SThree: Q1 Trading Update (997705)

March 16 2020 - 3:00AM

UK Regulatory

SThree (STEM)

SThree: Q1 Trading Update

16-March-2020 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside information

according to REGULATION (EU) No 596/2014 (MAR), transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

16 March 2020

SThree plc

Q1 Trading Update

Net fees flat in Q1 in line with management expectations

SThree plc ("SThree" or the "Group"), the global pure-play specialist

staffing business focused on roles in Science, Technology, Engineering and

Mathematics ('STEM'), issues the below trading update(1) covering the period

from 1 December 2019 to date; financial information relates to the quarter

ending 29 February 2020.

Highlights

· Group net fees for Q1 flat, in what is our seasonally quietest quarter

· Strong growth in Germany, with net fees up 7%

· Robust growth of 3% in Netherlands with USA flat

· Growth across Technology, Life Sciences and Engineering

· Contract net fees up 2%, in line with our strategy, now representing 75%

of Group net fees (2019: 74%)

· 87% of Group net fees generated from international(2) markets (2019:

86%)

· Group average headcount up 5% YoY

· Continued strong balance sheet with net cash at 29 February 2020 of

circa GBP9m

Mark Dorman, Chief Executive, commented:

"We have delivered these results despite a backdrop of significant and

increasing global macro-economic uncertainties and challenges. The

performance of our businesses in Germany and the Netherlands was

particularly impressive and demonstrates the benefits of our strategy,

focusing on Contract and STEM across diverse markets. This, combined with

the efforts of our employees worldwide, has enabled us to continue to

deliver a robust level of net fees despite the wider economic headwinds.

"Whilst the macro uncertainties are increasingly apparent, we continue to

invest selectively in our business, reflecting our commitment to building

for the future and driving the long-term success of our Group. We remain

confident that we have the right strategy, as we are uniquely positioned as

the only global pure-play STEM specialist.

"The uncertainties the market faces are, however, potentially very

significant, given the fast-developing situation with Covid-19, recent large

falls in oil prices, and increasing concerns about global confidence and GDP

growth. Notwithstanding this, demand for key STEM skills remains robust."

Reporting structure change

SThree has changed its reporting structure, as shown in the tables below, in

line with the updated strategy announced at its recent Capital Markets Day

and internal management structures. Going forward SThree will apply the new

groupings of DACH, EMEA excluding DACH, USA and APAC, as well as presenting

an analysis of net fees by its five key markets: Germany, Netherlands, USA,

UK and Japan. On a sector basis, the Energy and Engineering sectors will be

reported under Engineering.

Q1 2020 Q4 Q3 Q2 Q1

2019 2019 2019 2019

Net fees Q1 Q1 2019 YOY YOY YOY YOY YOY

2020

Management

Structure

DACH(3) GBP25.2m GBP24.2m +9% +5% +8% +18% +12%

EMEA excl GBP31.5m GBP34.4m -6% -5% -2% - +5%

DACH(4)

USA GBP16.0m GBP16.4m - +6% +5% +10% +17%

APAC GBP2.6m GBP3.1m -15% +1% +21% +25% -4%

GROUP GBP75.3m GBP78.1m - +1% +4% +9% +9%

Top five

countries

Germany GBP23.2m GBP22.6m +7% +5% +6% +16% +9%

Netherlands GBP11.8m GBP12.0m +3% +4% +7% +9% +13%

UK GBP9.7m GBP10.6m -8% -10% -8% -12% -9%

USA GBP16.0m GBP16.4m - +6% +5% +10% +17%

Japan GBP1.5m GBP1.7m -11% +1% +82% +63% +44%

ROW(5) GBP13.1m GBP14.8m -8% -5% -2% +10% +10%

GROUP GBP75.3m GBP78.1m - +1% +4% +9% +9%

Division Mix Q1

2020

Contract 75%

Permanent 25%

Sector Mix Q1

2020

Technology 46%

Life Sciences 21%

Engineering(6) 22%

Banking & 10%

Finance

Other 1%

Impact of Covid-19

The Coronavirus outbreak continues to develop globally, and it is difficult

to predict the potential impact it may have on our business. The Group is

continuing to monitor the situation closely and regional management teams

are ready to react as developments unfold.

Business performance

Group net fees for the year were flat in Q1, in what is our seasonally

quietest quarter. Contract, our more resilient business, grew net fees by 2%

and now accounts for 75% of Group net fees. Permanent net fees declined 6%

in the quarter, due to weaker performances in Japan, USA and UK. Germany,

our largest Permanent market, saw solid growth of 4%, up from Q4 2019 +3%.

DACH saw strong growth in the quarter with net fees up 9%. Germany, which

accounts for 92% of DACH, continues to outperform with growth of 7% driven

by Technology up 10% and Life Sciences up 12%. All other sectors also grew

and the region saw a strong growth in net fees in Switzerland and Austria.

EMEA excluding DACH saw net fees declining 6%, largely reflecting the UK's

performance, which was down 8%. As expected, we have begun to see the impact

of IR35 prompting change in our client and candidate behaviour in the UK

business in the quarter, as decision making processes extend ahead of the

April 2020 implementation date. The Netherlands, our largest country in the

region, saw growth of 3%, which was impressive given the market backdrop,

with notable performances in Engineering and Life Sciences.

Net fees in USA were flat in the quarter and short of our expectations. Life

Sciences saw good growth of 14% with Engineering growing 10% and Technology

up a modest 3%. This growth was offset by a decline in Banking & Finance

with net fees down 38%, broadly reflecting the challenges faced in this

sector globally. As a key area of focus for the Group we have continued to

invest in the region and are aligning our resources with the best long term

opportunities.

Despite a good performance from the Technology sector, APAC net fees

declined 15% in the quarter, impacted by several factors including the

wildfires in Australia and the outbreak of Covid-19.

Group period end headcount was up 3% with average headcount up 5%,

reflecting ongoing investment in Germany and USA offset by reductions in

EMEA excluding DACH and APAC.

Balance sheet

SThree remains in a strong financial position, with net cash at 29 February

2020 of circa GBP9m (28 February 2019: Net debt GBP12m). The Group has a GBP50m

revolving credit facility ("RCF") with HSBC and Citibank, which is committed

to 2023.

Analyst conference call

SThree is hosting an analyst conference call today at 0830 GMT. The details

are as follows:

Telephone number: 0800 358 9473

For access to the call please enter PIN: 31046987#

A replay facility will be available for 90 days on 0800 358 2049 Passcode:

301312966#

The Group will issue its trading update for six months ended 31 May 2020 on

15 June 2020.

(1) All year-on-year financial growth rates in this announcement are

expressed at constant currency

(2) International represents our businesses outside the UK

(3) DACH - Germany, Austria and Switzerland

(4) EMEA excl DACH - UK, Ireland, Belgium, Netherlands, Luxembourg, France,

Spain and Dubai

(5) ROW - All other countries we operate in excluding Germany, Netherlands,

UK, USA and Japan

(6) Engineering now includes Energy, which was previously reported

separately. Up-stream oil and gas comprises approximately 10% of the new

Engineering sector

- Ends -

Enquiries:

SThree plc 020 7268 6000

Mark Dorman, Chief Executive Officer

Alex Smith, Chief Financial Officer

Steve Hornbuckle, Company Secretary

Alma PR 020 3405 0205

Rebecca Sanders-Hewett SThree@almapr.co.uk

Hilary Buchanan

Notes to editors

SThree is a leading international STEM specialist staffing business,

providing permanent and contract specialist staff to a diverse client base

of over 9,000 clients.

The Group's operations cover the Technology, Banking & Finance, Engineering

and Life Sciences sectors. With a multi-brand strategy, the Group

establishes new operations to address growth opportunities. SThree brands

include Computer Futures, Huxley Associates, Progressive and The Real

Staffing Group. The Group has a network of 47 offices in 16 countries, of

which 41 are in our international(2) markets, with circa 3,100 employees.

SThree plc is quoted on the Official List of the UK Listing Authority under

the ticker symbol STEM and also has a US level one ADR facility, symbol

SERTY.

Important notice

Certain statements in this announcement are forward looking statements. By

their nature, forward looking statements involve a number of risks,

uncertainties or assumptions that could cause actual results or events to

differ materially from those expressed or implied by those statements.

Forward looking statements regarding past trends or activities should not be

taken as representation that such trends or activities will continue in the

future. Certain data from the announcement is sourced from unaudited

internal management information and is before any exceptional items.

Accordingly, undue reliance should not be placed on forward looking

statements.

ISIN: GB00B0KM9T71

Category Code: TST

TIDM: STEM

LEI Code: 2138003NEBX5VRP3EX50

Sequence No.: 52476

EQS News ID: 997705

End of Announcement EQS News Service

(END) Dow Jones Newswires

March 16, 2020 03:00 ET (07:00 GMT)

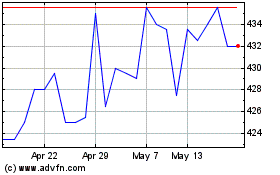

Sthree (LSE:STEM)

Historical Stock Chart

From Aug 2024 to Sep 2024

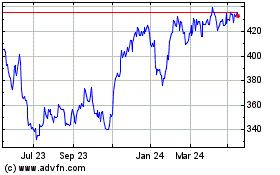

Sthree (LSE:STEM)

Historical Stock Chart

From Sep 2023 to Sep 2024