TIDMSVE

RNS Number : 1260O

Starvest PLC

28 May 2020

28 May 2020

Half-year report - six months ended 31 March 2020

Chairman's statement

Market performance in the latter half of calendar 2019 remained

as per the first half with little direction and minimal movement in

many of our portfolio stocks and commodity prices. But from January

2020 the market dynamic changed significantly following reduced oil

prices and the impact of COVID-19 which has resulted in major

changes across many sectors.

In our market sector focus (natural resources) precious metals

have seen much interest. We are fortunate that during the course of

2019 we refocussed our portfolio to reduce holdings in oil and gas

while increasing our exposure to precious metals. Through our

efforts we have benefitted significantly as reflected in our Net

Asset Value which has increased from GBP2.25m as at 30 Sept 2019 to

GBP4.66m as at 31 March 2020 an increase of more than 100%. This

increase in NAV continues into the current quarter largely

benefitted by the outstanding performance of Greatland Gold plc

(LON:GGP) and Ariana Resources plc (LON:AAU).

Accompanying the very pleasing increase in NAV, the Company made

an Operating Profit of GBP 2,532,834 during the six month period to

31 March 2020 mainly attributable to significant increases in

selected portfolio stocks such as Greatland Gold plc and Ariana

Resources plc. This Operating Profit resulted in a Profit per Share

of 4.53p for the period.

The Company continues its historic policy of investing in

companies with early stage resource projects but we also have the

mandate to invest directly in projects. We continue to review

promising projects, particularly with a precious metal focus. We

are also evaluating other commodities such as lithium and cobalt

which are forecast to increase in use and demand over the medium to

long term.

While COVID-19 has affected markets recently; mining and

exploration operations for several of our investee companies

remained largely unchanged. They have continued to provide very

positive news-flow while adapting to the pandemic situation and

take full consideration of both staff and stakeholders into

account. They are to be commended for their efforts under the

current circumstances.

Greatland Gold (LON:GGP) has seen continued exploration on its

Paterson project licences with drilling at the Havieron gold-copper

deposit producing more exciting results. The Newcrest Mining

Limited (ASX:NCM) operated Havieron project has expanded known

mineralisation to over 400m in length and 150m wide and up to 600m

below cover while remaining open to the northwest and at depth.

Newcrest currently have 9 drill rigs in operation at the site and

are undertaking a concept study investigating potential underground

mining techniques with completion targeted for H2 2020. Greatland

Gold have also been conducting their own exploration programmes and

continue to show encouraging drill results from their Tasmanian

licences. At Firetower, IP anomalies were drill tested and gold

mineralisation was proven coincident with further IP anomalies yet

to be drilled out, and at Warrentinna diamond drilling established

near surface high-grade gold. Geophysics and geochemical surveys in

the Paterson have established numerous high-priority targets for

drill testing, with signatures similar to those of the Havieron

target, and field work on these is set to commence once COVID-19

restrictions are lifted. Well funded and with a strong team in

place we look forward to further encouraging news from the

company.

Ariana Resources (LON:AAU) continues to report good silver-gold

production results from its Kiziltepe Mine. Annual production in

2019 exceed guidance by over 10% as well as reducing operating

costs in the last quarter from US$540 to US$500 and the Company has

now completed 100% repayment of its $33m capital loan on the mine

as reported on 1 May 2020. Q1 2020 preliminary results are

continuing to show strong results again with production exceeding

average annualised quarterly guidance by 14% at 5,129 oz at an

average grade of 3.22g/t gold. Ariana has also been continuing

exploration on its 100% owned Kizilcukur project with a view to

possibly developing the deposit as a satellite to the Kiziltepe

Mine.

Cora Gold (LON:CORA) has continued exploration activities on its

flagship Sanankoro gold project, with metallurgical testing and a

scoping study overseen by Wardell Armstrong International. The

Study based on a US$1,400 gold price sees an IRR of 84% and

US$30.9m NPV at 8% discount rate. With US$942 per oz all in

sustaining cost. Capex is estimated at a US$20.6m pre-production

with an 18-month pay-back period; based on the top 100m of known

mineralisation. The estimate is based on 25% of a total strike

length with a further approximate 30 linear km strike length of

potential mineralised zones yet to be drill tested. COVID-19

restrictions have curtailed the company's drilling on lower

priority projects in Senegal but exploration work on expanding the

resources at Sanankoro has not been affected. The company is well

funded with a recent equity raise of over GBP2.75m completed.

Kefi Minerals (LON:KEFI) are continuing with the construction of

the Tulu Kapi gold mine in Ethiopia and remain on target to start

full production in 2022 Off-site infrastructure construction

programmes are currently continuing for road and electricity

connections. The national Bank of Ethiopia approved the term sheet

for the project finance with two leading African banks and the

Central Bank registered $49m of past investment in the project with

further historical spending due to be registered. This will allow

for compliance with the 30/70 equity/debt capital ratio required

for foreign direct investment in the project which allows lenders

to trigger credit approvals and documentation to allow full

financial close of the project funding in October 2020.Kefi has

also seen significant advances in its exploration of the Hawiah

project in Saudi Arabia. Scout drilling targeted a volcanogenic

massive sulphide (VMS) system and intercepted anomalous gold,

silver, copper and zinc over a 4km section of a 5km long gossan

ridge and coincident geophysical anomaly. The company hopes to

delineate a JORC compliant maiden Mineral Resource Estimate by

mid-2020.

Other investee companies also continue to push ahead such as

Oracle Power (LOM:ORCP) with a new consortium established to help

see its proposed coal mine and power plant progress toward

development. Similarly, Sunrise Resources (LON:SRES) has continued

to advance a pozzolan-perlite project in Nevada, USA towards mine

permitting.

Overall, throughout the past year we moved our focus to precious

metals and trimmed our exposure to oil stocks: a strategy that is

now bearing fruit. We note the current market volatility but our

leverage to safe haven assets lets us feel confident that we can

retain value and continue to achieve a very positive outcome.

Callum N Baxter

Chairman & Chief Executive

28 May 2020

Income Statement

6 months 6 months Year ended

to 31 March to 31 March 30 September

2020 2019 2019

Unaudited Unaudited Audited

GBP GBP GBP

Revenue 62,253 27,165 287,655

Cost of sales (40,044) (16,257) (235,442)

------------- ------------- --------------

Gross profit 22,209 10,908 53,213

Administrative expenses (150,337) (127,149) (251,225)

Amounts written off against

trade investments (86,103) (133,086) (383,612)

Amounts written back against

trade investments 2,747,065 889,741 968,387

Operating profit 2,532,834 640,414 386,763

Interest receivable 20 37 87

------------- ------------- --------------

Profit on ordinary activities

before tax 2,532,854 640,451 386,850

Tax on profit on ordinary activities - - -

------------- ------------- --------------

Profit attributable to equity

holders of the Company 2,532,854 640,451 386,850

============= ============= ==============

Earnings per share - see note

3 4.53 pence 1.18 pence 0.70 pence

Basic 4.53 pence 1.02 pence 0.70 pence

Diluted

Statement of Financial Position

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2020 March 2019 2019

Unaudited Unaudited Audited

GBP GBP GBP

Current assets

Trade and other receivables 22,738 16,331 114,537

Trade investments 4,537,810 2,258,694 1,916,398

Cash and cash equivalents 118,078 36,429 60,167

------------ ------------ --------------

Total current assets 4,678,626 2,311,454 2,091,102

------------ ------------ --------------

Current liabilities

Trade and other payables (120,672) (44,504) (66,003)

------------ ------------ --------------

Total current liabilities (120,672) (44,504) (66,003)

------------ ------------ --------------

Net current assets 4,557,954 2,266,950 2,025,099

============ ============ ==============

Capital and reserves

Called up share capital 559,279 552,927 559,279

Share premium account 1,686,829 1,681,431 1,686,829

Profit and loss account 2,311,846 32,592 (221,009)

------------ ------------ --------------

Total equity shareholders'

funds 4,557,954 2,266,950 2,025,099

============ ============ ==============

Statement of Cash Flows

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2020 March 2019 2019

Unaudited Unaudited Audited

GBP GBP GBP

Cash flows from operating activities

Operating profit 2,532,834 640,414 386,763

Net interest receivable 20 37 87

Share based payment charge - 40,500 52,250

Reversal of bad debt provision - (20,000) (20,000)

Decrease/(increase) in trade

and other receivables 91,800 39,660 (58,545)

Increase/(decrease) in trade

and other payables 54,669 (77,396) (5,897)

------------ ------------ --------------

Net cash flows from operating

activities 2,679,323 623,215 354,658

------------ ------------ --------------

Cash flows from investing activities

Purchase of current asset investments - - (47,000)

Sale of current asset investments 61,904 26,928 286,648

Profit on sale of current asset

investments (22,354) (10,908) (53,213)

Increase in investment provisions 86,103 133,086 383,612

Decrease in investment provisions (2,747,065) (889,741) (968,387)

------------ ------------ --------------

Net cash flows from investing

activities (2,621,412) (740,635) (398,340)

------------ ------------ --------------

Cash flows from financing activities

Proceeds from issue of shares - - -

Transaction costs of issue of - - -

shares

Loan repayment - - (50,000)

------------ ------------ --------------

Net cash flows from financing

activities - - (50,000)

------------ ------------ --------------

Net increase/(decrease) in cash

and cash equivalents 57,911 (117,420) (93,682)

Cash and cash equivalents at

beginning of period 60,167 153,849 153,849

------------ ------------ --------------

Cash and cash equivalents at

end of period 118,078 36,429 60,167

============ ============ ==============

Statement of Changes in Equity

Equity reserve Total Equity

attributable to

Share capital Share premium Profit and loss account shareholders

GBP GBP GBP GBP GBP

At 30 September 2018 539,649 1,654,209 2,500 (607,859) 1,588,499

============= ============= ============== ======================= ======================

Profit for the period - - - 640,451 640,451

------------- ------------- -------------- ----------------------- ----------------------

Total recognised income

and expenses for the

period - - - 640,451 640,451

Shares issued 13,278 27,222 - - 40,500

Equity component of

convertible loan - - (2,500) - (2,500)

Total contribution by

and distributions to

owners 13,278 27,222 (2,500) - 38,000

At 31 March 2019 552,927 1,681,431 - 32,592 2,266,950

============= ============= ============== ======================= ======================

At 30 September 2019 559,279 1,686,829 - (221,009) 2,025,099

============= ============= ============== ======================= ======================

Profit for the period - - - 2,532,854 2,532,854

Total recognised income

and expenses for the

period - - - 2,532,854 2,532,854

Shares issued - - - - -

Equity component of - - - - -

convertible loan

------------- ------------- -------------- ----------------------- ----------------------

Total contributions by - - - - -

and distributions to

owners

At 31 March 2020 559,279 1,686,829 - 2,311,846 4,557,954

============= ============= ============== ======================= ======================

Interim report notes

1. Interim report

The information relating to the six month periods to 31 March

2020 and 31 March 2019 is unaudited.

The information relating to the year ended 30 September 2019 is

extracted from the audited accounts of the Company which have been

filed at Companies House and on which the auditors issued an

unqualified audit report.

2. Basis of preparation

This report has been prepared in accordance with applicable

United Kingdom accounting standards, including Financial Reporting

Standard 102 - 'The Financial Reporting Standard applicable in the

United Kingdom and Republic of Ireland' ('FRS102'), and with the

Companies Act 2006. Although the information included herein does

not constitute statutory accounts within the meaning of section 435

of the Companies Act 2006, the accounting policies that have been

applied are consistent with those adopted for the statutory

accounts for the year ended 30 September 2019.

The Company will report again for the full year to 30 September

2020.

The Company's investments at 31 March 2020 are stated at the

lower of cost and net realisable value or the valuation adopted at

30 September 2019 or the current market value based on market

quoted prices at the close of business. The Chairman's statement

includes a valuation based on market quoted prices at 31 March

2020.

3. Profit per share

6 months 6 months Year ended

ended 31 ended 31 30 September

March 2020 March 2019 2019

Unaudited Unaudited Audited

GBP GBP GBP

Profit for the year: 2,532,854 640,451 386,850

------------- ------------- --------------

Weighted average number of

Ordinary shares of GBP0.01

in issue 55,927,832 54,460,957 55,057,197

Earnings per share - basic 4.53 pence 1.18 pence 0.70 pence

============= ============= ==============

Warrants in issue - 8,500,000 -

Weighted average number of

Diluted Ordinary shares of

GBP0.01 in issue 55,927,832 62,960,957 55,057,197

Earnings per share - diluted 4.53 pence 1.02 pence 0.70 pence

============= ============= ==============

Investment portfolio

Starvest now holds trade investments in the companies listed

below; of these the following companies comprised 99% of the

portfolio value as at 31 March 2020:

Exploration for oil in England,

* Alba Mineral Resources plc lead-zinc in Ireland, uranium in

Mauritania and graphite in Greenland

www.albamineralresources.com

Gold-silver production and exploration

* Ariana Resources plc in Turkey

www.arianaresources.com

Gold exploration in West Africa

* Cora Gold Limited www.coragold.com

Gold exploration in Australia

* Greatland Gold plc www.greatlandgold.com

Gold and copper exploration in Ethiopia

* Kefi Minerals plc and Saudi Arabia

www.kefi-minerals.com

Coal mining in Pakistan

* Oracle Coalfields plc www.oraclecoalfields.com

Other direct and indirect mineral exploration companies:

Oil and gas exploration in Bulgaria

* Block Energy plc (formerly Goldcrest Resources plc) www.goldcrestresourcesplc.com

Gold exploration in South America

* Minera IRL Limited www.minera-irl.com

Exploration for industrial minerals

* Sunrise Resources plc in United States, Finland, Australia

and Ireland

www.sunriseresourcesplc.com

Other investee companies are listed in the Company's 2019 annual

report available on request or from the Company web site -

www.starvest.co.uk

Copies of this interim report are available free of charge by

application in writing to the Company Secretary at the Company's

registered office, Salisbury House, London Wall, London EC2M 5PS,

by email to info@starvest.co.uk or from the Company's website -

www.starvest.co.uk

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

Enquiries to:

Starvest PLC

Callum Baxter or Gemma Cryan 02077 696 876 or

info@starvest.co.uk

Grant Thornton UK LLP (Nomad)

Colin Aaronson, Harrison Clarke or Seamus Fricker 02073 835

100

SI Capital Ltd (Broker)

Nick Emerson or Alan Gunn 01483 413 500

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR PPUUWAUPUGAM

(END) Dow Jones Newswires

May 28, 2020 02:00 ET (06:00 GMT)

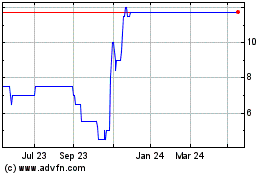

Starvest (LSE:SVE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Starvest (LSE:SVE)

Historical Stock Chart

From Nov 2023 to Nov 2024