TIDMPIP

RNS Number : 6303S

PipeHawk PLC

18 March 2021

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse (Amendment) (EU EXIT) Regulations 2019/310.

18 March 2021

PipeHawk plc

("PipeHawk" or the "Company")

Unaudited results for the six months ended 31 December 2020

Chairman's Statement

I am pleased to report that the Company's turnover in the six

months ended 31 December 2020 was GBP2,641,000 (H1 2019:

GBP4,518,000), a decrease of 42 per cent over the comparable period

last year, resulting in a loss before taxation of GBP336,000 (H1

2019: profit of GBP111,000) and a loss after taxation of GBP161,000

(H1 2019: profit GBP283,000). I believe that this is a very

creditable result given the exceptionally challenging six months of

uncertainty surrounding both Brexit and COVID lockdowns, with

orders being postponed and deferred, but few actually being

cancelled or being placed elsewhere. So, with the assistance of the

UK Government's COVID financial aid in the form of furlough grants

and CBILS loans, the operational side of our businesses, with the

notable exception of Adien, concentrated on completing the orders

in hand, whilst our salespeople have worked tirelessly on new

concepts and developments which clients have indicated they will

require once sufficient confidence returns. We believe that there

is a significant overhang of orders waiting to be placed when the

time is right.

In the meantime, we have taken the opportunity to implement some

strategic decisions: the post-period end acquisition of Utsi

Electronics to integrate with PipeHawk Technology; full absorption

of Wessex slip testing into QM Systems; and development of a

manufacturing offering also within QM Systems.

QM Systems

At QM Systems, trading has been hampered by the effect of the

initial lockdown and again by the effect of the third lockdown.

Despite entering the first lockdown with a very full orderbook, low

order intake for the period from March through to July 2020

impacted the ability to pull sales through the business in the

latter part of 2020 which has effectively resulted in the loss for

the period under review. However, once the first lockdown eased,

order intake returned to more normal levels and we were fortunate

in that short period to be able to secure orders that have enabled

the Company to return to trading at a near normal level.

We have now again returned to a period of uncertainty through

the third lockdown, where a number of expected orders have been

delayed. We have, however, secured a number of follow-on contracts

that will carry us through this period with the aim that we are in

an excellent position to capitalise on what is anticipated to be a

very buoyant market for our solutions later this year. At the time

of writing, we continue to remain relatively busy in all areas of

the business.

It is fair to say that we have weathered a difficult period

better than many of our competitors. Not content though with

standing still we have been exploring ways in which we can add

further value and revenue to our business. I am pleased to announce

that following a recent contract win we will be establishing a new

business enterprise to provide contract manufacturing capability to

our clients where this may be beneficial. This will move the

Company into a new and exciting direction and is designed to

complement the products and services that we offer today,

effectively enabling QM Systems to work with its clients, where

required, from conceptualisation through to product manufacture,

service and support.

Operationally we have taken the opportunity to make some changes

to our structure which has resulted in more efficient design and

manufacturing teams. All current projects are progressing well and

to plan, with a number due to be delivered by the end of this

financial year or early into the next financial year.

Following the acquisition of Wessex Precision Instruments Ltd in

October 2019, we have undertaken a major exercise to reduce costs

whilst dramatically improving the service that we offer. We have

relocated the manufacturing facilities to our Aldershot office and

have reviewed our stock and supplier structure to ensure that we

now maintain a stock of key products, spares and consumables 'on

the shelf' to ensure our clients can have orders fulfilled in the

shortest timeframe possible.

Thomson Engineering Design ("TED")

TED suffered similarly to QM with a significant slowdown in

orders over the summer months. However, during November 2020 TED

received a large order for 2 new products totalling over GBP200k

with a challenging delivery timescale of mid-February 2021. I am

pleased to report that the team at TED were able to demonstrate

their ability as a true 'can do' business and achieved the delivery

of this incredibly aggressive lead-time, on time.

I am pleased to report that, even ignoring the above, order

intake for TED since November 2020 has remained buoyant. Following

a very solid performance for 2019/20 FY, where TED achieved good

growth with a return to profit, TED is now set to continue its

growth trajectory with an increase in sales year-on-year. It has

been pleasing to see of late that the domestic market appears more

buoyant than last year whilst the international market also appears

strong. This we believe is down to increases in marketing, linked

to the solid reputation that TED has achieved for delivering

quality product and support internationally. At the time of writing

TED is quoting on further major contracts within the Asia Pacific

territory.

During the period, TED has delivered a mixture of domestic and

international sales across a broad spectrum of products including

Sleeper Spreaders, Panel Handlers, Rail Grabs, Gantries, Cable

Yokes, De-Clippers, Fast Clip Machines, Threader Draggers,

Manipulators and others. It is gratifying to see that the

investment provided by the Group to TED during the last three years

since acquisition to support the development of new products is

really starting to bear fruit.

I am fully expecting that TED's trading in the second part of

the 2020/21 FY will significantly outperform the initial six months

(a repeat of last year) and I anticipate TED will achieve growth on

last financial year's results. Given the current climate that TED

operates within, particularly within manufacturing, this would be a

great achievement.

Adien

Adien has had an excellent six months increasing turnover by

15%, working, as the team does, largely in the open air, and having

both adjusted quickly to the needs, and additional costs, of the

pandemic they continued to supply their service (whilst others

didn't), and were able to fulfil the long term framework contracts

which had been successfully re-secured in the previous year.

Increasingly within the framework contracts Adien is able to

supply a one-stop shop for the subcontract elements of Traffic

Management, CCTV, Jetting, Laser scanning and Drone 3D surveys with

inspections, which provides increased profitability over and above

the core survey elements of the contract.

The activity levels in both England and Scotland currently

remain very strong and we have recruited additional staff

experienced in the relevant sectors to assist Adien's growth.

The order book is positive as a result of the current upturn in

Defense, Telecoms, 5G and Power Distribution, plus infrastructure

renewal. Accordingly, the outlook for the remainder of the

financial year and beyond for Adien is most encouraging.

PipeHawk Technology

PipeHawk Technology has been in tickover/furlough mode for most

of the six months under review. However during the period,

discussions and negotiations were held with the owners of a

complementary company, Utsi Electronics Limited, and this business

was successfully acquired on 27 January 2021 for essentially net

asset value plus a profit related payout over the next two

years.

The Utsi products are technically well designed and recognised

internationally as being very capable ground penetrating radar

(GPR) systems with most models being available with a selection of

antenna types/frequencies making them suitable for use across a

wide range of markets from the common and highly competitive

Utility Survey market to the very specialist fields of Structural

Fault analysis, Environmental/Pollution research and Railway

standards compliance. Some models are also available in versions

designed specifically for operation in harsh climates

(deserts/polar regions) and/or over rough terrain.

The majority of these products and markets are complementary to

those of our own PipeHawk brand systems. The acquisition of Utsi

will provide an increased portfolio of GPR system offerings into a

significantly wider range of markets as well as offering excellent

opportunity to extend R&D activities into the highly desirable

Environmental/Water/Structural Faults markets and increase unit

profitability across the dual product ranges achieved through

enhanced marketing, rationalised designs and parts sourcing.

By combining the PipeHawk & Utsi systems there is the

opportunity for improvements and growth for both product lines

(thereby maintaining servicing of both ends of the market) while at

the same time rationalising boards and components used, to improve

sales, productivity and profit margins.

Related party transactions

As announced on 21 October 2020, my letter of financial support

dated 7 October 2019 was renewed on 28 September 2020 for a further

year.

In addition to the loans I have provided to the Company in

previous years, my fellow directors and I have deferred a certain

proportion of our fees and interest payments until the Company is

in a suitably strong position to make the full payments. During the

six months ended 31 December 2020, these deferred fees and interest

payments amounted to approximately GBP107,000 in total, all of

which have been accrued in the Company's accounts, and at 31

December 2020 amounted in total to GBP1,574,000.

Gordon Watt

Chairman

Enquiries:

PipeHawk Plc Tel no. 01252 338 959

Gordon Watt (Chairman)

Allenby Capital (Nomad and Broker) Tel no. 020 3328 5656

David Worlidge/Asha Chotai

Statement of Comprehensive Income

For the six months ended 31 December 2020

6 months ended 6 months ended Year ended

31 December 31 December 30 June

2020 2019 2020 (audited)

(unaudited) (unaudited) GBP'000

GBP'000 GBP'000

------------------ ------------------ -------------------

Revenue 2,641 4,518 8,325

Staff costs (1,697) (1,190) (3,776)

General administrative expenses (1,178) (2,404) (4,144)

------------------ ------------------ -------------------

(Loss)/profit on ordinary activities

before interest and taxation (234) 204 405

Finance costs (102) (118) (211)

------------------ ------------------ -------------------

(Loss)/profit before taxation (336) 111 194

Taxation 175 172 396

------------------ ------------------ -------------------

(Loss)/profit for the period

attributable to equity holders

of the Company (161) 283 590

Other comprehensive income - - -

------------------ ------------------ -------------------

Total comprehensive (expense)/income

for the period net of tax (161) 283 590

================== ================== ===================

(Loss)/ earnings per share

(pence) - basic (0.46) 0.82 1.69

(Loss)/earnings per share (pence)

- diluted (0.99) 0.58 0.93

================== ================== ===================

Consolidated Statement of Financial Position

As at 31 December 2020

As at As at As at

31 December 31 December 30 June

2020 2019

(unaudited) (unaudited) 2020 (audited)

GBP'000 GBP'000 GBP'000

Assets

----------------- ---------------- -------------------

Non-current assets

Property, plant and equipment 793 761 811

Goodwill 1,345 1,279 1,345

----------------- ---------------- -------------------

2,138 2,040 2,156

----------------- ---------------- -------------------

Current assets

Inventories 146 295 151

Current tax assets 255 167 394

Trade and other receivables 1,538 1,120 1,654

Cash 1,019 99 250

----------------- ---------------- -------------------

2,958 1,681 2,449

----------------- ---------------- -------------------

Total assets 5,096 3,721 4,605

================= ================ ===================

Equity and liabilities

Equity

Share capital 349 344 349

Share premium 5,215 5,205 5,215

Other reserves (8,467) (8,613) (8,306)

----------------- ---------------- -------------------

(2,903) (3,064) (2,742)

----------------- ---------------- -------------------

Non-current liabilities

Borrowings 3,321 2,846 3,255

Trade and other payable - 19 6

----------------- ---------------- -------------------

3,321 2,865 3,261

----------------- ---------------- -------------------

Current liabilities

Trade and other payables 2,771 1,677 1,949

Bank overdrafts and loans 1,907 2,224 2,137

----------------- ---------------- -------------------

4,678 3,920 4,086

----------------- ---------------- -------------------

Total equity and liabilities 5,096 3,721 4,605

================= ================ ===================

Consolidated Statement of Cash Flow

For the six months ended 31 December 2020

6 months ended 6 months ended Year ended

31 December 31 December 30 June

2020 2019 2020 (audited)

(unaudited) (unaudited) GBP'000

GBP'000 GBP'000

------------------ ------------------ -------------------

Cash inflow from operating

activities

(Loss)/profit from operations (234) 204 405

Adjustment for:

Depreciation 97 87 191

------------------ ------------------ -------------------

(137) 291 596

Decrease/(increase) in inventories 5 (112) (18)

Decrease/(increase) in receivables 115 480 (52)

Increase/(decrease) in liabilities 616 (1,706) (1,037)

------------------ ------------------ -------------------

Cash generated from/(used in)

operations 599 (1,047) (511)

Interest paid (31) (23) (69)

Corporation tax received 314 320 318

------------------ ------------------ -------------------

Net cash generated from/(utilised

in) operating activities 882 (750) (262)

------------------ ------------------ -------------------

Cash flows from investing activities

Purchase of plant and equipment (79) (319) (474)

Proceeds from disposal of fixed - (1) -

assets

Net cash utilised in investing

activities (79) (320) (474)

------------------ ------------------ -------------------

Cash flows from financing activities

New loans and finance leases 23 557 -

Proceeds from borrowings 35 - 523

Repayment of bank and other

loans (3) (105) (165)

Repayment of finance leases (89) (81) (170)

------------------ ------------------ -------------------

Net cash (utilised in)/generated

from financing activities (34) 371 188

------------------ ------------------ -------------------

Increase/(decrease) in cash

and cash equivalents 769 (699) (548)

Cash and cash equivalents at

beginning of period 250 774 774

Acquisition of subsidiary - 24 24

------------------ ------------------ -------------------

Cash and cash equivalents at

end of period 1,019 99 250

================== ================== ===================

Consolidated Statement of Changes in Equity

For the six months ended 31 December 2020

Share premium

Share capital account Retained

earnings Total

GBP'000 GBP'000 GBP'000 GBP'000

---------------- -------------- ----------- --------

6 months ended 31 December 2019

As at 1 July 2019 344 5,205 (8,896) (3,347)

Profit for the period - - 283 283

Total comprehensive income - - 283 283

---------------- -------------- ----------- --------

As at 31 December 2019 344 5,205 (8,613) (3,064)

================ ============== =========== ========

12 months ended 30 June 2020

As at 1 July 2019 344 5,205 (8,896) (3,347)

Loss for the period - - 590 590

Total comprehensive income - - 590 590

---------------- -------------- ----------- --------

Issue of shares 5 10 - 15

As at 30 June 2020 349 5,215 (8,306) (2,742)

================ ============== =========== ========

6 months ended 31 December 2020

As at 1 July 2020 349 5,215 (8,306) (2,742)

Profit for the period - - (161) (161)

Total comprehensive income - - (161) (161)

---------------- -------------- ----------- --------

As at 31 December 2020 349 5,215 (8,467) (2,903)

================ ============== =========== ========

Notes to the Interim Results

1. Basis of preparation

The Interim Results for the six months ended 31 December 2020

are unaudited and do not constitute statutory accounts in

accordance with section 240 of the Companies Act 2006.

Full accounts for the year ended 30 June 2020, on which the

auditors gave an unqualified report and contained no statement

under Section 498 (2) or (3) of the Companies Act 2006, have been

delivered to the Registrar of Companies.

The interim financial information has been prepared on a basis

which is consistent with the accounting policies adopted by the

Company for the last financial statements and in compliance with

basic principles of IFRS.

2. Segmental information

The Company operates in one geographical location being the UK.

Accordingly, the primary segmental disclosure is based on

activity.

Utility Development,

detection assembly Automation

and mapping and sale and test

services of GPR equipment system solutions

Total

GBP'000 GBP'000 GBP'000 GBP'000

------------- ------------------ ------------------- --------

6 months ended 31 December

2020

Total segmental revenue 814 25 1,802 2,641

============= ================== =================== ========

Segment result 148 (1) (381) (234)

Finance costs (16) (71) (15) (102)

Profit/(loss) before taxation 132 (72) (396) (336)

------------- ------------------ ------------------- --------

Segment assets 767 1,983 2,346 5,096

Segment liabilities 619 4,557 2,823 7,999

Non-current asset additions 45 - 34 79

Depreciation and amortisation 51 - 46 97

============= ================== =================== ========

6 months ended 31 December

2019

Total segmental revenue 638 49 3,831 4,518

============= ================== =================== ========

Segmental result (110) 51 263 204

Finance costs (7) (72) (14) (93)

(Loss)/profit before taxation (118) 23 206 111

------------- ------------------ ------------------- --------

Segment assets 691 1,604 1,426 3,721

Segment liabilities 610 4,329 1,846 6,785

Non-current asset addition 118 18 155 291

Depreciation and amortisation 43 6 38 87

============= ================== =================== ========

12 months ended 30 June 2020

Total segmental revenue 1,344 81 6,900 8,325

============= ================== =================== ========

Segmental result 75 (15) 345 405

Finance costs (33) (141) (37) (211)

Profit/(loss) before taxation 42 (156) 308 194

------------- ------------------ ------------------- --------

Segment assets 771 1,527 2,307 4,605

Segment liabilities 664 4,379 2,304 7,347

Non-current asset additions 225 1 258 484

Depreciation and amortisation 95 1 95 191

============= ================== =================== ========

3. (Loss)/earnings per share

This has been calculated on the loss for the period of

GBP161,000 (H1 2019: profit GBP283,000) and the number of shares

used was 34,860,515 (H1 2019: 34,360,515), being the weighted

average number of shares in issue during the period.

4. Dividends

No dividend is proposed for the six months ended 31 December

2020.

5. Copies of Interim Results

The Interim Results will be posted on the Company's website

www.pipehawk.com and copies are available from the Company's

registered office at 4, Manor Park Industrial Estate, Wyndham

Street, Aldershot, GU12 4NZ.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR GPUQUWUPGGRM

(END) Dow Jones Newswires

March 18, 2021 03:00 ET (07:00 GMT)

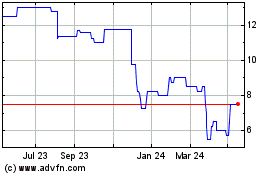

Pipehawk (LSE:PIP)

Historical Stock Chart

From Dec 2024 to Jan 2025

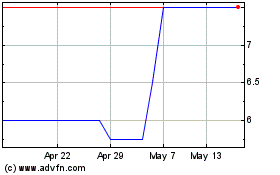

Pipehawk (LSE:PIP)

Historical Stock Chart

From Jan 2024 to Jan 2025