TIDMSUN

RNS Number : 1375F

Surgical Innovations Group PLC

19 April 2011

For immediate release 19 April 2011

Surgical Innovations Group plc

("SI" or "the Group")

Final Results

Surgical Innovations Group plc (AIM: SUN), the designer and

manufacturer of innovative medical devices, is pleased to announce

its final results for the 12 months ending 31 December 2010.

Financial highlights

-- Revenue increased 55% to GBP7.045 million (2009: GBP4.541

million)

-- Pre-tax profit increased 487% to GBP1.549 million (2009:

GBP264,000)

-- Operating margins increased to 22% (2009: 6%)

-- Net cash of GBP2.2 million generated from operating

activities

-- Basic earnings per share of 0.48p (2009: 0.14p)

Operational highlights

-- Own brand sales increased 30% to GBP3.852 million (2009:

GBP2.956 million); driven by flagship Resposable(R) products

-- OEM revenues increased 71% to GBP2.506 million (2009:

GBP1.463 million)

-- Industrial sales boosted by delivery of GBP616,000 order

-- Continued major investment in research and development, plant

and manufacturing

Doug Liversidge, Chairman of the Group, said: "The Group has

undergone yet another year of transformation, successfully meeting

the demands of rapid growth. We have continued to invest heavily in

the business while R&D capability has undergone a step-change

to speed up new product development and improvements to our

existing technology. This has proven to be very appealing to

potential OEM customers and as a result we are seeing an influx of

enquires for a range of minimally invasive devices. With an already

promising start to 2011, we are looking forward with

confidence."

Enquiries:

Surgical Innovations Group plc

Doug Liversidge CBE, Chairman

Graham Bowland, Chief Executive Officer Tel: +44 (0) 113 230

7597

graham.bowland@surginno.co.uk www.surginno.com

Seymour Pierce Limited

Freddy Crossley / Sarah Jacobs Tel: +44 (0) 20 7107 8000

Corporate Broking

Marianne Woods www.seymourpierce.com

Media enquiries:

The Communications Portfolio

Ariane Comstive Tel: +44 (0) 20 7536 2028

ariane.comstive@communications-portfolio.co.uk

Chairman's statement

I am pleased to report a record year in the continuing

development of the Group. Our strategy of producing innovative,

high quality and cost-effective instruments to an increasingly

cost-conscious market, coupled with the strong investment in 2008

and 2009, has really started to bear fruit, both for our own

branded and OEM products.

Given the growth of the business, and to provide greater clarity

of progress in the key markets in which we operate, the Group is

for the first time reporting across three segments: SI Brand, OEM

and Industrial.

Results

Revenue for the period was GBP7.045 million (2009: GBP4.541

million) and profit before tax increased nearly five-fold to

GBP1.549 million (2009: GBP264,000).

A large part of this growth has arisen from sales in the OEM

segment which accounted for 35% of total revenue (2009: 32%). Sales

growth of SI branded products was driven by our Resposable(R)

products and overall revenues were boosted by the delivery of a

GBP616,000 order in the Industrial segment in May 2010; sales to

industrial customers accounted for 10% of total revenues for

2010.

Retained profit for the period was GBP1.788 million (2009:

GBP525,000) including a taxation

Cash flow and investment

During the year the Group generated net cash of GBP2.202 million

from operating activities, enabling the Group to continue its

strong investment in product development with capitalised

investment in R&D increasing by 57% to GBP1.674 million (2009:

GBP1.066 million) reflecting a step-change in the structure of the

R&D team as well as a stronger focus on new product

development.

Elsewhere capital expenditure remained strong with GBP628,000

invested in plant and equipment while the total number of employees

and agency staff increased from 76 at the end of 2009 to 117 at the

end of 2010. We have continued to make staff appointments in all

areas of the business, while the R&D team has been re-organised

in such a way as to encourage product concept generation.

The Clinical Advisory Board now consists of nine

highly-experienced surgeons covering a wide range of specialisms in

minimally invasive surgery, with Mr Marco Adamo and Mr Jon Conroy

joining the Board in January 2011, the latter extending the team's

expertise into arthroscopy.

Dividend

In 2009, SI successfully applied to the courts to cancel the

Group's accumulated losses. The purpose of this was to enable the

Board to implement a dividend strategy at such time as it considers

appropriate. While a strategy remains under review, the Board

believes that at this stage in the Group's development it would be

more appropriate to continue its focus on strong inward

investment.

Acquisitions

The Board continues to review acquisition opportunities in the

area of minimally invasive surgery where strong synergies exist

with the Group and where our R&D expertise and in-house

manufacturing capabilities can create improvements to the products

and cost savings for the end user.

Outlook

Trading in the period since the year end has been encouraging,

particularly from the core business, where we have seen further

orders for SI branded products, particularly for YelloPort+plus(R).

The R&D team continues to improve the SI branded product range

to generate a wider range of new products and enhancements for our

global distributor network and affirm our position as a leading

innovator within the field of minimally invasive surgery.

In February 2011 we were pleased to announce the four year

exclusive contract for a minimum of $2.2 million with US-based

Mediflex Surgical Products ("Mediflex") with regard to the

inclusion of YelloPort+plus(R) in surgical trays in the US. We are

also being approached by several other OEM customers to develop new

laparoscopic products on an exclusive basis.

We remain confident about the future growth prospects of the

business for the remainder of 2011 and further into 2012 and 2013

as new products are launched towards the end of this year and the

increasing traction with OEM customers gains momentum.

I would like to thank the Board and staff for their tireless

work in 2010 and their contribution to the rapid growth of the

business. We are better positioned than ever to take full advantage

of the opportunities that are available to us and I look forward to

reporting on the continuing success of the Group over the coming

year.

Doug Liversidge CBE

Chairman

Operating review

The investment made in the Group throughout 2008 and 2009

started to make a material impact in 2010 and resulted in a year of

record performance.

All three segments of the business demonstrated significant

growth in 2010. The main focus remains our core business of

minimally invasive surgery, either through our own branded products

or on behalf of our OEM customers.

We continued to make significant investment in research and

development as well as in our manufacturing capability.

Research & Development

The Group's continuing success and growth is dependent on its

ability to create new concepts and intellectual property in the

field of minimally invasive surgery. Significant investment of

GBP1.834 million was made in 2010 (2009: GBP1.066 million) in the

R&D team as well in a change in its structure. R&D now

employs 28 individuals and is divided into concept and development

teams.

The concept team of seven has been given a wide brief to

generate new ideas across all areas of minimally invasive surgery.

Working closely with the Clinical Advisory Board, the team has a

target to generate six concepts per annum which can be transferred

to the development team for further work. The team is working on a

number of new products and improvements which are on course to be

brought to the market by the end of 2011. Furthermore, in 2010 the

Group filed nine new UK patents as compared to five in 2009.

The R&D team has also benefited from the investment in

in-house manufacturing, a 3D printer and advanced CAD technology,

with the result that new ideas and prototypes can now be presented

to potential customers in a matter of days rather than months.

Looking forward, the Group expects to continue its high level of

investment in R&D as part of an ongoing strategy to ensure a

regular stream of new products and continual product

improvement.

Manufacturing

During 2010, GBP628,000 was invested in tooling, plant and

machinery - this was a continuation of the GBP839,000invested in

2009. The focus in 2010 was in areas where additional capacity was

required, and in plastic injection moulding, which now enables the

Group to manufacture in-house instrumentation in their

entirety.

The manufacturing facility now operates a continuous daily

three-shift system, constituting a much higher return on capital

employed as compared to 2009. Capacity has increased in all areas

of the facility and this has been complemented by the introduction

of lean manufacturing practices to optimise process performance;

this will continue throughout 2011. Computerised data control

measuring has now been introduced to all areas of the machine shop,

giving us the ability to analyse tolerance information and enhance

quality control.

Our facility allows for further capacity in the foreseeable

future and investment scheduled for the current financial year will

facilitate the continued growth and optimisation of the

manufacturing arm. Injection moulding capacity will be expanded and

further automation within the cleanrooms is planned as part of our

wider initiative to improve operating efficiencies throughout the

Group.

SI Brand

Revenues from SI branded products increased over the period by

30% to GBP3.852 million (2009: GBP2.956 million). This growth was

driven by SI's flagship Resposable(R) products; YelloPort+plus(R)

and Logi(R)Range.

Demand for Resposable(R) instruments, where some elements are

disposable and others reusable, reflects a culture change within

the medical device industry and provides cost-effective solutions

to an increasingly cost-conscious environment.

The sales and marketing of SI's products continued apace in its

target regions. The business development team now consists of four

full time employees who are looking to expand distribution of SI's

products through its network of over 45 dealers in Europe, the

Middle East, India, Australasia and the US. The team continues to

attend international exhibitions in these territories.

In 2010 it became evident that the routes to market in the US

are different for each product. For example, the most effective way

to distribute the Logi(R)Range is via a master dealer, while

YelloPort+plus(R) benefits from being distributed via serviced tray

companies. Since the year end we announced a $2.2 million contract

with Mediflex Surgical Products with regard to the inclusion of

YelloPort+plus(R) in surgical trays throughout the US.

In the UK, the Group extended its exclusive distribution

partnership with Elemental Healthcare for a further three years,

with particular focus on YelloPort+plus(R) and Logi(R)Range

instruments.

New product development and product enhancement for the SI Brand

continues apace and is driven by the R&D team's close working

relationship with the Clinical Advisory Board.

All our existing products are under continuous scrutiny by the

R&D team to improve quality and performance, as well as product

line extensions. Investment in our own machinery allows us to

provide a greater range of disposable elements that complement the

reusable parts. We are currently expanding the Logi(R)Range to

include a broader range of jaws in different sizes introducing it

to new areas of laparoscopic surgery.

With increasing focus on safer surgery and cosmesis (the

cosmetic aspect surgery), there is a drive for smaller and even

less invasive surgery. To respond to this, SI is taking the

strategic step of developing a range of 3mm Resposable(R)

instrumentation which is compatible with its existing

non-disposable handles that are already in the market place. SI is

also designing percutaneous instruments - surgical devices that

access the patient through a needle puncture rather than a port -

and updates on these developments will be provided in due

course.

As a result the Group has steadily built a reputation as a

leading innovator in the field of minimally invasive surgery.

OEM

Revenues in the OEM segment increased during the period by 71%

to GBP2.506 million (2009: GBP1.463 million), of which royalties

were GBP347,000. The growth in this part of the business is a

reflection of our strong relationships with large medical device

companies such as Gyrus, Teleflex Medical and CareFusion.

The OEM business is reliant on our partners to drive business on

our behalf and it can, on occasion, be unpredictable in terms of

repeat revenue streams from individual partnerships. To counteract

this we collaborate closely with our partners to gain understanding

of the challenges they encounter in the marketing and acceptance of

their specific OEM product lines.

The greatest attraction to our OEM customers is undoubtedly our

strategic positioning of a value added, full service offering of

design, regulation and manufacturing. This approach has made us of

particular interest to US medical device companies and it is from

here that the majority of enquiries are now being generated.

Crucially and strategically, the Group retains the full

intellectual property rights for any devices it develops in return

for providing exclusive worldwide distribution rights to the OEM

customer over a fixed period of time. Importantly the Group is not

offering contract manufacturing or a long-term assignment of a

licence, with the exception of revenues that are generated from

royalties. The ownership of all intellectual property enables the

Group to take back distribution rights at the end of any

distribution agreement or if sales targets are not met.

Industrial

Total revenues for the Industrial segment during the year were

GBP687,000(2009: GBP122,000). As previously stated, the delivery of

a GBP616,000 order in May 2010 significantly boosted sales and

revenues. As predicted, sales in the second half of the year

returned to historic levels. We continue to seek opportunities

where our intellectual property can be adapted to industrial

applications and the Group continues to engage with major

industrial partners. We look forward to updating shareholders on

our progress.

Employees and management

In 2010 we continued to make appointments across all areas of

the business increasing the total number of employees and agency

staff to 117 (2009: 76). I would like to thank all our staff and

management for their support and hard work in the last year.

Financial review

Revenue

Revenue increased 55% to GBP7.045 million (2009: GBP4.541

million). This increase was as a result of a 71% increase in OEM

revenues to GBP2.506 million together with increases in the other

two reporting segments: SI Brand and Industrial.

Gross margin

Gross margin has increased to 50% (2009: 42%) with the Group

again targeting an improvement in 2011 with increasing volumes,

operational efficiencies and substantial investment in

machinery.

Operating expenses

The Group's operating expenses increased in 2010 by GBP404,000

(26%) as a consequence of investment in business development

personnel and associated sales and marketing costs.

Employee numbers increased substantially during the year in

areas which will add future value to the business and provide a

level of customer service that benefits our organisation. As a

consequence, operating expenses are projected to increase in 2011

but at levels that provide overall Group profitability within

planned objectives.

Notwithstanding our investment in personnel, the Group continues

to rigorously control costs and is aware of the need to generate

cash within the business as a means of funding future capital and

product investment.

Finance income and costs

The net financial expense for the year was GBP30,000 (2009:

GBP27,000). This reflects the reduced returns available on the

Group's cash deposits coupled with the cost of asset finance. We

continue to finance assets used in the manufacturing processes of

the business; ensuring funds remain within the Group for both

internal product development and our working capital needs.

Profitability and operating margins

The Group's operating profit for 2010 was GBP1.579 million

(2009: GBP291,000). This is after charging GBP8,000 of non-cash

expenditure relating to share-based payments. We are greatly

encouraged by the substantial uplift in operating margin to 22%

(2009: 6%). We believe there is further room for improvement

through product mix and continued capital investment within the

manufacturing facility.

Capitalised development costs

The Group has a policy of continuous product development both

for SI Brand and OEM partner devices. As in previous years, the

Board is confident in the success of these products and accordingly

GBP1.674 million of costs have been capitalised during the year,

increasing the total amount of capitalised costs to GBP3.984

million.

YelloPort+plus(R) continues to generate revenues and under the

Group's accounting policy GBP73,000 of associated development costs

were amortised in the period (2009: GBP101,000) together with

GBP111,000 in relation to other products where revenue commenced in

the period.

Following review the Board recognised an impairment charge of

GBP334,000 within the financial statements and at 31 December 2010

confirmed that no further provision for impairment was

necessary.

Foreign currency

The Group maintains foreign currency bank accounts and, wherever

possible, supplier payments are made in Euros or Dollars to utilise

currency receipts.

The Group has used forward exchange contracts and will continue

to monitor the need for such contracts depending upon the level of

natural hedging achievable.

Taxation

The Group recognised a tax credit of GBP239,000 resulting from

deferred tax, reflecting the extent to which recoverability of tax

losses can be foreseen with reasonable certainty. The Group holds

deferred tax assets on the balance sheet of GBP432,000 (2009:

GBP193,000). In addition there are a further GBP16.100 million

(2009: GBP14.600 million) of tax losses that have not been

recognised.

Earnings per share (EPS)

The Group achieved 0.48p (2009: 0.14p) underlying basic EPS in

2010. There were shares issued during the year and full details of

all the EPS calculations are set out in note 6 to the accounts.

Cash and net funds

At the end of 2010 the Group had GBP442,000 (2009: GBP622,000)

in net funds. Net funds are defined as cash and cash equivalents

less obligations under finance leases..

Working capital

Working capital increased to GBP3.942 million (2009: GBP3.630

million) as a result of a reduction of GBP211,000 in trade and

other payables to GBP607,000 (2009: GBP818,000). The business

generated net cash from operations of GBP2.202 million (2009:

GBP1.439 million), however after accounting for the acquisition of

non-current assets of GBP2.044 million (2009: GBP1.517 million)

there was a net cash increase in the year of GBP60,000 (2009:

decrease of GBP316,000).

Consolidated statement of comprehensive income

for the year ended 31 December 2010

2010 2009

-------------------------------- --------------------------------

Non-recurring Non-recurring

Headline costs Total Headline costs Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- ----- -------- ------------- ------- -------- ------------- -------

Revenue 5 7,045 - 7,045 4,541 - 4,541

Cost of sales (3,526) - (3,526) (2,447) (200) (2,647)

-------------- ----- -------- ------------- ------- -------- ------------- -------

Gross profit 3,519 - 3,519 2,094 (200) 1,894

Other

operating

expenses (1,932) - (1,932) (1,528) - (1,528)

Share-based

payments (8) - (8) (75) - (75)

-------------- ----- -------- ------------- ------- -------- ------------- -------

Operating

profit 1,579 - 1,579 491 (200) 291

Finance costs (39) - (39) (40) - (40)

Finance income 9 - 9 13 - 13

-------------- ----- -------- ------------- ------- -------- ------------- -------

Profit before

taxation 1,549 - 1,549 464 (200) 264

Taxation 239 - 239 261 - 261

-------------- ----- -------- ------------- ------- -------- ------------- -------

Profit and

total

comprehensive

income for

the period

attributable

to the owners

of the

parent 1,788 - 1,788 725 (200) 525

-------------- ----- -------- ------------- ------- -------- ------------- -------

Earnings per

share, total

and

continuing

Basic 6 0.48p 0.14p

Diluted 6 0.45p 0.14p

-------------- ----- -------- ------------- ------- -------- ------------- -------

Consolidated balance sheet

as at 31 December 2010

2010 2009

Notes GBP'000 GBP'000

-------------------------------------- ----- ------- --------

Assets

Non-current assets

Property, plant and equipment 2,477 2,056

Intangible assets 3,295 2,139

Deferred tax asset 432 193

-------------------------------------- ----- ------- --------

6,204 4,388

-------------------------------------- ----- ------- --------

Current assets

Inventories 2,033 2,047

Trade receivables 2,168 2,135

Other current assets 513 460

Cash and cash equivalents 2,622 2,508

-------------------------------------- ----- ------- --------

7,336 7,150

-------------------------------------- ----- ------- --------

Total assets 13,540 11,538

-------------------------------------- ----- ------- --------

Equity and liabilities

Equity attributable to equity holders

of the parent company

Share capital 7 3,815 3,738

Share premium account 75 18,809

Capital reserve 329 329

Retained earnings 6,369 (14,236)

-------------------------------------- ----- ------- --------

Total equity 10,588 8,640

-------------------------------------- ----- ------- --------

Non-current liabilities

Obligations under finance leases 653 511

-------------------------------------- ----- ------- --------

653 511

-------------------------------------- ----- ------- --------

Current liabilities

Bank overdraft 1,177 1,123

Trade and other payables 607 818

Obligations under finance leases 350 252

Accruals 165 194

-------------------------------------- ----- ------- --------

2,299 2,387

-------------------------------------- ----- ------- --------

Total liabilities 2,952 2,898

-------------------------------------- ----- ------- --------

Total equity and liabilities 13,540 11,538

-------------------------------------- ----- ------- --------

Consolidated cash flow statement

for the year ended 31 December 2010

Year ended Year ended

31 December 31 December

2010 2009

GBP'000 GBP'000

------------------------------------------------ ----------- -----------

Cash flows from operating activities

Operating profit 1,579 291

Adjustments for:

Depreciation of property, plant and equipment 448 345

Amortisation of intangible assets 518 101

Share-based payment 8 75

------------------------------------------------ ----------- -----------

Operating cash flows before movement in working

capital 2,553 812

Decrease/(increase) in inventories 14 (331)

(Increase)/decrease in receivables (86) 913

(Decrease)/increase in payables (240) 47

------------------------------------------------ ----------- -----------

Cash generated from operations 2,241 1,441

Interest paid (39) (40)

Tax received - 38

------------------------------------------------ ----------- -----------

Net cash generated from operating activities 2,202 1,439

------------------------------------------------ ----------- -----------

Cash flows from investing activities

Interest received 9 13

Acquisition of non-current assets (2,044) (1,517)

------------------------------------------------ ----------- -----------

Net cash used in investment activities (2,035) (1,504)

------------------------------------------------ ----------- -----------

Cash flows from financing activities

Cash received from issue of shares 152 -

Repayment of bank loans - (6)

Repayment of obligations under finance leases (259) (245)

------------------------------------------------ ----------- -----------

Net cash used in financing activities (107) (251)

------------------------------------------------ ----------- -----------

Net increase in cash and cash equivalents 60 (316)

Cash and equivalents at beginning of period 1,385 1,701

------------------------------------------------ ----------- -----------

Cash and cash equivalents at end of period 1,445 1,385

------------------------------------------------ ----------- -----------

Cash at bank and in hand 2,622 2,508

Bank overdraft (1,177) (1,123)

------------------------------------------------ ----------- -----------

Cash and cash equivalents at end of period 1,445 1,385

------------------------------------------------ ----------- -----------

Consolidated statement of changes in equity

for the year ended 31 December 2010

Share Share Capital Retained

capital premium reserve earnings Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------- -------- ------- -------- -------

Balance as at 1 January

2009 3,738 18,809 329 (14,836) 8,040

Employee share-based payment

options - - - 75 75

Profit and total comprehensive

income for the period - - - 525 525

------------------------------- ------- -------- ------- -------- -------

Balance as at 31 December

2009 3,738 18,809 329 (14,236) 8,640

Employee share-based payment

options - - - 8 8

Reorganisation - (18,809) - 18,809 -

Transactions with owners 77 75 - - 152

Profit and total comprehensive

income for the period - - - 1,788 1,788

------------------------------- ------- -------- ------- -------- -------

Balance as at 31 December

2010 3,815 75 329 6,369 10,588

------------------------------- ------- -------- ------- -------- -------

Notes to the financial statements

1. Reporting Entity

Surgical Innovations Group plc ("the Company") is a public

limited company incorporated and domiciled in England and Wales

(registration number 2298163). The Company's registered address is

Clayton Wood House, 6 Clayton Wood Bank, Leeds LS16 6QZ.

The Company's ordinary shares are traded on the AIM market of

the London Stock Exchange. The financial statements of the Company

for the twelve months ended 31 December 2010 comprise the Company

and its subsidiaries (together referred to as the "Group").

The Group is primarily involved in the design, development and

manufacture of devices for use in Minimally Invasive Surgery (MIS)

and industrial markets. Surgical devices are targeted at the

operating theatre environment in both public and private hospitals.

In international markets, the Group sells through independent

healthcare distributors, through Original Equipment Manufacture

(OEM) and licensing contracts with major suppliers of medical

equipment.

2. Basis of Preparation

These condensed consolidated financial statements have been

prepared in accordance with the accounting policies set out in the

annual report for the year ended 31 December 2010 and those to be

adopted at 31 December 2010 (see note 3).

While the financial information included in this preliminary

announcement has been prepared in accordance with the recognition

and measurement criteria of International Financial Reporting

Standards (IFRSs), as adopted for use in the EU, this announcement

does not itself contain sufficient information to comply with

IFRSs. The Group expects to publish full financial statements that

comply with IFRSs in May 2011.

3. Accounting policies

The same accounting policies, presentations and methods of

computation are followed in the condensed set of financial

statements as applied in the Group's latest annual audited

financial statements. The annual financial statements of Surgical

Innovations Group plc are prepared in accordance with International

Financial Reporting Standards as adopted by the European Union.

4. Publication of non-statutory financial statements

The financial information set out in this preliminary

announcement does not constitute statutory accounts as defined in

Sections 434 and 435 of the Companies Act 2006.

The consolidated statement of comprehensive income, the

consolidated statement of changes in equity, the consolidated

balance sheet at 31 December 2010 and the consolidated cash flow

statement have been extracted from the Group's financial statements

upon which the auditors opinion is unqualified and does not include

any statement under section 498(2) or 498(3) of the Companies Act

2006. Those financial statements have not yet been delivered to the

Registrar.

The statutory accounts for the year ended 31 December 2009 have

been delivered to the registrar, contained an unqualified audit

report and did not include a statement under section 498(2) or

498(3) of the Companies Act 2006.

The audited accounts will be posted to all shareholders in due

course and will be available on request by contacting the Company

Secretary at the Company's Registered Office.

5. Segmental Reporting

Geographic analysis

2010 2009

GBP'000 GBP'000

--------------- ------- -------

United Kingdom 2,119 1,454

Europe 2,908 1,827

US 1,410 624

Rest of World 608 636

--------------- ------- -------

7,045 4,541

--------------- ------- -------

Revenues are allocated geographically on the basis of where

revenues were received from and not from the ultimate final

destination of use.

For management purposes the Group is organised into three

business segments, SI Brand, OEM and Industrial. These revenue

streams are the basis on which the Group reports its segment

information.

Segment results, assets and liabilities include assets directly

attributable to a segment as well as those that can be allocated on

a reasonable basis. Unallocated items comprise mainly corporate

assets and liabilities and head office expenses.

These operating segments are monitored and strategic decisions

are made on the basis of adjusted segment operating results.

Business Segments

The principal activities of the SI Brand business unit are the

research, development, manufacture and distribution of SI branded

minimally invasive devices.

The principal activities of the OEM business unit are the

research, development, manufacture and distribution of minimally

invasive devices for third party medical device companies through

either own label or co-branding.

The principal activities of the industrial business unit are the

research, development, manufacture and sale of minimally invasive

technology products for industrial application.

SI Brand OEM Industrial Total

Year ended 31 December

2010 GBP'000 GBP'000 GBP'000 GBP'000

--------- -------- ----------- --------

Revenue 3,852 2,506 687 7,045

--------- -------- ----------- --------

Segment result 1,151 930 390 2,471

Unallocated expenses (892)

--------- -------- ----------- --------

Profit from operations 1,579

Finance income 9

Finance costs (39)

--------- -------- ----------- --------

Profit before taxation 1,549

Tax 239

--------- -------- ----------- --------

Profit for the year 1,788

--------- -------- ----------- --------

Year ended 31 December

2009 GBP'000 GBP'000 GBP'000 GBP'000

--------- -------- ----------- --------

Revenue 2,956 1,463 122 4,541

--------- -------- ----------- --------

Segment result 1,240 255 70 1,565

Unallocated expenses (1,274)

--------- -------- ----------- --------

Profit from operations 291

Finance income 13

Finance costs (40)

--------- -------- ----------- --------

Profit before taxation 264

Tax 261

--------- -------- ----------- --------

Profit for the year 525

--------- -------- ----------- --------

6. Earnings per ordinary share

Basic earnings per ordinary share

The calculation of basic earnings per ordinary share for the

year ended 31 December 2010 was based upon the profit attributable

to ordinary shareholders of GBP1,788,000 (2009: GBP525,000) and a

weighted average number of ordinary shares outstanding for the year

ended 31 December 2010 of 375,812,587 (2009: 373,841,902).

Diluted earnings per ordinary share

The calculation of diluted earnings per ordinary share for the

year ended 31 December 2010 was based upon the profit attributable

to ordinary shareholders of GBP1,788,000 (2009: GBP525,000) and a

weighted average number of ordinary shares outstanding for the year

ended 31 December 2010 of 397,339,910 (2009: 373,841,902). All

share options at the financial year end were anti-dilutive.

2010 2009

Earnings GBP'000 GBP'000

---------------------------------------------- ------- -------

Earnings for the purpose of basic and diluted

earnings per ordinary share 1,788 525

---------------------------------------------- ------- -------

7. Share capital

2010 2009

GBP'000 GBP'000

----------------------------------------------- ------- -------

Authorised 600,000,000

(2009: 600,000,000) ordinary shares of 1p each 6,000 6,000

----------------------------------------------- ------- -------

Allotted, called up and fully paid 381,491,902

(2009: 373,841,902) ordinary shares of 1p each 3,815 3,738

----------------------------------------------- ------- -------

8. Annual Report and AGM

The Annual Report will be available from the Company's website,

www.sigroupplc.com and posted to shareholders by 18 May 2011. The

Annual Report contains notice of the Annual General Meeting of the

Company which will be held at 1.00 p.m. on 20 June 2011 at Clayton

Wood House, 6 Clayton Wood Bank, Leeds LS16 6QZ.

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SFAFWAFFSESL

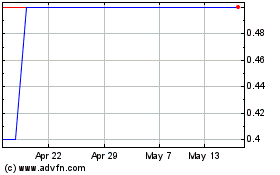

Surgical Innovations (LSE:SUN)

Historical Stock Chart

From Jun 2024 to Jul 2024

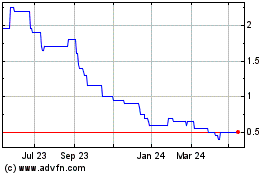

Surgical Innovations (LSE:SUN)

Historical Stock Chart

From Jul 2023 to Jul 2024