Policy Master Group - Interim Results

September 20 1999 - 3:30AM

UK Regulatory

RNS No 6905r

POLICY MASTER GROUP PLC

20 September 1999

POLICY MASTER GROUP PLC

INTERIM REPORT

HIGHLIGHTS

* Turnover up 53% to #7.715 million (1998: #5.054 million)

* Operating profit (before goodwill amortisation)up 37% to

#639,000 (1998: #468,000)

* Adjusted earnings per share 4.24p

* First revenues from e-commerce

* Two acquisitions successfully integrated

REVIEW OF RESULTS

I am delighted to report that first half-year results for 1999

show continued growth in both turnover and profitability.

Turnover of #7.7 million was achieved (#5.1 million in first half-

year 1998). This represents a 53% uplift, following sizeable deployment

of new systems, successes in solution sales and the emergence

of electronic commerce as a business line for the company.

Operating profit before goodwill amortisation and interest

was #639,000 (#468,000), an increase of 37%.

Adjusted earnings per share (EPS) was 4.24p and is based on

profit attributable to equity shareholders excluding goodwill.

An interim dividend of 1.0 pence per ordinary share will be paid

on 29 October 1999 to all shareholders on the register at the

close of business on 1 October 1999.

Principal sales growth has been achieved from the new sales areas

introduced since the first half of 1998. These include:

* Sirius Solutions to insurance companies and larger

intermediaries

* Aquarius software packages to the smaller brokers

* Special Projects to the affinity and tied agent broker market

* The Swift range of software for Independent Financial Advisers.

ELECTRONIC COMMERCE

Included within the solutions revenue line are the Group's

first revenues from electronic commerce projects. More importantly,

the period has seen the arrival of e-commerce in the Insurance market.

The Group has adopted a strategy of selling the enabling

technology to both existing and new entrant insurance providers. The Group

is now handling a significant prospect pipeline in this area and

confidently expects revenues in the second half-year and beyond to show

further growth.

The Group has identified this very real opportunity for growth

which needs to be supported by proper investment. In response, the Group

has taken a number of actions during the period:

* Continued conversion of existing products such as GEMINInet

to be web-enabled

* Development of new solutions such as PM Online and of

digital television capabilities

* The launch of a new team under the PMe brand, to provide a

total solution to customer needs, interfacing with key partners such

as Compaq and Microsoft

* Enhancing the capabilities of the team by the addition of

Media Maker.

As a consequence, the Group has invested heavily in

infrastructure that has, in part, impacted upon the net margins achieved. The

other sizeable impact upon margins results directly from the higher

than usual level of hardware sales emanating from the Special

Projects channel to tied agents.

ACQUISITIONS

During the period, the Group successfully entered into

negotiations to acquire MediQuote and Media Maker. These acquisitions were

completed on 29 June and 20 July 1999 respectively.

The MediQuote business is based upon the industry's only

Private Medical Insurance comparative quotation software. It is intended

to develop an improved version of this product that will be capable

of realising the considerable e-commerce potential for this line

of business.

Media Maker was acquired to allow the Group to present

specialist internet, intranet and multi-media design capabilities to

complement its existing e-commerce solutions.

PROSPECTS

Policy Master is well placed to lead the adoption of

electronic commerce in the general insurance market. It is close to

completion and delivery of our first digital television project and has

recently been awarded another major development project from a new entrant

in the market.

Our capabilities span a range of access channels (internet,

extranet, internet, digital and interactive television) and several classes

of insurance. Solutions developed can support insurer-to-

consumer, insurer-to-intermediary and consumer-to-intermediary

communication.

In conclusion the Board are confident of its trading performance

in the balance of the year

John Kimberley

Chairman

Group Balance Sheet

Unaudited Audited

As at As at

30 June 31 December

1999 1998

#'000 #'000

Fixed Assets

Intangible assets 3,087 2,992

Tangible assets 1,500 1,462

------- ------

4,587 4,454

------- ------

Current Assets

Stocks 36 144

Debtors 5,160 3,195

Cash at bank and in hand 79 123

------- ------

5,275 3,462

Creditors:

amounts falling due

within one year (3,353) (2,816)

------- ------

Net current assets 1,922 646

Total assets less current

liabilities 6,509 5,100

Creditors: amounts falling

due after more than one

year (1,346) (745)

Accruals and

deferred income

Deferred income (658) (202)

------- ------

4,505 4,153

------- ------

------- ------

Capital and Reserves

Called up share capital 145 143

Share capital to be issued - 250

Share premium account 2,569 2,321

Merger reserve 453 453

Profit & loss account 1,338 986

------- -------

4,505 4,153

------- -------

Shareholders' funds:

Equity 4,503 4,151

Non-equity 2 2

------- ------

4,505 4,153

------- ------

------- ------

Group Profit and Loss Account

For the six months ended 30 June 1999

Unaudited Audited

Six months Year to

to 30 June 31 December

1999 1998 1998

#'000 #'000 #'000

Turnover 7,715 5,054 11,338

Cost of Sales (4,703) (2,886) (6,235)

------- ------- -------

Gross Profit 3,012 2,168 5,103

Distribution costs (1,047) (633) (1,534)

Administration costs

(excluding goodwill

amortisation) (1,326) (1,067) (2,509)

------- ------- -------

Operating profit before

goodwill amortisation 639 468 1,060

Goodwill amortisation (105) (57) (129)

Operating Profit 534 411 931

Interest receivable 41 10 39

Interest payable and

similar charges (75) (257) (273)

------- ------- -------

Profit on ordinary

activities before taxation 500 164 697

Tax on profit on

ordinary activities - - -

Profit for the period 500 164 697

------- ------- -------

Equity dividends on

ordinary shares (148) - (141)

Non-equity dividend on cumulative

participating preferred

ordinary shares - (2) (2)

------- ------- -------

Retained profit

for the period 352 162 554

------- ------- -------

------- ------- -------

Earnings per

ordinary share 3.51p 1.32p 5.88p

Fully diluted earnings

per ordinary share 3.50p 1.32p 5.86p

Dividends per

ordinary share 1.0p nil 1.0p

There are no recognised gains or losses for the period other than

the profit for the period.

1. Earnings Per Ordinary Share

The calculation of basic earnings per ordinary share is based

on earnings of #500,181 (June 1998: #162,585, December 1998:

#695,549),being profit for the half year of #500,181 (June 1998:

#164,058, December 1998: #697,022) less cumulative participating

preferred ordinary dividends of #Nil (June 1998: #1,473, December 1998:

#1,473), and on 14,265,253 ordinary shares (June 1998: 9,573,077,

December 1998: 11,834,988), being the weighted average number of

ordinary shares in issue during the period.

The diluted earnings per share is based on profit for the half

year of #500,181 (June 1998: #162,585, December 1998: #695,549), and

on 14,268,411 (June 1998: 9,573,077, December 1998: 11,863,149)

ordinary shares, calculated as follows:

June 1999 June 1998 December 1998

Basic weighted average

number of shares 14,265,253 9,573,077 11,834,988

Dilutive potential ordinary shares:

Executive share options 3,158 - 33

Deferred consideration - - 28,128

14,268,411 9,573,077 11,863,149

2. Basis of Preparation of Interim Financial Information

The interim financial information has been prepared on the basis

of the accounting policies set out in the Group financial statements

for the year ended 31 December 1998.

3. Publication of Non-Statutory Accounts

The financial information contained in this interim statement does

not constitute statutory accounts as defined in section 240 of

the Companies Act 1985. The financial information for the full

preceding year is based on the statutory accounts for the financial year

ended 31 December 1998. Those accounts, upon which the auditors issued

an unqualified opinion, have been delivered to the Registrar

of Companies.

Copies of the Interim Financial Statement are being sent to

all shareholders. Further copies are available from the

Company's registered office, Policy Master House, Reddicroft, Sutton

Coldfield, West Midlands, B73 6BN.

4. Year 2000 Update

We reported in our Report and Accounts, issued in April 1999, that

our plan for delivering products to the market and installing upgrades

to customers with maintenance contracts had been completed. We

also reported that the last internal system would be replaced or

upgraded by the end of this month and this remains the case.

Whilst it is impossible to give absolute assurances, the

Directors believe that all of our major systems are year 2000 compliant

and, therefore, we do not expect any significant failures or

disruptions to arise from issues with our systems or products.

As stated in our Report and Accounts, the majority of any year

2000 project costs have been incurred and any further costs are not

likely to be material.

END

IR ALLSTADIDLAA

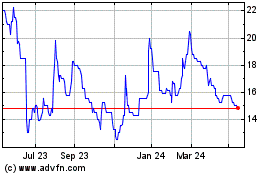

Parkmead (LSE:PMG)

Historical Stock Chart

From Sep 2024 to Oct 2024

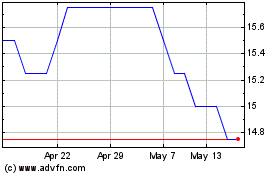

Parkmead (LSE:PMG)

Historical Stock Chart

From Oct 2023 to Oct 2024