Tufton Oceanic Assets Ltd. Acquisition of Product Tanker (3739O)

June 10 2022 - 2:00AM

UK Regulatory

TIDMSHIP

RNS Number : 3739O

Tufton Oceanic Assets Ltd.

10 June 2022

10 June 2022

Tufton Oceanic Assets Limited (The "Company")

Acquisition of Product Tanker

The Board of Tufton Oceanic Assets Limited (ticker: SHIP.L) is

pleased to announce the Company has agreed to acquire a Product

Tanker for $31.5m.

The Product Tanker, Marvelous, is being acquired at

approximately 90% of depreciated replacement cost. Initially the

vessel will be employed in a leading product tanker pool where

current net unlevered yield is in excess of 25%. We anticipate that

the yield will remain above 20% over the next 1-2 years during

which time we will decide if a longer term fixed rate charter is

more appropriate. Completion of the acquisition is expected by

early July.

Similarly to the Product Tanker Exceptional, which the Company

acquired at the end of 2021, Marvelous is in the top quartile of

fuel efficiency in its market segment but will nonetheless be

evaluated for further improvement, including the retrofit of energy

saving devices. Marvelous is being acquired at only a slightly

higher valuation multiple than Exceptional.

The investment follows earlier announcements regarding capital

re-allocation, ESG priorities and the recent strong improvement in

the product and chemical tanker markets. Following this acquisition

and previously announced divestments and acquisitions, the Company

will be fully invested.

For further information, please contact:

Tufton Investment Management Ltd (Investment

Manager)

Andrew Hampson

Paulo Almeida +44 (0) 20 7518 6700

Singer Capital Markets

James Maxwell, Alex Bond (Corporate Finance)

Alan Geeves, James Waterlow, Sam Greatrex

(Sales) +44 (0) 20 7496 3000

Hudnall Capital LLP

Andrew Cade +44 (0) 20 7520 9085

About the Company

Tufton Oceanic Assets Limited invests in a diversified portfolio

of secondhand commercial sea-going vessels with the objective of

delivering strong cash flow and capital gains to investors. The

Company's investment manager is Tufton Investment Management Ltd.

The Company has raised a total of approximately $316.5m (gross)

through its Initial Public Offering on the Specialist Fund Segment

of the London Stock Exchange on 20 December 2017 and subsequent

capital raises.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEALKNEDKAEFA

(END) Dow Jones Newswires

June 10, 2022 02:00 ET (06:00 GMT)

Tufton Oceanic Assets (LSE:SHIP)

Historical Stock Chart

From Jun 2024 to Jul 2024

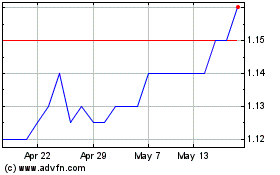

Tufton Oceanic Assets (LSE:SHIP)

Historical Stock Chart

From Jul 2023 to Jul 2024