Acquisition (2193T)

December 02 2011 - 2:00AM

UK Regulatory

TIDMCSS

RNS Number : 2193T

CSS Stellar PLC

02 December 2011

For Immediate Release 2 December 2011

CSS Stellar plc

("the Company")

Acquisition of interest in Gold Mines of Wales Limited

Implementation of Investing Policy

Total Voting Rights

CSS Stellar Plc (AIM: CSS) is pleased to announce that, in

accordance with the implementation of its Investing Policy, it has

completed an agreement to acquire 49% of the issued share capital

of Gold Mines of Wales Limited ("GMOW") ("the Acquisition

Agreement") which, through a wholly-owned subsidiary, holds a

licence to explore and extract gold and silver over about 120

square kilometres covering the Dolgellau gold belt in the County of

Gwynedd in Wales.

GMOW holds agreements with The Crown Estates Commissioners,

acting in exercise of the powers on the Crown Estate Act 1961 on

behalf of her Majesty the Queen, covering the two largest mines in

the region, the Clogau St David's and Gwynfynydd mines.

The consideration for the acquisition is GBP100,000 payable in

cash and 17,432,182 new ordinary shares in the Company ("the

Consideration Shares"), representing 24.9% of the enlarged issued

share capital of the Company. Based on the midmarket price of the

Company's ordinary shares at the close of business on 30 November

2011, the total value of the consideration is GBP636,040.

Victorian Gold Limited ("the Vendor") has undertaken in the

Acquisition Agreement to invest the cash proceeds of GBP100,000 in

the further development of GMOW's licences. It has also undertaken

to the Company and to Northland Capital Partners Limited not to

dispose of the Consideration Shares for a period of 12 months

following Admission, save in certain specified circumstances,

including by way of acceptance of an offer for all of the Company's

issued ordinary shares.

GMOW recorded a loss of GBP41,000 in respect of the year ended 5

April 2011.

Application will be made for the Consideration Shares, which

will rank pari passu with the existing ordinary shares, to be

admitted to AIM. Dealings in the Consideration Shares are expected

to commence on or around 8 December 2011 ("Admission").

Following Admission, there will be 70,008,763 ordinary shares in

issue. The Company holds 232 ordinary shares as treasury shares.

Therefore, the total number of voting rights in the Company is

70,008,531. This number may be used by shareholders in the Company

as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change in their interest in, the share capital of the Company.

Following the issue and allotment of the Consideration Shares

and Admission, the interests of the Directors and those

shareholders who are interested, where known, in 3% or more of the

issued share capital of the Company will be as follows:

Directors %

----------------------------- -----

Julian Jakobi 7.6

John Webber 7.7

David Lenigas 2.4

Donald Strang 2.4

----------------------------- -----

Others %

----------------------------- -----

Victorian Gold Limited 24.9

Nick Gold 7.6

Amberdays Limited 6.3

Green Hair Services Limited 4.0

----------------------------- -----

David Lenigas, CSS Stellar Director, commented;

"This acquisition will focus attention on the unique aspects of

this gold-belt, Traditionally, gold from the Clogau St David and

Gwynfynydd mines has been used in the production of Welsh Gold

Jewellery products."

"Recent geological studies have led to a better understanding of

the controls to gold mineralisation throughout the gold-belt. GMOW

intends to make use of this new data and undertake a rigorous

geological mapping and sampling programme extending to underground

access, diamond drilling, project feasibility and, ultimately

mining. Drilling is estimated to start in the first quarter of

2012."

For further information, contact:

CSS Stellar plc

----------------------------------- --------------------

Julian Jakobi Tel: 020 7535 7225

David Lenigas Tel: 020 7440 0640

----------------------------------- --------------------

Northland Capital Partners Limited

(Nominated Adviser and Broker)

----------------------------------- --------------------

Luke Cairns / Edward Hutton Tel: 020 7796 8800

----------------------------------- --------------------

This information is provided by RNS

The company news service from the London Stock Exchange

END

ACQBRBDDIXGBGBB

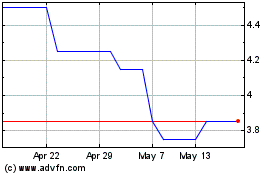

Primorus Investments (LSE:PRIM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Primorus Investments (LSE:PRIM)

Historical Stock Chart

From Jul 2023 to Jul 2024