TIDMDGB

RNS Number : 2710E

Digital Barriers plc

29 May 2012

29 May 2012

Digital Barriers plc

('Digital Barriers' or the 'Group')

Preliminary Results for the year ended 31 March 2012

Digital Barriers (LSE AIM: DGB), the specialist provider of

advanced surveillance technologies to the international homeland

security and defence markets, announces audited results for the

year ended 31 March 2012.

The Board is pleased to report that it has made significant

progress during the year, the highlights of which are:

Key Highlights

Increasing revenue by 129% from GBP6.6 million to GBP15.0

million and delivering organic revenue growth of 24%.

Loss before tax of GBP4.1 million (2011: GBP4.6 million) and

adjusted loss before tax* of GBP6.0 million (2011: GBP2.7

million).

Extending our highly differentiated portfolio of world-class

technology to include next generation video transmission,

unattended ground sensors, and standoff passive screening

technologies.

Achieving good international sales progress with key military

and homeland security customers across North America, Europe, the

Middle East and Asia-Pacific.

Completing seven further acquisitions since 31 March 2011

(bringing the total to twelve) and integrating all of these fully

into the Group.

Establishing a Dubai office to add to those in London, Singapore

and Washington DC.

* Adjusted loss before tax is calculated after adding back

amortisation of intangibles initially acquired on acquisition,

acquisition costs, reorganisation costs, and deducting adjustments

to deferred consideration and the gain on a bargain purchase.

Commenting on the results Dr Tom Black, Executive Chairman of

Digital Barriers said:

"We continue to see the opportunity for Digital Barriers as very

compelling over the medium to long term. The international sales

traction we have already achieved, combined with the very positive

feedback from customers and partners that our IP can outperform

that offered by competitors, gives us high levels of confidence in

our ability to grow revenue significantly in the coming year and in

the longer-term prospects of the Group".

For further information, please contact:

Digital Barriers plc Tel: 020 7940 4740

Tom Black, Executive Chairman

Colin Evans, Managing Director

Investec Investment Banking Tel: 020 7597 5970

Andrew Pinder

Dominic Emery

FTI Consulting Tel: 020 7831 3113

Edward Bridges

Matt Dixon

Elodie Castagna

About Digital Barriers

Digital Barriers provides advanced surveillance technologies to

the international homeland security and defence markets,

specialising in 'edge-intelligent' solutions that are designed for

remote, hostile or complex operating environments. We work with

governments, multinational corporations and system integrators in

the defence, law enforcement, critical infrastructure,

transportation and natural resources sectors. Our surveillance

technologies have been successfully proven on some of the most

demanding operational and environmental deployments around the

world.

www.digitalbarriers.com

Chairman's Statement

Introduction and Highlights

Digital Barriers has made significant progress since its IPO two

years ago. We now have established a broad international platform

to engage with key customers in each of our target regions. We have

an exceptional portfolio of genuinely world-class IP under

ownership and we have successfully integrated twelve acquisitions

under the Digital Barriers brand.

Our aim is to work with governments, multinational corporations

and system integrators in the defence, law enforcement, critical

infrastructure, transportation and natural resources sectors,

providing them with advanced surveillance solutions that can be

deployed across remote, hostile or complex operating environments.

We can now offer a full suite of differentiated cutting-edge

technologies to meet a wide range of surveillance requirements for

customers across the globe.

We have expanded our international reach significantly through

targeted investments in regions offering high potential and we are

establishing a strong reputation as an important provider of

advanced surveillance technologies to the homeland security and

defence sectors. As a result, we have already been able to achieve

sales across four continents and are now in a position to build

significantly on that achievement in the coming period.

The major highlights are as follows:

-- Extending a highly differentiated portfolio of world class IP

under our ownership, enabling us to offer an unrivalled range of

products and solutions. This includes next generation video

transmission, unattended ground sensors, and standoff passive

screening technologies. We sell technology both into large

surveillance programmes and as a range of stand-alone readily

deployable products.

-- Gaining international traction with military and homeland

security customers and partners across North America, Europe, the

Middle East and Asia-Pacific and making good early sales progress

in the US, UAE, Singapore and South Korea. In addition, our

technology has also been identified for potential use in much

larger government programmes which are being planned in all our

target regions.

-- Bringing the number of completed acquisitions since IPO to a

total of 12, all of which are now fully integrated under the

Digital Barriers brand. Our acquisitions have significantly

enhanced our capabilities, bringing exceptional new technology into

the Group. Where restructuring has been required to improve the

operational performance and prospects of a specific acquisition

this has been done with minimal impact on the wider performance of

the Group.

-- Increasing our revenues by 129%, from GBP6.6 million in our

first period to GBP15.0 million last year (pro forma organic

growth(1) 24% from GBP11.1m to GBP13.8m). We believe that this

level of organic growth illustrates the ability of Digital Barriers

to execute its strategy within the international homeland security

and defence markets.

-- Establishing a new office in Dubai as a hub from which to

service a fast-growing market in the Middle East region, where we

are seeing strong interest in our technologies and have achieved

initial sales. We expect to expand our presence into the Kingdom of

Saudi Arabia during the coming period.

-- Securing our position as the partner of choice in the UK for

advanced surveillance solutions into the most demanding Government

and law enforcement customers. We have established Digital Barriers

as a credible and respected company and are making significant

progress in establishing our technologies as the preferred choice

for new international partners.

(1) Assuming all prior period acquisitions occurred on 1 April

2010 and excluding all current year acquisition.

Results

The results for the year demonstrate encouraging growth in our

revenue and prove our ability to identify and integrate

acquisitions quickly and effectively.

Revenue in the year was GBP15.0 million. The Group's loss before

tax was GBP4.1 million. We recorded an adjusted loss before tax of

GBP6.0 million, after adding back amortisation of intangibles

initially acquired on acquisition of GBP2.0 million, acquisition

costs of GBP0.8 million, reorganisation costs of GBP0.5 million,

deducting adjustments to deferred consideration of GBP5.0 million

and the gain on a bargain purchase of GBP0.2 million.

Consideration for acquisitions in the year totalled GBP5.6

million, with GBP5.2 million of this paid in cash in the year. The

cash balance at the end of the year was GBP15.3 million.

People

We have now expanded to a team of 183 people at the year end,

based across our headquarters in London, strategic hubs across four

continents and subsidiary offices around the UK. We employ a

combination of world-class technologists, highly credible homeland

security and defence professionals and experienced sales

executives.

This year we have focused on integrating the acquisitions we

have made into the Group. We have sought to develop a strong ethos,

based on innovation and high momentum, throughout the business and

I have been particularly struck by the enthusiasm and commitment of

our staff, most of whom have joined through acquisition.

We have also ensured that we have highly qualified people

carrying out the critical work of building partnerships in our key

international markets. We have established a skilled management

team to oversee this and have successfully set up and integrated

our major hubs in Washington DC, Dubai and Singapore. Overall, our

sales force amounts to more than 30 of our staff.

As announced earlier this year, Chris Banks and Rupert Keeley

will step down from the Board at the Company's Annual General

Meeting in July. Chris Banks is retiring from the Board in order to

reduce his workload and Rupert Keeley is stepping down following

his recent appointment to a full-time executive role with PayPal in

Singapore.

I would also like to express my gratitude to both Chris and

Rupert for their contribution to the Board. Chris joined the Board

at the time of the Company's IPO in order to assist with setting up

our governance regime, a role in which he has added enormous value.

Rupert joined the Board in July 2010 to enhance our knowledge of

overseas markets, Asia and the Middle East in particular, and has

greatly assisted our early development.

Paul Taylor joined the Board in April and will replace Chris as

Chairman of the Audit Committee following our AGM and I am

delighted to welcome him. Our search to replace Rupert is well

advanced and I fully expect that we will appoint a replacement in

the near future.

Outlook

We have built our initial platform and are achieving good early

stage sales successes. We have confirmed our original view that a

very substantial opportunity exists in the global surveillance

market. The task now is to execute successfully in order to exploit

this opportunity. The board is very confident that we will do

so.

In the coming period, we will focus on five areas that have

emerged as critical to our ongoing success.

-- We will continue to invest in our already acquired technology

to ensure that it maintains its world-class status and that we

develop new solutions based on that technology. We will also seek

to identify additional technologies that can further enhance our

portfolio.

-- We will continue to develop strong relationships with the

twenty or so most important "flagship customers" to ensure that we

become a technology partner of choice to them across their most

demanding surveillance programmes.

-- We will expand our sales reach into key international markets

by supplementing these flagship relationships with an expanding

network of specialist partners and resellers to service broader

market demand.

-- We will continue to develop the Digital Barriers brand

internationally as a pre-eminent advanced surveillance technology

provider in our sector.

-- We will continue to invest in our existing regional sales

capability and will strengthen our presence in the Kingdom of Saudi

Arabia, which we see as a key market for our products.

We continue to see the opportunity for Digital Barriers as very

compelling over the medium to long term. The sales traction we have

already achieved combined with the very positive feedback from

customers and partners that our IP can outperform that offered by

competitors, gives us high levels of confidence in our ability to

grow revenue significantly in the coming year and in the

longer-term prospects of the Group.

Business Review

Introduction

Digital Barriers has made significant progress this year. We are

now engaged with many target "flagship" customers across our

regions, with a broad suite of genuinely world-class and

increasingly integrated Intellectual Property (IP) under ownership,

which we are marketing to customers around the world as readily

deployable solutions. Having completed seven acquisitions in the

period since 31 March 2011, bringing the total number to twelve,

and integrated all of these acquired businesses under the Digital

Barriers brand, we can now offer a wide range of leading-edge

surveillance solutions to the most demanding customers around the

world with critical and complex operational requirements.

We have secured our position as a trusted supplier to key UK

Government agencies. We have also made encouraging progress in

penetrating our targeted international markets, making important

early sales to influential foreign government agencies and systems

integrators in all of our key regions, specifically the US, the

Middle East and Asia Pacific.

This year has also seen a step change in the structure and

integration of companies into Digital Barriers. Each of our

acquisitions has been fully integrated into the Group and started

to develop a shared ethos and sense of mission. We have implemented

a clear and straightforward organisational structure to reinforce

this and have streamlined management structures and focused

research and development efforts in line with an integrated

technology roadmap. We have consolidated our estate portfolio with

clear plans in place and have deployed a unified sales force of

more than 30 staff operating successfully across the world. As a

result, the Digital Barriers brand is now recognised as a market

leader among our core UK-based customer base and we are building a

strong reputation internationally with target customers.

With good organic growth this year, seven further acquisitions

integrated into the Group and a growing reputation at home and

overseas, we now have the platform and customer reach to support

significant organic growth in the coming period.

Market Dynamics

Despite the economic difficulties that have affected many

developed countries around the world, the global defence and

homeland security market has proven resilient and continues to

grow. The outlook in particular for the global homeland security

market is one of sustained, longer-term expansion, with forecast

growth rates of between five and seven percent through to 2019*.

Despite the relative decline in most NATO members' defence budgets,

the global outlook for defence spending remains positive with many

countries increasingly focusing on the counter-terrorism and

counter-insurgency domains.

In the last year, Digital Barriers has sharpened its focus on

those sections of the homeland security market in which we see the

greatest potential for growth. We specialise in providing advanced

surveillance technologies to support our customers operating across

hostile, remote and complex environments. We concentrate

particularly on requirements relating to law enforcement, border

security, specialist areas of defence, airports, seaports and mass

transit, public safety and natural resources.

International Developments

Digital Barriers has taken significant steps to establish itself

as an international high technology products-based export business.

We are doing so by driving forward our targeted international sales

strategy.

Direct sales

Under this strategy, we have concentrated on the identification

and development of approximately 20 large international flagship

customers, mainly major government agencies, and commercial

organisations in the critical infrastructure and oil and gas

sectors, to whom we can sell directly. These flagship customers

will be the principal end-users of our technology and we have been

expanding our network of sales offices to focus on these

organisations. The majority are in the UK and the US, but there are

a handful of increasingly important organisations in the Gulf

Co-operation Council (GCC) states of the Middle East and also the

Asia Pacific region. We have therefore established offices and

full-time sales staff in Washington DC, Dubai and Singapore, with

the intention of increasing our presence in the Kingdom of Saudi

Arabia in the coming year. Our acquisition of Keeneo, based in

France, has also broadened our reach into Continental Europe.

Progress by region is summarised as:

-- In the US, we are now working to ensure our products meet the

specific requirements of our customers, who make up the largest and

most influential security and defence market in the world;

* Source; Visiongain Homeland Security Market Report 2009 to

2019

-- In the Middle East, we have established a regional hub in

Dubai and have made good progress in gaining traction with flagship

government and law enforcement customers, and with the

international systems integrators bidding for large government

programmes; and

-- In Asia Pacific, we have focused our direct sales efforts on

Singapore, Hong Kong and the Republic of Korea and have deepened

our engagement with various government agencies in these

markets.

Our regional sales teams have made significant progress in

successfully penetrating many of these flagship customers, having

invested significant effort in progressing our technology through

the inevitably long and complex government sales cycles. For these

highly discerning customers with complex requirements, we use a

consultancy-led approach to understand customer needs such that we

can jointly shape the right solutions, including appropriate

training and support. This process involves establishing our

credibility through references from UK Government, through the

quality of our IP and from proven expertise. We then demonstrate

our most relevant technologies and in many cases have secured

successful technology trials and then sales. The strength of our IP

truly differentiates our range of solutions and can provide

customers with game-changing solutions.

Indirect sales

In addition to targeting direct sales into flagship customers,

we continue to develop partnerships with the major systems

integrators, both globally and regionally. We focus tightly on

where interests align, where our partners can help us access major

government programmes, and where they have already developed

strategic relationships with the key customers in our target

regions. By way of example, our partnerships with Cassidian and

Boeing in the Middle East, and Singapore Technologies in Asia

Pacific are progressing well.

We have also appointed an initial group of carefully selected

value-added resellers (VARs) and other distributors to broaden our

reach, particularly into Europe and South East Asia. This network

is starting to open up additional revenue streams by selling proven

technology used by flagship customers into a much broader market.

Although at an early stage, it is expected that this route to

market will become more significant for us as time progresses.

Operational Review

Services Division

Our Services division has successfully established itself in the

UK market in the last year and grown well. Formed by the successful

integration of Security Applications and Overtis Solutions, the

division is based in Didcot.

The division implements solutions from both third party

technology providers and, increasingly, from our own products

division as our technology portfolio has grown. In the coming year

we plan for continued organic growth and will maintain our current

focus on the very high security areas of the UK Government market

where we have an established reputation with key customers as the

most technologically advanced, reliable and discreet partner for

the provision of fully integrated surveillance solutions.

Products Division

Our Products Division has expanded rapidly with strong

underlying organic growth coming from continuing penetration of the

UK and targeted international markets and with new acquisitions of

key technologies that broaden and strengthen our existing IP

set.

The division is now able to provide leading, fully integrated

and proven surveillance platforms for hostile, remote and complex

environments. These solutions range from edge-intelligent sensors

and image capture to real time transmission, advanced video

management systems and adaptive video analytics and image

processing and enhancement techniques. We have also moved beyond

the capture and transmission of purely visual surveillance. The

acquisition of Zimiti with its world-leading Remote Detection and

Classification ("RDC") unattended ground sensor ("UGS") technology

and ThruVision with its Standoff Passive Screening ("SPS")

detection capability bring emerging sensor technology into our

capability suite.

Our capabilities in these areas are highly differentiated and we

continue to invest to ensure we stay ahead of the competition both

in terms of technical edge and cost-effectiveness. Feedback from

major government, law enforcement and defence customers gives us

confidence that we can provide a level of technical capability not

available from other providers in the marketplace.

Since 31 March 2011, Digital Barriers has acquired seven

businesses, each bringing its own capabilities, together forming an

even more compelling and integrated product suite. These businesses

were Zimiti Ltd, Keeneo SAS, Stryker Communications Ltd, the IP and

assets of LMW, Codestuff Ltd, and the IP and assets of ThruVision

Systems and Enterprise Technologies.

These new acquisitions and their successful integration into the

Group have enabled us to bring an increased structure and focus to

our products and propositions. We have made sales into flagship

customers across each of our four key regions with significant

positive feedback gained from government and prime systems

integrators on the performance of our technology.

We have also made steady progress in integrating all our

acquisitions into better-defined product family groupings. These

groupings are as follows:

Advanced Technologies: This product family focuses on the

wireless and fixed video transmission technologies acquired through

COE, Essential Viewing Systems, and ETech. In this area, we design

solutions principally around our ultra-narrow band and high

security video streaming capability to meet the specific needs of

our military and law enforcement customers in remote and hostile

locations.

Solution Engineering: This product family focuses on command and

control, video content analytics and specialist image processing.

It includes the technology acquired through Waterfall Solutions,

Keeneo and Codestuff. In this area, we develop surveillance

software solutions that are managed at an enterprise level or

embedded into our products. This includes advanced 4D video

analytics, image processing, real time sensor/data fusion, 3D

imaging and command and control. These software capabilities are

sold into all our market areas.

Tactical Products: Formed from the acquisitions of Stryker and

LMW. It develops and manufactures readily deployable solutions that

are designed to work with little or no customisation. This includes

fixed-wireless surveillance units, mobile surveillance and

specialist cameras and sensors. Our principal customers are

military and law enforcement agencies, and organisations protecting

high profile sites and events.

Emerging Sensors: This family contains our 'edge' sensor

technologies; passive stand-off body scanning from Thruvision and

Unattended Ground Sensors from Zimiti. As the earlier stage

technologies in Digital Barriers, we continue to invest in final

productisation of both technologies in parallel with focused

international sales campaigns for each.

The Group has also made excellent progress in integrating the

various acquired technology components into a range of compelling

technical solutions. This allows us to meet the differing needs of

our market domains and geographic regions from the same underlying

technology. We are also working to optimise our supply chain

management across the Group and to take fullest advantage of the

economies of scale offered.

Performance Indicators

We monitor a number of metrics, both financial and

non-financial, on a monthly basis. The most important of these are

as follows:

-- Revenue: GBP15.0 million for the year under review (2011(2) : GBP6.6 million);

-- Pro forma organic revenue growth: 24% for the year under

review, growing from GBP11.1 million to GBP13.8 million;

-- Gross margin: 40.4% for the year under review (2011: 38.7%);

-- Corporate overhead: GBP5.3 million for the year (2011: GBP2.7 million);

-- Number of employees: 183 at 31 March 2012 (2011: 110); and

-- Cash: GBP15.3 million at 31 March 2012 (2011: GBP33.5 million).

The Board is satisfied with the status of the above performance

indicators given the current stage of the Group's development.

(2) First reported period being the 13 months to 31 March 2011.

Financial review

In its second full accounting year, Digital Barriers has

delivered revenue of GBP15.0 million (2011: GBP6.6 million)

generating an adjusted loss before tax of GBP6.0 million (2011

loss: GBP2.7 million) and adjusted loss per share of 12.83 pence

(2011 loss: 9.21 pence). On an unadjusted basis, the loss before

tax was GBP4.1 million (2011 loss: GBP4.6 million) and loss per

share was 8.11 pence (2011 loss: 15.38 pence).

Revenue and loss

Of the GBP15.0 million of revenue in year, GBP13.8 million was

delivered by acquisitions made during the prior period and GBP1.2

million was contributed by acquisitions in the current year.

The increase in revenue over the prior period was GBP8.4 million

(129%). On a pro forma basis (assuming all prior year acquisitions

occurred on 1 April 2010 and excluding all current year

acquisitions) revenue has increased by GBP2.7 million (24%).

Our acquisitions have contributed significantly to the results

of the Group in the year. In two cases the performance since

acquisition has fallen short of earn-out targets. In a further two

cases the timing of revenues rather than underlying poor

performance has impacted the achievement of earn-out targets. In

all four cases the related payments have either not been made or

settled early on a partial basis, resulting in a substantial

adjustment to deferred consideration as detailed below. Where

necessary, restructuring has been carried out to improve

operational performance and prospects. In all cases the customers,

skills and technology acquired remain important to the Group's

future development and we are confident they will contribute

significantly to the prospects of the Group in the longer term.

Significant acquisitions in the year were:

Date of acquisition

------------------------------ -------------------

Zimiti Limited 18 June 2011

Keeneo SAS 29 July 2011

Stryker Communications Limited 18 November 2011

LMW Electronics 20 January 2012

Codestuff Limited 1 March 2012

ThruVision 8 March 2012

------------------------------ -------------------

Results by division are shown below. Whilst revenue from each

division has grown substantially on the prior period, the operating

results reflect the legacy costs of running separate acquired

businesses prior to their full integration, reorganisation during

the year, and the on-going investment in certain product lines.

Services Products Total

2012 2012 2012

GBPm GBPm GBPm

--------------------------- -------- -------- -----

Revenue 6.3 8.7 15.0

Segment profit/(loss) 0.1 (0.9) (0.8)

Corporate overheads (5.3)

Adjusted Group operating

loss (6.1)

--------------------------- -------- -------- -----

Interest 0.1

--------------------------- -------- -------- -----

Adjusted Group loss before

tax (6.0)

--------------------------- -------- -------- -----

Revenue in the year was split 42% (2011: 64%) and 58% (2011:

36%) between Services and Products respectively. The movement from

the prior period is driven by the respective growth rates within

each division and the split of acquisitions made in the year, which

reflect the strategic focus of the Group. The swing towards

typically higher margin product sales has also driven the change in

gross margin, increasing from 38.7% to 40.4%.

An adjusted loss before tax figure is presented as the Directors

believe that this is a more relevant measure of the Group's

underlying performance. For the year this was GBP6.0 million (2011:

GBP2.7 million) and is detailed in the table below:

13 months

ended

2012 31March2011

GBP'000 GBP'000

------------------------------------------------- -------- ------------

Loss before tax (4,102) (4,605)

Add back:

Amortisation of intangibles initially recognised

on acquisition 2,024 668

IPO, Placing and deal costs 754 1,125

Adjustments to deferred consideration (i) (5,004) 89

Gain on bargain purchase (ii) (152) -

Reorganisation costs (iii) 510 -

------------------------------------------------- -------- ------------

Adjusted loss before tax (5,970) (2,723)

------------------------------------------------- -------- ------------

(i) Relates to the early settlement of deferred consideration

for Keeneo and Waterfall, a nil pay-out against the Essential

Viewing deferred consideration and a reassessment of the likely

deferred consideration payable for Zimiti, partly offset by the

unwind of discount against deferred consideration.

(ii) Relates to the purchase of ThruVision in March 2012.

(iii) Relates to the rationalisation of certain entities within

the Services and Products divisions.

The increase in adjusted loss over the prior period

reflects:

-- Increased expenditure on central sales and marketing,

building the international sales platform across all four key

regions;

-- Continued investment in key strategic product lines such as

those provided by Zimiti and ThruVision; and

-- Relatively static central corporate overhead, excluding the

investment in sales and marketing and the strengthening of the

central team as detailed in note (i) below.

The corporate overheads are broken down as follows:

13 months ended

2012 31 March 2011

GBP'000 GBP'000

------------------------ -------- ---------------

Sales and marketing 2,498 732

------------------------ -------- ---------------

Other overheads:

Board and Plc operating

costs (i) 1,484 999

Operations, finance and

facilities 1,177 973

LTIP charge 159 43

------------------------ -------- ---------------

2,820 2,015

Total 5,318 2,747

------------------------ -------- ---------------

(i) 2012 includes the impact of a full time Group Finance

Director and Company Secretary, the associated recruitment costs

and those for the new non-executive director, plus the market based

adjustments to executive remuneration in December 2010 as disclosed

in the prior period annual report.

Taxation

As a result of losses acquired through acquisitions and

corporate overheads we do not expect to pay the full rate of UK

corporation tax for a number of years. The tax credit for the

period of GBP0.6 million (2011: GBP0.3 million) principally relates

to the unwinding of deferred tax liabilities on acquired

intangibles and R&D tax credits.

At 31 March 2012 the Group had unutilised tax losses carried

forward of approximately GBP19.6 million (2011: GBP11.2 million).

Given the varying degrees of uncertainty as to the timescale of

utilisation of these losses, the Group has not recognised GBP3.7

million (2011: GBP2.2 million) of potential deferred tax assets

associated with GBP14.8 million (2011: GBP8.3 million) of these

losses.

At 31 March 2012 the Group's net deferred tax liability stood at

GBP0.4 million (2011: GBP0.5 million), relating to intangibles on

acquisitions made in the year of GBP1.6 million (2011: GBP1.3

million), offset by GBP1.2 million (2011: GBP0.8 million) relating

to tax losses.

Loss per share

The reported Loss per share is 8.11 pence (2011 loss: 15.38

pence). The adjusted Loss per share is 12.83 pence (2011 loss: 9.21

pence).

Cash and treasury

The Group ended the year with a cash balance of GBP15.3 million

(2011: GBP33.5 million).

During the course of the year GBP5.2 million was paid to acquire

new businesses, with an additional GBP0.8 million in associated

costs, and a further GBP2.0 million was paid in deferred

consideration in respect of current and prior period acquisitions.

GBP9.2 million funded the Group's operating loss and working

capital requirements, and the remaining cash movement during the

year of GBP1.0 million was invested in fixed assets.

The maximum deferred consideration payable in the future in

respect of acquisitions made to date is GBP9.7 million, of which

GBP2.5 million has been provided for within the accounts. The

Directors are of the opinion that any deferred consideration

payments falling due will be largely self-financing, and so view

the majority of the GBP15.3 million of cash held at the end of the

year as being available to the Group to fund future acquisitions

and growth in working capital.

Financing costs included a charge of GBP0.4 million in respect

of the discounting of the deferred consideration for Security

Applications Limited, Waterfall Solutions Limited, Essential

Viewing Systems Limited, Keeneo SAS, Stryker Communications

Limited, LMW and Codestuff Limited, which will be paid out over the

next two years.

Dividends

The Board is not recommending the payment of a dividend.

Consolidated income statement

for the year ended 31 March 2012

Year ended 13 months

31 March ended 31

2012 March 2011

Note GBP'000 GBP'000

-------------------------------------- ---- ---------- -----------

Revenue 14,996 6,555

Cost of sales (8,939) (4,021)

-------------------------------------- ---- ---------- -----------

Gross profit 6,057 2,534

Administration costs (15,782) (7,141)

Other income 5,828 -

-------------------------------------- ---- ---------- -----------

Operating loss (3,897) (4,607)

Finance revenue 160 98

Finance costs (365) (96)

-------------------------------------- ---- ---------- -----------

Loss before tax (4,102) (4,605)

Income Tax 561 257

-------------------------------------- ---- ---------- -----------

Loss after tax attributable to

owners of the parent (3,541) (4,348)

-------------------------------------- ---- ---------- -----------

Adjusted loss:

Loss before tax (4,102) (4,605)

Amortisation of intangibles initially

recognised on acquisition 2,024 668

IPO, Placing and deal costs 754 1,125

Adjustments to deferred consideration (5,004) 89

Gain on bargain purchase (152) -

Reorganisation costs 510 -

-------------------------------------- ---- ---------- -----------

Adjusted loss before tax for the

period 2 (5,970) (2,723)

-------------------------------------- ---- ---------- -----------

(Loss) per share - basic 3 (8.11p) (15.38p)

(Loss) per share - diluted 3 (8.11p) (15.38p)

(Loss) per share - adjusted 3 (12.83p) (9.21p)

(Loss) per share - adjusted diluted 3 (12.83p) (9.21p)

-------------------------------------- ---- ---------- -----------

The results for the year and the prior period are derived from

continuing activities.

Consolidated statement of comprehensive income

for the year ended 31 March 2012

13 months

Year ended ended 31 March

31 March 2012 2011

GBP'000 GBP'000

------------------------------------------------- -------------- ---------------

Loss for the period (3,541) (4,348)

Exchange differences on retranslation of foreign

operations (246) -

------------------------------------------------- -------------- ---------------

Total comprehensive loss attributable to owners

of the parent (3,787) (4,348)

------------------------------------------------- -------------- ---------------

Consolidated balance sheet

at 31 March 2012

31 March 2012 31 March 2011

Note GBP'000 GBP'000

-------------------------------------- ---- ------------- -------------

Assets

Non-current assets

Property, plant and equipment 892 389

Goodwill 21,716 12,966

Other intangible assets 8,150 5,912

-------------------------------------- ---- ------------- -------------

30,758 19,267

Current assets

Inventories 1,788 589

Trade and other receivables 4 6,760 3,243

Current tax recoverable 655 163

Cash and cash equivalents 15,289 33,524

-------------------------------------- ---- ------------- -------------

24,492 37,519

-------------------------------------- ---- ------------- -------------

Total assets 55,250 56,786

-------------------------------------- ---- ------------- -------------

Equity and liabilities

Attributable to equity holders of the

Parent

Equity share capital 437 436

Share premium 48,012 48,012

Capital redemption reserve 4,735 4,735

Merger reserve 348 -

Translation reserve (246) -

Other reserves (307) (307)

Retained earnings (7,687) (4,305)

-------------------------------------- ---- ------------- -------------

Total equity 45,292 48,571

Non-current liabilities

Deferred tax liabilities 414 507

Financial liabilities 6 1,000 673

-------------------------------------- ---- ------------- -------------

1,414 1,180

Current liabilities

Trade and other payables 5 6,794 3,680

Financial liabilities 6 1,750 3,355

-------------------------------------- ---- ------------- -------------

8,544 7,035

-------------------------------------- ---- ------------- -------------

Total liabilities 9,958 8,215

-------------------------------------- ---- ------------- -------------

Total equity and liabilities 55,250 56,786

-------------------------------------- ---- ------------- -------------

Consolidated statement of changes in equity

for the year ended 31 March 2012

Share Capital Profit

Share premium redemption Merger Translation Other and loss Total

capital account reserve reserve reserve reserves reserve equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------- -------- -------- ----------- -------- ------------ --------- --------- --------

At 8 February 2010 - - - - - - - -

Issue of shares in

exchange for shares

in

Digital Barriers

Services Ltd 4,783 - - - - - - 4,783

Arising on pooling

of interest transaction - - - - - (307) - (307)

Redemption of deferred

shares (4,735) - 4,735 - - - - -

Shares issued to market

- IPO 200 19,800 - - - - - 20,000

Share issue costs

- IPO - (700) - - - - - (700)

Shares issued to market

- placing 188 29,812 - - - - - 30,000

Share issue costs

- placing - (900) - - - - - (900)

Share-based payment

credit - - - - - - 43 43

Total comprehensive

loss - loss for the

year - - - - - - (4,348) (4,348)

------------------------- -------- -------- ----------- -------- ------------ --------- --------- --------

At 31 March 2011 436 48,012 4,735 - - (307) (4,305) 48,571

------------------------- -------- -------- ----------- -------- ------------ --------- --------- --------

Issue of shares on

acquisition of Keeneo 1 - - 348 - - - 349

Share-based payment

credit - - - - - - 159 159

Loss for the year - - - - - - (3,541) (3,541)

Other comprehensive

loss - - - - (246) - - (246)

------------------------- -------- -------- ----------- -------- ------------ --------- --------- --------

Total comprehensive

loss for the year - - - - (246) - (3,541) (3,787)

------------------------- -------- -------- ----------- -------- ------------ --------- --------- --------

At 31 March 2012 437 48,012 4,735 348 (246) (307) (7,687) 45,292

------------------------- -------- -------- ----------- -------- ------------ --------- --------- --------

Consolidated statement of cash flows

for the year ended 31 March 2012

Year ended 13 months ended

31 March 2012 31 March 2011

Note GBP'000 GBP'000

----------------------------------------------- ---- -------------- ---------------

Operating activities

Loss before tax (4,102) (4,605)

Non-cash adjustment to reconcile loss before

tax to net cash flows

Depreciation of property, plant and equipment 193 90

Amortisation of intangible assets 2,056 668

Share-based payment transaction expense 159 43

Gain on bargain purchase 2 (152) -

Release of deferred consideration 2 (4,021) -

Reassessment of deferred consideration 2 (1,693)

Disposal of fixed assets 5 -

Finance income (160) (98)

Finance costs 365 96

Working capital adjustments:

Increase in trade and other receivables (2,896) (1,163)

Increase in inventories (372) -

Increase in trade and other payables 526 691

----------------------------------------------- ---- -------------- ---------------

Cash utilised in operations (10,092) (4,278)

Income tax paid (34) (121)

----------------------------------------------- ---- -------------- ---------------

Net cash flow from operating activities (10,126) (4,399)

----------------------------------------------- ---- -------------- ---------------

Investing activities

Purchase of property, plant & equipment (443) (126)

Expenditure on intangible assets (563) -

Acquisition of subsidiaries (5,249) (16,525)

Payment of deferred consideration (2,034) -

Acquisition of cash and cash equivalents of

subsidiaries 31 1,410

Cash and cash equivalents arising on pooling

of interest transaction - 4,680

Interest received 160 88

----------------------------------------------- ---- -------------- ---------------

Net cash flow utilised in investing activities (8,098) (10,473)

----------------------------------------------- ---- -------------- ---------------

Financing activities

Proceeds from issue of shares - 50,000

Share issue costs - (1,600)

Interest paid (8) (4)

----------------------------------------------- ---- -------------- ---------------

Net cash flow from financing activities (8) 48,396

----------------------------------------------- ---- -------------- ---------------

Net (decrease) / increase in cash and cash

equivalents (18,232) 33,524

Cash and cash equivalents at beginning of

period 33,524 -

Effect of foreign exchange rate changes on

cash and cash equivalents (3) -

----------------------------------------------- ---- -------------- ---------------

Cash and cash equivalents at end of period 15,289 33,524

----------------------------------------------- ---- -------------- ---------------

Notes to the financial information

1. Accounting policies

Basis of preparation

The preliminary results of the year 31 March 2012 have been

extracted from audited accounts which have not yet been delivered

to the Registrar of Companies. The Financial Statements set out in

this announcement do not constitute statutory accounts for the year

ended 31 March 2012. The report of the auditors on the statutory

accounts for the year ended 31 March 2012 was unqualified and did

not contain a statement under Section 498 of the Companies Act

2006. The Financial Statements for the year ended 31 March 2012

included in this announcement were authorised for issue in

accordance with a resolution of the Board of Directors on 28 May

2012.

Subsidiary undertakings are those entities controlled directly

or indirectly by the Company. Control arises when the Group has the

power to govern the financial and operating policies of an entity

so as to obtain benefits from its activities. Subsidiaries are

consolidated from the date of their acquisition, being the date on

which the Group obtains control, and continue to be consolidated

until the date that such control ceases. Subsidiaries are

consolidated using the Group's accounting policies. Business

combinations are accounted for using the acquisition method of

accounting except for the acquisition of Digital Barriers Services

Limited by Digital Barriers plc which has been accounted for using

the pooling method. All inter-company balances and transactions,

including unrealised profits arising from them, are eliminated on

consolidation.

The Company is a limited liability company incorporated and

domiciled in England & Wales and whose shares are quoted on

AIM, a market operated by The London Stock Exchange.

The Group's financial statements have been prepared in

accordance with International Financial Reporting Standards

("IFRS") as adopted by the European Union as they apply to the

financial statements of the Group for the year ended 31 March 2012

and applied in accordance with the Companies Act 2006.

2. Adjusted loss before tax

An adjusted loss before tax measure has been presented as the

Directors believe that this is a more relevant measure of the

Group's underlying performance. Adjusted loss is not defined under

IFRS and has been shown as the Directors consider this to be

helpful for a better understanding of the performance of the

Group's underlying business. It may not be comparable with

similarly titled measurements reported by other companies and is

not intended to be a substitute for, or superior to, IFRS measures

of profit. The net adjustments to loss before tax are summarised

below:

13 months ended

2012 31 March 2011

GBP'000 GBP'000

-------------------------------------- -------- ---------------

Amortisation of intangibles initially

recognised on acquisition 2,024 668

IPO, Placing and deal costs 754 1,125

Adjustments to deferred consideration

(i) (5,004) 89

Gain on bargain purchase (ii) (152) -

Reorganisation costs (iii) 510 -

Total adjustments (1,868) 1,882

-------------------------------------- -------- ---------------

(i) Adjustments to deferred consideration comprise releases of

GBP3,986,000 and reassessments of GBP1,693,000 partly offset by the

unwind of discount on deferred consideration balances of GBP357,000

and legal and other fees associated with settling certain of the

earn-outs of GBP318,000. GBP669,000 was paid in cash in full

settlement of the Waterfall earn-out considerations and so the

balance of the deferred consideration held has been released to the

Other income line within the income statement. After the payment of

GBP200,000 for excess working capital, no further deferred

consideration was paid in relation to the Essential Viewing

earn-out considerations and so the full balance of the deferred

consideration has been released to the Other income line within the

income statement. GBP315,000 was paid in cash in the year and a

further GBP107,000 was issued in shares after year end in full

settlement of the Keeneo earn-out considerations, and the balance

of the deferred consideration held has been released to the Other

income line within the income statement. The undiscounted deferred

consideration in respect of Zimiti has been reassessed as at 31

March 2012 to be GBP1,720,000.

(ii) The gain on bargain purchase relates to the acquisition of

ThruVision, and has been recognised in the other income line within

the income statement.

(iii) Reorganisation costs relate to the rationalisation of the

organisational and geographical design, information systems and

support functions within both the Services and Products divisions.

As the expenditure relates to transforming the divisions for the

future these costs are not directly related to current

operations.

3. Loss per share

Unadjusted loss per share

Weighted Weighted

average average

Loss after number of Loss per Loss after number of Loss per

taxation shares share taxation shares share

2012 2012 2012 2011 2011 2011

GBP'000 No. Pence GBP'000 No. Pence

----------------------- ---------- ---------- -------- ---------- ---------- --------

Basic loss per share (3,541) 43,660,670 (8.11) (4,348) 28,279,011 (15.38)

----------------------- ---------- ---------- -------- ---------- ---------- --------

Diluted loss per share (3,541) 43,660,670 (8.11) (4,348) 28,279,011 (15.38)

----------------------- ---------- ---------- -------- ---------- ---------- --------

Adjusted loss per share

Weighted

average Weighted

Loss after number Loss per Loss after average number Loss per

Taxation of shares share Taxation of shares share

2012 2012 2012 2011 2011 2011

GBP'000 No. Pence GBP'000 No. Pence

------------------------------------------- ---------- ---------- -------- ---------- --------------- --------

Loss attributable to ordinary shareholders (3,541) 43,660,670 (8.11) (4,348) 28,279,011 (15.38)

Add back:

Amortisation of acquired intangible

assets, net of tax 1,833 - 4.20 529 - 1.87

IPO, Placing costs and deal costs 754 - 1.72 1,125 - 3.97

Adjustments to deferred consideration (5,004) - (11.46) 89 - 0.32

Gain on bargain purchase (152) - (0.35) - - -

Reorganisation costs 510 - 1.17 - - -

------------------------------------------- ---------- ---------- -------- ---------- --------------- --------

Basic adjusted loss per share (5,600) 43,660,670 (12.83) (2,605) 28,279,011 (9.21)

------------------------------------------- ---------- ---------- -------- ---------- --------------- --------

Diluted adjusted loss per share (5,600) 43,660,670 (12.83) (2,605) 28,279,011 (9.21)

------------------------------------------- ---------- ---------- -------- ---------- --------------- --------

The Directors consider that adjusted loss per share better

reflects the underlying performance of the Group.

The inclusion of potential ordinary shares arising from LTIPs

and Incentive Shares would be anti-dilutive. Basic and diluted loss

per share has therefore been calculated using the same weighted

number of shares. If the Incentive Shares had become convertible on

31 March 2012 and based on the share price of GBP1.815 (2011:

GBP2.05) on that day, 2,332,711 (2011: 2,679,206) ordinary shares

would have been issued in respect of the Incentive Share

conversion. Full details as to the basis of calculation are given

in the Placing Document available on the Company's website. The

Incentive Shares will immediately vest on change of control of the

Company.

The weighted average number of shares excludes any shares held

by employee share ownership plan (ESOP) trusts, which are treated

as cancelled.

4. Trade and other receivables

Gross carrying Provision Net carrying Gross carrying Provision Net carrying

amounts for impairment amounts amounts for impairment amounts

2012 2012 2012 2011 2011 2011

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------ -------------- --------------- ------------ -------------- --------------- ------------

Trade receivables 6,074 (118) 5,956 3,169 (355) 2,814

Prepayments and accrued

income 643 - 643 167 - 167

Amounts recoverable on

contracts - - - 233 - 233

Other receivables 161 - 161 29 - 29

------------------------ -------------- --------------- ------------ -------------- --------------- ------------

6,878 (118) 6,760 3,598 (355) 3,243

------------------------ -------------- --------------- ------------ -------------- --------------- ------------

5. Trade and other payables

2012 2011

GBP'000 GBP'000

-------------------------------- -------- --------

Current

Trade payables 2,807 2,030

Accruals 2,753 1,024

Payments received on account 275 220

Social security and other taxes 835 400

Other payables 124 6

-------------------------------- -------- --------

6,794 3,680

-------------------------------- -------- --------

6. Financial liabilities

2012 2011

GBP'000 GBP'000

----------------------- -------- --------

Current

Incentive Shares 218 218

Deferred consideration 1,532 3,137

----------------------- -------- --------

1,750 3,355

----------------------- -------- --------

Non-current

----------------------- -------- --------

Deferred consideration 1,000 673

----------------------- -------- --------

7. Business combinations

Business combinations in the year ended 31 March 2012

The Group has made six material acquisitions during the year,

each of which the Board believes has a product set and technology

capabilities that are complementary to those already offered by the

Group and which will expand the solutions the Group can bring to

its customers. These acquisitions were all made into the Group's

Products division. Non material 'Other Acquisitions' were made into

the Group's Services division.

Zimiti Limited

On 18 June 2011, the Group acquired the entire share capital of

Zimiti Limited ('Zimiti'). Zimiti is a wireless communications

specialist that develops very low power, wireless, autonomous

networks that operate securely over long ranges using small power

sources for long periods of time. Its technology is used to enable

sensor systems to operate in intelligent networks, or to enhance

existing fixed networks by making them more flexible and cheaper to

install and improve. Zimiti is currently focusing on the

development of unattended ground sensor technology that can be used

in a range of surveillance and protective applications across both

the defence and security sectors, being particularly effective in

remote or hostile locations.

Keeneo SAS

On 29 July 2011, the Group acquired the entire share capital of

Keeneo SAS ('Keeneo'). Keeneo was founded in 2005 as a spin-out

from INRIA, the French institute for computer science and automatic

control research, and provides proprietary video analytics software

solutions to the security, aviation, mass-transit, energy and

industrial sectors from its operational base in Sophia-Antipolis,

France. Keeneo operates primarily in Europe but has recently begun

to extend its presence into other regions, most notably the Middle

East. Keeneo's solutions enable the real-time detection of human

intrusion and other pre-defined activities or incidents within a

targeted 3D area or zone. Keeneo also offers a patented "4D"

solution that can intelligently adapt its surveillance to manage

adverse environmental effects, such as changing light or weather

conditions.

Stryker Communications Limited

On 18 November 2011, the Group acquired the entire share capital

of Stryker Communications Limited ('Stryker'). Stryker is a

specialist engineering business that focuses on re-deployable

integrated wireless CCTV systems. Stryker has developed a range of

readily deployable products that integrate various types of camera,

transmission technologies and DVR recording that can be used for

both overt and covert surveillance.

LMW Electronics

On 20 January 2012, the Group acquired the complete product set

and intellectual property, along with certain customer contracts,

of LMW Electronics Limited ('LMW'). LMW's products provide advanced

video capture and transmission technology to the international law

enforcement and military markets. Its leading edge products include

ruggedised video cameras, outstations, vehicle and body-worn

solutions, controller units and low-power point-to-point video

transmission solutions. The LMW products and associated

intellectual property will form part of the readily deployable

Tactical Product range that the Group is developing for its

customers around the world.

Codestuff Limited

On 1 March 2012 the Group acquired the entire share capital of

Codestuff Limited ('Codestuff'). Codestuff is the developer of a

range of best-in-class internet protocol video solutions for the

security, infrastructure, transportation and defence industries.

Operating primarily in the UK, Codestuff's solutions include video

management system ('VMS') software and network video recorder

('NVR') servers, in addition to system design and development

services that build on its extensive video management platform.

Codestuff offers its solutions to a variety of leading players in

the CCTV and security industries, as well as a number of original

end manufacturers, and is an existing supplier of VMS technology to

the Group.

ThruVision

On 8 March 2012 the Group acquired the assets, intellectual

property and customer contracts of ThruVision Systems Limited

('ThruVision'). ThruVision designs and manufactures standoff

passive TeraHertz screening products that can detect objects under

a person's clothes, such as weapons, explosives or smuggled

contraband. ThruVision's products incorporate proprietary passive

sensing technology that detect concealed objects safely using

natural energy. ThruVision's products have been deployed around the

world for a variety of screening applications including border

security, law enforcement, defence and loss prevention.

Other Acquisitions

During the year ended 31 March 2012 the Group made other

non-material acquisitions for total cash consideration of GBP0.2

million, paid on completion.

Purchase consideration

The purchase consideration for each acquisition was as

follows:

Zimiti Keeneo Stryker LMW Codestuff ThruVision Other Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- -------- -------- -------- -------- ---------- ----------- -------- --------

Cash consideration 878 1,416 716 450 639 950 200 5,249

Issue of share capital - 349 - - - - - 349

Discounted fair value

of deferred consideration 3,168 2,139 717 89 - - - 6,113

---------------------------- -------- -------- -------- -------- ---------- ----------- -------- --------

Total consideration 4,046 3,904 1,433 539 639 950 200 11,711

---------------------------- -------- -------- -------- -------- ---------- ----------- -------- --------

Pre-tax cost of debt 7.2% 7.0% 6.0% 6.0% - - -

Undiscounted fair

value of deferred

consideration 3,400 2,352 750 90 - - -

---------------------------- -------- -------- -------- -------- ---------- ----------- --------

In accordance with IFRS3R the Directors have assessed the

undiscounted fair value of deferred consideration payable for each

acquisition as stated above, based on expected cash flows. The

discounted fair values of deferred consideration payable have been

calculated from the undiscounted amounts using the pre-tax cost of

debt as stated above.

The Zimiti maximum consideration is GBP10.0 million payable in

cash and new Ordinary Shares at the Group's discretion, on a

cash-free, debt-free basis. Initial cash consideration of GBP1.5

million was paid less debt and working capital adjustments of

GBP0.6 million. Deferred consideration of up to GBP8.5 million is

payable over the period from completion to 30 September 2013,

subject to revenue, profit and operational targets. Up to GBP4.25

million of the deferred consideration may be satisfied through the

issue of new Ordinary Shares, with the balance satisfied in cash.

Up to GBP1.25 million of the deferred consideration is based on

operational targets through to 18 June 2012, but can be achieved

and paid prior to this date. Up to GBP1.25 million of the deferred

consideration is based on operational targets through to 30

September 2012, but can be achieved and paid prior to this date. Up

to GBP3.0 million of the deferred consideration is based on revenue

and profit targets for the year ended 30 September 2012 and a

further GBP3.0 million on the year ended 30 September 2013. The

amount of deferred consideration likely to be paid was reassessed

at 31 March 2012.

The Keeneo maximum consideration is EUR6.5 million payable in

cash and new Ordinary Shares at the Group's discretion. The Group

will also assume debt of up to EUR1.0 million. Initial

consideration paid on completion was EUR2.0 million of which EUR1.6

million was paid in cash and a further EUR0.4 million was satisfied

through the issue of new Ordinary Shares. Deferred consideration of

up to EUR4.5 million is payable over the period from completion to

31 March 2014, subject to revenue and profit targets. Up to EUR2.25

million of the deferred consideration may be satisfied through the

issue of new Ordinary Shares, with the balance satisfied in cash.

EUR0.5 million of this deferred consideration is based on certain

financial targets for the year ended 31 March 2012, EUR2.0 million

on the year ended 31 March 2013 and EUR2.0 million on the year

ended 31 March 2014. The deferred consideration recognised on

acquisition was GBP2.1 million. Following the settlement in full of

any earn-out considerations the balance of deferred consideration

held at 31 March 2012 has been reduced to GBP0.1 million.

The Stryker maximum consideration is GBP1.5 million payable in

cash. Initial cash consideration of GBP0.75 million was paid on

completion less a working capital adjustment of GBP0.03 million.

Deferred consideration of up to GBP0.75 million is payable in cash

over the period from completion to 30 September 20112, subject to

certain financial and operational conditions.

LMW maximum consideration is GBP0.75 million payable in cash.

Initial cash consideration of GBP0.45 million was paid on

completion. Deferred consideration of up to GBP0.30 million is

payable in cash over the period from completion to 19 July 2012

subject to certain operational conditions.

Codestuff maximum cash consideration is GBP1.50 million. Initial

cash consideration of GBP0.75 million was paid on completion less a

working capital adjustment of GBP0.1 million. A further GBP0.75

million is payable in two tranches shortly after the years ending

31 March 2013 (GBP0.3 million) and 31 March 2014 (GBP0.45 million),

and is contingent on the vendors continuing to be employed by the

Group at those dates. These amounts are treated as remuneration for

services to Codestuff and will be recognised within administrative

expenses over the respective years to 31 March 2013 and 31 March

2014.

The ThruVision total cash consideration of GBP0.95 million was

paid on completion.

Total deal costs of GBP754,000 (2011: GBP892,000) were incurred

and recorded within the administration costs line in the income

statement.

As at 31 March 2012, the maximum deferred consideration payable

in the future is GBP9.7 million (2011: GBP4.0 million), up to

GBP4.3 million (2011: GBPnil) of which may be satisfied through the

issue of new Ordinary Shares, and the remainder satisfied in

cash.

8. Post balance sheet events

On 23 April 2012, the Group acquired the complete product set

and intellectual property, along with certain customer contracts,

of Enterprise Technologies (UK) Limited ('E-Tech'). Under the terms

of the acquisition the Group has acquired the intellectual

property, products, know-how, stock and certain customer contracts

of E-Tech for the purchase on completion of E-Tech stock in the

amount of GBP149,000. In addition, commission will be payable on

legacy E-Tech products sold by Digital Barriers in the period

between completion and 31 March 2013.

E-Tech's exceptionally skilled staff of four each has a

background in technical surveillance, military and commercial

communications technologies across the defence and security

sectors. These employees have now joined the Group under the terms

of the Acquisition. Together with their very highly regarded, and

complementary to the Group, technology capabilities, they are

expected to expand the range of solutions the Group can offer to

its customers.

Provisional net assets acquired were GBP149,000 which will

result in provisional intangible assets and goodwill of GBP430,000

and GBP755,000 respectively.

On 4 May 2012, 59,216 Ordinary Shares were issued in settlement

of deferred consideration payable in respect of the acquisition of

Keeneo.

9. Issued share capital

On 5 August 2011 the Company issued 195,460 Ordinary Shares on

the acquisition of Keeneo.

At 31 March 2012 there were 43,727,960 Ordinary Shares in issue

(2011: 43,532,500).

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR EAESPAASAEAF

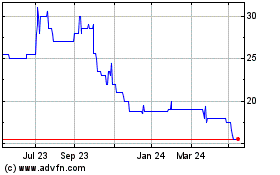

Thruvision (LSE:THRU)

Historical Stock Chart

From Jun 2024 to Jul 2024

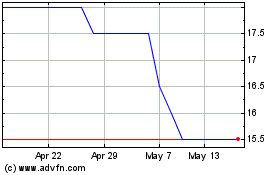

Thruvision (LSE:THRU)

Historical Stock Chart

From Jul 2023 to Jul 2024