---------- ---------- --------- --------- ----------

Cash at bank and

in hand 775 989 (22) - 1,742

Overdrafts (19,872) (534) 71 - (20,335)

---------- ---------- --------- --------- ----------

(19,097) 455 49 - (18,593)

---------- ---------- --------- --------- ----------

Debt due within one year

Bank loan (1,921) 1,032 178 - (711)

Finance lease

obligations (356) 141 - (59) (274)

---------- ---------- --------- --------- ----------

(2,277) 1,173 178 (59) (985)

---------- ---------- --------- --------- ----------

Debt due after one year

Bank loan (6,405) 3,772 502 - (2,131)

Finance lease

obligations (271) 359 - (229) (141)

---------- ---------- --------- --------- ----------

(6,676) 4,131 502 (229) (2,272)

---------- ---------- --------- --------- ----------

Net debt (28,050) 5,759 729 (288) (21,850)

====== ====== ====== ====== ======

8 ANNUAL REPORT AND ACCOUNTS

Copies of the Report and Accounts are being mailed to shareholders shortly

and will be made available upon request to members of the public at the

Company's registered office at United House, Shrewsbury Avenue, Woodston,

Peterborough, PE2 7BZ.

END

FR KKAKBFBKDNQB

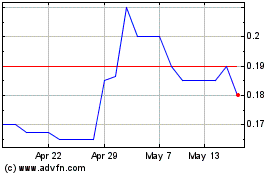

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Nov 2024 to Dec 2024

United Oil & Gas (LSE:UOG)

Historical Stock Chart

From Dec 2023 to Dec 2024