TIDMPET

RNS Number : 2102D

Petrel Resources PLC

20 June 2023

162 Clontarf Road

Dublin 3, D03 F6T0 Ireland

Tel: +353 1 833 2833

Fax: +353 1 833 3505

info@petrelresources.com

www.petrelresources.com

20 June 2023

Petrel Resources plc

("Petrel" or "the Company")

Audited Results for the Year Ended 31(st) December 2022

Petrel announces its results for the year ended 31(st) December

2022.

A copy of the Company's Annual Report and Accounts for 2022 will

be mailed shortly only to those shareholders who have elected to

receive it and extracts are set out in the announcement below.

Otherwise shareholders will be notified that the Annual Report will

be available on the website at www.petrelresources.com . Copies of

the Annual Report will also be available for collection from the

Company's registered office, 162 Clontarf Road, Dublin 3,

Ireland.

The Company's Annual General Meeting will be held on 27(th) July

2023 in the Hotel Riu Plaza The Gresham, 23 O'Connell Street Upper,

Dublin 1, D01 C3W7 at 12.00 pm.

E NDS

For further information please visit http://www.petrelresources.com/ or contact:

Enquiries:

Petrel Resources

+353 (0) 1 833 2833

David Horgan, Chairman

John Teeling, Director

Nominated Adviser and Broker

Beaumont Cornish - Nominated Adviser

Roland Cornish

Felicity Geidt +44 (0) 020 7628 3396

Novum Securities Limited - Broker

Colin Rowbury +44 (0) 20 399 9400

BlytheRay - PR +44 (0) 207 138 3206

Megan Ray +44 (0) 207 138 3553

Said Izagaren +44 (0) 207 138 3208

Teneo

Luke Hogg +353 (0) 1 661 4055

Alan Tyrrell +353 (0) 1 661 4055

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 ("MAR"). The person

who arranged for the release of this announcement on behalf of the

Company was Jim Finn, Director.

CHAIRMAN'S STATEMENT

Europe is de-industrialising, due to policies hostile to

reliable fuels. But global oil & gas demand continues to

recover, as Asia and especially China recovers from C-19 policies,

including lock-downs.

The withdrawal of most major oil and gas players from non-core

basins killed the farm-out market from 2014. Majors who had entered

projects in OPEC specific countries, often on uneconomic terms, now

seek to exit marginally profitable or non-core projects as they buy

shares back and issue record dividends instead of investing in

exploration activities.

At the same time, there has been a shortage of institutional

investor finance in London for several years now. Funds are

available, but mainly from private clients and traders who demand

discounts. In such circumstances, we have avoided issuing stock and

incurring expensive work commitments which would only have diluted

shareholders by issuing shares at too low a price. It is wiser to

keep our powder dry and prepare a portfolio of early-stage projects

to fund or farm out when markets turn.

However, it is worth remembering that Europe is now less than

15% of global energy consumption. BRICS+ now have a larger GDP than

the G-7. Europe is in decline, but Asia is not. The future is in

the emerging economies. Australian brokers and investors have

profited through the liquidity of Petrel's sister company, Clontarf

Energy plc. They are pressing Petrel Resources plc to open its

books for greater Australian and Asian participation. So far, the

board has been keen to avoid dilution, but as we roll out

high-potential new projects, it may be worthwhile to accept funding

- hopefully at much higher share prices.

Petrel has assessed a number of expansion projects in recent

months. So far, none have completed necessary due diligence or in

some cases demonstrated available funds on satisfactory terms.

Financing

The directors and their supporters have funded working capital

needs during C-19, etc. and are prepared to participate in any

necessary, future financing.

David Horgan

Chairman

19 June 2023

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE YEARED 31 DECEMBER 2022

2022 2021

EUR EUR

Administrative expenses (310,813) (322,077)

-

---------- ----------

Operating loss (310,813) (322,077)

---------- ----------

Loss before taxation (310,813) (322,077)

Income tax expense - -

---------- ----------

Loss for the financial year (310,813) (322,077)

Other comprehensive income - -

---------- ----------

Total comprehensive income for the financial year (310,813) (322,077)

========== ==========

Earnings per share attributable to the ordinary equity holders of the parent 2022 2021

Cents Cents

Loss per share - basic and diluted (0.19) (0.21)

========== ==========

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF FINANCIAL POSITION AS AT 31 DECEMBER

2022

2022 2021

EUR EUR

Assets

Non-current assets

Intangible assets 933,167 933,167

933,167 933,167

------------- -------------

Current assets

Trade and other receivables 33,807 25,663

Cash and cash equivalents 166,309 101,843

------------- -------------

200,116 127,506

------------- -------------

Liabilities

Current liabilities

Trade and other payables (889,927) (792,430)

------------- -------------

Total liabilities (889,927) (792,430)

------------- -------------

Net assets 243,356 268,243

============= =============

Equity

Share capital 2,223,398 1,962,981

Capital conversion reserve fund 7,694 7,694

Capital redemption reserve 209,342 209,342

Share premium 21,811,520 21,786,011

Share based payment reserve 26,871 26,871

Retained deficit (24,035,469) (23,724,656)

------------- -------------

Total equity 243,356 268,243

============= =============

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE FINANCIAL YEARED 31 DECEMBER 2022

Capital Share Based

Capital Conversion Payment

Share Share Redemption Reserve Fund Reserve Retained

Capital Premium Reserve EUR EUR Deficit Total

EUR EUR EUR EUR EUR

At 1 January

2021 1,962,981 21,786,011 209,342 7,694 26,871 (23,402,579) 590,320

Total

comprehensive

income for

the financial

year - - - - - (322,077) (322,077)

------------- -------------- ------------- ------------- ------------- ------------- ----------

At 31 December

2021 1,962,981 21,786,011 209,342 7,694 26,871 (23,724,656) 268,243

Issue of

shares 260,417 25,509 - - - - 285,926

Total

comprehensive

income for

the financial

year - - - - - (310,813) (322,077)

------------- -------------- ------------- ------------- ------------- ------------- ----------

At 31 December

2022 2,223,398 21,811,520 209,342 7,694 26,871 (24,035,469) 243,356

============= ============== ============= ============= ============= ============= ==========

PETREL RESOURCES PLC

CONSOLIDATED STATEMENT OF CASH FLOWS

FOR THE FINANCIAL YEARED 31 DECEMBER 2022

2022 2021

EUR EUR

Cash flows from operating activities

Loss for the year (310,813) (322,077)

Foreign exchange 2,527 (9,622)

---------- ----------

Operating cashflow before movements in working capital (308,286) (331,699)

Increase in trade and other payables 97,497 81,889

(Increase)/decrease in trade and other receivables (8,144) 9,331

---------- ----------

Cash used in operations 89,353 91,220

---------- ----------

Net cash used in operating activities (218,933) (240,479)

---------- ----------

Investing activities

Payments for exploration and evaluation assets - (1,200)

---------- ----------

Net cash used in investing activities - (1,200)

---------- ----------

Financing activities

Shares issued 285,926 -

---------- ----------

Net cash generated from financing activities 285,926 -

---------- ----------

Net cash increase/(decrease) in cash and cash equivalents 66,993 (241,679)

Cash and cash equivalents at the beginning of year 101,843 333,900

Exchange gains / (loss) on cash and cash equivalents (2,527) 9,622

---------- ----------

Cash and cash equivalents at the end of the year 166,309 101,843

========== ==========

NOTES:

1. ACCOUNTING POLICIES

There were no changes in accounting policies from those used to

prepare the Group's Annual Report for financial year ended 31

December 2021. The financial statements have been prepared in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union and in accordance with the

provisions of the Companies Act 2014.

2. LOSS PER SHARE

Basic loss per share is computed by dividing the loss after

taxation for the year attributable to ordinary shareholders by the

weighted average number of ordinary shares in issue and ranking for

dividend during the year. Diluted loss per share is computed by

dividing the loss after taxation for the year by the weighted

average number of ordinary shares in issue, adjusted for the effect

of all dilutive potential ordinary shares that were outstanding

during the year.

The following tables set out the computation for basic and

diluted earnings per share (EPS):

2022 2021

EUR EUR

Numerator

For basic and diluted EPS Loss after taxation (310,813) (322,077)

================ ===============

Denominator No. No.

For basic and diluted EPS 160,919,745 157,038,467

================ ===============

Basic EPS (0.19c) (0.21c)

Diluted EPS (0.19c) (0.21c)

================ ===============

Basic and diluted loss per share are the same as the effect of the outstanding share options

and warrants is anti-dilutive.

3. GOING CONCERN

The Group incurred a loss for the financial year of EUR310,813

(2021: loss of EUR322,077) and had net current liabilities of

EUR689,811 (2021: EUR664,924) at the balance sheet date. These

conditions as well as those noted below, represent a material

uncertainty that may cast significant doubt on the Group and

Company's ability to continue as a going concern.

Included in current liabilities is an amount of EUR857,531

(2021: EUR767,531) owed to key management personnel in respect of

remuneration due at the balance sheet date. Key management have

confirmed that they will not seek settlement of these amounts in

cash for a period of at least one year after the date of approval

of the financial statements or until the Group has generated

sufficient funds from its operations after paying its third-party

creditors.

The Group had a cash balance of EUR166,309 (2021: EUR101,843) at

the balance sheet date. The directors have prepared cashflow

projections for a period of at least twelve months from the date of

approval of these financial statements which indicate that

additional finance may be required to fund working capital

requirements and develop existing projects. As the Group is not

revenue or cash generating it relies on raising capital from the

public market.

These conditions as well as those noted below, represent a

material uncertainty that may cast significant doubt on the Group's

ability to continue as a going concern.

As in previous years the Directors have given careful

consideration to the appropriateness of the going concern basis in

the preparation of the financial statements and believe the going

concern basis is appropriate for these financial statements. The

financial statements do not include the adjustments that would

result if the Group was unable to continue as a going concern.

4. INTANGIBLE ASSETS

Group Group

2022 2021

EUR EUR

Exploration and evaluation assets:

Cost:

At 1 January 933,167 931,967

Additions - 1,200

Impairment - -

----------- --------

At 31 December 933,167 933,167

----------- --------

Carrying amount:

At 31 December 933,167 933,167

=========== ========

Segmental analysis

Group Group

2022 2021

EUR EUR

Ghana 933,167 933,167

Iraq - -

-------- --------

933,167 933,167

======== ========

Exploration and evaluation assets relate to expenditure incurred

in exploration in Ghana. The directors are aware that by its nature

there is an inherent uncertainty in exploration and evaluation

assets and therefore inherent uncertainty in relation to the

carrying value of capitalized exploration and evaluation

assets.

During 2018 the Group resolved the outstanding issues with the

Ghana National Petroleum Company (GNPC) regarding a contract for

the development of the Tano 2A Block. The Group has signed a

Petroleum Agreement in relation to the block and this agreement

awaits ratification by the Ghanian government.

Relating to the remaining exploration and evaluation assets at

the financial year end, the directors believe there were no facts

or circumstances indicating that the carrying value of the

intangible assets may exceed their recoverable amount and thus no

impairment review was deemed necessary by the directors. The

realisation of these intangible assets is dependent on the

successful discovery and development of economic reserves and is

subject to a number of significant potential risks, as set out

below:

-- licence obligations;

-- exchange rate risks;

-- uncertainty over development and operational costs;

-- political and legal risks, including arrangements with

Governments for licences, profit sharing and taxation;

-- foreign investment risks including increases in taxes,

royalties and renegotiation of contracts;

-- financial risk management; and

-- ability to raise finance.

Directors' remuneration of EURNil (2021: EURNil) and salaries of

EURNil (2021: EURNil) were capitalised as exploration and

evaluation expenditure during the financial year.

5. OTHER PAYABLES

Group Group

2022 2021

EUR EUR

Amounts due to key personnel 857,531 767,531

Accruals 12,000 16,500

Other payables 20,396 8,399

-------- --------

889,927 792,430

======== ========

It is the Group's normal practice to agree terms of

transactions, including payment terms, with suppliers. It is the

Group's policy that payments are made between 30 - 45 days and

suppliers are required to perform in accordance with the agreed

terms. The Group has financial risk management policies in place to

ensure that all payables are paid within the credit timeframe.

Key management personnel have confirmed that they will not seek

settlement in cash of the amounts due to them in relation to

remuneration for a period of at least one year after the date of

approval of the financial statements or until the Group has

generated sufficient funds from its operations after paying its

third party creditors.

6. SHARE CAPITAL

2022 2022 2021 2021

Number EUR Number EUR

Authorised

Ordinary shares of EUR0.0125 each 800,000,000 10,000,000 800,000,000 10,000,000

============== ============= ============== =============

Ordinary Shares - nominal value of EUR0.0125

Allotted, called-up and fully paid:

Number Share Capital Share Premium

EUR EUR

At 1 January 2021 157,038,467 1,962,981 21,786,011

Issued during the year - - -

--------------- -------------- --------------

At 31 December 2021 157,038,467 1,962,981 21,786,011

Issued during the year 20,833,333 260,417 25,509

--------------- -------------- --------------

At 31 December 2022 177,871,800 2,223,398 21,811,520

=============== ============== ==============

On 24 October 2022 a total of 20,833,333 shares were placed at a

price of 1.2 pence per share. Proceeds were used to provide

additional working capital and fund development costs. For each

share subscribed for, the investors also received one warrant to

subscribe for an additional ordinary share at a price of 1.8p per

share for a period of 2 years.

7. SHARE BASED PAYMENTS

The Group issues equity-settled share-based payments to certain

directors and individuals who have performed services for the

Group. Equity-settled share-based payments are measured at fair

value at the date of grant. Fair value is measured by the use of a

Black-Scholes valuation model.

Options

The Group plan provides for a grant price equal to the average

quoted market price of the ordinary shares on the date of grant.

The options vest immediately.

The options outstanding at 31 December 2022 have a weighted

average remaining contractual life of 4 years.

31 December 2022 31 December 2021

Options Weighted average exercise Options Weighted average exercise

price in pence price in pence

Outstanding at beginning of

year 500,000 10.50 500,000 10.50

Granted during the year - - - -

Outstanding at end of year 500,000 10.50 500,000 10.50

======== =============================== ======== ===============================

Warrants

31 December 2022 31 December 2021

Warrants Weighted average exercise Warrants Weighted average exercise

price in pence price in pence

Outstanding at beginning of - - - -

year

Issued 20,833,333 1.8 - -

Expired - - - -

----------- ----------------------------- --------- ------------------------------

Outstanding at end of year 20,833,333 1.8 - -

=========== ============================= ========= ==============================

On 24 October 2022 a total of 20,833,333 warrants were issued at

an exercise price of 1.8p per warrant as part of a placing. Further

information is note 6 above.

8. OTHER RESERVES

Capital Conversion Reserve

Capital Redemption Reserve Fund Share Based Payment Reserve

EUR EUR EUR

Balance at 1 January 2021 209,342 7,694 127,199

Movement during the year - - 29,295

---------------------------- --------------------------- ----------------------------

Balance at 31 December 2021 209,342 7,694 156,494

Movement during the year - - -

---------------------------- --------------------------- ----------------------------

Balance at 31 December 2022 209,342 7,694 156,494

============================ =========================== ============================

Capital redemption reserve

The Capital redemption reserve reflects nominal value of shares

cancelled by the Company.

Capital conversion reserve fund

The ordinary shares of the company were renominalised from

EUR0.0126774 each to EUR0.0125 each in 2001 and the amount by which

the issued share capital of the company was reduced was transferred

to the capital conversion reserve fund.

Share Based Payment Reserve

The share-based payment reserve arises on the grant of share

options under the share option plan. Share options expired are

reallocated from the share-based payment reserve to retained

deficit at their grant date fair value.

9. RETAINED DEFICIT

2022 2021

EUR EUR

Opening Balance (23,724,656) (23,402,579)

Profit/(Loss) for the year (310,813) (322,077)

------------- -------------

Closing Balance (24,035,469) (23,724,656)

============= =============

Retained deficit

Retained deficit comprises of losses incurred in the current and

prior years.

10. POST BALANCE SHEET EVENTS

There were no material post balance sheet events affecting the

Group.

11. ANNUAL GENERAL MEETING

The Company's Annual General Meeting will be held on 27 July

2023 in the Hotel Riu Plaza The Gresham, 23 O'Connell Street Upper,

Dublin 1, D01 C3W7 at 12.00 pm.

12. GENERAL INFORMATION

The financial information prepared using accounting policies

consistent with International Financial Reporting Standards

("IFRS") as adopted by the European Union included in this

preliminary statement does not constitute the statutory financial

statements for the purposes of Chapter 4 of part 6 of the Companies

Act 2014. Full statutory statements for the year ended 31 December

2022 prepared in accordance with IFRS, upon which the auditors have

given an unqualified report, have not yet been filed with the

Registrar of Companies. Full financial statements for the year

ended 31 December 2021 prepared in accordance with IFRS and

containing an unqualified report, have been filed with the

Registrar of Companies.

A copy of the Company's Annual Report and Accounts for 2022 will

be mailed shortly only to those shareholders who have elected to

receive it. Otherwise shareholders will be notified that the Annual

Report will be available on the website at www.petrelresources.com

. Copies of the Annual Report will also be available for collection

from the Company's registered office, 162 Clontarf Road, Dublin 3,

Ireland.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR QKLFFXQLFBBF

(END) Dow Jones Newswires

June 20, 2023 02:00 ET (06:00 GMT)

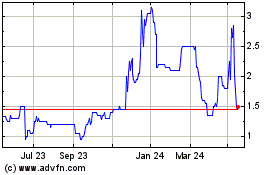

Petrel Resources (LSE:PET)

Historical Stock Chart

From Oct 2024 to Nov 2024

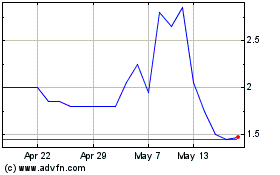

Petrel Resources (LSE:PET)

Historical Stock Chart

From Nov 2023 to Nov 2024