Steppe Cement Limited Market Update - First half of 2023 (7306F)

July 12 2023 - 2:00AM

UK Regulatory

TIDMSTCM

RNS Number : 7306F

Steppe Cement Limited

12 July 2023

12 July 2023

Steppe Cement Ltd

Market update for the first half of 2023

In the first half of 2023, Steppe Cement Ltd ("Steppe Cement" or

the "Company") sold 749,034 tonnes of cement for 16,977 million

Tenge, compared with 837,063 tonnes of cement for 19,579 million

Tenge in the first half of 2022. The volume of sales and the

turnover decreased by 11% and 13% respectively.

The average price for the current period for delivered cement

was 22,665 Tenge per tonne (ex-VAT), compared with 23,391 Tenge per

tonne in the corresponding period of 2022. The ex-factory price for

the current period was 19,205 Tenge per tonne, compared with 20,485

Tenge per tonne in the corresponding period of 2022.

Inflationary pressures have started to ease in June to 15% and

the National Bank base rate stands at 16.75%. The cost of

logistics, utilities and food items have experienced higher

increases. This will be reflected in the overall cost of production

of the factory.

The cement market in Kazakhstan in the first half of 2023

reduced by 5.6% compared to the same period last year.

After the first quarter when we maintained prices at the expense

of volumes, we decided to recover market share in the second

quarter at the expense of pricing. As of 30 June, our market share

has returned to 14.1% and the overall volume is in line with the

market evolution.

Imports represented 4.3% of the local market, 2% less than in

2022.

Exports from Kazakhstan remained the same as in 2022 at 0.55

million tonnes.

In response to evolving tax legislation in the jurisdictions of

our intermediary holding companies, we have diligently continued

the restructuring of the Company's holdings to mitigate the

potential risk of withholding tax on the dividend stream. Our

efficiency enhancement strategy focuses on both streamlining the

structure and minimizing associated costs. In line with this

strategic realignment, Steppe Cement has incorporated a

wholly-owned subsidiary in the Astana International Financial

Center (AIFC) as a future holding company of the Kazakh operating

entities. The Kazakh operating subsidiaries will remain 100% owned

by Steppe Cement through its subsidiary companies. The current

objective is to pay a dividend of 2 to 3 pence per share before

November 2023.

Steppe Cement's AIM nominated adviser and broker is RFC Ambrian

Limited.

Nominated Adviser contact: Stephen Allen or Andrew Thomson on

+61 8 9480 2500.

Broker contact: Charlie Cryer at +44 20 3440 6800

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDUUUUROUUBARR

(END) Dow Jones Newswires

July 12, 2023 02:00 ET (06:00 GMT)

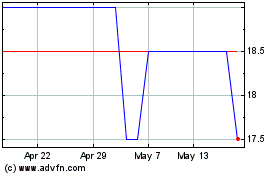

Steppe Cement (LSE:STCM)

Historical Stock Chart

From Feb 2025 to Mar 2025

Steppe Cement (LSE:STCM)

Historical Stock Chart

From Mar 2024 to Mar 2025