Interim Results

September 29 2000 - 3:00AM

UK Regulatory

RNS Number:7289R

10 Group PLC

29 September 2000

10 Group plc

Interim Results

10 Group plc, the AIM-listed e-commerce, media and publishing company,

announces its interim results for the half year ended 30 June 2000. Key

features are:

* Gross Profit up 50% compared to same period last year

* Development continuing at a fast pace as the Group transforms itself into a

focused mini conglomerate, aimed at maximising shareholder value

* Group building on core businesses in Publishing, Internet, Advertising, &

Marketing

* Investment in both Online and Offline ventures.

* Management ambitious for further growth - with individual divisions built

on the prospect of sale or flotation in due course

* Balance sheet includes over #4m in cash

"As a focused mini conglomerate, 10 Group faces the future with considerable

potential for future growth. The Board's five year plan has established a

solid platform from which the Group will continue to develop through both

organic growth and strategic acquisition.

"We are on course to create a highly skilled entrepreneurial enterprise.

Despite continuing to invest heavily in acquiring and starting new

businesses, we have strengthened our cash resources and reduced our net

losses in line with our philosophy of maximising shareholder value.

"One of the strategic aims is to develop a number of specialist divisions

which could then either be floated off in their own right, or sold at a

profit."

Andy Moore, Chairman

FULL STATEMENT ATTACHED

Enquiries:

Andy Moore Keith Gabriel

Chairman Citigate Dewe Rogerson

10 Group plc Tel: 0121 631 2299

Tel: 0121 234 1310 Mobile: 0958 985395

Mobile: 07836-722840

10 Group plc

Interim Results

for the half year ended 30 June 2000

STATEMENT BY THE CHAIRMAN, ANDY MOORE

Since taking over as Chairman in the second half of 1998, and strengthening

the management team of 10 Group plc, I am pleased to report that the Company

is successfully pushing ahead with its five year plan. We are actively

building on our core businesses in Publishing, Internet, Advertising and

Marketing to grow as a focused mini conglomerate with both Online and Offline

interests. Our aim is to develop a number of individual divisions which, in the

longer-term, may be floated as public companies in their own right, or sold

at a profit.

To date, we have created:

* 10 Publishing - traditional media with a powerful online future

* 10 Design - Online and Offline Advertising and Marketing services.

* 10 Property - building a traditional asset base.

* 10 Internet - our own Internet Service Provider, 10.co.uk, plus a portfolio

of over 3,000 Internet Gimme brands including GimmeMusic and GimmeJobs

* 10i - investment in the next exciting wave of entrepreneurs

I firmly believe that 10 Group is on course to create a rapidly-expanding,

highly skilled, entrepreneurial enterprise that will flourish in today's

hi-tech environment.

Last December marked the completion of 10 Group's first full financial year

under our new management, with a #1.398 m loss being recorded on a turnover

of #9.241m. Since then, we have continued to invest in both acquiring and

starting new businesses, while working to move the Group towards

profitability. We have built our Gross Profit to #1,905,000; up 50% on the

same period last year (#1,264,000 to 30.6.99).

We are committed to building value for our 10,000 shareholders. While focused

on our core businesses, we recognise that new opportunities come and go very

quickly in today's business climate. Therefore we shall continue to allocate

funds to take advantage of these opportunities as they arise.

10 Group plc

Interim Results

CONSOLIDATED PROFIT AND LOSS ACCOUNT

six months to 30 June 2000

6 months ended 6 months ended Year ended

30 June 2000 30 June 1999 31 December 1999

(unaudited) (unaudited) (audited)

#'000 #'000 #'000

Turnover 3,857 4,877 9,241

Cost of sales (1,952) (3,613) (5,606)

Gross profit 1,905 1,264 3,635

Administrative (2,275) (1,564) (4,788)

expenses

Operating (loss) (370) (300) (1,153)

Amortisation of (43) (62) (1,148)

goodwill

Other (90)

(413) (452) (2,301)

Profit on disposal 27 903

of subsidiaries

(Loss) on ordinary (385) (452) (1,398)

activities before

interest

Interest & similar 47 10 0

charges

Loss on ordinary (338) (442) (1,398)

activities before

taxation

Taxation 0

Loss on ordinary (338) (442) (1,398)

activities after

taxation

Loss per ordinary 0.06p 0.18p 0.43p

share

10 Group plc

Interim Results

CONSOLIDATED BALANCE SHEET

six months to 30 June 2000

30 June 2000 30 June 1999 31 December 1999

(unaudited) (unaudited) (audited)

#'000 #'000 #'000 #'000 #'000 #'000

Fixed assets

Goodwill 889 1,320 720

Tangible assets 1,345 475 360

Intangible assets 358

Investments 125

2,716 1,795 1,080

Current assets

Stock 910 69 79

Debtors 1,986 2,319 1,576

Cash 4,122 475 2,993

7,019 2,863 4,648

Creditors: (3,068) (3,668) (2,381)

amounts falling

due within one

year

Net current 3,950 (805) 2,267

assets/(liabilities)

Total assets 6,667 990 3,347

Creditors: (429) (787) (173)

amounts falling

due after more

than one year

Net assets 6,238 203 3,174

Capital and

reserves

Called up share 8,275 7,241 8,004

capital

Share premium 6,616 964 3,915

account

Capital 3,564 3,564 3,564

redemption

reserve

Merger reserve 642 213

Profit and loss (12,859) (11,566) (12,522)

account

Equity 6,238 203 3,174

shareholders'

funds

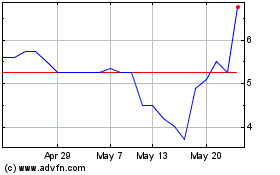

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jun 2024 to Jul 2024

Tirupati Graphite (LSE:TGR)

Historical Stock Chart

From Jul 2023 to Jul 2024