TIDMSSTY

RNS Number : 9367Z

Safestay PLC

24 September 2020

The information contained within this announcement is deemed by

the Group to constitute inside information as stipulated under the

Market Abuse Regulations (EU) No. 596/2014 ("MAR")

24 September 2020

Safestay plc

("Safestay" or "the Company" or "the Group")

Interim Results

For the Six Months to 30 June 2020

Safestay (AIM: SSTY), the owner and operator of an international

brand of contemporary hostels, announces its unaudited interim

results for the six months ended 30 June 2020

Trading Highlights

-- Safestay operates 20 hostels with approximately 4,800 beds across 11 European and 4 UK cities

-- In response to the COVID-19 pandemic, and in line with the

hospitality industry globally, all our hostels closed on 1 April

2020 and a gradual reopening programme began from 26 May 2020

-- As a result occupancy was 55% (based only on hostels while they were open)

-- Total revenues decreased by 58% to GBP3.4 million (2018: GBP8.1 million)

-- Recorded Adjusted EBITDA (post IFRS 16 adjustment) loss of

GBP1.2 million (2019: GBP2.5 million profit)

-- To offset the reduction in income, the Group reduced costs

where practical, taking advantage of government support schemes and

working with landlords to reduce rents

-- In April the Group secured a GBP5 million overdraft facility

with HSBC and as at 16 September 2020 the cash in bank was -GBP1

million

H2 2020 and beyond

-- All hostels re-opened by 28 August, except for London

Kensington Holland Park and Barcelona Gothic

-- On 2 September, the Company received a GBP0.2 million government backed loan in Germany

-- In July and August, the Company has traded at the higher end

of the Board's forecast scenarios

-- On 23 September, the Company agreed with HSBC in principle to

replace the GBP5 million overdraft facility with a GBP5 million

Coronavirus Business Interruption Loan Scheme (CBILS)

Larry Lipman, Chairman of Safestay, said:

"We made a good start to 2020, however, trading was materially

impacted by the Covid-19 pandemic from March onwards. We responded

quickly to protect our financial position and the safety of our

guests and employees. As a result, the business is stable and it is

encouraging to have now reopened nearly all our hostels. While it

is still difficult to predict the pace of our recovery, we are

re-engaging effectively with our customer base and we are confident

that we will in time return our hostel portfolio to pre-Covid-19

occupancy levels."

Safestay plc

Tel: +44 (0) 20 8815 1600

Larry Lipman

Liberum (Nomad & Joint Broker) Tel: +44 (0) 20 3100 2000

Andrew Godber / Edward Thomas / Miquela Bezuidenhoudt

Novella Tel: +44 (0) 20 3151 7008

Tim Robertson / Fergus Young

About Safestay

Safestay (AIM: SSTY) is the owner and operator of an

international brand of contemporary hostels.

For more information visit our:

Website: www.safestay.com

Vox Markets page:

https://www.voxmarkets.co.uk/company/SSTY/news/

Instagram page: www.instagram.com/safestayhostels/

Chairman's statement

Introduction

The trading results for the six months to 30 June 2020 reflect

the challenges which Safestay and more generally the hospitality

industry have had to face as a result of the Covid-19 pandemic. It

is however pleasing to see that the Company had a strong start in

January and February as an underlying reminder of the appeal of our

portfolio before the pandemic took effect. I am also pleased that

we were quick to implement adequate measures to protect our cash

position during the lock down period and successfully executed our

reopening strategy to ensure the safety of our guests and

employees. We are still operating in a very uncertain environment,

but we will work through these challenging times and emerge in a

positive position in 2021. Since the half-year end, we have been

seeing a gradual increase in occupancy across the hostels that have

been open.

Financial review

Due to the closure of the hostels, the Group operated just 45%

of its available bed stock for the first six months of 2020, and

recorded a 58% decrease in revenues to GBP3.4 million (2019: GBP8.1

million) leading to an adjusted EBITDA (post IFRS 16 adjustment)

loss of GBP1.2 million (2019: GBP2.5 million profit).

To mitigate the reduction in revenue, the Company negotiated

rent reductions from landlords and applied for government support

where it was available. Consequently, the Group benefited from

GBP0.4 million of rent relief from March to June and total revenue

includes GBP0.3 million of income received via government support

schemes. In some countries, employees were paid directly by the

government whilst being furloughed, which corresponded to

approximately a further GBP0.3 million saving.

The Group recorded a loss before tax of GBP4.7 million (2019:

loss before tax of GBP0.9 million) which includes GBP0.3 of

exceptional costs in relation to the expansion projects completed

in 2020. This led to a loss per share of 7.30p (2019: -1.40p per

share).

In April 2020, the Company agreed a new GBP5 million overdraft

facility from HSBC. Cash in bank as at 16 September 2020 was

approximately -GBP1 million.

As at 30 June 2020, net asset value per share was 48.2p per

share (2019: 41.8p per share) following the revaluation of the

London Elephant & Castle property in September 2019 to GBP26.8

million, increasing from GBP16 million in 2017.

Operating review

Safestay currently operates 3,937 beds in 18 properties across

11 European and 4 UK cities, with another 900 beds under

development in Paris and Venice where progress has been delayed due

to the Covid-19 pandemic and both sites are now expected to open in

2022. While revenues decreased in the first 6 months of 2020, it is

worth differentiating between the first 2 months of the year and

the last 4 months when the business was impacted by the pandemic.

In January and February, total revenue increased 32% versus the

previous year, with an underlying like for like increase of 15%.

Occupancy was 64%, up from 50% in 2019, for these first two months.

In March, the level of bookings started to fall following the

implementation of travel restrictions and by 1 April all hostels

were closed.

The Group has capitalised on the recent renovations of the

restaurants in Barcelona Passeig de Gracia and Edinburgh to

increase the like for like F&B revenue by 22% in the first 2

months of the year. Thanks to the new hostels opened in 2019 and

early 2020, this segment increased 46% during the same period.

Following the renovation of the Bar in Lisbon in February 2020, and

the addition of the Athens rooftop bar since January 2020, we hope

that we can continue this trend when the business normalises.

In 2019 the Group decided to set aside an annual capex fund to

improve as well as maintain the premium standards of the portfolio.

Some of the works planned in 2020 were completed by the time we

decided to pause the renovation program to protect our cash

position in March 2020. These included the renovation of the

Brussels property for GBP0.3 million which also included its

conversion from a hotel into a 185 bed hostel, and the renovation

of the Glasgow property acquired in October 2019, and its

conversion into a 251 bed hostel. The renovation of the rooms in

the Gothic hostel in Barcelona and the bar and showers in Lisbon,

which both started in December 2019, were also completed in the

first quarter of 2020. Other capex programs have been suspended for

the time being.

Post period end, on average, in July 2020, 30% of the Group's

bed stock was available and 16% of such bed stock was occupied.

This increased respectively to 63% and 22% in August. We are

encouraged that the occupancy levels gradually increased week on

week as more hostels re-opened.

Acquisitions

The Group has added 414 beds in 3 hostels in 2020. The

acquisition of the leasehold of the 132 bed hostel in Athens was

completed in January for GBP1.3 million. Also in January, Safestay

completed the GBP2.4 million acquisition of the 2 leasehold hostels

in Warsaw (158 beds) and Bratislava (124 beds), both acquired from

Dream Management Group Ltd. The 3 leases are capitalised in our

balance sheet under IFRS 16 and have increased the total lease

liability by GBP3.2 million.

Financing

On 13 January 2020, the Group completed the renewal of its debt

facility with HSBC. The GBP17.9 million facility which was agreed

for 5 years in April 2017 for an original amount of GBP18.4

million, was replaced with a new facility of GBP22.9 million for 5

years until 2025. The terms are similar to the previous facility,

with interests of 2.45% + LIBOR and same covenants as before.

It was announced on 14 April 2020 that the Company had agreed a

new GBP5 million overdraft facility, also from HSBC, which together

with the Company's cash reserves, would satisfy the Company's

working capital cash requirements during and after the lock down

period. At the same time, the covenants in the Company's GBP22.9

million debt facility have been waived until 31 December 2020.

On 23 September 2020, the Company agreed with HSBC in principle

to amend the covenant test for the period until 30 September 2021

inclusive. The Debt Service Cover Ratio and the Interest Cover

Ratio were both replaced with a commitment from the Company to

achieve a minimum level of adjusted EBITDA for each quarter from

October 2020 to September 2021.

On 23 September 2020, the Company agreed with HSBC in principle

to replace the existing GBP5 million overdraft facility with a GBP5

million Coronavirus Business Interruption Loan Scheme (CBILS). The

loan has a 6 year maturity. It is interest free in the first year

and 3.9% from the second year.

On 23 June, the Company received a GBP0.3 million government

backed loan in Austria.

As disclosed in the trading update released on 24 August 202,

the Company has produced forecasts under two alternative indicative

scenarios, a base case and a low case. The Company has sufficient

access to capital to support the business under its base case

forecast scenario until March 2021 by which time this scenario

predicts the business will be back to breakeven. That said, this is

an unpredictable period and the Company is evaluating additional

funding options to address the funding shortfall which would occur

by 31 January 2021 under the assumptions contained in its low case

forecast scenario. The Group owns the freeholds of the hostels in

Glasgow, Pisa and York, which could therefore be disposed of,

either in the form of a sale and lease back transaction or a

straight disposal. The Group might also contemplate the early

termination of the leases which are anticipated to generate losses

in the next months, subject to an agreement being reached with the

relevant landlords. The Group could also temporarily close some

hostels during the winter if it is anticipated that the income for

these hostels does not cover the incremental costs of opening the

hostels during this period. The Board is considering a range of

options in relation to the business, including raising equity, but

the Board is mindful of giving all shareholders the opportunity to

participate in any such equity raise.

Outlook

As at today, all properties have re-opened, with the exception

of the London Kensington Holland Park hostel and Barcelona Gothic.

While occupancy levels are still relatively low, the trend is

upwards, and we have the capital in place to support the business

into next year under our most conservative forecast. We are mindful

of the need to keep flexible and adapt to changing market

conditions as they arise. However, in the absence of any

significant changes the underlying trend across our portfolio is

positive based currently on just domestic guests, and hopefully we

can soon welcome foreign travelers back to our hostels.

Larry Lipman

Chairman

24 September 2020

Condensed consolidated statement

of comprehensive income Unaudited Unaudited Audited

6 months 6 months Year to

to 30 June to 30 June 31 December

2020 2019 2019

Note GBP000 GBP000 GBP000

------------ ------------ -------------

Revenue 2 3,412 8,083 18,379

Cost of sales (572) (1,223) (2,875)

Gross profit 2,840 6,860 15,504

Administrative expenses (6,104) (5,972) (12,996)

------------ ------------ -------------

Operating profit / (loss) before

exceptional expenses (3,264) 888 2,508

EBIT

Exceptional expenses (136) (336) (585)

------------ ------------ -------------

Operating profit / (loss) after

exceptional expenses 2 (3,400) 552 1,923

Finance costs (1,327) (1,456) (2,558)

Loss before tax (4,727) (904) (635)

Tax (66) - (325)

------------ ------------ -------------

Total comprehensive loss for

the period attributable to owners

of the parent company (4,793) (904) (960)

============ ============ =============

Condensed consolidated statement

of

financial position Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

Note GBP000 GBP000 GBP000

---------- ---------- ------------

Non-current assets

Property, plant and equipment 89,963 66,512 87,366

Intangible assets 1,026 1,244 1,084

Goodwill 15,614 11,378 12,603

Total non-current assets 106,603 79,134 101,053

---------- ---------- ------------

Current assets

Stock 64 44 85

Trade and other receivables 1,185 1,057 1,408

Derivative financial instruments - - -

Cash and cash equivalents (11) 8,305 2,954

Total current assets 1,238 9,406 4,447

---------- ---------- ------------

Total assets 107,841 88,540 105,500

Current liabilities

Borrowings (203) 280 279

Finance lease obligations 3 1,943 2,350 1,648

Trade and other payables 3,324 3,178 2,602

Total current liabilities 5,064 5,808 4,529

---------- ---------- ------------

Non-current liabilities

Borrowings 22,814 17,545 17,399

Finance lease obligations 3 48,492 37,313 46,483

Other payables - - -

Deferred tax 71 105 105

Trade and other payables due in

more than one year 217 720 767

Total non-current liabilities 71,594 55,683 64,754

---------- ---------- ------------

Total liabilities 76,658 61,491 69,283

---------- ---------- ------------

Net assets 31,183 27,049 36,217

---------- ---------- ------------

Equity

Share capital 10 647 647 647

Share premium account 23,904 23,904 23,904

Other components of equity 15,220 6,238 15,461

Retained earnings (8,588) (3,740) (3,795)

---------- ---------- ------------

Total equity attributable to owners

of the parent company 31,183 27,049 36,217

========== ========== ============

Condensed consolidated statement of changes in equity

For the six months to 30 June 2020 (unaudited)

Share Share Other Components Retained earnings Total

capital premium account of Equity GBP000 equity

GBP000 GBP000 GBP000 GBP000

-------- ---------------- ---------------- ----------------- -------

Balance at 1 January

2020 647 23,904 15,461 (3,795) 36,217

Comprehensive income

Loss for the period - - - (4,793) (4,793)

Movement in translation

reserve - - (258) - (258)

Total comprehensive

income - - (258) (4,793) (5,051)

-------- ---------------- ---------------- ----------------- -------

Transactions with owners

Share-based payment

charge for the period - - 17 - 17

-------- ---------------- ---------------- ----------------- -------

Balance at 30 June

2020 647 23,904 15,220 (8,588) 31,183

======== ================ ================ ================= =======

For the six months to 30 June 2019 (unaudited)

Share Share Other Components Retained Total

capital premium account of Equity earnings equity

GBP000 GBP000 GBP000 GBP000 GBP000

-------- ---------------- ---------------- --------- -------

Balance at 1 January

2019 647 23,904 6,221 (2,836) 27,936

342 14,504 1,772 (1,056) 19,837

Comprehensive income

Loss for the period - - - (904) (904)

Total comprehensive

income - - - (904) (904)

-------- ---------------- ---------------- --------- -------

Transactions with owners

Share-based payment

charge for the period - - 17 - 17

-------- ---------------- ---------------- --------- -------

Balance at 30 June

2019 647 23,904 6,238 (3,740) 27,049

======== ================ ================ ========= =======

Condensed consolidated statement of changes in equity

For the year ended 31 December 2019 (audited)

Share Share Other Components Retained earnings Total

Capital premium account of Equity GBP'000 equity

GBP'000 GBP'000 GBP'000 GBP'000

-------- ------------------------------ ---------------- ----------------- ---------

Balance at 1 January

2019 647 23,904 6,221 (2,836) 27,936

-------- ------------------------------ ---------------- ----------------- ---------

Comprehensive income

Loss for the year - - - (960) (960)

Movement in translation

reserve (47) (47)

Total comprehensive loss - - (47) (960) (1,007)

-------- ------------------------------ ---------------- ----------------- ---------

Transactions with owners

Issue of shares - - - 9,705

Share-based payment charge

for the year - - 34 - 34

Revaluation reserve - - 9,253 - 9,253

-------- ------------------------------ ---------------- ----------------- ---------

Balance at 31 December

2019 647 23,904 15,461 (3,795) 36,217

======== ============================== ================ ================= =========

Condensed consolidated statement

of cash flows Unaudited Unaudited Audited

Note 6 months 6 months Year to

to 30 June to 30 June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

------------ ------------ -------------

Operating activities

Cash generated from operations 5 (787) 3,538 5,445

Income tax paid (134) - (217)

------------ ------------ -------------

Net cash generated from operating

activities (921) 3,538 5,228

------------ ------------ -------------

Investing activities

Purchase of property, plant and

equipment (755) (2,774) (1,413)

Purchase of intangible assets (29) (2) (24)

Acquisition of business (3,652) (872) (7,122)

Payment of deferred consideration (498) - (395)

------------ ------------ -------------

Net cash outflow from investing

activities (4,934) (3,648) (8,954)

------------ ------------ -------------

Cash flows from financing activities

Proceeds from borrowings 5,348 - 1,180

Repayment of borrowings - (851) (528)

Proceeds from issue of share capital - 17 -

Fees related to borrowings (255) - -

Amounts paid under finance leases (1,857) (311) (3,242)

Interest paid (346) (299) (589)

2,890 (1,444) (3,179)

------------ ------------ -------------

Cash and cash equivalents at beginning

of period 2,954 9,859 (6,905)

Net increase/(decrease) in cash

and cash equivalents (2,965) (1,554) 9,859

------------ ------------ -------------

Cash and cash equivalents at end

of period (11) 8,305 2,954

============ ============ =============

1. ACCOUNTING POLICIES FOR THE GROUP AND COMPANY FINANCIAL STATEMENTS

Safestay plc is listed on the AIM market of the London Stock

Exchange and is incorporated and domiciled in the UK.

The Group and Company interim financial statements have been

prepared in accordance with International Financial Reporting

Standards (IFRSs) as adopted by the European Union. The financial

statements have also been prepared in accordance with IFRSs adopted

by the European Union and therefore the Group financial statements

comply with Article 4 of the EU IAS regulation.

These condensed interim financial statements have not been

audited, do not include all the information required for full

annual financial statements and should be read in conjunction with

the Group's consolidated annual financial statements for the year

ended 31 December 2019.

The financial statements have been presented in sterling,

prepared under the historical cost convention, except for the

revaluation of freehold properties and certain financial

instruments.

The accounting policies have been applied consistently

throughout all periods presented in these financial statements.

These accounting policies comply with each IFRS that is mandatory

for accounting periods ending on 30 June 2020.

New standards and interpretations effective in the year

The following standards were effective from 1 January 2019:

-- IFRS 3: Business combination - amendment effective 1 January 2020

IFRS 3 establishes different accounting requirements for a

business combination as opposed to the acquisition of an asset or a

group of assets that does not constitute a business. Business

combinations are accounted for by applying the acquisition method,

which, among other things, may give rise to goodwill. In contrast,

when accounting for asset acquisitions, the acquirer allocates the

transaction price to the individual identifiable assets acquired

and liabilities assumed on the basis of their relative fair values

and no goodwill is recognised. Therefore, whether or not an

acquired set of activities and assets is a business, is a key

consideration in determining how the transaction should be

accounted for. The amendments made to the IFRS 3 are set out to

clarify the definition of a business. The amendment also adds an

optional concentration test that allows a simplified assessment of

whether an acquired set of activities and assets is not a

business.

Acquisitions made in the 6 months to June 2020 have been treated

as business combinations under the amended IFRS 3 standard (Note

4)

2. SEGMENTAL ANALYSIS

Unaudited Unaudited Audited

6 months 6 months Year to

to 30 June to 30 June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

------------ ------------ -------------

Hostel accommodation 2,400 6,571 15,115

Food and Beverages sales 404 1,128 2,492

Other income 608 384 772

------------ ------------ -------------

Total Income 3,412 8,083 18,379

------------ ------------ -------------

UN Audited 6 months to 30 UK Spain Rest of Shared TOTAL

june 2020 Europe services

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 1,842 728 842 - 3,412

----------- -------- -------- ---------- --------

Profit/(Loss) before tax (571) (811) (1,613) (1,732) (4,727)

Finance costs 480 244 213 390 1,327

----------- -------- -------- ---------- --------

Operating Profit after exceptional

expenses (91) (567) (1,400) (1,342) (3,400)

Depreciation & Amortisation 734 692 620 26 2,072

Exceptional & Share based payment

expense - - - 136 136

----------- -------- -------- ---------- --------

Adjusted EBITDA 643 125 (780) (1,180) (1,192)

----------- -------- -------- ---------- --------

Rental charges (IFRS 16) - (757) (604) - (1,361)

Adjusted EBITDA (pre-IFRS 16) 643 (632) (1,384) (1,180) (2,553)

----------- -------- -------- ---------- --------

Audited Year to 31 December UK Spain Rest of Shared TOTAL

2019 Europe services

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Revenue 9,401 4,909 4,069 - 18,379

----------- -------- -------- ---------- --------

Profit/(Loss) before tax 3,347 (387) 498 (4,093) (635)

Finance costs 338 681 308 1,231 2,558

----------- -------- -------- ---------- --------

Operating Profit after exceptional

expenses 3,685 294 806 (2,862) 1,923

Depreciation & Amortisation 1,265 1,555 692 - 3,512

Exceptional & Share based payment

expense - - - 619 619

----------- -------- -------- ---------- --------

Adjusted EBITDA 4,950 1,849 1,498 (2,243) 6,054

----------- -------- -------- ---------- --------

Rental charges (IFRS 16) - (1,504) (744) - (2,248)

Adjusted EBITDA (pre-IFRS 16) 4,950 345 754 (2,243) 3,806

----------- -------- -------- ---------- --------

3. LEASES

Lease liabilities are presented in the statement of financial

position as follows:

Unaudited Unaudited Audited

30 June 30 June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

-------------------------- ----------------------- ---------------------------

Current 1,943 2,350 1,648

Non-current 48,492 37,313 46,483

Total 50,435 39,663 48,131

========================== ======================= ===========================

The Group has leases for hostels across Europe. With the exception

of short-term leases and leases of low-value underlying assets,

each lease is reflected on the balance sheet as an asset and

a lease liability. With the adoption of IFRS16, operating leases

under IAS17 are now categorised as a right-of-use asset. The

Group continues to classify its finance leases as a lease liability

and a leasehold land and buildings asset. The Group classifies

its right-of-use assets in a consistent manner to its property,

plant and equipment.

For leases classified as right-of-use assets, each lease generally

imposes a restriction that, unless there is a contractual right

for the Group to sublet the asset to another party, the right-of-use

asset can only be used by the Group. Leases are either non-cancellable

or may only be cancelled by incurring a substantive termination

fee. Some leases contain an option to extend the lease for

a further term. The Group is prohibited from selling or pledging

the underlying leased assets as security. The Group must keep

those properties in a good state of repair and return the properties

in their original condition at the end of the lease. Further,

the Group must insure items of property, plant and equipment

and incur maintenance fees on such items in accordance with

the lease contracts.

The table below describes the nature of the Group's leasing

activities by the type of right-of-use asset recognised on

the balance sheet:

Right-of-use No of Range Average No of No of No of No of

asset right-of-use of remaining leases leases leases leases

assets remaining lease with with with with

leased term term extension options variable termination

options to payments options

purchase linked

to an

index

Hostel

buildings

- Operating 7 -

leases 15 20 years 13 years 8 0 9 0

------------- ---------- ---------- ---------- --------- ---------

Hostel

buildings 50 -

- Long 150

leases 3 years 113 years 0 2 3 0

-------------- ------------- ---------- ---------- ---------- --------- --------- ------------

The lease liabilities are secured by the related underlying

assets. Future minimum lease payments

at 30 June 2020 were as follows:

Minimum lease payments due

Within 1 - 2 2 - 3 3 - 4 4 - 5 After Total

1 year years years years years 5 years

-------- -------- -------- -------- -------- --------- -------

Lease payments 3,789 3,797 3,798 3,798 3,757 65,069 84,009

Finance charges (1,846) (1,780) (1,712) (1,643) (1,569) (25,024) 33,573

Net present

values 1,943 2,017 2,086 2,156 2,188 40,046 50,435

The group has elected not to recognise a lease liability for

short term leases (leases with an expected term of 12 months or

less) or for leases of low value assets.

4. ACQUISITIONS

The Group added 3 hostels. Athens was completed in January for

GBP1.3 million. Also in January, Safestay acquired 2 leasehold

hostels from Dream Management Group Ltd in Warsaw and Bratislava

for GBP2.4 million. The 3 leases are capitalised in our balance

sheet under IFRS 16 and have increased the total lease liability by

GBP3.2 million.

The provisional fair values of assets and liabilities

acquired:

Athens Bratislava Warsaw Unaudited Unaudited30

30 June June 2019

2020

---------- ----------- -------------- ---------- ------------

Number of sites purchased 3 1

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Provisional fair value

Property, plant &

equipment 88 20 521 629 2,130

Right of use assets 1,978 514 731 3,223 -

Intangible assets - - - - -

Current assets 1 1 51 53 -

Cash - 29 63 92 85

Debt - - - - -

Deferred revenue, trade

& Other payables (9) (2) (67) (78) (33)

Lease Liabilities 1,978 514 731 3,223

Deferred tax - - - - -

Goodwill 1,224 1,126 606 2,956 790

Consideration

Net cash paid on acquisition 1,304 1,174 1,174 3,652 2,972

Deferred payments - - - - -

---------- ----------- -------------- ---------- ------------

Total Consideration 1,304 1,174 1,174 3,652 2,972

---------- ----------- -------------- ---------- ------------

5. NOTES TO THE CONDENSED CONSOLIDATED STATEMENT OF

CASH FLOWS

Unaudited Unaudited Audited

6 months 6 months Year to

to 30 June to 30 June 31 December

2020 2019 2019

GBP000 GBP000 GBP000

------------ ------------ -------------

Loss before tax (4,727) (904) (635)

Adjustments for:

Depreciation of property, plant and

equipment and 2,072 1,614 3,512

amortisation of intangible assets

Finance costs 1,327 1,456 2,440

Loss on disposal of fixed assets - - -

Share-based payments 17 17 34

Exchange movements (303) (67) (2)

Changes in working capital

Decrease/(Increase) in inventory 23 - (39)

(Increase)/Decrease in trade receivables 222 144 (170)

Increase/(Decrease) in trade and other

payables 582 1,278 305

------------ ------------ -------------

Cash generated from operating activities (787) 3,538 5,445

------------ ------------ -------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUPWBUPUGRW

(END) Dow Jones Newswires

September 24, 2020 02:00 ET (06:00 GMT)

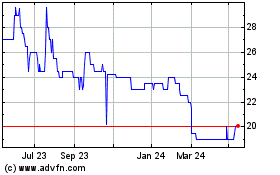

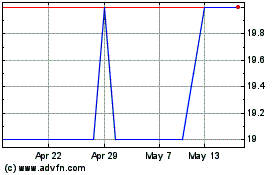

Safestay (LSE:SSTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Safestay (LSE:SSTY)

Historical Stock Chart

From Jul 2023 to Jul 2024