TIDMSCGL

RNS Number : 0583O

Sealand Capital Galaxy Limited

29 September 2023

For release: 07.00, 29 September 2023

Sealand Capital Galaxy Limited

("Sealand" or the "Company")

Unaudited Interim Results

Sealand Capital Galaxy Limited (LSE: SCGL) announces that it has

today published its unaudited Interim Results for the six months

ended 30 June 2023 with respect to the Company and its subsidiaries

(the "Group").

Nelson Law, Executive Chairman of the Company commented:

"The group's focus on expanding its presence in the e-commerce

sector in China has been a key priority. Significant resources have

been allocated to this endeavor, recognizing the vast potential of

this market. In addition to the existing presence on Tmall, the

group is actively working to collaborate with other platforms,

aiming to reach a wider customer base and increase market share in

online retail."

He added:

" The group is actively exploring opportunities for joint

ventures in China. Building upon previous success in the

advertising sector, the group seeks potential partnerships in this

area. Additionally, venturing into new but related areas such as

app design and interlink programs is a strategic move to diversify

revenue streams and enhance competitiveness in the market.

"Despite the challenges posed by the pandemic, the group remains

optimistic about the future and committed to identifying new growth

opportunities within current product lines and through strategic

partnerships. By continuously adapting to evolving market

conditions and leveraging strengths, the group is confident in its

ability to drive long-term success and deliver value to

stakeholders."

-Ends-

Enquiries:

Sealand Capital Galaxy Limited

Law Chung Lam Nelson, Executive + 44 (0) 753 795

Chairman 9788

Notes to Editors:

The Company's Shares are traded on the Official List of the

London Stock Exchange's main market for listed securities under the

ticker SCGL.

Further information on Sealand is available on its website http://www.scg-ltd.com/

MANAGEMENT DISCUSSION AND ANALYSIS

Sealand Capital Galaxy Limited is a company acting as a special

purpose acquisition company. The Group is engaged in digital

marketing, mobile payment and other IT related business. Today it

announces its results for the six months ended 30 June 2023.

Business Review

The group's focus on expanding its presence in the e-commerce

sector in China has been a key priority. Significant resources have

been allocated to this endeavor, recognizing the vast potential of

this market. In addition to the existing presence on Tmall, the

group is actively working to collaborate with other platforms,

aiming to reach a wider customer base and increase market share in

online retail.

Collaboration with local retail partners has also yielded

positive results. One of the group's sales partners has

successfully expanded to four physical stores, with plans for a

fifth store in the near future. The group's brand accounts for

approximately one-third of their total unit sales, demonstrating

the mutually beneficial nature of the partnership.

Further nurturing and strengthening such collaborations will

enhance the group's footprint in the retail sector.

Overall, the strategic focus on e-commerce expansion and

collaboration with local retail partners has proven successful. The

group remains committed to capitalizing on emerging opportunities,

both online and offline, to drive growth and maximize shareholder

value.

Financial Review

During the six months ended 30 June 2023, the loss attributable

to ordinary shareholders was GBP203,951 (2022:

GBP226,910), and the revenue for the period was GBP61,198 (2021:

GBP76,071).

Prospects

After the impact of the COVID-19 pandemic, the group has

observed a gradual recovery in sales, albeit slower than

anticipated. To fuel future growth and expansion, the group is

focusing on soliciting new agency partnerships for additional

brands, particularly in the female skincare category. Leveraging

existing distribution channels and industry expertise, the group

aims to capture a larger share of the market and drive sales.

Moreover, the group is actively exploring opportunities for

joint ventures in China. Building upon previous success in the

advertising sector, the group seeks potential partnerships in this

area. Additionally, venturing into new domains such as app design

and interlink programs is a strategic move to diversify revenue

streams and enhance competitiveness in the market.

Despite the challenges posed by the pandemic, the group remains

optimistic about the future and committed to identifying new growth

opportunities within current product lines and through strategic

partnerships. By continuously adapting to evolving market

conditions and leveraging strengths, the group is confident in its

ability to drive long-term success and deliver value to

stakeholders.

Going Concern

As at 30 June 2023, the Group has cash and cash equivalent

balances of GBP7,630 and net current liabilities and net

liabilities of GBP1,057,446.

The directors' cash-flow projections for the forthcoming 12

months conclude there will be a need for additional cash resources.

The directors are in discussions with some parties that may raise

further equity and/or loans. There is no certainty that any such

funds will be forthcoming or the price and other terms will be

acceptable.

Directors

The following directors served during the six months ended 30

June 2023: Mr Chung Lam Nelson Law(Chairman and Chief Financial

Officer)

Mr Geoffrey John Griggs(Non-executive Director)

I would like to thank my colleagues for their continued

perseverance and commitment towards reaching the Groups'

objectives.

Chung Lam Nelson Law Chairman

29 September 2023

SEALAND CAPITAL GALAXY

PRINCIPAL RISKS AND UNCERTAINTIES

The Board regularly monitors exposure to risks and uncertainties

that it considers key as set out below.

The group faces risks associated with integrating and

assimilating acquired businesses. Difficulties may arise due to

cultural differences, operational complexities, and organizational

alignment, which could impact the performance and profitability of

acquired entities.

International Interest Rates and Inflation

Rising international interest rates and inflation pose a risk to

the group's cost of goods sold. Increased borrowing costs and

higher input costs, can impact profitability. The group actively

monitors these macroeconomic factors and implements strategies to

mitigate their adverse effects on financial performance.

Currency Fluctuations

The depreciation of the RMB by 10% has affected the group's

total sales turnover. Weaker currency reduces purchasing power in

China, negatively impacting demand for products and services.

Currency fluctuations introduce volatility and uncertainty,

requiring active management of currency exposures through hedging

strategies.

Moreover the 10% depreciation of the RMB has impacted the total

sales turnover due to a decrease in purchasing power in China.

The group remains vigilant in managing these risks, implementing

appropriate risk mitigation strategies, and monitoring market

conditions to ensure long-term resilience and sustainability.

Competition

The group acknowledges the need for horizontal integration to

expand market presence and capture a larger industry share.

However, this expansion may strain resources. Negotiating new

product lines requires significant investments in distribution

networks, and marketing. Intensified competition may impact profit

margins. The group actively pursues strategic partnerships and

diversification to enhance competitive position. Prudent

decision-making and effective resource allocation are crucial in a

dynamic market environment.

Financial Risks

The Group financial risks including foreign exchange risk,

interest rate risk, credit risk, liquidity risk and cash flow risk

are carefully monitored by the Board.

Chung Lam Nelson Law Chairman

29 September 2023

SEALAND CAPITAL GALAXY LIMITED

STATEMENT OF DIRECTORS' RESPONSIBILITIES

The Directors confirm that to the best of their knowledge:

(a) the condensed set of financial statements, which has been

prepared in accordance with IAS 34 "Interim Financial Reporting",

gives a true and fair view of the assets, liabilities, financial

position and loss of the Group as a whole as required by DTR 4.2.4R

subject to the comment on the going concern position of the

Group.

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months of the year and a description of

principal risks and uncertainties for the remaining six months of

the year); and

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related parties'

transactions and changes therein).

By order of the Board

Chung Lam Nelson Law Chairman

29 September 2023

SEALAND CAPITAL GALAXY LIMITED

UNAUDITED CONSOLIDATED STATEMENT OF PROFIT OR LOSS FOR THE SIX

MONTHSED 30 JUNE 2023

Six months Six months

ended ended

30 June 30 June

2023 2022

(Unaudited) (Unaudited)

Note GBP GBP

Revenue 5 61,198 76,071

Cost of services (38,899) (62,953)

--------------- ---------------

Gross profit 22,299 13,118

Other income 5 8,151 16,313

Administrative expenses (275,488) (237,555)

Finance costs (425) (1,046)

Gain on disposal of a subsidiary - 7,644

Gain on deregistration of subsidiaries 41,207 -

--------------- ---------------

Loss before tax 6 (204,256) (201,526)

Income tax expenses - -

--------------- ---------------

Loss for the period (204,256) (201,526)

=============== ===============

Attributable to:

Equity holders of the Company (203,951) (226,910)

Non-controlling interests (305) 25,384

--------------- ---------------

(204,256) (201,526)

=============== ===============

Loss per share attributable to equity

holders of the Company

Pence Pence

Basic and diluted 8 (*) (*)

=============== ===============

* Less than 0.001 pence

The notes to the financial statements form an integral part of

these financial statements.

UNAUDITED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME FOR THE

SIX MONTHSED 30 JUNE 2023

Six months Six months

ended ended

30 June 2023 (Unaudited) 30 June

GBP 2022 (Unaudited)

Note GBP

Loss for the period (204,256) (201,526)

Other comprehensive income/(loss)

Items to be reclassified subsequently to

profit or loss:

- Exchange differences on translation of

foreign operations 39,653 (86,249)

------------------------ ------------------

Other comprehensive income for the

period, net of tax 39,653 (86,249)

------------------------ ------------------

Total comprehensive loss for the period (164,603) (287,775)

======================== ==================

Attributable to:

Equity holders of the Company (173,999) (287,823)

Non-controlling interests 9,396 48

------------------------ ------------------

(164,603) (287,775)

======================== ==================

The notes to the financial statements

form an integral part of these

financial

statements

UNAUDITED CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 30

JUNE 2023

At At

30 June 2023 31 December

(Unaudited) 2022 (Audited)

Note GBP GBP

ASSETS

Non-current assets

Property, plant and equipment 9 28,704 44,791

Current assets

Inventories 10 91,261 106,088

Prepayments and other receivables 55,965 58,305

Trade receivables 26,847 26,430

Cash and cash equivalents 7,630 35,567

--------------------------------- ------------------------------

181,703 226,390

Current liabilities

Trade payables 34,691 36,110

Other payables and accrued expenses 534,517 480,213

Amount due to a director 667,154 602,646

Finance lease liabilities 11 31,491 29,858

--------------------------------- ------------------------------

1,267,853 1,148,827

Net current liabilities (1,086,150) (922,437)

Total assets less current liabilities (1,057,446) (877,646)

Non-current liabilities

Finance lease liabilities 11 - 15,197

Net liabilities (1,057,446) (892,843)

Capital and reserves

Share capital 12 71,581 71,581

Reserves (817,121) (643,122)

--------------------------------- ------------------------------

Total equity attributable to equity

shareholders of the Company (745,540) (571,541)

Non-controlling interests (311,906) (321,302)

--------------------------------- ------------------------------

Total equity (1,057,446) (892,843)

The notes to the financial statements

form an integral part of these

financial

statements

SEALAND CAPITAL GALAXY LIMITED

UNAUDITED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY FOR THE

SIX MONTHSED 30 JUNE 2023

Attributable to the equity holders of the Company

Share Share-based Accumulated Non-controlling

capital Share payment losses Exchange Total interests Total

GBP premium reserve GBP reserve GBP GBP equity

GBP GBP GBP GBP

Six months

ended 30 June

2023

At 1 January

2023 (Audited) 71,581 6,917,830 357,417 (7,914,649) (3,720) (571,541) (321,302) (892,843)

------------- --------- ------------ ------------- --------- ----------- --------------- -----------

Loss for the

period - - - (203,951) - (203,951) (305) (204,256)

Exchange

differences

arising

on translation - - - - 29,952 29,952 9,701 39,653

------------- --------- ------------ ------------- --------- ----------- --------------- -----------

Total

comprehensive

(loss)/income - - - (203,951) 29,952 (173,999) 9,396 (164,603)

Deregistration - - - - - - - -

of subsidiaries

------------- --------- ------------ ------------- --------- ----------- --------------- -----------

At 30 June 2023

(Unaudited) 71,581 6,917,830 357,417 (8,118,600) 26,232 (745,540) (311,906) (1,057,446)

============= ========= ============ ============= ========= =========== =============== ===========

Six months

ended 30 June

2022

At 1 January

2022 (Audited) 59,569 6,660,898 357,417 (7,715,246) 4,817 (632,545) (385,572) (1,018,117)

------------- --------- ------------ ------------- --------- ----------- --------------- -----------

Loss for the

period - - - (226,910) - (226,910) 25,384 (201,526)

Exchange

differences

arising

on translation - - - - (60,913) (60,913) (25,336) (86,249)

------------- --------- ------------ ------------- --------- ----------- --------------- -----------

Total

comprehensive

(loss)/income - - - (226,910) (60,913) (287,823) 48 (287,775)

Issue of

ordinary

shares 491 26,509 - - - 27,000 - 27,000

Disposal of

subsidiaries - - - - - - 20,137 20,137

------------- --------- ------------ ------------- --------- ----------- --------------- -----------

At 30 June 2022

(Unaudited) 60,060 6,687,407 357,417 (7,942,156) (56,096) (893,368) (365,387) (1,258,755)

============= ========= ============ ============= ========= =========== =============== ===========

The notes to the financial statements form an integral part of

these financial statements.

SEALAND CAPITAL GALAXY LIMITED UNAUDITED CONSOLIDATED STATEMENT

OF CASH FLOWS

FOR THE SIX MONTHSED 30 JUNE 2023

Six months Six months

ended ended

30 June 2023 30 June 2022

(Unaudited) (Unaudited)

GBP GBP

CASH FLOWS FROM OPERATING ACTIVITIES

Loss before tax (204,256) (201,526)

Adjustments for :

Depreciation 14,693 16,373

Gain on disposal of a subsidiary - (7,644)

Gain on deregistration of subsidiaries (41,207) -

Interest expenses 425 1,025

Bank interest income (10) (10)

--------------------------------- ---------------------------------

Operating cash flows before movements in

working capital (230,355) (191,782)

Decrease/(increase) in inventories 14,827 (30,655)

Decrease/(increase) in prepayments and

other receivables 1,968 (1,746)

Increase in trade receivables (417) (23,753)

Increase in amount due to a director 64,508 180,197

(Decrease)/increase in trade payables (1,419) 40,361

Increase in other payables and accrued

expenses 98,009 106,288

--------------------------------- ---------------------------------

Net cash (used in)/generated from operations (52,879) 78,910

Payment of interest portion of lease

liabilities (425) (1,025)

--------------------------------- ---------------------------------

Net cash generated from/(used in) operating

activities (53,304) 77,885

CASH FLOWS FROM INVESTING ACTIVITIES

Net cash outflow in respect of the disposal

of a subsidiary - (143)

Net cash outflow on deregistration of

subsidiaries (989) -

Interest income received 10 10

--------------------------------- ---------------------------------

Net cash used in investing activities (979) (133)

CASH FLOWS FROM FINANCING ACTIVITIES

Issue of ordinary shares - 27,000

Payment of principal portion of lease

liabilities (12,099) (15,508)

--------------------------------- ---------------------------------

Net cash (used in)/generated from financing

activities (12,099) 11,492

Net (decrease)/increase in cash and cash

equivalents (66,382) 89,244

Foreign exchange realignment 38,445 (84,411)

Cash and cash equivalents at 1 January 35,567 8,198

--------------------------------- ---------------------------------

Cash and cash equivalents at 30 June 7,630 13,031

--------------------------------- ---------------------------------

The notes to the financial statements form an integral part of

these financial statements.

SEALAND CAPITAL GALAXY LIMITED

NOTES TO UNAUDITED INTERIM RESULTS

FOR THE SIX MONTHSED 30 JUNE 2023

1. GENERAL INFORMATION

Sealand Capital Galaxy Limited (the "Company") was incorporated

in the Cayman Islands on 22 May 2015 as an exempted Company with

limited liability under the Companies Law of the Cayman Islands.

The registered office of the Company is Willow House, PO Box 709,

Cricket Square, Grand Cayman, KY1-1107, Cayman Islands. These

unaudited consolidated interim financial statements comprise the

Company and its subsidiaries (together referred to as the

"Group").

The Company's nature of operations is to act as a special

purpose acquisition company. The Group engaged in digital marketing

and other IT and e-Commerce related businesses.

2. BASIS OF PREPARATION

The unaudited consolidated interim financial statements for the

six months ended 30 June 2023 have been prepared in accordance with

the International Accounting Standard ("IAS") No. 34 "Interim

Financial Reporting" issued by the International Accounting

Standards Board ("IASB"). These unaudited consolidated interim

financial statements were not reviewed or audited by our

auditor.

The consolidated interim financial information has been prepared

in accordance with the same accounting policies adopted in the 2022

annual financial statements extracted, except for the accounting

policy changes that are expected to be reflected in the 2023 annual

financial statements.

The preparation of the interim financial information in

conformity with IAS 34 requires management to make judgements,

estimates and assumptions that affect the application of policies

and reported amounts of assets and liabilities, income and expenses

on a year to date basis. Actual results may differ from these

estimates.

This consolidated interim financial information contains

consolidated financial statements and selected explanatory notes.

The notes include an explanation of events and transactions that

are significant to an understanding of the changes in financial

position and performance of the Group since the 2022 annual

financial statements. The consolidated interim financial statements

and notes thereon do not include all of the information required

for a full set of financial statements prepared in accordance with

International Financial Reporting Standards ("IFRSs").

3. GOING CONCERN

The directors' cash projections for the forthcoming 12 months

conclude that there will be a need for additional cash resources.

The directors are in discussion with a number of individuals that

may lead to further equity and/or loans being raised. There is no

certainty that any such funds will be forthcoming or the price and

other terms will be acceptable.

4. SEGMENT INFORMATION

The Chief Operating Decision Maker ("CODM") has been identified

as the executive director of the Company who reviews the Group's

internal reporting in order to assess performance and allocate

resources. The CODM has determined the operating segments based on

these reports.

For management purposes, the Group is organised into business

units based on their products and services and has reportable

operating segments as follows:

(a) The digital marketing and payment segment includes services

on enlisting merchants to mobile payment gateways and providing

digital advertising services; and

(b) The e-commerce segment includes sales of goods through

internet and provision for consultancy services related to

e-commerce.

Digital

marketing

and

payment e-Commerce Unallocated Total

GBP GBP GBP GBP

Six months ended 30 June 2023

(Unaudited)

Revenue - 61,198 - 61,198

============= ============ =============

Segment loss (6,366) (7,081) (190,809) (204,256)

============= ============ ============= --------------------------

Assets 26 149,841 60,540 210,407

============= ============ ============= --------------------------

Liabilities 6,488 99,863 1,161,502 1,267,853

============= ============ ============= --------------------------

Six months ended 30 June 2022

(Unaudited)

Revenue 776 75,295 - 76,071

============= ============ ============= --------------------------

Segment profit/(loss) (19,264) 13,118 (195,380) (201,526)

============= ============ ============= --------------------------

Assets 30,984 165,559 37,520 234,063

============= ============ ============= --------------------------

Liabilities 295,767 139,944 1,057,107 1,492,818

============= ============ ============= --------------------------

5. REVENUE AND OTHER INCOME

Six months Six months

ended ended

30 June 30 June

2023 (Unaudited) 2022 (Unaudited)

GBP GBP

REVENUE

Advertising services - 775

Commission income 642 669

Sales of goods 60,556 74,627

-------------------------------- --------------------------------

61,198 76,071

-------------------------------- --------------------------------

OTHER INCOME

Bank interest income 10 10

Others 8,141 16,303

-------------------------------- --------------------------------

8,151 16,313

-------------------------------- --------------------------------

6. LOSS BEFORE TAX

Six months Six months

ended ended

30 June 30 June

2023 (Unaudited) 2022 (Unaudited)

GBP GBP

Loss before tax has been arrived at after

charging:

Depreciation - Owned assets and right of

use assets 14,693 16,373

-------------------------------- --------------------------------

7. EMPLOYEES

The average number of employees during the

period

was made up as follows:

Six months Six months

ended ended

30 June 30 June

2023 (Unaudited) 2022 (Unaudited)

Directors 2 2

-------------------------------- --------------------------------

Staff 3 2

-------------------------------- --------------------------------

Directors' remuneration (GBP) 99,000 99,000

-------------------------------- --------------------------------

8. BASIC AND DILUTED LOSS PER SHARE

Basic loss per share is calculated by dividing the loss

attributable to the Company's owners of GBP203,951 (2022:

GBP226,910) by the weighted average number of 715,815,080 ordinary

shares (2022: 598,081,125) in issue during the six months ended 30

June 2023.

Diluted loss per share was the same as basic loss per share as

no potential dilutive ordinary shares were outstanding for both the

six months ended 30 June 2023 and 2022.

PROPERTY, PLANT AND EQUIPMENT

9.

Right

of use

assets

GBP

At 1 January 2023 (Audited) 44,791

Depreciation for the period (14,693)

Exchange differences (1,394)

---------------------------

At 30 June 2023 (Unaudited) 28,704

10. INVENTORIES

At At 31

30 June December

2023 2022

GBP GBP

(Unaudited) (Audited)

Finished goods 91,261 106,088

--------------------------- -------------------------

11. LEASE LIABILITIES

The total minimum lease liabilities under finance

leases and their present values at the reporting

date are as follows:

At At 31

30 June December

2023 2022

GBP GBP

(Unaudited) (Audited)

Current portion:

Gross finance lease liabilities 31,808 30,544

Finance expense not recognised (317) (686)

--------------------------- -------------------------

31,491 29,858

--------------------------- -------------------------

Non -current portion:

Gross finance lease liabilities - 15,272

Finance expense not recognised - (75)

--------------------------- -------------------------

- 15,197

--------------------------- -------------------------

Total 31,491 45,055

=========================== =========================

The net finance lease liabilities are analysed as

follows:

- Not later than 1 year 31,491 29,858

- Later than 1 year but not more than 5 years - 15,197

--------------------------- -------------------------

Net finance lease liabilities 31,491 45,055

=========================== =========================

12. SHARE CAPITAL

Number GBP

Ordinary shares issued and fully paid

At 1 January 2023 (Audited) and 30 June 2023

(Unaudited) 715,815,080 71,581

=========================== =========================

13. RELATED PARTY TRANSACTIONS

(a) Details of the compensation of key management personnel are

disclosed in Note 7 to the unaudited interim results.

(b) Apart from the balances with related parties at the end of

the reporting period disclosed elsewhere in the financial

statements, the Company had not entered into any significant

related party transactions for the six months ended 30 June

2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LPMATMTITBPJ

(END) Dow Jones Newswires

September 29, 2023 02:00 ET (06:00 GMT)

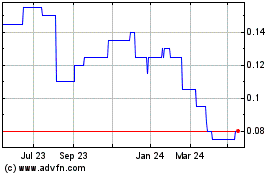

Sealand Capital Galaxy (LSE:SCGL)

Historical Stock Chart

From Nov 2024 to Dec 2024

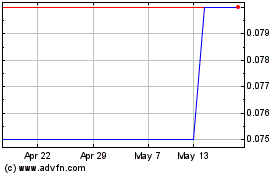

Sealand Capital Galaxy (LSE:SCGL)

Historical Stock Chart

From Dec 2023 to Dec 2024