TIDMTUNE

RNS Number : 8472L

Focusrite PLC

24 April 2018

Strictly embargoed until 07:00: 24 April 2018

Focusrite Plc ("Focusrite" or "the Group")

Half Year Results for the period ended 28 February 2018

Focusrite Plc, the global music and audio products company

supplying hardware and software products used by professional and

amateur musicians, today announces its Half Year Results for the

six months ended 28 February 2018.

Financial highlights

-- Group revenue up by 21.2% (26% at constant currency(1) ) to

GBP38.8 million (HY17: GBP32.0 million)

-- EBITDA(2) up by 30.0% to GBP8.0 million (HY17: GBP6.1

million)

-- Operating profit up by 36.3% to GBP6.2 million (HY17: GBP4.6

million)

-- Profit before tax up by 26.8% to GBP5.8 million (HY17: GBP4.6

million)

-- Basic earnings per share up 23.3% to 9.0p (HY17: 7.3p)

-- Diluted earnings per share up by 27.1% to 8.9p (HY17:

7.0p)

-- Free cash flow(3) up by 49.7% to GBP6.4 million (HY17: GBP4.3

million)

-- Net cash of GBP19.7 million (FY17: GBP14.2 million, HY17:

GBP9.4 million)

-- Interim dividend of 1.0 pence, up 33.3% from 0.75 pence in

HY17

Operational highlights

-- Revenue growth in all major regions and across both the

Focusrite and Novation segments

-- R&D remains core: five new products launched and five

software upgrades

-- New Focusrite Professional initiative progressing well

-- Strong Christmas holiday season for the more consumer-priced

products

-- Within Novation, sales of synthesizers up 90% as our new

flagship, PEAK, has gained wide recognition

-- Cumulative downloads of apps now up to 8.5 million with over

500,000 active users

-- Increased localisation of our eCommerce store, especially in

areas less well-served by resellers

-- Queen's Award for Innovation 2018; fourth time the Group has

received a Queen's Award

Tim Carroll, Chief Executive Officer, commented:

"Our strategy of innovation and expansion continues to underpin

our growth and we remain committed to making music easier to make

for professionals and hobbyists alike. Our success is driven by our

entrepreneurial and talented team, many of whom are themselves

musicians, and their skill and loyalty is the bedrock of our

success.

I am delighted with the Group's performance in the first half

which benefited from an especially strong Christmas holiday season.

Since the half year end, revenue and cash have continued to grow

although, as expected, at a slower rate than in the first half. We

remain confident about the outlook for the rest of the year and

beyond: future product plans are taking shape, the geographic

expansion continues and the strategy developments are bearing

fruit."

Philip Dudderidge, Executive Chairman, added:

"It has been a great first six months. We have again increased

revenue in all of our major regions and across all of our product

ranges, and the whole team should be congratulated. I am

particularly honoured that we have been awarded our fourth Queen's

Award this April. The playing and recording of music is such a

great positive force and I am so pleased that this continues to

grow across the world, with Focusrite at its core."

(1) Where we make reference to constant currency growth rates,

these are prepared by retranslating the current year revenues using

the average exchange rates that prevailed in the prior year rather

than the actual exchange rates that applied in the current

year.

(2) Comprising of earnings adjusted for interest, taxation,

depreciation and amortization. This is shown on the face of the

income statement.

(3) Free cash flow equals net cash inflow from operating

activities less net cash used in investing activities.

Dividend timetable

The timetable for the interim dividend is as follows:

3 May 2018 Ex-dividend Date

4 May 2018 Record Date

30 May 2018 Dividend payment date

Enquiries:

Focusrite Plc: +44 1494 836301

Tim Carroll (CEO)

Jeremy Wilson (CFO)

Panmure Gordon +44 20 7886 2500

(Nominated Adviser and

Broker)

Freddy Crossley

Belvedere Communications +44 20 3567 0510

John West

Kim Van Beeck

The information communicated in this announcement contains

inside information for the purposes of Article 7 of the Market

Abuse Regulation (EU) No. 596/2014.

Notes to Editors

Focusrite plc is a global music and audio products group that

develops and markets proprietary hardware and software products.

Used by audio professionals and amateur musicians alike, its

solutions facilitate the high-quality production of recorded and

live sound. The Focusrite Group trades under four established and

rapidly growing brands: Focusrite, Focusrite Pro, Novation and

Ampify.

With a high-quality reputation and a rich heritage spanning

decades, its brands are category leaders in the music-making

industry. Focusrite and Focusrite Pro offer audio interfaces and

other products for recording musicians, producers and professional

audio facilities. Novation and Ampify products are used in the

creation of electronic music, from synthesisers and grooveboxes to

industry-shaping controllers and inspirational music-making

apps.

The Focusrite Group has a global customer base with a

distribution network covering approximately 160 territories.

Focusrite is headquartered in High Wycombe, UK, with marketing

offices in Los Angeles and Hong Kong. Focusrite plc is traded on

the AIM market, London Stock Exchange.

Business and operating review

Overview

Focusrite is pleased to report Half Year Results that show

continued strong organic growth across the business. Year-on-year

growth in the first half of the current financial year continued,

with revenue growing by 21.2%.

Total revenue for the period grew to GBP38.8 million (HY17:

GBP32.0 million), resulting in an operating profit of GBP6.2

million (HY17: GBP4.6 million), with EBITDA up to GBP8.0 million

(HY17: GBP6.1 million).

Revenue growth on a constant currency basis accelerated further

to 26% (HY17: 12%). The Group had an especially strong Christmas

holiday season for the more consumer-priced products. We also saw

the benefit of our focused efforts in previously identified

geographies with growth potential, and growth in our professional

product lines from our newly formed Professional division.

Research and development remains core to our strategy and a key

driver of our growth. During this half year, we introduced five new

products and delivered five upgrades to existing products.

Additionally, we delivered new tools focused on simplifying the new

user experience, thereby significantly reducing the actual time

between first contact with our products and making music. These

efforts have been well received by our customers and played a key

role in the strong performance reported today, especially for our

products and solutions aimed at the new user.

Sales grew in all major geographies and particularly in the USA.

We have invested resources into high-potential growth markets such

as Asia and Latin America which have begun generating significant

year-on-year gains. Additionally, we continue to grow in our other

more established markets such as the UK and mainland Europe.

Our strategy of innovation and expansion continues to underpin

our growth and we remain committed to making music easier to make

for professionals and hobbyists alike. Our success is driven by our

entrepreneurial and talented team, many of whom are themselves

musicians, and their skill and loyalty is the bedrock of our

success.

We will add more people globally to our sales, marketing,

engineering and product groups to support our future growth

plans.

Operating review

We continue to exceed our core growth KPI benchmarks and

consequently the Group continues to perform well both operationally

and financially. The management team is committed to pursuing its

stated goals of innovation; disruption; making music easier to

make; and expanding our addressable market. We have firmly

established ourselves as a market leader and our aim is to

capitalise further on this by continuing to excite and empower our

customers. By improving the product and customer experience, we

will seek to extend the customer lifecycle, encouraging them to use

our products longer throughout their music-making lifetime.

Segmental analysis - markets

Six months to Six months to Year to

28 February 2018 (unaudited) 28 February 2017 (unaudited) 31 August 2017 (audited)

--------------

GBP'000 GBP'000 GBP'000

-------------- ----------------------------------- ----------------------------------- -------------------------------

Continuing

operations

USA 16,123 13,246 27,990

Europe, Middle

East and

Africa 15,997 12,958 25,153

Rest of World 6,699 5,816 12,912

Consolidated

revenue 38,819 32,020 66,055

--------------- ----------------------------------- ----------------------------------- -------------------------------

Regionally, the USA grew by 34% on a constant currency basis.

This was driven by a number of factors, including continued success

and market share gain in our 2(nd) generation Scarlett series of

audio interfaces, as well as continued growth of our Launch

products for electronic musicians, and progress by our new

Focusrite Professional division into new vertical markets such as

post-production.

In Europe, Middle East and Africa, sales were up by 19% on a

constant currency basis. All of the major territories (UK, Germany

and mainland Europe) have experienced solid growth. Overall, we

have seen increased stabilisation in the market along with an

increased awareness and acceptance of our Focusrite and Novation

solutions.

The Rest of World grew at 26% on a constant currency basis, and

in particular Asia performed well showing a healthy increase

following our investment in a local office and the addition of more

people. We continue to invest more resources into regional

localisation and support to maintain our growth momentum.

eCommerce

The Group's eCommerce store, which launched in March 2016, now

accounts for over 1% of the Group's total revenue and this

continues to grow. In addition to providing a direct revenue

stream, the store creates improved conversion through all sales

channels. We have expanded this and it now ships a wider range of

products globally, with targeted regional strategies in place to

support operations. Part of our recent efforts include localisation

in Spanish, Korean and Japanese languages.

Segmental analysis - products

Six months to Six months to Year to

28 February 2018 28 February 2017 31 August 2017

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

-------------------------------- ------------------ --------------------------------- -----------------------------

Revenue from external customers

Focusrite 25,693 20,856 44,552

Novation 11,419 9,604 18,862

Distribution 1,707 1,560 2,641

Total 38,819 32,020 66,055

-------------------------------- ------------------ --------------------------------- -----------------------------

Alongside engineering, innovation is paramount to our success

and we continue to spend around 6% of annual revenue on research

and development to provide a constant pipeline of new and relevant

products for our various channels.

We launched five new products during the period: the Clarett USB

family (three products), Red 16 and Red X2P, as well as significant

software updates including those for Circuit, Launchpad, Groovebox

and BlocsWave. These new products and updates are across different

price segments and target customer markets, giving us further

penetration and reach. Feedback from the consumer, retailer and

distribution channels has been positive and acceptance so far has

been pleasing.

Focusrite

Among existing products, our 2(nd) generation Scarlett USB audio

interface range has continued to gain market share since its launch

in June 2016. The Clarett range has also seen solid growth of 28%

year on year, mostly driven by the launch of our USB range this

half year. Rednet and Red ranges have also grown as our newly

formed Focusrite Professional division begins netting strategic

sales wins in previously untargeted vertical markets such as the

post-production and broadcast sectors.

Novation

Launchpad, Novation's grid instrument that comes pre-loaded with

Ableton Live Lite software, continues to grow worldwide with

revenue increasing by 26% over the period. This is due, in part, to

a wider market acceptance of grid controllers, especially amongst

younger musicians, and the addition of more consumer electronic

partners added to the distribution channel. This move has created

greater reach into both new and existing mainstream audiences.

Online sales remain an area of importance for the Group, as we seek

to stay relevant to the way consumers shop and spend.

Additionally, within the Novation business the Synthesizer

category is up 90% year on year as our new flagship offering, PEAK,

establishes itself as a best-in-class solution for professionals in

electronic music.

Circuit, the inspirational grid-based groove box, continues to

build a foundation in the market. We are pleased with its progress

and are watching the groove box product space carefully to

ascertain how we should progress in this specific area.

The London Innovation division continues to disrupt the market

with a growing portfolio of innovative music-making software. The

new Ampify brand continues to drive awareness of music creation to

a vast new market of music creators, which in turn supports the

growth of the Focusrite and Novation brands. The suite of music

apps has now reached an impressive 8.5 million downloads, and this

number is increasing at around 200,000 per month. Software is a

crucial component of the business strategy to solve the problems of

music creation, increasing customer loyalty and overall lifetime

value.

Distribution

Focusrite's distribution of adjacent products, such as KRK

monitors and sE microphones, remains a small overall proportion of

Group revenue, but it is profitable and it remains important to us

as it offers add-on products within the music-making industry and

provides us with valuable market feedback, insight and

knowledge.

Financial review

Revenue and profit

Group revenue for the half year was GBP38.8 million, up 21.2% on

the previous year and up 26% on a constant currency basis. All

major product groups and geographical areas increased, with the

biggest increases in the Launch range of products (within the

Novation segment), which had a volume increase of 24%, and the

Scarlett range of products (within the Focusrite segment), which

had a volume increase of 38%.

The gross margin also increased to 41.7% (HY17: 40.1%), helped

by the stronger Euro and closer monitoring of the discounts given

to distributors and dealers. As explained at the last year end,

operating costs were increased in sales and marketing to support

the strategic initiatives around the professional products within

the Focusrite segment and the eCommerce sales channel. Operating

costs were increased by 20.4%. Taking these factors into account,

EBITDA for the period grew by 30.0% to GBP8.0 million (HY17: GBP6.1

million).

Capitalisation of research and development

The Group typically spends approximately 6% of its revenue on

research and development, developing future ranges of products. The

normal product life is between three and six years. Where costs can

be reliably assigned to a particular product, the costs are

capitalised and written-off over three years. Typically around 70%

of R&D costs are capitalised. The net income statement effect

of the capitalisation less the amortisation in the period was a

gain of GBP0.1 million (HY17: a gain of GBP0.3 million).

Foreign currency

Six months Six months

to to Year to

28 February 28 February 31 August

2018 2017 2017

Exchange rates

Average $:GBP 1.35 1.26 1.27

-------------------- ------------- ------------- -----------

Average EUR:GBP 1.13 1.16 1.16

-------------------- ------------- ------------- -----------

Period end $:GBP 1.38 1.24 1.29

-------------------- ------------- ------------- -----------

Period end EUR:GBP 1.13 1.17 1.09

-------------------- ------------- ------------- -----------

The movements in exchange rates were far smaller than in the

previous year. The US Dollar weakened by 7% and the Euro

strengthened marginally. The US Dollar accounts for approximately

60% of Group revenue (North America, Asia and Latin America) and

all of the purchases of product from Chinese contract

manufacturers. Therefore there is a substantial natural hedge in

place. Consequently, the 7% weakening of the US Dollar reduced

revenue but had little impact on profit.

The Euro accounts for approximately 25% of Group revenue with

very little related Euro cost. The Group has hedged approximately

2/3 of its Euro flows to convert them into Sterling at an average

rate of EUR1.12. Therefore the blended Euro exchange rate in the

period was EUR1.12 (HY17: EUR1.25).

The Group has hedged approximately 2/3 of the Euro cash flows

for the rest of this financial year (at an average rate of EUR1.12)

and approximately 25% of Euro cash flows for 2018/19 at an average

rate of EUR1.07.

The Group uses hedge accounting, meaning that the hedging

contracts have been matched to the associated income flows.

Therefore, provided that the hedge remains effective, movements in

the fair value of unexpired hedge contracts are shown in a hedging

reserve in the balance sheet.

Net financing charges

The net financing charges were GBP0.4 million (HY17: GBPnil) due

largely to the revaluation of bank balances held in US Dollars.

Profit before tax

Reported profit before tax grew to GBP5.8 million, up 26.8% on

the prior period (HY17: GBP4.6 million) driven by all of the

factors discussed above, most particularly the higher revenue and

the increased gross margin.

Tax

The standard rate of Corporation Tax in the UK is 19%. The Group

gains additional tax relief on the substantial research and

development effort, which reduces the effective tax rate to 12%

(HY17: 12%).

Profit after tax and earnings per share

Profit after tax was GBP5.1 million, up 26.6% on the prior year

(HY17: GBP4.0 million).

The reported basic earnings per share increased by 23.3% to 9.0

pence (HY17: 7.3 pence). This was lower than the increase in the

profit after tax because the number of shares in issue was

increased due largely to the vesting of 1.4 million options which

were satisfied out of the Employee Benefit Trust.

A much smaller number of new share options was issued during the

period so the diluted earnings per share increased by 27.1% to 8.9

pence (HY17: 7.0 pence), a rate similar to the increase in profit

before tax.

Balance sheet

Non-current assets totalled GBP6.6 million (28 February 2017:

GBP6.7 million). These are mainly capitalised research and

development costs and during the period capitalised R&D costs

were similar to the amortisation.

Stock as at 28 February 2018 was GBP10.9 million (28 February

2017: GBP10.1 million). This 7% increase compares well with the 21%

increase in revenue, signalling the continued positive efforts to

manage stock carefully whilst ensuring that the business has the

ability to satisfy customer demand.

Debtors totalled GBP10.9 million (28 February 2017: GBP10.2

million). The Group has an effective credit control process

including credit limits and a potential refusal to supply if the

customer has overdue debts. At 28 February 2018 the debtors balance

represented 49 days' sales (28 February 2017: 51 days).

Trade and other payables increased to GBP9.1 million (28

February 2017: GBP6.4 million). This was due to the increased stock

purchases close to the period end.

Cash flow

The conversion of profit to cash has been strong with free cash

flow up 49.7% to GBP6.4 million (HY17: GBP4.3 million). In part,

this was assisted by control over the working capital. Normally, it

would be reasonable to assume an increase in working capital of

about 20% of the increase in revenue, driven by higher debtors and

a higher value of stock to service that demand. In this period, the

movement in working capital has been an inflow (decrease) of GBP1.0

million (HY17: GBPnil), due to a reduction in debtors since the

prior year end.

Overall, cash flow from operating activities was 105% (HY17:

101%) of EBITDA and free cash flow was 16% of revenue (HY17: 13%).

Both of these measures have been strong; however, it should be

noted that the average of free cash flow as a percentage of revenue

since the IPO has been approximately 7%.

As a result of this cash generation, cash balances grew from

GBP14.2 million in August 2017 to GBP19.7 million as at 28 February

2018. It is intended that this will fund the Group's entry into

related market segments, which is a key element of the Group's

growth strategy.

Dividend

At the last year end, the Group announced that it would move

towards an ongoing dividend cover of 4-5x. Therefore, as a step

towards that, the interim dividend is raised by 33.3% from 0.75

pence to 1.0 pence per share.

Outlook and current trading

The first half benefited from an especially strong Christmas

holiday season. Since the half year end, revenue and cash have

continued to grow although, as expected, at a slower rate than in

the first half. We remain confident about the outlook for the rest

of the year and beyond: future product plans are taking shape, the

geographic expansion continues and the strategy developments are

bearing fruit.

Tim Carroll Jeremy Wilson

Chief Executive Officer Chief Financial Officer

Condensed Consolidated Income Statement

For the six months ended 28 February 2018

Six months to Six months to Year to

Note 28 February 2018 28 February 2017 31 August 2017

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------------------------------------- ------- ------------------ ------------------ ----------------

Revenue 2 38,819 32,020 66,055

Cost of sales (22,619) (19,165) (39,704)

------------------------------------------- ------- ------------------ ------------------ ----------------

Gross profit 16,200 12,855 26,351

Administrative expenses (9,970) (8,284) (16,881)

EBITDA (non-GAAP measure) 7,969 6,131 13,109

Depreciation and amortisation (1,739) (1,560) (3,639)

Operating profit 6,230 4,571 9,470

Finance income 1 52 86

Finance costs (398) (24) (44)

------------------------------------------- ------- ------------------ ------------------ ----------------

Profit before tax 5,833 4,599 9,512

Income tax expense 4 (709) (552) (959)

------------------------------------------- ------- ------------------ ------------------ ----------------

Profit for the period from continuing operations 5,124 4,047 8,553

---------------------------------------------------- ------------------ ------------------ ----------------

Earnings per share

From continuing operations

Basic (pence per share) 6 9.0 7.3 15.4

------------------------------------------- ------- ------------------ ------------------ ----------------

Diluted (pence per share) 6 8.9 7.0 14.8

------------------------------------------- ------- ------------------ ------------------ ----------------

Condensed Consolidated Statement of Other Comprehensive

Income

For the six months ended 28 February 2018

Six months to Six months to Year to

28 February 2018 28 February 2017 31 August 2017

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

----------------------------------------------------- ------------------ ------------------ ----------------

Profit for the period 5,124 4,047 8,553

Items that may be reclassified subsequently to the income statement

Exchange differences on translation of foreign

operations (30) 29 (8)

Gain/(loss) on forward foreign exchange contracts

designated and effective as a hedging instrument 743 700 659

Tax on hedging instrument (144) (142) (134)

------------------------------------------------------ ------------------ ------------------ ----------------

Total comprehensive income for the period 5,693 4,634 9,070

------------------------------------------------------ ------------------ ------------------ ----------------

Profit attributable to:

Equity holders of the Company 5,693 4,634 9,070

------------------------------------------------------ ------------------ ------------------ ----------------

5,693 4,634 9,070

----------------------------------------------------- ------------------ ------------------ ----------------

Condensed Consolidated Statement of Financial Position

Note 28 February 2018 28 February 2017 31 August 2017

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

---------------------------------------------- ----- ------------------ ------------------ ----------------

Assets

Non-current assets

Goodwill 419 419 419

Other intangible assets 4,818 4,823 4,544

Property, plant and equipment 1,369 1,502 1,369

---------------------------------------------- ----- ------------------ ------------------ ----------------

Total non-current assets 3 6,606 6,744 6,332

---------------------------------------------- ----- ------------------ ------------------ ----------------

Current assets

Inventories 10,894 10,145 8,334

Trade and other receivables 10,811 10,234 12,952

Derivative financial instruments 7 258 - -

Cash and cash equivalents 7 19,734 9,391 14,174

---------------------------------------------- ----- ------------------ ------------------ ----------------

Total current assets 41,697 29,770 35,460

---------------------------------------------- ----- ------------------ ------------------ ----------------

Total assets 48,303 36,514 41,792

---------------------------------------------- ----- ------------------ ------------------ ----------------

Equity and liabilities

Capital and reserves

Share capital 58 58 58

Share premium 114 - -

Merger reserve 14,595 14,595 14,595

Merger difference reserve (13,147) (13,147) (13,147)

Translation reserve 1 68 31

Hedging reserve 210 (356) (389)

Treasury reserve (2) (3) (3)

Retained earnings 36,451 27,428 31,739

Equity attributable to owners of the Company 38,280 28,643 32,884

---------------------------------------------- ----- ------------------ ------------------ ----------------

Total equity 38,280 28,643 32,884

---------------------------------------------- ----- ------------------ ------------------ ----------------

Current liabilities

Trade and other payables 9,126 6,390 7,720

Current tax liabilities 257 523 459

Derivative financial instruments 7 - 443 484

Total current liabilities 9,383 7,356 8,663

---------------------------------------------- ----- ------------------ ------------------ ----------------

Non-current liabilities

Deferred tax 640 515 245

Total liabilities 10,023 7,871 8,908

---------------------------------------------- ----- ------------------ ------------------ ----------------

Total equity and liabilities 48,303 36,514 41,792

---------------------------------------------- ----- ------------------ ------------------ ----------------

Condensed Consolidated Statements of Changes in Equity

For the six

months ended Merger Treasury

28 February Share Share Merger difference Translation Hedging share Retained

2018 capital premium reserve reserve reserve reserve reserve(1) earnings(2) Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

September

2017 58 - 14,595 (13,147) 31 (389) (3) 31,739 32,884

--------------- -------- -------- -------- ----------- ------------ -------- ----------- ------------ --------

Profit for the

period - - - - - - - 5,124 5,124

Other

comprehensive

income for

the period - - - - (30) 599 - - 569

--------------- -------- -------- -------- ----------- ------------ -------- ----------- ------------ --------

Total

comprehensive

income for

the period - - - - (30) 599 - 5,124 5,693

--------------- -------- -------- -------- ----------- ------------ -------- ----------- ------------ --------

Transactions

with owners of

the Company:

Share-based

payment

deferred tax

deduction in

excess of

remuneration

expense - - - - - - - (254) (254)

Share-based

payment

current tax

deduction in

excess of

remuneration

expense - - - - - - - 661 661

Shares from

EBT exercised - - - - - - 1 188 189

New shares

issued - 114 - - - - - - 114

Share-based

payments - - - - - - 103 103

Dividends paid - - - - - - - (1,110) (1,110)

Balance at 28

February 2018 58 114 14,595 (13,147) 1 210 (2) 36,451 38,280

--------------- -------- -------- -------- ----------- ------------ -------- ----------- ------------ --------

(1) The reserve for the Company's treasury shares comprises the

cost of the Company's shares held by the Group. At 28 February

2018, the Employee Benefit Trust held 1,188,025 of the Company's

shares (six months ended 28 February 2017: 2,586,845).

(2) Of the retained earnings totalling GBP36,451,000, GBP615,000

(28 February 2017: GBP421,000) relates to the gain on exercise of

share options from the EBT and is therefore non-distributable.

Condensed Consolidated Statements of Changes in Equity

(Continued)

For the six

months ended Merger Treasury

28 February Share Merger difference Translation Hedging share Retained

2017 capital reserve reserve reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

September

2016 58 14,595 (13,147) 39 (914) (5) 23,251 23,877

--------------- ------------ ----------- ----------- ------------ ----------- ----------- ----------- --------

Profit for the

period - - - - - - 4,047 4,047

Other

comprehensive

income for

the period - - - 29 558 - - 587

--------------- ------------ ----------- ----------- ------------ ----------- ----------- ----------- --------

Total

comprehensive

income for

the period - - - 29 558 - 4,047 4,634

--------------- ------------ ----------- ----------- ------------ ----------- ----------- ----------- --------

Transactions with owners of the Company:

Share-based

payment

deferred tax

deduction in

excess of

remuneration

expense - - - - - - (30) (30)

Share-based

payment

current tax

deduction in

excess of

remuneration

expense - - - - - - 556 556

Shares from

EBT exercised - - - - - 2 250 252

Share-based

payments - - - - - - 75 75

Dividends paid - - - - - - (721) (721)

Balance at 28

February 2017 58 14,595 (13,147) 68 (356) (3) 27,428 28,643

--------------- ------------ ----------- ----------- ------------ ----------- ----------- ----------- --------

Condensed Consolidated Statements of Changes in Equity

(Continued)

For the year Merger Treasury

ended 31 Share Merger difference Translation Hedging share Retained

August 2017 capital reserve reserve reserve reserve reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1

September

2016 58 14,595 (13,147) 39 (914) (5) 23,251 23,877

--------------- ------------ ----------- ----------- ------------ ----------- ----------- ----------- --------

Profit for the

period - - - - - - 8,553 8,553

Other

comprehensive

income for

the period - - - (8) 525 - - 517

--------------- ------------ ----------- ----------- ------------ ----------- ----------- ----------- --------

Total

comprehensive

income for

the period - - - (8) 525 - 8,553 9,070

--------------- ------------ ----------- ----------- ------------ ----------- ----------- ----------- --------

Transactions

with owners of

the Company:

Share-based

payment

deferred tax

deduction in

excess of

remuneration

expense - - - - - - 114 114

Share-based

payment

current tax

deduction in

excess of

remuneration

expense - - - - - - 558 558

Shares from

EBT exercised - - - - - 2 256 258

Share-based

payments - - - - - - 145 145

Dividends paid - - - - - - (1,138) (1,138)

Balance at 31

August 2017 58 14,595 (13,147) 31 (389) (3) 31,739 32,884

--------------- ------------ ----------- ----------- ------------ ----------- ----------- ----------- --------

Consolidated Statement of Cash Flow

For the six months ended 28 February 2018

Six months to Six months to Year to

28 February 2018 28 February 2017 31 August 2017

GBP'000 GBP'000 GBP'00

Cash flows from operating activities

Profit for the period 5,124 4,047 8,553

Adjustments for:

Income tax expense 709 552 959

Net finance charge/(income) 397 (28) (42)

Loss/(profit) on disposal of property, plant and

equipment - 8 (8)

Amortisation of intangibles 1,399 1,198 2,950

Depreciation of property, plant and equipment 340 362 689

Share-based payment charge 103 75 145

Operating cash flow before movements in working capital 8,072 6,214 13,246

Decrease/(increase) in trade and other receivables 2,141 990 (1,728)

(Increase)/decrease in inventories (2,560) 1,216 3,027

Increase/(decrease) in trade and other payables 1,406 (2,222) (892)

Operating cash flow before interest and tax paid 9,059 6,198 13,653

Net interest paid (29) (22) (42)

Income tax paid (253) (56) (633)

Cash generated by operations 8,777 6,120 12,978

Net foreign exchange movement (397) 78 84

Net cash inflow from operating activities 8,380 6,198 13,062

---------------------------------------------------------- ------------------ ------------------ ----------------

Cash flows from investing activities

Purchases of property, plant and equipment (340) (299) (493)

Development of intangible assets (1,673) (1,645) (3,121)

---------------------------------------------------------- ------------------ ------------------ ----------------

Net cash used in investing activities (2,013) (1,944) (3,614)

---------------------------------------------------------- ------------------ ------------------ ----------------

Cash flows from financing activities

Issue of equity shares 303 252 258

Equity dividends paid (1,110) (721) (1,138)

Net cash used in financing activities (807) (469) (880)

---------------------------------------------------------- ------------------ ------------------ ----------------

Net increase in cash and cash equivalents 5,560 3,785 8,568

Cash and cash equivalents at beginning of the period 14,174 5,606 5,606

---------------------------------------------------------- ------------------ ------------------ ----------------

Cash and cash equivalents at end of the period 19,734 9,391 14,174

Notes to the Condensed Consolidated Interim Financial

Statements

1. Basis of preparation and significant accounting policies

Focusrite Plc (the 'Company') is a company incorporated in the

UK. The condensed consolidated interim financial statements

('interim financial statements') as at and for the six months ended

28 February 2018 comprised the Company and its subsidiaries

(together referred to as the 'Group').

The Group is a business engaged in the development, manufacture

and marketing of professional audio and electronic music

products.

Statement of compliance

The interim financial statements are for the six months ended 28

February 2018 and are presented in pounds Sterling ('GBP'). This is

the functional currency of the Group. The statement is presented to

the nearest GBP1,000 ("GBP'000"). The interim financial report has

been prepared in accordance with the International Financial

Reporting Standards ('IFRS'), International Accounting Standards

('IAS') and interpretations currently endorsed by the International

Accounting Standards Board ('IASB') and its committees as adopted

by the EU and as required to be adopted by AIM listed companies.

AIM listed companies are not required to comply with IAS 34

'Interim Financial Reporting' and accordingly the Company has taken

advantage of this exemption. They do not include all the

information required for a complete set of IFRS financial

statements. However, selected explanatory notes are included to

explain events and transactions that are significant to an

understanding of the changes in the Group's financial position and

performance since the last annual consolidated financial statements

as at and for the year ended 31 August 2017.

These interim financial statements were authorised for issue by

the Company's Board of Directors on 24 April 2018.

Significant accounting policies

The interim financial statements have been prepared in

accordance with the accounting policies adopted in the Group's

financial statements for the year ended 31 August 2017.

1.1 Basis of consolidation

The consolidated financial statements comprise the financial

statements of the Company and subsidiaries controlled by the

Company drawn up to 28 February 2018.

1.2 Subsidiaries

Subsidiaries are entities controlled by the Group. Control

exists when the Group has the power to govern the financial and

operating policies of an entity so as to obtain benefits from its

activities. In assessing control, the Group takes into

consideration potential voting rights that are currently

exercisable. The acquisition date is the date on which control is

transferred to the acquirer. The financial statements of

subsidiaries are included in the consolidated financial statements

from the date that control commences until the date control

ceases.

1.3 Going concern

The Board of Directors have a reasonable expectation that the

Company and the Group have adequate resources to continue in

operational existence for the foreseeable future. Accordingly, the

financial statements have been prepared on a going concern

basis.

1.4 Earnings per share

The Group presents basic and diluted earnings per share ('EPS')

data for its ordinary shares. Basic EPS is calculated by dividing

the profit attributable to ordinary shareholders by the weighted

average number of ordinary shares outstanding during the period.

For diluted EPS, the weighted average number of ordinary shares is

adjusted for the dilutive effect of potential ordinary shares

arising from the exercise of granted share options.

1.5 Accounting estimates and judgements

In application of the Group's accounting policies, the Directors

are required to make judgements, estimates and assumptions about

the carrying amounts of assets and liabilities that are not readily

apparent from other sources. The estimates and associated

assumptions are based on historical experience and other factors

that are considered to be relevant. Actual results may differ from

these estimates.

In preparing these condensed consolidated interim financial

statements, the significant judgements made by the Directors in

applying the Group's accounting policies and key sources of

estimation uncertainty were the same as those applied to the

Group's financial statements for the year ended 31 August 2017.

1.6 Foreign currencies

The individual financial statements of each subsidiary are

presented in the currency of the primary economic environment in

which it operates (its functional currency). Sterling is the

predominant functional currency of the Group and presentation

currency for the consolidated financial information.

In preparing the financial statements of the individual

companies, transactions in currencies other than the entity's

functional currency (foreign currencies) are recognised at the

rates of exchange prevailing on the dates of the transactions. At

each balance sheet date, monetary assets and liabilities that are

denominated in foreign currencies are retranslated at the rates

prevailing at that date. Non-monetary items carried at fair value

that are denominated in foreign currencies are translated at the

rates prevailing at the date when the fair value was determined.

Non-monetary items that are measured in terms of historical cost in

a foreign currency are not retranslated.

Exchange differences are recognised in profit or loss in the

period in which they arise except for:

-- Exchange differences on transactions entered into to hedge certain foreign currency risks

-- Exchange differences on monetary items receivable from or

payable to a foreign operation for which settlement is neither

planned nor likely to occur (therefore forming part of the net

investment in the foreign operation), which are recognised

initially in other comprehensive income and reclassified from

equity to profit or loss on disposal or partial disposal of the net

investment.

For the purpose of presenting consolidated financial

information, the assets and liabilities of the Group's foreign

operations are translated at exchange rates prevailing on the

balance sheet date. Income and expense items are translated at the

average exchange rates for the period, unless exchange rates

fluctuate significantly during that period, in which case the

exchange rates at the date of the transactions are used. Exchange

differences arising, if any, are recognised in the income

statement.

1.7 Hedge accounting

For the year ended 31 August 2016 and subsequent years, the

Group has adopted hedge accounting for qualifying transactions.

Derivatives are initially recognised at fair value at the date a

derivative contract is entered into and are subsequently remeasured

to their fair value at each balance sheet date. The resulting gain

or loss is recognised in profit or loss immediately unless the

derivative is designated and effective as a hedging instrument, in

which event the timing of the recognition in profit or loss depends

on the nature of the hedge relationship. The Group designates

certain derivatives as either hedges of the fair value of

recognised assets or liabilities of firm commitments (fair value

hedges), hedges of highly probable forecast transactions or hedges

of foreign currency risk of firm commitments (cash flow hedges), or

hedges of net investments in foreign operations.

Cash flow hedges

Where a derivative financial instrument is designated as a hedge

of the variability in cash flows of a recognised asset or

liability, or a highly probable forecast transaction, the effective

part of any gain or loss on the derivative financial instrument is

recognised directly in the hedging reserve. Any ineffective portion

of the hedge is recognised immediately in the income statement.

For cash flow hedges, the associated cumulative gain or loss is

removed from equity and recognised in the income statement in the

same period or periods during which the hedged forecast transaction

affects profit or loss.

When a hedging instrument expires or is sold, terminated or

exercised, or the entity revokes designation of the hedge

relationship but the hedged forecast transaction is still expected

to occur, the cumulative gain or loss at that point remains in

equity and is recognised in accordance with the above policy when

the transaction occurs. If the hedged transaction is no longer

expected to take place, the cumulative unrealised gain or loss

recognised in equity is recognised in the income statement

immediately.

A derivative with a positive fair value is recognised as a

financial asset whereas a derivative with a negative fair value is

recognised as a financial liability.

2. Revenue

An analysis of the Group's revenue is as follows:

Six months to

28 February 2018 Six months to Year to

(unaudited) 28 February 2017 (unaudited) 31 August 2017 (audited)

-----------------

GBP'000 GBP'000 GBP'000

----------------- --------------------- ------------------------------------- ----------------------------------

Continuing

operations

USA 16,123 13,246 27,990

Europe, Middle

East and Africa 15,997 12,958 25,153

Rest of World 6,699 5,816 12,912

Consolidated

revenue 38,819 32,020 66,055

------------------ --------------------- ------------------------------------- ----------------------------------

3. Operating segments

Products and services from which reportable segments derive

their revenues

Information reported to the Group's Chief Executive Officer (who

has been determined to be the Group's Chief Operating Decision

Maker) for the purposes of resource allocation and assessment of

segment performance is focused on the main product groups which the

Group sells. The Group's reportable segments under IFRS 8 are

therefore as follows:

Focusrite - Sales of Focusrite and Focusrite Pro branded

products

Novation - Sales of Novation and Ampify branded products

Distribution - Distribution of third party brands, including

KRK

speakers, Stanton, Cerwin Vega, Cakewalk and sE Electronics

The revenue and profit generated by each of the Group's

operating segments are summarised as follows:

Six months to Six months to Year to

28 February 2018 28 February 2017 31 August 2017

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

---------------- ------------------------------------ -------------------------------------- -----------------------------------

Revenue from

external

customers

Focusrite 25,693 20,856 44,552

Novation 11,419 9,604 18,862

Distribution 1,707 1,560 2,641

Total 38,819 32,020 66,055

---------------- ------------------------------------ -------------------------------------- -----------------------------------

Segment profit

Focusrite 12,503 9,873 20,221

Novation 6,000 4,773 9,198

Distribution 481 434 711

---------------- ------------------------------------ -------------------------------------- -----------------------------------

18,984 15,080 30,130

Central

distribution

costs and

administrative

expenses (12,754) (10,509) (20,660)

---------------- ------------------------------------ -------------------------------------- -----------------------------------

Operating

profit 6,230 4,571 9,470

Finance income 1 52 86

Finance costs (398) (24) (44)

---------------- ------------------------------------ -------------------------------------- -----------------------------------

Profit before

tax 5,833 4,599 9,512

Tax (709) (552) (959)

Profit after

tax 5,124 4,047 8,553

---------------- ------------------------------------ -------------------------------------- -----------------------------------

Segment profit represents the profit earned by each segment

without allocation of the share of central administration costs,

including Directors' salaries, finance income and finance costs,

and income tax expense. This is the measure reported to the Group's

Chief Executive Officer for the purpose of resource allocation and

assessment of segment performance.

Central administration costs comprise principally the

employment-related costs and other overheads incurred by the Group.

Also included within central administration costs is the charge

relating to the share option scheme of GBP103,000 for the six-month

period to 28 February 2018 (six months to 28 February 2017:

GBP75,000; year to 31 August 2017: GBP145,000).

Segment net assets and other segment information

Management does not make use of segmental data relating to net

assets and other balance sheet information for the purposes of

monitoring segment performance and allocating resources between

segments. Accordingly, other than the analysis of the Group's

non-current assets by region shown below, this information is not

available for disclosure in the consolidated financial

information.

The Group's non-current assets, analysed by region, were as

follows:

28 February 2018 28 February 2017 31 August 2017

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

------------- ------------------------------------ ------------------------------------- ------------------------------

Non-current

assets

USA 99 59 52

Europe,

Middle East

and Africa 5,865 5,998 5,676

Rest of

World 642 687 604

Total

non-current

assets 6,606 6,744 6,332

------------- ------------------------------------ ------------------------------------- ------------------------------

4. Taxation

The tax charge for the six months to 28 February 2018 is based

on the estimated tax rate for the full year in each

jurisdiction.

5. Dividends

The following equity dividends have been declared:

Year to

Six months to Six months to 31 August 2017

28 February 2018 (unaudited) 28 February 2017 (unaudited) (audited)

--------------------------------- ------------------------------- ------------------------------- -----------------

Dividend per qualifying ordinary

share 1.00p 0.75p 2.70p

--------------------------------- ------------------------------- ------------------------------- -----------------

During the period, the Company paid a final dividend in respect

of the year ended 31 August 2017 of 1.95 pence per share, amounting

to GBP1,110,000.

6. Earnings per share

Reported earnings per share

The calculation of the basic and diluted earnings per share is

based on the following data:

Six months to Year to

28 February Six months to 31 August

2018 28 February 2017 2017

(unaudited) (unaudited) (audited)

Earnings GBP'000 GBP'000 GBP'000

--------------------------------------- ------------------------- ------------------------- -----------------------

Earnings for the purposes of basic and

diluted earnings per share being net

profit for the

period 5,124 4,047 8,553

--------------------------------------- ------------------------- ------------------------- -----------------------

Six months to Six months to Year to

28 February 28 February 31 August

2018 2017 2017

number number number

Number of shares '000 '000 '000

--------------------------------------- ------------------------- ------------------------- -----------------------

Weighted average number of ordinary

shares for the purposes of basic

earnings per share calculation 56,690 55,298 55,432

Effect of dilutive potential ordinary

shares:

EMI share option scheme and unapproved

share option plan 1,151 2,356 2,357

Weighted average number of ordinary

shares for the purposes of diluted

earnings per share

calculation 57,841 57,654 57,789

--------------------------------------- ------------------------- ------------------------- -----------------------

Earnings per share Pence Pence Pence

--------------------------------------- ------------------------- ------------------------- -----------------------

Basic earnings per share 9.0 7.3 15.4

--------------------------------------- ------------------------- ------------------------- -----------------------

Diluted earnings per share 8.9 7.0 14.8

--------------------------------------- ------------------------- ------------------------- -----------------------

At 28 February 2018, the total number of ordinary shares issued

and fully paid was 58,111,639. This included 1,188,025 shares held

by the Employee Benefit Trust ('EBT') to satisfy options vesting in

future years. The operation of this Employee Benefit Trust is

funded by the Group so the EBT is required to be consolidated, with

the result that the weighted average number of ordinary shares for

the purpose of the basic earnings per share calculation is the net

of the weighted average number of shares in issue (58,094,838) less

the weighted average number of shares held by the Employee Benefit

Trust (1,405,082). It should be noted that the only right

relinquished by the Trustees of the Employee Benefit Trust is the

right to receive dividends. In all other respects, the shares held

by the Employee Benefit Trust have full voting rights.

The effect of dilutive potential ordinary share issues is

calculated in accordance with IAS 33 and arises from the employee

share options currently outstanding, adjusted by the profit element

as a proportion of the average share price during the period.

7. Financial instruments

The fair value of the Group's derivative financial instruments

is calculated using the quoted prices. Where such prices are not

available, a discounted cash flow analysis is performed using

applicable yield curve for the duration of the instruments for

non-optional derivatives, and option pricing model for optional

derivatives. Foreign currency forward contracts are measured using

quoted forward exchange rates and yield curves derived from quoted

interest rates matching maturities of the contract.

IFRS 13 Fair Value Measurements requires the Group's derivative

financial instruments to be disclosed at fair value and categorised

in three levels according to the inputs used in the calculation of

their fair value.

Financial instruments carried at fair value should be measured

with reference to the following levels:

-- Level 1: quoted prices (unadjusted) in active markets for

identical assets or liabilities;

-- Level 2: inputs other than quoted prices included within

Level 1 that are observable for the asset or

liability, either directly (i.e. as prices) or indirectly (i.e.

derived from prices); and

-- Level 3: inputs for the asset or liability that are not based

on observable market data (unobservable inputs).

The financial instruments held by the Group that are measured at

fair value all related to financial assets/(liabilities) measured

using a Level 2 valuation method.

The fair value of financial assets and liabilities held by the

Group are:

28 February 2018 28 February 2017 31 August 2017

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

---------------------------------------------------- -------------------------- ------------------ ----------------

Financial assets

Amortised cost

Cash and cash equivalents 19,734 9,391 14,174

Trade and other receivables 10,243 9,211 11,203

Designated cash flow hedge relationships

Derivative financial assets designated and

effective as cash flow hedging instruments 258 - -

30,235 18,602 25,377

---------------------------------------------------- -------------------------- ------------------ ----------------

Financial liabilities

Designated cash flow hedge relationships

Derivative financial liabilities designated and

effective as cash flow hedging instruments - 443 484

Amortised cost

Trade and other payables 8,861 3,468 4,042

---------------------------------------------------- -------------------------- ------------------ ----------------

8,861 3,911 4,526

---------------------------------------------------- -------------------------- ------------------ ----------------

Independent Review Report to Focusrite Plc

Conclusion

We have been engaged by the company to review the condensed set

of financial statements in the half-yearly report for the six

months ended 28 February 2018 which comprises the Condensed

Consolidated Income Statement, Condensed Consolidated Statement of

Other Comprehensive Income, Condensed Consolidated Statement of

Financial Position, Condensed Consolidated Statement of Changes in

Equity, Condensed Consolidated Statement of Cash Flow and the

related explanatory notes.

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly report for the six months ended 28 February 2018

is not prepared, in all material respects, in accordance with the

recognition and measurement requirements of International Financial

Reporting Standards (IFRSs) as adopted by the EU and the AIM

Rules.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity issued by the Auditing Practices Board for use in the

UK. A review of interim financial information consists of making

enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review

procedures. We read the other information contained in the

half-yearly report and consider whether it contains any apparent

misstatements or material inconsistencies with the information in

the condensed set of financial statements.

A review is substantially less in scope than an audit conducted

in accordance with International Standards on Auditing (UK) and

consequently does not enable us to obtain assurance that we would

become aware of all significant matters that might be identified in

an audit. Accordingly, we do not express an audit opinion.

Directors' responsibilities

The half-yearly report is the responsibility of, and has been

approved by, the directors. The directors are responsible for

preparing the half-yearly report in accordance with the AIM

Rules.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the EU.

The directors are responsible for preparing the condensed set of

financial statements included in the half-yearly financial report

in accordance with the recognition and measurement requirements of

IFRSs as adopted by the EU.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly report

based on our review.

The purpose of our review work and to whom we owe our

responsibilities

This report is made solely to the company in accordance with the

terms of our engagement. Our review has been undertaken so that we

might state to the company those matters we are required to state

to it in this report and for no other purpose. To the fullest

extent permitted by law, we do not accept or assume responsibility

to anyone other than the company for our review work, for this

report, or for the conclusions we have reached.

Peter Meehan

for and on behalf of KPMG LLP

Chartered Accountants

One Snowhill

Snow Hill Queensway

Birmingham

B4 6GH

24 April 2018

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR IJMRTMBITBFP

(END) Dow Jones Newswires

April 24, 2018 02:00 ET (06:00 GMT)

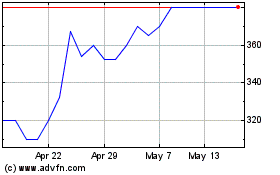

Focusrite (LSE:TUNE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Focusrite (LSE:TUNE)

Historical Stock Chart

From Jul 2023 to Jul 2024