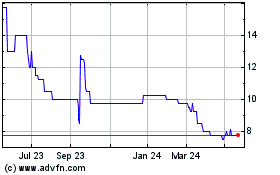

TIDMRAI

RNS Number : 8987M

RA International Group PLC

26 May 2022

RA INTERNATIONAL GROUP PLC

("RA International", "RA", the "Group" or the "Company")

Results for the year ended 31 December 2021

RA International Group plc (AIM: RAI) a specialist provider of

complex and integrated remote site services to Humanitarian,

Governmental and Commercial organisations globally, announces its

full year results for the year ended 31 December 2021.

HIGHLIGHTS

-- Revenue of USD 54.6m (2020: USD 64.4m) and underlying EBITDA

of USD 6.7m (2020: USD 14.2m), in-line with the guidance provided

in our pre-close trading statement.

-- Statutory loss before tax of USD 32.2m including USD 31.5m in

non-underlying charges relating to our Mozambique project of which

USD 5.9m relates to cash costs and USD 23.4m is a provision to

impair the carrying value of assets. We are pursuing opportunities

to dispose of USD 7.2m of project related assets located in storage

and remain confident that development works will restart in

Mozambique, although timing is difficult to predict

-- Resilience of IFM services continues to be a feature, with

revenue for the year of USD 31.2m (2020: USD 31.3m); IFM represents

56% of contract order book value

-- 2021 year-end order book of USD 100m, with USD 40m of new

contracts, contract uplifts and extensions awarded during the year

and adjusted for the removal of the USD 60m Mozambique contract

-- Government and humanitarian clients represented 95% of 2021

revenue (2020: 92%), with government an increasing proportion of

the mix (47% of 2021 revenue). These are stable, high-value clients

that support our strategy to diversify geographically through

customer-led growth

-- In 2021 we established a US subsidiary, RA Federal Services,

to target further growth with relevant US federal government

departments, which we see as a significant growth opportunity

-- Maturity of the USD 10m MTN debt programme has recently been

extended to 2024 and additional working capital facilities are

available as required to support implementing material new project

awards

-- Reflecting the Board's cautious view on the operating

environment in the near-term, the Board is not recommending a

dividend for the FY21 financial year

2021 2020

USD'm USD'm

Revenue 54.6 64.4

Underlying EBITDA(1) 6.7 14.2

Underlying EBITDA margin 12.3% 22.0%

(Loss)/Profit before tax (32.2) 6.6

EPS, basic (cents) (18.7) 3.8

Underlying EPS, basic (cents)

(2) 0.1 5.6

Dividend per share Nil 1.35

Net (debt)/cash (end of period)

(3) (1.5) 11.2

Commenting on the 2021 results and outlook, Soraya Narfeldt, CEO

of RA International, said:

"We responded with agility and resilience to the major external

challenges we faced in 2021 and delivered on significant projects

for our clients, building our reputation as a trusted partner.

Looking ahead, it remains difficult to forecast with real authority

how the current year will play out but we are continuing to

stabilise the business post the pandemic and its effects, and see

the scope for a return to accelerated contract awards as and when a

more normalised operating environment returns. In the meantime, we

take great confidence in the strength of our offering, which is

differentiated by our technical capability, proven ability to

innovate and continue to perform under extraordinarily challenging

circumstances, and by our attractive pricing, particularly where we

self-perform.

As we execute on our plans, our main priorities for this year

are to grow the pipeline, particularly with US federal Government

departments, build balance sheet liquidity, and drive value from

recent investment in our business, systems and processes. We thank

shareholders for their patience over what has been a challenging

period and we look forward to realising the value from supporting

our customers as they emerge from the residual challenges of the

last two years. "

Online Investor Presentation

RA International management will host an online investor

presentation and Q&A session at 11am BST on Monday, 30 May

2022.

Anyone wishing to participate should register with PI World

at:

https://bit.ly/RAI_FY21_results_webinar

A replay will be available subsequently on the Company

website.

Notes to Highlights:

(1) Underlying EBITDA is calculated by adding depreciation,

non-underlying items and share based payment expense to operating

profit.

(2) Underlying EPS reflects underlying operating profit after

deducting net finance costs and taxation, divided by the weighted

average number of ordinary shares outstanding during the

period.

(3) Net cash represents cash less overdraft balances, term loans

and notes outstanding. A negative net cash balance is referred to

as net debt.

Enquiries:

RA International Group PLC Via Bamburgh Capital

Soraya Narfeldt, Chief Executive Officer

Lars Narfeldt, Chief Operating Officer

Andrew Bolter, Chief Financial Officer

Canaccord Genuity Limited (Nominated Adviser

and Broker)

Bobbie Hilliam +44 (0) 207 523

Alex Aylen 8000

Bamburgh Capital Limited (Investor Relations +44 (0) 131 376

& Media) 0901

Murdo Montgomery investors@raints.com

Background to the Company

RA International is a leading provider of services to remote

locations. The Company offers its services through three channels:

construction, integrated facilities management and supply chain,

and services three main client groups: humanitarian and aid

agencies, governments and commercial customers, predominantly in

the oil and gas and mining sectors. It has a strong customer base,

largely comprising UN agencies, western governments and global

corporations.

The Company provides comprehensive, flexible, mission critical

support to its clients enabling them to focus on the delivery of

their respective businesses and services. Focusing on integrity and

values alongside making on-going investment in its people,

locations and operations has over time created a reliable and

trusted brand within its sector.

CHAIR'S STATEMENT

2021 was a year where the employees of our Company had to

respond to two major external challenges as they dealt with the

effects of COVID-19 and the tragic events in Mozambique. On behalf

of the Board, I would like to acknowledge the difficulties our

people have experienced and to thank them for their sense of

purpose, community, and commitment in dealing with these

challenges.

It is clear that for our customers the effects of COVID-19 have

been particularly pronounced. This has caused further delays to

mobilising project activity across our business, stalling the

momentum that was building in the third quarter of last year. We

remain confident that we will re-establish this momentum but we are

cautious on timings.

Against this backdrop, the Group still delivered USD 54.6m of

revenue and underlying EBITDA of USD 6.7m. The loss before tax of

USD 32.2m recorded for the year highlights impairment charges we

have recorded in relation to our operations in Northern Mozambique,

where there remains significant uncertainty. As we outline in this

report, we are working hard to recover value from these assets.

The market opportunity remains attractive for RA and, as a

Board, we have assessed how we align our strengths and resources

with these market opportunities to best drive sustainable

profitable growth. We came to market in 2018 looking to expand our

customer base more broadly beyond our established humanitarian

client base.

We have made great strides in developing the government side of

our business, and Soraya provides the substance of this in her

review. We believe our work with western Governments, particularly

US and UK overseas departments, is likely to be a core part of our

success going forward. As such, we are looking to reallocate

greater investment to this side of the business, particularly in

the US through developing RA Federal Services ("RAFS") - our US

subsidiary. As we do this, we will still look to undertake projects

with Commercial customers and build on our extensive relationships

with the UN and other humanitarian organisations.

At the right time, we also see the opportunity for this organic

investment to be complemented by bolt-on M&A strengthening our

past performance in attractive undeserved markets.

In line with the Board's cautious approach to the prevailing

environment, with suppressed levels of activity in terms of

contract awards and project starts continuing to be a feature in

2022, the Board is not recommending the payment of a final

dividend. The Board's intention is to reinstate the dividend as

soon as is practicable, taking into consideration the financial

strength of RA and its confidence in its future performance. More

generally on cash and the balance sheet, the Board remains

confident in our position to fund existing project activity, to

mobilise on new projects, and to bid successfully for tenders.

Environmental, social, governance, and corporate culture

A great deal of work was done behind the scenes in 2021 to set

the future direction for RA's sustainability activities and ensure

progress continues to be made with regards to our environmental and

social activities. This included a rigorous refresh of our

materiality - looking at our own priorities and the expectations of

our stakeholders and selecting areas of investment where we feel we

can do more and have a greater impact. Through this we identified

eight key focus areas where we will set specific targets and

appoint dedicated managers to drive improvements.

In parallel, the Group reviewed and affirmed its purpose,

mission, and values, providing a strong foundation for our

corporate culture, the types of projects we want to take on, and

the organisations we want to work with and for. We now include key

sustainability indicators relating to shared values, social,

environmental and governance alignment, and country related risks

within our project selection process.

The Group also refreshed its system for identifying, monitoring,

and managing risk, and established a Group Risk Assessment

Committee ("GRAC") to support the EMT in managing the principal

risks that are most likely to have the largest negative impact on

the business.

More detail on RA's approach to doing business the right way is

set out in our 2021 Sustainability Report.

A final note

The Board remains focused on delivering value for shareholders

and believes the refreshed strategic focus outlined above supports

this through targeting a high-quality customer base and

international diversification supporting significant contract

visibility, sustained earnings growth, and strong free cash

generation.

On behalf of the Board, I would like to commend the leadership

team and all our staff for their ability to respond to the

challenges of the last two years. Adaptability and finding

solutions in difficult

situations is embedded in RA's culture, and this was proven many

times over in 2021.

Sangita Shah

Non-Executive Chair

26 May 2022

CHIEF EXECUTIVE OFFICER'S REVIEW

As we work through the residual challenges of the last two

years, we should not lose sight of the strengths of the business.

As we outlined in our pre-close trading statement, the second half

of the year saw unprecedented operating constraints, causing

inefficiencies and exceptional delays in executing projects, in

tender issues, awards, and in project mobilisations. This impacted

our profitability for the second half of 2021 and stalled our order

book momentum.

Whilst we are not reporting the financial performance we would

want to for this period, it is primarily a function of the broader

environment and events which are out of our control. Revenue of USD

54.6m and underlying EBITDA of USD 6.7m are markedly lower than the

prior year and reflect the full-year impact of the pandemic and the

events in Mozambique. The Group reported a loss before tax of USD

32.2m, which included a USD 31.5m non-underlying expense relating

to Mozambique. Investors will be aware that this area was subject

to an insurgency attack in March 2021 and, as at the time of these

results, the local situation had not yet stabilised sufficiently to

see sizable commercial activity restarting. We are working hard to

realise value from our investments made relating to this project,

which will support our cash position.

To give further context to these headlines, 2021 was very

disruptive from an operational perspective. Clearly, our customers'

spending over the last two years has been focused on mitigating the

impact of COVID-19 and less on project development. As a result,

government and humanitarian agencies have suffered from staff

shortages which impacted requests for proposals, bids, and project

execution. In September 2021 we believed that these challenges were

abating, however this view was superseded by a return to

government-imposed lockdowns and restrictions which led to further

delays and uncertainty.

Despite these ongoing challenges, we exited 2021 with an order

book backlog of USD 100m, reflecting USD 40m of new contract

awards, uplifts, and extensions, offset by the force majeure

declaration relating to the Palma Project and the subsequent

removal of that contract from the order book.

Contract order book:

USD'm

Opening order book 187

New contracts, contract uplifts

and extensions 40

Contracts suspended, cancelled etc.

(includes Mozambique) (72)

Contracted revenue delivered (55)

----------------

Closing order book as at 31 December

2021 100

Our pipeline activity remains very solid but given the extended

delays we continue to experience and the current run-rate of new

business awards and project starts, we are adopting a very

conservative position in terms of forecasting the extent to which

new project activity lands in the current financial year. We are

confident that as and when a more normal operating environment

returns, we will re-establish significant order book growth but the

timelines for this are beyond our control, meriting the cautious

approach.

The fundamental strengths of the business remain. We are

delivering on some 20 high-value IFM projects which represent 56%

of the order book and provide long-term visibility typically at

above Group average profit margins. We are delivering on multiple

construction projects, with many expected to be the first phase of

much larger contracts. This is augmented by our supply chain

activities which represent around 10% of order book, and again

include projects of significant value.

In terms of an update on our operational involvement in the Cabo

Delgado province in Mozambique, we continue to believe that given

the considerable multi-national commercial investment and the

significance to both Mozambique and the international community,

the project will come to fruition - although timing is difficult to

predict. Given the prevailing uncertainty, the Board has taken the

prudent approach of impairing the assets and associated costs

related to the project. Whilst we have taken this impairment

charge, we are working hard to realise value from these assets

which would bolster our cash resources. We remain well-positioned

to provide the originally planned services as and when they are

required.

Clearly Group profitability and cash have been impacted by the

prevailing environment but as Andrew details in his review, we have

taken the requisite steps to strengthen our liquidity position and

have sufficient resources to fulfil our project deployments and bid

for the types of projects we want.

Our refreshed strategy plays to our strengths across significant

market opportunities

We continue to drive long-term value by executing on our

customer-led growth strategy underpinned by a core principle of

doing business the right way. Our focus on sustainability is a key

differentiator for us as our customers become increasingly aware of

the benefits of incorporating environmental and social

considerations into their projects.

While our commercial projects remain in the pipeline, and we

will continue to bid for new contracts which meet our risk adjusted

return profile, we have reflected on our strong track record and

competitive advantage in supporting blue-chip customers in the

humanitarian and government sectors relative to the emerging

opportunity we have in the commercial sector.

We are particularly encouraged about the success and

opportunities we have with western Governments, and where we are

building a specialist capability with respect to supporting US

Government ("USG") activity overseas. In 2021, this was evidenced

by key contracts signed with the US Navy, USAID, and Cherokee

Nation Mechanical.

In addition, we are looking to prioritise work with UK

Government departments including the Ministry of Defence, the

Foreign, Commonwealth & Development Office, as well as other

international government agencies.

The table below highlights this trajectory with a marked

increase in Government revenues, particularly since 2020.

2014 2015 2016 2017 2018 2019 2020 2021

----- ----- ----- ----- ----- ----- ----- -----

Humanitarian 87% 81% 85% 74% 62% 55% 48% 48%

Government 6% 8% 9% 21% 31% 32% 44% 47%

Commercial 7% 11% 6% 4% 8% 12% 8% 5%

It is worth breaking this down further to illustrate the success

we have established with US federal Government overseas budgets.

This has been a strategic focus of the business over the last four

to five years, has been a significant driver of our financial

performance over the last couple of years, and is expected to

contribute an increased proportion of Group revenue going

forward.

Over the last two financial years, US Government related

revenues have contributed approximately one-third of Group

revenues. This figure was 25% in 2019 and below 10% prior to that.

This growth reflects a targeted approach to business development,

particularly with the US Department of Defense and the US

Department of State, including USAID and the Bureau of Overseas

Building Operations ("OBO") projects. These departments have

contributed materially to the marked growth in Government revenues

since 2020, including the following landmark projects:

- USD 5.7m contract to provide Training and Life Support

Services in Central African Republic for the US Department of

Defense,

- USD 15.1m Embassy Upgrade Project in East Africa for the US

Department of State, and

- USD 21.5m contract to provide comprehensive life support and

maintenance services at a joint USAID/ Embassy compound.

This success has been based on establishing partnerships with US

companies to bid for and deliver US Government work, across a

number of different contract frameworks:

- Indefinite Delivery/Indefinite Quantity ("IDIQ") Contract

Vehicles, of which our seat on the USD 249m IDIQ for design and

construction services supporting the island of Diego Garcia is a

good example,

- Single Contracts, where we deliver life support and

construction contracts for Embassies and are presently executing

projects on three continents,

- Sole Source Teaming Agreements, where we have a successful

partnership with Cherokee Nation Mechanical, and

- Broader partnerships and JVs, including with IAP, who awarded

us a USD 24.1m contract to procure and deliver food to multiple

locations across Africa.

In 2021, we established a wholly owned US based subsidiary,

RAFS, to bid directly on USG projects and accelerate growth in this

area. RAFS has an independent Board of Directors and we have

reallocated resources and personnel from our support hubs in Dubai

and Kenya to the US business. Overall, we are investing USD 1.5m to

USD 2.0m through 2023 in building our US capability through RAFS as

we look to build on our USG momentum.

Strategically, RAFS allows us to be more competitive in our

tenders and complements our existing relationships with

organisations such as Cherokee Nation Mechanical and Sincerus where

a partnership arrangement makes sense. Establishing RAFS has

already broadened discussions and the scope of opportunities

available to us given the clear advantages our proposition

offers:

- track record to self-perform large scale USG contracts across

the range of our services including through our "one-supplier"

model,

- our offering is particularly competitive where we self-

perform as we combine technical capability through past performance

and a clear cost advantage,

- we operate in markets which are underserved by existing

providers, and/or where US organisations look to partner with local

sub-contractors that do not have the capability to deliver to

requisite international standards, and

- our ability to offer additional value through our industry

leading ESG credentials, the breadth and depth of

- our experience, including our humanitarian work, our

reputation as acknowledged specialists in our field.

Overall, we expect government clients to become an increasingly

important part of our business, providing high-quality earnings,

decreasing the risk profile of our clients, and diversifying

geographically through customer-led growth.

We continue to explore broader opportunities that play to our

core strengths. For example, we are in discussions with DFIs such

as the Development Finance Corporation, with a view to establish

relationships as a project manager for DFI funded works. RA adds

value through its social and environmental impact and strong

governance. DFIs fund large infrastructure projects across Africa

and Asia which fall within operational geographies. We are also

exploring ECA funded projects. UKEF, the export credit agency of

the British Government, has more than tripled its investment in

Africa to GBP2.3b.

Current trading and outlook

We responded with agility and resilience to the major external

challenges we faced in 2021 and delivered on significant projects

for our clients, building our reputation as a trusted partner.

Looking ahead, it remains difficult to forecast with real authority

how the current year will play out but we are continuing to

stabilise the business post the pandemic and its effects, and see

the scope for a return to accelerated contract awards as and when a

more normalised operating environment returns. In the meantime, we

take great confidence in the strength of our offering, which is

differentiated by our technical capability, proven ability to

innovate and continue to perform under extraordinarily challenging

circumstances, and by our attractive pricing, particularly where we

self-perform.

As we execute on our plans, our main priorities for this year

are to grow the pipeline, particularly with US federal Government

departments, build balance sheet liquidity, and drive value from

recent investment in our business, systems and processes. We thank

shareholders for their patience over what has been a challenging

period and we look forward to realising the value from supporting

our customers as they emerge from the residual challenges of the

last two years.

Soraya Narfeldt

Chief Executive Officer

26 May 2022

FINANCIAL REVIEW

Revenue of USD 54.6m and underlying EBITDA of USD 6.7m summarise

our financial performance for the year. Results are in line with

the guidance we provided in a trading update on 16 February 2022

and reflect a challenging operating environment and the result of

events taking place in Cabo Delgado, Mozambique which, in addition

to having a material impact on our revenue and profitability in

2021, has significantly altered the makeup of our balance

sheet.

We have addressed these challenges and the impact of the Palma

Project both strategically, as Soraya has touched upon, but also

from a financial standpoint. In 2022 we completed a USD 12.0m debt

raise through the issuance of loan notes maturing in November 2024.

As part of this exercise, USD 8.4m of the USD 10.0m of notes

outstanding at 31 December 2021, maturing in the second half of

2022, were cancelled. Additionally, we have put in place a

long-term working capital facility to support the business, if

required, in implementing material new project awards.

In September 2021 we highlighted the significant increase in

inventory caused by the suspension of the Palma Project and the

corresponding impact on cash. The unwinding of this balance

continues to progress (decrease of USD 0.6m since the end of H1 21)

and we expect this to accelerate in 2022.

Overall, despite the external difficulties faced by the business

during 2021, the Company remains in a strong position to bid for

and execute large projects and significant opportunities remain to

increase liquidity in 2022.

Highlights:

2021 2020

USD'm USD'm

Revenue 54.6 64.4

Gross profit 12.0 18.8

Gross profit margin 22.0% 29.2%

Underlying EBITDA 6.7 14.2

Underlying EBITDA margin 12.3% 22.0%

(Loss)/Profit before tax (32.2) 6.6

(Loss)/Profit before tax

margin (59.0%) 10.3%

EPS, basic (cents) (18.7) 3.8

Underlying EPS, basic (cents) 0.1 5.6

Net cash (end of period) (1.5) 11.2

Revenue

Reported revenue for 2021 of USD 54.6m (2020: USD 64.4m)

represents a USD 9.8m or 15% decrease year on year. This both

contrasts the momentum the Company had entering 2020 with the

challenging operating situation that has continued to develop since

the onset of COVID-19 and highlights the financial impact of the

events in Mozambique.

As was communicated to the market shortly after the event in

March, this project was anticipated to generate USD 10.0m of

revenue in 2021.

In September 2021 we advised that we were encouraged by a recent

uptick in construction contracts being awarded, which although

relatively small in terms of contract value were seen as an

important indicator of returning to a more normal operating

environment. This led to construction revenue increasing by 23% in

the second half of 2021, albeit full year construction revenue

decreased by 26% when compared with 2020.

IFM revenue continues to be resilient and broadly constant from

period-to-period. Lower income from our hotel facility in Somalia

was offset by revenue from new contracts awarded during the year.

Consistent with prior year, approximately 75% of supply chain

revenue was earned from long-term contracts, often three to five

years in length.

Consistent with prior year, approximately 75% of supply chain

revenue was earned from long-term contracts, often three to five

years in length.

H2 2021 H1 2021 H2 2020 H1 2020

USD'm USD'm USD'm USD'm

Integrated facilities management 15.8 15.4 15.3 15.9

Construction 8.0 6.2 8.4 10.7

Supply chain 4.6 4.6 5.3 8.8

---------------- ---------------- ---------------- ----------------

28.4 26.2 29.1 35.4

Profit margin

Gross margin in 2021 was 22.0% (2020: 29.2%), with a significant

variance between H1 2021 and H2 2021 (29.2% and 15.5%

respectively). Gross profit decreased by USD 6.8m when compared

with 2020 and is reflective of:

2021

USD'm

Decrease in revenue 2.4

Increased direct cost depreciation 0.9

Credit provision 0.5

Decrease in project margins - Construction 0.6

Decrease in project margins - IFM 2.2

Decrease in project margins - Supply

Chain 0.2

--------------

Total 6.8

Decreased margins from construction activities resulted from a

number of near nil margin contracts being executed in H2 2021 which

relate to the initial phase of what may become much larger

projects. General inefficiencies were also encountered given the

fitful nature of project execution during the period.

Approximately half of the decrease attributed to IFM services

relates to lower occupancy in our Somalia hotel facility, with the

remainder being the effect of general inefficiencies and

inflationary pressures.

In H2 2021 inflationary pressure was primarily seen on food and

beverage imports and logistics costs, however in some locations we

are seeing significant wage inflation as well. We have recently

been successful in agreeing price increases on some IFM contracts,

however, we anticipate continued margin pressure in 2022. We

continue to work with our long-term suppliers, and plan to leverage

our existing inventory holdings to mitigate inflationary effects

where possible.

Reconciliation of (loss)/profit to underlying EBITDA:

2021 2020

USD'm USD'm

(Loss)/Profit (32.1) 6.6

Tax expense (benefit) (0.1) 0.1

---------------- ----------------

(Loss)/Profit before tax (32.2) 6.6

Finance costs 1.3 1.0

Investment income (0.1) (0.3)

---------------- ----------------

Operating (loss)/profit (30.9) 7.3

Non-underlying items 32.2 3.0

---------------- ----------------

Underlying operating profit 1.3 10.4

Share based payments 0.5 0.1

Depreciation 4.9 3.7

---------------- ----------------

Underlying EBITDA 6.7 14.2

Underlying EBITDA margin was 12.3% in 2021 (2020: 22.0%),

reflecting lower gross margin and a USD 2.3m increase in

administrative expenses driven by centralisation efforts enacted in

2020 and investment made in establishing RAFS during 2021. Outside

of a planned investment in RAFS of between USD 1.5m to USD 2.0m, we

anticipate the strategic shift to de-emphasise commercial projects

will lead to administrative cost savings in 2022.

During the year, the Company incurred non-underlying costs of

USD 32.2m (2020: USD 3.0m).

Non-underlying items:

2021 2020

USD'm USD'm

COVID-19 costs 0.8 1.4

Other share based payments - 1.2

Restructuring costs - 0.3

Acquisition costs - 0.2

Palma Project, Mozambique 31.5 -

---------------- ----------------

32.2 3.0

COVID-19 costs of USD 0.8m are almost entirely incremental staff

costs and PPE relating to the pandemic. Further detail on these

costs can be found in note 9 of the consolidated financial

statements.

Non-underlying costs related to the Palma Project can broadly be

classified into two categories, the impairment of assets related to

the project, and incremental costs

incurred by the Company as a direct result of the attack and

subsequent project suspension.

Asset impairment

The full carrying value of Palma Project assets, totalling USD

25.6m has been impaired, however it is important to note that of

this balance, we consider only USD 2.1m to be a realised loss while

the remainder, USD 23.4m, has been impaired through the

establishment of a provision. These assets will be assessed to

establish if there is a basis for reversal of the impairment

provision at each reporting date or when an event transpires which

may indicate a material change in the value of these assets.

Of the USD 23.4m in assets where a provision has been

established, USD 7.2m relates to equipment and material located

within various secure storage locations in Africa and the Middle

East ("Offsite Assets"). These assets were either on-route to Palma

at the time of the March attack and diverted to or held at safe

storage facilities, or assets which we were able to relocate from

our Mozambique camp during the second half of 2021. Given the

uncertainty as to when development activities will recommence in

Northern Mozambique and the cost of storage, we believe it to be in

the best interest of stakeholders that the Group sell these assets

in the short term, both so as to recover maximum value and cease

incurring storage costs. These assets may also be utilised in new

projects during 2022.

The USD 2.1m that is considered permanently impaired is

primarily made up of assets which have been damaged, stolen, or

otherwise deemed unusable in the future. We have lodged an

insurance claim relating to a significant portion of this balance

and are currently in discussions with our insurers.

Incremental costs

In 2021, the Group incurred USD 4.5m in incremental costs

directly related to the Mozambique attack and resulting contract

suspension. These costs are primarily made up of logistics and

storage charges relating to the Offsite Assets referenced above,

but also include evacuation costs and mental health counselling

provided to staff post incident.

The Group has also recorded a provision of USD 1.4m for

unavoidable costs associated with the Offsite Assets. This

provision will be reassessed as at the date of our 2022 interim

reporting or as the Offsite Assets are disposed.

As with those assets identified as permanently impaired, we have

lodged an insurance claim relating to a significant portion of

incremental costs and are currently in discussions with our

insurers.

Further details of these balances and the process we followed

when assessing the level of impairment to be recorded can be found

in note 9.

A breakup of the USD 31.5m non-underlying expense related to

Mozambique is below:

2021 2020

USD'm USD'm

Provision for asset impairment 23.4 -

Permanent asset impairment 2.1 -

Incremental costs incurred 1.1 -

but unpaid

Provision for unavoidable 1.4 -

costs

---------------- ----------------

28.0 -

Incremental costs incurred 3.4 -

and paid

---------------- ----------------

Total 31.5 -

Finance Costs net of Investment Revenue increased to USD 1.3m

(2020: USD 0.7m) as the Company incurred a full year of interest

expense related to loan notes issued in 2020 and 2021 and realised

USD 0.2m less in foreign exchange gains. The average loan balance

outstanding in 2021 was USD 7.1m compared with USD 2.1m in

2020.

Earnings per share

Basic loss per share was 18.7 cents in the current period (2020:

3.8 cents). Adjusting for non-underlying items, underlying earnings

per share was 0.1 cents (2020: 5.6 cents).

Cash flow

Our cash balance decreased by USD 9.1m during the year (2020:

decrease of USD 3.8m), primarily resulting from asset purchases and

costs incurred relating to Mozambique.

Summary cash flows:

2021 2020

USD'm USD'm

Operating Profit (30.9) 7.3

Asset impairment 28.0 -

Depreciation 4.9 3.7

Other items pre-working capital

adjustments 1.0 1.7

---------------- ----------------

3.0 12.7

Working capital adjustments (7.8) 8.7

Tax & end of service benefits paid (0.2) (0.2)

---------------- ----------------

Net cash flows from operating activities (5.1) 21.1

Investing activities (excluding

Capital Expenditure) 0.9 0.3

Capital Expenditure (3.5) (24.5)

---------------- ----------------

Net cash flows used in investing

activities (2.6) (24.1)

Financing activities (excluding

borrowings) (5.2) (6.8)

Proceeds from borrowing 3.9 6.1

---------------- ----------------

Net cash flows used in financing

activities (1.3) (0.7)

Net change in cash during the period (9.1) (3.8)

Cash outflows from operations were USD 4.8m in the year (2020:

inflows of USD 21.3m) reflecting lower profitability and a variance

of USD 16.5m in working capital adjustments (negative USD 7.8m in

2021 and positive USD 8.7m in 2020).

At the end of 2021, USD 3.4m of the USD 9.4m carrying value of

inventory related to prefabricated camp assets purchased in 2020

and partially used in the Palma Project. The Company will utilise

these assets on certain projects if they commence in 2022 but is

also pursuing a sale which may lead to a significant cash benefit

being realised. USD 3.2m of inventory which has been provided for,

relates to Offsite Assets, which if sold, may also lead to a

significant cash uplift.

2021 2020

USD'm USD'm

Gross inventory 12.7 9.1

Provision for asset impairment (3.3) -

---------------- ----------------

Carrying value of inventory 9.4 9.1

Prefabricated camp assets (3.4) (2.1)

---------------- ----------------

Normalised inventory balance 6.0 7.0

Trade receivables and accrued revenue increased by USD 4.5m as

at the end of 2021 when compared with prior period. This variance

is primarily due to timing with regards to invoicing and collection

but does reflect a USD 2.1m build-up of accrued revenue relating to

one UN construction project. The full balance has been invoiced in

2022.

We entered 2021 anticipating capital expenditure of between USD

7.0m and USD 10.0m, with the majority of spend relating to

finalising the construction of our camp facility near Palma,

Mozambique. Instead, as a result of the attack and contract

suspension, capital expenditure for 2021 totalled USD 3.5m. Our

underlying business is not particularly capital intensive; unless

linked to a significant new project award, we anticipate 2022

capital expenditure to be between USD 1.0m and USD 2.0m.

Balance sheet and liquidity

Net assets at 31 December 2021 were USD 37.3m (2020: USD 72.1m).

Our balance sheet has been reshaped by the events in Mozambique and

related impairment charge and whilst we cannot impact the timing of

recommencement of oil and gas development activities which may

trigger a recovery of asset impairment, with considerable work

already undertaken we are confident that significant opportunities

exist to improve our liquidity profile in the short term. These

primarily relate to the sale of the Offsite Assets and USD 3.4m

prefabricated camp.

Breakdown of net assets:

2021 2020

USD'm USD'm

Cash and cash equivalents 8.5 17.6

Loan notes (10.0) (6.5)

---------------- ----------------

Net cash (1.5) 11.2

Net working capital 13.8 14.4

Non-current assets 30.9 51.0

Tangible owned assets 25.5 47.3

Right-to-use assets 5.4 3.5

Goodwill - 0.1

Lease liabilities and end

of service benefit (5.9) (4.5)

---------------- ----------------

Net assets 37.3 72.1

During the second half of 2021, we raised USD 3.5m of debt under

the Medium-Term Note ("MTN") programme launched in 2020. This debt

was raised to ensure the Company maintained adequate available cash

to execute certain large projects in the pipeline. In May 2022, we

completed a refinancing and fundraising exercise to synchronise and

extend the maturity of the loan notes issued under the MTN

programme.

USD 12.0m of loan notes were issued, of which USD 8.4m relates

to a refinancing of notes outstanding at 31 December 2021 and USD

3.6m relates to new investment. Notes issued in 2022 mature in

November 2024.

Notes outstanding at 31 December 2021 which were not refinanced

will be repaid in the second half of 2022 as per the original

maturity date. Further details of the MTN programme and refinancing

can be found in note 24 and 34 of the consolidated financial

statements.

In addition to refinancing the MTNs, we have also established a

GBP 10m long-term debt facility. This facility, while not expected

to be utilised, provide us with increased "available cash".

Liquidity and available cash are often assessed by potential

customers during the contract adjudication process. Given the above

actions taken and possible cash benefits from the sale of fixed

assets and inventory we remain satisfied, despite the financial

impacts of Mozambique, that both our cash position and liquidity

profile as a whole are sufficient so that we can continue to bid

for larger projects and have the financial capacity to mobilise

multiple large projects simultaneously.

Dividend

The Board is not recommending the payment of a final dividend in

line with its cautious approach to the prevailing environment. The

Board's intention is to reinstate the dividend as soon as is

practicable, taking into consideration the financial strength of RA

and its confidence in its future performance.

Andrew Bolter

Chief Financial Officer

26 May 2022

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the year ended 31 December 2021

2021 2020

Notes USD'000 USD'000

Revenue 7 54,595 64,441

Cost of sales 9 (42,050) (45,647)

Credit provision 20 (505) -

-------- --------

Gross profit 12,040 18,794

Administrative expenses 9 (10,719) (8,429)

-------- --------

Underlying operating profit 1,321 10,365

Non-underlying items 9 (32,222) (3,046)

-------- --------

Operating (loss)/profit (30,901) 7,319

Investment revenue 55 278

Finance costs (1,314) (970)

-------- --------

(Loss)/Profit before tax (32,160) 6,627

Tax benefit/(expense) 11 80 (61)

(Loss)/Profit and total comprehensive income

for the year (32,080) 6,566

========

Basic earnings per share (cents) 12 (18.7) 3.8

Diluted earnings per share (cents) 12 (18.5) 3.8

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 31 December 2021

Notes 2021 2020

USD'000 USD'000

------------------ ------------------

Assets

Non-current assets

Property, plant, and equipment 16

Right-of-use assets 17 25,512 47,358

Goodwill 18 5,374 3,528

- 138

------------------ ------------------

30,886 51,024

Current assets

Inventories 19 9,397 9,142

Trade and other receivables 20 16,522 12,666

Cash and cash equivalents 21 8,532 17,632

------------------ ------------------

34,451 39,440

------------------ ------------------

Total assets 65,337 90,464

------------------ ------------------

Equity and liabilities

Equity

Share capital 22 24,300 24,300

Share premium 18,254 18,254

Merger reserve (17,803) (17,803)

Treasury shares 23 (1,199) (1,363)

Share based payment reserve 534 177

Retained earnings 13,223 48,509

------------------ ------------------

Total equity 37,309 72,074

------------------ ------------------

Non-current liabilities

Loan notes 24 - 6,471

Lease liabilities 25 5,206 3,720

Employees' end of service benefits 26 731 517

------------------ ------------------

5,937 10,708

------------------ ------------------

Current liabilities

Loan notes 24 10,000 -

Lease liabilities 25 834 318

Trade and other payables 27 9,835 7,364

Provisions 28 1,422 -

------------------ ------------------

22,091 7,682

------------------ ------------------

Total liabilities 28,028 18,390

------------------ ------------------

Total equity and liabilities 65,337 90,464

================== ==================

CONSOLIDATED STATEMENT IN CHANGES IN EQUITY

For the year ended 31 December 2021

Share

based

Share Share Merger Treasury payment Retained

capital premium reserve shares reserve earnings Total

---------------

USD'000 USD'000 USD'000 USD'000 USD'000 USD'000 USD'000

--------------- --------------- -------------- ------------- ------------- ------------- ------------- ---------

As at 1

January

2020 24,300 18,254 (17,803) - 47 44,685 69,483

Total

comprehensive

income for

the

period - - - - - 6,566 6,566

Share based

payments

(note 13) - - - - 130 - 130

Dividends

declared

and paid

(note

14) - - - - - (2,674) (2,674)

Purchase of

treasury

shares (note

23) - - - (2,600) - - (2,600)

Issuance of

treasury

shares (note

23) - - - 1,237 - (68) 1,169

--------------- --------------- -------------- ------------- ------------- ------------- ------------- ---------

As at 31

December

2020 24,300 18,254 (17,803) (1,363) 177 48,509 72,074

Total

comprehensive - - - - - (32,080) (32,080)

income for the

period

Share based

payments - - - - 487 - 487

(note 13)

Dividends

declared

and - - - - - (3,206) (3,206)

paid (note 14)

Issuance of

treasury - - - 164 (130) - 34

shares (note

23)

--------------- --------------- -------------- ------------- ------------- ------------- ------------- -----------

As at 31

December

2021 24,300 18,254 (17,803) (1,199) 534 13,223 37,309

=============== =============== ============== ============= ============= ============= ============= ===========

CONSOLIDATED STATEMENT OF CASH FLOWS

For the year ended 31 December 2021

Notes 2021 2020

USD'000 USD'000

----------------------------------------------------- ------------------ ------------------

Operating activities

Operating (loss)/profit (30,901) 7,319

Adjustments for non-cash and other items:

Depreciation on property, plant, and equipment

16, 17 4,855 3,731

(Profit)/Loss on disposal of property, plant,

and equipment 16 (16) 93

Unrealised differences on translation of foreign

balances 133 5

Provision for employees' end of service benefits

26 433 209

Share based payments 13 487 1,299

Non-underlying items - Palma Project, Mozambique

9 28,035 -

----------------------------------------------------- ------------------ ------------------

3,026 12,656

----------------------------------------------------- ------------------ ------------------

Working capital adjustments:

Inventories (5,071) (2,964)

Trade and other receivables (4,284) 12,240

Trade and other payables 1,513 (616)

----------------------------------------------------- ------------------ ------------------

Cash flows (used in)/ generated from

operations (4,816) 21,316

Tax paid 11 (20) (117)

Employees' end of service benefits paid 26 (219) (83)

------------------------------------------------- ------------------ ------------------

Net cash flows (used in)/from operating activities (5,055) 21,116

----------------------------------------------------- ------------------ ------------------

Investing activities

Investment revenue received 55 278

Purchase of property, plant, and equipment 16 (3,478) (24,450)

Proceeds from disposal of property,

plant, and equipment 16 823 24

------------------------------------------------- ------------------ ------------------

Net cash flows used in investing activities (2,600) (24,148)

----------------------------------------------------- ------------------ ------------------

Financing activities

Proceeds from borrowings 24 3,916 6,084

Repayment of lease liabilities 25 (742) (564)

Finance costs paid (1,314) (970)

Dividends paid 14 (3,206) (2,674)

Purchase of treasury shares 23 - (2,600)

Proceeds from share options exercised 23 34 -

------------------------------------------------- ------------------ ------------------

Net cash flows used in financing activities (1,312) (724)

----------------------------------------------------- ------------------ ------------------

Net decrease in cash and cash equivalents (8,967) (3,756)

Cash and cash equivalents as at start

of the period 21 17,632 21,393

Effect of foreign exchange on cash and

cash equivalents (133) (5)

------------------------------------------------- ------------------ ------------------

Cash and cash equivalents as at end

of the period 21 8,532 17,632

================================================= ================== ==================

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

For the year ended 31 December 2021

1 CORPORATE INFORMATION

The principal activity of RA International Group plc ("RAI" or

the "Company") and its subsidiaries (together the "Group") is

providing services in demanding and remote areas. These services

include construction, integrated facilities management, and supply

chain services.

RAI was incorporated on 13 March 2018 as a public company in

England and Wales under registration number 11252957. The address

of its registered office is One Fleet Place, London, EC4M 7WS.

2 BASIS OF PREPARATION

The consolidated financial statements have been prepared in

accordance with UK adopted international accounting standards. They

have been prepared under the historical cost basis and have been

presented in United States Dollars ("USD"). All values are rounded

to the nearest thousand (USD'000), except where otherwise

indicated.

The financial information set out above does not constitute the

Company's statutory accounts for the years ended 31 December 2021

or 2020 but is derived from those accounts. Statutory accounts for

the year ended 31 December 2020 have been delivered to the

Registrar of companies and those for 2021 will be delivered in due

course. The auditor has reported on both sets of accounts; its

reports were unqualified, did not contain an emphasis of matter

reference and did not contain statements under section 498 (2) or

(3) of the Companies Act 2006.

Going concern

In assessing the basis of preparation of the financial

statements the Board has undertaken a rigorous assessment of going

concern, considering financial forecasts covering a period to 30

June 2023 and utilising scenario analysis to test the adequacy of

the Group's liquidity. The primary uncertainties facing the

business at present are related to the timing and success of

contract awards, as well as the time frame and value at which

unutilised fixed assets and inventory can be used or sold.

In addition to a Base Case scenario, additional scenarios were

prepared which reflect the primary uncertainties facing the

business. One forecasts a worst-case trading environment whereby

the Group is not awarded any new contracts in the future. Another

assumes that the Group is unable to sell or dispose of a

significant value of currently unutilised assets and as a result

continues to incur the related storage costs throughout the going

concern period, additionally all working

capital assumptions were assumed to deteriorate to levels unseen

previously. Under all scenarios, the Group has concluded that it

has sufficient cash reserves and facilities to fund trading,

capital investment, and principal and interest repayments

associated with loan notes maturing during the period.

During May 2022, the Group refinanced its debt so as to extend

and synchronise the maturity date. Of the USD 10m loan notes

outstanding at 31 December 2021, USD 1.6m were not refinanced and

will be repaid utilising the USD 3.6m of new funding raised through

this new programme. The loan notes now mature in November of 2024.

The Group also has access to a GBP 10m long-term debt facility

which is not expected to be utilised at any point throughout the

going concern period.

Under all scenarios reviewed by the Board the Group continues to

have sufficient cash reserves to operate for the foreseeable

future. Any scenario whereby trading performance is worse than

those modelled is considered to be remote given the level of

committed contracted work in place. On that basis, the Board is

therefore satisfied that it is appropriate to adopt the going

concern basis of accounting in preparing the financial

statements.

Climate change

In preparing the financial statements, the management has

considered the impact of the physical and transition risks of

climate change and identified this as an emerging risk but have

concluded that it does not have a material impact on the

recognition and measurement of the assets and liabilities in these

financial statements as at 31 December 2021.

3 BASIS OF CONSOLIDATION

The financial statements comprise the financial statements of

the Company and its subsidiaries as at 31 December 2021. Control is

achieved when the Group is exposed, or has rights, to variable

returns from its involvement with the investee and has the ability

to affect those returns through its power over the investee.

Specifically, the Group controls an investee if, and only if, the

Group has:

-- power over the investee (i.e., existing rights that give it

the current ability to direct the relevant activities of the

investee),

-- exposure, or rights, to variable returns from its involvement with the investee, and

-- the ability to use its power over the investee to affect its returns.

Generally, there is a presumption that a majority of voting

rights results in control. To support this presumption and when the

Group has less than a majority of the voting or similar rights of

an investee, the Group considers all relevant facts and

circumstances in assessing whether it has power over an investee,

including:

-- the contractual arrangement with the other vote holders of the investee,

-- rights arising from other contractual arrangements, and

-- the Group's voting rights and potential voting rights.

The Group reassesses whether or not it controls an investee if

facts and circumstances indicate that there are changes to one or

more of the three elements of control. Consolidation of a

subsidiary begins when the Group obtains control over the

subsidiary and ceases when the Company loses control over the

subsidiary. Assets, liabilities, income, and expenses of a

subsidiary acquired or disposed of during the year are included in

the financial statements from the date the Group gains control

until the date the Group ceases to control the subsidiary.

When necessary, adjustments are made to the financial statements

of a subsidiary to bring their accounting policies into line with

the Group's accounting policies. All intra-group assets and

liabilities, equity, income, expenses, and cash flows relating to

transactions between members of the Group are eliminated in full on

consolidation.

A change in the ownership interest of a subsidiary, without a

change of control, is accounted for as an equity transaction.

If the Company loses control over a subsidiary, it derecognises

the related assets (including goodwill), liabilities,

non-controlling interest, and other components of equity while any

resultant gain or loss is recognised in the profit or loss. Any

investment retained is recognised at fair value.

Business combinations

Business combinations are accounted for using the acquisition

method. The cost of an acquisition is measured as the aggregate of

the consideration transferred, which is measured at the fair value

on the acquisition date. The net identifiable assets acquired, and

liabilities assumed are recorded at their respective fair values on

the acquisition date. Acquisition- related costs are expensed as

incurred and included in acquisition costs.

When the Group acquires a business, it assesses the financial

assets and liabilities assumed for appropriate classification and

designation in accordance with the contractual terms, economic

circumstances, and pertinent conditions as at the acquisition

date.

4 SIGNIFICANT ACCOUNTING POLICIES

Revenue recognition

Revenue from contracts with customers is recognised when control

of the goods or services are transferred to the customer at an

amount that reflects the consideration to which the Group expects

to be entitled in exchange for those goods or services. The Group

has concluded that it is acting as a principal in all its revenue

arrangements.

Sale of goods (supply chain)

Revenue from the sale of goods and the related logistics

services is recognised when control of ownership of the goods have

passed to the buyer, usually on delivery of the goods.

Construction

Typically, revenue from construction contracts is recognised at

a point in time when performance obligations have been met.

Generally, this is the same time at which client acceptance has

been received. Dependent on the nature of the contracts, in some

cases revenue is recognised over time using the percentage of

completion method on the basis that the performance does not create

an asset with an alternative use and the Group has an enforceable

right to payment for performance completed to date. Contract

revenue corresponds to the initial amount of revenue agreed in the

contract and any variations in contract work, claims, and incentive

payments are recognised only to the extent that it is highly

probable that they will result in revenue, and they are capable of

being reliably measured.

Services (integrated facilities management)

Revenue from providing services is recognised over time,

applying the time elapsed method for accommodation and similar

services to measure progress towards complete satisfaction of the

service, as the customers simultaneously receive and consume the

benefits provided by the Group.

Cost of sales

Cost of sales represent costs directly incurred or related to

the revenue generating activities of the Group, including staff

costs, materials, and depreciation.

Contract balances

Trade receivables

A receivable represents the Group's right to an amount of

consideration that is unconditional, meaning only the passage of

time is required before payment of the consideration is due.

Accrued revenue

Accrued revenue represents the right to consideration in

exchange for goods or services transferred to a customer in

connection with fulfilling contractual performance obligations. If

the Group performs by transferring goods or services to a customer

before invoicing, accrued revenue is recognised in an amount equal

to the earned consideration that is conditional on invoicing. Once

an invoice has been accepted by the customer accrued revenue is

reclassified as a trade receivable.

Customer advances

If a customer pays consideration before the Group transfers

goods or services to the customer, a customer advance is recognised

when the payment is received by the Group. Customer advances are

recognised as revenue when the Group meets its obligations to the

customer.

Borrowing costs

Borrowing costs directly attributable to the construction of an

asset are capitalised as part of the cost of the asset.

Capitalisation commences when the Group incurs costs for the asset,

incurs borrowing costs and undertakes activities that are necessary

to prepare the asset for its intended use or sale. Capitalisation

ceases when the asset is ready for use or sale. All other borrowing

costs are expensed in the period in which they occur. Borrowing

costs consist of interest and other costs that are incurred in

connection with the borrowing of funds.

Tax

Current income tax assets and liabilities are measured at the

amount expected to be recovered from or paid to the taxation

authorities. The tax rates and tax laws used to compute the amount

are those that are enacted or substantively enacted

at the reporting date in the countries where the Group operates

and generates taxable income. Management periodically evaluates

positions taken in the tax returns with respect to situations in

which applicable tax regulations are subject to interpretation and

establishes provisions where appropriate.

Property, plant, and equipment

Property, plant, and equipment are stated at cost less

accumulated depreciation and any impairment in value. Capital

work-in-progress is not depreciated until the asset is ready for

use. Depreciation is calculated on a straight line basis over the

estimated useful lives. At the end of the useful life, assets are

deemed to have no residual value. Contract specific assets are

depreciated over the lesser of the length of the project, or the

useful life of the asset. The useful life of general property,

plant, and equipment is as follows:

Buildings Lesser of 5 to 20 years and term of land lease

Machinery, motor vehicles, furniture and equipment 2 to 10 years

Leasehold improvements Lesser of 10 years, or term of lease

The carrying values of property, plant, and equipment are

reviewed for impairment when events or changes in circumstances

indicate that the carrying value may not be recoverable. If any

such indication exists and where the carrying values exceed the

estimated recoverable amount, the assets are written down, with the

write down recorded in profit or loss to their recoverable amount,

being the greater of their fair value less costs to sell and their

value in use.

Expenditure incurred to replace a component of an item of

property, plant, and equipment that is accounted for separately is

capitalised and the carrying amount of the component that is

replaced is written off. Other subsequent expenditure is

capitalised only when it increases future economic benefits of the

related item of property, plant, and equipment. All other

expenditure is recognised in profit or loss as the expense is

incurred.

An item of property, plant, and equipment is derecognised upon

disposal or when no future economic benefits are expected from its

use. Any gain or loss arising on derecognition of the asset

(calculated as the difference between the net disposal proceeds and

carrying amount of the asset) is included in the profit or loss in

the year the asset is derecognised.

Assets' residual values, useful lives, and methods of

depreciation are reviewed at each financial year end, and adjusted

prospectively, if appropriate.

Goodwill

Goodwill is stated as cost less accumulated impairment losses.

Cost is calculated as the total consideration transferred less net

assets acquired.

Inventories

Inventories are stated at the lower of cost and net realisable

value. Costs include those expenses incurred in bringing each

product to its present location and condition. Cost is calculated

using the weighted average method. Net realisable value is based on

estimated selling price less any further costs expected to be

incurred in disposal.

Cash and cash equivalents

Cash and cash equivalents comprise cash in hand and balances

with banks, which are readily convertible to known amounts of cash

and have a maturity of three months or less from the date of

acquisition. This definition is also used for the consolidated cash

flow statement.

Impairment of non-financial assets

The Group assesses at each reporting date whether there is an

indication that an asset may be impaired. If any indication exists,

or when annual impairment testing for an asset is required, the

Group estimates the asset's recoverable amount. An asset's

recoverable amount is the higher of an asset's or cash-generating

unit's ("CGU") fair value less costs to sell and its value in use.

An asset's recoverable amount is determined for an individual

asset, unless the asset does not generate cash inflows that are

largely independent of those from other assets or groups of assets.

Where the carrying amount of an asset or CGU exceeds its

recoverable amount, the asset is considered impaired and is written

down to its recoverable amount. In assessing value in use, the

estimated future cash flows are discounted to their present value

using a pre-tax discount rate that reflects current market

assessments of the time value of money and the risks specific to

the asset. In determining fair value less costs to sell, an

appropriate valuation model is used, maximising the use of

observable inputs. These calculations are corroborated by valuation

multiples, quoted share prices for publicly traded entities or

other available fair value indicators.

The Group bases its impairment calculation on detailed budgets

and forecasts which are prepared separately for each of the Group's

CGUs to which the individual assets are allocated. These budgets

and forecasts generally cover a period of five years. For longer

periods, a long-term growth rate is calculated and applied to

project future cash flows after the fifth year.

Impairment losses relating to continuing operations are

recognised in those expense categories consistent with the function

of the impaired asset.

An assessment is made at each reporting date as to whether there

is any indication that previously recognised impairment losses may

no longer exist or may have decreased. If such indication exists,

the Group estimates the asset's or CGU's recoverable amount. A

previously recognised impairment loss is reversed only if there has

been a change in the assumptions used to determine the asset's

recoverable amount since the last impairment loss was recognised.

The reversal is limited so that the carrying amount of the asset

does not exceed its recoverable amount, nor exceed the carrying

amount that would have been determined, net of depreciation, had no

impairment loss been recognised for the asset in prior years. Such

reversal is recognised in the profit or loss unless the asset is

carried at a revalued amount, in which case, the reversal is

treated as a revaluation increase.

Provisions

Provisions are recognised when the Group has a present

obligation (legal or constructive) as a result of a past event, it

is probable that an outflow of resources embodying economic

benefits will be required to settle the obligation and a reliable

estimate can be made of the amount of the obligation. The expense

relating to a provision is presented in the statement of profit or

loss.

If the effect of the time value of money is material, provisions

are discounted using a current pre-tax rate that reflects, when

appropriate, the risks specific to the liability. When discounting

is used, the increase in the provision due to the passage of time

is recognised as a finance cost.

Financial instruments

i) Financial assets

Initial recognition and measurement

The classification of financial assets at initial recognition

depends on the financial asset's contractual cash flow

characteristics and the Group's business model for managing them.

With the exception of trade receivables that do not contain a

significant financing component or for which the Group has applied

the practical expedient, the Group initially measures a financial

asset at its fair value plus, in the case of a financial asset not

at fair value through profit or loss, transaction costs. Trade

receivables that do not contain a significant financing component

or for which the Group has applied the practical expedient are

measured at the transaction price determined under IFRS 15.

Subsequent measurement

Financial assets at amortised cost are subsequently measured

using the effective interest method and are subject to impairment.

Gains and losses are recognised in profit or loss when the asset is

derecognised, modified, or impaired.

Other receivables are subsequently measured at amortised

cost.

Derecognition of financial assets

A financial asset (or, where applicable a part of a financial

asset or part of a group of similar financial assets) is

derecognised when the rights to receive cash flows from the asset

has expired.

Impairment of financial assets

The Group recognises an allowance for expected credit losses

("ECLs") for all debt instruments not held at fair value through

profit or loss. ECLs are based on the difference between the

contractual cash flows due in accordance with the contract and all

the cash flows that the Group expects to receive, discounted at an

approximation of the original effective interest rate. The expected

cash flows will include cash flows from the sale of collateral held

or other credit enhancements that are integral to the contractual

terms.

ECLs are recognised in two stages. For credit exposures for

which there has not been a significant increase in credit risk

since initial recognition, ECLs are provided for credit losses that

result from default events that are possible within the next twelve

months (a twelve-month ECL). For those credit exposures for which

there has been a significant increase in credit risk since initial

recognition, a loss allowance is required for credit losses

expected over the remaining life of the exposure, irrespective of

the timing of the default (a lifetime ECL).

For trade receivables and contract assets, the Group applies a

simplified approach in calculating ECLs. Therefore, the Group does

not track changes in credit risk, but instead recognises a loss

allowance based on lifetime ECLs at each reporting date. When

arriving at the ECL we consider historical credit loss experience

including any adjustments for forward-looking factors specific to

the debtors and the economic environment.

A financial asset is deemed to be in default when internal or

external information indicates that the Group is unlikely to

receive the outstanding contractual amounts in full before taking

into account any credit enhancements held by the Group. A financial

asset is written off when there is no reasonable expectation of

recovering the contractual cash flows.

Income from financial assets

Investment revenue relates to interest income accrued on a time

basis, by reference to the principal outstanding and at the

effective interest rate applicable, which is the rate that exactly

discounts estimated future cash receipts through the expected life

of the financial asset to that asset's net carrying amount.

ii) Financial liabilities

Initial recognition and measurement

Financial liabilities are initially recognised at fair value and

subsequently classified at fair value through profit or loss, loans

and borrowings, or payables. Loans and borrowings and payables are

recognised net of directly attributable transaction costs.

The Group's financial liabilities include trade and other

payables and loan notes.

Subsequent measurement

The measurement of financial liabilities depends on their

classification as described below:

Financial liabilities at fair value through profit or loss

Financial liabilities at fair value through profit or loss

include financial liabilities held for trading and financial

liabilities designated upon initial recognition as held at fair

value through profit or loss.

Financial liabilities designated upon initial recognition at

fair value through profit or loss are designated at the initial

date of recognition, and only if the criteria in IFRS 9 are

satisfied. The Group has not designated any financial liability as

at fair value through profit or loss.

Financial liabilities are classified as held for trading if they

are incurred for the purpose of repurchasing in the near term. This

category also includes derivative financial instruments entered

into by the Group that are not designated as hedging instruments in

hedge relationships as defined by IFRS 9. Separated embedded

derivatives are also classified as held for trading unless they are

designated as effective hedging instruments.

Loans and payables

This is the category most relevant to the Group. After initial

recognition, interest-bearing loans and borrowings are subsequently

measured at amortised cost using the EIR method. Gains and losses

are recognised in profit or loss when the liabilities are

derecognised as well as through the EIR amortisation process.

Amortised cost is calculated by taking into account any discount

or premium on acquisition and fees or costs that are an integral

part of the EIR. The EIR amortisation is included as finance costs

in the statement of profit or loss.

Derecognition of financial liabilities

A financial liability is derecognised when the obligation under

the liability is discharged, cancelled, or expires.

Where an existing financial liability is replaced by another

from the same lender on substantially different terms, or the terms

of an existing liability are substantially modified, such an

exchange or modification is treated as a derecognition of the

original liability and the recognition of a new liability, and the

difference in the respective carrying amounts is recognised in the

profit or loss.

Leases

Right-of-use assets

The Group recognises right-of-use assets at the commencement

date of the lease (i.e. the date the underlying asset is available

for use). Right-of-use assets are measured at cost, less any

accumulated depreciation and impairment losses, and adjusted for

any remeasurement of lease liability. The cost of right-of-use

assets includes the amount of lease liabilities recognised and

initial direct costs incurred. Right-of-use assets are depreciated

on a straight line basis over the shorter of the lease term and the

estimated useful lives of the assets.

Lease liabilities

At the commencement date of the lease, the Group recognises

lease liabilities measured at the present value of lease payments

to be made over the lease term. In calculating the present value of

lease payments, the Group uses its incremental borrowing rate at

the lease commencement date because the interest rate implicit in

the lease is not readily determinable. After the commencement date,

the amount of lease liabilities is increased to reflect the

accretion of interest and reduced for the lease payment made. In

addition, the carrying amount of lease liabilities is remeasured if

there is a modification, a change in the lease term or a change in

the lease payments.

Short-term leases and leases on low-value assets

The Group applies the short-term lease recognition exemption to

its short-term leases (i.e. those leases that have a lease term of

twelve months or less from the commencement date). It also applies

the lease of low-value assets recognition exemption to leases that

are considered to be low value. Lease payments on short-term leases