Smiths Group PLC Smiths Group to divest Artificial Lift business (6464K)

September 23 2016 - 2:00AM

UK Regulatory

TIDMSMIN

RNS Number : 6464K

Smiths Group PLC

23 September 2016

News Release

London, 23 September 2016

For immediate release

Smiths Group divestment of its Artificial Lift business

Smiths Group plc ("Smiths Group" or the "Group") today announces

that it has entered into an agreement to sell its Artificial Lift

business ("Artificial Lift"), part of the John Crane division, to

Endurance Lift Solutions, LLC. The total gross consideration

payable at completion is $39.5m in cash subject to an adjustment

based upon the working capital position at completion.

Artificial Lift is engaged in the sale of products and services,

principally sucker rods for onshore upstream oil and gas customers

in the United States and Romania.

For the year ended 31 July 2015, the business and assets subject

to the transaction had combined revenues of $90.8m and an operating

loss before certain non-recurring items of $1.8m. The gross assets

of the combined business at 31 July 2015 were $63.2m.

For the unaudited year ended 31 July 2016, the business and

assets subject to the transaction had combined revenues of $53.4m

and an operating loss before certain non-recurring items of $10.1m.

The gross assets of the combined business at 31 July 2016 were

$32.1m.

The management team will transfer with the business. The

transaction is subject to customary regulatory approvals and is

expected to close by the end of the calendar year.

Andy Reynolds Smith, Chief Executive of Smiths Group, commented

as follows: "This disposal demonstrates our ongoing commitment to

increasingly focus our portfolio on building technology

differentiated leadership positions in our chosen markets. The

capital released from this transaction will be reinvested in

attractive growth opportunities, whilst allowing the Artificial

Lift business to progress under different ownership."

PPHB, an independent investment banking firm focused on the

energy services sector, acted as exclusive financial advisor to

Smiths Group in the sale of Artificial Lift.

ENDS

Contact details

Investor enquiries

Andrew Lappin, Smiths Group

+44 (0)20 7004 1657

+44 (0)78 0500 7035

andrew.lappin@smiths.com

Kirsty Law, Smiths Group

+44 (0)20 7004 1672

+44 (0)75 8315 4386

kirsty.law@smiths.com

Media enquiries

Andrew Lorenz, FTI Consulting

+44 (0)203 727 1323

+44 (0)777 564 1807

smiths@fticonsulting.com

Smiths is a global technology company listed on the London Stock

Exchange (SMIN) and operates a sponsored level one ADR programme

(SMGZY). A world leader in the practical application of

technologies, Smiths Group delivers products and services for the

threat & contraband detection, medical devices, energy and

communications markets worldwide. Our products and services make

the world safer, healthier and more productive. Smiths Group

employs more than 23,000 people in over 50 countries. For more

information visit www.smiths.com

Disclaimer

This announcement contains certain statements that are

forward-looking statements. They appear in a number of places

throughout this announcement and include statements regarding our

intentions, beliefs or current expectations and those of our

officers, directors and employees concerning, amongst other things,

our results of operations, financial condition, liquidity,

prospects, growth, strategies and the business we operate. By their

nature, these statements involve uncertainty since future events

and circumstances can cause results and developments to differ

materially from those anticipated. The forward-looking statements

reflect knowledge and information available at the date of

preparation of this announcement and, unless otherwise required by

applicable law, Smiths undertakes no obligation to update or revise

these forward-looking statements. Nothing in this document should

be construed as a profit forecast.

No statement in this announcement is intended to be a profit

forecast and no statement in this announcement should be

interpreted to mean that earnings per Smiths ordinary share for the

current or future financial years would necessarily match or exceed

the historical published earnings per Smiths ordinary share. Prices

and values of, and income from, shares may go down as well as up

and an investor may not get back the amount invested. It should be

noted that past performance is no guide to future performance.

Persons needing advice should consult an independent financial

adviser. Any statement to the effect that the Acquisition is

expected to be earnings enhancing for Smiths should not be

interpreted to mean that earnings per Smiths ordinary share in the

first full financial year following the Acquisition, nor in any

subsequent period, will necessarily match or be greater than those

for a preceding financial year.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCSEWSIDFMSELU

(END) Dow Jones Newswires

September 23, 2016 02:00 ET (06:00 GMT)

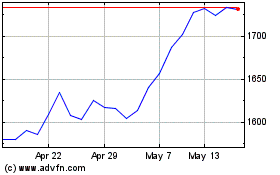

Smiths (LSE:SMIN)

Historical Stock Chart

From Oct 2024 to Nov 2024

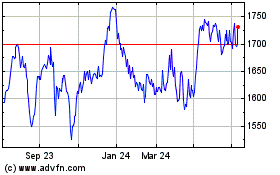

Smiths (LSE:SMIN)

Historical Stock Chart

From Nov 2023 to Nov 2024