TIDMTPX

RNS Number : 1487Q

TPXimpact Holdings PLC

16 October 2023

16 October 2023

TPXimpact Holdings PLC

("TPX", "TPXimpact", or the "Company")

First Half Trading Update & Disposal of TPXimpact Norway

Strong first half trading in line with expectations; full year

targets reiterated

TPXimpact Holdings PLC (AIM: TPX), the technology-enabled

services company focused on people-powered digital transformation,

is pleased to provide an update on its first half trading for the

period ended 30 September 2023 ("H124") and announce the disposal

of TPXimpact Norway AS.

First Half Trading

The Group's strong trading performance in H124 has been

encouraging and in line with management expectations. The Board

expects to report first-half revenues of GBP41-42 million which

would equate to like-for-like(1) revenue growth of around 20% for

H124. Like-for-like(1) Adjusted EBITDA margins are expected to

increase to 4-5% in H124 from less than 3% in H123.

New business wins in H124 amounted to GBP105 million and the

pipeline for new business remains robust. Net debt (excluding lease

liabilities) was c. GBP13 million at 30 September 2023 (compared

with GBP17.9 million at 30 June 2023) and the Company has

comfortably satisfied its H124 banking covenants.

The Board expects to release the Group's interim results for

H124 in early December 2023 and will provide more detail in due

course.

Outlook

The Board reaffirms its FY24 targets of 15-20% like-for-like(1)

revenue growth and Adjusted EBITDA margins of 5-6%. These targets

would equate to FY24 revenue in the range of GBP80-85 million and

Adjusted EBITDA in the range of GBP4-5 million. Management are

targeting net debt (excluding lease liabilities) to be in the range

of GBP11-12 million at 31 March 2024 and, therefore, a net debt to

Adjusted EBITDA ratio of <2.5x by the end of the financial year,

or shortly thereafter.

The outlook for FY25 is also maintained with like-for-like

revenue growth of 10-15% and further margin improvement of 2-3% on

top of that achieved in FY24.

(1) Like-for-like performance excludes the Questers business

(sold on 15 September 2023) and TPXimpact Norway (sold on 13

October 2023) from H124 results and FY24 targets and comparative

figures.

Disposal of TPXimpact Norway AS

The Board has assessed the prospects of the TPXimpact Norway

business and concluded it is unlikely to contribute to the Group's

targets for revenue growth and margin improvement, in part due to a

lack of scale that introduces elevated risk in the event key

clients or staff are lost. The Group has therefore disposed of its

equity interests in TPXimpact Norway AS to companies controlled by

the following managing partners of TPXimpact Norway AS: Anders Rygh

(ARygh Holding AS), Geir Ødegård (Produco Invest 1 AS ) and Lars

Christian Torhaug (T5 Invest AS) for a nominal consideration of

GBP1.00. This disposal is considered a related party transaction

and the directors consider, having consulted with its nominated

adviser, that the terms of the transaction are fair and reasonable

insofar as its shareholders are concerned.

The disposal further reinforces the Board's strategy to simplify

the business and focus the Company on its core strengths of Digital

Transformation and Digital Experience in the UK, whilst de-risking

the Group's future performance.

TPXimpact Norway has 12 employees who provide strategic

consulting services to local clients in Norway. For the year ended

31 March 2023, TPXimpact Norway generated GBP2.0m of revenue,

GBP0.2m of Adjusted EBITDA and GBP0.2m of profit after tax. Gross

assets as at 31 March 2023 were GBP2.7m (including GBP1.9m of

goodwill and intangible assets).

Björn Conway, Chief Executive Officer at TPXimpact, said:

"I am pleased by the progress we have made in the first half of

the financial year in executing our strategy and three-year plan.

Trading has improved and we are beginning to achieve efficiencies

across the Group and capitalise on the sizeable market opportunity

available to the Group.

The disposal of TPXimpact Norway, as well as the recent sale of

Questers for GBP7.5 million, is firmly aligned with our strategic

vision for TPXimpact by enabling us to concentrate our resources

and energies around those prospects within the UK public sector and

broader digital transformation market where there is considerable

scope for further growth."

- Ends -

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) No 596/2014 as it forms part of UK

domestic law by virtue of the European Union (Withdrawal) Act 2018.

The person responsible for this announcement is Steve Winters,

Group CFO.

Enquiries:

TPXimpact Holdings PLC Via Alma PR

Bjorn Conway, Group CEO

Steve Winters, Group CFO

Stifel Nicolaus Europe Limited +44 (0) 207 710 7600

(Nomad and Joint Broker)

Fred Walsh

Ben Burnett

Dowgate Capital Limited

(Joint Broker)

James Serjeant

Russell Cook +44 (0) 203 903 7715

Alma PR +44 (0) 203 405 0209

(Financial PR) tpx@almapr.co.uk

Josh Royston

Kieran Breheny

Matthew Young

About TPXimpact

TPXimpact exists to transform the organisations, services and

systems that underpin society and that drive business success. It

applies strategic and creative thinking, technology, innovative

design and user-centred approaches to bring about numerous

improvements which together multiply the impact of change.

The Company works closely with its clients in agile,

multidisciplinary teams that span organisational design,

technology, and digital experiences. It shares a deep understanding

of people and behaviours and a philosophy of putting people and

communities at the heart of every transformation.

The business is being increasingly recognised as a leading

alternative digital transformation provider to the UK public

services sector, with 72% of its client base representing the

public sector and 28% representing the commercial sector in the

year ended 31 March 2023.

More information is available at www.tpximpact.com .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTZZMMGNKVGFZM

(END) Dow Jones Newswires

October 16, 2023 02:00 ET (06:00 GMT)

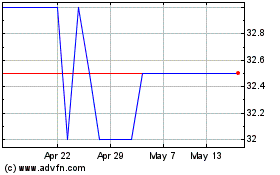

Tpximpact (LSE:TPX)

Historical Stock Chart

From Dec 2024 to Jan 2025

Tpximpact (LSE:TPX)

Historical Stock Chart

From Jan 2024 to Jan 2025