System1 Group PLC Trading Update (6748A)

January 24 2024 - 2:00AM

UK Regulatory

TIDMSYS1

RNS Number : 6748A

System1 Group PLC

24 January 2024

24 January 2024

System1 Group PLC (AIM: SYS1)

("System1", or "the Company", or "the Group")

Quarter 3 Trading Update

Increase in Full Year Guidance

System1, the marketing decision-making platform

www.system1group.com today issues an update on trading for the

quarter ended 31 December 2023 (Q3).

Revenue GBP million Q3 Q3 Q3 YTD YTD YTD

- unaudited

FY24 FY23 % YoY FY24 FY23 % YoY

---------------------------------- ----- ----- ------ ----- ----- ------

Predict Your (data) 5.2 3.4 53% 14.2 9.6 49%

Improve Your (data-led

consultancy) 1.0 0.9 16% 2.9 2.3 25%

Platform Revenue 6.2 4.3 46% 17.1 11.9 44%

---------------------------------- ----- ----- ------ ----- ----- ------

Other consultancy (non-platform) 1.8 2.0 -6% 4.2 4.9 -13%

Total Revenue 8.0 6.2 29% 21.4 16.7 28%

---------------------------------- ----- ----- ------ ----- ----- ------

Quarter 3

System1 made further progress on delivery against the strategic

review objectives that the Board set out following the 2022

strategic review, growing Q3 platform revenue by 46% versus Q3

FY23.

Predict Your (data) revenue grew by 53% on the comparable

prior-year quarter to GBP5.2m and Improve Your (data-led

consultancy) revenue increased by 16% over the comparable

prior-year quarter to GBP1.0m, bringing total platform revenue to

GBP6.2m, up 46%.

Total Group revenue grew by GBP1.9m to GBP8.0 million, up 29% on

Q3 FY23, with strong growth in the US, Europe and the UK.

Nine Months to 31 December 2023

Predict Your (data) revenue grew by 49% on the comparable

prior-year period to GBP14.2m and Improve Your (data-led

consultancy) revenue increased by 25% over the comparable prior

year to date to GBP2.9m, bringing total platform revenue to

GBP17.1m, up 44%.

Total Group revenue grew by GBP4.7m to GBP21.4m, up 28%, with

year-to-date gross profit margin at 87% remaining strong.

The Group's Q3 period end cash balance rose to GBP6.4m (31 March

2023: GBP5.7m).

New Clients and Partners

System1 won over 60 new clients in Q3, and over 200 new clients

in FY24 Q1 - Q3. These new clients include Pfizer, M&S, Tesco,

easyJet, Toyota, Muller, B&Q, and Just Eat.

New partnerships were secured with one of the leading

ad-supported broadcast and cable networks in the US as well as Roku

TV, Radiocentre, Aardman Animations and Fuse OMD Worldwide.

Outlook

The Group enters the final quarter of the year with good trading

momentum following a consistently strong December quarter. As a

consequence, the Board believes that the Group is now well placed

to deliver results ahead of previous expectations. Revenue for the

current financial year is expected to be at least GBP29 million

(FY23: GBP23.4 m) and statutory profit before tax to be comfortably

above GBP2 million and materially ahead of current consensus (FY23:

GBP0.7m).

Commenting on the trading update, CEO James Gregory said: "We

continue to deliver quarter on quarter revenue and profit growth,

exceeding GBP8m revenue for the last quarter and increasing

platform revenue by 46%. We are executing our go-to-market plans

and building out ever-improving customer propositions, creating the

momentum to grow further over the coming years".

Capital Markets Day

The Company will be holding a Capital Markets Day via Investor

Meet Company at 3:00pm GMT on Wednesday 7 February 2024.The meeting

is open to all existing and potential shareholders. Questions can

be submitted pre-event via your Investor Meet Company dashboard up

until 9:00am the day before the meeting or at any time during the

live presentation.

Investors can sign up to Investor Meet Company for free and add

to meet System1 Group PLC via:

https://www.investormeetcompany.com/system1-group-plc/register-investor

Investors who already follow System1 Group PLC on the Investor

Meet Company platform will automatically be invited.

Further information on the Company can be found at

www.system1group.com .

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

For further information, please contact:

System1 Group PLC Tel: +44 (0)20 7043

1000

James Gregory, Chief Executive Officer

Chris Willford, Chief Financial Officer

Canaccord Genuity Limited (Nominated Adviser Tel: +44 (0)20 7523

& Broker) 8000

Simon Bridges / Andrew Potts / Harry Rees

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTQKNBNOBKDCDB

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

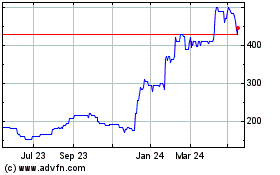

System1 (LSE:SYS1)

Historical Stock Chart

From Oct 2024 to Nov 2024

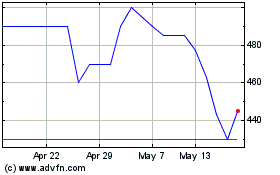

System1 (LSE:SYS1)

Historical Stock Chart

From Nov 2023 to Nov 2024