TIDMRGL

RNS Number : 2583Q

Regional REIT Limited

25 February 2021

25 February 2021

REGIONAL REIT Limited

("Regional REIT", the "Group" or the "Company")

2020 Year-End Valuation, Q4 Dividend Confirmation and Positive

Rent Collection Update

97.8% Portfolio Rent Collection for 2020

Regional REIT (LSE: RGL), the regional real estate investment

specialist focused on building a portfolio of income producing

regional UK core and core plus office property assets, today

announces its portfolio valuation as at 31 December 2020, Q4 2020

dividend confirmation and a positive rent collection update.

Full Year 2020 Portfolio Valuation

-- Portfolio valuation GBP732.4m (2019: GBP787.9m)

-- The like-for-like value of the portfolio decreased in H2 2020

by 2.9%, a like-for-like decrease of 7.2% for the year, after

adjusting for capital expenditure and disposals during the

period

-- Gross rent roll GBP64.2m (2019: GBP64.3m)

-- 153 assets (2019: 160); 898 occupiers (2019: 904)

-- Offices (by value) were 83.5% of the portfolio (2019: 79.9%),

industrials 11.1% (2019: 13.7%), retail 4.1% (2019: 5.0%), and

Other 1.3% (2019: 1.4%)

-- England & Wales (by value) represented 82.7% (2019:

82.0%) of the portfolio with the remainder in Scotland

-- EPRA Occupancy (by ERV) 89.4% (2019:89.4%)

-- Average lot size c. GBP4.8m (2019: c. GBP4.9m)

-- Net loan-to-value ratio was 40.8% (2019: 38.9%)

Rent Collection - Update

As at 19 February 2021, rent collections continued to

strengthen, with Q1 collections increasing to 99.4%, Q2 to 97.9%

and Q3 to 97.8%. Currently, Q4 rent collection, adjusting for

monthly rent and agreed collection plans, stands at 96.1%, which is

in line with the equivalent period in 2019 when 95.2% had been

collected. The total rent collection for 2020 is currently at 97.8%

compared with 98.6% at this time last year.

% Q1 2020 Q2 2020 Q3 2020 Q4 2020 YTD

Rent paid 98.1 95.1 96.5 91.2 95.2

Adjusted for monthly

rents 0.2 0.2 0.2 2.3 0.8

Agreed collections

plans 1.0 2.6 1.0 2.6 1.8

-------- -------- -------- -------- -----

99.4 97.9 97.8 96.1 97.8

Table may not sum due to roundings.

Quarterly rental collection refers to all invoices issued during

the calendar quarters:

Q1: 1 January 2020 to 31 March 2020

Q2: 1 April 2020 to 30 June 2020

Q3: 1 July 2020 to 30 September 2020

Q4: 1 October 2020 to 31 December 2020

The Company remains in supportive and ongoing discussions with

occupiers regarding the remainder of the outstanding rent and

expects to collect the vast majority in due course.

Q4 2020 Dividend

As previously indicated the Company will pay a dividend of 1.50

pence per share ("pps") for the period 1 October 2020 to 31

December 2020 (1 October 2019 to 31 December 2019: 1.90pps), which

amounts to a total dividend of 6.4pps for 2020. The dividend

payment will be made on 9 April 2021 to shareholders on the

register as at 5 March 2021. The ex-dividend date will be 4 March

2021. The entire dividend will be paid as a REIT property income

distribution ("PID").

Stephen Inglis, CEO of London and Scottish Property Investment

Management, the Asset Manager, commented:

"In very uncertain times for many businesses, created not just

by the ongoing pandemic but also by Brexit, our active portfolio

management approach and unique platform continues to deliver. We

have collected 97.8% of our rent roll for 2020, which is broadly

in-line with 2019, despite 2020 having brought considerable

challenges for owners of commercial property assets. It is a clear

testament to the strength and specialist expertise of our

management team.

We look forward to 2021 as we progress our strategy of

re-focusing our portfolio solely on the highly attractive regional

office market. We have confidence in the office sector and believe

through careful asset selection and our asset management skills, we

will continue to deliver a high yield and capital value growth to

our shareholders over the long-term. "

Forthcoming Events

25 March 2021 Full year 2020 Preliminary Results Announcement

19 May 2021 May 2021 Trading Update and Outlook Announcement

Q1 2021 Dividend Declaration Announcement

TBC* Annual General Meeting

* The Board has made the decision to delay the Company's 2021

Annual General Meeting until later in the year with the hope that

shareholders will be able to attend in person.

- ENDS -

Enquiries:

Regional REIT Limited

Toscafund Asset Management Tel: +44 (0) 20 7845

6100

Investment Manager to the Group

Adam Dickinson, Investor Relations, Regional

REIT Limited

London & Scottish Property Investment Management Tel: +44 (0) 141

248 4155

Asset Manager to the Group

Stephen Inglis

Buchanan Communications Tel: +44 (0) 20 7466

5000

Financial PR regional@buchanan.uk.com

Charles Ryland / Henry Wilson / George

Beale

About Regional REIT

Regional REIT Limited ("Regional REIT" or the "Company") and its

subsidiaries (the "Group") is a United Kingdom ("UK") based real

estate investment trust that launched in November 2015. It is

managed by London & Scottish Property Investment Management

Limited, the Asset Manager, and Toscafund Asset Management LLP, the

Investment Manager.

Regional REIT's commercial property portfolio is comprised

wholly of income producing UK assets and comprises, predominantly,

offices located in the regional centres outside of the M25

motorway. The portfolio is highly diversified, with 153 properties,

898 occupiers as at 31 December 2020, with a valuation of

GBP732.4m.

Regional REIT pursues its investment objective by investing in,

actively managing and disposing of regional core and core plus

property assets. It aims to deliver an attractive total return to

its Shareholders, targeting greater than 10% per annum, with a

strong focus on income supported by additional capital growth

prospects.

The Company's shares were admitted to the Official List of the

UK's Financial Conduct Authority and to trading on the London Stock

Exchange on 6 November 2015. For more information, please visit the

Group's website at www.regionalreit.com .

Cautionary Statement

This document has been prepared solely to provide additional

information to Shareholders to assess the Group's performance in

relation to its operations and growth potential. The document

should not be relied upon by any other party or for any other

reason. Any forward looking statements made in this document are

done so by the Directors in good faith based on the information

available to them up to the time of their approval of this

document. However, such statements should be treated with caution

due to the inherent uncertainties, including both economic and

business risk factors, underlying any such forward-looking

information.

ESMA Legal Entity Identifier ("LEI"): 549300D8G4NKLRIKBX73

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DIVFZGZZNDZGMZM

(END) Dow Jones Newswires

February 25, 2021 02:00 ET (07:00 GMT)

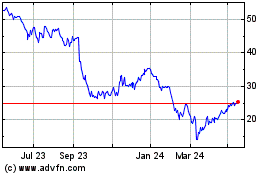

Regional Reit (LSE:RGL)

Historical Stock Chart

From Oct 2024 to Nov 2024

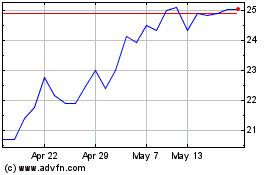

Regional Reit (LSE:RGL)

Historical Stock Chart

From Nov 2023 to Nov 2024