TIDMSDX

RNS Number : 6176V

SDX Energy PLC

10 August 2022

The following amendment has been made to the "Results of Court

Meeting and General Meeting and Lapsing of the Scheme" announcement

released 29 July 2022 at 14:19 under RNS No. 3086U.

The original announcement incorrectly stated that the percentage

of voting scheme shareholders at the court meeting was 13.29% for,

10.49% against and 23.78% in total. It should have stated that the

percentage was 55.88% for, 44.12% against and 100% in total.

All other details remain unchanged. The full amended text is

shown below.

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM THE UNITED STATES,

AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION WHERE TO DO SO WOULD

BE UNLAWFUL OR CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THE INFORMATION CONTAINED WITHIN THIS ANNOUNCEMENT IS DEEMED BY

THE COMPANY TO CONSTITUTE INSIDE INFORMATION AS STIPULATED UNDER

THE MARKET ABUSE REGULATION (EU) NO. 596/2014 AS IT FORMS PART OF

UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018 AS AMED.

FOR IMMEDIATE RELEASE

29 July 2022

RECOMMED ALL-SHARE COMBINATION WITH CASH ALTERNATIVE

between

Tenaz Energy Corp. ("Tenaz")

and

SDX Energy plc ("SDX")

to be effected by means of a Scheme of Arrangement under Part 26

of the Companies Act 2006

Results of Court Meeting and General Meeting and Lapsing of the

Scheme

On 25 May 2022, the boards of SDX and Tenaz announced that they

had reached agreement on the terms of a recommended share-for-share

combination pursuant to which Tenaz would acquire the entire issued

ordinary share capital of SDX (the "Combination") which was

proposed to be effected by means of a Scheme of Arrangement under

Part 26 of the Companies Act 2006 (the "Scheme"). On 30 June 2022,

Tenaz announced the introduction of a cash alternative that was

made available under the terms of the Combination, through which

shareholders of SDX could elect to receive cash instead of some or

all of the share consideration to which they would otherwise be

entitled to under the terms of the Combination.

Earlier today, SDX convened the Court Meeting and General

Meeting in connection with the Combination. The total votes in

favour of the resolutions were 48.30% at the Court Meeting and

54.27% at the General Meeting, which were below the minimum

threshold (75% of those shares voted) needed to approve the

resolutions.

Accordingly, certain of the conditions of the Scheme were not

satisfied and, consequently, the Combination has been terminated

and the Scheme has lapsed. As a result, no Court Hearing to

sanction the Scheme will be held and SDX is no longer in an offer

period as defined by the City Code on Takeovers and Mergers.

Voting Results of the Court Meeting

The table below sets out the results of the poll at the Court

Meeting. Each Scheme Shareholder, present in person or by proxy,

was entitled to one vote per Scheme Share held at the Voting Record

Time.

Results of No. of Scheme Number of Percentage Number of Percentage

Court Meeting Shares voted Scheme Shareholders of voting Scheme Shares of Scheme

as a percentage who voted Scheme Shareholders* voted Shares which

of the total were voted

Scheme Shares*

For 20.18% 19 55.88% 41,281,230 48.30%

----------------- --------------------- ---------------------- --------------- --------------

Against 21.60% 15 44.12% 44,187,084 51.70%

----------------- --------------------- ---------------------- --------------- --------------

Total 41.78% 34 100% 85,468,314 100%

----------------- --------------------- ---------------------- --------------- --------------

* Rounded to two decimal places

Voting Results of the General Meeting

The table Total Total Number Percentage Number Percentage Votes

below sets votes votes of votes of votes of votes of votes withheld**

out the validly validly "for" validly against validly

results cast cast as cast "for"* cast against*

of the poll a percentage

at the General of the

Meeting. issued

Each SDX share

Shareholder, capital*

present

in person

or by proxy,

was entitled

to one vote

per SDX

Share held

at the Voting

Record Time.

Special

Resolution

approving

implementation

of the Scheme

and amendment

to articles

of association 91,902,890 44.93% 49,878,987 54.27% 42,023,903 45.73% 11,509,915

----------- -------------- ----------- ------------- ----------- -------------- --------------

* Rounded to two decimal places

** A vote withheld is not a vote in law and is not counted in

the calculation of the proportion of votes 'For' or 'Against' the

Special Resolution.

The total number of SDX Shares in issue at the Voting Record

Time was 204,563,045, none of which were held in treasury.

Consequently, the total voting rights in the Company at the Voting

Record Time were 204,563,045.

Prior to the Shareholder Meetings, the Company received an

enquiry from the Alberta Securities Commission (the "ASC") seeking

confirmation that security holders in Canada beneficially own more

than 10% of the outstanding voting securities of SDX, and that SDX

is not a designated foreign issuer under Canadian securities laws

(the "ASC Enquiry"). The ASC Enquiry also relates to certain

notifications of shareholdings in the Company made between 18 and

22 July 2022, and specifically whether the acquisition of those

shareholdings and related notifications were in compliance with

Canadian securities legislation. Following engagement with the ASC,

an early warning report on Form 62-103F1 was filed by certain

shareholders of the Company. Having taken legal advice, the Company

does not currently believe that there is a material risk of

regulatory action or successful litigation against the Company with

regard to these issues, however there can be no certainty that

there will be no regulatory action or litigation.

Capitalised terms used but not otherwise defined in this

announcement have the meanings given to them in the Scheme Document

published on 5 July 2022 in relation to the Combination.

Enquiries

SDX Energy plc

Michael Doyle, Chairman Tel: + 44 (0) 203 219 5640

Mark Reid, Chief Executive Officer

Rothschild & Co (Rule 3 and Financial Adviser to SDX)

James McEwen Tel: +44 (0) 207 280 5000

Tanvi Ahuja

Stifel Nicolaus Europe Limited (Nominated Adviser and Broker to

SDX)

Callum Stewart Tel: +44 (0) 20 7710 7600

Camarco (Financial PR Adviser to SDX)

Billy Clegg/Owen Roberts/Violet Wilson Tel: +44 (0) 203 757

4980

Important notices

Rothschild & Co, which is authorised and regulated by the

Financial Conduct Authority in the United Kingdom, is acting

exclusively for SDX and for no one else in connection with the

matters described in this announcement and will not be responsible

to anyone other than SDX for providing the protections afforded to

clients of Rothschild & Co or for providing advice in

connection with any matter referred to in this announcement.

Neither Rothschild & Co nor any of its affiliates (nor their

respective directors, officers, employees or agents) owes or

accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Rothschild & Co

in connection with this announcement, any statement contained

herein, the Combination or otherwise. No representation or

warranty, express or implied, is made by Rothschild & Co as to

the contents of this announcement.

Stifel Nicolaus Europe Limited ("Stifel"), which is authorised

and regulated by the Financial Conduct Authority in the United

Kingdom, is acting exclusively for SDX and for no one else in

connection with the matters described in this announcement and will

not be responsible to anyone other than SDX for providing the

protections afforded to clients of Stifel or for providing advice

in connection with any matter referred to in this announcement.

Neither Stifel nor any of its affiliates (nor their respective

directors, officers, employees or agents) owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of Stifel in connection with this

announcement, any statement contained herein, the Combination or

otherwise. No representation or warranty, express or implied, is

made by Stifel as to the contents of this announcement.

Publication on websites and availability of hard copies

Pursuant to Rule 26.1 of the Takeover Code, a copy of this

announcement and other documents in connection with the Combination

will be available free of charge, subject to certain restrictions

relating to persons resident in Restricted Jurisdictions, at SDX's

websites at https://www.sdxenergygroup.com/ promptly following the

publication of this announcement and in any event by no later than

12 noon on the Business Day following this announcement until the

end of the Offer Period (or, if later, the end of any competition

reference period).

For the avoidance of doubt, the content of the websites referred

to above is not incorporated into and does not form part of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ROMGPUCCRUPPGAU

(END) Dow Jones Newswires

August 10, 2022 12:00 ET (16:00 GMT)

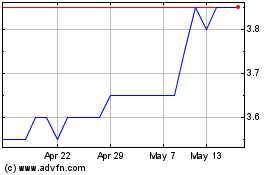

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sdx Energy (LSE:SDX)

Historical Stock Chart

From Nov 2023 to Nov 2024