TIDMRTW

RNS Number : 3705A

RTW Biotech Opportunities Ltd

22 January 2024

LEI: 549300Q7EXQQH6KF7Z84

22nd January 2024

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED IN IT ARE NOT

FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN, INTO OR FROM, THE UNITED STATES OF

AMERICA (INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF

THE UNITED STATES AND THE DISTRICT OF COLUMBIA), AUSTRALIA, CANADA,

JAPAN, THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION WHERE

TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

THIS ANNOUNCEMENT IS NOT AN OFFER TO SELL, OR THE SOLICITATION

OF AN OFFER TO ACQUIRE, ANY SECURITIES IN THE UNITED STATES

(INCLUDING ITS TERRITORIES AND POSSESSIONS, ANY STATE OF THE UNITED

STATES, AND THE DISTRICT OF COLUMBIA) OR ANY OTHER JURISDICTION IN

WHICH ANY OFFER, SOLICITATION OR SALE OF SECURITIES WOULD BE

UNLAWFUL PRIOR TO REGISTRATION OR QUALIFICATION UNDER THE

SECURITIES LAWS OF ANY SUCH JURISDICTION. NO SECURITIES MAY BE

OFFERED OR SOLD IN THE UNITED STATES ABSENT REGISTRATION OR AN

APPLICABLE EXEMPTION FROM REGISTRATION REQUIREMENTS. ANY PUBLIC

OFFERING OF SECURITIES TO BE MADE IN THE UNITED STATES WILL BE MADE

BY MEANS OF A PROSPECTUS THAT MAY BE OBTAINED FROM THE ISSUER (OR,

IF APPLICABLE, A SELLING SECURITY HOLDER) AND THAT WILL CONTAIN

DETAILED INFORMATION ABOUT THE COMPANY AND MANAGEMENT, AS WELL AS

FINANCIAL STATEMENTS. RTW BIOTECH OPPORTUNITIES LIMITED DOES NOT

INT TO MAKE ANY PUBLIC OFFERING OF SECURITIES IN THE UNITED STATES.

NEITHER THIS ANNOUNCEMENT NOR ANY PART OF IT SHALL FORM THE BASIS

OF OR BE RELIED ON IN CONNECTION WITH OR ACT AS AN INDUCEMENT TO

ENTER INTO ANY CONTRACT OR COMMITMENT WHATSOEVER.

RTW Biotech Opportunities Ltd ("RTW BIO" or the "Company")

Update on Arix Scheme and RTW BIO Capital Allocation

-- RTW BIO has completed the previously announced $57.1M

acquisition of a 25.5% stake in Arix , representing a purchase

price of GBP1.37 per Arix share

-- RTW BIO reaffirms the highly compelling transaction with Arix

that delivers immediate and long-term benefits for both RTW BIO and

Arix shareholders

-- RTW BIO's NAV has increased by 29.3% since the announcement

of the transaction on 1 November 2023 and currently delivers value

equivalent of GBP1.58 per Arix share

-- Arix's first general meeting is due to take place on 29

January 2024 and RTW BIO has undertaken to vote its 25.5% stake to

support the Arix Scheme, which has been recommended by the Arix

Special Committee

-- Two leading proxy advisory firms have published recommendations in favour of the Arix Scheme

-- RTW BIO to increase capital returns to shareholders to a

total of up to $30 million post completion of the Arix Scheme

London - 22 January 2024 - RTW BIO, a London Stock

Exchange-listed investment company focused on identifying

transformative assets with high growth potential across the

biopharmaceutical and medical technology sectors, has completed the

previously announced investment in Arix Bioscience plc ("Arix") to

support the previously announced all-share acquisition of Arix's

assets by RTW BIO, to be effected through a scheme of

reconstruction and the voluntary winding-up of Arix under section

110 of the Insolvency Act 1986 (the "Arix Scheme").

New Investment in Arix Bioscience

RTW BIO has acquired 33,023,210 Arix shares from Merton

Acquisition HoldCo LLC, a wholly owned subsidiary of Acacia

Research Corporation, representing a 25.5% interest in Arix (the

"Acacia Stake"). As previously agreed, the transaction was at a

fixed price of US$57,078,670.12 , which today represents an

equivalent purchase price of GBP1.37 per Arix share ( based on

USD:GBP foreign exchange rate of 0.7900 as at 17 January 2024) ,

with RTW BIO benefiting from the weakening dollar-pound exchange

rate since deal signing. The transaction was agreed and settled in

USD contingent upon receiving clearance from the FCA, which was

granted on 15 January 2024.

RTW BIO has undertaken to vote all 33,023,210 Arix shares in

favour of all resolutions in respect of the Arix Scheme,

representing a 25.5% interest of Arix shareholder registry.

Update on RTW BIO Performance

Since the Arix Scheme was announced on 1 November 2023, RTW

BIO's NAV has increased by 29.3% as of 31 December 2023. The RTW

BIO share price has also seen a meaningful increase since

announcement and, at the Arix Scheme's fixed exchange ratio of

1.4633 RTW BIO share per Arix share, the Arix Scheme currently

delivers value equivalent of GBP1.58 per Arix share, meaningfully

higher than the Arix share price of GBP1.35 (based on RTW BIO share

price of $1.37 and USD:GBP foreign exchange rate of 0.7900, all as

at 17 January 2024). This price represents a 61.6% premium to the

Arix unaffected price as of 12 July 2023, the day immediately prior

to Arix's announcement commencing a strategic review, and a 34.2%

premium to the closing Arix share price on 31 October 2023, the day

immediately prior to the announcement of the Arix Scheme. This is a

meaningful immediate economic opportunity for Arix shareholders in

addition to the announced long-term benefits of the transaction

that include:

-- RTW as a best-in-class manager with superior capabilities for Arix's assets

-- An enhanced return potential from deployment of Arix's capital

-- Immediate scale and complementary portfolio benefits

-- Compelling value creation today and in the future for all shareholders

-- Enhanced profile providing liquidity and re-rating opportunity

-- Unique opportunity to buy into a depressed market while innovation is booming

Update on the Arix Scheme

With RTW BIO completing the purchase of the Acacia Stake, after

receiving written confirmation from the FCA confirming that it has

approved the proposed change in control of Arix, Arix is expected

to publish the shareholder circular in due course to convene the

second general meeting in connection with the Scheme. Subject to

satisfaction (or, if applicable, waiver) of the conditions to the

Scheme, the Scheme is expected to become effective in Q1 2024.

Proxy Adviser Recommendations

RTW BIO is pleased to note that two leading independent proxy

adviser firms have each published proxy advisory reports

recommending that Arix shareholders vote in favour of the

resolution in respect of the Arix Scheme to be proposed at the

first general meeting.

Update on RTW BIO Capital Allocation

The Board of RTW BIO continues to believe that the discount to

NAV per Ordinary Share at which the Company's shares currently

trade materially undervalues the Company and its portfolio.

Therefore, given the increased scale that the Arix Scheme will

provide, the Board of RTW BIO intends to increase capital returns

to shareholders to a total of up to $30 million post completion of

the Arix Scheme. This total includes the previously announced share

buyback of up to $10 million, of which c.$2.8 million has already

been executed. The NAV-accretive share buyback will be implemented

over time at the Company's discretion. The Board believes that this

allocation clearly demonstrates its confidence in the outlook for

the biotech sector and the Company's portfolio and its capital

allocation discipline whilst also providing additional liquidity to

shareholders. On 31 December 2023, 12.9% of the Company's NAV was

held in "cash and other" and 20.4% was invested in the "other

public" segment of the portfolio, which is an invested liquidity

pool designed to mitigate the drag of setting aside cash for future

deployment.

Roderick Wong, M.D., Managing Partner and Chief Investment

Officer of RTW Investments, said:

"We remain excited to partner with Arix and combine our

complementary portfolios to capitalize on the tremendous

opportunities across the life sciences markets. Today's

announcement is an important milestone towards the overall

completion of the transaction and RTW BIO has undertaken to vote

its entire Arix shareholding to support the Arix Scheme. We believe

this combination will create immense value and opportunity for both

RTW BIO and Arix shareholders and are pleased two leading proxy

advisory firms have published recommendations in favour of the Arix

Scheme. We look forward to closing this transaction and leveraging

our talented investment team and scientific expertise to unlock

value day 1 and drive long-term value in an enhanced RTW BIO for

all of our future combined shareholders."

About RTW Biotech Opportunities Ltd

RTW Biotech Opportunities Ltd (LSE: RTW & RTWG) is an

investment fund focused on identifying transformative assets with

high growth potential across the biopharmaceutical and medical

technology sectors. Driven by a long-term approach to support

innovative businesses, RTW Biotech Opportunities Ltd invests in

companies developing next-generation therapies and technologies

that can significantly improve patients' lives. RTW Biotech

Opportunities Ltd is managed by RTW Investments, LP, a leading

healthcare-focused entrepreneurial investment firm with deep

scientific expertise and a strong track record of supporting

companies developing life-changing therapies.

About RTW Investments, LP

RTW Investments, LP is a New York-based, global, full life-cycle

investment firm that focuses on identifying transformational and

disruptive innovations across the biopharmaceutical and medical

technologies sectors. As a leading partner of industry and

academia, RTW combines deep scientific expertise with a

solution-oriented investment approach to advance emerging medical

therapies by building and supporting the companies and/or academics

developing them. For further information about RTW, please visit

www.RTWfunds.com .

Enquiries

RTW Biotech Opportunities Ltd +44 20 7959 6361

Woody Stileman ir@rtwfunds.com

BofA Securities (Sole Financial Adviser & Joint

Corporate Broker to RTW Bio) +44 20 7628 1000

Kieran Millar

Ed Peel

James Machin

Alex Penney

Deutsche Numis (Joint Corporate Broker to RTW Bio) +44 20 7260 1000

Freddie Barnfield

Nathan Brown

Euan Brown

Buchanan (PR & Communications adviser to RTW Bio) +44 20 7466 5107

Charles Ryland

Henry Wilson

George Beale

Cadarn Capital +44 7368 88321

David Harris

Important information

Merrill Lynch International ("BofA Securities"), which is

authorised by the Prudential Regulation Authority ("PRA") and

regulated by the Financial Conduct Authority ("FCA") and the PRA in

the United Kingdom, is acting exclusively for RTW BIO and for no

one else in connection with the matters referred to in this

announcement and will not be responsible to anyone other than RTW

BIO for providing the protections afforded to its clients or for

providing advice in relation to the matters referred to in this

announcement. Neither BofA Securities, nor any of its affiliates,

owes or accepts any duty, liability or responsibility whatsoever

(whether direct or indirect, whether in contract, in tort, under

statute or otherwise) to any person who is not a client of BofA

Securities in connection with this announcement, any statement

contained herein or otherwise, or any transaction or arrangement

referred to herein.

Numis Securities Limited (which is trading for these purposes as

Deutsche Numis) ("Deutsche Numis"), which is authorised and

regulated by the Financial Conduct Authority in the United Kingdom,

is acting as corporate broker exclusively for RTW BIO and for no

one else and will not be responsible to anyone other than RTW BIO

for providing the protections afforded to its clients or for

providing advice in relation to the matters referred to in this

announcement. Neither Deutsche Numis, nor any of its affiliates,

owes or accepts any duty, liability or responsibility whatsoever

(whether direct or indirect, whether in contract, in tort, under

statute or otherwise) to any person who is not a client of Deutsche

Numis in connection with this announcement, any statement contained

herein or otherwise, or any transaction or arrangement referred to

herein.

Notice to US Shareholders in Arix

This announcement is not for publication or distribution,

directly or indirectly, in or into the United States of America.

This announcement is not an offer of securities for sale into the

United States. The securities referred to herein have not been and

will not be registered under the U.S. Securities of 1933, as

amended (the "Securities Act"), any state securities laws or the

securities laws of any other jurisdiction and may not be offered or

sold in the United States or to any "U.S. persons" (as defined in

Rule 902 under the Securities Act), except pursuant to an

applicable exemption from registration. No public offering of

securities is being made in the United States.

The Scheme Shares will be offered and sold for investment

purposes only in the United States or to U.S. Persons (as such

terms are defined in Rule 902 of Regulation S promulgated under the

Securities Act) under the exemption from registration provided by

Section 4(a)(2) of the Securities Act and/or Regulation D

promulgated thereunder and in compliance with the applicable

securities laws of each state or other jurisdiction in which the

offering will be made. Each prospective investor that is within the

United States or that is a U.S. Person (as such term is defined in

Rule 902 of Regulation S promulgated under the Securities Act) must

be both (i) an "accredited investor" as defined in Rule 501(a) of

Regulation D of the Securities Act and (ii) a (A) "qualified

purchaser" as the term is defined under Section 2(a)(51) of the

U.S. Investment Company Act of 1940, as amended (the "1940 Act")

and the rules and regulations promulgated thereunder or (B)

"knowledgeable employee" as such term is defined in Rule 3c-5(a)(4)

promulgated under the 1940 Act. Scheme Shares will be offered and

sold outside of the United States to investors that are not U.S.

Persons in accordance with Regulation S under the Securities

Act.

RTW BIO is not registered, and does not intend to be subject to

registration, as an investment company under the 1940 Act in

reliance upon one or more exclusions or exemptions from

registration thereunder. U.S. Shareholders of Arix are requested to

execute an investor letter ("AI/QP Investor Letter") appended to

the Prospectus. The AI/QP Investor Letter contains representations

and restrictions on transfer designed to assure that the conditions

of such exclusions or exemptions will be met. Investors in RTW BIO

will therefore not receive the protections afforded by the 1940 Act

to investors in a registered investment company. RTW BIO will not

make a public offering of the Scheme Shares to satisfy the

exclusion from registration as an investment company under the 1940

Act. If RTW BIO is deemed to be an investment company and therefore

is required to register under the 1940 Act, such requirement could

prohibit RTW BIO from operating in its intended manner and could

have a material adverse effect on RTW BIO .

The Scheme Shares are subject to restrictions on transferability

and resale and may not be transferred or resold except as permitted

under the Securities Act, the 1940 Act and any applicable state and

other securities laws, pursuant to registration or an exclusion or

exemption therefrom. The transferability of the Scheme Shares are

further restricted by the terms of the AI/QP Investor Letter, and

any re-offer or resale of any Scheme Shares in the United States or

to U.S. Persons may constitute a violation of U.S. law. U.S.

Shareholders of Arix should be aware that they may be required to

bear the financial risks of any investment in RTW BIO for an

indefinite period of time. RTW BIO reserves the right to refuse to

accept any subscriptions, resales or other transfers of Scheme

Shares to U.S. Persons or to any person, including on the basis

that doing so would risk RTW BIO's loss of an exclusion or

exemption under U.S. securities laws (e.g., the Securities Act and

the 1940 Act). RTW BIO further reserves the right to require the

transfer or redemption of Scheme Shares held by any person for any

reason, including circumstances that may prejudice the tax status

of RTW BIO , may cause RTW BIO to be in violation of the Securities

Act, the 1940 Act or any applicable state securities act or may

cause RTW BIO to suffer any pecuniary, fiscal or administrative

disadvantage which may be unlawful or detrimental to the interests

or well-being of RTW BIO .

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDFLFIILLILFIS

(END) Dow Jones Newswires

January 22, 2024 02:00 ET (07:00 GMT)

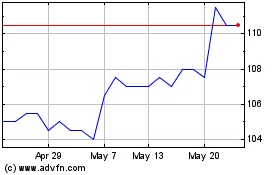

Rtw Biotech Opportunities (LSE:RTWG)

Historical Stock Chart

From Nov 2024 to Dec 2024

Rtw Biotech Opportunities (LSE:RTWG)

Historical Stock Chart

From Dec 2023 to Dec 2024