Aisi Realty Public Limited Half Yearly Report -2-

September 05 2012 - 2:00AM

UK Regulatory

H1 2011 H1 2012

----------------------- ------------ -----------------------------------------

Recurring Non Recurring- Total

Expenses One-off

Expenses

----------------------- ------------ ---------- --------------- ------------

Revenues 1 184.633 757.502 757.502

----------------------- ------------ ---------- --------------- ------------

Payroll 2,3 251.029 355.329 284.571 639.900

----------------------- ------------ ---------- --------------- ------------

Public Entity,

Audit & Accounting 372.676 177.092 177.092

----------------------- ------------ ---------- --------------- ------------

Legal/ Consulting

Fees 245.378 413.614 298.296 711.910

----------------------- ------------ ---------- --------------- ------------

Directors/ Management

remuneration

4 1.485.246 308.400 308.400

----------------------- ------------ ---------- --------------- ------------

Operating expenses2 314.029 297.226 297.226

----------------------- ------------ ---------- --------------- ------------

Total Expenses 2.668.358 1.551.661 582.867 2.134.528

----------------------- ------------ ---------- --------------- ------------

Net Operating (2.483.725) (794.159) (1.377.026)

Profit (Loss)

----------------------- ------------ ---------- --------------- ------------

1. Full effect of current leases is expected in H2-12

2. Large part of H1-11 payroll and operating expenses

was paid after the Narrowpeak deal in July-August

2011

3. H1-12 includes Director Ukraine severence pay

and AISI Realty Capital LLC expense reimbursement

4. Directors as well as CEO and CFO have deferred

payment of their remunaration to assist company's

liquidity

During the period, the first two tranches of the Capital Injection

$4million capital injection, approved by the Company's

shareholders in July 2011 as part of the Narrowpeak

deal, were injected into Aisi with two existing shareholders

contributing $1.500.000 and two new ones an additional

$850.000.

The Group continues its prudent and optimal cash Liquidity Management-Cash

flow management in line with liquidity needs and Flow Risk

at the end of the period the Company had $1 million

in immediate cash liquidity. With Terminal Brovary

currently 83% let, the Group has now turned operationally

cash flow positive. Management entered into discussions

with the European Bank for Reconstruction and Development

(EBRD) to restructure the Terminal Brovary construction

loan facility and hopes to provide a positive update

on this initiative in due course.

2. Regional Economic Developments

Ukraine

The Ukrainian economy continued to grow, although

at a slower pace, by 2% year on year ('YoY') in

Q1 2012 down from 4,7% YoY recorded in Q4 2011.

This deceleration in growth was mainly driven by

a slump in the industrial sector due to weakened

international demand for metals, particularly from

the Eurozone and Russia, impacting Ukraine's steel

industry.

On the other hand, the consumer sector retained

its upward trend supported by robust real wage growth

and slowing inflation. Retail sales recorded a growth

of 13,9% YoY in April whilst real wages grew by

16,9% in the same month from 12,6% YoY and from

15,8% in the prior month.

The downward trend of headline inflation continued,

receding for 10 consecutive months (from a peak

of 11,9% in June 2011) turning negative by 0,5%

in May 2012. The deflation stemmed from the sharp

decline in food prices. Lower inflation allowed

the National Bank of Ukraine to cut its central

interest rate by 25bps to 7,50% in late March, which

has been unchanged since August 2010.

The Parliamentary elections scheduled for October

2012 are considered important in terms of both the

political climate within the country and the nation's

relationships with Russia and the European Union.

In relation to currency movements, the UAH maintains

its level against the major currencies but the impact

of the upcoming elections has the potential to cause

some devaluation.

The new government (led by social democrats-PSD) Romania

,which has been formed following a turbulent period,

successfully negotiated with the IMF-EU the upward

revision of 2012 deficit targets thus facilitating

a restoration of public wages to their early 2010

levels, whilst in parallel it declared its commitment

to the present IMF-EU austerity program. The government

instigated referendum failed to impeach the ex President,

turnout being less than 45%, short of the 50% needed,

continuing the political uncertainty and the poor

relations between the two political institutions.

It should be noted that Romania has made visible

progress in fiscal consolidation over the last couple

of years, reducing the general government deficit,

on a cash basis, from 7,3%-of-GDP in 2009 to 4,2%-of-GDP.

The Romanian economy, affected by the uncertainty

in the euro-area, a reducing demand for its exports

and severe weather, slightly contracted by 0,1%

quarter on quarter ('QoQ')in Q1 2012. At the same

time, the current account deficit ended at 4,1%

of GDP in April, far from the unsustainable pre

crisis 10-13% levels. While annual inflation slightly

increased to 2% in June, the first increase in eight

months after the historical low of 1,79% at the

end of May 2012, retail sales grew by 3,8% YoY in

Q1 2012 and infrastructure works by 14,8% YoY, the

latter providing the strongest boost to investment

(+11,8%).

Domestic financial markets were affected negatively

from the political volatility with the EUR/RON FX

rate fluctuating between 4,25-4,40 during the period.

Meanwhile, the National Bank of Romania halted its

monetary easing policy during Q2 2012, retaining

central interest rates at 5,25%.

The Bulgarian economy remained in positive territory Bulgaria

as real GDP grew by 0,5% in the first quarter of

2012, still stronger than the EU-27 average of +0,1%.

However, close trade links with Greece as well as

bank deleveraging and a large surplus of uncompleted

housing stock have stalled further economic recovery.

However, individual consumption, driven mainly by

rising wages, 8,8% YoY, and easing inflation, 1,6%

YoY in June, recorded a modest growth of 1% YoY

in Q1 2012, but was still 5,4% below its pre-crisis

peak.

Positive signs came from the banking sector which

remains profitable, as net profit after tax jumped

by 11,7% YoY in Q1 2012 to BGN 176 million (EUR

90 million or 0,2% of GDP), compared with profits

of BGN 102 million in Q4 2011. Bulgaria's banking

system remains well-capitalised as the loans-to-deposits

ratio dropped from 123,32% in November 2008, the

highest level of the decade, to 101,8% in February

2012, the lowest level since Q1 2008.

3. Real Estate Market Developments

3.1. Ukraine

The first half of 2012 was characterised by a strengthened General

demand in the Ukrainian property market, especially

for high quality, income generating, premises in

Kiev. This interest has driven the compression of

yields, which despite this, are still higher than

in other CEE countries.

The national vacancy rate remained stable at 12% Logistics Market

as no new logistics properties were put into operation

during the first half of 2012 in the Greater Kiev

area. The forthcoming increase in commercial activity

and strengthening of occupier demand is expected

to lead to a further fall in vacancy and an upward

pressure on logistics rents.

The upward trend of demand continued in the first Office Market

semester of 2012 mainly supported by manufacturing,

finance and business services companies which relocated

to larger premises, better quality buildings and/or

better locations.

Despite the increasing interest from new retail Retail Market

operators to enter into the Kiev market, the lack

of critical mass of quality retail space is preventative.

The rapid delivery of new quality projects in the

coming years is expected to stimulate retailer expansion.

As no new completed projects entered the market

during the first semester of 2012, vacancy rates

slightly decrease near to 2,5% from 3% with rental

levels remaining unchanged.

3.2. Romania

During the first semester of 2012, the Romanian General

real estate market remained stable despite the economic

and political uncertainties at local and European

levels.

The upward trend of demand continued in the first Logistics Market

half of 2012 supported by various industries such

as electronic components, FMCG distributors, plastics

and fashion. With few projects planned to be delivered

in the remainder of 2012, of which most are purpose

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jun 2024 to Jul 2024

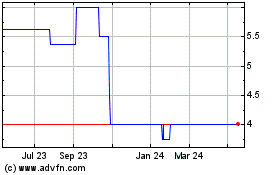

Secure Property Developm... (LSE:SPDI)

Historical Stock Chart

From Jul 2023 to Jul 2024