TIDMSMS

RNS Number : 6724S

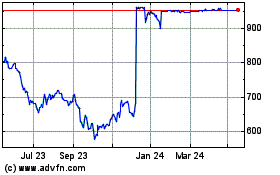

Smart Metering Systems PLC

21 March 2016

21 March 2016

Smart Metering Systems plc

("SMS" or "the Company" or "the Group")

Final results for the year ended 31 December 2015

Smart Metering Systems plc (AIM: SMS.L) is pleased to announce

its final results for the 12 months to 31 December 2015, which show

continued growth across all business areas.

Financial Highlights

-- Revenue increased by 27% to GBP53.9m (2014: GBP42.4m)

-- Total annualised recurring income* increased by 33% to GBP34.73m (2014: GBP26.2m)

o Gas: meter recurring rent increased 27% to GBP27.8m (2014:

GBP21.9m) and data recurring income more than doubled to GBP2.2m

(2014: GBP1.0m)

o Electricity: meter recurring rent doubled to GBP1.25m (2014:

GBP0.6m) and data recurring income grew 28% to GBP3.45m (2014:

GBP2.7m)

-- Gross profit increased by 32% to GBP36.5m (2014: GBP27.6m)

-- Gross profit margin at 68% (2014: 65%)

-- Underlying EBITDA** increased by 38% to GBP26.3 (2014: GBP19.1m)

-- Underlying PBT** increased by 38% to GBP17.4m (2014: GBP12.6m)

-- EBITDA** margin at 49% (2014: 45%)

-- Underlying earnings per share*** increased 67% to 17.46p (2014: 10.46p)

-- Final dividend of 2.2p per ordinary share making 3.3p for the

full year (2014: 2.82p), an increase of 17%

* Recurring revenue refers to revenue generated by meter rental

and data contracts. Annualised recurring income refers to the

revenue being generated at a point in time.

** Underlying PBT & EBITDA is before deduction of

exceptional items, other operating income and intangible

amortisation.

*** Underlying earnings per share is profit after taxation but

before exceptional items, other operating income and intangible

amortisation, divided by the weighted average number of ordinary

shares in issue.

Operational Highlights

-- Total Gas and Electricity metering and data assets increased

by 211,000 to just under 1 million under management at 31 December

2015 (December 2014: 768,000)

o Total gas meter portfolio increased by 19% to 723,000

(December 2014: 607,000), with industrial and commercial

("I&C") meters increasing by 75% to 114,000 (December 2014:

65,000). Gas data portfolio increased by 107% to 85,000 (December

2014: 41,000)

o Total electricity meter portfolio increased by 142% to 29,000

(December 2014: 12,000). Electricity data portfolio increased by

31% to 142,000 (December 2014: 108,000)

-- ADM(TM) installations up 80% to 74,000 units at 31st December

2015 (December 2014: 41,000) with international trials

continuing

-- Capital expenditure on meters increased by 15% to GBP41.2m,

reaching a monthly run rate of approximately GBP3.5m in December

2015

-- Celebrated 20 years in operation in June 2015 and first

anniversary of the integration of the electricity business, having

acquired UPL in April 2014, now SMS ES

-- Completed rebranding of the business in June 2015, bringing

all group subsidiaries under the single SMS brand, setting out a

simplified integrated gas, electricity and dual fuel offering to

clients

-- Strong start to 2016 with new agreements and acquisitions:

o With the opening of the domestic smart meter market, SMS

signed five framework agreements with independent energy suppliers

including RHE, Green Energy, Flow Energy, Spark Energy and Our

Power

o Strategic acquisitions of meter installation suppliers, CH4

Gas Utility and Maintenance Services Limited and Trojan Utilities

Limited, and IT specialists, Qton Solutions Limited

Alan Foy, Chief Executive Officer, commented:

"2015 has been another successful year with substantial progress

across all segments of the business. As we celebrate 20 years in

operation, SMS has again recorded double-digit growth. During the

year we completed the rebranding of the business, bringing all

group subsidiaries under the single SMS brand, setting out a

simplified integrated gas and electricity offering to clients with

the integration of UPL now complete.

We remain focused on the continued expansion of our core

business while also pursuing the significant opportunities

available to SMS in the domestic smart meter market. 2016 has

started well with the signing of five new domestic smart meter

agreements along with three important strategic acquisitions to

control our installation capacity in our markets. We remain

confident in our outlook for the business and market development in

2016."

Smart Metering Systems

plc 0141 249 3850

Alan Foy, Chief Executive

Officer

Glen Murray, Finance Director

0131 220 6939 / 0207 397

Cenkos Securities plc 8900

Neil McDonald

Nick Tulloch

Kreab 020 7074 1800

Matthew Jervois

Natalie Biasin

Daniel Holgersson

Notes to Editors

About Smart Metering Systems

Established in 1995, Smart Metering Systems plc, based in

Glasgow, connects, owns, operates and maintains metering systems

and databases on behalf of major energy companies. The Company

provides a fully integrated service from beginning to end to cover

the installation of a gas/electricity supply/connection to the

procurement, installation and management of a gas or electricity

meter asset to the collection and management of customer data and

ongoing energy management services.

The Company has further applications for gas with its ADM(TM)

device which allows "smart" functions such as remote reading and

half-hourly consumption data to be offered to customers in addition

to the normal metering services. The Company was admitted to the

AIM market in July 2011 and is now part of the FTSE AIM 50 index.

For more information on SMS please visit the Company's website:

www.sms-plc.com.

Chairman's statement

Review of the year

2015 has been a year of continued progress in our business,

notably with the acquisition last year of UPL (now SMS ES), and

continued growth and expansion during our 20(th) anniversary year.

We also completed the rebranding of the SMS business, bringing all

group subsidiaries under the single SMS brand and setting out a

simplified integrated gas and electricity offering to clients.

Following the rebrand, we now operate three divisions under the

single SMS Plc brand: Connections Management, Metering and Data and

Energy Management, with gas and electricity service offerings

across all three divisions.

In the first half of the year, the Metering and Data division

signed an agreement for the provision and ownership of electricity

meters and data management services for an initial order of 5,000

meters with Total Gas & Power Limited, an existing customer of

SMS's Gas business. This contract win followed a strong end to 2014

where we won contracts with BES Utilities, British Gas Business,

DONG Energy Services Limited, and Opus Energy, all of which now

benefit from our integrated offering across both gas and

electricity.

Our Business

SMS has delivered double-digit growth during the year across all

segments of the business with strong recurring income in our gas

and electricity business and a substantial increase in our gas

meter portfolio.

We have a strong order book to install and own gas and

electricity meters in the I&C and domestic market and we will

continue to fill that order book over the next few years. This will

continue to generate an asset-backed, high-quality annuity stream

that will provide high visibility of revenues.

We continue to develop a strong market position in the UK smart

metering market with a focus on the cross-selling of services

between gas and electricity customers by providing an integrated

suite of services across all three divisions.

SMS also has significant additional growth opportunities arising

from the UK government initiative mandating the installation of a

smart meter in every home and small business across the UK by 2020.

This presents a significant market opportunity with a substantial

proportion of an estimated 1.6 million gas meters and 2.1 million

electricity meters in the UK I&C market to be exchanged for a

smart metering solution by the target date of 2020. There is added

potential of a rollout of some 22 million gas meters and 27 million

electricity meters in the UK domestic market within that

period.

Strategy

Our medium term strategy is to increase the run rate with our

customers, and continue to grow the meter asset portfolio alongside

targeting of the new I&C and domestic smart meter market.

Our priority in 2016 and beyond is to focus on four key

strategic areas, reflecting the opportunity of the growing domestic

smart meter market is to:

-- Continue to install and own gas meters and data contracts and

maximise the contracted order book in the I&C and domestic

meter market organically with existing customers and through new

contracts

-- Drive recurring rental income from the I&C market

-- Target the significant domestic smart meter market

opportunity in the UK based on our proven business model and

established market position

-- Increase levels of business with, and services provided to

key gas and electricity suppliers, with a focus on cross-selling

between Gas and Electricity across our suite of services

People and Systems

Our people have been instrumental in driving the business

forward and in the successful integration of UPL and also the

rebranding of the expanded business.

Equally important in terms of operational performance is our IT

systems and compliance management work with our customers, the gas

and electricity suppliers. These are integral to the way in which

we deliver our dual fuel metering service and achieve customer

satisfaction and build relationships of trust.

We are excited to be driving forward our strategic vision,

values and culture through our enlarged team and strengthened

senior management.

Dividend

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:01 ET (07:01 GMT)

We announced a progressive dividend policy in our interim

results and increased our interim dividend by 17% to 1.1p. SMS is

delighted to announce a proposed final cash dividend of 2.2p for

the year ended 31 December 2015. In addition to the interim

dividend of 1.1p, this will make a total dividend of 3.3p. The

final dividend will be paid on 2 June 2016 to those shareholders on

the register (record date) on 29 April 2016 with an ex-dividend

date of 28 April 2016.

Outlook

The team, under Alan Foy's leadership, has continued to deliver

on SMS's strategy and operational plans and SMS is ideally

positioned to maintain our competitive advantage and continue to

make progress on its strategy. We have seen a strong start to 2016

with five framework agreements with independent energy suppliers in

the domestic smart meter market. We have also made important

strategic acquisitions to control our installation capacity for the

delivery of our customer contracts in all our markets. We remain

confident on the outlook for 2016, and view the future of the

business and market development as highly promising.

Chief Executive Officer's statement

I am very pleased to report on the continued strong performance

of the business for the year ended 31 December 2015.

Recurring income now represents 57% of our total revenue

compared with 53% of total revenue in 2014, as we see the continued

benefits of building up recurring income streams from our long-term

contracts from a diversified blue chip customer base.

Operational Review

During 2015 our gas and electricity meter portfolios increased

by 19% and 142% respectively. The gas meter portfolio increased

from 607,000 to 723,000 at the year end. The number of electricity

meters rose from 12,000 to 29,000 at year end. Our Gas and

Electricity metering and data assets rose by over 20% in 2015.

Our two key financial metrics both demonstrated substantial

growth in the year. Our revenue increased by 27%, and our long-term

recurring revenue for gas meter recurring rent by 27%. The

electricity meter recurring rent doubled from GBP0.6m to GBP1.25m.

Gas data recurring income also doubled, while electricity data grew

by just over 28%.

These metrics are core to our long-term annuity financial model

and the recurring rental revenue is based on the ownership and

future purchase of meter assets. Once installed, these meters will

be on SMS's long-term index linked contracts and provide recurring

revenue for the lifetime of the assets, expected to be 25

years.

Industrial and Commercial Meters

2015 has been another successful year and we were delighted to

announce a number of new contracts and contract extensions with

major customers during the year.

We nearly doubled our I&C gas metering portfolio to 114,000

from 65,000 meters in 2014 and grew our customer base during 2015

to a point where SMS contracts are in place with over 80% of the

total I&C meter market in the UK with national and

multinational clients.

The I&C electricity metering business has also witnessed

more than a doubling of its metering portfolio to 29,000 from

12,000 meters in 2014 following the introduction of new contracts

with BES, Total Gas & Power, Opus Energy and Dong Energy. The

electricity business has also been successful in delivering new

contracts with existing and new customers in order to satisfy

increasing market demand for half hourly metering services

following the introduction of new OFGEM regime which will see more

than 160,000 meters move to the half hourly market by April 2017.

These industry changes provide opportunities for increased meter

ownership and in particular for increased recurring data revenue

due to the increased demand for half hourly data.

UK Domestic Smart Market Opportunity

SMS will provide UK domestic smart meters as part of the

government's domestic smart meter programme overseen by the

Department of Energy and Climate Change. The programme requires

domestic energy supply companies to provide all of their customers

with a smart meter in homes and small businesses (larger businesses

are subject to separate regulations and are already using smart

meters) across the UK by 2020. In total, this represents 22 million

domestic gas and 27 million domestic electricity smart meters to be

installed, requiring an approximate GBP6.5 billion aggregate

capital investment.

This new market presents an important opportunity for SMS to

extend its current business model, based on owning and installing

assets in the I&C and domestic market, and to replicate this

with the installation of domestic smart meters in the roll-out out

between now and 2020.

Gas and electricity suppliers must appoint a Meter Asset Manager

(MAM) and SMS is one of only four companies in the Smart Domestic

market. We are very well positioned for this new market, given our

business model.

SMS has the ability to fund substantial growth of this new

market with, inter alia, a GBP150 million term facility from a club

of banks. We firmly believe that the nascent domestic smart meter

market will prove attractive to our funders.

While the new market presents a considerable opportunity, there

are also challenges. There will, in all likelihood, be new

entrants, and while the Government has committed to the roll-out

timetable, given its scale, it would not be surprising to see some

delay.

Domestic Meters

Over the period, we grew our domestic gas meter portfolio by 12%

from 542,000 to 609,000 by the year end 2015.

Our combined gas and electricity full service offering has both

strengthened our position and our opportunity in the domestic meter

market, ideally positioning the business for the domestic smart

meter roll out programme in the UK.

ADM(TM)

The ADM(TM) device is SMS's advanced metering solution which

allows for remote meter reading on a half-hourly basis and has been

designed to meet our customer requirements. SMS continues to deploy

the ADM(TM) devices in the UK.

In 2015 the number of ADM(TM) installations increased 74,000, up

from 41,000 in 2014, and we remain confident that our ADM(TM)

device technology has a broad range of potential applications in

gas, electricity, water and LPG markets.

Business Summary

2015 has been a successful year and our business is strong,

notably our I&C installation business and the recurring rental

income. SMS continues to deliver operational and financial growth

and along with the significant opportunities in the domestic smart

metering market we remain confident in the outlook for the business

and market development in 2016.

Consolidated statement of comprehensive income

For the year ended 31 December 2015

2015 2014 Restated

Notes GBP'000 GBP'000

----------------------------------------------------------------------------------- ------ --------- --------------

Revenue 2 53,945 42,386

Cost of sales 3 (17,427) (14,766)

----------------------------------------------------------------------------------- ------ --------- --------------

Gross profit 36,518 27,620

Administrative expenses 3 (18,484) (14,832)

Other operating income 3 1,546 215

----------------------------------------------------------------------------------- ------ --------- --------------

Profit from operations 3 19,580 13,003

----------------------------------------------------------------------------------- ------ --------- --------------

Attributable to:

Operating profit before exceptional items, Other operating income and amortisation

of intangibles 19,493 14,580

Amortisation of intangibles (1,459) (1,155)

Other operating income 1,546 215

Exceptional items and fair value adjustments 3 - (637)

----------------------------------------------------------------------------------- ------ --------- --------------

Finance costs 6 (2,118) (2015)

Finance income 6 3 30

----------------------------------------------------------------------------------- ------ --------- --------------

Profit before taxation 17,465 11,018

Taxation 7 (2,463) (2,143)

----------------------------------------------------------------------------------- ------ --------- --------------

Profit for the year attributable to equity holders 15,002 8,875

Other comprehensive income -

----------------------------------------------------------------------------------- ------ --------- --------------

Total comprehensive income 15,002 8,875

----------------------------------------------------------------------------------- ------ --------- --------------

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:01 ET (07:01 GMT)

The profit from operations arises from the Group's continuing

operations.

Earnings per share attributable to owners of the parent during

the year:

Notes 2015 2014 Restated

------------------------------------ ------ ------ --------------

Basic earnings per share (pence) 8 17.46 10.46

Diluted earnings per share (pence) 8 16.78 10.06

------------------------------------ ------ ------ --------------

Consolidated statement of financial position

As at 31 December 2015

31 December 2014 1 January 2014

(restated) (restated)

31 December 2015

Notes GBP'000 GBP'000 GBP000

------------------------------------------------------ ------ ------------------ ----------------- ---------------

Assets

Non-current

Intangible assets 10 10,028 10,932 2,018

Property, plant and equipment 11 125,700 91,277 57,382

Investments 12 83 83 -

Trade and other receivables 15 901 1,172 -

------------------------------------------------------ ------ ------------------ ----------------- ---------------

136,712 103,464 59,400

------------------------------------------------------ ------ ------------------ ----------------- ---------------

Current assets

Inventories 14 1,099 1,211 2,504

Trade and other receivables 15 10,205 8,245 6,052

Income tax recoverable - 66 433

Cash and cash equivalents 16 5,711 4,285 2,073

Other current financial assets 20 - - 207

------------------------------------------------------ ------ ------------------ ----------------- ---------------

17,015 13,807 11,269

------------------------------------------------------ ------ ------------------ ----------------- ---------------

Total assets 153,727 117,271 70,669

------------------------------------------------------ ------ ------------------ ----------------- ---------------

Liabilities

Current liabilities

Trade and other payables 17 14,919 16,694 10,810

Income tax payable 445 - -

Bank loans and overdrafts 18 8,496 7,904 3,933

Commitments under hire purchase agreements 19 64 90 3

Other current financial liabilities 20 46 70 -

------------------------------------------------------ ------ ------------------ ----------------- ---------------

23,970 24,758 14,746

------------------------------------------------------ ------ ------------------ ----------------- ---------------

Non-current liabilities

Bank loans 18 76,219 53,645 31,475

Commitments under hire purchase agreements 19 14 64 6

Deferred tax liabilities 22 6,139 4,395 3,395

------------------------------------------------------ ------ ------------------ ----------------- ---------------

82,372 58,104 34,876

------------------------------------------------------ ------ ------------------ ----------------- ---------------

Total liabilities 106,342 82,862 49,622

------------------------------------------------------ ------ ------------------ ----------------- ---------------

Net assets 47,385 34,409 21,047

------------------------------------------------------ ------ ------------------ ----------------- ---------------

Equity

Share capital 23 861 856 838

Share premium 9,650 9,291 8,971

Other reserve 25 4,258 4,258 1

Treasury shares 24 (231) (92) -

Retained earnings 32,847 20,096 11,237

------------------------------------------------------ ------ ------------------ ----------------- ---------------

Total equity attributable to equity holders of the

parent company 47,385 34,409 21,047

------------------------------------------------------ ------ ------------------ ----------------- ---------------

Consolidated statement of changes in equity

For the year ended 31 December 2015

Share Share Other Treasury Retained

Attributable to the owners capital premium reserve shares Earnings Total

of the parent company: GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------- -------- --------- -------- --------- --------- --------

As at 1 January 2014 838 8,971 1 - 12,782 22,592

Prior Year adjustment (Note 1) - - - - (1,545) (1,545)

------------------------------------------------------- -------- --------- -------- --------- --------- --------

As at 1 January 2014 (restated) 838 8,971 1 - 11,237 21,047

Total comprehensive income for the year (as restated) - - - - 8,875 8,875

Transactions with owners in their capacity as owners:

Dividends (note 9) - - - - (2,174) (2,174)

Shares issued 18 320 4,257 - - 4,595

Shares held by SIP - - - (92) - (92)

Share options - - - - 240 240

Income tax effect of share options - - - - 1,918 1,918

------------------------------------------------------- -------- --------- -------- --------- --------- --------

As at 31 December 2014 856 9,291 4,258 (92) 20,096 34,409

Total comprehensive income for the year - - - - 15,002 15,002

Transactions with owners in their capacity as owners:

Dividends (note 9) - - - - (2,564) (2,564)

Shares issued 5 359 - - - 364

Shares held by SIP - - - (139) - (139)

Share options - - - - 410 410

Income tax effect of share options - - - - (97) (97)

------------------------------------------------------- -------- --------- -------- --------- --------- --------

As at 31 December 2015 861 9,650 4,258 (231) 32,847 47,385

------------------------------------------------------- -------- --------- -------- --------- --------- --------

See notes 24 and 25 for details of the Treasury shares and Other

reserve.

Consolidated statement of cash flows

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:01 ET (07:01 GMT)

For the year ended 31 December 2015

2015 2014

GBP'000 GBP'000

---------------------------------------------------------------------- --------- ---------

Cash flow from operating activities

Profit before taxation 17,465 11,018

Finance costs 2,118 1,738

Finance income (3) (30)

Fair value movement on derivatives (24) 277

Depreciation 6,816 4,526

Amortisation 1,459 1,155

Share-based payment expense 271 148

Movement in inventories 112 1,636

Movement in trade and other receivables (1,689) 1,709

Movement in trade and other payables (1,776) 3,159

---------------------------------------------------------------------- --------- ---------

Cash generated from operations 24,749 25,336

Taxation (304) (220)

---------------------------------------------------------------------- --------- ---------

Net cash generated from operations 24,445 25,116

---------------------------------------------------------------------- --------- ---------

Investing activities

Payments to acquire property, plant and equipment (41,474) (35,779)

Disposal of property, plant and equipment 235 52

Payments to acquire intangible assets (555) (539)

Acquisition of subsidiary - (12,632)

Cash acquired with subsidiary - 3,420

Finance income 3 30

---------------------------------------------------------------------- --------- ---------

Net cash used in investing activities (41,791) (45,448)

---------------------------------------------------------------------- --------- ---------

Financing activities

New borrowings 33,059 33,003

Capital repaid (9,893) (6,862)

Hire purchase repayments (76) (10)

Finance costs (2,118) (1,738)

Net proceeds from share issue 364 325

Dividend paid (2,564) (2,174)

---------------------------------------------------------------------- --------- ---------

Net cash generated from financing activities 18,772 22,544

---------------------------------------------------------------------- --------- ---------

Net increase in cash and cash equivalents 1,426 2,212

Cash and cash equivalents at the beginning of the financial year 4,285 2,073

---------------------------------------------------------------------- --------- ---------

Cash and cash equivalents at the end of the financial year (note 16) 5,711 4,285

---------------------------------------------------------------------- --------- ---------

Accounting policies

The consolidated financial statements of the Group for the year

ended 31 December 2015 were approved and authorised for issue in

accordance with a resolution of the Directors on 21 March 2016.

Smart Metering Systems plc is a public limited company incorporated

in Scotland. The company's ordinary shares are traded on AIM.

The financial information set out in the audited results does

not constitute the Group's statutory financial statements for the

year ended 31 December 2015 within the meaning of section 434 of

the Companies Act 2006 and has been extracted from the full

financial statements for the year ended 31 December 2015.

Statutory financial statements for the year ended 31 December

2014 ("2014"), which received an unqualified audit report, have

been delivered to the Registrar of Companies. The reports of the

auditors on the financial statements for the year ended 31 December

2014 and for the year ended 31 December 2015 were unqualified and

did not contain a statement under either section 498(2) or section

498(3) of the Companies Act 2006. The financial statements for the

year ended 31 December 2015 will be delivered to the Registrar of

Companies and made available to all shareholders in due course.

Basis of preparation

The consolidated financial statements, which have been prepared

in accordance with EU Endorsed International Financial Reporting

Standards (IFRS), and IFRIC interpretations and the Companies Act

2006 applicable to companies reporting under IFRS. The consolidated

financial statements are presented in British pounds Sterling (GBP)

and all values are rounded to the nearest thousand (GBP'000) except

where otherwise indicated.

Going concern

Management prepares budgets and forecasts on a rolling 24 month

basis. These forecasts cover operational cash flows and investment

capital expenditure. The Group has committed bank facilities which

extend to March 2017 and available cash resources at 31 December

2015 of GBP26m.

Based on the current projections and facilities in place the

Directors consider it appropriate to continue to prepare the

financial statements on a going concern basis.

Basis of consolidation

The consolidated accounts of the Group include the assets,

liabilities and results of the Company and subsidiary undertakings

in which Smart Metering Systems plc has a controlling interest,

with the exception of UPL Italia SRL which is deemed immaterial to

the group as a whole, using accounts drawn up to 31 December.

Control is achieved when the Group is exposed, or has rights, to

variable returns from its involvement with the investee and has the

ability to affect those returns through its power over the

investee. Specifically, the Group controls an investee if, and only

if, the Group has all of the following: power over the investee

(i.e. existing rights that give it the current ability to direct

the relevant activities of the investee); exposure, or rights, to

variable returns from its involvement with the investee; and the

ability to use its power over the investee to affect its

returns.

When necessary, adjustments are made to the financial statements

of subsidiaries to bring their accounting policies into line with

the Group's accounting policies. All intragroup assets and

liabilities, equity, income, expenses and cash flows relating to

transactions between members of the Group are eliminated in full on

consolidation.

Use of estimates and judgements

The preparation of the financial statements requires the use of

estimates and assumptions. Although these estimates are based on

management's best knowledge, actual results ultimately may differ

from these estimates.

The key sources of estimation uncertainty that have a

significant risk of causing material adjustment to the carrying

amounts of assets and liabilities within the next financial year

are acquisitions and business combinations. When an acquisition

arises the group is required under IFRS 3 to calculate the Purchase

Price Allocation ("PPA"). The PPA requires companies to report the

fair value of assets and liabilities acquired and it establishes

useful lives for identified assets.

Subjectivity is involved in PPA with the estimation of the

future value of technology, customer relationships and

goodwill.

Revenue recognition

Revenue is recognised to the extent that it is probable that the

economic benefits will flow to the Group and the revenue can be

reliably measured. Revenue is measured at the fair value of the

consideration received or receivable, excluding discounts and

VAT.

Revenue is recognised when the significant rewards and risk of

ownership have been passed to the buyer. The risk and rewards of

ownership transfer when the Group fulfils its contractual

obligations to customers by supplying services.

Meter rental income

Rental income represents operating lease payments receivable

from gas and electricity suppliers. Revenue is recognised on a

straight-line basis over the lease term. Rental income is

calculated on a daily basis and invoiced monthly. Rental contracts

do not operate on a fixed-term basis and are cancellable at any

time by the lessee, in which case termination payments are levied

and recognised as other operating income in accordance with the

terms of the contract with immediate effect and do not transfer

risks and rewards of ownership of the underlying asset. They are

therefore considered as operating lease arrangements and accounted

for as such.

In line with the underlying contractual terms, termination fees

due are recognised at fair value upon notification of deappoinment

and are classified as other operating income.

Utility connection

Revenue from connection contracts is recognised upon delivery of

the related service.

Data management

Data income is recognised on a straight line basis over the

contract period. Amounts invoiced in advance are recorded as

deferred income.

Financial assets

Initial recognition and measurement

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:01 ET (07:01 GMT)

Financial assets within the scope of IAS 39 are classified as

financial assets at fair value through profit or loss, loans and

receivables, held-to-maturity investments, available-for-sale

financial assets or as derivatives designated as hedging

instruments in an effective hedge, as appropriate. The Group

determines the classification of its financial assets at initial

recognition.

Purchases or sales of financial assets that require delivery of

assets within a time frame established by regulation or convention

in the marketplace (regular way trades) are recognised on the trade

date, i.e. the date that the Group commits to purchase or sell the

asset.

The Group's financial assets include cash and short-term

deposits, trade and other receivables, loans and other receivables,

quoted and unquoted financial instruments and derivative financial

instruments.

Financial liabilities

Initial recognition and measurement

Financial liabilities within the scope of IAS 39 are classified

as financial liabilities at fair value through profit or loss,

loans and borrowings or as derivatives designated as hedging

instruments in an effective hedge, as appropriate. The Group

determines the classification of its financial liabilities at

initial recognition. All financial liabilities are recognised

initially at fair value and, in the case of loans and borrowings,

net of directly attributable transaction costs.

The Group's financial liabilities include trade and other

payables, bank overdraft, loans and borrowings, financial guarantee

contracts and derivative financial instruments.

Derecognition

A financial liability is derecognised when the obligation under

the liability is discharged or cancelled or expires. When an

existing financial liability is replaced by another from the same

lender on substantially different terms, or the terms of an

existing liability are substantially modified, such an exchange or

modification is treated as a derecognition of the original

liability and the recognition of a new liability and the difference

in the respective carrying amounts is recognised in the

consolidated statement of comprehensive income.

Offsetting of financial instruments

Financial assets and financial liabilities are offset, and the

net amount reported in the consolidated statement of financial

position, if, and only if, there is a currently enforceable legal

right to offset the recognised amounts and there is an intention to

settle on a net basis, or to realise the assets and settle the

liabilities simultaneously.

Initial recognition and subsequent measurement

The Group uses derivative financial instruments such as interest

rate swaps to hedge its interest rate risk. Such derivative

financial instruments are initially recognised at fair value on the

date on which a derivative contract is entered into and are

subsequently remeasured at fair value. Derivatives are carried as

financial assets when the fair value is positive and as financial

liabilities when the fair value is negative. The Group has not

designated any derivatives for hedge accounting.

Current versus non-current classification

Derivative instruments that are not designated as effective

hedging instruments are classified as current or non-current or

separated into a current and non-current portion based on an

assessment of the facts and circumstances (i.e. the underlying

contracted cash flows).

Where the Group will hold a derivative as an economic hedge (and

does not apply hedge accounting) for a period beyond twelve months

after the reporting date, the derivative is classified as

non-current (or separated into current and non-current portions)

consistent with the classification of the underlying item.

Derivative instruments that are designated as, and are effective

hedging instruments, are classified consistent with the

classification of the underlying hedged item. The derivative

instrument is separated into a current portion and non-current

portion only if a reliable allocation can be made.

Exceptional items and separately disclosed items

The Group presents as exceptional items on the face of the

consolidated statement of comprehensive income those material items

of income and expense which, because of the nature or expected

infrequency of the events giving rise to them, merit separate

presentation to allow shareholders to understand better the

elements of financial performance in that year, so as to facilitate

comparison with prior periods and to assess better trends in

financial performance. Termination fee income is reported as a

separately disclosed given the materiality & nature.

Research and development

Expenditure on pure and applied research activities is

recognised in the consolidated statement of comprehensive income as

an expense as incurred.

Expenditure on product development activities is capitalised if

the product or process is technically and commercially feasible and

the Group intends and has the technical ability and sufficient

resources to complete development; if future economic benefits are

probable; and if the Group can measure reliably the expenditure

attributable to the intangible asset during its development. The

expenditure capitalised includes the cost of materials, direct

labour and an appropriate proportion of overheads.

Capitalised development expenditure is stated at cost less

accumulated amortisation and accumulated impairment losses.

Amortisation is calculated, when the product or system is

available for use, so as to write off the cost of an asset, less

its estimated residual value, over the useful economic life of that

asset as follows:

Amortisation 5% on cost straight line

Intangible assets

Intangible assets acquired separately from third parties are

recognised as assets and measured at cost.

Following initial recognition, intangible assets are measured at

cost at the date of acquisition less any amortisation and any

impairment losses. Amortisation costs are included within the net

administrative expenses disclosed in the consolidated statement of

comprehensive income.

Intangible assets acquired as part of a business combination are

recognised outside goodwill if the asset is separable or arises

from contractual or other legal rights and its fair value can be

measured reliably.

Intangible assets are amortised over their useful lives as

follows:

Software 12.5% and 20% straight line

Customer contracts 20%

Useful lives are examined on an annual basis and adjustments,

where applicable, are made on a prospective basis.

Goodwill

Goodwill arising on consolidation represents the excess of the

consideration transferred and the fair value of the identifiable

assets and liabilities of the acquiree at the date of acquisition.

Goodwill on acquisitions of subsidiaries is included in 'intangible

assets'. Goodwill is not amortised but is tested annually for

impairment and is carried at cost less accumulated impairment

losses. See note [13] for detailed assumptions and methodology.

Impairment losses are not subsequently reversed.

Goodwill is allocated to cash-generating units for the purpose

of impairment testing. The allocation is made to those

cash-generating units or groups of cash-generating units that are

expected to benefit from the business combination in which the

goodwill arose identified according to operating segment.

Provisional fair values are adjusted against goodwill if

additional information is obtained within one year of the

acquisition date, about facts or circumstances existing at the

acquisition date. Other changes in provisional fair values are

recognised through profit or loss.

Changes in contingent consideration arising from additional

information, obtained within one year of the acquisition date,

about facts or circumstances that existed at the acquisition date

are recognised as an adjustment to goodwill. Other changes in

contingent consideration are recognised through profit or loss,

unless the contingent consideration is classified as equity. In

such circumstances, changes are recognised within equity.

Impairment

At each reporting date, the Group reviews the carrying amounts

of its property, plant and equipment and intangibles to determine

whether there is any indication that those assets have suffered an

impairment loss. If any such indication exists, the recoverable

amount of the asset is estimated in order to determine the extent

of the impairment loss (if any). Where the asset does not generate

cash flows that are independent from other assets, the Group

estimates the recoverable amount of the cash-generating unit (CGU)

to which the asset belongs.

Recoverable amount is the higher of fair value less costs to

sell and value in use. In assessing value in use, the estimated

future cash flows are discounted to their present value using a

pre-tax discount rate that reflects current market assessments of

the time value of money and the risks specific to the asset for

which the estimates of future cash flows have been adjusted.

If the recoverable amount of an asset (or CGU) is estimated to

be less than its carrying amount, the carrying amount of the asset

(or CGU) is reduced to its recoverable amount. An impairment loss

is recognised as an expense immediately.

Where an impairment loss subsequently reverses, the carrying

amount of the asset (CGU) is increased to the revised estimate of

its recoverable amount, but so that the increased carrying amount

does not exceed the carrying amount that would have been determined

had no impairment loss been recognised for the asset (CGU) in prior

years. A reversal of an impairment loss is recognised as income

immediately.

Detailed assumptions with regard to discount, growth and

inflation rates are set out in note 13 to the accounts.

Property, plant and equipment

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:01 ET (07:01 GMT)

Property, plant and equipment is stated at cost, net of

accumulated depreciation and/or accumulated impairment losses, if

any. Such cost includes the cost of replacing part of the plant and

equipment and borrowing costs for long-term construction projects

if the recognition criteria are met. When significant parts of

property, plant and equipment are required to be replaced in

intervals, the Group recognises such parts as individual assets

with specific useful lives and depreciation, respectively.

All other repair and maintenance costs are recognised in the

consolidated statement of comprehensive income as incurred.

Depreciation is calculated on a straight line basis over the

estimated useful life of the asset as follows:

Freehold property 2% on cost

Short leasehold Shorter of the lease term or 15%

property and 20% on cost

Plant and machinery 5% and 10% on cost

Fixtures, fittings 15% and 33% on cost

& equipment

Motor vehicles 25% on cost

Land is not

depreciated.

An item of property, plant and equipment and any significant

part initially recognised is derecognised upon disposal or when no

future economic benefits are expected from its use or disposal. Any

gain or loss arising on derecognition of the asset (calculated as

the difference between the net disposal proceeds and the carrying

amount of the asset) is included in the consolidated statement of

comprehensive income when the asset is derecognised. The asset's

residual values, useful lives and methods of depreciation are

reviewed at each financial year end and adjusted prospectively, if

appropriate.

Property, plant and equipment are initially recorded at

cost.

Inventories

Inventories are stated at the lower of cost and net realisable

value. Costs comprise direct materials. Net realisable value

represents the estimated selling price for inventories less all

estimated costs of completion and costs to be incurred in

marketing, selling and distribution.

Cash and cash equivalents

Cash and cash equivalents in the consolidated statement of

financial position comprises cash at bank and in hand and

short-term deposits with an original maturity of three months or

less. For the purpose of the consolidated statement of cash flows,

cash and cash equivalents consists of cash and short-term deposits

as defined above, net of outstanding bank overdrafts.

Hire purchase agreements

Assets held under hire purchase agreements are capitalised and

disclosed under property, plant and equipment at their fair value.

The capital element of the future payments is treated as a

liability and the notional interest is charged to the statement of

comprehensive income in proportion to the remaining balance

outstanding.

Leased assets and obligations as lessee

Leases are classified as finance leases whenever the terms of

the lease transfer substantially all the risks and rewards of

ownership to the lessee. All other leases are classified as

operating leases. Assets acquired under finance leases are

capitalised in the Balance Sheet at their fair value or, if lower,

at the present value of the minimum lease payments, each determined

at the inception of the lease. The corresponding liability to the

lessor is recorded in the Balance Sheet as a finance lease

obligation. The lease payments are apportioned between finance

charges to the Income Statement and a reduction of the lease

obligations.

Rental payments under operating leases are charged to the Income

Statement on a straight-line basis over the applicable lease

periods.

Group as lessor

Leases in which the Group does not transfer substantially all

the risks and rewards of ownership of assets are classified as

operating leases with meter income recognised in line with the

meter rental income policy.

Pension costs

The Group operates a defined contribution pension scheme for

employees. The assets of the scheme are held separately from those

of the Group. The annual contributions payable are charged to the

statement of comprehensive income.

Share-based payments

The costs of equity-settled share-based payments are charged to

the consolidated statement of comprehensive income over the vesting

period. The charge is based on the fair value of the equity

instrument granted and the number of equity instruments that are

expected to vest.

Taxation

Tax currently payable is based on the taxable profit for the

year. Taxable profit differs from accounting profit as reported in

the consolidated statement of comprehensive income because it

excludes items of income or expense that are taxable or deductible

in other years and it further excludes items that are never taxable

or deductible. The Group's liability for current tax is measured

using tax rates that have been enacted or substantively enacted by

the reporting date.

Deferred tax is the tax expected to be payable or recoverable on

differences between the carrying amount of assets and liabilities

in the financial statements and the corresponding tax bases used in

the computation of taxable profit and is accounted for using the

balance sheet liability method. Deferred tax liabilities are

recognised for all taxable temporary differences and deferred tax

assets are recognised to the extent that it is probable that

taxable profits will be available against which deductible

temporary differences can be utilised. The deferred tax balance is

calculated based on tax rates that have been enacted or

substantively enacted by the reporting date.

Deferred tax assets include temporary differences related to

employee benefits settled via the issue of share options.

Recognition of the deferred tax assets assumes share options will

have a positive value at the date of vesting, which is greater than

the exercise price.

Standards and interpretations

Several new standards and amendments are applicable for the

first time in 2015. However, they do not impact the annual

consolidated financial statements of the Group.

Standards and amendments to standards that have been issued but

are not effective for 2015 and have not been early adopted

Periods commencing

Standard or interpretation on or after

------------------------------------ ------------------------------------------------------------------------------

Amendments to IAS 1 Disclosure Initiative 1 January 2016

IFRS 9* Financial Instruments 1 January 2018

IFRS 15* Revenue from contracts with customers 1 January 2016

Annual Improvements to IFRSs 2012 to 2014 cycle 1 January 2016

Amendments to IFRS 10 and IAS 28* Sale or Contribution of Assets between an Investor and its 1 January 2016

Associate or Joint Venture

Amendments to IAS 16 and IAS 38 Clarification of Acceptable Methods of Depreciation and 1 January 2016

Amortisation

Amendments to IFRS 11 Accounting for Acquisition of Interests in Joint Operations 1 January 2016

IFRS 16* Leases 1 January 2019

Amendments to IAS 7* Disclosure Initiative 1 January 2017

Amendments to IAS 12* Recognition of Deferred Tax Assets for Unrealised Losses 1 January 2017

Note * - Not yet adopted for use in the European Union

The above standards and interpretations will be adopted in

accordance with their effective dates and have not been adopted in

these financial statements.

For standards with a future effective date, the Directors are in

the process of assessing the likely impact and look to finalisation

of the standards before formalising their view.

Notes to the financial statements

For the year ended 31 December 2015

1 Prior period restatement

Over a number of years, the revenue on gas connection services

has been incorrectly recognised upon advance payment by customers

rather than upon the delivery of the underlying service. The

related subcontractor cost was accrued at the point of revenue

recognition. This resulted in the accelerated recognition of both

revenue and cost of sales across a number of years. The scale of

the gas connections business has been consistent over a number of

years with the exception of 2013 when the revenue was higher due to

a number of significant contracts.

The financial statements have been restated to correct the

cumulative impact on the Consolidated statement of financial

position as at 1 January 2014. In addition, income tax receivable

and payable and long term trade & other receivables have been

reclassified to be shown on the face of the consolidated statement

of financial position. No adjustment has been made to the 2014

profit before tax as previously reported, as the impact on the year

after the consideration of the effect of the turnaround error from

pre 1 January 2014 is considered immaterial at both revenue and

profit level.

The impact is as follows:

31 December 1 January

2014 2014

GBP000 GBP000

Increase in Advance payments 3,448 3,448

Decrease to Accruals (1,517) (1,517)

Decrease to Income tax payable/increase

to Income tax repayble (386) (386)

Decrease in Equity (1,545) (1,545)

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:01 ET (07:01 GMT)

In addition, in 2014, a credit of GBP1,918,000 was recognised

through the income statement in connection with the recognition of

deferred tax benefits arising on share based payments which should

have been recognised directly in equity. Accordingly, the

comparative financial statements have been restated to correct the

charge as follows:

31 December 2014

GBP000

Increase to taxation charge 1,918

Increase to amount recognised directly

in equity (1,918)

This adjustment has had the following impact on earnings per

share:

As restated As previously reported

Earnings per share:

- basic (pence) 10.46 12.71

- diluted (pence) 10.06 12.23

Adjusted earnings per share:

- basic (pence) 11.90 14.36

- diluted (pence) 11.45 13.81

------------------------------ ------------ -----------------------

2 Segmental reporting

For management purposes, the Group is organised into three core

divisions, Asset Management, Asset Installation and Energy

Management, which form the basis of the Group's reportable

operating segments and Operating segments within those divisions

are combined on the basis of their similar long-term economic

characteristics and similar nature of their products and services,

as follows:

Asset Management comprises regulated management of gas meters,

electric meters and ADM(TM) units within the UK.

Asset installation of meters comprises installation of domestic

and Industrial and Commercial gas meters and electricity meters

throughout the UK.

Energy Management comprises the provision of energy advice.

For greater clarity the trade in the Energy Management business

has been separated out from Asset Installation.

Comparatives have been altered accordingly.

Management monitors the operating results of its divisions

separately for the purpose of making decisions about resource

allocation and performance assessment. The operating segments

disclosed in the financial statements are the same as reported to

the Board. Segment performance is evaluated based on gross

profit.

At the most granular level of information presented to the CODM,

Asset Management aggregates four operating segments (Gas meter

rental, Electricity meter rental, Gas data and Electricity data)

principally on the basis that they derive from the same asset using

similar processes for consistent customers and are often provided

together. Asset Installation aggregates two operating segments (Gas

Transactional and Electricity Transactional) due to the consistent

nature of the service, customers and delivery processes.

The following segment information is presented in respect of The

Groups reportable segments together with additional balance sheet

information:

Asset Asset Energy Total

management installation Management Unallocated operations

31 December 2015 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------- ----------- ------------- ----------- ------------ -----------

Segment/Group revenue 30,233 19,535 4,177 - 53,945

Cost of sales (4,148) (10,891) (2,388) - (17,427)

---------------------------------------------- ----------- ------------- ----------- ------------ -----------

Segment profit - Group gross profit 26,085 8,644 1,789 - 36,518

Items not reported by segment:

Other operating costs/income - - - (8,663) (8,663)

Depreciation (5,846) - - (970) (6,816)

Amortisation (121) - - (1,338) (1,459)

Exceptional items and fair value adjustments - - - - -

---------------------------------------------- ----------- ------------- ----------- ------------ -----------

Profit from operations 20,118 8,644 1,789 (10,971) 19,580

Net finance costs (2,127) 0 4 8 (2,115)

---------------------------------------------- ----------- ------------- ----------- ------------ -----------

Profit before tax 17,991 8,644 1,793 (10,963) 17,465

Tax expense (2,463)

---------------------------------------------- ----------- ------------- ----------- ------------ -----------

Profit for year 15,002

---------------------------------------------- ----------- ------------- ----------- ------------ -----------

Restated

Asset Asset Energy Total

management installation Management Unallocated Operations

31 December 2014 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------------------------- ----------- ------------- ------------ ------------ -----------

Segment/Group revenue 22,404 17,639 2,343 - 42,386

Cost of sales (3,712) (9,656) (1,398) - (14,766)

---------------------------------------------- ----------- ------------- ------------ ------------ -----------

Segment profit - Group gross profit 18,692 7,983 945 - 27,620

Items not reported by segment:

Other operating costs/income - - - (8,299) (8,299)

Depreciation (4,200) - - (326) (4,526)

Amortisation (746) - - (409) (1,155)

Exceptional items and fair value adjustments - - - (637) (637)

---------------------------------------------- ----------- ------------- ------------ ------------ -----------

Profit from operations 13,746 7,983 945 (9,671) 13,003

Net finance costs (1,985) - - - (1,985)

---------------------------------------------- ----------- ------------- ------------ ------------ -----------

Profit before tax 11,761 7,983 945 (9,671) 11,018

Tax expense (2,143)

---------------------------------------------- ----------- ------------- ------------ ------------ -----------

Profit for year 8,875

---------------------------------------------- ----------- ------------- ------------ ------------ -----------

All revenues and operations are based and generated in the

UK.

The Group has one major customer that generated turnover within

each segment as listed below:

2015 2014

GBP'000 GBP'000

--------------------------------- -------- --------

Customer 1 - Asset Management 11,865 9,847

Customer 1 - Asset Installation 4,704 5,089

--------------------------------- -------- --------

16,569 14,936

--------------------------------- -------- --------

Segment assets and liabilities

Asset Asset Energy Total

management installation Management Operations

31 December 2015 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------------- ----------- ------------- ----------- -----------

Assets by segment

Intangible assets 10,028 - - 10,028

Plant, plant and equipment 119,435 - 6,265 125,700

Inventories 996 - 103 1,099

-------------------------------------------- ----------- ------------- ----------- -----------

130,459 - 6,368 136,827

Assets not by segment 16,900

-------------------------------------------- ----------- ------------- ----------- -----------

Total assets 153,727

-------------------------------------------- ----------- ------------- ----------- -----------

Liabilities by segment

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:01 ET (07:01 GMT)

Bank loans 84,715 - - 84,715

Obligations under hire purchase agreements 63 - 15 78

-------------------------------------------- ----------- ------------- ----------- -----------

84,778 - 15 84,793

Liabilities not by segment 21,549

-------------------------------------------- ----------- ------------- ----------- -----------

Total liabilities 106,342

-------------------------------------------- ----------- ------------- ----------- -----------

Restated

Asset Asset Energy Total

management installation Management Operations

31 December 2014 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------------- ----------- ------------- ----------- -----------

Assets by segment

Intangible assets 10,932 - - 10,932

Plant, plant and equipment 84,649 - 3,855 88,504

Inventories 1,091 - 120 1,211

-------------------------------------------- ----------- ------------- ----------- -----------

96,672 - 3,975 100,647

Assets not by segment 16,624

-------------------------------------------- ----------- ------------- ----------- -----------

Total assets 117,271

-------------------------------------------- ----------- ------------- ----------- -----------

Liabilities by segment

Bank loans 61,549 - - 61,549

Obligations under hire purchase agreements 84 - 70 154

-------------------------------------------- ----------- ------------- ----------- -----------

61,633 - 70 61,703

Liabilities not by segment 21,159

-------------------------------------------- ----------- ------------- ----------- -----------

Total liabilities 82,862

-------------------------------------------- ----------- ------------- ----------- -----------

3 Income statement by nature and items of expenditure included

in the consolidated statement of comprehensive income

2015 2014

GBP'000 GBP'000

---------------------------------------------- --------- --------

Revenue 53,945 42,386

Direct rental costs (4,148) (3,712)

Direct subcontractor costs (6,504) (6,125)

Other direct sales costs and systems rental (6,775)) (4,929)

Staff costs (7,166) (6,549)

Depreciation:

- owned assets (6,751) (4,447)

- leased assets (65) (79)

Amortisation (1,459) (1,155)

Other operating income 1,546 215

Auditor's remuneration:

- as auditor (80) (68)

- other services - (179)

Exceptional costs and fair value adjustments - (637)

Operating lease costs: -

- plant and equipment - (5)

Other operating charges (2,963) (1,713)

---------------------------------------------- --------- --------

Profit from operations 19,580 13,003

Finance costs (2,118) (2,015)

Finance income 3 30

---------------------------------------------- --------- --------

Profit before taxation 17,465 11,018

---------------------------------------------- --------- --------

Included in exceptional items and fair value adjustments

expenses are: GBPNil (2014: GBP479,691) acquisition costs and

GBPNil (2014: GBP157,500) redundancy costs. . Included within other

direct sales costs and systems rental are staff costs of

GBP2,924,000 (2014: GBP2,245,000).

Auditors' remuneration can be analysed as:

2015 2014

GBP'000 GBP'000

------------------------------------------------------------ -------- --------

Statutory group audit (Ernst & Young) 80 -

Statutory group audit (Baker Tilly UK Audit LLP) - 56

Statutory parent audit - 12

Taxation services (Baker Tilly Tax and Accounting Limited) - 13

Corporate finance (Baker Tilly Corporate Finance LLP) - 157

Non-statutory audit services (Baker Tilly UK Audit LLP) - 9

------------------------------------------------------------ -------- --------

80 247

------------------------------------------------------------ -------- --------

4 Particulars of employees

The average number of staff employed by the Group, including

Executive Directors, during the financial year was:

2015 2014

Number Number

-------------------------------- ------- -------

Number of administrative staff 17 20

Number of operational staff 276 208

Number of sales staff 3 5

Number of IT staff 12 12

Number of Directors 2 2

-------------------------------- ------- -------

310 247

-------------------------------- ------- -------

The aggregate payroll costs, including Executive Directors, of

the employees were:

2015 2014

GBP'000 GBP'000

------------------------ -------- --------

Wages and salaries 9,205 7,654

Social security costs 935 734

Staff pension costs 192 145

Share-based payment 410 240

Director pension costs 20 21

------------------------ -------- --------

10,762 8,794

------------------------ -------- --------

5 Directors' emoluments

The Directors' aggregate remuneration in respect of qualifying

services were:

2015 2014

GBP'000 GBP'000

---------------------------------------------------------------- -------- --------

Emoluments receivable 821 738

Value of Group pension contributions to money purchase schemes 5 5

Other pension 16 16

---------------------------------------------------------------- -------- --------

842 759

---------------------------------------------------------------- -------- --------

2015 2014

Emoluments of highest paid Director GBP'000 GBP'000

------------------------------------- -------- --------

Total emoluments 488 423

Pension contributions 16 16

------------------------------------- -------- --------

The number of Directors who accrued benefits under Company

pension schemes was as follows:

2015 2014

Number Number

------------------------ ------- -------

Money purchase schemes 2 1

------------------------ ------- -------

6 Finance costs and finance income

2015 2014

GBP'000 GBP'000

-------------------------------- -------- --------

Finance costs

Bank loans and overdrafts 2,134 1,731

Interest rate hedge fair value (24) 277

Hire purchase 8 7

-------------------------------- -------- --------

Total finance costs 2,118 2,015

-------------------------------- -------- --------

Finance income

Bank interest receivable 3 30

Interest rate hedge fair value - -

-------------------------------- -------- --------

Total finance income 3 30

-------------------------------- -------- --------

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:01 ET (07:01 GMT)

7 Taxation

2015 2014 Restated

GBP'000 GBP'000

--------------------------------------------------- -------- --------------

Analysis of charge in the year

Current tax:

Current income tax expense 1,159 372

Over provision in prior year (163) -

--------------------------------------------------- -------- --------------

Total current income tax 996 372

Deferred tax:

Origination and reversal of temporary differences 1,467 1,771

--------------------------------------------------- -------- --------------

Tax on profit on ordinary activities 2,463 2,143

--------------------------------------------------- -------- --------------

The charge for the period can be reconciled to the profit per

the consolidated statement of comprehensive income as follows:

Profit before tax 17,465 11,018

----------------------------------------------------------------- ------- -------

Tax at the UK corporation tax rate of 20.25% (2014: 21.5%) 3,536 2,314

Expenses not deductible for tax purposes / (non taxable income) (62) 121

Adjustments to tax charge in respect of previous periods (107) 132

Change in tax rate (904) -

Changes in amounts recognised for deferred tax - (424)

----------------------------------------------------------------- ------- -------

Tax expense in the income statement 2,463 2,143

----------------------------------------------------------------- ------- -------

8 Earnings per share

The calculation of EPS is based on the following data and number

of shares:

2015 2014 restated

GBP'000 GBP000's

---------------------------------------------------------------------------- ----------- --------------

Profit for the year used for calculation of basic EPS 15,002 8,875

Amortisation of intangible assets 1,459 1,155

Other operating income (1,546) (215)

Exceptional costs - 637

Tax effect of adjustments 19 (347)

---------------------------------------------------------------------------- ----------- --------------

Earnings for the purpose of adjusted EPS 14,934 10,105

---------------------------------------------------------------------------- ----------- --------------

Number of shares 2015 2014

---------------------------------------------------------------------------- ----------- --------------

Weighted average number of ordinary shares for the purposes of basic EPS 85,928,114 84,887,262

Effect of potentially dilutive ordinary shares:

- share options 3,463,275 3,370,617

---------------------------------------------------------------------------- ----------- --------------

Weighted average number of ordinary shares for the purposes of diluted EPS 89,391,389 88,257,879

---------------------------------------------------------------------------- ----------- --------------

Earnings per share:

- basic (pence) 17.46 10.46

- diluted (pence) 16.78 10.06

Adjusted earnings per share:

- basic (pence) 17.38 11.90

- diluted (pence) 16.70 11.45

---------------------------------------------------------------------------- ----------- --------------

The Directors consider that the adjusted earnings per share

calculation gives a better understanding of the Group's earnings

per share.

9 Dividends

2015 2014

GBP'000 GBP'000

-------------------------------------------------- -------- --------

Equity dividends

Paid during the year:

Interim paid in respect of 2015, 1.1p per share 947

Final paid in respect of 2014, 1.88p per share 1,617

Interim paid in respect of 2014, 0.7p per share 1,370

Final paid in respect of 2013, 1.61p per share 804

Total dividends 2,564 2,174

-------------------------------------------------- -------- --------

10 Intangible assets

Customer

Goodwill contracts Development Software Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- --------- ---------- ------------ --------- --------

Cost

As at 1 January 2014 - - 1,192 1,810 3,002

Additions - - 356 183 539

Additions as part of UPL acquisition 4,112 2,160 - 3,258 9,530

-------------------------------------- --------- ---------- ------------ --------- --------

As at 31 December 2014 4,112 2,160 1,548 5,251 13,071

Additions - - 525 30 555

As at 31 December 2015 4,112 2,160 2,073 5,281 13,626

-------------------------------------- --------- ---------- ------------ --------- --------

Amortisation

As at 1 January 2014 - - 44 940 984

Charge for year - 332 77 746 1,155

-------------------------------------- --------- ---------- ------------ --------- --------

As at 31 December 2014 - 332 121 1,686 2,139

Charge for year - 666 121 672 1,459

-------------------------------------- --------- ---------- ------------ --------- --------

As at 31 December 2015 - 998 242 2,358 3,598

-------------------------------------- --------- ---------- ------------ --------- --------

Net book value

At 31 December 2015 4,112 1,162 1,831 2,923 10,028

-------------------------------------- --------- ---------- ------------ --------- --------

At 31 December 2014 4,112 1,828 1,427 3,565 10,932

-------------------------------------- --------- ---------- ------------ --------- --------

At 1 January 2014 - - 1,148 870 2,018

-------------------------------------- --------- ---------- ------------ --------- --------

11 Property, plant and equipment

Freehold/ Fixtures,

leasehold Plant and fittings and Motor

property machinery equipment vehicles Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- ---------- ---------- ------------- --------- --------

Cost

As at 1 January 2014 136 63,000 511 - 63,647

Additions 5 35,715 214 - 35,934

Additions as part of UPL acquisition 1,990 - 437 112 2,539

Disposals - (69) - - (69)

-------------------------------------- ---------- ---------- ------------- --------- --------

As at 31 December 2014 2,131 98,646 1,162 112 102,051

Additions 13 41,192 256 - 41,461

Disposals - (222) - (32) (254)

-------------------------------------- ---------- ---------- ------------- --------- --------

As at 31 December 2015 2,144 139,616 1,418 80 143,258

-------------------------------------- ---------- ---------- ------------- --------- --------

Depreciation

As at 1 January 2014 50 5,959 256 - 6,265

Charge for year 56 4,200 236 34 4,526

Disposals - (17) - - (17)

-------------------------------------- ---------- ---------- ------------- --------- --------

As at 31 December 2014 106 10,142 492 34 10,774

(MORE TO FOLLOW) Dow Jones Newswires

March 21, 2016 03:01 ET (07:01 GMT)

Charge for year 64 6,378 340 34 6,816

Disposals - (21) - (11) (32)

-------------------------------------- ---------- ---------- ------------- --------- --------

As at 31 December 2015 170 16,499 832 57 17,558

-------------------------------------- ---------- ---------- ------------- --------- --------

Net book value

At 31 December 2015 1,974 123,117 586 23 125,700

-------------------------------------- ---------- ---------- ------------- --------- --------

At 31 December 2014 2,025 88,504 670 78 91,277

-------------------------------------- ---------- ---------- ------------- --------- --------

At 1 January 2014 86 57,041 92 163 57,382

-------------------------------------- ---------- ---------- ------------- --------- --------

Hire purchase agreements

Included within the net book value of GBP125,700,000 (2014:

GBP91,277,000; 2013: GBP57,382,000) is GBP73,258 (2014: GBP208,000;

2013: GBP84,000) relating to assets held under hire purchase

agreements. The depreciation charged to the consolidated financial

statements in the year in respect of such assets amounted to

GBP65,060 (2014: GBP79,000; 2013: GBP31,000).

The assets are secured by a bond and floating charge (note

[18]).

12 Financial asset investments

Shares in Group Unlisted

undertaking investments Total

GBP'000 GBP'000 GBP'000

------------------------ ---------------- ------------ --------

Cost

As at 1 January 2015 43 40 83

As at 31 December 2015 43 40 83

------------------------ ---------------- ------------ --------

Subsidiary undertakings

Country of Proportion of

incorporation Holding shares held Nature of business