TIDMSURE

RNS Number : 4804W

Sure Ventures PLC

12 December 2023

Sure Ventures plc ('Sure Ventures' or 'the Company')

Portfolio Update Q3 2023, NAV Calculation and Director

commentary

Sure Ventures is a London listed venture capital fund which

invests in early-stage software companies in the rapidly growing

technology areas of Augmented Reality ('AR'), Virtual Reality

('VR'), Internet of Things ('IoT') and Artificial Intelligence

(AI). We are pleased to provide an update on the Company's

investment portfolio.

SURE VALLEY VENTURES FUND

Sure Ventures made a EUR7million commitment to Sure Valley

Ventures Fund ('Sure Valley') representing an interest in Sure

Valley of approximately 25.9%. This commitment was made at a price

of EUR1.00 per share. The current NAV of the Sure Valley Ventures

ICAV as of Q2 2023 is EUR1.34388 which is a 2.9% decrease from its

NAV as at Q2 2023.

Sure Valley has several investments across the AI, AR, VR and

IoT sectors and the major contributing factors and commentary on

underlying portfolio companies that has driven this NAV calculation

are as follows:

Smarttech247 Group PLC

Smarttech247 signed a deal with VisonX for 900K euros over a

3-year period, signed a strategic partnership with Splunk on

digital resilience and won a new contract of 400K euros with the

Irish Government. It was an eventful period with a business update

displaying the progress the business is making.

Cameramatics

The company is making significant progress in building its

reoccurring revenue model and are gaining traction in the vehicle

safety, fuel efficiency and accident reduction. The company has

successfully won new contracts in the US, Europe, UK and Ireland.

The company have a diverse spread of clients with some large UK,

European and US logistic Businesses rolling out their technology

across their fleets. The growth trajectory Cameramatics is on gives

us great faith in the future.

Getvisibility

Getvisibility has successfully onboarded 35 new channel partners

in the last quarter, taking the number of active customers to 184.

This level of growth is translating to an increase in annual

reoccurring revenue and the company are building their presence

with the partnership with Forcepoint. The partnership allows

Forcepoint to offer corporate clients a data classification tool,

powered by Getvisibility using the Company's patented AI

technology.

Wia Technologies Ltd

WIA https://www.wia.io/ is an Internet of Things (IoT) company

with a ground-breaking cloud platform https://www.wia.io/product,

enabling developers to turn any type of sensor device into a

secure, smart, and useful application in a matter of minutes. WIA

is the easiest and fastest way to link sensors and devices to

develop IoT applications. WIA's end-to-end platform provides full

device and application management, security, data capture and

storage, analysis, control, as well as the seamless integration of

enterprise systems. During the quarter Wia closed out a deal worth

up to EUR2m with global logistics firm for rollout of energy

monitoring across 5 million square metres of property in 14

countries.

Sure Valley Ventures Enterprise Capital Fund

Sure Valley Ventures ("SVV") has led a GBP2.2 million seed round

in Captur, a company that has built an enterprise AI platform for

real-time, rules-based image recognition. Existing investors, MMC

Ventures and Ascension Ventures participated in this round, along

with other investors including ex-Deliveroo, and enterprise AI

investors Concept Ventures and Two Culture Capital, backers of

ElevenLabs and Electric AI.

Captur's visual AI solution is fast to implement and offers

product owners easy-to-embed APIs and SDKs that act as a smart

camera within their mobile apps. Captur is currently being used in

the delivery sector for drivers to map doorways and verify the

correct address, reducing delivery to incorrect addresses and fraud

by up to 40%.

Captur aims to expand its visual AI automation technology across

the logistics, transportation, and automotive sectors and to

integrate its solutions into modern enterprise's logistics. The

company's customers include Forest, Dott, and Moove, and

discussions are taking place with prominent logistics firms and

Fortune 100 retailers. With operations in Europe, Captur plans to

enter the US market next year.

Sure Ventures PLC NAV

The Sure Ventures PLC NAV at the end of September 2023 sits at

113p. This represents a 1.739% decrease across the period, down

from 115p per share at the end of Q2 2023. This means that the Sure

Ventures share price trades at a 21.68% discount to its NAV.

The Sure Valley Ventures Enterprise Capital fund commitment has

such a small weighting to the NAV of Sure Ventures PLC until

deployment increases. It currently equates to 1.63% of the overall

investment to date. Despite this, AI technologies are beginning to

create a new wave of exciting software solutions and the pipeline

continues to build.

Director Commentary:

" There has been little change in the NAV of both Sure Ventures

PLC or either of the Sure Valley Ventures Funds. The small decline

in NAV is largely due to costs of running the fund and the PLC.

This is a unique position to be in, with many Companies' finding it

very hard to raise money in the present climate without undergoing

a down-round.

The Sure Valley Ventures portfolio has continued to perform well

in difficult market conditions, and we have a number of Investee

Companies that are discussing possible funding rounds or possible

exits. The Sure Valley Ventures team are continuing to build

pipeline traction in the UK fund, and we have seen another

portfolio addition in Captur AI in the quarterly period. We are

pleased with overall progress.

There is no doubt that the possibilities, opportunities, and

enterprise potential of AI technology is becoming more apparent in

our day-to-day lives. The team are seeing some exciting

technologies, and we look forward to the continued deployment by

the Fund management team"

For further information, please visit www.sureventuresplc.com or

contact:

Gareth Burchell

Sure Ventures plc

+44 (0) 20 7186 9918

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

PFUUUVWROAUUARA

(END) Dow Jones Newswires

December 12, 2023 03:53 ET (08:53 GMT)

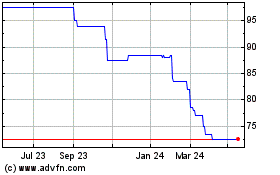

Sure Ventures (LSE:SURE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sure Ventures (LSE:SURE)

Historical Stock Chart

From Nov 2023 to Nov 2024