TIDMRST

RNS Number : 8879E

Restore PLC

04 July 2023

4 July 2023

Restore plc

("Restore" or the "Group" or "Company")

Trading Update

Restore (AIM: RST), the UK's leading provider of digital and

information management and secure lifecycle services, provides the

following trading and business update.

The Group continues to deliver revenue growth in its core

Records Management business but notes the continued weakness in its

Technology business, a reduction in demand for certain service

lines since the last update, particularly in bulk digital scanning,

and that the price of recycled shredded paper has significantly

fallen in the past month with this trend anticipated to continue

into H2.

As a result of these factors, whilst the Group continues to

demonstrate its cash generative characteristics, the Board

anticipates that the adjusted profit before tax will be lower than

previously expected and will be GBP31 million for the full

year.

Digital and Information Management Division

Records Management, which represents 70% of Group profits, is

seeing expansion in storage revenues and good cost control with the

new contract wins for the Department for Work and Pensions and BBC

commencing successfully.

These positive effects are offsetting the anticipated year to

year fall in revenues in the Digital business due to the

non-repeating large public sector contract delivered in H1 2022 of

GBP5.2 million. However, the Digital business has additionally

experienced a slow down in order conversion and demand for bulk

scanning services, reducing profit expectation from this business

for the year.

The other services (Cloud, Digital Mailrooms, BPO, Records

Preservation) in Digital, which represent over 40% of the business

unit revenues and contain a large proportion of longer term

contracts, are trading in line with management expectations.

Despite these headwinds, Records Management continues to make

progress and in Digital, win rates are consistent YoY and the

overall size of the opportunity pipeline is slightly larger versus

the start of the year.

As a result, the division continues to take significant actions

to reduce costs whilst preserving the operational capabilities of

the business to respond when demand improves.

Secure Lifecycle Services Division

As previously reported, Restore Technology IT Recycling (ITAD)

revenues are declining year to year due to the contraction of IT

hardware investment by customers following their unique and

significant increase in procurement in 2021 driven by the pandemic.

Demand remains weak despite quoting activity improving in June and

we are now assuming volumes and resale values remain consistent H2

vs H1 and therefore are lowering expectations from this business

for the year.

A number of strategic and tactical actions are in hand including

the closure of one processing site with a number of further actions

planned to reduce costs across the business, whilst ensuring

capacity and skills are maintained for future recovery in

demand.

IT Relocation and Mid Life services growth continues and is in

line with our expectations for FY23 driven by data centre

relocations and office moves.

Restore Datashred is delivering consistent volume of service

visits YoY and we expect this to continue into H2. Service visits

contribute c.70% of the revenues with the remaining c.30% from the

sale of shredded/recycled paper.

Paper pricing has shown a sharp decline in recent weeks due to

an over-supply of paper (particularly from Europe) and weaker

overall activity in the UK/EU economies. Whilst profit is likely to

be in line with expectation for H1, the lower recycled paper

pricing will impact H2 profitability significantly. The overall

impact is partly mitigated by continued strong cost control.

Restore Harrow Green is performing well and is expected to grow

in FY23 with committed larger projects already started and the

overall activity driven by significant customer organisational

restructuring and office moves across the UK. In addition, storage

revenues are also expected to grow in FY23.

Financial

With the recent changes in the UK base rate and in anticipation

of further increases in Q3 and Q4, we have assumed higher interest

cost for the year notwithstanding lower net debt. Total interest

cost, excluding the impact of IFRS16, is now assumed to be

cGBP9.6million for 2023 (2022: GBP5.9m, 2021: GBP2.9m).

As a result of the weaker outlook for the business, an

assessment of potential non-cash impairment on intangible assets

will be performed as part of the H1 close.

Cost Reductions

We continue to focus on structural cost savings in staff and

supplier input costs, and these programmes are delivering the

targeted results.

With actions already taken and further planned steps in early Q3

we expect to reduce permanent staff by 230. These roles are across

senior managers, sales, support functions and operations. The total

savings in FY23 are GBP4.5m with H1 savings of GBP1.1m and H2

savings of GBP3.4m.

Outlook

The Board anticipates that the Group will deliver revenue growth

for the year underpinned by the core storage and long term contract

income that are a central feature of the Group's strength.

Cash generation remains good and net debt for H1 is in line with

management expectations.

Whilst the near-term economic outlook remains uncertain, the

fundamentals of the business remain strong, with the core long term

contracted and storage revenues underpinning the profitability of

the business, strong cash generation and the ability to implement

inflation indexed price increases and structural cost savings.

The Group's half year results will be announced on August 16(th)

2023.

For further information:

Restore plc www.restoreplc.com

Jamie Hopkins, Interim CEO

Sharon Baylay-Bell, Executive Chair

Neil Ritchie, CFO

Chris Fussell, Company Secretary +44 (0) 207 409 2420

Investec (Nominated Adviser and Joint www.investec.com

Broker)

Carlton Nelson

James Rudd +44 (0) 207 597 5970

Canaccord Genuity (Joint Broker, Corporate www.canaccordgenuity.com

Advisor)

Max Hartley

Chris Robinson +44 (0) 207 523 8000

Citi (Joint Broker) www.citigroup.com

Stuart Field

Luke Spells +44 (0) 207 986 4074

Buchanan Communications (PR enquiries) www.buchanan.uk.com

Charles Ryland

Simon Compton

Note: +44 (0) 207 466 5000

This announcement includes inside information as defined in

Article 7 of the Market Abuse Regulation No. 596/2014 (which forms

part of domestic UK law pursuant to the European Union (Withdrawal)

Act 2018) and is disclosed in accordance with the Company's

obligations under Article 17 of those Regulations.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEZLBBXDLXBBE

(END) Dow Jones Newswires

July 04, 2023 02:00 ET (06:00 GMT)

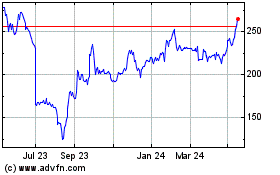

Restore (LSE:RST)

Historical Stock Chart

From Feb 2025 to Mar 2025

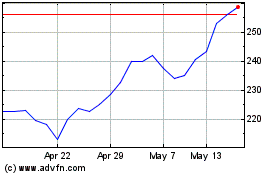

Restore (LSE:RST)

Historical Stock Chart

From Mar 2024 to Mar 2025