TIDMPOW

RNS Number : 3961Z

Power Metal Resources PLC

24 January 2022

24 January 2022

Power Metal Resources PLC

("Power Metal" or the "Company")

Transaction Update - Pilot Mountain Project

Transaction Complete and Power Metal Agrees Terms for the Early

Clearance of the Tail Benefit Held by Thor Mining on the Pilot

Mountain Project, Nevada, USA

Power Metal Resources PLC (LON:POW) the London AIM listed

company which finances and manages global resource exploration

projects, announces a transaction update following the exercise of

the option (the "Option") on the Pilot Mountain Project ("Pilot

Mountain" or the "Project") located in Nevada, United States of

America ("USA") (the "Transaction").

The Company's announcement in respect of the Transaction of 1

November 2021 may be viewed through the following link:

https://www.londonstockexchange.com/news-article/POW/acquisition-of-pilot-mountain-project/15193667

Paul Johnson, Chief Executive Officer of Power Metal Resources

plc commented:

"I am pleased to confirm completion of the Pilot Mountain

transaction and the further signing of a Variation Agreement

enabling Power Metal to secure early clearance of the tail

benefit.

Our ongoing technical work in respect of the Pilot Mountain

project has increasingly demonstrated significant upside potential

within the existing 2018 Mineral Resource Estimate and we

considered there was a reasonable likelihood that the tail benefit

would become payable within the 2 year payment period.

The early clearance of the tail benefit also frees Power Metal

from any future contractual financial encumbrance in respect of the

Project.

The recent classification of tungsten as a critical mineral from

the United States Geological Survey, and the lack of primary

domestic tungsten production makes the Project in our view highly

strategic, both now, and potentially much more so in the future

with successful further exploration work which will be undertaken

by Golden Metal Resources."

HIGHLIGHTS

Transaction Completion

Power Metal subsidiary Golden Metal Resources Limited ("Golden

Metal UK") has established a new wholly owned subsidiary Golden

Metal Resources Australia Pty Limited ("Golden Metal Australia")

which has now completed the 100% acquisition of the Pilot Mountain

project.

Variation Agreement

The terms of the Transaction are outlined below, and included

the Tail Benefit of deferred consideration of US$500,000

(cGBP368,000) payable to Thor Mining plc (the "Vendor" or "Thor

Mining") in the event that Golden Metal UK publishes a JORC or

43-101 compliant resource at Pilot Mountain which increases against

current declared levels by 25% across total indicated and inferred

categories within two years after the Transaction agreement

date.

Power Metal has now agreed terms to secure the early clearance

of this Tail Benefit through the payment of GBP50,000 cash and

issue to Thor Mining of 4 million Power Metal new ordinary shares

of 0.1p each in the Company at an issue price of 2.5p per share

(GBP100,000) ("Variation Shares").

Power Metal and Thor Mining plc have signed a Variation

Agreement to effect the above. Following completion of the payments

due under the Variation Agreement, all amounts due or potentially

due under the Transaction have now been settled in full and no

further consideration is due.

Listing of Golden Metal

Golden Metal UK is making good progress with its proposed

listing process and a further update will be provided in the near

future.

TRANSACTION INFORMATION

Power Metal subsidiary Golden Metal Resources Limited ("Golden

Metal UK") has established a new wholly owned subsidiary Golden

Metal Resources Pty Limited ("Golden Metal Australia") which has

now completed the 100% acquisition of the Pilot Mountain

Project.

Power Metal has paid US$115,000 in cash consideration to Thor

Mining and US$1,650,000 of consideration through the issue to Thor

Mining of 48,118,920 new Ordinary Shares at an issue price of 2.5

pence per share ("Initial Consideration Shares").

Thor Mining will hold the Initial Consideration Shares in full

for a minimum of 6 months after the Option Exercise date and

thereafter the Initial Consideration Shares will become freely

tradable in 25% instalments (25% tradable 6 months after Option

Exercise date, 50% - 9 months after Option Exercise date, 75% - 12

months after Option Exercise date and 100% - 15 months after Option

Exercise date.) This trading restriction period may be varied with

the written agreement of both parties.

In addition, Power Metal have issued to Thor Mining 12.5 million

warrants to subscribe for Ordinary Shares with an exercise price of

4p per Ordinary Share and life to expiry of 3 years from the Option

Exercise date ("Initial Consideration Warrants"). Should the volume

weighted average price ("VWAP") of Power Metal shares meet or

exceed 10 (ten) pence for 5 consecutive trading days Power Metal

may serve notice on Thor Mining providing 14 calendar days to

exercise and pay for the Initial Consideration Warrants or the

Initial Consideration Warrants will be cancelled.

Should Thor Mining exercise the Initial Consideration Warrants

above within 12 months from the Option Exercise date, Thor Mining

will receive one for one replacement warrants to subscribe for

Ordinary Shares at a fixed price of 8p per Ordinary Share, and life

to expiry ending 3 years from the date of Option Exercise ("Super

Warrants"). Should the Power Metal volume weighted average share

price meet or exceed 20p for five consecutive trading days Power

Metal may at any time issue Thor Mining with a written notice

providing 14 days to exercise and pay for the Super Warrants or the

Super Warrant will be cancelled.

All Option Exercise Consideration items outlined above have now

been paid or issued in full.

Tail Benefit

Power Metal was to issue Thor Mining with a further US$500,000

of consideration in new Ordinary Shares if Golden Metal UK

publishes a JORC or 43-101 compliant resource at Pilot Mountain

which increases against current declared levels by 25% across total

indicated and inferred categories within two years after the

Agreement date. The number of Ordinary Shares to be issued was to

be calculated based on the volume weighted average Power Metal

share price in the ten trading days immediately preceding the

announcement by Golden Metal of the JORC or 43-101 compliant

increase.

With the Variation Agreement announced today, the above Tail

Benefit is now eliminated.

Additional Terms

Thor Mining and their professional corporate, licensing and

geological teams will continue to work with Power Metal and Golden

Metal to assist with Pilot Mountain ownership transfer and to

manage local corporate & exploration/development operations in

the 12 months following the Option Exercise date. Power Metal and

Golden Metal will pay for any assistance provided post Transaction

on reasonable commercial terms to be agreed.

PILOT MOUNTAIN OWNERSHIP STRUCTURE

Wholly owned(1) Power Metal subsidiary Golden Metal Resources UK

through its wholly owned subsidiary Golden Metal Resources

Australia Pty Ltd., now holds 100% of Black Fire Industrial

Minerals Pty Ltd., (Australian private company) which owns 100% of

Industrial Minerals (USA) Pty Ltd., (Australian private company)

which owns 100% of: BFM Resources Inc., and Pilot Metals Inc., (USA

private companies) which own tenements covering the entire Pilot

Mountain Project and the 2018 Mineral Resource Estimate.(2)

Further disclosures

As at the date of option announcement on 31.08.21 the following

disclosures were made:

As at 30 June 2020 BFM Resources Inc had Gross Assets of

AUD$21,449 (circa GBP11,317) and incurred no profit or loss

(AUD$Nil) for the year ended 30 June 2020.

As at 30 June 2020 Pilot Metals Inc had Gross Assets of

US$3,055,411 (circa GBP2,226,602) and a loss of US$106,164 (circa

GBP77,366) for the year ended 30 June 2020.

As at 30 June 2020 Black Fire Industrial Minerals Pty Ltd on a

consolidated basis had Gross Assets of AUD$5,181,951 (circa

GBP2,738,397) and a loss of AUD$154,690 (circa GBP81,746) for the

year ended 30 June 2020.

It is further noted that since the announcement of the Pilot

Mountain option, Thor Mining plc transferred the Pilot Mountain

project and all holding companies to "Held for Sale Assets" with a

written down value of GBP1,050,000 as at 30 June 2021 their

reported financial year end.

ADMISSION AND VOTING RIGHTS

Application will be made for the 4,000,000 Tail Benefit Shares

to be admitted to trading on AIM which is expected to occur on or

around 31 January 2022 ("Admission"). The Tail Benefit Shares will

rank pari passu in all respects with the Ordinary Shares of the

Company currently traded on AIM.

Following Admission, the Company's issued share capital will

comprise 1,448,339,986 ordinary shares of 0.1p each. This number

will represent the total voting rights in the Company and may be

used by shareholders as the denominator for the calculation by

which they can determine if they are required to notify their

interest in, or a change to their interest in, the Company under

the Financial Conduct Authority's Disclosure and Transparency

Rules.

Reference Notes:

(1) As announced on 9.12.21 Golden Metal Resources Limited has

undertaken a pre-IPO financing raising GBP750,000. Following the

issue of shares in respect of this financing Power Metal will hold

83.13% of Golden Metal Resources Limited.

(2)

https://www.thormining.com/sites/thormining/media/pdf/asx-announcements/20182019/20181214-pilot-mountain-resource-update.pdf

This announcement contains inside information for the purposes

of Article 7 of the Market Abuse Regulation (EU) 596/2014 as it

forms part of UK domestic law by virtue of the European Union

(Withdrawal) Act 2018 ("MAR"), and is disclosed in accordance with

the Company's obligations under Article 17 of MAR.

For further information please visit

https://www.powermetalresources.com/ or contact:

Power Metal Resources plc

Paul Johnson (Chief Executive Officer) +44 (0) 7766 465 617

SP Angel Corporate Finance (Nomad and Joint Broker)

Ewan Leggat/Charlie Bouverat +44 (0) 20 3470 0470

SI Capital Limited (Joint Broker)

Nick Emerson +44 (0) 1483 413 500

First Equity Limited (Joint Broker)

David Cockbill/Jason Robertson +44 (0) 20 7330 1883

NOTES TO EDITORS

Power Metal Resources plc (LON:POW) is an AIM listed metals

exploration company which finances and manages global resource

projects and is seeking large scale metal discoveries.

The Company has a principal focus on opportunities offering

district scale potential across a global portfolio including

precious, base and strategic metal exploration in North America,

Africa and Australia.

Project interests range from early-stage greenfield exploration

to later-stage prospects currently subject to drill programmes.

Power Metal will develop projects internally or through

strategic joint ventures until a project becomes ready for disposal

through outright sale or separate listing on a recognised stock

exchange thereby crystallising the value generated from our

internal exploration and development work.

Value generated through disposals will be deployed internally to

drive the Company's growth or may be returned to shareholders

through share buy backs, dividends or in-specie distributions of

assets.

Power Metal Exploration Programmes Underway/Results Awaited

Power Metal has exploration programmes completed or underway,

with results awaited, as outlined below:

Project Location POW % Work Completed Results Awaited

or Underway

Alamo Gold USA Earn-in Excavation of multiple Field and assay

Project to 75% test pits and mapping results from on-site

& sampling. work programme.

---------- ---------- ------------------------ ----------------------

Authier North Canada Earn-in Soil & rock sampling Interpretation

Lithium to 100% completed of laboratory assay

results of samples

collected.

---------- ---------- ------------------------ ----------------------

Ditau Project Botswana 50% Preparatory exploration Field programme

work underway on findings and defined

target I10 leading drill targets for

to planned accelerated near term drilling.

drilling targeting

rare-earth elements

and base metals

---------- ---------- ------------------------ ----------------------

Kalahari Copper Botswana 50% Exploration programme Field programme

Belt underway across findings and defined

the South Ghanzi drill targets for

Project and further near term drilling

exploration at

the more recently

acquired South

Ghanzi Extension

and Mamuno licence

areas

---------- ---------- ------------------------ ----------------------

Molopo Farms Botswana 53%(A) Kavango Option Results from various

to acquire an interest work activities

in local project underway as part

holding company. of the Kavango

Option fee payable Option

through defined

work programme

---------- ---------- ------------------------ ----------------------

Tati Gold/Nickel Botswana 100% Reverse circulation Laboratory assay

drill programme results awaited

completed

---------- ---------- ------------------------ ----------------------

H aneti Project Tanzania 35% Diamon drill programme Results from field

underway programme including

drill programme

underway

---------- ---------- ------------------------ ----------------------

Victoria Goldfields Australia 49.9% Ongoing exploration Results from field

across 848km(2) programme including

of granted exploration drill programme

licences underway

---------- ---------- ------------------------ ----------------------

Wallal Gold/Copper Australia 83.33%(B) Passive seismic Results awaited

Project and 2D seismic

processing work

programme completed.

Ground reconnaissance

work underway.

---------- ---------- ------------------------ ----------------------

(A) should Kavango exercise their option to acquire Kalahari

Key, Power Metal interest would reduce to 40% of the Molopo Farms

Complex project

(B) assuming all licences held by URE Metals Pty Limited are

granted as outlined in the Company's announcement of 19.11.21

resulting in the issue of First Development Resources Ltd shares to

URE vendors

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDBBGDBXDDDGDS

(END) Dow Jones Newswires

January 24, 2022 07:00 ET (12:00 GMT)

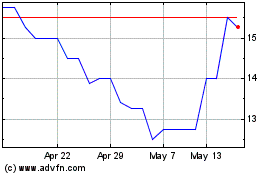

Power Metal Resources (LSE:POW)

Historical Stock Chart

From May 2024 to Jun 2024

Power Metal Resources (LSE:POW)

Historical Stock Chart

From Jun 2023 to Jun 2024