TIDMSHIP TIDMSHPP

RNS Number : 8987Z

Tufton Oceanic Assets Ltd.

17 January 2024

17 January 2024

This announcement contains inside information for the purposes

of the UK version of the Market Abuse Regulation ("MAR") which

forms part of UK law by virtue of the European Union (Withdrawal)

Act 2018; as amended. Upon publication of this announcement, the

inside information is now considered to be in the public domain for

the purposes of MAR.

Tufton Oceanic Assets Limited ("SHIP" or the "Company")

4Q23 Net Asset Value, Dividend Declaration and Mid-Term Strategy

Review

The Company announces that as at 31 December 2023, the unaudited

net asset value ("NAV") was $427.1 million (GBP335.0 million*) and

the unaudited NAV per ordinary share was $ 1 .452 (GBP1.139*). The

NAV total return for the quarter was 6.7% and for 2023 was 10%.

The Company is pleased to announce a dividend of $0.02125 per

ordinary share for the quarter ending 31 December 2023. The

dividend will be paid on 9 February 2024 to holders of ordinary

shares recorded on the register as at the close of business on 26

January 2024 with an ex-dividend date of 25 January 2024.

Mid-Term Strategy Review

Since its IPO in December 2017, the Company has delivered strong

results in line with its original objectives, despite the very

challenging economic and operational backdrop during Covid, ongoing

geopolitical events and the impact of inflation.

In light of the ongoing share price discount to NAV and the

Company's forthcoming continuation vote at the AGM in October 2024,

the Board, in consultation with the Investment Manager, has

undertaken a review of the Company's mid-term strategy.

Continuing Investment Opportunity

The Investment Manager anticipates the investment opportunity

set for fuel-efficient secondhand vessels to be very strong for the

next decade as the shipping industry slowly transitions to zero

carbon fuels to meet tightening regulations and decarbonisation

targets. The Board and the Investment Manager believe that strong

supply-side fundamentals will continue to support high yields and

secondhand values, resulting in future IRRs being higher than the

Company's published target.

The Board therefore believes the correct strategy for SHIP over

the medium term through to 2030 is to continue investing in

fuel-efficient secondhand vessels to maximise shareholder returns,

intending to realise the Company's portfolio of assets starting

from 2028, well before the decarbonisation of shipping

accelerates.

Continuation votes will be held as planned in 2024 and 2027 to

reconfirm the opportunity set and the strategy with the Company's

shareholders, before the realisation period starting in 2028.

Revised Capital Allocation Policy

Acknowledging investor feedback and the current discount to NAV,

the Board has also considered its capital allocation policy and use

of investible cash as follows:

-- With effect from 1Q24, SHIP's annual target dividend will be

increased by c.17.6% from $0.085/share to $0.10/share(**) . Based

on this increased target the Company is forecast to have a dividend

cover of c.1.5x over the next 18 months.

-- The Board is evaluating a proposed one-off return of capital

in 2Q24 representing between 5% and 10% of NAV at a price

representing the prevailing NAV/share less attributable costs.

Shareholders will be notified of the terms of the return of capital

accordingly.

* 1 January 2024 closing mid-rate of USD/GBP 0.7844. Source:

Morningstar

** This is a target only and there can be no assurance that the

target can or will be met and it should not be taken as an

indication of the Company's expected or actual future results.

Accordingly, potential investors should not place any reliance on

this target in deciding whether to invest in the Company or assume

that the Company will make any distributions at all and should

decide for themselves whether the target dividend yield is

reasonable or achievable.

-- The Company sees fleet renewal (based on age, technology, and

sector outlook) as a priority. Returns from all new asset

investments over a three-year holding period will be compared to

the benefit from a return of capital given the prevailing share

price at the time of the proposed investment and medium-term market

outlook.

-- The Board will annually evaluate a further return of capital

using excess investible cash if no suitable investment

opportunities are presented.

-- The current buy-back policy is to remain in place (excess

cash may be used, at the discretion of the directors, to repurchase

shares should they trade at a >10% discount to NAV, as set out

in the Company's listing documents).

The Company's quarterly factsheet as at 31 December 2023 will

shortly be available on the Company's website in

the Investor Relations section at www.tuftonoceanicassets.com/quarterly-reports .

Dividend currency declaration

The Company advises that the default payment for dividends

remains in US Dollar, however, dividends are capable of being paid

in GBP Sterling, provided that the relevant shareholder has

registered to receive their dividend in GBP Sterling under the

Company's Dividend Currency Election. A copy of the Dividend

Currency Election form, which should be sent to Computershare

Investor Services plc, The Pavilions, Bridgwater Road, Bristol,

BS99 6BD no later than 29 January 2024, is available on the

Company's website at

http://www.tuftonoceanicassets.com/company-documents/ .

The Dividend Currency Election Form should only be completed by

shareholders who hold shares in certificated form. CREST

shareholders must elect via CREST. Non-CREST shareholders wishing

to receive Company dividends by electronic funds transfer directly

to their bank accounts can register for Computershare's Global

Payment

Service at www.investorcentre.co.uk

For further information, please contact:

Tufton Investment Management Limited +44 (0) 20 7518 6700

("Investment Manager" or "Tufton")

Andrew Hampson

Nicolas Tirogalas

Singer Capital Markets +44 (0) 20 7496 3000

James Maxwell, Alex Bond, Angus Campbell

(Corporate Finance)

Alan Geeves, James Waterlow, Sam Greatrex

(Sales)

Hudnall Capital LLP +44 (0) 20 7520 9085

Andrew Cade

About the Company

Tufton Oceanic Assets Limited invests in a diversified portfolio

of secondhand commercial sea-going vessels with the objective of

delivering strong cash flow and capital gains to investors. The

Company's investment manager is Tufton Investment Management Ltd.

The Company has raised a total of approximately $316.5m (gross)

through its Initial Public Offering on the Specialist Fund Segment

of the London Stock Exchange on 20 December 2017 and subsequent

capital raises.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVGPUCUGUPCGMQ

(END) Dow Jones Newswires

January 17, 2024 02:00 ET (07:00 GMT)

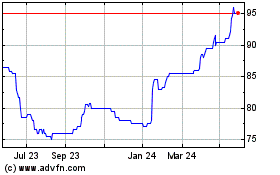

Tufton Assets (LSE:SHPP)

Historical Stock Chart

From Dec 2024 to Jan 2025

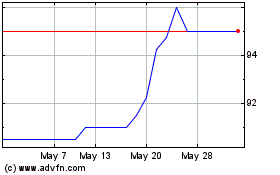

Tufton Assets (LSE:SHPP)

Historical Stock Chart

From Jan 2024 to Jan 2025