TIDMROCK

RNS Number : 5819M

Rockfire Resources PLC

15 September 2023

THIS ANNOUNCEMENT AND THE INFORMATION CONTAINED HEREIN IS

RESTRICTED AND IS NOT FOR PUBLICATION, RELEASE, TRANSMISSION,

DISTRIBUTION OR FORWARDING, IN WHOLE OR IN PART, DIRECTLY OR

INDIRECTLY, IN, INTO OR FROM THE UNITED STATES, AUSTRALIA, CANADA,

JAPAN OR THE REPUBLIC OF SOUTH AFRICA OR ANY OTHER JURISDICTION IN

WHICH SUCH PUBLICATION, RELEASE, TRANSMISSION, DISTRIBUTION OR

FORWARDING WOULD BE UNLAWFUL (OR TO ANY PERSONS IN ANY OF THOSE

JURISDICTIONS).

THIS ANNOUNCEMENT IS FOR INFORMATION PURPOSES ONLY AND DOES NOT

CONSTITUTE OR CONTAIN ANY INVITATION, SOLICITATION, RECOMMATION,

OFFER OR ADVICE TO ANY PERSON TO PURCHASE AND/OR SUBSCRIBE FOR,

OTHERWISE ACQUIRE OR DISPOSE OF ANY SECURITIES IN ROCKFIRE

RESOURCES PLC OR ANY OTHER ENTITY IN ANY JURISDICTION. NEITHER THIS

ANNOUNCEMENT NOR THE FACT OF ITS DISTRIBUTION, SHALL FORM THE BASIS

OF, OR BE RELIED ON IN CONNECTION WITH ANY INVESTMENT DECISION IN

RESPECT OF ROCKFIRE RESOURCES PLC.

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION FOR THE PURPOSES

OF ARTICLE 7 OF THE UK VERSION OF THE MARKET ABUSE REGULATION (EU)

NO.596/2014, WHICH FORMS PART OF UK LAW BY VIRTUE OF THE EUROPEAN

UNION (WITHDRAWAL) ACT 2018 ("UK MAR"). IN ADDITION, MARKET

SOUNDINGS (AS DEFINED IN UK MAR) WERE TAKEN IN RESPECT OF CERTAIN

OF THE MATTERS CONTAINED WITHIN THIS ANNOUNCEMENT, WITH THE RESULT

THAT CERTAIN PERSONS BECAME AWARE OF INSIDE INFORMATION (AS DEFINED

UNDER UK MAR). UPON THE PUBLICATION OF THIS ANNOUNCEMENT VIA A

REGULATORY INFORMATION SERVICE, ANY PERSONS WHO RECEIVED INSIDE

INFORMATION IN A MARKET SOUNDING ARE NO LONGER IN POSSESSION OF

SUCH INSIDE INFORMATION, WHICH IS NOW CONSIDERED TO BE IN THE

PUBLIC DOMAIN.

15 September 2023

Rockfire Resources plc

("Rockfire" or the "Company")

Proposed Acquisitions of Emirates Gold DMCC & Emperesse

Bullion LLC

Suspension of Trading in the Company's Shares

and

Proposed Subscription to raise GBP3.5 million

Proposed Acquisition

Rockfire Resources plc (LON: ROCK), the gold, base metal and

critical mineral exploration company, is pleased to announce the

execution of a conditional share purchase agreement (the

"Agreement") with Paloma Precious DMCC ("Paloma") for the

acquisition of 100% of Emirates Gold DMCC ("Emirates") and 99% of

Emperesse Bullion LLC ("Emperesse") (Emirates and Emperesse are

together the "Targets") (the "Transaction"). The Transaction is

subject to, inter alia, shareholder and regulatory approvals.

The Directors of Rockfire are embarking on an ambitious growth

strategy through the acquisition of two cash-generating and

profitable companies. The Directors consider the Transaction to

represent a potentially transformational, value enhancing

transaction for shareholders, which is expected to accelerate the

Company's growth strategy.

Suspension of Trading in the Company's Shares on AIM

The Transaction will constitute a reverse takeover ("RTO") under

the AIM Rules for Companies (the "AIM Rules") and therefore, in

accordance with rule 14 of the AIM Rules, will require application

to be made for the enlarged share capital to be readmitted to AIM

("Admission") the publication of an AIM admission document

("Admission Document") and approval of shareholders of the Company

at a general meeting. Also, in accordance with rule 14 of the AIM

Rules, trading in the Company's ordinary shares of 0.1 pence each

("Ordinary Shares") will be suspended on AIM from 7.30 a.m. this

morning, 15 September 2023, until the publication of the Admission

Document or an announcement that the proposed Transaction is not

proceeding. While the Company will seek to publish the Admission

Document as soon as possible, the timing of this cannot yet be

accurately forecast.

Information on Emirates and Emperesse

Paloma is the largest shareholder in Rockfire, with an interest

of 21.7% in the Company's issued share capital, and owns two

operating subsidiaries, Emirates (100%) and Emperesse (99%).

Emirates' principal activities are operating a gold and silver

refinery and trading of non-manufactured precious metals and

jewellery in Dubai's DMCC multi commodities centre free-trade zone.

During 2022, Emirates processed approx. 119.6 million grams

(approx. 3.85m ounces) of gold and sold approx. 82.7 million grams

(approx. 2.66m ounces) of gold. Emirates also processed approx.

39.1 million grams (approx. 1.26m ounces) of silver and sold

approx. 100.2 million grams (approx. 3.22m ounces) of silver. In

the year ended 31 December 2022, Emirates made a profit before

interest and depreciation (EBITDA) of approx. 11.1 million UAE

Dirham ("AED") (approx. GBP2.4 million) on revenue of AED17.8

billion (approx. GBP3.9 billion) and at the same date had audited

net assets of approx. AED GBP192.3 million (approx. GBP41.8

million).

Emperesse is engaged in precious metal trading and operates a

gold, silver and platinum trading shop in the 'Dubai Gold Souk'

market. The trading shop is leased by Emperesse. In the year ended

31 December 2022, Emperesse made a profit for the year of approx.

USD$0.081 million (approx. GBP0.065 million) on revenue of approx.

USD$0.77 million (approx. GBP0.616 million) and at the same date

had audited net assets of approx. USD$4.5 million (approx. GBP3.6

million).

In July 2023, Emirates was removed from the United Arab

Emirates' good delivery list of approved refineries and

certification scheme (the "UAE Delivery List"), thereby preventing

Emirates from delivering into Dubai's bullion market. As a result,

the London Bullion Market Association ("LBMA") also revoked

Emirates' affiliate membership. The Transaction is conditional,

amongst other things, on Emirates being restored to the UAE

Delivery List.

Summary Transaction Terms

Rockfire has signed the Agreement to acquire the Targets for a

total consideration of USD$20 million. The Transaction will be

structured as follows:

On signing of the Agreement, Rockfire will acquire 10% of

Emirates and 10% of Emperesse (the "Initial Shares"). Rockfire has

also conditionally agreed to acquire the remaining shares in the

Targets currently owned by Paloma (the "Final Shares"), which will

be transferred to Rockfire on completion of the Transaction. The

consideration for the Initial Shares will be USD$2 million in cash

(the "Initial Consideration"). Rockfire will satisfy the Initial

Consideration with its existing cash resources and the proceeds of

the Subscription (described below). The consideration for the Final

Shares will be USD$18 million (the "Final Consideration") to be

satisfied in cash.

The acquisition of the Final Shares is subject to, amongst other

conditions, the conditions set out below (the "Conditions"):

i. The publication of the Admission Document in respect of the

proposed enlarged entity and convening a general meeting (the

"General Meeting");

ii. Consent of Rockfire's shareholders being given in the

General Meeting for the acquisition of the Final Shares;

iii. Proceeds being received by Rockfire (or as it may direct)

from the RTO Fundraise (described below);

iv. Required regulatory approvals being received for the

Transaction and the acquisition of the Final Shares by

Rockfire;

v. Emirates being added back to the UAE Delivery List; and

vi. Satisfactory due diligence being completed by Rockfire in

respect of the Targets and their respective businesses.

If the Conditions are not satisfied, the Agreement will lapse

and the acquisition of the Final Shares by Rockfire will not

proceed. In that event, Rockfire would still own the Initial

Shares.

Additional Features of the Transaction

As part of the Transaction, Rockfire will undertake a fundraise

of approximately GBP14.7 million (the "RTO Fundraise") at a price

of 0.5 pence per share (the " Subscription Price") . The investors

in the RTO Fundraise (the "RTO Subscribers") have entered into

binding but conditional subscription agreements to subscribe for

Ordinary Shares pursuant to the RTO Fundraise. The proceeds from

the RTO Fundraise will be utilised to satisfy the Final

Consideration. The Final Consideration will be paid by Rockfire to

Paloma on completion of the Transaction and shortly after

Admission.

As part of the Transaction, Gordon Hart (Chairman of Rockfire)

and David Price (Chief Executive Officer of Rockfire) have also

today joined the management team of the Targets (but not the boards

of directors of the Targets) and will provide advice to Paloma on

the management of the Targets up until the completion of the

Transaction.

Related party transaction

Rockfire entering into the Agreement with Paloma to acquire the

Initial Shares is deemed to be a transaction with a related party

pursuant to rule 13 of the AIM Rules by virtue of Paloma being a

21.7% shareholder of the Company. The directors of the Company (who

are all independent of Paloma) consider, having consulted with the

Company's nominated adviser, Allenby Capital Limited, that the

terms of the Agreement pertaining to the acquisition of the Initial

Shares are fair and reasonable insofar as the Company's

shareholders are concerned and as such have approved the Company

entering into the Agreement to acquire the Initial Shares.

The acquisition of the Final Shares will constitute a further

related party transaction under rule 13 of the AIM Rules, and

further disclosures in this regard will be made in the Admission

Document when published.

Proposed Subscription

The Company also today announces that it is proposing to raise

GBP3.5 million (before expenses), from two new institutional

investors (the "Institutional Investors") subscribing for

700,000,000 new ordinary shares (the "Subscription Shares") at the

Subscription Price.

The Subscription Price of 0.5 pence per share represents a

premium of approximately 36 per cent. to the closing mid-market

price of an Ordinary Share on 14 September 2023, being the latest

practicable date prior to the publication of this announcement.

The Subscription Shares are to be issued pursuant to the

authorities granted to the Board at the Company's annual general

meeting held on 30 June 2023. The Subscription Shares will

represent 27.5% of the Company's issued share capital as enlarged

by the Subscription. The net proceeds of the Subscription will be

used to: (i) satisfy the Initial Consideration; (ii) contribute

towards the costs associated with the Transaction; (iii) to

continue drilling at the Company's existing Molaoi zinc, silver,

lead and germanium project in Greece; and (iv) to fund the working

capital requirements within the Company.

A further announcement will be made when the Subscription has

been completed.

David Price, Chief Executive of Rockfire, said :

"The Board of Rockfire has identified an exceptional opportunity

to acquire two cash-generating businesses, which are entirely in

line with the full value-add integration of precious and base metal

exploration, development, production, refining and trading.

"The proposed acquisition of Emirates and Emperesse would not

only be transformational for our shareholders but would enable

Rockfire to continue to grow as a global explorer and refiner of

metals, all backed with positive cash flow.

"The board has been successful in identifying supportive

investors, with a shared goal to build Rockfire through its

ambitious growth strategy. We are delighted to welcome them to our

share register and we appreciate their support, vision and

belief.

"We will continue to provide updates on progress with our

drilling at Molaoi. Molaoi will remain an important part of our

mining integration and the Company intends to continue its constant

appraisal of new mining projects.

"With the suspension of trading, we would like to reassure our

shareholders that we have every intention of restoring the shares

to trading on AIM as quickly as possible. However, our due

diligence must be completed thoroughly, professionally and in

accordance with the AIM Rules. Rockfire's lawyers, Fladgate, our

auditor, PKF, our nominated adviser, Allenby Capital and the

Company's Dubai advisers have all agreed to complete this due

diligence and the Admission Document, so our shareholders can take

comfort in a quality and experienced team to complete this very

important phase of our growth.

"We look forward to keeping the market informed and we thank our

shareholders in advance for their patience and support during this

exciting and transformational phase for the Company."

The person responsible for arranging the release of this

announcement on behalf of the Company is David Price, Chief

Executive Officer of the Company.

For further information on the Company, please visit

www.rockfireresources.com or contact the following:

Rockfire Resources plc : info@rockfire.co.uk

David Price, Chief Executive Officer

Gordon Hart, Chairman

Allenby Capital Limited (Nominated Adviser Tel: +44 (0) 20

& Broker): 3328 5656

John Depasquale / George Payne (Corporate

Finance)

Matt Butlin / Kelly Gardner (Sales and

Corporate Broking)

Notes to Editors

Rockfire Resources plc (LON: ROCK) is a gold, base metal and

critical mineral exploration company, with a high-grade

zinc/lead/silver/germanium deposit in Greece, and a portfolio of

gold/copper/silver projects in Queensland Australia..

-- The Molaoi deposit in Greece has a JORC resource of 210,000

tonnes of zinc, 39,000 tonnes of lead and 3.5 million ounces of

silver, using a 4% Zn cut off.

-- The Plateau deposit in Queensland has a JORC resource of

131,000 ounces of gold and 800,000 ounces of silver, using a 0.5g/t

Au cut off. 53,000 of these ounces lie within the top 100m from

surface.

-- The Copperhead deposit in Queensland has a JORC resource of

80,000 tonnes of copper, 9,400 tonnes of molybdenum and 1.1 million

ounces of silver, using a 0.13% CuEq. cut off.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQGZGMLFKRGFZG

(END) Dow Jones Newswires

September 15, 2023 02:00 ET (06:00 GMT)

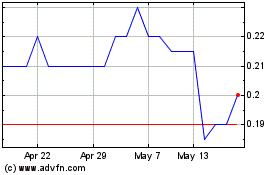

Rockfire Resources (LSE:ROCK)

Historical Stock Chart

From Oct 2024 to Nov 2024

Rockfire Resources (LSE:ROCK)

Historical Stock Chart

From Nov 2023 to Nov 2024