TIDMSQS

RNS Number : 5638Q

SQS Software Quality Systems AG

13 September 2017

13 September 2017

SQS Software Quality Systems AG

("SQS" or the "Company")

Results for the six months ended 30 June 2017

SQS Software Quality Systems AG (AIM: SQS), the leading global

provider of quality assurance services for digital business

processes, today announces its unaudited results for the six months

ended 30 June 2017.

These first half results further demonstrate progress in

implementing the Company's medium term strategy to help customers

migrate towards a more digital focused business model. In pursuing

this strategy, SQS intends to deliver sustainable improvements in

gross margin, adj. EBIT and the annual dividend distribution, which

is evidenced in the numbers presented here.

Financial Highlights

-- Total revenue decreased 3.9% to EUR160.1m (H1 2016: EUR166.6; H2 2016: EUR160.5m)

o At constant currencies, revenue would have been EUR1.7m higher

at EUR161.8m

o Decrease due to one banking client loss of EUR7.0m

-- Gross margin improved by 90bps to 32.6% reflecting more

efficient and automated service delivery

-- Adjusted* gross profit decreased 1.1% to EUR52.2m (H1 2016: EUR52.8m)

-- Adjusted* EBIT increased by 5.4% to EUR12.1m (H1 2016: EUR11.5m)

o Reflecting improved gross margin, continued focus on improved

operating profit margins and strict cost management

o Adj. EBIT margin increased to 7.5% (H1 2016: 6.9%)

-- Adjusted* PBT increased by 7.9% to EUR12.8m (H1 2016: EUR11.9m)

o Includes a net positive finance result (net interest and

realised forex results of EUR0.7m, H1 2016: EUR0.4m)

-- Adjusted EPS* increased by 18.2% to EUR0.26 (H1 2016: EUR0.22)

o Driven by better operational profitability, a lower local GAAP

tax rate and a positive effect from a lower minority profit

share

-- Operating cash outflow at EUR(6.6)m (H1 2016: EUR(1.2)m)

o Reflecting typical H1 seasonality from bonus pay outs and

deferral of larger client invoicing and payments to H2

o Full year expecting another year of strong EBITDA to operating

cash flow conversion

-- Net debt EUR32.6m (at as 31 Dec 2016: net debt EUR12.4m, as

at 30 June 2016: net debt EUR32.9m)

o Reflecting effects from operating cash outflow, normalised

capex outflow of EUR4.0m and dividend payments of EUR4.8m during

H1

(*) Notes regarding adjustments can be found in the financial

review section.

Operational Highlights

-- A number of new clients secured in H1 with further contracts

expected to begin in the second half of the year

-- Momentum within Management Consulting ("MC") continued during

the first half of 2017, now accounting for 18.8% of total revenues

in H1 (H1 2016: 17.2%)

-- Continued demand for Managed Services ("MS") offering (now at

46% of revenues, H1 2016 at 47%), including a EUR4.0m contract with

a European online payments processing business

-- More than 52% of total revenues now derived from "digital"

engagements where SQS executes on a digital strategy or

transformation to open up new business models (up from 40% of total

revenues in the year to 31 December 2016)

-- Improved operational efficiency through more consistent use

of automation in project delivery

-- Healthy pipeline including opportunities across all major industries

Diederik Vos, Chief Executive Officer of SQS, commented:

"SQS continues to deliver on its strategy to equip its clients

with best in class digital transformation services. This can be

seen in solid gross margin and EBIT growth, a clear product of our

continued focus on increasing profitability through our

consistently improving service delivery and shift to higher margin

MC projects, which will drive future growth.

We are seeing healthy demand for our service offering, with

continued good performance across all our verticals - including our

core technology and automotive sectors - and we are excited about

the increasing breadth of our addressable market, as a result of

the quality of the Company's approach, expertise and product set.

As an increasing number of businesses seek to use smarter, more

automated processes to boost operational efficiency, meet evolving

regulatory standards and remain competitive, the Company is well

positioned to capitalise on favourable industry trends over the

next few years.

Looking ahead, SQS expects H2 2017 revenues to be above H1,

despite current currency headwinds. With an exciting market, a good

pipeline and an improving EBIT margin we have a great opportunity

to continue growing the returns to shareholders."

Enquiries:

SQS Software Quality Systems AG Tel. +49 (0) 2203 91 54 0

Diederik Vos, Chief Executive Officer

Rene Gawron, Chief Financial Officer

Numis Securities - Nomad and Joint Broker Tel +44 (0) 20 7260 1000

Simon Willis / Jamie Lillywhite / Mark Lander

Stockdale Securities - Joint Broker Tel. +44 (0) 20 7601 6100

Robert Finlay / Antonio Bossi

FTI Consulting - Financial Media and Investor Relations Tel. +44 (0)20 3727 1000

Matt Dixon / Dwight Burden sqs@fticonsulting.com

About SQS

SQS is the leading global provider of quality assurance services

for digital business processes. This position stems from over 35

years of successful consultancy operations. SQS consultants provide

solutions for all aspects of quality throughout the whole software

product lifecycle driven by a standardised methodology,

industrialised automation processes and deep domain knowledge in

various industries. Headquartered in Cologne, Germany, the company

now employs approximately 4,400 staff. SQS has offices in Germany,

UK, US, Australia, Austria, Egypt, Finland, France, India, Ireland,

Italy, Malaysia, the Netherlands, Norway, Singapore, South Africa,

Sweden, Switzerland and UAE. In addition, SQS maintains a minority

stake in a company in Portugal. In 2016, SQS generated revenues of

EUR327.1 million.

SQS is the first German company to have a primary listing on

AIM, a market operated by the London Stock Exchange. In addition,

SQS shares are also traded on the German Stock Exchange in

Frankfurt am Main.

With over 10,000 completed projects, SQS has a strong client

base, including half of the DAX 30, nearly a third of the EURO

STOXX 50 and 20 per cent of the FTSE 100 companies.

For more information, see www.sqs.com

Chief Executive's Statement

Introduction

Through digitisation and exciting advances in technology, the

global business environment continues to evolve, and that shift

also includes the space that SQS occupies.

SQS is helping to make customers more agile to the challenge by

increasing the speed of new technology deployment, adding greater

process automation, ultimately helping to create new revenue

opportunities and recognise better returns on investment.

Recent high profile IT incidents have increased the pressure on

companies to ensure that digital infrastructure is robust, secure

and able to adapt to meet future business needs. Decisions around

what level of digital transformation to undertake and how to ensure

the continuous quality and integrity of those new systems therefore

become increasingly important. SQS, through its Management

Consulting and Managed Services capabilities, is well positioned to

support companies in these important areas.

At the same time, and because digital systems themselves change

more frequently, there is growing demand for more efficient,

automated and smarter processes for implementing quality assured

software.

It is this growing operational agility and intelligence that

SQS, mainly through its MC and MS offerings, but also through its

Professional Services ("PS") capabilities, is offering to customers

across all end-markets.

As outlined in the 3 July trading update, MC will become the

growth engine as customer demands shift towards solutions to deploy

new digital environments and ultimately deliver the quality

assurance for these. To respond effectively to the changing

environment, SQS continues to look to, and invest in, process

automation, which remains at a relatively early stage of reaching

its full potential, to deliver its services more efficiently and

profitably.

Our focus is on increased profitability from operations and, in

the medium term, SQS expects to be able to deliver organically an

adjusted EBIT margin of at least 9% and corresponding operating

cash flow improvements - the two key metrics we use to measure

successful progress.

New Business

We are seeing strong demand for MC services across a number of

sectors, and are pleased to have secured new clients that are among

some of the world's best known global technology brands, operating

at the cutting edge of digital and technology trends. Demand within

automotive and manufacturing remains particularly high as the

necessity for reliable, quality assured, cutting edge software

capable of enabling the introduction of connected and autonomous

cars is expected to grow.

MS has accounted for 45.8% of total revenues in H1 2017 (H1

2016: 46.6%). The slight decline seen in the first half was largely

due to the reduced mandate from one major banking client (as

announced previously). We continue to see good demand for our MS

offering, evidenced by the award of a EUR4.0m MS contract from a

European online payments processing business keen to optimise the

manner in which it approaches quality assurance, and by further

interest being demonstrated in the retail and logistics

sectors.

In line with our strategy PS delivered 27.8% of revenues (H1

2016: 29.2%).

Regional Performance

Europe continues to be a significant growth market. As the shift

to digital systems takes hold in Europe, this opens up particular

opportunities for growth where we already enjoy strong existing

customer relationships and brand awareness. This is particularly

the case in our core geographies of Germany, Ireland and Italy

where we have made good progress, experiencing solid net organic

growth.

The US remains a key geography for us, given its position as the

largest single addressable software quality and consulting services

market. As expected, revenue share from the US in H1 2017 was

marginally down year-on-year at 15.0% of total revenue (H1 2016:

17.0%) as some of the key industries in which SQS is active in the

US remain subdued. Following recent market uncertainty we have seen

businesses in the US delay making business decisions, particularly

in healthcare and financial services, whilst some policy and

regulatory frameworks remain uncertain under the current

government. At the same time we have won a number of initial

contracts with US technology businesses which are expected to

contribute to growth in the second half and beyond. The Company's

acquisitions have given SQS the capabilities and brand awareness

needed to drive future growth in this key geography.

Strategy

SQS continues to deliver on its strategy to remain at the centre

of digital transformation and, in doing so, support its clients

across all stages in their shift to automation and digitisation,

chiefly in:

-- assessing their digital readiness

-- shaping their digital strategy and ensuring its effective deployment

-- aligning software quality with business strategy

-- ensuring the continuous quality and integrity of the software once deployed

As we innovate and expand our services portfolio, we continue to

increase the breadth of our capabilities and grow the scale of our

service offering, to best cater to the needs of our clients. This

includes deploying faster and better performing technology, and

implementing process automation across the organisation, to open up

new revenue streams and greater operational efficiencies for the

businesses we work with.

We are focussed on continuing to drive up profitability from our

operations and believe we can achieve this organically to deliver

an improved EBIT margin and operating cash flow. Whilst we continue

to integrate our US acquisitions, new acquisition opportunities are

likely to be more focussed on Europe where they are expected to

further strengthen the Company's offering for its clients.

Dividend

In accordance with German law, SQS pays one dividend in each

financial year. We expect to declare a dividend with our final

results for the year ending 31 December 2017, in line with our

current policy of paying out approximately 30% of adjusted profit

after tax as a dividend.

Employees

Total headcount as at 30 June 2017 was 4,402 (30 June 2016:

4,612), with an additional circa 240 contractors retained during

the period. This is in line with revenue development and reflects

our continued focus on delivering an increasingly automated service

to our clients. Further operational efficiencies can be

expected.

Outlook

SQS continues to deliver on its strategy to equip its clients

with best in class digital transformation services. This can be

seen in solid gross margin and EBIT growth, a clear product of our

continued focus on increasing profitability through our

consistently improving service delivery and shift to higher margin

MC projects, which will drive future growth.

We are seeing healthy demand for our service offering, with

continued good performance across all our verticals - including our

core technology and automotive sectors - and we are excited about

the increasing breadth of our addressable market, as a result of

the quality of the Company's approach, expertise and product set.

As an increasing number of businesses seek to use smarter, more

automated processes to boost operational efficiency, meet evolving

regulatory standards and remain competitive, the Company is well

positioned to capitalise on favourable industry trends over the

next few years.

Looking ahead, SQS expects H2 2017 revenues to be above H1,

despite current currency headwinds. With an exciting market, a good

pipeline and an improving EBIT margin we have a great opportunity

to continue growing the returns to shareholders.

Diederik Vos

Chief Executive Officer

13 September 2017

Financial Review H1 2017

Summary

Revenues of EUR160.1m have remained at largely the same level as

H2 2016, which represents a decline of 3.9% to H1 2016 (H2 2016

EUR160.5m, H1 2016: EUR166.6m), including a negative revenue impact

from translational forex of EUR1.7m and the effect of one banking

client loss of EUR7.0m.

The business units, which represent the accounting segments

according to IFRS 8, are:

-- Our Managed Services (MS) business unit meets the demand of

clients seeking efficiency in long-term engagements (between twelve

months and five years) of which a substantial share is delivered

from nearshore and offshore delivery centres. This also includes

long term engagements for quality assurance services on standard

software package products. MS continues to perform well, generating

good quality of earnings for the Group;

-- Our Management Consulting (MC) business unit meets the demand

of clients seeking transformation and quality through IT Portfolio

Programme and Project Management, Digital Transformation

Consulting, Business & Enterprise Architecture, Process

Modelling and Business Analysis. Our MC services portfolio offers

strong opportunities for growth and opens broader addressable

markets;

-- Our Professional Services (PS) business unit meets the demand

of more price conscious clients in IT projects who tend to be given

a smaller number of consultants on a more local basis and typically

contracted for a short term period (e.g. three months);

Alongside these major segments we conduct business with

contractors (as far as these have not been included in MS or MC),

training & conferences and software testing tools summarised as

"Other".

Breakdown by business unit

Managed Services (MS)

Revenue in MS, our largest segment and one of our strategic

focus areas, amounted to EUR73.4m in the period (H1 2016:

EUR77.6m), a decrease of (5.4)% on the prior year, representing 46%

of Group revenue. The decrease in revenue predominantly came from

the scope reduction of a larger banking managed services contract

that had ended last year.

Management Consulting (MC)

Revenue in this segment, our other strategic focus area, saw an

increase during the period of 5.2% to EUR30.1m (H1 2016: EUR28.6m),

representing 19% of Group revenue, up from 17% at H1 2016. Growth

for this segment was mainly driven by organic growth and a build up

of MC business in the key European markets.

Professional Services (PS)

Revenue in this segment decreased by (8.4)% to EUR44.5m (H1

2016: EUR48.6m) on the prior year period, representing 28% of Group

revenue. The revenue reduction has been in line with our strategy

to continue to reduce the share of this lower margin segment to a

range of around 25% of our total revenue.

Other

Revenue in the "Other" segment amounted to EUR12.1m in the

period (H1 2016: EUR11.8m), an increase of 2.5% on the prior year

and representing 7% of Group revenue. A slight increase in revenue

from contractors was the key driver for this development.

Margins and Profitability

Operating profits and margins were adjusted(*), as in all

previous reporting periods, by the following non-cash items and

acquisition costs:

-- Adjustment on gross profit:

o EUR0.33m for amortisation of order backlog of acquired

companies

-- Adjustment on G&A costs:

o EUR0.70m for amortisation of client relationship of acquired

companies

o EUR0.25 for acquisition costs

The above adjustments account for the difference between

reported EBIT of EUR10.8m and Adjusted EBIT of EUR12.1m. Further

adjustments are made to the reported finance costs and tax charge

as below, in order to derive Adjusted PBT and Adjusted Earnings

respectively:

-- Adjustment on finance result:

o EUR0.3m for pro forma interests on deferred payments for

acquisitions

-- Adjustment on taxes:

o EUR(0.6)m profit tax adjustment, as actual local GAAP profit

taxes are higher than IFRS taxes including deferred taxes

Adjusted* gross profit decreased by 1.1% to EUR52.2m (H1 2016:

EUR52.8m), with the gross margin up to 32.6% (H1 2016: 31.7%). The

improvement in gross margin was driven by an increased blended

contribution from MS and MC that deliver higher client value and

better margins in the range above 36%. Gross margins in the PS

segment also slightly improved to 27.6% (H1 2016: 27.0%).

Gross margins in the "Other" segment were at 20.1% (H1 2016:

16.7%) reflecting an improved contractor gross margin and a lower

share from tool licences re-selling.

Adjusted* earnings before interests and taxes (adj. EBIT) for

the period was EUR12.1m (H1 2016: EUR11.5m), an increase of 5.4%,

with the adjusted EBIT margin at 7.5% (H1 2016: 6.9%). The adj.

EBIT was driven by a blended gross margin of about 36% in MS, MC

and an increased share from these two strategic business lines of

65% of total revenue (H1 2016: 64% of total revenue).

Adjusted* profit before tax for the period was EUR12.8m (H1

2016: EUR11.9m), an increase of 7.9%, with the adjusted profit

margin at 8.0% (H1 2016: 7.1%). The profit before tax was driven by

the effects mentioned under EBIT above, and a slightly improved

finance result from lower net interest costs and better net

realised exchange rate gains.

Adjusted* earnings per share were EUR0.26 (H1 2016: EUR0.22)

resulting from the above outlined improvements in margins and

finance results and a positive effect from a reduced minority

profit share mainly from SQS India BFSI of EUR(0.8)m (H1 2016:

EUR(1.3)m).

Costs

Total overhead costs (adjusted for the non-finance effects under

* above) moved up to 25.1% of revenue from 24.8% in H1 2016 due to

lower revenues, but overall costs came down by EUR1.2m.

General & Administrative expenses (adjusted for the

non-finance effects under * above) for the period were EUR26.2m (H1

2016: EUR27.9m). As a percentage of revenue these costs remained

flat at 16.8% (H1 2016: 16.7%). The absolute reduction was mainly

due to better operational efficiencies and the increased global use

of shared services.

Sales & Marketing costs for the period were EUR11.7m (H1

2016: EUR11.7m), representing 7.3% of revenues (H1 2016: 7.0%).

Research & Development expenses during the period were up at

EUR2.3m (H1 2016: EUR1.7m) representing 1.4% (H1 2016: 1.0%) of

revenues. This investment was focused on the development of our

proprietary software testing tools, the PractiQ methodology and new

platforms around predictive quality analytics. Our research

technology centre in Belfast was expanded during the period to

improve the competitive positioning of SQS services with more

intellectual property. We expect to maintain this slightly

increased level of R&D spend going forward.

Finance Income and Costs

Net finance income of EUR0.4m comprises net interest costs of

EUR(0.7)m offset by foreign exchange net gains of EUR1.1m

Cash Flow and Financing

Cash outflow from operating activities was at EUR(6.6)m (H1

2016: EUR(1.2)m outflow). This profile of an operating cash outflow

during the first half is due to the typical seasonality we have

seen in previous first half year periods, reflecting payment of

staff bonuses and the usual seasonal increase in debtor days (which

increased to 81 as compared to 70 at the end of 2016 and 77 days at

mid-2016). We therefore expect an improved cash collection and full

EBITDA to operating cash conversion by the end of the full year, as

in previous years.

We have also during the period adopted a significantly

accelerated month end accounts closing timetable which results in

increased levels of work-in-progress and a corresponding decrease

in trade debtors. This has no impact on the actual billing of

customers or the timing of cash receipts.

Cash outflow from investments came down to EUR(4.0)m (H1 2016:

EUR(6.3)m outflow), as no payments for acquisitions or building

infrastructure investments were due. The current level of

investment is largely a "normalised" level for IT infrastructure

and R&D spend.

Total cash inflow from financing activities was EUR9.6m (H1

2016: EUR7.2m inflow) reflecting a net increase in finance loans of

EUR14.3m during H1 2017, mainly to fund the outflow from operating

and investment activities. Additionally dividend payments to SQS

Group shareholders resulted in an outflow of EUR(4.8)m (H1 2016:

EUR(4.1)m outflow).

Balance Sheet

We closed the period with EUR23.9m (31 Dec 2016: EUR29.8m) of

cash and cash equivalents on the balance sheet and borrowings of

EUR56.5m (31 Dec 2016: EUR42.2m). The increase in borrowings was

mainly due to fund the seasonal first half requirements from

working capital and dividend payments. Cash reserves are held in a

broader range of currencies and the transfer of funds is restricted

in some geographies, such as India. Therefore, the offset between

cash and debt positions has become less flexible as we also seek to

avoid the realisation of negative exchange rate movements. The

resulting net debt position at the period end was EUR(32.6)m (31

Dec 2016: net debt of EUR(12.4)m; 30 June 2016: net debt of

EUR(32.9)m).

SQS has borrowing facilities with four main banks and

additionally continues to have local overdraft facilities in some

countries. In total its facilities with the four main banks are now

EUR83m and are in place until 2021. These facilities are subject to

customary covenants, are not secured and the borrowing costs are

lower than historically.

For the acquired companies Bitmedia, Trissential and Galmont,

intangible assets for client relationships and order backlog with a

fair value of EUR8.6m were recognised in the 30 June 2017 balance

sheet, reflecting a further amortisation of EUR1.0m during the

period. On average these intangible assets are amortised over a

period of up to nine years.

In total goodwill and intangible assets from the acquired

companies came down to EUR84.6m in the H1 2017 balance sheet (YE

2016: EUR89.1m) resulting from the aforementioned amortisation and

forex adjustments of recognised goodwill.

As these amortisation charges are non-cash-items and do not

impact the normal business of SQS, they are adjusted within the

Gross Profit, EBIT, PBT and EPS reporting.

Taxation

The tax charge of EUR3.1m (H1 2016: EUR2.3m) includes current

tax expenses of EUR3.7m (H1 2016: EUR3.7m) and deferred tax income

of EUR(0.6)m (H1 2016: EUR(1.4)m). The tax rate on local GAAP

results was 28.9% (H1 2016: 31.0%), the lower tax rate being a

consequence of changes in the geographic spread of profits. Going

forward, we expect an actual tax rate of c. 29%.

Foreign Exchange

Approximately 61.7% (H1 2016: 55.2%) of the Group's turnover is

generated in Euro. For the conversion of revenues and costs

generated in other currencies into Euro, the relevant official

average exchange rate for the first six-month-period of 2017 was

applied. For the conversion of the balance sheet items from other

currencies into Euro, the official exchange rate as at 30 June 2017

was used.

Foreign exchange had a EUR0.3m positive translational impact on

earnings for the period. Had the Pound Sterling/Swiss Franc/Indian

Rupee/Swedish Krona/Egyptian Pound/US-$/Euro exchange rates

remained the same as in H1 2016, our non-Euro revenues for the

period would have been EUR1.7m higher and the adj. EBIT would have

been EUR0.3m lower.

International Financial Reporting Standards (IFRS)

The Consolidated Financial Statements of SQS and its subsidiary

companies ("SQS Group") are prepared in conformity with all IFRS

(International Financial Reporting Standards) and Interpretations

of the IASB (International Accounting Standards Board) which are

mandatory at 30 June 2017.

The SQS Group Consolidated Financial Statements for the 6-month

period ended 30 June 2017 were prepared in accordance with uniform

accounting and valuation principles in Euro.

Rene Gawron

Chief Financial Officer

13 September 2017

Consolidated Income Statement

for the six months ended 30 June 2017

Six months Six months Year ended

ended 30 ended 30 31 December

June 2017 June 2016 2016

(Notes) (unaudited) (unaudited) (audited)

kEUR kEUR kEUR

Revenue 160,134 166,623 327,103

Cost of sales (3) 108,222 114,533 223,482

Gross profit 51,912 52,090 103,621

General and administrative expenses (3) 27,142 31,350 61,981

Sales and marketing expenses (3) 11,678 11,745 23,898

Research and development expenses (3) 2,306 1,745 4,154

Profit before amortisation,

tax and finance costs (EBIT) 10,786 7,250 13,588

Amortisation of goodwill 0 0 5,600

Profit before tax and finance

costs (EBIT) 10,786 7,250 7,988

Finance income 1,750 1,197 9,754

Finance costs 1,332 1,281 3,002

Net finance income (costs) (4) 418 -84 6,752

Profit before taxes (EBT) 11,204 7,166 14,740

Income tax expense (5) 3,089 2,276 4,231

Profit for the period 8,115 4,890 10,509

Attributable to:

Owners of the parent (6) 7,282 4,478 10,004

Non-controlling interests (13) 833 412 505

Consolidated profit for the

period 8,115 4,890 10,509

============ ============ ===============

Earnings per share, undiluted

(EUR) (6) 0.23 0.14 0.32

============ ============ ===============

Earnings per share, diluted

(EUR) (6) 0.22 0.13 0.30

============ ============ ===============

Adjusted earnings per share

(EUR), for comparison only (6) 0.26 0.22 0.47

============ ============ ===============

Consolidated Statement of Comprehensive Income

for the six months ended 30 June 2017

Six months Six months Year ended

ended 30 ended 30 31 December

June 2017 June 2016 2016

(unaudited) (unaudited) (audited)

kEUR kEUR kEUR

Profit for the period 8,115 4,890 10,509

Exchange differences on translating

foreign operations -4,259 -6,189 -6,431

Gains / losses arising from cash flow

hedges 15 63 86

Other comprehensive income to be reclassified

to profit or loss in subsequent periods -4,244 -6,126 -6,345

Re-measurement losses on defined benefit

plans 0 0 1,651

Other comprehensive income not being

reclassified

to profit or loss in subsequent periods 0 0 1,651

Other comprehensive income for the period,

net of tax -4,244 -6,126 -4,694

Total comprehensive income for the period,

net of tax 3,871 -1,236 5,815

============ ============ =================

Attributable to:

Owners of the parent 2,961 -2,086 4,907

Non-controlling interests 910 850 908

Consolidated Statement of Financial Position

as at 30 June 2017 (IFRS)

30 June 2017 30 June 2016 31 December

2016

(Notes) (unaudited) (unaudited) (audited)

kEUR kEUR kEUR

Current assets

Cash and cash equivalents 23,919 26,399 29,824

Trade receivables 50,292 61,360 56,424

Other receivables 10,950 6,880 7,207

Work in progress 36,812 23,546 17,207

Income tax receivables 3,172 1,931 3,261

125,145 120,116 113,923

Non-current assets

Intangible assets (7) 22,198 23,378 23,121

Goodwill (7) 75,916 87,389 78,860

Property, plant and equipment (8) 15,987 16,517 16,711

Financial assets 30 33 30

Income tax receivables 192 1,339 285

Deferred tax assets 5,689 5,443 5,615

120,012 134,099 124,622

Total Assets 245,157 254,215 238,545

Current liabilities

Bank loans and overdrafts (9) 55,215 59,062 41,119

Finance lease 0 63 0

Trade payables 7,450 6,038 9,834

Other provisions 0 0 0

Income tax accruals 3,049 5,176 2,573

Other current liabilities (10) 41,657 40,500 45,294

107,371 110,839 98,820

Non-current liabilities

Bank loans (9) 1,275 250 1,058

Finance lease 110 54 115

Other provisions 0 0 0

Pension provisions 3,793 5,927 4,034

Deferred tax liabilities 5,399 6,548 6,136

Other non-current liabilities (10) 8,288 16,077 8,845

18,865 28,856 20,188

Total Liabilities 126,236 139,695 119,008

Equity (11)

Share capital 31,676 31,676 31,676

Share premium 57,148 56,686 56,902

Statutory reserves 53 53 53

Other reserves -10,790 -6,293 -6,469

Retained earnings 31,593 21,884 29,062

Equity attributable to owners

of the parent 109,680 104,006 111,224

Non-controlling interests (13) 9,241 10,514 8,313

Total Equity 118,921 114,520 119,537

Equity and Liabilities 245,157 254,215 238,545

Consolidated Statement of Cash Flows

for the six months ended 30 June 2017 (IFRS)

Six months Six months Year ended

ended 30 ended 30 31 December

June 2017 June 2016 2016

(Notes) (unaudited) (unaudited) (audited)

kEUR kEUR kEUR

Net cash flow from operating activities

Profit before taxes 11,204 7,166 14,740

Add back for

Depreciation and amortisation (3) 4,384 7,708 15,824

Loss on the sale of property, plant

and equipment 110 269 309

Other non-cash income not affecting

payments 2,185 2,368 -2,455

Net finance costs (4) -418 84 -1,253

Operating profit before changes in the net

current assets 17,465 17,595 27,165

Increase / Decrease in trade receivables 6,132 -267 4,669

Increase / Decrease in work in progress and

other receivables -23,127 -8,970 -2,276

Decrease / Increase in trade payables -2,384 -4,479 -683

Decrease / Increase in pension provisions -40 215 83

Decrease / Increase in other liabilities

and deferred income -4,661 -5,261 2,279

Cash flow from operating activities -6,615 -1,167 31,237

Interest payments (4) -455 -594 -1,386

Tax payments (5) -3,713 -4,062 -8,037

Net cash flow from operating activities -10,783 -5,823 21,814

Cash flow from investment activities

Purchase of intangible assets -3,085 -3,763 -8,515

Purchase of property, plant and equipment -972 -2,602 -3,299

Purchase of net assets of acquired

companies 0 -3 0

Interest received (4) 49 112 398

Net cash flow from investment activities -4,008 -6,256 -11,416

Cash flow from financing activities

Dividends paid -4,751 -4,118 -4,118

Proceeds from non-controlling interests on

the exercise of stock options 18 330 345

Payments for the acquisition of non-controlling

interests 0 0 -10,403

Dividends paid to non controlling

interests 0 0 -2,274

Repayment of finance loans (9) -6,058 -12,618 -26,152

Increase of finance loans (9) 20,371 34,041 30,440

Payments to minority shareholders

from put option 0 -10,403 0

Redemption of finance lease contracts -25 0 -116

Net cash flow from financing activities 9,555 7,232 -12,278

Change in the level of funds affecting

payments -5,236 -4,847 -1,880

Changes in cash and cash equivalents

due to exchange rate movements -669 -743 -286

Cash and cash equivalents

at the beginning of the period 29,824 31,990 31,990

Cash and cash equivalents

at the end of the period 23,919 26,400 29,824

Consolidated Statement of Changes in Equity

for the six months ended 30 June 2017 (IFRS)

Attributed to equity owners of the parent Non- Total

------------------------------------------------------------------------------------------

cash

Share Share Statutory Other flow Translation Retained Total controlling equity

capital premium reserves reserves hedge of foreign earnings interest

reserve operations

EURk EURk EURk EURk EURk EURk EURk EURk EURk EURk

31 December 2015

(audited) 31,676 56,478 53 -1,693 -201 2,165 21,524 110,002 9,335 119,337

======== ======== ========== ========= ======== ============ ========= ======== ============= ========

Dividends paid -4,117 -4,117 -4,117

Transactions with

owners

of the parent -4,117 -4,117 -4,117

-------- -------- ---------- --------- -------- ------------ --------- -------- ------------- --------

Business

combinations 0 0

Acquisition of

subsidiary 0 0

Capital increase 0 329 329

Acquisition of

non-controlling

interests 0 0

Share-based

payments 208 208 208

Profit for the

period 4,478 4,478 412 4,890

Exchange

differences

on translating

foreign

operations -6,627 -6,627 438 -6,189

Gains arising

from cash

flow hedges 63 63 63

Total

comprehensive

income 63 -6,627 4,478 -2,086 850 -1,236

30 June 2016

(unaudited) 31,676 56,686 53 -1,693 -138 -4,462 21,885 104,007 10,514 114,521

======== ======== ========== ========= ======== ============ ========= ======== ============= ========

Dividends paid 0 -2,274 -2,274

Capital increase

out

against

contribution

in kind 0 15 15

Transactions with

owners

of the parent 0 0 -2,259 -2,259

-------- -------- ---------- --------- -------- ------------ --------- -------- ------------- --------

Business

combinations 0 0 0

Capital increase 0 0

Acquisition of

non-controlling

interests 0 0

Share-based

payments 216 216 216

Profit for the

period 5,526 5,526 93 5,619

Exchange

differences

on translating

foreign

operations -207 -207 -35 -242

Re-measurement

gains

on defined

benefit plans 1,651 1,651 1,651

Gains arising

from cash

flow hedges 23 23 23

Other changes 8 8 8

Total

comprehensive

income 23 -207 7,177 6,993 58 7,051

31 December 2016

(audited) 31,676 56,902 53 -1,685 -115 -4,669 29,062 111,224 8,313 119,537

======== ======== ========== ========= ======== ============ ========= ======== ============= ========

Dividends paid -4,751 -4,751 -4,751

Transactions with

owners

of the parent -4,751 -4,751 -4,751

-------- -------- ---------- --------- -------- ------------ --------- -------- ------------- --------

Business

combinations 0 0

Acquisition of

subsidiary 0 0

Capital increase 0 18 18

Acquisition of

non-controlling

interests 0 0

Share-based

payments 246 246 246

Profit for the

period 7,282 7,282 833 8,115

Exchange

differences

on translating

foreign

operations -4,336 -4,336 77 -4,259

Gains arising

from cash

flow hedges 15 15 15

Total

comprehensive

income 15 -4,336 7,282 2,961 910 3,871

30 June 2017

(unaudited) 31,676 57,148 53 -1,685 -100 -9,005 31,593 109,680 9,241 118,921

======== ======== ========== ========= ======== ============ ========= ======== ============= ========

Notes to the interim consolidated financial statements

(unaudited)

at 30 June 2017

1. Summary of Significant Accounting Policies

Basis of preparation and statement of compliance

The Interim Consolidated Financial Statements of SQS and its

subsidiaries ("SQS Group") are prepared in conformity with all IFRS

Standards (International Financial Reporting Standards) and

Interpretations of the IASB (International Accounting Standards

Board) which are mandatory at 30 June 2017. The interim

consolidated financial statements for the six months ended 30 June

2017 have been prepared in accordance with IAS 34 Interim Financial

Reporting. The Interim Consolidated Financial Statements have

neither been audited nor reviewed.

The accounting policies applied preparing the Interim

Consolidated Financial Statements 2017 are consistent with those

used for the Consolidated Financial Statements at 31 December

2016.

The Financial Information has been prepared on a historical cost

basis. The Financial Information is presented in Euros and amounts

are rounded to the nearest thousand (EURk) except when otherwise

indicated. Negative amounts are presented in parentheses.

The interim consolidated financial statements do not include all

the information and disclosures required in the annual financial

statements, and should be read in conjunction with the Group's

annual financial statements as at 31 December 2016.

New Standards, Interpretations and Amendments

The accounting policies adopted in the preparation of the

interim consolidated financial statements are consistent with those

followed in the preparation of the Group's annual consolidated

financial statements for the year ended 31 December 2016, except

for the adoption of new standards effective as of 1 January 2017.

The Group has not early adopted any other standard, interpretation

or amendment that has been issued but is not yet effective.

The following changes to Standards and Interpretations published

by the IASB are effective generally since 1 January 2017. The

European Union has not endorsed the following standards and

therefore these are not yet applicable for SQS:

IAS 7 Statement of Cash Flows - Disclosure Initiative (Amendment)

IAS 12 Recognition of Deferred Tax Assets for Unrealised Losses

(Amendment)

Annual Improvements Cycle 2014 - 2016 Amendments to IFRS 12

Disclosure of Interests in Other Entities: Clarification of the

scope of disclosure requirements in IFRS 12.

The Group does not expect significant impacts on its

Consolidated Financial Statements.

Recent accounting pronouncement, not yet adopted

In July 2014, the IASB issued IFRS 9 Financial Instruments. The

new standard is effective for annual reporting periods beginning on

or after 1 January 2018, while early application is permitted. The

Group will adopt IFRS 9 for the fiscal year beginning as of 1

January 2018. The amendments and improvements will not have any

material impact on the consolidated financial statements of SQS

Group.

In May 2014, the IASB issued IFRS 15 Revenue from Contracts with

Customers. IFRS 15 supersedes IAS 11 Construction Contracts and IAS

18 Revenue as well as related interpretations. The standard is

effective for annual periods beginning on or after 1 January 2018;

early application is permitted. The Group will adopt the standard

for the fiscal year beginning as of 1 January 2018. Currently, it

is expected that changes in the total amount of revenue to be

recognised for a customer contract will be very limited. Besides,

changes to the Statement of Financial Position are expected, e.g.

separate line items for contract assets and contract liabilities

will be required, and quantitative and qualitative disclosures will

be added. The Group does not expect significant impacts on its

Consolidated Financial Statements.

In January 2016, the IASB issued IFRS 16 Leases. IFRS 16 is

effective for annual periods beginning on or after 1 January 2019;

earlier application is permitted if IFRS 15 is already applied. The

Group is currently assessing the impact of adopting IFRS 16 on the

Group's Consolidated Financial Statements and will adopt the

standard for the fiscal year beginning as of 1 January 2019.

Basis of consolidation

As at 30 June 2017, the Company held interests in the share

capital of more than 50% of the following undertakings (all of

those subsidiaries have been consolidated):

Consolidated companies Country of Six month Six month Year ended

incorporation ended 30 ended 30 31 December

June 2017 June 2016 2016

----------- ----------- -------------

Share of Share of Share of

capital capital capital

% % %

SQS Group Limited, London UK 100.0 100.0 100.0

SQS Software Quality Systems

(Ireland) Ltd., Dublin Ireland 100.0 100.0 100.0

SQS Nederland BV, Utrecht The Netherlands 95.1 95.1 95.1

SQS GesmbH, Vienna Austria 100.0 100.0 100.0

SQS Software Quality Systems

(Schweiz) AG, Zurich Switzerland 100.0 100.0 100.0

SQS Group Management Consulting

GmbH, Vienna Austria 100.0 100.0 100.0

SQS Group Management Consulting

GmbH, Munich Germany 100.0 100.0 100.0

SQS Egypt S.A.E, Cairo Egypt 100.0 100.0 100.0

SQS Software Quality Systems

Nordic AB, Stockholm Sweden 100.0 100.0 100.0

SQS Software Quality Systems

Sweden AB, Stockholm Sweden 100.0 100.0 100.0

SQS Software Quality Systems

Norway AS, Oslo Norway 100.0 100.0 100.0

SQS Software Quality Systems

Finland OY, Espoo Finland 100.0 100.0 100.0

SQS India Infosytems Private

Limited, Pune India 100.0 100.0 100.0

SQS France SASU, Paris France 100.0 100.0 100.0

SQS USA Inc., Chicago (Illinois) USA 100.0 100.0 100.0

SQS India BFSI Limited,

Chennai India 53.84 53.95 53.9

SQS Software Quality Systems

Italia S.p.A., Rome Italy 90.0 90.0 90.0

Trissential LLC, Waukesha

(Wisconsin) USA 100.0 100.0 100.0

SQS North America LLC (previously:

Galmont Consulting LLC),

Chicago (Illinois) USA 100.0 100.0 100.0

------------------------------------ ----------------- ----------- ----------- -------------

SQS AG holds 15% of the shares of SQS Portugal Lda with a book

value of EUR nil (previous year EUR nil).

SQS India BFSI Ltd. is the sole shareholder of SQS BFSI Pte.

Ltd., Singapore, SQS BFSI Inc., USA, Thinksoft Global Services

(Europe) GmbH, Germany, SQS BFSI UK Ltd., UK, and SQS BFSI FZE,

United Arab Emirates. None of these companies each has a main

impact on the financial data of the group.

Use of estimates

The preparation of the Interim Financial Statements requires the

disclosure of assumptions and estimates made by management, which

have an effect on the amount and the presentation of revenues,

expenses, assets and liabilities shown in the other comprehensive

income or profit or loss, in the statement of financial position as

well as any contingent items.

The main estimates and judgements of the management of SQS refer

to:

-- the useful life of intangible assets and property, plant and equipment

-- the criteria regarding the capitalisation of development costs

-- the recoverability of deferred taxes on tax losses carried forward

-- the stage of completion of work in progress regarding fixed price contracts

-- the discount rate, future salary increases, mortality rates,

future pension increases and future employee contributions

regarding the valuation of defined benefit obligations

-- the inputs such as risk free rate, expected share volatility

and expected dividends as well as expected forfeiture rate for the

measurement of the share-based-payments

-- the assumptions regarding the fair value of assets and

liabilities from business combinations

There have been no changes in estimates compared to the year

2016.

2. Segmental reporting

Based on the organisational structure and the different services

rendered, SQS Group operates the following segments:

-- Managed Services (MS) to meet the demand of clients seeking

efficiency in long-term engagements (between six months up to five

years) of which a substantial share (in many cases) is delivered

from nearshore and offshore delivery centres. This also includes

long term engagements for quality assurance services on standard

software package products;

-- Management Consulting (MC) (previously called Specialist

Consultancy Services (SCS)) to meet the demand of clients seeking

transformation and quality through IT Portfolio Programme and

Project Management, Business & Enterprise Architecture, Process

Modelling and Business Analysis;

-- Professional Services (PS) (previously called Regular Testing

Services (RTS)) to meet the demand of more price conscious clients

in IT projects who tend to be served with a smaller number of

consultants on a more local basis and typically contracted for a

short term period (e.g. three months).

Alongside these major business activities there is the business

with contractors (as far as these have not been included in MS),

training & conferences and software testing tools. Each of

these minor operating segments represents less than 10% of the

Group's revenues and the Group's profit. Thus, all these other

segments are presented as "Other".

The group management board consisting of CEO (Chief Executive

Officer), CFO (Chief Financial Officer), COO (Chief Operations

Officer) and Executive Director Management Consulting monitors the

results of the operating segments separately in order to allocate

resources and to assess the performance of each segment. Segment

performance is evaluated based on gross profit.

Non-profit centres represent important functions such as

Portfolio Management, Marketing, Finance & Administration, IT

and Human Resources.

The non-profit centres are not allocated to the operating

segments as they provide general services to the whole group. Their

costs are shown under 'Non-allocated costs'.

The assets and liabilities relating to the operating segments

are not reported separately to the Group Management Board. Finance

costs and income taxes are managed on a group basis. Therefore they

are not allocated to operating segments.

The following tables present revenue and profit information

regarding the SQS Group's reportable segments for the interim

periods ended 30 June 2017 and 30 June 2016 and for the year ended

31 December 2016, respectively.

Six month ended MS MC PS Other Total

30 June 2017 (unaudited)

EURk EURk EURk EURk EURk

Revenues 73,438 30,094 44,505 12,097 160,134

Segment profit (gross

profit) 26,833 10,698 11,949 2,431 51,912

Non-allocated costs (41,126)

EBIT 10,786

Financial result 418

Taxes on income (3,089)

Result for the period 8,115

--------------------------- ------- ------- ------- ------- ---------

Six month ended MS MC PS Other Total

30 June 2016 (unaudited)

EURk EURk EURk EURk EURk

Revenues 77,610 28,596 48,614 11,803 166,623

Segment profit (gross

profit) 27,940 9,779 13,143 1,977 52,839

Non-allocated costs (45,589)

EBIT 7,250

Financial result (84)

Taxes on income (2,276)

Result for the period 4,890

--------------------------- ------- ------- ------- ------- ---------

Year ended 31 MS MC PS Other Total

December 2016 (audited)

EURk EURk EURk EURk EURk

Revenues 146,411 57,317 93,409 29,966 327,103

Segment profit (Gross

profit) 52,708 19,946 24,660 6,307 103,601

Non-allocated costs (90,033)

Amortisation of goodwill (5,600)

EBIT 7,988

Financial result 6,752

Taxes on income (4,231)

Result for the period 10,509

-------------------------- -------- ------- ------- ------- ---------

3. Expenses

The Consolidated Income Statement presents expenses according to

function. Additional information regarding the origin of these

expenses by type of cost is provided below:

Cost of material

Cost of material included in the cost of sales in the interim

period ended 30 June 2017 amounted to EUR12,948k (at mid-year 2016:

EUR12,254k). Cost of material mainly relates to the procurement of

external services such as contracted software engineers. In

addition, certain project-related or internally used hardware and

software is shown under cost of material.

Employee benefits expenses

Six month Six month Year ended

ended 30 ended 30 31 December

June 2017 June 2016 2016

(unaudited) (unaudited) (audited)

EURk EURk EURk

Wages and salaries 95,676 100,654 196,197

Social security contributions 11,570 12,106 23,681

Expenses for retirement benefits 2,644 2,194 5,120

Total 109,890 114,954 224,998

---------------------------------------- ------------- --- ------------- --- -------------

The expenses for retirement benefits include current service

costs from defined benefit plans and expenses for defined

contribution plans.

Amortisation and depreciation

Amortisation and depreciation charged in the interim period

ended 30 June 2017 amounted to EUR4,384k (at mid-year 2016:

EUR7,709k). Of this, EUR1,684k (at mid-year 2016: EUR1,828k) was

attributable to the amortisation of development costs and EUR1,026k

to customer relationships and order backlog regarding SQS Software

Quality Systems Italia S.p.A., Trissential LLC and SQS North

America LLC. In the interim period ended 30 Jun 2016 an amount of

EUR4,192k had been recognised as amortisation of customer

relationships and order backlog regarding SQS India BFSI, SQS

Software Quality Systems Italia S.p.A. and Trissential LLC.

4. Net finance costs

The net finance costs are comprised as follows:

Six month Six month Year ended

ended 30 ended 30 31 December

June 2017 June 2016 2016

(unaudited) (unaudited) (audited)

EURk EURk EURk

Interest income 49 112 397

Exchange rate gains 1,701 1,085 3,857

---------------------------------- ------------- --- ------------- --- -------------

Total finance income 1,750 1,197 4,254

---------------------------------- ------------- --- ------------- --- -------------

Interest expense (761) (1,081) (1,966)

Exchange rate losses (571) (200) (1,036)

---------------------------------- ------------- --- ------------- --- -------------

Total finance costs (1,332) (1,281) (3,002)

---------------------------------- ------------- --- ------------- --- -------------

Effects from the valuation

of financial liabilities

at fair value 0 0 5,500

---------------------------------- ------------- --- ------------- --- -------------

Net finance costs 418 (84) 6,752

---------------------------------- ------------- --- ------------- --- -------------

Interest expense relates to interest on bank loans, finance

lease liabilities and pension obligations.

5. Taxes on earnings

The line item includes current tax expenses in the amount of

EUR3,693k (at mid-year 2016: EUR4,065k) and deferred tax income in

the amount of EUR(604)k (at mid-year 2016 deferred tax income:

EUR(1,789)k).

6. Earnings per share

The earnings per share presented in accordance with IAS 33 are

shown in the following table

:

Six month Six month Year ended

ended 30 ended 30 31 December

June 2017 June 2016 2016

(unaudited) (unaudited) (audited)

Profit for the year attributable

to owners of the parent,

EURk 7,282 4,478 10,004

---------------------------------------- ------------- --- ------------- --- -------------

Diluted profit for the year,

EURk 7,282 4,478 10,004

---------------------------------------- ------------- --- ------------- --- -------------

Weighted average number of

shares in issue, undiluted 31,675,617 31,675,617 31,675,617

---------------------------------------- ------------- --- ------------- --- -------------

Weighted average number of

shares in issue, diluted 33,760,617 33,697,343 33,749,900

---------------------------------------- ------------- --- ------------- --- -------------

Undiluted profit per share,

EUR 0.23 0.14 0.32

---------------------------------------- ------------- --- ------------- --- -------------

Diluted profit per share,

EUR 0.22 0.13 0.30

---------------------------------------- ------------- --- ------------- --- -------------

Adjusted profit per share

(optional), EUR 0.26 0.22 0.47

---------------------------------------- ------------- --- ------------- --- -------------

Undiluted profit per share is calculated by dividing the profit

for the six month period attributable to owners of the parent by

the weighted average number of shares in issue during the six month

period ended 30 June 2017: 31,675,617 (at mid-year 2016:

31,675,617).

Diluted profit per share is determined by dividing the profit

for the six month period attributable to equity shareholders by the

weighted average number of shares in issue plus any share

equivalents which would lead to a dilution.

Adjusted profit per share is calculated by adjusting the profit

before tax for current taxes, amortised costs of acquired customer

relationships and order backlog as part of the business combination

SQS Italia S.p.A., SQS North America LLC and Trissential LLC,

valuation differences and non-controlling interest effects. This

adjusted profit after tax divided by the weighted average number of

shares in issue during the six month period ended 30 June 2017:

31,675,617 shares, (at mid-year 2016: 31,675,617 shares) shows

adjusted earnings per share of EUR0.26 (at mid-year 2016:

EUR0.22).

7. Intangible assets

The composition of this item is as follows:

Book values Six month Six month Year ended

ended 30 ended 30 31 December

June 2017 June 2016 2016

(unaudited) (unaudited) (audited)

EURk EURk EURk

Goodwill 75,916 87,389 78,860

------------------------------------- ------------- --- ------------- --- -------------

Development costs of software 3,221 2,832 2,473

Other development costs 3,628 3,236 3,762

Acquired Software 6,705 4,529 6,242

Customer relationships 7,678 11,163 8,950

Order backlog 966 1,618 1,292

Right to a design method 0 - 402

Intangible assets 22,198 23,378 23,121

------------------------------------- ------------- --- ------------- --- -------------

Total 98,114 110,768 101,981

------------------------------------- ------------- --- ------------- --- -------------

Development costs were capitalised in the interim period ended

30 June 2017 in the amount of EUR2,316k (at mid-year 2016:

EUR1,540k). Development cost of software are amortised over a

period of 36 months. Other development costs mainly relate to the

methodology 'PractiQ', used by SQS to provide Managed Services. The

estimated useful life of these intangible assets covers a period of

five years.

The customer relationships were acquired within the business

combination of SQS Software Quality Systems Italia S.p.A.,

Trissential LLC and SQS North America LLC (previously Galmont

Consulting LLC). The order backlog was acquired within the business

combination of SQS Software Quality Systems Italia S.p.A.

Amortisation over the expected Customer relationship Order backlog

useful life in years

-------------------------------- ---------------------- --------------

SQS Software Quality Systems

Italia S.p.A. 6 3,9

Trissential LLC 10 -

SQS North America LLC 4 -

--------------------------------- ---------------------- --------------

The amortisation of software and remaining intangible assets is

allocated to the functional costs by an allocation key. The

amortisation of development costs is shown in the research and

development expenses.

8. Property, plant and equipment

The development of property, plant and equipment of the SQS

Group is presented as follows:

Book values Six month Six month Year ended

ended 30 ended 30 31 December

June 2017 June 2016 2016

(unaudited) (unaudited) (audited)

EURk EURk EURk

Freehold land and buildings 9,261 5,355 9,655

Office and business equipment 5,972 4,236 6,283

Construction in progress 754 6,926 773

Total 15,987 16,517 16,711

------------------------------------- ------------- --- ------------- --- -------------

9. Bank loans and overdrafts

The finance liabilities are comprised as follows:

Six month Six month Year ended

ended 30 ended 30 31 December

June 2017 June 2016 2016

(unaudited) (unaudited) (audited)

EURk EURk EURk

Bank overdrafts and other

short-term bank loans 55,215 59,062 41,119

----------------------------------- ------------- --- ------------- --- -------------

Bank loans with maturity

between one and five years 1,275 250 1,058

----------------------------------- ------------- --- ------------- --- -------------

Total bank liabilities 56,490 59,312 42,177

of these, secured 0 114 0

----------------------------------- ------------- --- ------------- --- -------------

For SQS AG and some subsidiaries bank overdraft agreements are

in place.

10. Other current and non-current liabilities

The item is comprised as follows:

Six month Six month Year ended

ended 30 ended 30 31 December

June 2017 June 2016 2016

(unaudited) (unaudited) (audited)

EURk EURk EURk

Personnel liabilities (holiday,

leave, bonus claims) 14,233 15,594 18,846

Put Option SQS Italia 1,039 994 1,017

Purchase obligation from

Trissential 7,291 7,240 7,798

Purchase obligation from

SQS North America LLC (previously

Galmont Consulting LLC) 2,090 10,251 1,599

Sales tax and value-added

tax liabilities 6,237 6,709 7,923

Liabilities in regard to

social security 3,556 3,515 3,799

Outstanding invoices 6,823 5,628 4,922

Granted rebates and discounts 1,144 521 863

Liabilities for employees'

travelling expenses 893 1,129 1,071

Interest swap (fair value) 123 312 166

Deferred income 4,025 1,081 1,701

Remaining other liabilities 2,491 3,602 4,434

Total 49,945 56,576 54,139

------------------------------------------ ------------- --- ------------- --- -------------

The remaining other liabilities comprise trade accruals and

other items due in short term. Their carrying amounts are

considered to be reasonable approximation of their fair value.

11. Equity

SQS is listed on the AIM market in London and traded on the Open

Market in Frankfurt (Main).

The development of equity is presented in the Consolidated

Statement of Changes in Equity.

Subscribed Capital

The subscribed capital amounts to EUR31,675,617 (at 31 December

2016: EUR31,675,617) and is divided into 31,675,617 (at 31 December

2016: 31,675,617) individual registered shares with an arithmetical

share in the share capital of EUR1 each. Each share entitles the

holder to one right to vote. No preference shares have been issued.

The capital is fully paid up.

SQS had no shares in its ownership as at 30 June 2017.

Conditional Capital

The conditional capital is to be composed as follows:

- the Conditional Capital 3 amounts to EUR1,300,000;

- the Conditional Capital 4 amounts to EUR1,050,000;

- the Conditional Capital 5 amounts to EUR700,000.

The Conditional Capital 3, 4 and 5 serve to grant share options

to the management board members and employees respectively.

There are no changes in the Conditional Capital compared to 31

December 2016.

Authorised Capital

The Authorised Capital amounts to EUR13,887,062 (at 31 December

2016: EUR13,887,062).

Statutory reserves

The statutory reserves in SQS AG were created in accordance with

Section 150 of the Stock Corporation Act (Germany). Statutory

reserves must not be used for dividends.

Other reserves

Other reserves comprise differences from the translation of

foreign operations, IPO costs from former years and a cash flow

hedge reserve regarding the fair values of interest and currency

swaps.

Retained earnings

Retained earnings represent the accumulated retained profits of

SQS Group less dividend payments.

The General Meeting of 24 May 2017 resolved to pay a EUR0.15

dividend per share for the business year 2016 in the total amount

of EUR4,751,342.55, the dividends have been paid to the

shareholders of SQS AG in 2017.

12. Employee participation programme

Share-based Payment

SQS policy is to offer management and key employees share-based

payments. Therefore SQS has decided and granted the share-based

payment programmes 2013, 2014 and 2015.

The number and weighted-average exercise prices of share option

granted in 2013 and 2014 were as follows:

Granted in 2013 Granted in 2014

--------------- ---------------------------------------------------------------- -------------------------------

For management For key employees For key employees

board (Tranche I) (Tranche II)

--------------- ------------------------------- ------------------------------- -------------------------------

Number Weighted-average Number Weighted-average Number Weighted-average

of options price of options price of options price

--------------- ------------ ----------------- ------------ ----------------- ------------ -----------------

Outstanding

at beginning

of period 1,145,000 3.07 430,000 3.59 230,000 5.79

--------------- ------------ ----------------- ------------ ----------------- ------------ -----------------

Outstanding

at end

of half

period 1,145,000 3.07 430,000 3.59 230,000 5.79

--------------- ------------ ----------------- ------------ ----------------- ------------ -----------------

Exercisable --- --- --- --- --- ---

at end

of period

--------------- ------------ ----------------- ------------ ----------------- ------------ -----------------

The number and weighted-average exercise prices of the 2015

share option programme were as follows:

Granted in 2016

------------------- ------------------------------------------------------------

For key employees & For key employees &

management board management board

(Tranche I) (Tranche II)

------------------- ----------------------------- -----------------------------

Number of Weighted-average Number of Weighted-average

options price options price

------------------- ---------- ----------------- ---------- -----------------

Outstanding

at beginning

of period 180,000 5.65 100,000 5.27

------------------- ---------- ----------------- ---------- -----------------

Outstanding

at end of half

period 180,000 5.65 100,000 5.27

------------------- ---------- ----------------- ---------- -----------------

Exercisable --- --- --- ---

at end of period

------------------- ---------- ----------------- ---------- -----------------

13. Non-controlling Interests

SQS attributes the profit or loss and each component of

comprehensive income to the owners of the parent and to the

non-controlling interests applying the relevant percentage of share

on the contribution of profit or loss of each entity to the

consolidated comprehensive income of the period. Non-controlling

interests participate in the net assets recognised in the financial

statement of SQS Group. Share-based payments relating to

non-controlling interests are attributed exclusively to those

non-controlling interests.

14. Notes to the Statement of Cash flows

The consolidated Statement of Cash flows shows how the funds of

the Group have changed in the course of the business year through

outflows and inflows of funds. The payments are arranged according

to investing, financing and operating activities.

The sources of funds on which the statement of cash flows is

based consist of cash and cash equivalents (cash on hand and bank

balances).

15. Related party transactions

Under IAS 24, related persons and related companies are persons

and companies who are able to control or to exercise a significant

influence over their finance or business policy on the reporting

entity. Regarding SQS Group, these are the management board and the

supervisory board members. Further, two real estate investment

funds who are landlords of SQS offices at Cologne are considered to

be related parties as these entities are controlled by one

supervisory board member and employees of SQS AG.

The following related party transactions have taken place:

Mr. Vos, Mr. Gawron and part of the members of the supervisory

board and their relatives received dividends as shareholders of SQS

AG. At the date the dividends were paid Mr. Vos and Mr. Gawron held

0.2% and the members of the supervisory board and their relatives

held 12.0% of the shares in SQS AG.

SQS uses property owned by the closed real estate investment

fund "S.T.O.L. Immobilien Verwaltung GmbH & Co. KG", Cologne,

and the real estate investment fund "Immobilienfond Am Westhofer

Berg GbR mbH", Cologne. The shares in these companies are held by

supervisory board members, employees and former management board

members of SQS AG. The contractual conditions of the lease terms

are based on market prices. The total expenses incurred under these

contracts amounted in the interim period to EUR345k (at mid-year

2016: EUR345k).

The total emoluments of the management board members in the

interim period ended 30 June 2017 amounted to EUR1,088k (at

mid-year 2016: EUR798k).

The emoluments of the supervisory board members amounted in

total to EUR168k (at mid-year 2016: EUR168k), of which EUR168k have

not yet been paid by the end of the interim period.

16. Events after the interim period

On May 24, 2017 the Management Board of SQS decided to increase

the share capital of SQS AG by partially using the Authorised

Capital in the amount of 330,360 by issuing new registered non-par

value shares against contribution in kind. These new shares were

used to fulfil remaining obligations from the purchase of

Trissential LLC, Minnesota, USA. This resolution became effective

by its registration in the commercial register of SQS AG on August

1, 2017.

Cologne, 12 September 2017

SQS Software

Quality Systems

AG

----------------- ---------- ------------- -----------

D. Vos R. Gawron R. Gillessen M. Hodgson

SQS Software Quality Systems AG

Stollwerckstrasse 11

D-51149 Cologne

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR BRGDCSBBBGRD

(END) Dow Jones Newswires

September 13, 2017 02:00 ET (06:00 GMT)

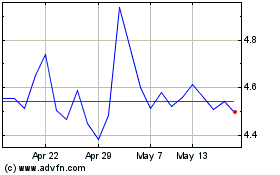

-1x Square (LSE:SQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

-1x Square (LSE:SQS)

Historical Stock Chart

From Jul 2023 to Jul 2024