TIDMRC2

RNS Number : 8062K

Reconstruction Capital II Ltd

30 August 2023

30 August 2023

Reconstruction Capital II Limited (the "Company")

Interim Unaudited Financial Statements

for the six months ended 30 June 2023

Reconstruction Capital II Limited ("RC2", the "Company" or the

"Group"), a closed-end investment company incorporated in the

Cayman Islands admitted to trading on the AIM market of the London

Stock Exchange, today announces its results for the six months

ended 30 June 2023.

Copies of the company's interim financial statements will today

be posted to shareholders. The interim report is also available on

the Company's website http://www. reconstructioncapital2.com/.

Financial highlights

On 30 June 2023, Reconstruction Capital II Limited ("RC2") had a

total unaudited net asset value ("NAV") of EUR23.4m or EUR0.1729

per share, which represents a 1.59% fall since the beginning of the

year.

As at 30 June 2023, RC2 and its subsidiary, RC2 (Cyprus) Ltd had

cash and cash equivalents of approximately EUR0.017m and

receivables of EUR0.017m. As at 30 June 2023, RC2 had short-term

liabilities of EUR0.243m.

Operational highlights

During the first half of 2023, the macroeconomic challenges

which started in 2022 due to the outbreak of war in neighbouring

Ukraine continued to erode consumers' purchasing power, affecting

all of the Fund's investee companies, although inflationary

pressures which had been fuelled by the outbreak of war fell

significantly in the second quarter.

The Policolor Group achieved revenues of EUR 37.6m during the

first semester, 22.7% below budget and 15.9% lower year-on-year, as

the anhydrides division struggled to source the necessary raw

materials due to the less available ortho-xylene, pursuant to the

EU banning imports from Russia. The coatings division's sales were

slightly higher year-on-year but 9% below budget, as the

cost-of-living crisis reduced consumers' discretionary spending,

while the construction market weakened. Although the Group's gross

margin overperformed the budget in percentage terms, the Group's

six-month EBITDA of EUR 1.5m was EUR 1.3m below budget, mainly due

to the reduced activity at the anhydrides division and the

underperformance of the coatings division.

The Mamaia Hotel did not meet its budget over the first half of

2023, as the cost-of-living crisis and the ongoing war in Ukraine

across the Black Sea significantly impacted demand for the Hotel in

the second quarter, despite an unexpectedly good performance in the

first quarter. In addition, unseasonal bad weather, including lots

of rainfall on weekends in May and June, led to the cancellation of

a number of corporate events and a significant reduction in the

number of walk-in clients. As a result, the Hotel generated

revenues of EUR 0.90m, 22% below budget. During the first half of

the year, the Hotel posted an EBITDA loss of EUR 0.52m, EUR 0.14m

higher than the budgeted loss of EUR 0.38m, mainly due to lower

accommodation revenues, higher food and beverage costs, and higher

salaries due to a tight labour market.

During the first half of 2023, Telecredit generated interest

revenues of EUR 0.83m, 7.8% higher year-on-year but 10% below

budget, and an operating profit before depreciation and interest

expenses of EUR 0.25m, below both the EUR 0.34m budget target and

last year's result of EUR 0.38m. The underperformance was mainly

driven by lower demand in the first quarter since Telecredit

outperformed its budgeted financing volumes in the second quarter.

In May, Telecredit extended the maturity of its EUR 2.0m loan from

a specialized institutional lender by a year to 2024, and increased

the facility amount to EUR 3.0m.

At the end of June, RC2 had cash and cash equivalents of EUR

0.017m, receivables of EUR 0.017m, and short-term

liabilities of EUR 0.243m.

For further information, please contact:

Reconstruction Capital II Limited

Cornelia Oancea / Luca Nicolae

Tel: +40 21 316 76 80

Grant Thornton UK LLP

(Nominated Adviser)

Philip Secrett

Tel: +44 (0) 20 7383 5100

finnCap Limited

(Broker)

William Marle / Giles Rolls

Tel: +44 20 7220 0500

ADVISER'S REPORT

For the six months ended 30 June 2023

During the first half of 2023, the macroeconomic challenges which

started in 2022 due to the outbreak of war in neighbouring Ukraine

continued to erode consumers' purchasing power, affecting all of

the Fund's investee companies, although inflationary pressures which

had been fuelled by the outbreak of war fell significantly in the

second quarter.

The Policolor Group achieved revenues of EUR 37.6m during the first

semester, 22.7% below budget and 15.9% lower year-on-year, as the

anhydrides division struggled to source the necessary raw materials

due to the less available ortho-xylene, pursuant to the EU banning

imports from Russia. The coatings division's sales were slightly

higher year-on-year but 9% below budget, as the cost-of-living crisis

reduced consumers' discretionary spending, while the construction

market weakened. Although the Group's gross margin overperformed

the budget in percentage terms, the Group's six-month EBITDA of EUR

1.5m was EUR 1.3m below budget, mainly due to the reduced activity

at the anhydrides division and the underperformance of the coatings

division.

The Mamaia Hotel did not meet its budget over the first half of 2023,

as the cost-of-living crisis and the ongoing war in Ukraine across

the Black Sea significantly impacted demand for the Hotel in the

second quarter, despite an unexpectedly good performance in the first

quarter. In addition, unseasonal bad weather, including lots of rainfall

on weekends in May and June, led to the cancellation of a number

of corporate events and a significant reduction in the number of

walk-in clients. As a result, the Hotel generated revenues of EUR

0.90m, 22% below budget. During the first half of the year, the Hotel

posted an EBITDA loss of EUR 0.52m, EUR 0.14m higher than the budgeted

loss of EUR 0.38m, mainly due to lower accommodation revenues, higher

food and beverage costs, and higher salaries due to a tight labour

market.

During the first half of 2023, Telecredit generated interest revenues

of EUR 0.83m, 7.8% higher year-on-year but 10% below budget, and

an operating profit before depreciation and interest expenses of

EUR 0.25m, below both the EUR 0.34m budget target and last year's

result of EUR 0.38m. The underperformance was mainly driven by lower

demand in the first quarter since Telecredit outperformed its budgeted

financing volumes in the second quarter. In May, Telecredit extended

the maturity of its EUR 2.0m loan from a specialized institutional

lender by a year to 2024, and increased the facility amount to EUR

3.0m.

At the end of June, RC2 had cash and cash equivalents of EUR 0.017m,

receivables of EUR 0.017m, and short-term liabilities of EUR 0.243m.

STATEMENT OF COMPREHENSIVE INCOME

For the six months ended 30 June 2023

30 June 30 June 31 December

2023 2022 2022

EUR EUR EUR

Unaudited Unaudited Audited

Investment Income

Fair value loss on financial

assets at

fair value through profit

or loss (261,845) (102,597) (2,615,823)

Interest income 255,360 257,916 518,085

--------------- --------------- ---------------

Net investment income (6,485) 155,319 (2,097,738)

--------------- --------------- ---------------

Expenses

Operating expenses (363,202) (394,892) (844,981)

Net financial income/(expense) (11,925) (35) (871)

--------------- --------------- ---------------

Total expenses (375,127) (394,927) (845,852)

--------------- --------------- ---------------

(Loss)/profit for the

period/year (381,612) (239,608) (2,943,590)

--------------- --------------- ---------------

Other comprehensive income - - -

--------------- --------------- ---------------

Total comprehensive (loss)/profit

for the period/year attributable

to owners (381,612) (239,608) (2,943,590)

--------------- --------------- ---------------

Earnings Per Share attributable

to the owners of the Company

Basic and diluted earnings

per share (0.0028) (0.0018) (0.0217)

--------------- --------------- ---------------

STATEMENT OF FINANCIAL POSITION

As at 30 June 2023

30 June 30 June 31 December

2023 2022 2022

EUR EUR EUR

Unaudited Unaudited Audited

ASSETS

Non-current assets

Financial assets at fair

value through profit or

loss 24,027,598 26,557,140 24,104,083

--------------- --------------- ---------------

Total non-current assets 24,027,598 26,557,140 24,104,083

--------------- --------------- ---------------

Current assets

Trade and other receivables 17,126 19,172 15,492

Cash and cash equivalents 17,221 46,438 73,337

--------------- --------------- ---------------

Total current assets 34,347 65,610 88,829

--------------- --------------- ---------------

TOTAL ASSETS 24,061,945 26,622,750 24,192,912

--------------- --------------- ---------------

LIABILITIES

Current liabilities

Trade and other payables 243,207 91,174 124,485

Total current liabilities 243,207 91,174 124,485

--------------- --------------- ---------------

Non-current liabilities

--------------- --------------- ---------------

Borrowings 382,756 - 250,833

--------------- --------------- ---------------

Total non-current liabilities 382,756 - 250,833

--------------- --------------- ---------------

TOTAL LIABILITIES 625,963 91,174 375,318

--------------- --------------- ---------------

NET ASSETS 23,435,982 26,531,576 23,817,594

=============== =============== ===============

EQUITY ATTRIBUTABLE TO

OWNERS

Share capital 1,355,784 1,357,034 1,355,784

Share premium 109,187,284 109,196,034 109,187,284

Accumulated deficit (87,107,086) (84,021,492) (86,725,474)

--------------- --------------- ---------------

TOTAL EQUITY 23,435,982 26,531,576 23,817,594

--------------- --------------- ---------------

Net Asset Value per share

Basic and diluted net asset

value per share 0.1729 0.1955 0.1757

--------------- --------------- ---------------

STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 June 2023

Retained

Share (deficit)/

Share capital premium EUR EUR earnings Total

EUR EUR

Balance at 1 January 2022 1,358,569 109,206,779 (83,781,884) 26,783,464

Loss for the period - - (239,608) (239,608)

Other comprehensive income - - - -

------------- -------------

Total comprehensive loss for the period - - (239,608) (239,608)

------------- -------------

Repurchase and cancellation of own shares (1,535)

(10,745) - (12,280)

------------- -------------

Transactions with owners (1,535) (10,745) - (12,280)

------------- -------------

Balance at 30 June 2022 1,357,034 109,196,034 (84,021,492) 26,531,576

------------- -------------

Profit for the period - - (2,703,982) (2,703,982)

Other comprehensive income - - - -

------------- -------------

Total comprehensive profit for the period -

- (2,703,982) (2,703,982)

------------- -------------

Repurchase and cancellation of own shares

(1,250)

(8,750) - (10,000)

------------- -------------

Transactions with owners (1,250) (8,750) - (10,000)

------------- -------------

Balance at 31 December 2022 1,355,784

109,187,284 (86,725,474) 23,817,594

------------- -------------

Loss for the period - - (381,612) (381,612)

Other comprehensive income - - - -

------------- -------------

Total comprehensive loss for the period - - (381,612) (381,612)

------------- -------------

Balance at 30 June 2023 1,355,784 109,187,284 (87,107,086) 23,435,982

------------- -------------

CASH FLOW STATEMENT

For the six months ended 30 June 2023

30 June 30 June 31 December

2023 2022 2022

EUR EUR EUR

Unaudited Unaudited Audited

Cash flows from operating activities

(Loss)/profit before taxation (381,612) (239,608) (2,943,590)

Adjustments for:

Fair value loss on financial

assets at fair value

through profit or loss 261,845 102,597 2,615,823

Interest income (255,360) (257,916) (518,085)

Financial expenses 11,923 - 833

Net (gain)/loss on foreign exchange 2 35 6

--------------- --------------- ---------------

Net cash outflow before changes

in working

capital (363,202) (394,892) (845,013)

(Increase)/Decrease in trade

and other receivables (1,634) (13,145) (9,465)

(Decrease)/Increase in trade

and other payables 118,722 (114,511) (81,200)

Repayments of financial assets 70,000 570,000 770,000

Net cash provided by/(used

in) operating (176,114) 47,452 (165,678)

--------------- --------------- ---------------

Cash flows from financing activities

Payments to purchase own shares - (12,280) (22,280)

Proceeds from borrowings 120,000 - 250,000

Net cash flow (used in)/provided

by financing 120,000 (12,280) 227,720

--------------- --------------- ---------------

Net increase/(decrease) in

cash and cash

equivalents before currency

adjustment (56,114) 35,172 62,042

Effects of exchange rate differences

on cash and cash equivalents (2) (35) (6)

Net increase/(decrease) in

cash and cash

equivalents after currency

adjustment (56,116) 35,137 62,036

Cash and cash equivalents at

the beginning of the period/year 73,337 11,301 11,301

Cash and cash equivalents at

the end of the

period/year 17,221 46,438 73,337

--------------- --------------- ---------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR EAPPEDLDDEEA

(END) Dow Jones Newswires

August 30, 2023 04:46 ET (08:46 GMT)

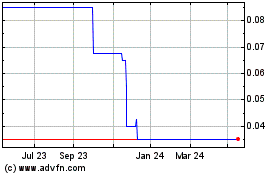

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Jan 2025 to Feb 2025

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Feb 2024 to Feb 2025