Trading Emissions PLC Disposal - Librandello Sale (7648I)

September 02 2016 - 2:00AM

UK Regulatory

TIDMTRE

RNS Number : 7648I

Trading Emissions PLC

02 September 2016

Trading Emissions PLC

Librandello Sale

Trading Emissions PLC (the "Company") is pleased to announce the

sale of a portion of its Italian solar portfolio.

The Company's ultimately wholly owned subsidiary, TEP (Solar

Holdings) Limited ("TEPS"), has entered into a sales and purchase

agreement ("SPA") with a member of the Sonnedix group ("Sonnedix")

in respect of the sale of its entire interest in two Italian

subsidiaries, Etuno Srl and Solar Energy Italia 6 Srl (also known

as Librandello), comprising three ground-mounted solar photovoltaic

plants located in Basciano and Cupello in Abruzzo and Chiaramonte

Gulfi in Sicily respectively, with combined capacity of 11.2MW (the

"Investments").

The aggregate net proceeds from the sale of the Investments,

after allowing for transaction costs, are estimated to be EUR8.5

million. Under the terms of the SPA, completion and receipt of the

sales proceeds are subject to various conditions precedent being

fulfilled by TEPS no later than 14 December 2016. Of the payment by

Sonnedix at completion, EUR3 million will be deposited in escrow,

to be released to TEPS as to EUR1 million on the first anniversary

after completion and the remaining EUR2 million on the second

anniversary after completion, subject to no claims having been

received pursuant to indemnities provided by TEPS customary for

this type of transaction.

Sonnedix (http://www.sonnedix.com/) is an independent solar

power producer with plants at various stages of maturity located

globally, including Italy.

The Company was represented and advised in this transaction by

ValeCap Srl (http://www.valecap.com/) and Orrick, Herrington &

Sutcliffe LLP (http://www.orrick.com).

The Company's financial statements are prepared in accordance

with IFRS 10 and all subsidiaries are measured at fair value

through profit or loss. As the Investments were not consolidated

into the Company's financial statements for the periods ended 31

December 2015 and 30 June 2015, no operating profits or losses were

attributed to the Company. The Company disclosed in its interim

financial statements for the period ended 31 December 2015 a fair

value of its private equity portfolio of GBP16.1 million

(equivalent, at that date, to EUR21.8 million). The Investments

comprised part of the Company's private equity portfolio.

The net proceeds to be received by TEPS from Sonnedix will be

paid to the Company. In accordance with the Company's investment

policy, all cash not required to meet operating costs will be

distributed to shareholders.

Enquires:

FIM Capital Limited +44 (0) 1624 681250

(Philip Scales)

Liberum Capital Limited +44 (0) 20 3100 2222

(Steve Pearce/ Henry Freeman / Josh Hughes)

This information is provided by RNS

The company news service from the London Stock Exchange

END

DISLLFVAATILIIR

(END) Dow Jones Newswires

September 02, 2016 02:00 ET (06:00 GMT)

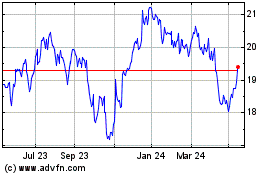

Ft Tre (LSE:TRE)

Historical Stock Chart

From Apr 2024 to May 2024

Ft Tre (LSE:TRE)

Historical Stock Chart

From May 2023 to May 2024