TIDMTLW

RNS Number : 1415U

Tullow Oil PLC

24 March 2023

TULLOW OIL PLC

Annual report and accounts

Tullow Oil plc ("Tullow" or the "Company")

24 March 2023 - Following the release on 8 March 2023 of the

Company's preliminary full year results announcement for the year

ended 31 December 2022 (the "Preliminary Announcement"), the

Company announces it has published its Annual Report and Accounts

for this period (the "Annual Report and Accounts").

A copy of the Annual Reports and Accounts are available to view

on the Company's website: www.tullowoil.com

The Company is also pleased to announce it has published its

Sustainability Report and Climate Risk & Resilience Report,

which is also available on the Company's website: www.tullowoil.com

.

The Company's 2023 Annual General Meeting will be held on

Wednesday 24 May 2023. The Notice of Meeting will be released at a

later date.

In accordance with Disclosure Guidance and Transparency Rule

6.3.5(2)(b), additional information is set out in the appendices to

this announcement. This information is extracted in full unedited

text from the Annual Report and Accounts.

The Preliminary Announcement included a set of condensed

financial statements and a fair review of the development and

performance of the business and position of the Company and its

group.

In accordance with Listing Rule 9.6.1, a copy of the Annual

Report and Accounts have been submitted to the Financial Conduct

Authority via the National Storage Mechanism and will be available

for viewing shortly at :

https://data.fca.org.uk/#/nsm/nationalstoragemechanism

In addition, all of the above documents have been submitted to

the Ghana Stock Exchange, and therefore will shortly be available

to shareholders located in Ghana by contacting the Company's

registrar: Central Securities Depository (GH) Limited, 4th Floor,

Cedi House, PMB CT 465 Cantonments, Accra, Ghana (Telephone: +233

(0)302 906 576).

CONTACTS

==================== ====================

Tullow Oil plc Camarco

(London) (London)

(+44 20 3249 9000) (+44 20 3781 9244)

Robert Hellwig Billy Clegg

Nicola Rogers Georgia Edmonds

Matthew Evans Rebecca Waterworth

==================== ====================

Notes to editors

Tullow is an independent oil & gas, exploration and

production group which is quoted on the London and Ghanaian stock

exchanges (symbol: TLW) and is a constituent of the FTSE250 index.

The Group has interests in over 30 licences across eight countries.

In March 2021, Tullow committed to becoming Net Zero on its Scope 1

and 2 emissions by 2030.

For further information, please refer to our website at

www.tullowoil.com .

Follow Tullow on:

Twitter: www.twitter.com/TullowOilplc

YouTube: www.youtube.com/TullowOilplc

Facebook: www.facebook.com/TullowOilplc

LinkedIn: www.linkedin.com/company/Tullow-Oil

Appendices

Appendix A : Directors' responsibility statement

The following directors' responsibility statement is extracted

from the Annual Report and Accounts (page 102).

Directors' responsibility statement required by DTR 4.1.12R

The Directors confirm, to the best of their knowledge:

- that the consolidated Financial Statements, prepared in

accordance with International Accounting Standards in conformity

with the requirements of the Companies Act 2006 and IFRSs adopted

pursuant to Regulation (EC) No.1606/2002 as it applies in the

European Union, give a true and fair view of the assets,

liabilities, financial position and profit of the Parent Company

and undertakings included in the consolidation taken as a

whole;

- that the Annual Report, including the Strategic Report,

includes a fair review of the development and performance of the

business and the position of the Company and undertakings included

in the consolidation taken as a whole, together with a description

of the principal risks and uncertainties that they face; and

- that they consider the Annual Report, taken as a whole, is

fair, balanced and understandable and provides the information

necessary for shareholders to assess the Company's position,

performance, business model and strategy.

By order of the Board

Rahul Dhir Richard Miller

Chief Executive Officer Chief Financial Officer

8 March 2023 8 March 2023

Appendix B: A description of the principal risks and uncertainties that the Company faces

The following description of the principal risks and

uncertainties that the Company faces is extracted from the Annual

Report and Accounts (pages 40 to 45).

Risk oversight and governance

A risk focused culture and consistent risk management framework

is embedded across all levels at Tullow and is driven by the Board.

The Board is responsible for overseeing the risk identification,

assessment and mitigation process. To this end, the Board

undertakes a bi-annual assessment of the risks facing the Company,

including those risks that could threaten our business strategy,

operating model, performance, solvency and liquidity. Emerging

risks are discussed by the Board and the Senior Leadership Team

periodically throughout the year.

The Board is responsible for ensuring Tullow maintains an

effective risk management and internal control system and works

closely with Tullow's Senior Leadership Team to ensure this is in

place. The Senior Leadership Team is collectively responsible and

accountable for the risk management process in place across the

organisation, with individual members taking ownership for risks

that fall in their business area.

Tullow recognises that risk cannot be fully eliminated and that

there are certain risks the Board and/or the Senior Leadership Team

accept when pursuing strategic business opportunities. Acceptance

of risk is made at an appropriate authority level and within

Tullow's defined risk appetite and tolerance levels.

Risk management process

Our risk management framework takes a 'top-down, bottom-up'

approach. It is a rigorous method that ensures ownership and

responsibility for identification, assessment and management of key

risks and opportunities, and is embedded throughout the business.

The Board sets the context for risk management through defining

principal risks, setting the strategic direction and establishing

the appropriate risk appetite for the organisation.

Risk identification and assessment

Each Business Head and Head of Function is responsible, and

accountable, for managing risk and risk mitigation within their

remit. Extended Leadership Team members review and re-assess risk

on at least a quarterly basis in their functional areas to evaluate

the strength of existing controls and determine whether changes in

risk reduction actions are needed to ensure the risk level is

within the risk appetite set by the Board.

Consolidation of business risks

To facilitate assessment of the main risks facing the business,

Tullow's leadership undertakes a bottom-up review of the key risks

faced by the business. The key risks in each area are identified by

the Business Heads and Heads of Functions, including mitigating

actions and any emerging risks. These are consolidated upwards into

the Business Unit risk registers and assessed according to their

likelihood of occurring, and the potential consequences to Tullow

in terms of safety, reputational, financial, legal and regulatory

impact.

From this, the Senior Leadership Team identifies the principal

and enterprise-wide risks which can be either a single risk or a

set of aggregated risks which, taken together, are significant for

Tullow. Members of the Senior Leadership Team have ownership and

accountability for stewardship of each of the principal and

enterprise-wide risks. As a collective, the Senior Leadership Team

reviews and discusses the risks bi-annually to understand whether

mitigations are being effectively executed within the agreed

timeframe.

The principal risks and mitigants are discussed by the Board

bi-annually to provide 'top-down' challenge and support. The result

of this review is communicated back down to the SLT and Business

Units to facilitate risk awareness and effective decision making

throughout the organisation.

Risk appetite

The Board sets Tullow's risk appetite and acceptable risk

tolerance levels for each of the principal risk categories. In

considering Tullow's risk appetite, the Board reviews the risk

identification process, the assessment of enterprise level risks,

the existing controls and mitigating actions and the residual

risks. During this process, the Board articulates which risks

Tullow should not tolerate, which risks should be managed to an

acceptable level and which risks are accepted in order to deliver

our business strategy.

The risk appetite is reviewed at least annually by the Board to

ensure that it reflects the current external and market conditions.

A revised risk appetite was last reviewed by the Board in March

2023.

Evolution of Tullow's management of risk

Development of the risk management framework is an ongoing

process. During 2022 senior risk owners have been working to

promote a culture of risk awareness and challenge throughout the

business with an increased focus on managing risk. Further

consistency in risk identification, measurement and reporting has

been rolled out across the organisation.

Tullow's risk profile

The Company risk profile has been closely monitored throughout

the year, with consideration given to the risks to delivering the

Business Plan, as well as whether external factors such as the war

in Ukraine, inflationary pressures and oil price volatility have

resulted in any new risks or changes to existing risks. The impact

of these factors has been considered and managed across all

principal risks. The following table represents the Company's

current principal risks.

Principal risk categories

Commercial Stakeholder Climate EHS or security Financial People Ethics and Cyber

conduct

Failure to deliver production targets (commercial and financial risk)

Risk details Risk mitigations

---------------------------------------- --------------------------------------------

Tullow's Business Plan is anchored -- Robust control over operations

on production from the Jubilee and & maintenance (O&M) contract as well

TEN fields in Ghana and non-operated as the Jubilee O&M transformation

fields in Côte d'Ivoire and project successfully completed in

Gabon. A decline, or problems with July 2022

the performance, of wells or facilities -- Cross-discipline integrated performance

could result in not meeting planned management including clear KPIs and

production levels which in turn forums

would lead to a reduction in revenue -- Maintenance and integrity management

and cash flow ultimately impairing plans covering all equipment classes

our ability to reduce leverage. -- Management and oversight of JV

Partners to ensure maintenance and

integrity plans are implemented effectively

---------------------------------------- --------------------------------------------

A failure to grow the business via -- Jubilee Expansion project, Jubilee

targeted investment in existing South East, North East and TEN Enhancement

fields and/or investment in new Projects

fields could ultimately impact our -- Exploration strategy focused on

ability to deliver the Business acreage close to existing infrastructure,

Plan and meet longer-term production to enable discoveries to be converted

targets. to production quickly

-- Continued investment in non-operated

portfolio, including accelerating

projects where possible

-- Mergers & acquisitions (M&A),

inorganic growth with a focus on

producing assets

-- Working to secure a long-term

gas offtake commercialisation contract

in Ghana as agreed in principle by

the Board

-- Continued investment in the non-operated

portfolio

---------------------------------------- --------------------------------------------

Risk of an asset integrity breach (commercial and EHS or security risk)

Risk details Risk mitigations

------------------------------------------- ----------------------------------------------------

A loss of asset integrity could -- The FPSO vessels are subject to

be cause by failures to follow our regular internal and external certification

procedural requirements for operating -- Our asset and well integrity and

equipment within safety limits, maintenance programmes are in place,

equipment failure on the FPSO or and overseen by senior managers

lack of critical equipment or spares. -- When incidents do occur we complete

The effects could include reduction a root cause analysis for every incident

in production, revenue and cash -- Robust control over operations

flow, damage to facilities and damage & maintenance (O&M) contract as well

to relationships with JV Partners as the Jubilee O&M transformation

and host governments. project successfully completed in

July 2022

------------------------------------------- ----------------------------------------------------

Risk of a major accident event (EHS or security risk)

Risk details Risk mitigations

------------------------------------------- ----------------------------------------------------

A major incident could potentially -- Risk management processes embedded

result in asset integrity failures at all levels of the organisation

and/or extensive damage to facilities. -- Asset and well integrity and maintenance

This may in turn lead to a loss programmes are in place, including

of life, environmental damage, increased regular self-verification and external

costs and reputational damage. certification, audit and assurance

of integrity plans

-- Root cause failure analysis processes

in place for production losses and

EHS incidents to prevent recurrence

and ensure lessons are learned

-- Emergency Response Plans and Incident

Management Framework to aid in escalation

when incidents do occur

------------------------------------------- ----------------------------------------------------

A failure of our colleagues or contractors -- Tiered assurance activities ensuring

to meet safety standards or adhere all critical processes are adhered

to procedural requirements could to

result in operation of equipment -- Robust EHS aspects are included

outside safe operating limits leading at all stages of contract management

to a major EHS or operation incident. (from specification/pre-qualification

through to contract closure)

-- Active contractor engagement on

safety throughout life of contract

including EHS forums to enable direct

participation

------------------------------------------- ----------------------------------------------------

Failure to unlock value (stakeholder, commercial and financial risk)

Risk details Risk mitigations

------------------------------------------- ----------------------------------------------------

Significant non-associated gas resource -- A workstream has been established

has been identified on current licences to assess commercialisation opportunities

and failure to secure gas market in Ghana and the region that will

share could delay development of enable development of the identified

these resources. resources while playing an important

role for the industrial development

of Ghana

------------------------------------------- ----------------------------------------------------

Delay in approval of a revised Field -- A revised FDP has been submitted

Development Plan (FDP) by the Government to the Government of Kenya for approval

of Kenya could impact a final investment in line with the licence extension

decision. conditions

-- Continued engagement with the

Government of Kenya and regulators

to ensure timely approval of the

revised FDP

------------------------------------------- ----------------------------------------------------

Failure to secure a strategic partner -- The Kenya JV Partners via an ongoing

would impact our ability to progress farm-down process are actively seeking

the Kenya project to final investment a strategic partner to fund the next

decision and unlock value. stage of development and unlock value.

Discussions are under way with potential

bidders around a range of commercial

arrangements

------------------------------------------- ----------------------------------------------------

The inability to successfully explore -- Close collaboration focused on

and add accretive upside value to fully leveraging geoscience expertise

Tullow's assets through addition to identify and mature reserves and

of reserves and resources around resources which have the potential

producing assets could limit the to rapidly unlock value for producing

return on the licences. assets

-- This is reinforced by an infrastructure-led

exploration (ILX) strategy to strengthen

the portfolio, by focusing on opportunities

near producing assets, and create

value through integration of assets,

expertise and regional knowledge

------------------------------------------- ----------------------------------------------------

The inability to limit our capital -- A number of farm-down processes

exposure to historical exploration are under way to limit capital exposure

commitments in selective emerging on selective emerging basins by aiming

basins of Guyana and Argentina may to reduce our equity share. This

result in having to divert capital will ensure Tullow can participate

from producing assets. at an equity consistent with our

capital allocation guidance

------------------------------------------- ----------------------------------------------------

Failure to manage geopolitical risks (stakeholder and financial risk)

Risk details Risk mitigations

------------------------------------------- ----------------------------------------------------

Political instability in the West -- An extensive relationship management

Africa region, where our producing plan is in place, to actively manage

assets are concentrated, could delay senior relationships with host governments,

and impact decision making by host including an Advisory Board in Ghana

governments and local partners and -- We ensure alignment of our business

may also impact security arrangements. plans with national priorities and

have developed a communication plan

to inform stakeholders of the positive

impact of our activities on host

nations and communities

-- We maintain constructive non-partisan

relationships with all political

parties in Ghana

------------------------------------------- ----------------------------------------------------

Unreasonable fiscal or regulatory -- We have robust stabilisation clauses

demands by host governments could in all our Petroleum Agreements and

obstruct efficient operations, delay Production Sharing Contracts with

implementation of our growth plans international dispute resolution

and cause increased costs and financial to protect us against unreasonable

loss. demands

------------------------------------------- ----------------------------------------------------

Failure to manage climate change risks (climate risk)

Risk details Risk mitigations

------------------------------------------- ----------------------------------------------------

Tullow recognises climate change -- There is recognition and support

as a material risk for our business. from the Board that decarbonisation

There is a potential for climate-related requires investment. We are implementing

risks, including regulatory constraints, our plan to achieve Net Zero by 2030

carbon pricing mechanisms, low oil (Scope 1 and 2 net equity), through

price or conditional access to capital, reducing our emissions from routine

to affect Tullow's ability to implement flaring and offsetting hard to abate

our strategy. emissions

Challenges to our business strategy -- We stress test our portfolio to

and failure to align with broader ensure core assets are resilient

energy transition goals could result in different oil and carbon price

in reduced or conditional access environments

to capital or shareholder/investor -- There is ongoing engagement with

reluctance to invest. host countries to understand and

Failure to deliver on our commitment align with their long-term energy

to eliminate routine flaring by transition strategies, including

2025 and thereby mitigate the carbon Paris Nationally Determined Contributions

intensity of Tullow's business or -- We are aligning our objectives

to off-set hard to abate emissions with the Ghana Forestry Commission

(e.g. through nature-based off-set and local stakeholders to implement

schemes, which we continue to investigate a project, with a Final Investment

in Ghana) may lead to erosion of Decision expected in 2023

stakeholder confidence and impact

our ability to attract and retain

talent.

------------------------------------------- ----------------------------------------------------

Risk of insufficient liquidity and funding capacity to sustain and

grow the business or failure to deliver a highly cash-generative business

(financial risk)

Risk details Risk mitigations

------------------------------------------- ----------------------------------------------------

Tullow remains exposed to erosion -- Business Plan in place and being

of its balance sheet and revenues delivered to deliver strong cash

due to oil price volatility, unexpected flow and deleveraging

operational incidents, cost inflation -- Capital structure provides liquidity

and failure to deliver targeted headroom through to December 2024

farm downs of exploration assets even in a low oil price environment

and Kenya. -- Disciplined capital allocation

Failure to deliver our Business prioritising high-return and short-payback

Plan could have a material negative investments, and a strong focus on

impact on cash flow and our ability cost control

to reduce debt and strengthen the -- Material commodity hedging programme

balance sheet, which may affect protects against the impact of a

our ability to meet our financial sustained low oil price environment

obligations when they fall due. -- Options and timings for refinancing

are regularly reviewed

------------------------------------------- ----------------------------------------------------

Failure to develop, retain and attract capability (people risk)

Risk details Risk mitigations

------------------------------------------- ----------------------------------------------------

There is a risk that critical staff -- The Employee Value Proposition

leave the organisation resulting (EVP) rolled out in 2021, covering

in difficulty to deliver against culture, working environment, remuneration,

our Business Plan. learning and development and performance

We operate a lean and agile structure management was further developed

and are dependent on a small number in 2022

of key and critical roles. Loss -- Employee engagement initiatives

of staff would increase pressure are in place, including an employee

on remaining colleagues and could advisory panel, Tullow town halls,

lead to deterioration in the wellbeing coffee mornings and employee engagement

of our colleagues, a poor working surveys

environment and, potentially, further -- We have refreshed our Inclusion

attrition. and Diversity (I&D) policy and hosted

We may be unable to recruit the a number of speakers during the year,

skills needed due to the overheated to increase awareness and re-affirm

global labour market in oil & gas. our focus on I&D

-- Succession plans are in place

for critical roles. We have undertaken

a leadership capability review of

the extended leadership team, to

ensure a focus on development and

ensuring the right capability is

in the organisation

------------------------------------------- ----------------------------------------------------

Risk of a compliance or regulatory breach (ethics and conduct risk)

Risk details Risk mitigations

------------------------------------------- ----------------------------------------------------

Non-compliance with bribery and -- Tullow maintains high ethical

corruption legislation or contractual standards across the business. Strong

obligations along with other applicable anti-bribery and corruption (ABC)

business conduct requirements could governance processes/procedures are

expose the Company to penalties in place as a core element of the

or regulatory oversight. Ethics and Conduct (E&C) programme

In particular, an unforeseen material -- A mandatory annual Code of Ethical

compliance breach could lead to Conduct eLearning and acknowledgement/certification

regulatory action, an unsettled process is in place for all employees.

litigation/dispute or additional Third-party due diligence procedures

future litigation that may result and assurance processes are in place

in unplanned cash outflow, penalty/fines, -- Investigation procedures and an

reputational damage and a loss of associated misconduct and loss reporting

stakeholder confidence in Management. standard are in place

-- Third-party due diligence and

assurance processes are in place

-- Anti-tax evasion risk assessments

are undertaken with clear mitigation

actions identified, including targeted

employee training

------------------------------------------- ----------------------------------------------------

Risk of major cyber-attack (cyber risk)

Risk details Risk mitigations

------------------------------------------- ----------------------------------------------------

The external cybersecurity threat -- Security Incident Event Management

environment is continuously evolving (SIEM) system in place, supported

and intensifying; therefore, the by an Advanced Security Operations

risk of a major cyber-attack is Centre (SOC) providing 24/7 network

an ongoing risk that requires constant and device monitoring, alerting and

monitoring and management. response

Tullow may suffer an external cyber-attack -- Security awareness programme in

which could have far reaching consequences place supported by regular staff

for the business. This could limit susceptibility phishing training

our ability to operate, impact production, and testing. Annual mandatory security

expose the Company to high ransomware awareness training for all staff

demands or potentially trigger a -- An independent technical assurance

major incident. This could result programme is in place

in financial loss, loss of stakeholder

confidence, loss of production,

or additional cost by way of fines

or resolution of service.

------------------------------------------- ----------------------------------------------------

Lines of defence

First line of defence

Business management (ownership and management of risk)

* Own and manage business risks. Implement and execute

controls in business. Monitor risks and control at

business level.

* Assurance provided through self-reviews and focused

assurance reviews.

* Projects - implement and execute controls at

site/project level. Monitor risks and controls at

site/project level.

-------------------------------------------------------------------------

Second line of defence

Business leadership, risk management and compliance functions (oversight

of risk management)

* Set the framework and support embedding of effective

risk management practices.

* Provide oversight and management challenge to

leadership on the identification and management of

risk.

* Monitor compliance with functional standards (minimum

controls).

* Provide assurance through periodic reporting and

focused reviews.

-------------------------------------------------------------------------

Third line of defence

Internal Audit (independent assurance)

* Provide independent assurance of respective

governance, internal control systems and controls

across all levels of the business.

* Assurance provided through risk-based internal audit

reviews.

-------------------------------------------------------------------------

Internal control

A foundation of effective governance, risk management and

control exists throughout the organisation. The effectiveness of

the internal control framework is reviewed through the risk

management process and challenged as described above. In addition

to this, the Senior Leadership Team and Audit Committee perform an

annual review of the effectiveness of internal control. This was

last undertaken in February 2023 and reported to the Audit

Committee and the Board on 28 February and 1 March,

respectively.

Nature of assurance

-- Assurance activities are put in place across the three lines

of defence to assure that control activities are effective in

mitigating risks to the business. These specifically focus on areas

where there are internal/external changes, control failures and

historical issues.

-- Business management is the first line of defence and is

responsible for ensuring their key risks have been identified and

that adequate controls are in place to manage those risks.

-- Business leadership, risk management and compliance functions

act as the second line of defence, providing support, oversight and

challenge to the business in managing risks effectively, and

providing assurance that compliance with functional standards is

being met.

-- Internal Audit acts as the third line of defence and is

responsible for providing independent assurance through its

risk-based internal audit programme. The Internal Audit Plan and

outputs are reviewed by the Audit Committee. Agreed actions for

improving the control environment and managing risk are owned by

assigned individuals and monitored through Tullow's actions

tracking process. The Audit Committee monitors the implementation

of actions.

-- Tullow's risk management and assurance processes provide the

Board and the Management Team with reasonable, but not absolute,

assurance that our assets and reputation are protected.

Appendix C: Viability statement

Assessment period

In accordance with the provisions of the UK Corporate Governance

Code, the Board has assessed the prospects and the viability of the

Group over a longer period than the 12 months required by the

'Going Concern' provision. The Board assesses the business over a

number of time horizons for different reasons, including the

following: Annual Corporate Budget (i.e. 2023), Corporate Business

Plan (five years i.e. 2023-2027), long-term Business Plan (10

years). The Board's period of assessment for the purpose of the

viability statement is five years considering maturity of bonds in

2025 and 2026.

Notwithstanding the assessment period selected for the viability

statement the Group will continue to assess the business over all

time horizons noted above.

Assessment of the Group's principal risks

In order to make an assessment of the Group's viability, the

Directors have made a detailed assessment of the Group's principal

risks, and the potential implications these risks could have on the

Group's business delivery and liquidity over the assessment period.

This assessment included, where appropriate, detailed cash flow

analysis, and the Directors also considered a number of reasonably

plausible downside scenarios, and combinations thereof, together

with associated supporting analysis provided by the Group's Finance

team. A summary of the key assumptions aligned to the Group's

principal risks and reasonably plausible downside scenarios can be

found below. It should be noted that some assumptions encompass

multiple risks but have not been repeated to avoid unnecessary

duplication.

Principle Base case assumptions Downside scenario

risks

Failure to Production is assumed to be 5% reduction in production in

deliver production in line with the Corporate each year.

targets Business Plan.

------------------------------------ ---------------------------------------

Failure to The Group has assumed no cash The Group has included $72 million

manage geopolitical outflow associated with tax for potential outflows related

risks exposures and provisions. to settlement for legal claims

in 2024. These are

currently not deemed to be probable

but whose likelihood is greater

than remote.

------------------------------------ ---------------------------------------

Failure to The key impact of climate The Directors have considered

manage climate change on the Group's portfolio an oil price sensitivity in

change risks of assets is reflected in line with the IEA 'Net Zero

the oil price assumptions. by 2050 Scenario'; see below.

See below. The Group has also assessed

the impact of carbon pricing;

refer to the TCFD disclosure.

------------------------------------ ---------------------------------------

Risk of insufficient Oil price assumptions are The Group has analysed two downside

liquidity based on the forward curve oil price scenarios; the first

and funding at 31 December 2022 for two is based on the Directors' assessment

capacity to years, followed by the Group's of a reasonably plausible downside

sustain and Corporate Business Plan assumption scenario: 2023: $70/bbl 2024:

grow the business from 2025 onwards: 2023: $84/bbl $70/bbl 2025: $65/bbl 2026:

/ failure 2024: $79/bbl 2025: $70/bbl $65/bbl 2027: $65/bbl. The second

to deliver 2026: $70/bbl 2027: $70/bbl. is in line with the IEA "Net

a highly cash Operating costs and capital Zero by 2050 Scenario": 2023:

generative investment are assumed to $61/bbl 2024: $58/bbl 2025:

business be in line with the Corporate $54/bbl 2026: $50/bbl 2027:

Business Plan. $46/bbl

Operating cost are assumed to

be 12% than those included in

the Corporate Business Plan.

------------------------------------ ---------------------------------------

For detailed information on risk mitigation, assurance and

progress in 2022 refer to the detailed discussion of risks in

Appendix B.

For 'Risk of an asset integrity breach', 'Failure to unlock

value', 'Risk of a major EHS accident and Security', 'Risk of a

compliance or regulatory breach', 'Failure to develop, retain and

attract capability', and 'Risk of major cyber-attack' the Group has

assessed that there is no reasonably plausible scenario that can be

modelled in isolation or in combination with other risks from a

cash flow perspective.

Conclusion

The Group has $2.5 billion notes outstanding, maturing in 2025

and 2026. The Corporate Business Plan does not project sufficient

free cash flow generation to allow the Group to fully repay these

notes when they fall due, and therefore it will need to access debt

markets within the viability assessment period.

In the base case, net debt and gearing are forecast to reduce

sufficiently such that the Directors are confident that the Group

will be able to secure the funding required to maintain adequate

liquidity headroom throughout the viability assessment period.

Under the two downside scenarios, which assume all risks arise

simultaneously, execution of a refinancing would be challenging.

Management is focused on mitigating the risks around production,

operating cost increases and potential outflows associated with

disputes in order to reduce the likelihood of these risks

materialising, or their impact in the event these risks

materialise. Furthermore, the Directors have considered additional

mitigating actions that may be available to the Group, such as

incremental commodity hedging executed in periods of higher oil

prices, alternative funding options, further rationalisation of the

Group's cost base including cuts to discretionary capital

expenditure, M&A, portfolio management and careful management

of stakeholder relationships.

Based on the results of the analysis and the ability to mitigate

some of the risks associated with the downside scenarios, the Board

of Directors has a reasonable expectation that the Group will be

able to continue in operation and meet its liabilities, including

through refinancing activities, as they fall due over the five-year

period of their assessment.

Appendix D: Related party transactions

The following related party transactions are extracted from the

Annual Report and Accounts (page 157).

The Directors of Tullow Oil plc are considered to be the only

key management personnel as defined by IAS 24 Related Party

Disclosures.

2022 2021

$m $m

------------------------------ ------ ------

Short term employee benefits 2.5 3.9

Post-employment benefits 0.1 0.3

Share-based payments 1.4 1.8

------------------------------ ------ ------

4.0 6.0

------------------------------ ------ ------

Short-term employee benefits

These amounts comprise fees paid to the Directors in respect of

salary and benefits earned during the relevant financial year, plus

bonuses awarded for the year.

Post-employment benefits

These amounts comprise amounts paid into the pension schemes of

the Directors.

Share-based payments

This is the cost to the Group of Directors' participation in

share-based payment plans, as measured by the fair value of options

and shares granted, accounted for in accordance with IFRS 2

Share-based Payment .

[END]

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSJIMRTMTBTMBJ

(END) Dow Jones Newswires

March 24, 2023 03:13 ET (07:13 GMT)

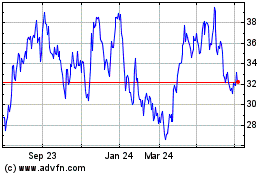

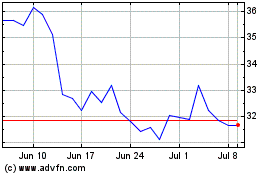

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tullow Oil (LSE:TLW)

Historical Stock Chart

From Jul 2023 to Jul 2024