TIDMRTC

RNS Number : 1728N

RTC Group PLC

24 July 2014

RTC Group Plc

("RTC", "the Company" or "the Group")

Interim results for the six months ended 30 June 2014

RTC Group Plc,the business services organisation focussing on

white and blue collar recruitment providing temporary, permanent

and contingent staff to a broad range of industries and clients in

both domestic and international markets, is pleased to announce its

interim results for the six months ended 30 June 2014.

Highlights

-- Group revenue from continuing operations GBP25.3m (2013: GBP23.4m)

-- Group operating profit GBP467k (2013: GBP66k)

-- Significantly improved cash flow from operations of GBP1.3m (2013: outflow GBP1.3m)

-- Basic earnings per share of 2.32p (2013: 0.04p)

The directors propose an interim dividend of 0.5p per share

(2013: nil). The Company has a progressive dividend policy. Subject

to approval of the Directors, the interim dividend will be paid on

the 1 October 2014 to shareholders on the register on 5 September

2014.

Commenting on the results Bill Douie, Chairman, said:

"The staffing and structural changes in ATA Recruitment have

settled in well and are continuing to deliver value to the Group.

This coupled with the solid first half performance of all our core

businesses give the Directors confidence that the year as a whole

will meet market expectations."

Copies of the interim report will be available on the Company's

website, www.rtcgroupplc.co.uk.

Enquiries:

RTC Group Plc 01332 861 835

Bill Douie, Chairman

Andy Pendlebury, Chief Executive

Sarah Dye, Group Finance Director

Allenby Capital Limited - Nominated

Adviser & Broker 020 3328 5656

Jeremy Porter, Corporate Finance

Michael McNeilly, Corporate Finance

About RTC

RTC has three principal trading subsidiaries engaged in the

recruitment of human capital resources and the provision of managed

services.

ATA Recruitment is one of the UK's leading engineering and

technical recruitment consultancies, supplying white and blue

collar engineering and technical staff to a broad range of SME

clients and vertical markets.

Ganymede Solutions is focussed on the supply and operation of

blue collar contingent labour into safety critical markets.

Global Staffing Solutions predominantly provides managed service

solutions.

Chairman's statement

Six months ended 30 June 2014

I am pleased to present the interim report of the Company for

the six months to 30 June 2014.

Trading in the first six months of 2014 has exceeded

expectations with pleasing results in all operational areas.

All of our core businesses have at least performed in line with

expectations with Ganymede Solutions continuing to achieve

accelerated growth. During the first half of 2013, we invested

heavily in ATA Recruitment both in consultant headcount and the

management team. The rewards from that investment began to emerge

during the second half of 2013 and I am delighted to report that

this has continued into 2014. Global Staffing Solutions has begun

managing the gradual decline of contractors deployed in Afghanistan

as NATO involvement in the region comes to a close. Whilst we

anticipate some level of activity during 2015, precise numbers are

not yet clear. However the business is continuing to secure other

international opportunities to mitigate the anticipated

reduction.

Given the solid performance in the first half we are now

confident that the year as a whole will meet market

expectations.

Management and Board

During the first half, our Non-Executive Director, John White,

decided he had achieved the objectives he established when making a

substantial and welcome investment in our Group. Accordingly, he

sold his shares and resigned his position. We are happy to have

secured, as a replacement Non-Executive Director, Tim Jackson,

previously Finance Director at Staffline Plc. Tim brings a wealth

of wisdom and experience in our industry which will provide a vital

input to the overall effectiveness of the Group Board team at this

strategically important time.

Dividends

The directors propose an interim dividend of 0.5p per share

(2013: nil). The Company has a progressive dividend policy. Subject

to approval of the Directors, the interim dividend will be paid on

the 1 October 2014 to shareholders on the register on 5 September

2014.

Outlook & Strategy

All of our core businesses support sectors and industries are

showing signs of long term sustainable growth. The United Kingdom's

domestic manufacturing and construction sectors which fuel ATA

Recruitment's branch network growth remain extremely buoyant and we

will therefore continue throughout the year to invest in headcount

and infrastructure to capitalise on the opportunities this optimism

brings. The rail industry is set for another long term investment

programme driven by the Government's continued commitment to invest

in the sector. Both ATA Recruitment and Ganymede Solutions are

becoming increasingly well placed to capture further growth with

their respective clients as this spend emerges. The international

landscape is also promising and whilst contracts are more difficult

to secure and have longer lead times, the volumes and margins offer

significant rewards where successful.

W J C Douie 24 July 2014

Chairman

Finance Director's statement

Six months ended 30 June 2014

Revenue

In the period ended 30 June 2014, Group revenue increased to

GBP25.3m (2013:GBP23.4m) reflecting a solid performance across all

Group companies. Overall gross margin is up slightly to 20% (2013:

19%).

Gross profit

Following a review by the directors of the group's policy for

presenting costs arising within the recruitment segments against

companies within the same industry the group has restated the prior

year consolidated statement of comprehensive income in order to

re-allocate certain expenses within cost of sales to administrative

expenses in order to enhance comparability with those companies

(refer note 1 d).

Profit from operations

Overall group profit from operations was GBP467k (2013:

GBP66k).

ATA Recruitment

In 2013 the Group invested in staffing and structural changes in

ATA Recruitment. Profit from operations of GBP502k (2013: GBP385k)

is testament to the success of those changes. Gross margin is also

showing improvement at 22% (2013: 20%).

Ganymede Solutions

Profit from operations has improved by in excess of 80% at

GBP510k (2013:GBP274k), reflecting a continuation of the increased

levels of activity with existing customers that we saw in the

second half of 2013. Gross margin is also showing improvement at

17% (2013: 16%).

Global Staffing Solutions

Increased profit from operations of GBP463k (2013:364k) reflects

continuing efficiencies in managing the contract in Afghanistan

offsetting a slight decline in number of contractors as the

contract begins to draw down, coupled with an increase in income

from other sources. Those efficiencies reflected in gross margin of

16% (2013:14%).

Taxation

The total tax charge for the period is estimated at GBP92k

(2013: nil).

Earnings per share

The basic earnings per share figure has increased significantly

to 2.32p (2013: 0.04p). The diluted earnings per share also

increased significantly to 2.14p (2013: 0.04p). Profit before tax

is GBP405k (2013: GBP5k).

Dividends

The directors propose an interim dividend of 0.5p per share

(2013: nil). The Company has a progressive dividend policy. Subject

to approval of the Directors, the interim dividend will be paid on

the 1 October 2014 to shareholders on the register on 5 September

2014.

Finance Director's statement

For the year ended 31 December 2014

Statement of financial position

We have worked very closely with key customers during the period

to improve processes and speed up payment and I am very pleased to

report a decrease in trade receivables since 31 December 2013 of

GBP0.9m against a backdrop of increasing turnover.

As a direct consequence, the Group balance sheet strengthened

significantly compared to the same period last year, with net

working capital increasing by GBP1.0m to GBP1.6m (2013: GBP0.6m)

and an increased ratio of current assets to current liabilities of

1.24 (2013: 1.07).

The Group's gearing ratio has fallen to 1.2 times (2013: 4.1

times). Interest cover has increased to 7.5 times (2013: 6.5 times)

further evidence of improvement in the Group's financial

position.

Cash flow

Cash generation over the period has improved significantly as a

result of our work with customers and our pro-active approach to

debtor management. We are now reporting positive cash flows from

operations of GBP1.3m versus a net outflow of GBP1.3m in the

corresponding period in 2013.

Financing

The Group's current bank facilities include an overdraft of

GBP50,000 and a confidential invoice discounting facility of up to

GBP7.0m with HSBC. The Group is currently operating well within its

facility cap.

The Board closely monitors the level of facility utilisation and

availability to ensure that there is sufficient headroom to manage

current operations and support the growth of the business.

The Group continues to be focussed on cash generation and

building a robust balance sheet to support the growth of the

business.

Sarah Dye 24 July 2014

Group Finance Director

Consolidated statement of comprehensive income

Six months ended 30 June 2014

Six month Six month Year ended

period ended period ended 31 December

30 June 30 June 2013 2013

2014

Unaudited Unaudited Audited

Restated Restated

Notes GBP'000 GBP'000

Revenue 2 25,268 23,386 48,817

Cost of sales 2 (20,225) (19,013) (39,552)

------------------------- ------ -------------------------- -------------------------- ------------------------

Gross profit 2 5,043 4,373 9,265

Administrative expenses (4,576) (4,307) (8,394)

Profit from operations 467 66 871

Financing expense (62) (61) (135)

------------------------- ------ -------------------------- -------------------------- ------------------------

Profit before tax 405 5 736

Tax expense 3 (92) - (224)

------------------------- ------ -------------------------- -------------------------- ------------------------

Net profit and total

comprehensive income

for the year 313 5 512

------------------------- ------ -------------------------- -------------------------- ------------------------

Earnings per ordinary

share 6

Basic 2.32p 0.04p 3.79p

------------------------- ------ -------------------------- -------------------------- ------------------------

Diluted 2.14p 0.04p 3.69p

------------------------- ------ -------------------------- -------------------------- ------------------------

Consolidated statement of changes in equity

Six months ended 30 June 2014

Share Share Capital Share Accumulated Total

capital premium redemption based losses equity

reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2014

(audited) 135 2,468 50 18 (970) 1,701

--------------------- --------- --------- ------------ --------- ------------ --------

Profit and total

comprehensive

income for the

period - - - - 313 313

--------------------- --------- --------- ------------ --------- ------------ --------

Share based payment

reserve - - - 8 - 8

--------------------- --------- --------- ------------ --------- ------------ --------

At 30 June 2014

(unaudited) 135 2,468 50 26 (657) 2,022

--------------------- --------- --------- ------------ --------- ------------ --------

Six months ended 30 June 2013

Share Share Capital Share Accumulated Total

capital premium redemption based losses equity

reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2013

(audited) 135 2,468 50 - (1,482) 1,171

--------------------- --------- --------- ------------ --------- ------------ --------

Profit and total

comprehensive

income for the

period - - - - 5 5

--------------------- --------- --------- ------------ --------- ------------ --------

Share based payment

reserve - - - 15 - 15

--------------------- --------- --------- ------------ --------- ------------ --------

At 30 June 2013

(unaudited) 135 2,468 50 15 (1,477) 1,191

--------------------- --------- --------- ------------ --------- ------------ --------

Consolidated statement of changes in equity

Year ended 31 December 2013

Share Share Capital Share Accumulated Total

capital premium redemption based losses equity

reserve payment

reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January 2013

(audited) 135 2,468 50 - (1,482) 1,171

--------------------- --------- --------- ------------ --------- ------------ --------

Profit and total

comprehensive

income for the

year - - - - 512 512

--------------------- --------- --------- ------------ --------- ------------ --------

Share based payment

reserve - - - 18 - 18

--------------------- --------- --------- ------------ --------- ------------ --------

At 31 December

2013 (audited) 135 2,468 50 18 (970) 1,701

--------------------- --------- --------- ------------ --------- ------------ --------

The share based payment reserve comprises the cumulative share

option charge under IFRS 2 less the value of any share options that

have been exercised or have lapsed.

Consolidated statement of financial position

As at 30 June 2014

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2013 Audited

June 2014 June 2013

Unaudited Unaudited

Note GBP'000 GBP'000 GBP'000

Assets

Non-current

Property, plant and equipment 389 378 431

Deferred tax asset 4 70 238 110

--------------------------------- ----- ----------- ----------- --------------

459 616 541

Current

Cash and cash equivalents 69 232

Inventories 12 10 15

Trade and other receivables 8,193 9,092 9,127

--------------------------------- ----- ----------- ----------- --------------

8,274 9,102 9,374

Total assets 8,733 9,718 9,915

--------------------------------- ----- ----------- ----------- --------------

Liabilities

Current

Trade and other payables (4,141) (3,642) (4,230)

Corporation tax (147) - (95)

Current borrowings (2,406) (4,885) (3,867)

--------------------------------- ----- ----------- ----------- --------------

Total liabilities (6,694) (8,527) (8,192)

Non-current liabilities

Creditors falling due after one year

- finance leases (17) - (22)

---------------------------------------- ----------- ----------- --------------

Net assets 2,022 1,191 1,701

--------------------------------- ----- ----------- ----------- --------------

Equity

Share capital 135 135 135

Share premium 2,468 2,468 2,468

Capital redemption reserve 50 50 50

Share based payment reserve 26 15 18

Accumulated losses (657) (1,477) (970)

Total equity 2,022 1,191 1,701

--------------------------------- ----- ----------- ----------- --------------

Consolidated statement of cash flows

Six months ended 30 June 2014

Six month Six month Year ended

period ended period ended 31 December

30 June 30 June 2013

2014 Unaudited 2013 Unaudited Audited

GBP'000 GBP'000 GBP'000

Cash flows from operating activities

Profit before tax 405 5 736

Adjustments for:

Depreciation, loss on disposal

and amortisation 107 94 181

Profit on sale of property, plant

and equipment - 1 3

Employee equity settled share

options 8 15 18

Change in inventories 3 3 (2)

Change in trade and other receivables 934 (1,036) (1,068)

Change in trade and other payables (94) (382) 245

---------------------------------------- ---------------- ---------------- -------------

Cash generated from operations 1,363 (1,300) 113

Net cash from/(used) in operating

activities 1,363 (1,300) 113

---------------------------------------- ---------------- ---------------- -------------

Cash flows from investing activities

Purchases of property, plant and

equipment (65) (76) (212)

Purchases of shares in subsidiary

companies - - -

---------------------------------------- ---------------- ---------------- -------------

Net cash used in investing activities (65) (76) (212)

---------------------------------------- ---------------- ---------------- -------------

Cash flows from financing activities

Net cash inflow/(outflow) from

financing activities - - (27)

---------------------------------------- ---------------- ---------------- -------------

Net increase/(decrease) in cash

and cash equivalents from operations 1,298 (1,376) (126)

---------------------------------------- ---------------- ---------------- -------------

Total net (decrease) in cash and

cash equivalents 1,298 (1,376) (126)

---------------------------------------- ---------------- ---------------- -------------

Cash and cash equivalents at beginning

of period (3,635) (3,509) (3,509)

---------------------------------------- ---------------- ---------------- -------------

Cash and cash equivalents at end

of period (2,337) (4,885) (3,635)

---------------------------------------- ---------------- ---------------- -------------

Notes to the interim statement

Six months ended 30 June 2014

1. Accounting policies

a) General information

RTC Group PLC incorporated and domiciled in England whose shares

are publicly traded on AIM. The registered office address is The

Derby Conference Centre, London Road, Derby, DE24 8UX. The

company's registered number is 02558971. The principal activities

of the Group are described in note 2.

The Board consider the principal risks and uncertainties

relating to the Group for the next six months to be the same as

detailed in our last Annual Report and Accounts to 31 December

2013. The Group's financial risk management objectives and policies

are consistent with those disclosed in the consolidated financial

statements as at and for the year ended 31 December 2013.

b) Basis of preparation

The unaudited interim group financial statements of RTC Group

PLC are for the six months ended 30 June 2014 and do not comprise

statutory accounts within the meaning of S.435 of the Companies Act

2006. The unaudited interim group financial statements have been

prepared in accordance with the AIM rules. This report should be

read in conjunction with the Group's Annual Report and Accounts for

the year ended 31 December 2013, which have been prepared in

accordance with IFRS's as adopted by the European Union.

These unaudited interim group financial statements were approved

for issue on 24 July 2014. No significant events, other than those

disclosed in this document, have occurred between 30 June 2014 and

this date.

c) Comparatives

The comparative figures for the year ended 31 December 2013 do

not constitute statutory accounts within the meaning of S.435 of

the Companies Act 2006, but they have been derived from the audited

financial statements for that year, which have been filed with the

Registrar of Companies. The report of the auditor was unqualified

and did not contain a statement under section 498 (2) or (3) of the

Companies Act 2006 nor a reference to any matters which the auditor

drew attention by way of emphasis of matter without qualifying

their report.

d) Accounting policies

Other than the reallocation of certain expenses from cost of

sales to administrative expenses, as explained below, the

accounting policies adopted are consistent with those described in

the annual financial statements for the year ended 31 December

2013. There have been no significant changes in the basis upon

which estimates have been determined, compared to those applied at

31 December 2013 and no change in estimate has had a material

effect on the current period. Other than the restatement of gross

profit as explained below.

Restatement of gross profit

Following a review by the directors of the group's policy for

presenting costs arising within the recruitment segments against

companies within the same industry the group has restated the prior

year consolidated statement of comprehensive income in order to

re-allocate certain expenses within cost of sales to administrative

expenses in order to enhance comparability with those companies.

The expenses reallocated to administrative expenses are those not

directly attributable to contractors. The effect of the

re-allocation was to increase administrative expenses for the year

ended 31 December 2013 by GBP3.7m and reduce cost of sales by

GBP3.7m and increasing gross profit by GBP3.7m. There was no change

to reported revenue or profit from operations. Segment reporting in

note 2 has been restated to reflect the change in basis of

allocation.

The following enhancements to the accounting policy on revenue

have also been made and will be reflected in the annual financial

statements for the year ended 31 December 2014:

Cost of sales

Cost of sales consists of the salary cost of temporary staff,

direct costs associated with temporary staff including equipment

and work wear, travel and training costs and direct costs

associated with conferencing revenue.

Gross profit

Gross profit represents revenue less cost of sales and consists

of the total placement fees of permanent candidates, the margin

earned on the placement of temporary candidates and the margin on

conferencing revenue.

This interim announcement has been prepared based on IFRS's

which are in issue that are effective or available for early

adoption at the Group's annual reporting date as at 31 December

2014.

2. Segment analysis

The Group is a provider of recruitment services that is based at

the Derby Conference Centre. The recruitment business comprises

three distinct business units - ATA Recruitment servicing the UK

SME engineering market and a number of vertical markets; Global

Staffing Solutions predominantly providing managed service

solutions and Ganymede Solutions predominantly supplying blue

collar labour into rail.

Segment information is provided below in respect of ATA

Recruitment, Global Staffing Solutions, Ganymede Solutions and

Derby Conference Centre which houses the Group's head office and

also provides hotel and conferencing facilities.

The Group manages the trading performance of each segment by

monitoring operating contribution and centrally manages working

capital, borrowings and equity.

Revenues are generated from permanent and temporary recruitment

in the Recruitment division. Revenue is analysed by origin of

customer/point of invoicing and as such all recruitment division

revenues are supplied in the United Kingdom. Hotel and conferencing

services are wholly provided in the United Kingdom at the Derby

Conference Centre.

All revenues have been invoiced to external customers. During

2014, one customer in the ATA Global Staffing Solutions segment

contributed 10% or more of that segment's revenues being GBP6.9m

(2013: GBP7.3m).

The segmental information for the reporting period is as

follows:

Six months ended 30 June 2014

<--------- Recruitment --------> Conferencing Total

ATA Recruitment Global Ganymede Derby Conference Group

Staffing Solutions Centre

Solutions Limited

Unaudited Unaudited Unaudited Unaudited Unaudited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External sales

revenue 11,139 7,040 6,291 798 25,268

Cost of sales (8,683) (5,937) (5,252) (353) (20,225)

------------------- ---------------- ------------ ----------- ----------------- ----------

Segment gross

profit 2,456 1,103 1,039 445 5,043

Administrative

expenses (1,928) (639) (524) (416) (3,507)

Depreciation (26) (1) (5) (39) (71)

Segment operating

profit 502 463 510 (10) 1,465

------------------- ---------------- ------------ ----------- ----------------- ----------

Group costs (998)

----------

Operating profit per statement of comprehensive

income 467

----------

Six months ended 30 June 2013

<--------- Recruitment --------> Conferencing Total

ATA Recruitment Global Ganymede Derby Conference Group

Staffing Solutions Centre

Solutions Limited

Unaudited Unaudited Unaudited Unaudited Unaudited

Restated Restated Restated Restated Restated

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External sales

revenue 10,973 7,377 4,257 779 23,386

Cost of sales (8,735) (6,359) (3,575) (344) (19,013)

------------------- ---------------- ------------ ----------- ----------------- ----------

Segment gross

profit 2,238 1,018 682 435 4,373

Administrative

expenses (1,820) (646) (394) (380) (3,240)

Depreciation (33) (8) (14) (39) (94)

Segment operating

profit 385 364 274 16 1,039

------------------- ---------------- ------------ ----------- ----------------- ----------

Group costs (973)

----------

Operating profit per statement of comprehensive

income 66

----------

Year ended 31 December

2013

<--------- Recruitment --------> Conferencing Total

ATA Recruitment Global Ganymede Derby Conference Group

Staffing Solutions Centre

Solutions Limited

Audited Audited Audited Audited Audited

Restated Restated Restated Restated Restated

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

External sales

revenue 22,500 14,840 9,938 1,539 48,817

Cost of sales (17,875) (12,645) (8,309) (723) (39,552)

---------------------- ---------------- ------------ ----------- ----------------- ---------

Segment gross

profit 4,625 2,195 1,629 816 9,265

Administrative

expenses (3,624) (1,270) (839) (678) (6,411)

Depreciation (27) - (8) (78) (113)

Segment contribution 974 925 782 60 2,741

Group costs (1,870)

---------

Operating profit per statement of comprehensive

income 871

---------

All assets and liabilities are held in the United Kingdom.

3. Income tax

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2013 Audited

June 2014 June 2013

Continuing operations Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Analysis of tax:-

Current tax

UK corporation tax 52 - 95

--------------------------------------- ----------- ----------- --------------

52 - 95

Deferred tax

Origination and reversal of temporary

differences 40 - 129

Tax 92 - 224

--------------------------------------- ----------- ----------- --------------

Factors affecting the tax expense

The tax assessed for the six month period ended 30 June 2014 is

less than would be expected by multiplying profit on ordinary

activities by the standard rate of corporation tax in the UK of

21.5% (2013:23.5%). The differences are explained below:

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2013 Audited

June 2014 June 2013

Factors affecting tax expense Unaudited Unaudited

GBP'000 GBP'000 GBP'000

Result for the year before tax 405 - 736

--------------------------------------- ----------- ----------- --------------

Profit multiplied by standard rate of

tax of 21.5% (2013: 23.5%) 87 - 173

Non-deductible expenses 5 - 17

Utilisation of losses - - 34

--------------------------------------- ----------- ----------- --------------

Tax charge/ (credit) for the year 92 - 224

--------------------------------------- ----------- ----------- --------------

4. Deferred tax

Six month Six month Year ended

period period 31 December

ended 30 ended 30 2013 Audited

June 2014 June 2013

Unaudited Unaudited

GBP'000 GBP'000 GBP'000

At 1 January 2014 110 - 239

(Charge)/ credit to the profit or loss

for the year (40) - (129)

---------------------------------------------- ----------- ----------- --------------

At 30 June 2014 70 - 110

---------------------------------------------- ----------- ----------- --------------

The deferred tax asset is analysed as:

Depreciation in excess of capital allowances 64 - 98

Tax losses carried forward 6 - 11

---------------------------------------------- ----------- ----------- --------------

70 - 109

---------------------------------------------- ----------- ----------- --------------

Unrecognised

Tax losses carried forward 83 - 83

---------------------------------------------- ----------- ----------- --------------

5. Dividends

The directors propose an interim dividend of 0.5p per share

(2013: nil). The Company has a progressive dividend policy. Subject

to approval of the Directors, the interim dividend will be paid on

1 October 2014 to shareholders on the register on 5 September

2014.

6. Earnings per share

The calculation of basic earnings per share is based on the

earnings attributable to ordinary shareholders divided by the

weighted average number of shares in issue during the year.

The calculation of diluted earnings per share is based on the

basic earnings per share adjusted to allow for all dilutive

potential ordinary shares.

<------------- Basic -------------> <------------- Diluted ------------->

Six month Six month Total group Six month Six month Total group

period period year ended period period year ended

ended ended 31 December ended ended 31 December

30 June 30 June 2013 30 June 30 June 2013

2014 2013 2014 2013

Unaudited Unaudited Audited Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Earnings GBP'000 313 5 512 313 5 512

------------------- --------------- ----------- --------------- --------------- ----------- ---------------

Weighted average

number of shares 13,511,626 13,511,626 13,511,626 14,633,961 13,906,286 13,889,918

------------------- --------------- ----------- --------------- --------------- ----------- ---------------

Earnings per

share (pence) 2.32p 0.04p 3.79p 2.14p 0.04p 3.69p

------------------- --------------- ----------- --------------- --------------- ----------- ---------------

7. Analysis of changes in net debt

At Cash Other non- At

Flows cash movements

1 January 30 June

2014

2014

(Audited) (Unaudited)

GBP'000 GBP'000 GBP'000 GBP'000

Cash in hand net

of bank overdraft

and invoice discounting

arrangements (3,635) 1,298 - (2,337)

-------------------------- -------------- -------- ---------------- -------------

Net debt (3,635) 1,298 - (2,337)

-------------------------- -------------- -------- ---------------- -------------

The Group has a working capital facility with HSBC PLC that

allows it to borrow up to 90% of the invoiced trade debtors of ATA

Recruitment Limited, Ganymede Solutions Limited and Global Staffing

Solutions Limited up to GBP7.0m and an overdraft facility of

GBP50,000.

8. Contingent liabilities

Included in current borrowings are bank overdrafts and an

invoice discounting facility. During the year the Group has used

its bank overdraft and invoice discounting facility, which is

secured by a cross guarantee and debenture over the Group

companies. There have been no defaults or breaches of interest

payable during the current or prior period.

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR UOOARSBABUUR

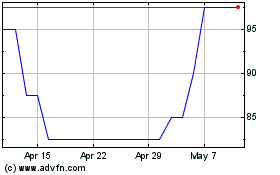

Rtc (LSE:RTC)

Historical Stock Chart

From Jun 2024 to Jul 2024

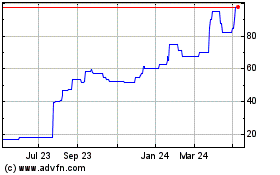

Rtc (LSE:RTC)

Historical Stock Chart

From Jul 2023 to Jul 2024