TIDMRC2

RNS Number : 0578S

Reconstruction Capital II Ltd

20 June 2018

20 June 2018

Reconstruction Capital II Limited (the "Company")

Annual Report and Audited Financial Statements

for the year ended 31 December 2017

Reconstruction Capital II Limited ("RC2", the "Company" or the

"Group"), a closed-end investment company incorporated in the

Cayman Islands admitted to trading on the AIM market of the London

Stock Exchange, today announces its results for the year ended 31

December 2017.

Copies of the Company's annual report will today be posted to

shareholders. The annual report is also available to view on the

Company's website http://www.reconstructioncapital2.com.

Financial highlights

-- The audited net asset value as at 31 December 2017 was

EUR0.2504 per share (EUR0.3670 per share as at 31 December 2016), a

31.77% decrease over the year;

-- The decrease is mainly the result of RC2 returning EUR17.4m to its shareholders;

-- The Directors do not recommend the payment of a dividend.

Operational highlights

Private Equity Programme

In March, RC2 disposed of its stake in Top Factoring SRL and the

related portfolio of non-performing loans held by RC2's wholly

owned subsidiary, Glasro Holdings Ltd (together, the "Top Factoring

Group"). The sale was completed in April. The total consideration

received amounted to EUR12.8m, net of various closing adjustments.

Glasro Holdings Limited distributed EUR7.5m of its exit proceeds to

RC2 in the form of dividends and used EUR2.85m to make an

investment in Telecredit IFN S.A., a Romanian non-banking financial

institution that provides consumer loans to individuals. Glasro

owns 80% of Telecredit, with the balance of 20% being owned by

RC2's former partner in Top Factoring SRL and his family.

At the end of December, the investments held under the Private

Equity Programme had a total fair value of EUR27.7m, which was

significantly less than the 2016 valuation of EUR36.0m, primarily

related to the Top Factoring Group's disposal.

Trading Programme

RC2 (Cyprus) Limited continued to sell down its residual listed

equities portfolio held under the Trading Programme, generating

cash proceeds of EUR0.08m over the year. At the end of 2017, the

residual Trading Programme portfolio was worth EUR0.09m compared to

EUR0.15m at the end of the prior year. All the investments held

under the Trading Programme were in Romanian equities.

For further information, please contact:

Reconstruction Capital II Limited

Cornelia Oancea / Anca Moraru

Tel: +40 21 3167680

Grant Thornton UK LLP (Nominated Adviser)

Philip Secrett

Tel: +44 (0) 20 7383 5100

finnCap Limited (Broker)

William Marle / Giles Rolls

Tel: +44 20 7220 0500

ADVISER'S REPORT

For the year ended 31 December 2017

During 2017, Reconstruction Capital II Limited ("RC2") issued

16,997,375 B shares at a nominal value of EUR1 per share as a bonus

to existing ordinary shareholders, redeemable at the option of RC2,

and subsequently redeemed all of those shares, thereby returning

EUR17.0m to its shareholders using the bulk of the Albalact S.A.

disposal proceeds which had been generated over the prior year. In

addition, RC2 bought back 2.6m of its own shares for cancellation

in 2017, at a further cost of EUR 0.4m. In total, EUR17.4m was

returned to RC2's shareholders and explains the bulk of the

EUR17.9m fall in the overall NAV of RC2 over the year. Mainly due

to the issuance and subsequent cancellation of the new class B

Class shares, the NAV per ordinary share fell from EUR0.3670 to

EUR0.2504 over the year.

In March, RC2 disposed of its stake in Top Factoring SRL and the

related portfolio of non-performing loans held by RC2's wholly

owned subsidiary, Glasro Holdings Ltd (together, the "Top Factoring

Group"). The sale was completed in April. The total consideration

received amounted to EUR12.8m, net of various closing adjustments.

Glasro Holdings Limited distributed EUR7.5m of its exit proceeds to

RC2 in the form of dividends and used EUR2.85m to make an

investment in Telecredit IFN S.A., a Romanian non-banking financial

institution that provides consumer loans to individuals. Glasro

owns 80% of Telecredit, with the balance of 20% being owned by

RC2's former partner in Top Factoring SRL and his family.

The disposal boosted RC2's cash reserves which had fallen to

EUR1.1m after the redemption of the B shares. By the end of 2017,

RC2 had cash and cash equivalents of approximately EUR6.4m whilst

liabilities amounted to EUR0.4m, of which EUR0.15m represents

outstanding B share redemptions and EUR0.28m represents sundry

other liabilities.

Private Equity Programme

At the end of December, the investments held under the Private

Equity Programme had a total fair value of EUR27.7m, which was

significantly less than the 2016 valuation of EUR36.0m, primarily

related to the Top Factoring Group's disposal. The results of the

annual independent valuation process of its remaining private

equity investments are presented in the table below:

Valuations

2017 2016

EUR EUR

Policolor S.A. 20,600,000 20,640,000

Top Factoring Group - 11,284,423

Telecredit IFN S.A. 2,664,000 -

Mamaia Hotel Resorts SRL 4,404,658 4,079,921

27,668,658 36,004,344

The private equity investments are held through two Cyprus-based

wholly-owned subsidiaries, RC2 (Cyprus) Limited and Glasro Holdings

Limited, which are not consolidated in the present financial

statements, in accordance with IFRS. Consequently, the financial

assets at fair value through profit or loss shown in the present

financial statements, which amount to EUR30.1m, reflect the

valuations of the underlying private equity holdings outlined in

the above table, as well as the cash balances of EUR1.3m and

EUR0.1m of sundry financial assets and liabilities of these

intermediary holding companies, including shares held under the

Trading Programme as summarised below.

Trading Programme

RC2 (Cyprus) Limited continued to sell down its residual listed

equities portfolio held under the Trading Programme, generating

cash proceeds of EUR0.08m over the year. At the end of 2017, the

residual Trading Programme portfolio was worth EUR0.09m compared to

EUR0.15m at the end of the prior year. All the investments held

under the Trading Programme were in Romanian equities.

Economic Overview

Romania's GDP increased by 7% year-on-year in 2017, mainly

triggered by higher private consumption. According to its latest

forecast published in February, the EU Commission expects Romania's

GDP growth to slow down to 4.5% in 2018, as rising inflation erodes

disposable income, tempering domestic demand. Bulgaria's GDP is

estimated to have grown by 3.6% in 2017, whilst the EU Commission

forecasts it will grow by 3.7% in 2018, also based on strong

domestic demand.

Events after the Reporting Period

At a general shareholder meeting on 21 February 2018, the

investment objective of RC2 was changed so that it now aims to

achieve capital appreciation and/or to generate investment income

returns through the acquisition of real estate assets in Romania,

including the development of such assets, and/or the acquisition of

significant or controlling stakes in companies established in, or

operating predominantly in Romania, primarily in the real estate

sector. Any new private equity investments in companies operating

in sectors other than real estate would be limited to 25% of RC2's

total assets at the time of effecting the investment. However, RC2

may continue to make follow-on investments in existing portfolio

companies without any such limitation. The same shareholder meeting

decided that the next continuation vote will be held in 2023 and

that RC2 can acquire 22% of the issued share capital of

Reconstruction Capital Plc for EUR1.6m and 10% of the issued share

capital of the Romanian Investment Fund Limited for EUR1.7m, two

Romanian-focused investment funds whose main underlying asset is a

60% shareholding in Policolor S.A. in which RC2 already owns the

balance of 40%. The main objective of the acquisition, which will

give RC2 a further 15.36% indirect shareholding in Policolor S.A.,

is to provide RC2 with greater control over the exit process from

this asset. Only a part of the above-mentioned acquisition has been

settled to date, amounting to EUR1.2m, with the rest being delayed

by technical settlement issues which are in the course of being

resolved with the vendors.

INVESTMENT POLICY

Private Equity Programme

Under the Private Equity Programme, the Company takes

significant or controlling stakes in companies operating primarily

in Romania, Serbia, Bulgaria and neighbouring countries (the

"Target Region"). The Company invests in investee companies where

it believes New Europe Capital SRL (the "Adviser") can add value by

implementing operational and/or financial restructuring over a 3 to

5 year horizon. The Company only makes an investment under the

Private Equity Programme if its Adviser believes there is a clear

exit strategy available, such as trade sale, break up and

subsequent disposal of different divisions or assets, or flotation

on a stock exchange.

Trading Programme

Under the Trading Programme, the Company aims to generate short

and medium term returns by investing such portion of its assets as

determined by the Directors from time to time in listed equities

and fixed income securities, including convertible and other

mezzanine instruments, issued by entities in the Target Region. The

Trading Programme differs from the Private Equity Programme in the

key respect that the Company will typically not take significant or

controlling stakes in investee companies and will typically hold

investments for shorter periods of time than investments made under

the Private Equity Programme.

Value Creation

Under its Private Equity Programme, the Adviser is involved at

board level in the investee entity to seek to implement operational

and financial changes to enhance returns. As part of the Company's

pre-acquisition due diligence, the Adviser seeks to identify

specific actions that it believes will create value in the target

investee post acquisition and, where appropriate, seek to work with

third party professionals to develop, in combination with the

proposed management team of the target, a value creation plan with

clear and identifiable short and medium term targets. These plans

are likely to address different parts of the business and are

tailored to reflect the specific challenges of the relevant target

investee. The Adviser believes that the investment strategies under

the Private Equity and Trading Programme can achieve returns which

are different than the returns of the relevant market indices.

Investing Restrictions and Cross-Holdings

The Directors and the Adviser have sought to ensure that the

portfolio of investments is sufficiently diversified to spread the

risks of those investments. The Investment Strategy does not

restrict the Company from investing in other closed-ended funds

operating in the Target Region. In line with the Company's

investment policy, the Directors do not normally authorise any

investment in a single investee that is greater than 20% of the

Company's net asset value at the time of effecting the investment

and in no circumstances will it approve an investment in a single

investee that is greater than 25% of the Company's net asset value

at the time of effecting the investment.

Change of Investment Objective and Policy of the Company

At a general shareholder meeting on 21 February 2018, the

investment objective of the Company was changed so that it now aims

to achieve capital appreciation and/or to generate investment

income returns through the acquisition of real estate assets in

Romania, including the development of such assets, and/or the

acquisition of significant or controlling stakes in companies

established in, or operating predominantly in Romania, primarily in

the real estate sector. Any new private equity investment in

companies operating in sectors other than real estate is limited to

25% of the Company's total assets at the time of effecting the

investment. However, the Company may continue to make follow-on

investments in existing portfolio companies without any such

limitation. The same shareholder meeting decided that the next

continuation vote will be held in 2023 and that the Company can

acquire 22% of the issued share capital of Reconstruction Capital

Plc for EUR1.6m and 10% of the issued share capital of the Romanian

Investment Fund Limited for EUR1.7m.

Gearing

The Company may borrow up to a maximum level of 30% of its gross

assets (as defined in its articles).

Distribution Policy

The Company's investment objective is focused principally on the

provision of capital growth. For further details of the Company's

distribution policy, please refer to the Admission Document on the

Company's website.

STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2017

2017 2016

EUR EUR

Investment income

Fair value (loss)/gain on

financial assets at fair

value

through profit or loss (10,981,533) 4,699,325

Recovery of previously written

off receivable 189,000 -

Interest income 4,334,820 5,854,313

Dividend income 7,619,610 2,000,000

Other income - 11,347

Net investment income 1,161,897 12,564,985

Expenses

Operating expenses (1,619,749) (1,230,810)

Financial expenses (188) (775,195)

Total expenses (1,619,937) (2,006,005)

(Loss)/profit for the year (458,040) 10,558,980

Other comprehensive income - -

Total comprehensive (loss)/income

for the year

attributable to owners (458,040) 10,558,980

Earnings Per Share

Basic and diluted earnings

per share (0.0031) 0.0971

STATEMENT OF FINANCIAL POSITION

As at 31 December 2017

2017 2016

EUR EUR

ASSETS

Non-current assets

Financial assets at fair

value through profit or

loss 30,143,162 36,300,265

Total non-current assets 30,143,162 36,300,265

Current assets

Trade and other receivables 136,439 17,791

Cash and cash equivalents 6,439,763 18,004,241

Total current assets 6,576,202 18,022,032

TOTAL ASSETS 36,719,364 54,322,297

LIABILITIES

Current liabilities

Trade and other payables 430,510 138,006

Total current liabilities 430,510 138,006

TOTAL LIABILITIES 430,510 138,006

NET ASSETS 36,288,854 54,184,291

EQUITY AND RESERVES

Share capital 1,449,460 1,476,223

Share premium 110,581,355 127,991,989

Retained deficit (75,741,961) (75,283,921)

TOTAL EQUITY 36,288,854 54,184,291

Net Asset Value per share

Basic and diluted net asset

value per share 0.2504 0.3670

CASH FLOW STATEMENT

For the year ended 31 December 2017

2017 2016

EUR EUR

Cash flows from operating activities

(Loss)/profit for the year (458,040) 10,558,980

Adjustments for:

Fair value loss/(gain) on financial

assets at fair value through

profit or loss 10,981,533 (4,699,325)

Reversal of loan impairment (189,000) -

Interest income (4,334,820) (5,854,313)

Financial expenses - 775,152

Dividend income (7,619,610) (2,000,000)

Net loss on foreign exchange 188 43

Net cash outflow before changes

in working capital (1,619,749) (1,219,463)

Decrease in trade and other receivables 7,352 19,671

Increase in trade and other payables 138,108 14,945

Purchase of financial assets (370,000) (2,710)

Disposals and repayments of financial

assets 63,000 20,410,000

Dividends received 7,500,000 2,000,000

Net cash generated by operating

activities 5,718,711 21,222,443

Cash flows from financing activities

Payments to purchase own shares (440,022) (3,439,849)

Redemptions of B shares (16,842,979) -

Loans received from subsidiaries - 200,000

Repayment of loans from subsidiaries - (240,000)

Interest paid - (8,029)

Net cash flow generated from

financing activities (17,283,001) (3,487,878)

Net increase in cash and cash

equivalents before currency

adjustment (11,564,290) 17,734,565

Effects of exchange rate differences

on cash and cash equivalents (188) (43)

Net increase in cash and cash

equivalents after currency

adjustment (11,564,478) 17,734,522

Cash and cash equivalents at

the beginning of the year 18,004,241 269,719

Cash and cash equivalents at

the end of the year 6,439,763 18,004,241

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR BLGDLUDDBGIG

(END) Dow Jones Newswires

June 20, 2018 12:32 ET (16:32 GMT)

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Oct 2024 to Nov 2024

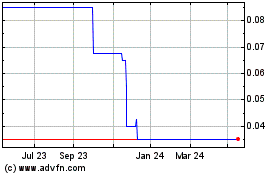

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Nov 2023 to Nov 2024