Reabold Resources PLC Victory -- Submission of Draft FDP (5396W)

December 23 2021 - 1:59AM

UK Regulatory

TIDMRBD

RNS Number : 5396W

Reabold Resources PLC

23 December 2021

23 December 2021

Reabold Resources plc

("Reabold" or the "Company")

Victory - Submission of Draft Field Development Plan

Reabold, the AIM investing company focused on upstream oil and

gas projects, is pleased to provide an update on the Victory Gas

Discovery ("Victory"), which is located ca. 50 kilometres northwest

of the Shetland Isles . Reabold has a 49.99 per cent. interest in

Corallian Energy Limited ("Corallian"), which has a 100 per cent.

interest in Victory and is the operator of the asset.

As communicated to its shareholders, Corallian has confirmed

that it has submitted a draft Field Development Plan ("FDP") for

the Victory gas field to the Oil and Gas Authority ("OGA"). The

related Environmental Statement for Victory is expected to be

finalised during Q1 2022 and will be issued to the department for

Business, Energy and Industrial Strategy's ("BEIS") Offshore

Petroleum Regulator for Environment & Decommissioning

("OPRED"), as part of the FDP approval process.

It is anticipated that the FDP will be reviewed by the OGA

during H1 2022, and that approval will be sought towards the end of

2022, concurrent with the Final Investment Decision ("FID") for the

project.

Further to the Company's announcement on 20 October 2021,

progress continues to be made on the strategic review of Corallian

and an update on the process is expected during Q1 2022.

Competent Persons Report on Victory Project

A Competent Persons Report ("CPR"), recently completed by RPS

Energy Limited ("RPS") following the finalisation of both static

and dynamic modelling, together with well / network optimisation

studies for the development, estimates a total Victory field 2C or

best / mid case technically recoverable resource of 179bcf dry gas

1 .

Corallian's 2C economic valuation (NPV10) of Victory, based on

an historical average gas price valuation of 50p/therm is GBP193

million.

Sachin Oza, Co-CEO of Reabold, commented:

"Submission of a draft Field Development Plan is a significant

milestone for this important gas field. Victory is in relatively

shallow water, close to pre-existing subsea infrastructure,

allowing a cost-effective tie-back solution. It is fully appraised

and requires no additional pre-development drilling. A recently

compiled CPR has ascribed recoverable resources of 179bcf(1) of dry

gas to the field, which is situated in an area of significant

infrastructure, meaning its development is expected to be simple

whilst providing meaningful gas resource to the UK.

"This is an important period for Reabold's interest in the

Victory Gas project, and we look forward to providing further

updates on the project in the near future."

[1] the 2C or best / mid case technically recoverable contingent

resources estimate is a Corallian derived aggregate of "contingent

resources - development pending" (145bcf) and "contingent resources

- development unclarified" (34bcf)" from the RPS CPR (dated October

2021).

For further information, contact:

Reabold Resources plc c/o Camarco

Sachin Oza +44 (0) 20 3757

Stephen Williams 4980

Strand Hanson Limited - Nominated & Financial

Adviser

James Spinney

Rory Murphy

James Dance

Stifel Nicolaus Europe Limited - Joint Broker

Callum Stewart +44 (0) 20 7409

Simon Mensley 3494

Ashton Clanfield +44 (0) 20 7710

Panmure Gordon - Joint Broker 7600

Hugh Rich +44 (0) 207 886

Nick Lovering 2733

Camarco

James Crothers

Rebecca Waterworth +44 (0) 20 3757

Billy Clegg 4980

Notes to Editors

Reabold Resources plc is an investing company investing in the

exploration and production ("E&P") sector. The Company's

investing policy is to acquire direct and indirect interests in

exploration and producing projects and assets in the natural

resources sector, and consideration is currently given to

investment opportunities anywhere in the world.

As an investor in upstream oil & gas projects, Reabold aims

to create value from each project by investing in undervalued,

low-risk, near-term upstream oil & gas projects and by

identifying a clear exit plan prior to investment.

Reabold's long term strategy is to re-invest capital made

through its investments into larger projects in order to grow the

Company. Reabold aims to gain exposure to assets with limited

downside and high potential upside, capitalising on the value

created between the entry stage and exit point of its projects. The

Company invests in projects that have limited correlation to the

oil price.

Reabold has a highly-experienced management team, who possess

the necessary background, knowledge and contacts to carry out the

Company's strategy.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCTTBFTMTBTBTB

(END) Dow Jones Newswires

December 23, 2021 01:59 ET (06:59 GMT)

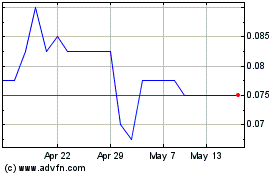

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Sep 2024 to Oct 2024

Reabold Resources (LSE:RBD)

Historical Stock Chart

From Oct 2023 to Oct 2024