TIDMSURE

RNS Number : 3470D

Sure Ventures PLC

02 March 2022

Sure Ventures plc ('Sure Ventures' or 'the Company')

Investment in Sure Valley Ventures UK Software Technology

Fund

Alongside the British Business Bank

Sure Ventures plc, a London listed venture capital fund which

invests in early stage software companies in the rapidly growing

technology areas of Augmented Reality ('AR'), Virtual Reality

('VR'), Internet of Things ('IoT') and Artificial Intelligence

(AI), is pleased to announce that it has agreed to invest,

alongside the British Business Bank ("BBB"), in a new venture

capital fund, the Sure Valley Ventures UK Software Technology Fund

(the "New SVV Fund").

Highlights

-- The principal investor in the New SVV Fund is the British

Business Bank, an investment arm of the UK Government. The first

close of this fund will amount to GBP85 million, with the BBB

investing up to GBP50 million and other investors ("Private

Investors"), including Sure Ventures PLC, investing up to GBP35

million over the 10-year life of the fund.

-- The New SVV Fund will invest in a range of private UK

software companies with a focus on companies in the Immersive

Technology and Metaverse sectors, including Augmented and Virtual

Reality, Artificial Intelligence, the Internet of Things and

Security.

-- Sure Ventures PLC, will initially be investing circa

GBP90,000, in the New SVV Fund on first close in order to fund the

New SVV Fund's first investment which has already been identified.

It expects to invest up to GBP5 million in total over the life of

the New SVV Fund which would equate to a circa 5.9% interest.

-- The New SVV Fund will be managed by the same Sure Valley

Ventures fund ("SVV") team which, to date, has been highly

successful in achieving a number of cash realisations from, and

upward revaluations of, companies in the SVV portfolio.

-- The profit share arrangements within the New SVV Fund are

designed to encourage the involvement of Private Investors

alongside the BBB, meaning that Sure Ventures PLC and the other

Private Investors would expect to receive a significantly enhanced

profit share of the total return generated by the fund compared to

industry standard.

-- This investment will enable Sure Ventures PLC shareholders to

gain exposure to exciting, fast growing venture capital investments

through a listed company structure with the expectation of an

enhanced return which would otherwise be difficult for such

investors to achieve.

-- The Company has several sources available to fund this

investment over the coming years. These would include a combination

of potential realisations from SVV Fund 1, an Equity Subscription

Agreement and Loan Agreement, funds from future subscriptions and

receipts generated from any sales of listed investments.

Comment from Gareth Burchell

" Given the market conditions, raising GBP35m privately and

attracting investment from an organisation such as the British

Business Bank is testament to the success and talent of the Sure

Valley Ventures team.

The Board recognise this is a very attractive investment

opportunity for shareholders in Sure Ventures given that the New

SVV Fund is a larger size than SVV Fund 1 which will allow for a

more diverse investment portfolio and the structure of the new fund

provides for enhanced returns to investors, when compared to the

more traditional structure of SVV Fund 1. The existing team from

SVV will continue to manage the new fund having demonstrated a

proven track record from the returns to date achieved from managing

SVV Fund 1.

Fund 2 has been created as part of the BBB's Enterprise Capital

Funds programme that only accepts a very limited number of fund

managers on to the programme, so this is a clear validation of the

quality of the investment team at SVV"

The British Business Bank (BBB) and Enterprise Capital Funds

The BBB is the largest domestic backer of venture capital funds

in the UK. Established in 2006, the Enterprise Capital Funds

("ECF") programme helps those looking to operate in the UK market

to raise venture capital funds specifically targeting early-stage

small businesses believed to have long-term growth potential.

The ECF programme combines private and public money to make

equity investments into high growth businesses. The aim is to

increase the supply of equity to UK growth companies and to lower

the barriers to entry for fund managers looking to operate in the

venture capital market. The BBB's ECF programme only accepts a very

limited number of fund managers on to its programme i.e. some 24

fund management groups over the last 16 years since the programme

started in 2006.

The BBB specifically invests alongside venture capital funds on

terms which improve the outcome for the co-investors. The reason

for this clear advantage is simply to encourage venture capital

funds to operate in a part of the market where smaller businesses

may not be able to access the growth capital they need.

Other well-known fund managers that have been involved with the

BBB ECF programme include Dawn Capital, Notion Capital, Amadeus

Capital Partners, IQ Capital, and Episode 1.

Details of the New SVV Fund

The New SVV Fund is expected to complete its first close with

total investment commitments of GBP85 million, of which GBP50

million will be invested by the BBB with the balance of GBP35

million coming from Private Investors, including financial

institutions and family offices. The total investment may, however,

increase to GBP95 million, with the Private Investors investing up

to GBP45 million. Sure Ventures PLC's investment allocation of GBP5

million will, however, not be required to increase in these

circumstances.

Sure Ventures PLC's investment commitment over the life of the

New SVV Fund will be drawn down in tranches as and when funds are

required for investment over the 10 year life of the fund. However,

as is similar to the existing SVV fund, any realisations of its

investments will be distributed to investors at the time of

realisation (as is common with funds of this nature) therefore the

return on this investment is expected to be received throughout the

life of the fund.

The New SVV Fund will invest in a range of private UK software

companies with a focus on companies in the Immersive Technology and

Metaverse sectors, including Augmented and Virtual Reality,

Artificial Intelligence, the Internet of Things and Security and is

aligned with Sure Ventures PLC's investment strategy.

The Sure Valley Ventures UK Software Technology Fund has been

created under the partnership, Sure Valley Ventures Enterprise

Capital LP ("Partnership"). The Partnership has been constituted

under an agreement between Sure Valley General Partner Limited

("GP") and Sure Valley Ventures Founder LLP ("FP") to carry on the

business of an investor and, in particular, of identifying,

negotiating, making, monitoring and realising investments and to

carry out all functions and acts in connection therewith.

Shard Capital AIFM LLP has been selected by the GP to act as the

Alternative Investment Fund Manager (AIFM) of the Partnership and

has been appointed by the Partnership to (i) admit Investors to the

Partnership and thereafter to operate the Partnership and manage

its investments, and (ii) act as Alternative Investment Fund

Manager (as defined in the AIFMD) to the Partnership.

The role of Sure Valley Ventures Limited shall include sourcing

investors and deal flow for the Partnership, advising the Manager

on making investments, and arranging deals in investments for the

Partnership. If Sure Valley Ventures Limited or another Associate

of the General Partner becomes an Authorised Person permitted under

FSMA to act as Manager of the Partnership, it is intended that Sure

Valley Ventures Limited or its Associate (as applicable) shall be

appointed as AIFM of the Partnership.

This announcement contains inside information for the purposes

of the UK Market Abuse Regulation and the Directors of the Company

are responsible for the release of this announcement.

Enquiries:

Sure Ventures PLC

Gareth Burchell

Director

0207 186 9951

Corporate Broker

Damon heath

Shard Capital

0207 186 9952

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFIFSRVVIFIIF

(END) Dow Jones Newswires

March 02, 2022 02:01 ET (07:01 GMT)

Sure Ventures (LSE:SURE)

Historical Stock Chart

From Nov 2024 to Dec 2024

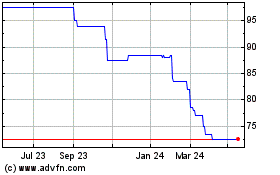

Sure Ventures (LSE:SURE)

Historical Stock Chart

From Dec 2023 to Dec 2024