TIDMSTCM

RNS Number : 9106M

Steppe Cement Limited

19 September 2023

19 September 2023

Steppe Cement Limited

("Steppe Cement" or the "Company")

Interim Results for the Half Year Ended 30 June 2023 and General

Market Update

1. Interim Results

During the six-month period to 30 June 2023, the Group posted

revenue of USD36.9 million, a decline of 14% from USD43.1 million

in the corresponding period in 2022. The decline was mainly

attributable to the 11% lower sales volume. The drop was

concentrated in the first few months of the year when cement prices

were maintained. Consequently the Company decided to adjust pricing

to recover the volumes.

6 months 6 months % of

ended ended change

30 June 30 June

2023 2022

Sales (Tonnes) 749,034 837,063 -11%

------------------ -------------------- ---------------------

Consolidated Turnover (KZT

million) 16,702 19,779 -16%

------------------ -------------------- ---------------------

Consolidated Turnover (USD

million) 36.9 43.1 -14%

------------------ -------------------- ---------------------

Consolidated profit after

tax (USD million) 0.1 10.2 -99%

------------------ -------------------- ---------------------

Earnings per share (Cents) 0.1 4.7 -99%

------------------ -------------------- ---------------------

Average exchange rate (USD/KZT) 454 449 1%

------------------ -------------------- ---------------------

The average sales price was USD50 (KZT22,665) per tonne compared

with USD52 (KZT23,391) per tonne in the corresponding period in

2022.

The gross margin was reduced to 26% in the six-month period to

30 June 2023 compared with 46% in the same period last year due to

the combination of higher production costs, lower volumes and a

lower selling price. Selling expenses increased by USD0.9 million

or 16% to USD6.2 million, while general and administration expenses

increased 7% by USD0.2 million to USD3.4 million.

Volumes are recovering in the second half of the current year

and prices have been slightly increased, while the cost of

production is improving as well.

General inflation in Kazakhstan was 17% during the period, but

the situation has improved in the second half of 2023.

The Group posted a small net profit for the period of USD0.1

million compared with USD10.2 million profit after tax in the same

period in 2022.

2. Production and capex

-- Cash production costs increased by 11% in KZT in the first

half of 2023 primarily due to the higher electricity, diesel and

spare parts for maintenance costs together with lower production

volumes and significant repairs in line 5.

-- There were significant stoppages and repairs in the first

half of 2023 as a consequence of the unexpectedly cold weather

during the general stoppage of November 2022.

-- The separator of cement mill number 1 has been commissioned and work has started in

the separator of cement mill number 2. Together these two

projects will allow the increase of slag usage, reduce power

consumption and improve cement quality and stability.

3. Update on the Kazakh cement market

-- The Kazakh cement market during the first half of 2023

reduced by 5.6% compared to the same period last year.

-- The Company expects to maintain its market share at around 14% for the full year.

-- Exports from Kazakhstan [in the first half of 2023] remained

the same as in the corresponding period in 2022 at 0.55 million

tonnes.

-- Imports in the current period represented 4.3% of the local market, 2% less than in 2022.

4. Finance

-- Total finance costs for the period were USD 0.5 million with

interest expenses on bank debt falling to USD 0.2 million mostly on

subsidised loans while the Company maintained interest expenses on

lease liabilities at USD 0.1 million after the application of IFRS

16 on the 3-year wagon leases. The rental on those wagons was

previously treated as selling expenses. The contract to rent wagons

is due for renewal in the second half of 2023.

-- The borrowings of the Company as at 30 June 2023 were USD6.7 million while we

carried a cash balance of USD6.0 million. For comparison, on 30

June 2022 the

Company had USD5.4 million of borrowings and USD14.7 million in

cash.

A pdf copy of the announcement and the full interim financial

statements is available on the company's website at

www.steppecement.com

For further information, please contact:

Steppe Cement Limited www.steppecement.com

Javier del Ser Pérez, Chief Executive Tel: +(603) 2166

Officer 0361

Strand Hanson Limited (Nominated & Financial www.strandhanson.co.uk

Adviser and Broker)

James Spinney / Ritchie Balmer / Robert Collins Tel: +44 20 7409

3494

SUMMARY OF INTERIM FINANCIAL STATEMENT

FOR THE PERIODED 30 JUNE 2023 (UNAUDITED)

(In United States Dollars)

The Notes to the Interim Financial Statements form an integral

part of the Condensed Financial Statement. Please visit the

Company's website at www.steppecement.com to view the full interim

financial statements.

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

AND ITS SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENT OF PROFIT AND LOSS

FOR THE PERIODED 30 JUNE 2023 (UNAUDITED)

The Group The Company

6 months ended 6 months ended

30 June 30 June 30 June 30 June

2023 2022 2023 2022

USD'000 USD'000 USD'000 USD'000

Revenue 36,882 43,125 683 670

Cost of sales (27,405) (23,148) - -

------------- ------------- ------------ ------------

Gross profit 9,477 19,977 683 670

Selling expenses (6,154) (5,285) - -

General and administrative

expenses (3,421) (3,183) (176) (165)

------------- ------------- ------------ ------------

Operating (loss)/profit (98) 11,509 507 505

Interest income 93 266 - -

Finance costs (483) (435) - -

Net foreign exchange

(loss)/gain (14) (246) 18 3

Other income, net 563 940 - -

------------- ------------- ------------ ------------

Profit before income

tax 61 12,034 525 508

Income tax expense (9) (1,831) - -

------------- ------------- ------------ ------------

Profit for the period 52 10,203 525 508

============= ============= ============ ============

Attributable to shareholders

of the Company 52 10,203 525 508

============= ============= ============ ============

Earning per share:

Basic and diluted

(cents) 0.1 4.7

============= =============

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

AND ITS SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENT OF PROFIT AND LOSS AND OTHER

COMPREHENSIVE INCOME FOR THE PERIODED 30 JUNE 2023 (UNAUDITED)

The Group The Company

6 months ended 6 months ended

30 June 30 June 30 June 30 June

2023 2022 2023 2022

USD'000 USD'000 USD'000 USD'000

Profit for the period 52 10,203 525 508

Other comprehensive

income/ (loss):

Item that may not

be reclassified subsequently

to profit or loss

------------------------------------

Exchange differences

arising on translation

of foreign operations 48 (4,941) - -

Total comprehensive

income for the period 100 5,262 525 508

============ ============== ============ ===========

Attributable to shareholders

of the Company 100 5,262 525 508

============ ============== ============ ===========

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

AND ITS SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023 (UNAUDITED)

The Group The Company

Unaudited Audited Unaudited Audited

30 June 31 Dec 2022 30 June 31 Dec

2023 2023 2022

USD'000 USD'000 USD'000 USD'000

Assets

Non-Current Assets

Property, plant

and equipment 49,822 49,362 - -

Right-of-use assets 3 5 - -

Investment in subsidiary

companies - - 36,200 36,200

Loan to subsidiary

company - - 30,040 30,050

Other assets 196 1,531 - -

Total Non-Current

Assets 50,021 50,898 66,240 66,250

-------------- ---------------- -------------- -------------

Current Assets

Inventories 21,190 20,646 - -

Trade and other

receivables 1,938 2,045 3,461 2,372

Other assets 2,409 1,082 - -

Income tax receivable 1,421 603 - -

Loans and advances

to subsidiary companies - - 60 60

Advances and prepaid

expenses 8,687 8,577 16 7

Cash and cash equivalents 6,002 4,144 652 1,240

Total Current

Assets 41,647 37,097 4,189 3,679

-------------- ---------------- -------------- -------------

Total Assets 91,668 87,995 70,429 69,929

============== ================ ============== =============

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

AND ITS SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2023 (UNAUDITED)

The Group The Company

Unaudited Audited Unaudited Audited

30 June 31 Dec 30 June 31 Dec

2023 2022 2023 2022

USD'000 USD'000 USD'000 USD'000

Equity and Liabilities

Capital and Reserves

Share capital 73,761 73,761 73,761 73,761

Revaluation reserve 1,747 1,793 - -

Translation reserve (125,804) (125,852) - -

Retained earnings

/

(Accumulated losses) 115,476 115,378 (3,695) (4,220)

-------------- -------------- --------------- --------------

Total Equity 65,180 65,080 70,066 69,541

-------------- -------------- --------------- --------------

Non-Current Liabilities

Borrowings 5,104 3,914 - -

Deferred taxes 2,460 3,267 - -

Deferred income 2,700 2,713 - -

Provision for

site restoration 182 178 - -

Total Non-Current

Liabilities 10,446 10,072 - -

-------------- -------------- --------------- --------------

Current liabilities

Trade and other

payables 10,402 7,348 - -

Accrued and other

liabilities 3,568 2,251 148 144

Amount due to

a subsidiary company - - 215 244

Borrowings 1,651 2,814 - -

Lease liabilities 421 59 - -

Taxes payable - 371 - -

Total Current

Liabilities 16,042 12,843 363 388

-------------- -------------- --------------- --------------

Total Liabilities 26,488 22,915 363 388

-------------- --------------

Total Equity

and Liabilities 91,668 87,995 70,429 69,929

============== ============== =============== ==============

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

AND ITS SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 30 JUNE 2023 (UNAUDITED)

Non-distributable Distributable

The Group Share Revaluation Translation Retained Total

capital reserve reserve earnings

USD'000 USD'000 USD'000 USD'000 USD'000

As at 1 January 2023 73,761 1,793 (125,852) 115,378 65,080

------------ ------ ---------------- ------ ---------------- ------ ------ ------------------ ------ ------------

Profit for the period - - - 52 52

Other comprehensive income - - 48 - 48

Total comprehensive income

for the period - - 48 52 100

Transfer of revaluation

reserve relating to

property,

plant and equipment through

use - (46) - 46 -

As at 30 June 2023 73,761 1,747 (125,804) 115,476 65,180

============ ================ ================ ================== ============

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

AND ITS SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD ENDED 30 JUNE 2023 (UNAUDITED)

Non-distributable Distributable

The Group Share Revaluation Translation Retained Total

capital reserve reserve earnings

USD'000 USD'000 USD'000 USD'000 USD'000

As at 1 January

2022 73,761 2,068 (120,438) 110,190 65,581

------------- ---------------- ---------------- ------------------ ------------

Profit for the

period - - - 10,203 10,203

Other

comprehensive

loss - - (4,941) - (4,941)

Total

comprehensive

(loss)/income

for the period - - (4,941) 10,203 5,262

Transfer of

revaluation

reserve relating

to property,

plant and

equipment through

use - (137) - 137 -

As at 30 June 2022 73,761 1,931 (125,379) 120,530 70,843

============= ================ ================ ================== ============

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

AND ITS SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIOD ENDED 30 JUNE 2023 (UNAUDITED)

The Company Share Accumulated Total

capital losses

USD'000 USD'000 USD'000

As at 1 January 2023 73,761 (4,220) 69,541

Total comprehensive income for the

period - 525 525

As at 30 June 2023 73,761 (3,695) 70,066

============= ============== ===========

As at 1 January 2022 73,761 (5,606) 68,155

Total comprehensive income for the

period - 508 508

As at 30 June 2022 73,761 (5,098) 68,663

=========== ============ ===========

STEPPE CEMENT LTD

(Incorporated in Labuan FT, Malaysia under the Labuan Companies

Act, 1990)

AND ITS SUBSIDIARY COMPANIES

CONDENSED CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIOD ENDED 30 JUNE 2023 (UNAUDITED)

The Group The Company

6 months ended 6 months ended

30 June 30 June 30 June 30 June 2022

2023 2022 2023

USD'000 USD'000 USD'000 USD'000

OPERATING ACTIVITIES

Profit before income

tax 61 12,034 525 508

Adjustments for:

Depreciation of property,

plant and equipment 2,837 3,203 - -

Depreciation of

right-of-use

assets 3 823 - -

Other non-cash items 578 218 (1,088) (1,090)

---------------------- ------------ ------------ -------------------

Operating Profit/(Loss)

Before Working Capital

Changes 3,479 16,278 (563) (582)

(Increase)/Decrease

in:

Inventories 345 (2,922) - -

Trade and other

receivables,

advances and prepaid

expenses (22) (6,444) (9) (12)

Loans and advances from

subsidiary companies - - (20) (24)

Increase in:

Trade and other payables,

accrued and other

liabilities 3,622 3,494 4 56

Cash Generated From/(Used

In) Operations 7,424 10,406 (588) (562)

Income tax paid (1,777) (1,785) - -

Interest paid (483) (198) - -

---------------------- ------------ ------------ -------------------

Net Cash Generated

From/(Used

In) Operating Activities 5,164 8,423 (588) (562)

---------------------- ------------ ------------ -------------------

The Group The Company

6 months ended 6 months ended

30 June 30 June 30 June 30 June

2023 2022 2023 2022

USD'000 USD'000 USD'000 USD'000

INVESTING ACTIVITIES

Purchase of property,

plant and equipment (2,721) (2,870) - -

Purchase of other assets (24) (18) - -

Interest received 93 267 - 1,550

-------------- -------------- ------------ ------------

Net Cash (Used In)/Generated

From Investing Activities (2,652) (2,621) - 1,550

-------------- -------------- ------------ ------------

FINANCING ACTIVITIES

Proceeds from borrowings 1,703 3,346 - -

Repayment from borrowings (1,980) (2,815) - -

Payment of lease liabilities (363) (1,090) - -

-------------- -------------- ------------ ------------

Net Cash Used In Financing

Activities (640) (559) - -

-------------- -------------- ------------ ------------

NET INCREASE/(DECREASE)

IN CASH AND CASH EQUIVALENTS 1,872 5,243 (588) 988

EFFECTS OF FOREIGN EXCHANGE

RATE CHANGES (14) (685) - -

CASH AND CASH EQUIVALENTS

AT BEGINNING OF THE PERIOD 4,144 10,136 1,240 614

-------------- -------------- ------------ ------------

CASH AND CASH EQUIVALENTS

AT END OF THE PERIOD 6,002 14,694 652 1,602

============== ============== ============ ============

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFISWUEDSEIU

(END) Dow Jones Newswires

September 19, 2023 04:00 ET (08:00 GMT)

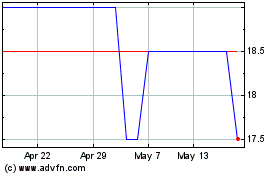

Steppe Cement (LSE:STCM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Steppe Cement (LSE:STCM)

Historical Stock Chart

From Mar 2024 to Mar 2025