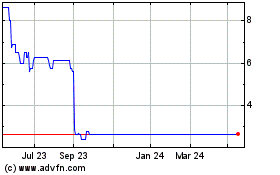

TIDMSIXH

RNS Number : 9475F

600 Group PLC

20 November 2020

The 600 Group plc

De-risked business well-placed for the future

Results for the year ended 28 March 2020

The 600 Group PLC ("the Group"), the diversified industrial

engineering company (AIM: SIXH), today announces its results for

year ended 28 March 2020.

Financial highlights

-- Revenue from continuing operations increased by 3.1% to $67.2m (2019: $65.2m)

-- Group profit before tax and adjusting items of $1.1m (2019: $4.1m)

-- Loss before tax after adjusting items of $0.63m (2019: profit $4.3m)

-- Given the current uncertainty, no dividend recommended for remainder of the year

Strategic & operational highlights

-- Results impacted by difficult trading environment

o Challenging market conditions compounded by the significant

disruption caused by the Coronavirus pandemic in the second

half

o Decisive action taken to reduce costs and keep the workforce

and technical competencies together so that the Group can react

quickly as markets improve

-- Group de-risked

o Receipt of surplus from the successful pension scheme buy out

and the sale of the Gamet business and property, has stabilised

Group debt levels

o Rationalisation of UK Machine Tool division has reduced

operational risk and future capital expenditure requirements

o Move into higher specification work through the acquisition of

Control Micro Systems supports gross margin, advances capabilities

and brings reduced cyclical customers into the Group

-- Group restructure

o Decision taken to expand and enhance operations in the US with

new office in Orlando, Florida

o As a result, certain management functions will relocate to

Orlando during the course of 2021 but the Group will remain London

listed

o Synergies between laser businesses in Ohio and Florida will be

realised throughout 2021

o Group CFO, Neil Carrick, has decided that for personal reasons

he will be unable to relocate to Orlando and will leave 600 Group

at the end of the next AGM

o New CFO appointed with effect from conclusion of AGM

-- Macro-economic uncertainty continues but positive long-term fundamentals

o Whilst there continues to be reduced activity, orders have

returned to acceptable levels

o Continue to focus on operational efficiencies and increased

operational flexibility

o Opportunities to grow and enhance customer offering through

investment in new, higher end product capabilities and

diversification into new markets

Paul Dupee, Executive Chairman of the Group, commented:

"The Group made significant strides forward in the first half of

the year, eliminating the Group's UK final salary pension scheme,

significantly de-risking the Group's balance sheet, opening of the

new European Technology Centre and acquiring Control Micro Systems,

a highly complementary business to the Group's existing laser

division, which brings ever more sophisticated, value-added and

custom solutions in the use of industrial lasers.

"We have taken the decision to expand our growth in Orlando,

Florida. Orlando leads the US in photonics technology and we see

exciting opportunities in the region. As a result of the Group's

relocation of certain functions, Neil Carrick has decided to leave

the business. I would like to personally thank him for all his hard

work and great contribution during his time with 600 Group. I am

pleased to announce that G.Mitchell (Mitch) Krasny, CPA, will

succeed Neil. Mitch brings with him a great wealth of financial and

operational experience.

" I would like to thank all our employees for their ongoing

support, commitment and dedication to the Group during these

difficult times. Their adaptability has helped us to respond

quickly and mitigate the impact.

"Despite the short-term end-market weaknesses and macroeconomic

uncertainty, the Board continues to believe in the long-term

fundamentals of the Group; in brand promotion, investment in new,

higher end product capabilities and diversification into new

markets and selective acquisitions. We have taken decisive action

to ensure that as market conditions improve, we can react

quickly."

Enquiries:

The 600 Group PLC Tel: 01924 415000

Paul Dupee, Executive Chairman

Instinctif Partners Tel: 0207 457 2020

Mark Garraway

Rosie Driscoll

Spark Advisory Partners Limited Tel: 020 3368 3553

(NOMAD)

Matt Davis

WH Ireland (Broker) Tel: 020 7220 1666

Harry Ansell

Chairman's statement

Overview

The Group made significant strides forward in the first half of

the FY20 year, eliminating the Group's UK final salary pension

scheme, significantly de-risking the Group's balance sheet, opening

the European Technology Centre in May 2019 as the new home of the

re-launched Colchester Machine Tool Solutions and in June 2019

acquiring Control Micro Systems (CMS), a business highly

complementary to the Group's existing laser division and bringing

ever more sophisticated, value-added and custom solutions in the

use of industrial lasers.

The second half of the year has, unfortunately, been dominated

by the downturn in economic conditions, led by the global slowdown

in the auto industry, concerns over a trade war between the USA and

China and the significant worldwide disruption from the Coronavirus

pandemic.

Divisional overview

The benefits of the rationalisation of the UK Machine Tool

division resulted in much improved performance for the year with

revenues up 14% and increased operating margins. The final phase of

this process was completed in the second half of the year with the

sale of the Gamet bearings business and its associated freehold

property. This rationalisation has also reduced operational risk

and future capital expenditure requirements. The US Machine Tool

business, however, suffered in an industry wide slowdown of some

12% and in addition with the Coronavirus pandemic affecting all

areas in the last few months of the financial year, the Machine

Tool division overall was unable to match the performance of the

prior year.

The Industrial Laser division for the first time in over a

decade encountered a contracting market place with global laser

sales falling in the region of 12% and increased competition and

price deflation in the standard laser sector of the industry. The

acquisition of CMS helped revenue from June onwards and the

existing TYKMA Electrox brand made significant moves into more

custom and higher specification work where its strengths in design

and proprietary software provide greater opportunities for growth

and enhanced margins. The acquisition of CMS has significantly

enhanced capabilities and brought reduced cyclical customers into

the Group. Whilst the move into higher specification work helped

maintain gross margins it could not compensate for the fall in

volumes in the standard product and the general market issues

created in the last few months of the period by the Coronavirus

pandemic. As a result, operating profit was lower than the prior

year.

Response to COVID-19

The Group has responded quickly to the Coronavirus pandemic

adopting short time and home working. To help mitigate the

financial effects, the Group has used government stimulus packages,

post March 2020, including loans under the USA Government Paycheck

Protection Program and the UK Coronavirus Large Business

Interruption Scheme (CLBILS). Some staff have been furloughed under

the UK Coronavirus Job Retention Scheme and many employees accepted

temporary salary reductions. The Board has taken action to reduce

overheads and deferred all non-critical capital expenditure.

The de-risking of the Group with the receipt of the surplus from

the successful pension scheme buy out and the sale of the Gamet

business and property has helped stabilise debt levels. Group debt

is currently at $13.8m, excluding lease liabilities but including

the government loan assistance, which is broadly in line with that

at the end of March 2020 and the Group is covenant compliant with

adequate banking facilities.

Given the current circumstances no dividend will be paid this

year.

Group restructure

The Board has taken the decision to expand and enhance growth

and oversight of the operations in the US by opening an office in

Orlando, Florida. Orlando leads the US in photonics technology.

Consequently, certain management functions will relocate there

during the course of 2021. The Group will also continue to realise

the synergies between the laser businesses in Ohio and Florida

throughout 2021. The Group will remain UK domiciled and listed in

London.

Neil Carrick, CFO, has decided that for personal reasons he will

be unable to relocate to Orlando and will leave 600 Group. Neil

joined the business in 2011 and has made a great contribution since

his arrival, particularly in overseeing the buyout of the UK

pension scheme and strengthening the Group's financial position. I

would like to personally thank him for all his hard work. He leaves

the business well-placed for the future.

I am pleased to announce that G. Mitchell (Mitch) Krasny, CPA,

formerly CFO of technology companies, Ucell and Kcell, subsidiaries

of Telia Company, Bulgaria Telecom, TV 3 Russia and CFO Eastern

Europe and Russia for Millicom and Metromedia International will

succeed Neil and be appointed a Director with effect from the end

of the next Annual General Meeting. Mitch brings over 35 years of

financial and operational experience in public and private

companies.

To ensure an orderly handover, Neil will stay with the business

and remain a Director until the conclusion of the next Annual

General Meeting, which is expected to be held no later than 31

December 2020.

People

Our people are central in continuing the improvement of our

business and their safety has been paramount in the recent months.

I would like to thank all our employees for their ongoing support,

commitment and dedication to The 600 Group during these difficult

times. I am hopeful that the sacrifices made will help us to keep

our teams together and come out of this well placed to reap the

benefits when markets return to some normality.

Outlook

Despite the short-term end-market weaknesses and macroeconomic

uncertainty created by the Coronavirus pandemic, the Board

continues to believe in the long-term fundamentals of the Group; in

brand promotion, investment in new, higher end product capabilities

and diversification into new markets and selective acquisitions.

Whilst there continues to be reduced activity, the level of order

backlog has returned to acceptable levels, given the circumstances,

compared to the previous year. The Board have taken decisive action

to reduce costs and to keep the workforce and technical

competencies together to ensure the Group can react quickly as

markets improve.

Paul Dupee

Executive Chairman

19 November 2020

Strategic report

Our businesses

The 600 Group PLC ("the Group") is a leading engineering group

with a world class reputation in the design, manufacture and

distribution of industrial laser systems and design and

distribution of machine tools and associated precision engineered

components. The Group operates from locations in North America,

Europe and Australia selling into more than 100 countries

worldwide.

Group businesses serve customers across a very broad range of

industry sectors, from medical, pharmaceutical and education

through to automotive, aerospace and defence equipment. A large

proportion of revenue is derived from sales via third party

distribution channels who support these industries locally.

The Group products are noted for their quality and reliability

and consequently the Group benefits from a high degree of loyalty

and repeat business. Given the large number of customers and

established distributors in many countries there are no major sales

concentrations of customers or products. In the year ended 28 March

2020 the top 20 customers, of which 15 were distributors,

contributed 26% (2019 - 27%) of revenues.

Revenues

Revenues are generated across many diverse geographical

territories:

Percentage of worldwide revenues 2020 2019

(by destination) % %

United States of America 66 65

United Kingdom 17 15

Europe (excluding UK) 7 10

Rest of the World 10 10

Total 100 100

Macroeconomic and industry trends

Industrial laser systems

Industry use of industrial lasers for material processing has

continued to expand worldwide. Laser systems have now become a

mainstream manufacturing process covering the areas of laser

machining, including cutting and drilling, marking, ablation and a

host of other niche applications. One of the main drivers of this

industry has been legislation and the continual increase in the

requirement for traceability of products in all industries from

aerospace and transport to medical and pharmaceutical.

The global industrial laser market is estimated to be in the

region of $5bn but given this is just the laser sources, the actual

market for systems incorporating these lasers and associated

equipment and software is estimated to be much larger in the region

of $15-$20bn. The industry had seen mid-single digit increases

until 2019 when a fall was recorded. Metal cutting is by far the

largest application by value and the market is dominated by China

which is the largest producer and consumer of industrial lasers.

The fall in the overall market in 2019 is estimated to be in the

region of 12% and largely driven by Chinese decline in cutting

systems which mirrors the decline in machine tools, both of which

are heavily influenced by Chinese demand.

The laser marking and micro-materials processing subset of the

market (in which the Group competes) is smaller than the

macro-materials processing subset and has seen low single digit

growth in recent years. Growth is underpinned by enhanced

performance in the speed, cost and quality of the systems being

implemented compared to other techniques as well as by legislative

changes driving a requirement for greater traceability. The

industry subset occupied by the Group has however seen a

proliferation of vendors and selling price pressure at the lower

commodity end of the market and whilst unit volumes have continued

to increase, revenue has been held back. It is for this reason the

Group has focused on the higher end custom products where its

strengths in design and proprietary software provide greater

opportunities to grow and enhance margin and where the acquisition

of CMS during the year has significantly enhanced these

capabilities.

The Coronavirus pandemic industry predictions for the laser

industry are similar to machine tools with a rapid decline followed

by recovery later in 2020 and a return to normal growth through

2021.

Machine tools and precision engineered components

The worldwide machine tool industry was estimated by Oxford

Economics at nearly $85bn in annual sales in its Spring 2020

report. The market continues to be driven by the investment

intentions of manufacturers and is sensitive to changes in the

economic and financial climate. Demand responds to economic trends

which typically lag the main cycle of the economy. 2019 had already

seen a global decline of 10% in machine tool consumption and the

industry has been severely affected by the Coronavirus pandemic,

with estimates of a fall of 28% in World machine tool consumption

in the calendar year 2020. However, growth is expected to return in

2021 with a predicted rebound of 33% improvement.

The global market is dominated by China with consumption of

$29bn but this is largely served domestically with China also being

the largest producer. The USA is the second largest consumer of

machine tools at $9.6bn followed by Germany at $7.8bn.

Our main markets

The main markets we operate in are the USA, Europe and

Australia. All these markets had already seen a degree of demand

weakness towards the end of 2019 led by Global automotive weakness

and the GM strike in the USA and then Boeing's decision to halt

production of its 737 MAX aircraft in January 2020. The Global

effects of the Coronavirus pandemic have impacted all areas in

which the Group operates and it remains to be seen if the predicted

pick up in 2021 becomes reality. In addition the possibility of

disruption remains due to the ongoing Brexit issues in the UK, and

concerns in the USA over tariffs and a trade war with China.

Activity in the 2019/20 financial year

Industrial laser systems

The existing TYKMA Electrox business continued to see increased

competition and price deflation in the lower end standard products

sector and although there was a significant increase in custom

higher specification sales and a further improvement in gross

margins, this was not sufficient to offset the effects of the

volume decline from the standard products. The standard product

business was also affected by the overall decline in the laser

market for the first time in over a decade with Europe and the Far

East sales being affected in particular by the decline in the

automotive sector. The US market weakened with trade war concerns

with China, the General Motors strike and latterly Boeing halting

aircraft production. The Coronavirus pandemic further compounded

these problems and affected the last few months of the financial

year and into the FY21 year.

The acquisition of Control Micro Systems Inc. (CMS) in June 2019

significantly enhanced the Laser Division's competencies in the

more sophisticated value-add custom solutions for customers. The

business brought vision and robotic capabilities and industry

leading positions in the high growth precision medical equipment

and pharmaceuticals markets. Whilst these industries are less

affected by the capital goods cycles the economic conditions and

effects of the Coronavirus pandemic slowed the pace of new projects

in this part of the business. The sales organisation has integrated

well with the existing business and engineering and software

capabilities are being shared to improve services and capabilities

for customers.

The UK spares and service operation and legacy Electrox business

was integrated into the new European Technology Centre machine

tools operation which now supports both the UK and Europe. A direct

sales operation was established in the UK based in this facility

which provides a permanent showroom to demonstrate the full range

of laser machines.

Results for the financial year were as follows:

2020 2019

$ 000 $ 000

Revenues 23,695 20,592

Underlying operating

profit 1,689 2,563

Underlying operating

margin 7.1% 12.4%

Underlying operating profit is before adjusting items, which are

explained in note 14 Alternative Performance Measurers and set out

in note 3.

Machine tools and precision engineered components

This division operates from sites in the UK, USA, and Australia

providing solutions for metal processing through the design and

development of machine tools sold under the brand names Colchester,

Harrison and Clausing and the design and supply of precision

engineering components under the brand name Pratt Burnerd. There

are also spares, accessories and service operations which support

the significant number of machines sold over the Group's long

history of supplying quality equipment. Sales are made worldwide,

with a mix of direct sales and distribution in North America,

Europe, and Australia and a network of distributors in all other

key end-user markets.

The machine tools division's overall revenue was down on the

prior year by 2.4%, but this was against the backdrop of a Global

industry fall of over 10% in the year to December 2019 and the

beginning of the Coronavirus pandemic shutdowns in the last few

months of the financial year. Consequently, operating margins

reduced to 7.4% from the prior year's 8.1%.

The UK operation performed very well in its first full year of

business as the re-launched "Colchester Machine Tool Solutions"

from the new site in West Yorkshire. The new European Technology

Centre integrates a modern, open plan office environment, enhanced

manufacturing and warehousing space as well as serving as a

dedicated year-round product showroom, demonstration and customer

training capability to showcase the business' increasingly

innovative product range.

Revenue was up 14% and operating margins improved again from

6.7% to 7.9%. The business had a good order book at the start of

2020 as a result of increased direct sales in the UK which allowed

it to continue to operate fairly normally until the end of April

when the business then took advantage of Government assistance and

furloughed a number of employees as orders reduced with many

customers shutting down or restricting site access.

The move of premises was part of the restructuring of the UK

operation which saw a de-risking of operations and reduction in the

requirement for ongoing capital expenditure by the outsourcing of

further manufacturing. The process was completed towards the end of

the year with the sale of the Gamet Bearings operation and its

associated property based in Colchester. The revenue and trading

results of this operation have been excluded from the ongoing

trading and disclosed as a discontinued operation in the

Consolidated Income Statement. The assets held for sale were

separately disclosed at their expected fair value in the Statement

of Financial Position at 30 March 2019.

The US machine tool business struggled in a weak market place

affected by concerns over tariffs and a trade war with China, the

General Motors strike late in 2019 and the Boeing delay to

production of its 737 MAX aircraft in January 2020. As a result of

COVID shutdowns in the USA, orders started to reduce towards the

end of the FY20 financial year and action has been taken to reduce

costs and take advantage of Government schemes. As a result of the

near 10% fall in revenues in FY20, operating margins reduced to

8.1% from the previous year's 9.3%.

The Australian machine tools business also struggled in an Asian

market that bore the brunt of the Global machine tool contraction

in addition to difficult economic conditions within Australia.

Consequently, a small operating loss was generated for the year.

The business is restructuring following a number of retirements and

will aim to leverage the Colchester Machine Tool Solutions

rebranding in areas where the brand name remains well known.

The financial results of these activities were as follows:

2020 2019

$ 000 $ 000

Revenues 43,511 44,575

Underlying operating

profit 3,216 3,610

Underlying operating

margin 7.4% 8.1%

Group Results

Revenue from continuing operations increased by 3.1% to $67.2m

(2019: $65.2m) and Group profit before tax and adjusting items was

$1.1m (2019: $4.1m). The loss before tax after adjusting items was

$0.63m (2019: profit $4.3m).

Changes in accounting standards

The Group has adopted the new leasing accounting standard in the

year, IFRS 16, which has required all former operating leases to

now be recognised on the balance sheet as right of use assets and a

corresponding liability created for the future payments. The new

standard has been adopted from 31 March 2019 under the modified

retrospective approach and therefore comparative figures have not

been restated. The rental payments for these leases are no longer

reported in the Consolidated Income Statement and are replaced by

depreciation of the right of use asset and an interest charge on

the lease liabilities. Full details of the effects of this change

can be found in note 11.

Adjusting items

The directors have highlighted transactions which are material

and unrelated to the normal trading activity of the Group.

In the opinion of the directors the disclosure of these entries

should be reported separately for a better understanding of the

underlying trading performance of the Group. These underlying

figures are used by the Board to monitor business performance, form

the basis of bonus incentives and are used for the purposes of the

bank covenants.

These non-GAAP measures are explained in note 14 alternative

performance measures and set out in note 3. All adjusting items are

taken into account in the GAAP figures in the Income Statement.

The buy-out of the Group pension scheme was completed in April

2019 and a profit of $0.8m has been recorded in the Income

Statement as the final cash refund of surplus of $5.2m, net of tax,

was higher than originally expected.

As a result of the outsourcing of manufacturing in the UK, the

existing premises were vacated and a sublet was in the process of

being completed when the premises flooded in February 2020. Given

this issue and the uncertainty over economic conditions as a result

of the Coronavirus pandemic it is not known if a sub-let can now be

achieved and consequently the right of use asset has been impaired

resulting in a further charge in the year of $0.4m. A further

provision has been recognised in the year relating to the

unavoidable costs associated with the ongoing lease, resulting in a

charge of $0.4m.

Acquisition costs on CMS and abortive costs on a further two

acquisitions in the year were $0.7m and costs in relation to duty

and tariff misdeclarations between 2016 and 2019 which were

discovered in TYKMA were $0.3m. Amortisation of the intangible

assets acquired through the CMS deal of $0.3m is also included in

adjusting items.

In the prior year before the buy-out of the Group pension scheme

was completed the trustees undertook a number of exercises to

reduce the liabilities of the scheme which had an actuarial cost of

$1.28m. Given these had a beneficial effect on the ultimate buy-out

cost of the scheme they were supported by the Group. This amount

was shown in adjusting items within operating profit in the prior

year.

In the prior year a credit of $1.26m was recorded in financial

income in respect of the final salary pension scheme. No cash was

paid to or received from the scheme in respect of this transaction

which arose as a pension accounting entry under the required

standard due to the surplus in the scheme recorded in the balance

sheet.

In the prior year the carrying value of the amortised cost of

the loan notes was re-assessed and a net credit of $0.82m arose in

financial income as a result of the extension of these instruments

by a further two years. The current year includes amortisation cost

of $0.5m as an adjusting item in financial expense.

An amount of $0.5m (2019 $0.96m) has been recorded to reduce the

value of the Gamet assets sold in line with proceeds of sale.

Taxation

As a result of adjustments to deferred taxes and taxable losses

in the current year there is a credit for taxation of $1.2m (2019

charge of $0.07m) on pre adjusting items profit.

The UK businesses continue to benefit from substantial previous

tax losses and no taxation is payable in the UK. There are

substantial unrecorded deferred tax assets in the UK that are

released onto the balance sheet as existing recorded losses are

utilised which will help maintain a lower tax charge. There remains

an unrecognised deferred tax asset of over $2m in addition to the

recognised asset of $2m in respect of UK tax losses at the year

end. The US businesses are subject to Federal taxation on their

profits at the rate of 21% but also suffer State taxes which

increases their overall composite rate to 25%.

Net profit and earnings per share

The total continuing amount attributable to equity holders of

the parent for the current financial year amounted to a profit of

$0.6m (2019: $4.2m profit) with pre-adjusting items profit of $2.3m

(2019: $4m). The total loss including the effects of the Gamet

discontinued operation is $0.4m (2019: profit $3.1m).

Underlying basic earnings from continuing operations before

adjusting items and related taxation were 1.97 cents (equivalent to

1.55p) per share (2019: 3.53 cents, equivalent to 2.69p) and basic

earnings per share were a profit of 0.51 cents (equivalent to

0.40p) (2019: 3.75 cents profit, equivalent to 2.88p) see note

7.

Financial position and utilisation of resources

Cash flow

Cash generated from operations before working capital movements

was $3.1m (2019: $4.8m).

Working capital remains under control and stock levels were

unchanged from the prior year despite the acquisition of CMS during

the year. Trade receivables and payables decrease reflects the

deterioration in trading conditions in the last quarter of the year

which was exacerbated by the start of the Coronavirus pandemic.

Interest paid (excluding the effect of lease accounting) reduced

slightly to $1.1m (2019: $1.2m) although the largest component of

this is fixed, being the interest on the GBP8.5m ($9.6m) 8% loan

notes.

Capital expenditure consisted of the final stages of development

work on the upgrading of the industrial laser division proprietary

software of $0.4m, demonstration and showroom equipment for the

laser business of $0.1m, and machine shop equipment and fixtures to

finalise the new European Technology Centre in the UK for $0.3m.

The development and fit out expenditure will not repeat and the

sale of the Gamet business and outsourcing of manufacturing has

significantly reduced future capital expenditure requirements.

The business and asset sale of the discontinued Gamet Bearings

operation was concluded in October 2019 with the receipt of $0.45m

and the Colchester property sale completed in February 2020 with a

further $0.5m of proceeds received.

The $10m consideration for CMS was funded by $4m of the $5.2m of

pension scheme refund along with the utilisation of existing credit

lines and a new $3.25m 5-year term loan from Bank of America plus

the issue of $1m of shares to the CMS founder, Tim Miller, who

remains with the business.

Dividends of $1.1m were paid during the year (2019: $1.1m).

Net borrowings

Group net debt at 28 March 2020 excluding lease liabilities is

largely unchanged on the prior year at $14.2m (2019 $14.5m)and

comprised net bank indebtedness of $4.8m (2019: $5m) and the

discounted amount outstanding on the loan notes of $9.4m (2019:

$9.5m). The loan notes are shown net of un-amortised discounting

and costs and also amounts disclosed in equity reserve which amount

to $0.2m in the current financial year (2019: $0.2m).

Working capital facilities totaling $10.6m were renewed with

HSBC and Bank of America during the year and are due to be reviewed

in the normal course over the next few months and are expected to

be continued on the same basis. An additional term loan of $3.25m

was taken out to help fund the acquisition of CMS in June 2019. The

mortgage on the Gamet building of $0.3m was repaid on the sale of

the property in February 2020. The Group maintains a mixture of

term loans and revolving working capital facilities with maturities

between 1 and 4 years. Headroom on bank facilities was $8.7m at the

year-end (2019: $8.7m) and all financial covenants in place were

met during the year.

Subsequent to the year end the Group has taken advantage of

Government schemes and has received $2.2m of loans across our three

USA businesses under the Paycheck Protection Program. These loans

may be forgiven dependent on expenditure on certain items and

employment numbers with any amount not forgiven repayable as a 2

year loan at 1% interest rate. The UK machine tools business

received a $1.5m loan under the Coronavirus Large Business

Interruption Loan Scheme with a 3 year bullet repayment in

September 2023 and 1.92% interest.

The GBP8.5m ($9.6m) 8% loan notes maturity was extended to

February 2022 at the end of February 2019 and the warrants of equal

value to subscribe for new ordinary shares at 20p were similarly

extended to the same date.

Gearing (excluding lease accounting) amounted to 50% of

aggregate net assets (2019: 49%).

Going concern

The Group's business activities, together with the factors

likely to affect its future development, performance and position

are set out in the Chairman's Statement on pages 1 to 2 and the

Strategic Report on pages 3 to 9.

The financial position of the Group, liquidity, cash flows and

borrowing facilities are described in the Strategic Report. Note 26

to the Financial Statements also sets out the Group's objectives,

policies and processes for measuring and managing its capital and

financial risk management. Details of its financial instruments,

exposure to foreign exchange, credit and interest rate risk is also

covered in note 26. Further details on the Group's cash and bank

borrowings are included in notes 18,19 and 25 of the financial

statements.

The UK bank facilities with HSBC have no specific financial

covenants. Trade loans and invoice financing need to be backed by

the assets they are funding. There are no covenants in respect of

the new Coronavirus Large Business Interruption Loan scheme

(CLBILS) taken out in August 2020.The borrowings with Bank of

America are subject to adjusted EBITDA to a fixed charge and to

senior debt and an overall asset cover test. The short term trade

and credit facilities are due to be reviewed over the coming months

and are expected to continue in the ordinary course of business on

the same terms.

The Director's believe that the Group is well placed to manage

its business risks and, after making enquiries including a review

of forecasts and assumptions, which take account of reasonably

possible changes in trading activity and considering the existing

banking facilities, including discussion with the Bank of America

on the possibility of covenant adjustments should this be required,

have a reasonable expectation that the Group has adequate resources

to continue in operational existence for the next 12 months

following the date of approval of the financial statements.

The continuing uncertainty of the impact of the Covid-19

pandemic on the Group has been considered as part of the Group's

adoption of the going concern basis. Whilst all facilities remain

open there are reduced working hours and staffing levels in place

in certain areas. Operating costs have been reduced, government

employment assistance schemes and government loans have been

utilised where available.

As part of their assessment the Directors have considered

downside scenarios that reflect the current unprecedented

uncertainty in the worldwide markets the Group operates in and

which are considered to be severe but plausible. Revenue deductions

of 25% against the 2020 financial year and 30% against the pre

pandemic 2019 year have been considered against which mitigating

actions of headcount reduction, utilisation of government

assistance, pay reductions and cash preservation actions including

reductions in capital expenditure and deferral of taxation have

been applied.

The results of these scenarios show that there is sufficient

liquidity in the businesses for a period of at least 12 months from

the date of approval of these financial statements. Lenders remain

supportive and have indicated a willingness to assist with covenant

changes in the event that flexibility may be required in the short

term.

In the most severe case where revenue falls are greater than 30%

and lenders elect not to provide covenant flexibility, and trigger

a repayment of outstanding debt, then without further mitigating

actions or additional funding the Group maybe unable to realise

assets and discharge liabilities in the normal course of

business.

Having undertaken this work, the Directors are of the opinion

that the Company and the Group have adequate resources to continue

in operational existence for the foreseeable future. Accordingly

they continue to adopt the going concern basis in preparing the

consolidated financial statements.

Retirement benefits

The UK pension scheme buy-out was completed in late April 2019

and the remaining surplus in the scheme of $8.3m repaid to the

Group after deduction of 35% tax with the Group receiving the net

$5.2m at the end of May 2019. As a result of the accounting surplus

on the UK scheme at 30 March 2019 being $7.5m, a profit on disposal

of the pension scheme of $0.8m is recorded in the consolidated

income statement in adjusting items and associated taxation of

$0.3m is recognised through other comprehensive income.

The US retiree health scheme and pension fund deficits increased

slightly to $1.3m (2019: $1.2m).

Key performance indicators (KPI's)

The Group monitors performance against key financial objectives

that the Directors judge to be effective in measuring the delivery

of strategic aims and managing and controlling the business. These

focus at Group level on revenue and underlying operating

profit.

At individual business unit level, KPI's also include working

capital control, and customer related performance measures such as

on-time delivery and minimisation of warranty concerns.

These key performance indicators are measured and reviewed

against budget projections and prior year on a regular basis and

this enables the business to set and communicate its performance

targets and monitor its performance against these targets. Revenue

targets are to outperform the market forecasts by 1% (3% market

forecast for 2020) and achieve a 10% underlying operating margin

target.

The Group's recent performance on these financial KPI's is set

out as follows:

KPI 2020 2019

Revenue (annual

growth rate) 3.1% 1.9%

Underlying operating

margin (% of revenue) 4.1% 8.1%

All figures are pre adjusting items

These KPI's are used to assess performance and manage the

business and have been discussed in the strategic report and

divisional commentary on pages 3 to 5.

Principal risks

The Board of Directors has identified the main categories of

business risk in relation to the implementation of the Group's

strategic aims and objectives, and has considered reasonable steps

to prevent, mitigate or manage these risks.

Macro-economic - the Group's businesses are active in markets

which can be cyclical in nature as the overall level of market

demand is dependent upon capital investment intentions. Economic or

financial market conditions determine global demand and could

adversely affect our customers, distributors, operations,

suppliers, and other parties with whom we transact. Such factors as

the ongoing Brexit issues and the concerns over a trade war between

the USA and China and the Coronavirus pandemic during the financial

year are examples of factors which have resulted in changes in

demand. The Directors seek to ensure that overall risk is mitigated

by avoiding excessive concentration of exposure to any given

geographical or industry segment, or to any individual customer.

Market conditions, lead indicators and industry forecasts are

monitored for any early warning signs of changes in overall market

demand, and measures to exploit opportunities or manage elevated

risks are taken as appropriate. Key business risks are set out in

the strategic review.

Production and supply chain - the continuity of the Group's

business activities is dependent upon the cost-effective supply of

products for sale from our own facilities, and those of our key

vendors. Supply can be disrupted by a variety of factors including

raw material shortages, labour disputes and unplanned machine down

time. Delays in the shipment of goods as a result of Brexit may

affect lead times and create some disruption. In particular, the

Directors are mindful that a small number of key manufacturing

outsource partners are located in relatively close proximity to

each other in Taiwan.

Taiwan is ranked by Gardner Research as the eighth largest

producer nation of machine tools, with global production valued at

almost US $2.1 billion. Taiwanese suppliers represent approximately

one third of the total cost of sales for the Group. Group

businesses mitigate such risk by carefully selecting high quality

vendors and maintaining long term constructive and open

relationships. The effectiveness of such mitigation would be

limited, however, in certain catastrophic circumstances (for

example, extreme weather or seismic activity in the vicinity),

against which the Group carries appropriate insurance.

Additionally, supply sources in India have been developed as a

consequence and an increasing amount of product is now made in the

USA as well.

Laws and regulations - Group businesses may unknowingly fail to

comply with all relevant laws and regulations in the countries in

which they operate and contract business. There is a risk of breach

of legal, safety, environmental or ethical standards which can be

more difficult to identify, comprehend, or monitor in certain

territories than others. The Directors believe that they have taken

all reasonable steps to ensure that operations are conducted to

high ethical, environmental and health and safety standards.

Controls are in place to keep regulatory and other requirements

under careful review, and scrutinise any identified instances of

elevated risk.

Information Technology ("IT") - Group IT systems and the

information they contain are subject to security risks including

the unexpected loss of continuity from virus or other issues, and

the deliberate breach of security controls for commercial gain or

mischief. Any such occurrences could have a significant detrimental

effect on the Group's business activities. These risks are

mitigated by the utilisation of physical and embedded security

systems, regular back-ups and comprehensive disaster recovery

plans.

Market risks

The Group's main exposure to market risk arises from increases

in input costs in so far as it is unable to pass them on to

customers through price increases. The Group does not undertake any

hedging activity in this area and all materials and utilities are

purchased in spot markets. The Group seeks to mitigate increases in

input costs through a combination of continuous improvement

activities to minimise increases in input costs and passing cost

increases on to customers, where this is commercially viable.

The Group is also aware of market risk in relation to the

dependence upon a relatively small number of key vendors in its

supply chain. This risk could manifest in the event of a commercial

or natural event leading to reduced or curtailed supply. The Group

seeks to mitigate these risks by maintaining transparent and

constructive relationships with key vendors, sharing long term

plans and forecasts, and encouraging effective disaster recovery

planning. Alternative sources of supply in different geographic

regions have also been put in place.

Other risks and uncertainties

Pension funding risk was a significant risk to the Group, but

this has largely been eliminated by the buy-out of the UK final

salary scheme. There remains a small closed pension arrangement in

the USA and a requirement to provide health insurance cover to a

limited extent to a number of retired people in the USA. The

Directors regularly review the performance of the pension scheme

and any recovery plan. Proactive steps are taken to identify and

implement cost effective activities to mitigate the pension scheme

liabilities and insurance premium of the retiree health scheme.

The remaining main risks faced by the Group are to its

reputation as a consequence of a significant failure to comply with

accepted standards of ethical and environmental behaviour.

The Directors have taken steps to ensure that all of the Group's

global operations are conducted to the highest ethical and

environmental standards. Regulatory requirements are kept under

review, and key suppliers are vetted in order to minimise the risk

of the Group being associated with a company that commits a

significant breach of applicable regulations.

Neil Carrick

Finance Director

19 November 2020

Consolidated income statement

For the 52-week period ended 28 March 2020

Before After Before After

Adjusting Adjusting Adjusting Adjusting Adjusting Adjusting

Items Items Items Items Items Items

52 weeks 52 weeks 52 weeks 52 weeks 52 weeks 52 weeks

ended ended ended ended ended ended

28 March 28 March 28 March 30 March 30 March 30 March

2020 2020 2020 2019 2019 2019

Notes $000 $000 $000 $000 $000 $000

------------------------------------ ----- --------- --------- --------- --------- --------- ---------

Continuing

Revenue 2 67,206 - 67,206 65,167 - 65,167

Cost of sales (43,491) (254) (43,745) (41,641) - (41,641)

------------------------------------ ----- --------- --------- --------- --------- --------- ---------

Gross profit 23,715 (254) 23,461 23,526 - 23,526

Net operating expenses (20,988) (1,742) (22,730) (18,269) (1,786) (20,055)

Profit on disposal of pension

scheme - 809 809 - - -

------------------------------------ -----

Operating profit/(loss) 2,727 (1,187) 1,540 5,257 (1,786) 3,471

Financial income 4 5 22 27 35 2,077 2,112

Financial expense 4 (1,664) (536) (2,200) (1,236) - (1,236)

Profit/(loss) before tax 1,068 (1,701) (633) 4,056 291 4,347

Income tax (charge)/credit 5 1,228 - 1,228 (66) (48) (114)

------------------------------------ ----- --------- --------- --------- --------- --------- ---------

Profit for the period on continuing

activities 2,296 (1,701) 595 3,990 243 4,233

attributable to equity holders

of the parent

Loss on discontinued operations (417) (543) (960) (146) (961) (1,107)

------------------------------------ ----- --------- --------- --------- --------- --------- ---------

Profit/(loss) for the period

attributable to the equity

holders of the parent 1,879 (2,244) (365) 3,844 (718) 3,126

Basic earnings per share -

continuing activities 7 1.97c 0.51c 3.53c 3.75c

Diluted earnings per share

- continuing activities 7 1.92c 0.50c 3.50c 3.71c

Basic earnings per share 7 1.61c (0.31c) 3.40c 2.77c

Diluted earnings per share 7 1.57c (0.31c) 3.37c 2.74c

Company Number 00196730

As explained in note 3, the directors have highlighted adjusting

items which are material and unrelated to the normal trading

activity of the group. The "before adjusting items" column in the

consolidated income statement shows non-GAAP measures. The "after

adjusting items" column shows the GAAP measures.

The Group has initially applied IFRS16 using the modified

retrospective method. Under this method, the comparative

information is not restated. See note 11.

Consolidated statement of comprehensive income

For the 52-week period ended 28 March 2020

52-week 52-week

period period

ended ended

28 March 30 March

2020 2019

Notes $000 $000

------------------------------------------------------------ --------- ---------

(Loss)/profit for the period (365) 3,126

Other comprehensive income/(expense)

Items that will not be reclassified to the Income

Statement:

Remeasurement of defined benefit asset (36) (43,083)

Property revaluation 199 -

Deferred taxation (282) 15,071

------------------------------------------------------------- --------- ---------

Total items that will not be reclassified to

the Income Statement: (119) (28,012)

------------------------------------------------------------- --------- ---------

Items that are or may in the future be reclassified

to the Income Statement:

Foreign exchange translation differences (606) (3,005)

Total items that are or may in the future be

reclassified to the Income Statement: (606) (3,005)

------------------------------------------------------------- --------- ---------

Other comprehensive expense for the period,

net of income tax (725) (31,017)

Total comprehensive expense for the period (1,090) (27,891)

------------------------------------------------------------- --------- ---------

Attributable to:

Equity holders of the Parent Company (1,090) (27,891)

------------------------------------------------------------- --------- ---------

Consolidated statement of financial position

As at 28 March 2020

As at As at

28 March 2020 30 March

2019

Notes $000 $000

----------------------------------- ----- ------------- --------

Non-current assets

Property, plant and equipment 4,060 3,435

Goodwill 13,174 10,329

Other Intangible assets 3,868 1,110

Right of use assets 11 9,060 -

Deferred tax assets 4,415 4,578

34,577 19,452

----------------------------------- ----- ------------- --------

Current assets

Inventories 19,054 19,030

Trade and other receivables 8 8,084 9,163

Employee Benefits - 7,459

Taxation 8 222 294

Deferred tax assets 1,148 -

Assets classified as held for sale - 1,108

Cash and cash equivalents 2,878 948

----------------------------------- ----- --------

31,386 38,002

----------------------------------- ----- ------------- --------

Total assets 65,963 57,454

----------------------------------- ----- ------------- --------

Non-current liabilities

Employee benefits (1,261) (1,239)

Loans and other borrowings (11,654) (10,173)

Lease liabilities 11 (8,344) -

(21,259) (11,412)

----------------------------------- ----- ------------- --------

Current liabilities

----------------------------------- ----- ------------- --------

Trade and other payables 9 (8,298) (8,095)

Lease liabilities 11 (1,608) -

Deferred tax liabilities (236) (2,541)

Provisions 10 (590) (447)

Loans and other borrowings (5,414) (5,316)

(16,146) (16,399)

----------------------------------- ----- ------------- --------

Total liabilities (37,405) (27,811)

----------------------------------- ----- ------------- --------

Net assets 28,558 29,643

----------------------------------- ----- ------------- --------

Shareholders' equity

Called-up share capital 1,803 1,746

Share premium account 3,828 2,885

Revaluation reserve 1,348 1,149

Equity reserve 201 201

Translation reserve (7,130) (6,524)

Retained earnings 28,508 30,186

----------------------------------- ----- ------------- --------

Total equity 28,558 29,643

----------------------------------- ----- ------------- --------

Consolidated statement of changes in equity

As at 28 March 2020

Ordinary Share

share premium Revaluation Translation Equity Retained

capital account reserve reserve reserve Earnings Total

$000 $000 $000 $000 $000 $000 $000

----------------------------------- -------- ------- ----------- ----------- ------- -------- --------

At 31 March 2018 1,746 2,885 1,149 (3,519) 201 56,131 58,593

----------------------------------- -------- ------- ----------- ----------- ------- -------- --------

Profit for the period - - - - - 3,126 3,126

Other comprehensive income:

Foreign currency translation - - - (3,005) - - (3,005)

Net defined benefit asset movement - - - - - (43,083) (43,083)

Deferred tax - - - - - 15,071 15,071

Total comprehensive income - - - (3,005) - (24,886) (27,891)

----------------------------------- -------- ------- ----------- ----------- ------- -------- --------

Transactions with owners:

Dividend - - - - - (1,104) (1,104)

Credit for share-based payments - - - - - 45 45

----------------------------------- -------- ------- ----------- ----------- ------- -------- --------

Total transactions with owners - - - - - (1,059) (1,059)

----------------------------------- -------- ------- ----------- ----------- ------- -------- --------

At 30 March 2019 1,746 2,885 1,149 (6,524) 201 30,186 29,643

----------------------------------- -------- ------- ----------- ----------- ------- -------- --------

Loss for the period - - - - - (365) (365)

Other comprehensive income:

Foreign currency translation - - - (606) - - (606)

Property revaluation - - 199 - - - 199

Net defined benefit movement - - - - - (36) (36)

Deferred tax - - - - - (282) (282)

Total comprehensive income - - 199 (606) - (683) (1,090)

----------------------------------- -------- ------- ----------- ----------- ------- -------- --------

Transactions with owners:

Share capital subscribed for 57 943 - - - - 1,000

Dividend - - - - - (1,088) (1,088)

Credit for share-based payments - - - - - 93 93

Total transactions with owners 57 943 - - - (995) 5

----------------------------------- -------- ------- ----------- ----------- ------- -------- --------

At 28 March 2020 1,803 3,828 1,348 (7,130) 201 28,508 28,558

----------------------------------- -------- ------- ----------- ----------- ------- -------- --------

Consolidated cash flow statement

As at 28 March 2020

52-week 52-week

period ended period ended

28 March 2020 30 March 2019

Notes $000 $000

---------------------------------------------------- ----- ------------- --------------------

Cash flows from operating activities

(Loss)/profit for the period (365) 3,126

Adjustments for:

Amortisation 325 73

Depreciation 651 540

Depreciation of right of use assets 1,254 -

Net financial expense/(income) 4 2,173 (876)

Non-cash adjusting items 879 2,238

Loss/(profit) on disposal of property, plant

and equipment 32 (461)

Loss on assets held for resale 127 -

Profit on disposal of pension fund (809) -

Equity share option expense 93 45

Income tax (credit)/expense 5 (1,228) 114

---------------------------------------------------- ----- ------------- --------------------

Operating cash flow before changes in working

capital and provisions 3,132 4,799

Decrease/(increase) in trade and other receivables 2,587 (451)

Decrease/(increase) in inventories 67 (730)

Decrease in trade and other payables (973) (352)

Employee benefits contributions (78) (13)

Proceeds from Pension fund disposal 5,213 -

Cash generated by operations 9,948 3,253

Interest paid (1,141) (1,236)

Lease interest (375) -

Income tax received/(paid) - (125)

---------------------------------------------------- ----- ------------- --------------------

Net cash flows from operating activities 8,432 1,892

---------------------------------------------------- ----- ------------- --------------------

Cash flows used in investing activities

Interest received 5 1

Proceeds from sale of property, plant and

equipment 57 514

Proceeds from assets held for sale 926 -

Payment for acquisition of subsidiary, net

of cash acquired 15 (6,072) -

Purchase of property, plant and equipment (649) (1,245)

Development and IT software expenditure capitalised (351) (1,399)

Proceeds from sale of development expenditure - 639

Net cash flows used in investing activities (6,084) (1,490)

---------------------------------------------------- ----- ------------- --------------------

Cash flows used in financing activities

Dividends paid 6 (1,088) (1,104)

Proceeds from external borrowing 1,928 2

Lease payments (1,212) -

Net finance (expenditure)/income - 59

---------------------------------------------------- ----- ------------- --------------------

Net cash flows used in financing activities (372) (1,043)

---------------------------------------------------- ----- ------------- --------------------

Net increase/(decrease) in cash and cash

equivalents 12 1,976 (641)

Cash and cash equivalents at the beginning

of the period 948 1,676

Effect of exchange rate fluctuations on cash

held (46) (87)

---------------------------------------------------- ----- ------------- --------------------

Cash and cash equivalents at the end of the

period 2,878 948

---------------------------------------------------- ----- ------------- --------------------

Notes

1.Basis of preparation

The consolidated financial statements of the Group have been

prepared in accordance with the International Financial Reporting

Standards (IFRS) issued by the International Accounting Standards

Board (IASB), as adopted for use by the European Union (EU)

effective at 28 March 2020, and with those parts of the Companies

Act 2006 applicable to companies reporting under IFRS.

The Financial information set out in this preliminary

announcement does not constitute the company's Consolidated

Financial Statements for the financial years ended 28 March 2020 or

30 March 2019 but is derived from those Financial Statements.

Statutory Financial Statements for 2019 have been delivered to the

Registrar of Companies and those for 2020 will be delivered

following the company's AGM.

The Auditors, BDO LLP, have reported on those financial

statements. Their reports were unqualified, did not draw attention

to any matters by way of emphasis without qualifying their reports

and did not contain statements under Section 498(2) or (3) of the

Companies Act 2006.

The Statutory accounts are available on the Company's website

and will be posted to shareholders who have requested a copy and

thereafter by request to the company's registered office.

2. Segment information

IFRS 8 - "Operating Segments" requires operating segments to be

identified on the basis of internal reporting about components of

the Group that are regularly reviewed by the chief operating

decision maker to allocate resources to the segments and to assess

their performance. The chief operating decision maker has been

identified as the Executive Directors. The Executive Directors

review the Group's internal reporting in order to assess

performance and allocate resources.

The Executive Directors consider there to be two continuing

operating segments being machine tools and precision engineered

components and industrial laser systems.

The Executive Directors assess the performance of the operating

segments based on a measure of underlying operating profit/(loss).

This measurement basis excludes the effects of adjusting items from

the operating segments. "Head Office and unallocated" represent

central functions and costs.

The following is an analysis of the Group's revenue and results

by reportable segment:

Continuing

------------------------------------------------------

Machine

52 Weeks ended 28 March tools

2020 & precision

engineered Industrial Head Office

components laser systems & unallocated Total Discontinued

Segmental analysis of revenue $000 $000 $000 $000 $000 Group Total

-------------------------------- ------------ -------------- -------------- -------- ------------ -----------

Total revenue 43,511 23,695 - 67,206 830 68,036

-------------------------------- ------------ -------------- -------------- -------- ------------ -----------

o

Segmental analysis of operating

profit/(loss) before Adjusting

Items 3,216 1,689 (2,178) 2,727 (417) 2,310

-------------------------------- ------------ -------------- -------------- -------- ------------ -----------

Adjusting Items - (254) (933) (1,187) (543) (1,730)

-------------------------------- ------------ -------------- -------------- -------- ------------ -----------

Group operating profit/(loss) 3,216 1,435 (3,111) 1,540 (960) 580

-------------------------------- ------------ -------------- -------------- -------- ------------ -----------

o

Other segmental information:

Reportable segment assets 35,073 14,164 16,726 65,963 - 65,963

Reportable segment liabilities (18,085) (6,990) (12,330) (37,405) - (37,405)

Fixed asset additions 368 330 302 1,000 - 1,000

Depreciation and amortisation 901 883 446 2,230 - 2,230

Continuing

------------------------------------------------------

Machine

52 Weeks ended 30 March tools

2019 & precision

engineered Industrial Head Office

components laser systems & unallocated Total Discontinued

Segmental analysis of

revenue $000 $000 $000 $000 $000 Group Total

------------------------------- ------------ -------------- -------------- -------- ------------ -----------

Total revenue 44,575 20,592 65,167 1,572 66,739

------------------------------- ------------ -------------- -------------- -------- ------------ -----------

o

Segmental analysis of

operating profit/(loss)

before Adjusting Items 3,610 2,563 (916) 5,257 (146) 5,111

------------------------------- ------------ -------------- -------------- -------- ------------ -----------

Adjusting Items (1,355) - (431) (1,786) (961) (2,747)

------------------------------- ------------ -------------- -------------- -------- ------------ -----------

Group operating profit/(loss) 2,255 2,563 (1,347) 3,471 (1,107) 2,364

------------------------------- ------------ -------------- -------------- -------- ------------ -----------

o

Other segmental information:

Reportable segment assets 28,126 9,492 18,728 56,346 1,108 57,454

Reportable segment liabilities (11,131) (4,496) (12,184) (27,811) - (27,811)

Fixed asset additions 686 559 - 1,245 - 1,245

Depreciation and amortisation 275 292 46 613 - 613

------------------------------- ------------ -------------- -------------- -------- ------------ -----------

Inter-segment pricing is determined on an arm's length basis.

Segment results, assets and liabilities include items directly

attributable to a segment as well as those that can be allocated on

a reasonable basis.

Segment capital expenditure is the total cost incurred during

the period to acquire segment assets that are expected to be used

for more than one period.

Disaggregation of revenue is shown by origin, destination and

product group in the following two tables:

Disaggregation of revenue by origin 2020 2019

------------- -------------

$000% $000%

------------------------------------ ------ ---- ------ ----

UK 16,453 24.5 14,249 21.8

North America 48,094 71.6 47,387 72.8

Australasia 2,659 3.9 3,531 5.4

------------------------------------ ------ ----- ------ -----

67,206 100.0 65,167 100.0

------------------------------------ ------ ----- ------ -----

Disaggregation of revenue by destination:

2020 2019

------------- -------------------

$000% $000%

Gross sales revenue:

--------------------- ------ ----- ------------ -----

UK 11,500 17.1 9,507 14.6

Other European 5,032 7.5 6,951 10.7

North America (USA) 43,804 65.2 42,534 65.2

Africa 538 0.8 644 1.0

Australasia 2,561 3.8 3,370 5.2

Central America 1,101 1.6 126 0.2

Middle East 1,346 2.0 485 0.7

Far East 1,324 2.0 1,550 2.4

--------------------- ------ ----- ------------ -----

67,206 100.0 65,167 100.0

--------------------- ------ ----- ------------ -----

Disaggregation of revenue by product group:

2020 2019

------------- -------------

$000% $000%

Sector

CNC lathes 6,282 9.4 4,761 7.3

Conventional lathes 13,968 20.8 13,941 21.4

CNC other 1,351 2.0 1,209 1.9

Conventional other 9,126 13.6 11,587 17.8

Workholding 6,611 9.8 7,062 10.8

Spares & service 3,120 4.6 5,620 8.6

Lasers 23,263 34.6 19,814 30.4

Laser spares and service 3,485 5.2 1,173 1.8

--------------------------------------- ------ ----- ------ -----

Total 67,206 100.0 65,167 100.0

--------------------------------------- ------ ----- ------ -----

Timing of revenue recognition

Products and services transferred at a

point in time 57,811 65,167

Products and services transferred over

time 9,395 -

--------------------------------------- ------ ----- ------ -----

Total 67,206 65,167

--------------------------------------- ------ ----- ------ -----

There are no customers that represent 10% or more of the Group's

revenues.

Assets and liabilities related to contracts with customers:

The group has recognised the following assets and liabilities

related to contracts with customers.

2 020 2 019

----------------------------------------- ----- -----

$000 $000

----------------------------------------- ----- -----

Current contract liabilities relating to

deposits from customers 38 5 5 38

----- -----

2 020 2 019

-------------------------------------------- ----- -----

$000 $000

-------------------------------------------- ----- -----

Current contract assets relating to amounts

due from customers 246 -

----- -----

Remaining performance obligations

The vast majority of the groups' contracts are for the delivery

of goods within the next 12 months for which the practical

expedient in paragraph 121(a) of IFRS 15 applies.

The following table shows how much of the revenue recognised in

the current reporting year relates to carried forward contract

liabilities:

2020 2019

------------------------------------------------- ----- -----

$'000 $'000

------------------------------------------------- ----- -----

Revenue recognised that was included in

the contract liability balance at the beginning

of the year 538 1,244

----- -----

3. adjusting ITEMS

The directors have highlighted transactions which are material

and unrelated to the normal trading activity of the Group.

In the opinion of the directors the disclosure of these

transactions should be reported separately for a better

understanding of the underlying trading performance of the Group.

These underlying figures are used by the Board to monitor business

performance, form the basis of bonus incentives and are used for

the purposes of the bank covenants.

These non-GAAP measures are explained in note 14 alternative

performance measures and set out below. All adjusting items are

taken into account in the GAAP figures in the Income Statement.

The items below correspond to the table below;

a) The buy-out of the Group pension scheme was completed in

April 2019 and a profit of $0.8m was recorded as the amount

received was higher than the carrying value of the asset previously

recognised. During the year ended March 2019 the trustees undertook

a number of exercises to reduce the liabilities of the scheme which

had an actuarial cost. Given these had a beneficial effect on the

ultimate buy out cost of the scheme they were supported by the

Group and a charge of $1.28m plus $0.08m of associated legal costs

was included as a result of work by the Trustees of the UK pension

scheme and the Group in reducing pension liabilities.

b) As a result of the outsourcing of manufacturing in the UK in

the prior year, the existing premises were vacated, and a sublet

was in the process of negotiation. However due to flooding at the

site these negotiations failed to be completed and as a result a

right of use asset impairment charge of $0.4m has been recognised

in the year, in addition to a provision for associated unavoidable

costs, including amortisation and interest under IFRS 16 totaling

$0.4m. In the prior year an onerous lease charge of $0.4m was

recognised and was subsequently incorporated into the right of use

asset impairment on adoption of IFRS 16.

c) A credit of $22K (2019: credit of $1.26m) is recorded in

financial income in respect of the final salary pension scheme. No

cash was paid to or received from the scheme in respect of this

transaction which arises as a pension accounting entry under the

required standard due to the surplus in the scheme recorded in the

balance sheet.

d) The net adjustment to the carrying value of the amortised

loan note costs on their extension in the prior year is shown as a

credit of $0.8m in financial income with the corresponding charge

of $0.5m for the year shown in financial expense. These are non

cash movements and relate to the discounting of the loan notes and

associated costs which unwind over the term of the notes.

e) A charge of $0.7m was incurred as a result of the acquisition

of Control Micro Systems Inc for legal and professional fees.

f) A charge of $0.3m arose as a result of amortisation of

intangible assets acquired through the Control Micro Systems Inc

deal.

g) In the prior period a charge of $0.96m has been recorded

against the value of the Gamet Bearings assets held for sale to

bring their carrying value into line with the expected proceeds of

sale, less costs to sell. In the current year a charge has been

incurred of $0.5m which included additional costs of the closure of

the Gamet business in October 2019 as well as a loss on disposal as

a result of receiving less than originally anticipated.

h) A charge of $0.3m was expensed in cost of sales relating to

US duty and tariff charges from prior years

Adjusting items

2020 2019

$000 $000

------------------------------------------------------ ------- ----------

Items included in c ost of sales:

US Tariffs & Duty charges relating to prior years (h) ( 254) -

(254) -

------------------------------------------------------ ------- ----------

Items included in operating e xpenses :

Pensions charge (a) - (1,277)

Pensions legal costs (a) - (78)

Onerous lease provision (b) - (431)

Unavoidable lease costs (b) (378) -

Right of use asset impairment (b) (392 ) -

Acquisition costs (e) (684) -

Amortisation of intangible assets acquired (f) (288) -

Profit on sale of pension (a) 809

(933) ( 1,786)

------------------------------------------------------ ------- --------

Items included in financial (income)/expense:

Pensions interest on surplus (c) 22 1,255

Adjustment to loan notes (d) - 822

------------------------------------------------------ ------- --------

Financial income 2 2 2 ,077

------------------------------------------------------ ------- --------

Amortisation of Loan notes and costs (d) (536) -

(1,7 01

Total adjusting items before tax ) 291

Income tax on adjusting items - (48)

(1,7 01

Total adjusting items after tax ) 243

------------------------------------------------------ ------- --------

Loss on discontinued activity (g) (543 ) (961)

------------------------------------------------------ ------- --------

4. Financial income and expense

2020 2019

$000 $000

----------------------------------------- ------- -------

Bank and other interest 5 35

Interest on employee benefit surplus 22 1,255

Loan note and net adjustment - 822

----------------------------------------- ------- -------

Financial income 27 2,112

----------------------------------------- ------- -------

Bank overdraft and loan interest (315) (236)

Other loan interest ( 918) (948)

Loan note interest ( 536) -

Other finance charges - (1)

Finance charges ( 12) (6)

Lease interest ( 375) -

Interest on employee benefit liabilities (44) (45)

Financial expense (2,200) (1,236)

----------------------------------------- ------- -------

5. Taxation

2020 2019

$000 $000

---------------------------------------------------- ----- -----

Current tax:

- UK Corporation tax at 19% (2019: 19%):

Overseas taxation:

- current period 151 77

---------------------------------------------------- ----- -----

Total current tax credit 151 77

---------------------------------------------------- ----- -----

Deferred taxation:

- current period 891 92

- effect of rate change in UK 143 -

- prior period 43 (283)

---------------------------------------------------- ----- -----

Total deferred taxation credit/(charge) 1,077 (191)

---------------------------------------------------- ----- -----

Taxation credited/(charged) to the income statement 1,228 (114)

---------------------------------------------------- ----- -----

The rate for deferred tax in UK was changed from 17% to 19% in

the current year. The rate for Federal tax in the USA is 21%.

Tax reconciliation

The tax (credit)/charge assessed for the period is higher than

(2019: lower than) the standard rate of corporation tax in the UK

of 19 % (2019: 19%). The differences are explained below:

2020 2019

-------

$000 $000

------------------------------------------------------ ------- -----

(Loss)/profit before tax (633) 4,347

------------------------------------------------------ ------- -----

( Loss)/ profit before tax multiplied by the standard

rate of corporation tax

in the UK of 19% (2019: 19%) (120) 826

Effects of:

- income not taxable and/or expenses not deductible 68 274

- overseas tax rates 55 14

- pension fund surplus taxed at higher rate - 3

- US state taxes 60 166

- utilisation of discontinued business losses (243) (140)

- deferred tax prior period adjustment (43) -

- impact of rate change in the UK on deferred tax (143) 290

- tax losses utilised not previously recognised (4) (912)

- additional deferred tax recognised on losses in the

period (858) (124)

- R&D claims in the USA (prior periods) - (283)

Taxation (credited)/charged to the income statement (1,228) 114

------------------------------------------------------ ------- -----

6. Dividends

No dividends have been proposed this year. In the prior year a

final dividend of 0.5p was paid on 30 September 2019 to holders on

the register at 30 August 2019.

2020 2019

$000 $000

-------------------------------------------------- ----- -----