TIDMSAE

RNS Number : 2811N

SIMEC Atlantis Energy Limited

28 September 2021

RNS

28(th) September 2021

SIMEC ATLANTIS ENERGY LIMITED

("SAE", the "Company" and, together with its subsidiaries, the

"Group")

-- Interim Results (unaudited)

-- Proposed Share Placing

-- Directorate Change

Interim Results

SAE announces its unaudited Interim Results for the six months

ended 30 June 2021

Summary of Results

The overall loss before tax of GBP10.7 million for the six

months ended 30 June 2021 compares to the loss of GBP6.2 million

reported for the same period in 2020. There are a number of factors

behind this increase. There was reduced revenue performance from

the MeyGen project as a result of significant outages in three of

its four turbines, which necessitated retrieval for onshore repair.

2021 results for the tidal turbine and engineering services

division have seen a drop off following a very strong 2020, which

benefitted from revenues on the phase 1 Japanese tidal project. GHR

continued to deliver stable growth.

Overall, costs were in line with expectations, with increased

contractors' costs being incurred in the MeyGen retrievals and the

ongoing Uskmouth development costs.

Graham Reid, CEO of SAE, commented

"I am immensely proud and inspired by my team's unwavering

commitment to the delivery of our projects and I can see that

commitment paying off as our projects continue to make progress, in

often challenging environments. Our projects, and the technologies

we are developing with our partners, will be critical in the global

fight against climate change. Energy is at the forefront of our

minds as the impact of climate change becomes more common and

extreme but so too is the cost and security of our energy. We have

the solutions. Our projects tackle climate change, deliver

predictable, local, low carbon electricity while creating jobs and

powering vital industries. We are proud of our projects and will

continue to focus on their successful delivery."

Share Placing

On 28 September 2021 the Company announced a proposed Placing at

2.5 pence per Ordinary Share to raise gross proceeds (before

expenses) of approximately GBP2.5 million.

Directorate Change

SAE announces that Mr Jay Hambro has today resigned his position

as a SIMEC representative on the SAE Board of Directors.

The Chairman and the Board of Directors would like to thank Mr

Hambro for his support and hard work during his time on the Board

and wish him well in his future endeavours.

For more information please contact:

+44 (0) 7739 832

SIMEC Atlantis Energy Limited 446

Sean Parsons, Director of

External Affairs

----------------------

Investec Bank PLC - NOMAD +44 (0) 20 7597

and Joint Broker 5970

----------------------

Jeremy Ellis

Ben Griffiths

----------------------

Arden Partners PLC - Joint

Broker +44 (0) 20 7614 5900

----------------------

Ruari McGirr

Richard Johnson

Simon Johnson

----------------------

Notes to Editors

SIMEC Atlantis Energy

SAE is a global developer, owner and operator of sustainable

energy projects with a diverse portfolio in various stages of

development. This includes a 77 per cent. stake in the world's

largest tidal stream power project, MeyGen, 100 per cent. of the

220MW Uskmouth Power Station conversion project and 100 per cent.

of Green Highland Renewables, a leading developer of mini-hydro

projects.

https://www.simecatlantis.com/

More on the MeyGen Project:

https://simecatlantis.com/projects/meygen/

More on the Uskmouth Project:

https://simecatlantis.com/project-development-operation/simec-uskmouth-power/

Chairman's Statement

SIMEC Atlantis Energy Limited ("SAE") commenced 2021 under the

leadership of our new Chief Executive Officer, Graham Reid. As the

economy started to return to some semblance of normality, we have

continued to make progress in all key areas of our business.

Power Station Conversion

The Uskmouth conversion project continues to progress and the

statement of case response to the Welsh Government's decision to

call the planning in was made earlier this year. This outlined the

existing consents that the power station holds and emphasised the

broader economic case for the facility. Natural Resources Wales

(NRW) is undertaking a final peer review before it issues an

interim permit for public consultation. This supports the technical

case for the project and gives increased confidence in the ability

of the SAE team to deliver this 'first-of-a-kind' project.

The global significance of this project was further underlined

by the announcement of our partnership with Remediiate (UK) Ltd, an

integrated sustainable developer of patented technologies that

utilise waste gases to deliver high value algae products. This

technology has the potential to make the Uskmouth conversion

project carbon negative and creates a high value economic

product.

SAE's development of the detailed engineering design, fuel

specification and CO(2) removal solution for the conversion of

coal-fired power plants to burn low carbon waste derived fuel

pellets on a carbon negative basis provides a significant

contribution to the world's journey to net zero. Utilising

end-of-waste plastics in the fuel pellets provides an important

solution to the plastic waste issue. We look forward to moving

ahead with the Uskmouth project following the grant of the permit

from NRW and further developing a pipeline of coal-fired generation

conversion projects globally to meaningfully contribute to the

global challenges of carbon emissions and waste plastic

pollution.

Marine Energy

MeyGen experienced interruption to generation during the first

half of 2021. We expect the AR1500 turbine and Andritz turbine

number 1 to be redeployed during Q4 of 2021, at which point 3 out

of 4 turbines will be deployed and generating. Andritz turbine

number 2 remains out of the water whilst waiting for long lead

items, the delivery of which have been affected by COVID-19.

Andritz turbine number 3 is deployed and has been generating

successfully with above 95% availability since December 2018,

continuing to prove the viability of tidal energy.

In Japan, the AR500 tidal turbine was recently recognised as an

official power generation facility by the Ministry of Economy,

Trade and Industry (METI), a key stakeholder in consenting

renewable energy projects in Japan. The turbine tests, which were

successfully passed during one of the strongest tides expected this

year, follow an exhaustive process of inspection and verification

of both the onshore facility and offshore equipment against

national electrical standards.

Since January, the AR500 tidal turbine has generated over 100

MWh of power from the tidal flow in the Goto islands. It is the

first large scale project of its kind in Japanese waters and

continues to support Japan's ambition in further diversifying its

energy supply towards renewable sources.

The Raz Blanchard project continues as planned through its

development phase and we remain in close discussions with the

French authorities around possible grants and feed in tariffs.

Hydro Power

SIMEC GHR Ltd ("GHR"), SAE's hydro division, has now

commissioned three of the four schemes that remained under

construction and continues to develop the asset management and

operations and maintenance side of its business. GHR is providing

asset management services for most of the circa 50 schemes that it

has constructed, predominantly under long term agreements.

Share Placement Agreement

In March 2021 the Company received the second tranche investment

of GBP2,000,000 under the share placement agreement with New

Technology Capital Group LLC announced in December 2020. On 28

September 2021 the Company terminated the share placement agreement

with New Technology Capital Group LLC. No further funds will be

drawn down pursuant to the agreement. The balance of funds due to

New Technology Capital Group of GBP930,000 will be settled as

required through the issue of new SAE shares in due course, under

the surviving terms of the agreement.

Share Placing

On 28 September 2021 the Company announced a proposed placing at

2.5 pence per Ordinary Share to raise gross proceeds (before

expenses) of approximately GBP2.5 million.

Further Funding

As noted in the recent going concern statement in SAE's final

results for the year ended 31 December 2020, as SAE continues to

develop its key projects, it remains dependent upon external

financing.

The Directors' assessment of going concern is described at Note

4 below. In concluding on the appropriateness of the going concern

basis for preparation of the financial statements, the Directors

have acknowledged the need for further funding in the short term to

support continuing Group operations and the development of key

projects.

The Board is considering a range of funding options for the

Group including the disposal of certain non-core assets within the

Group.

Summary of Results

The overall loss before tax of GBP10.7 million for the six

months ended 30 June 2021 compares to the loss of GBP6.2 million

reported for the same period in 2020. There are a number of factors

behind the increase. There was reduced revenue performance from the

MeyGen project as a result of significant outages in three of its

four turbines and which necessitated retrieval for onshore repair.

2021 results for the tidal turbine and engineering services

division have seen a drop off following a very strong 2020, which

benefitted from revenues on the phase 1 Japanese tidal project. GHR

continued to deliver stable growth.

Overall, costs were in line with expectations, with increased

contractors' costs being incurred in the MeyGen retrievals and the

ongoing Uskmouth development costs.

Depreciation, as expected, remains stable and is driven by the

Uskmouth and MeyGen projects.

Finance costs in the current period are materially in line with

the same period last year.

As noted above, in March 2021 the Company received the second

tranche investment of GBP2,000,000 from a subscription for ordinary

shares under the share placement deed announced in December 2020.

On 28 July 2021 the Company issued 11,904,762 ordinary shares in

relation to GBP500,000 of subscription under this share placement

deed. On 20 August 2021 the Company issued 11,904,762 ordinary

shares in relation to GBP500,000 of subscription under this share

placement deed.

The unaudited consolidated cash position of the Group at 30 June

2021 was GBP3.6 million. Included in cash and cash equivalents in

the statements of financial position is GBP1.5 million (2020:

GBP1.4 million) of encumbered deposits. On 31 August 2021 GBP0.5m

was released back to the Group.

On 28 September 2021, George Jay Hambro resigned his position on

the Board. I would like to thank Jay for the contribution he made

during his time on the Board.

Duncan Black

Chairman

Condensed consolidated statement of profit and loss and

other comprehensive income

For the six months ended 30 June 2021

Group

Six months ended

30 June 30 June

Note 2021 2020

GBP'000 GBP'000

Revenue 5,203 7,935

Other gains and losses 696 154

Employee benefits expense (3,153) (3,203)

Subcontractor costs (4,237) (2,251)

Depreciation and amortisation (5,378) (5,318)

Acquisition costs - -

Other operating expenses (2,122) (1,534)

----------- -----------

Total expenses (14,922) (12,306)

Results from operating activities (8,991) (4,217)

Finance costs (1,741) (1,959)

Loss before tax (10,732) (6,176)

Tax (charge)/ credit (943) 69

Loss for the period (11,675) (6,107)

Other comprehensive income:

Items that are or may be reclassified

subsequently to profit or loss

Exchange differences on translation

of foreign operations 34 4

----------- -----------

Total comprehensive income for

the period (11,641) (6,103)

=========== ===========

Loss attributable to:

Owners of the Group (10,915) (5,868)

Non-controlling interests (760) (239)

----------- -----------

Total comprehensive income attributable

to:

Owners of the Group (10,881) (5,864)

Non-controlling interests (760) (239)

----------- -----------

Loss per share (basic and diluted)

(pence) 5 (0.02) (0.01)

=========== ===========

Condensed consolidated statement of financial position

As at 30 June 2021

Group

30 June 31 December

2021 2020

GBP'000 GBP'000

Assets

Property, plant and equipment 128,011 131,085

Intangible assets 14,575 15,434

Right-of-use assets 1,563 1,739

Investment in joint venture 511 511

Loan to joint venture 410 -

Non-current assets 145,070 148,769

------------ --------------

Trade and other receivables 2,374 3,216

Inventory 861 861

Cash and cash equivalents 3,626 5,814

Current assets 6,861 9,891

------------ --------------

Total assets 151,931 158,660

============ ==============

Liabilities

Trade and other payables 9,245 8,055

Lease liabilities 231 327

Provisions 126 162

Loans and borrowings 3,751 5,488

Current liabilities 13,353 14,032

------------ --------------

Lease liabilities 1,350 1,350

Provisions 14,925 14,879

Loans and borrowings 45,422 43,041

Deferred tax liabilities 4,504 3,582

------------ --------------

Non-current liabilities 66,201 62,852

------------ --------------

Total liabilities 79,554 76,884

------------ --------------

Net assets 72,377 81,776

============ ==============

Equity

Share capital 197,376 195,375

Capital reserve 12,665 12,665

Translation reserve 7,114 7,080

Share option reserve 901 787

Accumulated losses (150,629) (139,841)

Total equity attributable to owners

of the Company 67,427 76,066

Non-controlling interests 4,950 5,710

------------ --------------

Total equity 72,377 81,776

============ ==============

Condensed consolidated statement of changes in equity

For the six months ended 30 June 2021

Attributable to owners of the Company

-------------------------------------------------------------

Share Non-

Share Capital Translation option Accumulated controlling

capital reserve reserve reserve losses Total interest Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Group

At 1 January 2020 188,018 12,665 7,079 740 (120,786) 87,716 6,315 94,031

-------------------- ------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period

Loss for the period - - - - (5,868) (5,868) (239) (6,107)

Other comprehensive

income - - 4 - - 4 - 4

-------------------- ------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period - - 4 - (5,868) (5,864) (239) (6,103)

Transactions with

owners

Contributions and

distributions

-------------------- ------- ------- ----------- ------- ----------- -------- ----------- --------

Issue of share - -

capital - - - - - -

Recognition of - - -

share-based

payments - - - - -

Transfer between - - -

reserves - - - - -

- - - - - - - -

Total transactions

with owners - - - - - - - -

------- ------- ----------- ------- ----------- -------- ----------- --------

At 30 June 2020 188,018 12,665 7,083 740 (126,654) 81,852 6,076 87,928

-------------------- ------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period

Loss for the period - - - - (13,211) (13,211) (366) (13,577)

Other comprehensive

income - - (3) - - (3) - (3)

-------------------- ------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period - - (3) - (13,211) (13,214) (366) (13,580)

Transactions with

owners

Contributions and

distributions

-------------------- ------- ------- ----------- ------- ----------- -------- ----------- --------

Issue of share

capital

net of issue costs 7,357 - - - - 7,357 - 7,357

Recognition of

share-based

payments - - - 71 - 71 - 71

Transfer between

reserves - - - (24) 24 - - -

-------------------- ------- ------- ----------- ------- ----------- -------- ----------- --------

Total transactions

with owners 7,357 - - 47 24 7,428 - 7,428

------- ------- ----------- ------- ----------- -------- ----------- --------

At 31 December 2020 195,375 12,665 7,080 787 (139,841) 76,066 5,710 81,776

Total comprehensive

income for the

period

Loss for the period - - - - (10,915) (10,915) (760) (11,675)

Other comprehensive

income - - 34 - - 34 - 34

-------------------- ------- ------- ----------- ------- ----------- -------- ----------- --------

Total comprehensive

income for the

period - - 34 - (10,915) (10,881) (760) (11,641)

Transactions with

owners

Contributions and

distributions

-------------------- ------- ------- ----------- ------- ----------- -------- ----------- --------

Issue of share

capital

net of issue costs 2,001 - - - - 2,001 - 2,001

Recognition of

share-based

payments - - - 241 - 241 - 241

Transfer between

reserves - - - (127) 127 - - -

-------------------- ------- ------- ----------- ------- ----------- -------- ----------- --------

Total transactions

with owners 2,001 - - 114 127 2,242 - 2,242

------- ------- ----------- ------- ----------- -------- ----------- --------

At 30 June 2021 197,376 12,665 7,114 901 (150,629) 67,427 4,950 72,377

------- ------- ----------- ------- ----------- -------- ----------- --------

Condensed consolidated statement of cash flows

For the six months ended 30 June 2021

Group

Six months ended

30 June 30 June

2021 2020

GBP'000 GBP'000

Cash flows from operating activities

Loss before tax for the period (10,732) (6,176)

Adjustments for:

Grant income (9) (71)

Depreciation of property, plant and

equipment 4,531 4,497

Amortisation of intangible asset 847 821

Interest income (8) (18)

Finance costs 1,741 1,959

Share-based payments 241 -

Provision movement (35) -

Net foreign exchange 190 (23)

Operating cash flows before movements

in working capital (3,234) 989

Movement in trade and other receivables 842 1,376

Movement in trade and other payables 819 1,625

Net cash used in operating activities (1,573) 3,990

----------------- ---------------

Cash flows from investing activities

Purchase of property, plant and equipment (1,282) (3,514)

Loan to joint venture (410) -

Net cash used in investing activities (1,692) (3,514)

----------------- ---------------

Cash flows from financing activities

Proceeds from grants received 9 1,509

Proceeds from issue of shares 2,250 4,000

Costs related to fund raising (249) -

Proceeds from borrowings - 1,056

Repayment of borrowings (383) (961)

Deposits (pledged) / released (18) (492)

Payment of lease liabilities (147) (235)

Interest paid (544) (547)

Net cash from financing activities 918 4,330

----------------- ---------------

Net (decrease)/increase in cash and

cash balances (2,347) 4,806

Cash and cash equivalents at beginning

of period 4,315 3,602

Effect of foreign exchange on cash

held in currency 141 -

Cash and cash equivalents at end

of period 2,109 8,408

================= ===============

Included in cash and cash equivalents in the statements of

financial position is GBP1.5 million (2020: GBP1.4 million) of

encumbered deposits. On 31 August 2021 GBP0.5m was released back to

the Group

Notes to the Consolidated Interim Financial Statements

The condensed consolidated statement of financial position of

SIMEC Atlantis Energy Limited (the "Company") and its subsidiaries

(the "Group") as at 30 June 2021, the condensed consolidated

statement of profit or loss and other comprehensive income, the

condensed consolidated statement of changes in equity and the

condensed consolidated statement of cash flows for the Group for

the six-month period then ended and certain explanatory notes (the

"Consolidated Interim Financial Statements"), were approved by the

Board of Directors for issue on 28 September 2021.

These notes form an integral part of the Consolidated Interim

Financial Statements.

The Consolidated Interim Financial Statements do not comprise

statutory accounts of the Group within the meaning in the

provisions of the Singapore Companies Act, Chapter 50. The Group's

statutory accounts for the year ended 31 December 2020 were

prepared in accordance with Singapore Financial Reporting Standards

(International) (SFRS(I)) and International Financial Reporting

Standards (IFRS). SFRS(I)s are issued by the Accounting Standards

Council Singapore, which comprise standards and interpretations

that are equivalent to IFRS issued by the International Accounting

Standards Board. All references to SFRS(I)s and IFRSs are

subsequently referred to as IFRS in these financial statements

unless otherwise specified.

The Group's statutory accounts for the year ended 31 December

2020 were approved by the Board of Directors on 29 June 2021.

1. Domicile and activities

SIMEC Atlantis Energy Limited (the "Company") is a company

incorporated in Singapore. The Company's registered office address

is c/o Level 4, 21 Merchant Road, #04-01, Singapore 058267. The

principal place of business is Edinburgh Quay 2, 139

Fountainbridge, Edinburgh, EH3 9QG, United Kingdom.

The principal activity of the Group is to develop and operate as

a global sustainable energy provider. The Company is an inventor,

developer, owner, marketer and licensor of technology, intellectual

property, trademarks, products and services and an investment

holding company.

2. Significant accounting policies

Basis of preparation

The Consolidated Interim Financial Statements have been prepared

in accordance with the AIM Rules for Companies and are therefore

not required to comply with International Accounting Standard 34

Interim Financial Reporting to maintain compliance with IFRS. In

all other respects, the financial statements are drawn up in

accordance with International Financial Reporting Standards as

issued by the International Accounting Standards Board.

Selected explanatory notes are included to explain events and

transactions that are significant to an understanding of the

changes in financial position and performance of the Group since

the last annual consolidated financial statements as at and for the

year ended 31 December 2020.

The Consolidated Interim Financial Statements, which do not

include the full disclosures of the type normally included in a

complete set of financial statements, are to be read in conjunction

with the last issued consolidated financial statements of the Group

as at and for the year ended 31 December 2020.

Accounting policies

The accounting policies and method of computation used in the

Consolidated Interim Financial Statements are consistent with those

applied in the last issued consolidated financial statements of the

Group for the year ended 31 December 2020.

3. Critical accounting judgements and key sources of estimation

uncertainty

In preparing this set of Consolidated Interim Financial

Statements, the significant judgements made by management in

applying the Group's accounting policies and the key sources of

estimation uncertainty were the same as those that applied to the

consolidated financial statements for the year ended 31 December

2020.

4. Going concern basis

In adopting the going concern basis for preparing the Interim

Financial Statements, the Board has considered the Group's business

activities, together with factors likely to affect its future

development, its performance and principal risks and uncertainties.

The Board has undertaken the assessment of the going concern

assumptions using financial forecasts for the period to 31 December

2022.

The Directors cannot envisage all possible circumstances that

may impact the Group in the future. However, after reviewing the

current liquidity position, financial forecasts, stress testing of

risks and taking account of future plans and available cash

resources, the Directors have a reasonable expectation that the

Group will have sufficient resources to support the Company to meet

all ongoing working capital and committed capital expenditure

requirements as they fall due. As a result, the Board continues to

adopt the going concern basis of accounting in preparing the

Interim Financial Statements. In arriving at this assessment the

Directors have acknowledged the need to secure further funding in

the short term to support continuing Group operations and the

development of key projects. The Board is considering a range of

funding options for the Group including the disposal of certain

non-core assets within the Group.

On 28 September 2021 the Company announced a proposed placing at

2.5 pence per Ordinary Share to raise gross proceeds (before

expenses) of approximately GBP2.5 million.

The Directors draw attention to the material uncertainties,

highlighted in the 31 December 2020 consolidated financial

statements, published on 29 June 2021, which may cast doubt upon

the Group's ability to continue as a going concern:

-- Access to related party loans from SIMEC UK Energy Holdings Ltd and SIMEC Group Ltd.

-- Refinancing of the Abundance bonds due for repayment in June 2022.

-- Timing of the repayment of EU grant funding.

The Interim Financial Statements do not include any adjustments

that would result if the Group were unable to continue as a going

concern.

5. Other notes

In respect of the six months to 30 June 2021, the diluted

earnings per share is calculated on a loss attributable to owners

of the Company of GBP10.9 million on the basic weighted average of

514,099,831 ordinary shares (30 June 2020: loss of GBP5.8 million

and basic weighted average shares of 429,077,656). Share options

were excluded from the diluted weighted average number of ordinary

shares calculations as their effect would have been anti-dilutive.

No dividend has been declared (2020: nil).

6. Events after the reporting date

On 28 July 2021 the Company issued 11,904,762 ordinary shares in

relation to GBP500,000 of subscription under the share placement

deed announced to the market on 16 December 2020.

On 20 August 2021 the Company issued 11,904,762 ordinary shares

in relation to GBP500,000 of subscription under the share placement

deed announced to the market on 16 December 2020.

On 28 September 2021 the Company announced a proposed placing at

2.5 pence per Ordinary Share to raise gross proceeds (before

expenses) of approximately GBP2.5 million.

On 28 September 2021 the Company terminated the share placing

agreement with New Technology Capital Group LLC.

COMPANY INFORMATION

NON-EXECUTIVE DIRECTORS AUDITOR

Mark Edward Monckton Elborne Ernst & Young LLP

George Jay Hambro (resigned 28/9/21) One Raffles Quay

Duncan Stuart Black North Tower, Level 18

John Anthony Clifford Woodley Singapore 048583

EXECUTIVE DIRECTORS REGISTRAR

Graham Matthew Reid Boardroom Corporate & Advisory

Andrew Luke Dagley Services Pte Ltd

50 Raffles Place

#32-01 Singapore Land Tower

Singapore 048623

REGISTERED OFFICE AND DEPOSITARY

COMPANY NUMBER Link Group

c/o Level 4, 21 Merchant Road, 10(th) Floor

#04-01 Central Square

Singapore 058267 29 Wellington Street

Company Number: 200517551R Leeds

LS1 4DL

COMPANY SECRETARY GUERNSEY BRANCH REGISTER

Kelly Tock Mui Han Link Market Services (Guernsey)

21 Merchant Road Limited

#04-01 Royal Merukh S.E.A Mont Crevelt House

Singapore 058267 Bulwer Avenue

St Sampson

Guernsey GY2 4LH

NOMINATED ADVISER AND BROKER WEBSITE

Investec Bank plc www.simecatlantis.com

30 Gresham Street

London

EC2V 7QP

BROKER

Arden Partners plc

125 Old Broad Street

London

EC2N 1AR

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUWGBUPGGQR

(END) Dow Jones Newswires

September 28, 2021 12:19 ET (16:19 GMT)

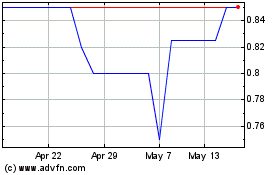

Simec Atlantis Energy (LSE:SAE)

Historical Stock Chart

From Jun 2024 to Jul 2024

Simec Atlantis Energy (LSE:SAE)

Historical Stock Chart

From Jul 2023 to Jul 2024