SQS Software Quality Systems AG Acquisition of Remaining Shares (6636X)

May 09 2016 - 6:58AM

UK Regulatory

TIDMSQS

RNS Number : 6636X

SQS Software Quality Systems AG

09 May 2016

9 May 2016

SQS Software Quality Systems AG

("SQS", the "Company" or the "Group")

Acquisition of Remaining Shares of SQS India Infosystems Private

Limited ("SQS-India")

SQS Software Quality Systems AG (AIM: SQS.L), the world's

largest specialist supplier of software quality services, announces

that it has on 9 May 2016 agreed to acquire the remaining 25% of

the issued share capital of SQS India Infosystems (the "Remaining

Shares"), subject to statutory Indian approvals. SQS announced the

acquisition of 75% of the issued share capital of SQS-India,

formerly named Verisoft Infosystems Private Limited, on 16 June

2008 (the "Acquisition"). It is consolidated into the Group's

results and is SQS' subsidiary in Pune, India.

The Acquisition was effected by a sale & purchase agreement

(the "SPA") which provided an option, exercisable by either SQS or

the vendors, for SQS to acquire the Remaining Shares for a

consideration determined by SQS-India's profit after tax and SQS'

price/earnings ratio. The Remaining Shares are to be acquired,

following the exercise by SQS of its option under the terms of the

SPA, from Gireendra Kasmalkar and his wife, Snigdha Kasmalkar, from

whom the initial 75% of the issued share capital was acquired. The

consideration for the Remaining Shares is INR 785 million

(approximately EUR10.5 million), paid in cash. In the year ended 31

December 2015 SQS-India made profits after tax of approximately

EUR3.1 million. Following the completion of the acquisition of the

Remaining Shares SQS will own the entire issued share capital of

SQS-India.

The acquisition of the Remaining Shares falls to be treated as a

related party transaction under the AIM Rules by virtue of the fact

that Gireendra Kasmalkar continued as managing director of

SQS-India until 31 March 2016, following which date he has

continued as a non-executive director. SQS' directors consider,

having consulted with its nominated adviser, Numis Securities, that

the terms of the transaction are fair and reasonable insofar as its

shareholders are concerned.

Diederik Vos, CEO, commented:

"SQS has invested considerably in India over the past decade to

ensure the Company can meet the growing service demands of our

global clients, while seeking to drive more efficiency and output

from our employee base. Therefore, today's announcement is in line

with that stated strategy."

Ends

Enquiries:

SQS Software Quality Systems AG Tel. +49 (0) 2203 91

54 0

Diederik Vos, Chief Executive Officer

Rene Gawron, Chief Financial Officer

Numis Securities - Nomad and Joint Broker Tel +44 (0) 20 7260

1000

Simon Willis / Jamie Lillywhite / Mark Lander

Stockdale Securities - Joint Broker Tel. +44 (0) 20 7601

6100

Robert Finlay / Antonio Bossi

FTI Consulting - Financial Media and Investor Tel. +44 (0)20 3727

Relations 1000

Matt Dixon / Dwight Burden sqs@fticonsulting.com

About SQS

SQS is the world's leading specialist in software quality

services. This position stems from over 30 years of successful

consultancy operations. SQS consultants provide solutions for all

aspects of quality throughout the whole software product lifecycle

driven by a standardised methodology, offshore automation processes

and deep domain knowledge in various industries. Headquartered in

Cologne, Germany, the company now employs approximately 4,600

staff. SQS has offices in Germany, UK, US, Australia, Austria,

Egypt, Finland, France, India, Ireland, Italy, Malaysia, the

Netherlands, Norway, Singapore, South Africa, Sweden, Switzerland

and UAE. In addition, SQS maintains a minority stake in a company

in Portugal. In 2015, SQS has generated revenues of EUR320.7

million.

SQS is the first German company to have a primary listing on

AIM, a market operated by the London Stock Exchange. In addition,

SQS shares are also traded on the German Stock Exchange in

Frankfurt am Main.

With over 10,000 completed projects under its belt, SQS has a

strong client base, including half of the DAX 30, nearly a third of

the STOXX 50 and 20 per cent of the FTSE 100 companies. These

include, among others, Allianz, BP, Commerzbank, Daimler, Deutsche

Post, Generali, Meteor, UBS and Volkswagen as well as other

companies from the six key industries on which SQS is focused.

For more information, see www.sqs.com

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQUKVRRNNAVRAR

(END) Dow Jones Newswires

May 09, 2016 06:58 ET (10:58 GMT)

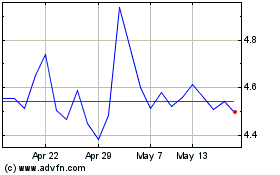

-1x Square (LSE:SQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

-1x Square (LSE:SQS)

Historical Stock Chart

From Jul 2023 to Jul 2024