TIDMPDL

RNS Number : 4969W

Petra Diamonds Limited

18 April 2023

18 April 2023 LSE: PDL

Petra Diamonds Limited

("Petra" or "the Company")

Q3 FY 2023 Operating Update

Petra reports improved diamond production in the third quarter

of FY 2023

Richard Duffy, Chief Executive Officer of Petra, commented:

"We are pleased to report higher diamond production following

improved ROM grades and tailings production at Cullinan Mine and

increased throughput at Finsch. We expect to deliver on our revised

guidance of 2.75-2.85 Mcts for FY 2023. With Williamson targeted to

resume production in Q1 FY 2024, we are well positioned to increase

production by c.1Mct to 3.6-3.9 Mcts in FY 2025.

The key mitigating actions initiated over the last 6 months have

been successful and occurred against a backdrop of recently

improved diamond pricing which we largely attribute to a post-COVID

19 recovery in demand from China. We continue to expect a

supportive diamond market in the medium to longer-term as a result

of the structural supply deficit, while noting potential volatility

in the near-term owing to recent geopolitical and macroeconomic

uncertainty."

Highlights vs Q2 FY 2023

-- LTIs and LTIFR increased to 8 and 0.47, respectively, due

largely to a single incident at the Cullinan Mine in which 4

employees were injured. Petra has renewed its safety focus directed

at addressing the quarter-on-quarter regression

-- Total diamond production increased 3% to 653,700 carats as

production improved 14% at Finsch following the introduction of new

equipment, despite some ground handling challenges. Production at

the Cullinan Mine increased by 7%, supported by higher tailings and

ROM grades. Together, this more than offset the temporary

suspension of production at Williamson and the placing of

Koffiefontein on care and maintenance

-- Ore processed decreased 25% to 1.65Mt, largely due to the

temporary suspension of production at Williamson, which is targeted

to restart in Q1 FY 2024

-- At Koffiefontein the Section 189(3) labour reduction process

was completed during the quarter, resulting in the retrenchment of

382 employees at a cost of around ZAR99 million with around 80-90

employees being retained for care and maintenance activities in the

run-up to a responsible closure

-- Support from a weaker Rand and more stable diamond pricing continued throughout the quarter

-- Revenue amounted to US$67.8 million (Q2 FY 2023: US$107.8

million) as higher pricing at the Cullinan Mine and Finsch in the

quarter was more than offset by tender cycle timings (one tender in

Q3 FY 2023 vs two in Q2 FY 2023); the resultant inventory build is

expected to be released in Q4 FY 2023

-- Gross debt increased to US$248.5 million (31 December 2022:

US$241.7 million), reflecting the accrued interest charges for the

three months to 31 March 2023. Consolidated net debt of US$124.7

million (31 December 2022: US$90.8 million) increased due to the

timing of the Company's diamond sales tenders, coupled with the

previously announced capital expenditure programmes for the

expansion projects at the Cullinan Mine and Finsch

Three months Nine months YTD

Q3 Q2 Q3

FY 2023 FY 2023 Var. FY 2022 FY 2023 FY 2022 Var.

------ -------- -------- ------ -------- --------- --------- ------

Safety

------ -------- -------- ------ -------- --------- --------- ------

LTIFR - 0.47 0.22 +114% 0.18 0.28 0.18 +56%

------ -------- -------- ------ -------- --------- --------- ------

LTIs Number 8 4 +100% 3 15 9 +67%

------ -------- -------- ------ -------- --------- --------- ------

Sales

------ -------- -------- ------ -------- --------- --------- ------

Diamonds sold Carats 465,138 792,889 -41% 735,225 1,778,051 2,331,076 -24%

------ -------- -------- ------ -------- --------- --------- ------

Revenue(1) US$m 67.8 107.8 -37% 140.6 278.5 405.4 -31%

------ -------- -------- ------ -------- --------- --------- ------

Contribution

from Exceptional

Stones(2) US$m 7.0 0.0 - 5.5 7.0 83.3 -92%

------ -------- -------- ------ -------- --------- --------- ------

Production

------ -------- -------- ------ -------- --------- --------- ------

ROM tonnes Mt 1.65 2.20 -25% 2.8 6.9 8.2 -16%

------ -------- -------- ------ -------- --------- --------- ------

Tailings and

other tonnes Mt 0.11 0.09 +20% 0.1 0.3 0.4 -12%

------ -------- -------- ------ -------- --------- --------- ------

Total tonnes

treated Mt 1.76 2.29 -23% 2.9 7.2 8.6 -16%

------ -------- -------- ------ -------- --------- --------- ------

ROM diamonds Carats 593,691 604,917 -2% 780,896 1,931,622 2,430,885 -21%

------ -------- -------- ------ -------- --------- --------- ------

Tailings and

other diamonds Carats 60,009 31,612 +90% 49,560 121,827 176,995 -31%

------ -------- -------- ------ -------- --------- --------- ------

Total diamonds Carats 653,700 636,529 +3% 830,456 2,053,449 2,607,880 -21%

------ -------- -------- ------ -------- --------- --------- ------

(1) Revenue reflects proceeds from the sale of rough diamonds

and excludes revenue from profit share arrangements

(2) Petra classifies "Exceptional Stones" as rough diamonds

which sell for US$5 million or more each

Outlook

Ongoing actions taken to strengthen the business and improve

cash flow generation, together with capital discipline, enable

Petra to take advantage of the current supportive diamond market

fundamentals. Petra's projects remain on track to deliver a c.1Mct

annual increase in FY 2025, with work commencing on the C-Cut

extension to unlock a further 2.3Mct from FY 2025 through to FY

2033, as the Company develops the long-term potential of its

resource base.

Petra continues to strive to create a zero harm environment. The

Company is increasing its focus on identifying and mitigating

safety risks with behaviour-focused intervention programmes.

INVESTOR WEBCASTS

Webcast presentation for institutional investors and analysts at

09:30am BST today

Petra's CEO, Richard Duffy, and CFO, Jacques Breytenbach, will

host a live webcast for institutional investors and analysts today

at 09:30 BST to discuss this operating update.

Webcast link for live presentation:

https://brrmedia.news/PDL_OU

Dial in details:

United Kingdom 033 0551 0200

South Africa 0800 980 512

United States (Local) +1 786 697 3501

Password (if prompted): Quote "Petra Diamonds Operating

Update"

Link for recording (available later in the day):

https://www.petradiamonds.com/investors/results-reports/

Investor Meet Company webcast at 14.30pm BST today

Petra will also present these results live on the Investor Meet

Company platform, predominantly aimed at retail investors. To join:

https://www.investormeetcompany.com/petra-diamonds-limited/register-investor

FURTHER INFORMATION

Please contact

Petra Diamonds, London

Patrick Pittaway Telephone: +44 207494 8203

Julia Stone investorrelations@petradiamonds.com

Camarco (Financial PR)

Gordon Poole Telephone: +44 20 3757 4980

Owen Roberts petradiamonds@camarco.co.uk

Elfie Kent

Notes:

1. The following definitions have been used in this announcement:

a. cpht: carats per hundred tonnes

b. LTIs: lost time injuries

c. LTIFR: lost time injury frequency rate, calculated as the

number of LTIs multiplied by 200,000 and divided by the number of

hours worked

d. FY: financial year ending 30 June

e. CY: calendar year ending 31 December

f. Q: quarter of the financial year

g. ROM: run-of-mine (i.e. production from the primary orebody)

h. m: million

i. Mt: million tonnes

ABOUT PETRA DIAMONDS

Petra Diamonds is a leading independent diamond mining group and

a supplier of gem quality rough diamonds to the international

market. The Company's portfolio incorporates interests in three

underground mines in South Africa (Cullinan Mine, Finsch and

Koffiefontein) and one open pit mine in Tanzania (Williamson). The

Koffiefontein mine is currently on care and maintenance in

preparation of closure.

Petra's strategy is to focus on value rather than volume

production by optimising recoveries from its high-quality asset

base in order to maximise their efficiency and profitability. The

Group has a significant resource base which supports the potential

for long-life operations.

Petra strives to conduct all operations according to the highest

ethical standards and only operates in countries which are members

of the Kimberley Process. The Company aims to generate tangible

value for each of its stakeholders, thereby contributing to the

socio-economic development of its host countries and supporting

long-term sustainable operations to the benefit of its employees,

partners and communities.

Petra is quoted with a premium listing on the Main Market of the

London Stock Exchange under the ticker 'PDL'. The Company's loan

notes due in 2026 are listed on the Irish Stock Exchange and

admitted to trading on the Global Exchange Market. For more

information, visit www.petradiamonds.com.

Corporate and financial summary 31 March 2023

Unit As at 31 As at 31 As at 30 As at 30

March December September June

2023 2022 2022 2022

--------- ---------- ---------- -----------

Cash at bank

- (including

restricted amounts)(1) US$m 96.8 146.6 154.0 288.2

--------------------------- --------- ---------- ---------- ----------- ---------

Diamond debtors US$m 27.0 4.3 4.2 37.4

--------------------------- --------- ---------- ---------- ----------- ---------

Diamond inventories(2,3) US$m 73.9 59.9 76.3 52.7

Carats 728,765 540,153 692,219 453,380

------------------------------------- ---------- ---------- ----------- ---------

2026 US$336.7m

loan notes (4) US$m 248.5 241.7 235.8 366.2

--------------------------- --------- ---------- ---------- ----------- ---------

Bank loans and US$m - - - -

borrowings(5)

--------------------------- --------- ---------- ---------- ----------- ---------

Consolidated

Net Debt(6) US$m 124.7 90.8 77.6 40.6

--------------------------- --------- ---------- ---------- ----------- ---------

Bank facilities

undrawn and available(5) US$m 56.2 58.8 55.1 61.5

--------------------------- --------- ---------- ---------- ----------- ---------

Note: The following exchange rates have been used for this

announcement: average for 9M FY 2023 US$1: ZAR17.46 (9M FY 2022:

US$1: ZAR15.10, FY 2022: US$1:ZAR15.22); closing rate as at 31

March 2023 US$1: ZAR17.78 (31 March 2022: US$1:ZAR14.60), 31

December 2022: US$1: ZAR17.00, 30 September 2022: ZAR18.15 and 30

June 2022: ZAR16.27.

Notes:

1. The Group's cash balances comprise unrestricted balances of

US$80.9 million, and restricted balances of US$15.9 million.

2. Recorded at the lower of cost and net realisable value.

3. Diamond inventories includes the Williamson 71,654.45 carat

parcel of diamonds blocked for export during August 2017, with a

carrying value of US$12.5 million. Under the framework agreement

reached with the Government of Tanzania, as announced on 13

December 2021, the proceeds from the sale of this parcel are

required to be allocated to Williamson.

4. The 2026 US$336.7 million loan notes, originally issued

following the capital restructuring (the "Restructuring") completed

during March 2021, have a carrying value of US$248.5 million which

represents the outstanding principal amount of US$210.2 million

(after the early participation phase of the debt tender offers as

announced in September and October 2022) plus US$49.5 million of

accrued interest and net of unamortised transaction costs

capitalised of US$11.2 million.

5. Bank loans and borrowings represent the Group's ZAR1 billion

revolving credit facility which remains undrawn and available.

6. Consolidated Net Debt is bank loans and borrowings plus loan

notes, less cash and diamond debtors.

Mine-by-mine tables:

Cullinan Mine - South Africa

Three months Nine months YTD

Q3 Q2 Q3

Unit FY 2023 FY 2023 Var. FY 2022 FY 2023 FY 2022 Var.

--------- --------- ------ --------- --------- --------- ------

Sales

------- --------- --------- ------ --------- --------- --------- ------

Revenue US$m 47.9 45.8 5% 73.7 150.6 241.4 -38%

------- --------- --------- ------ --------- --------- --------- ------

Diamonds sold Carats 310,300 400,999 -23% 409,030 979,027 1,281,334 -24%

------- --------- --------- ------ --------- --------- --------- ------

Average price

per carat US$ 154 114 35% 180 154 188 -18%

------- --------- --------- ------ --------- --------- --------- ------

ROM Production

------- --------- --------- ------ --------- --------- --------- ------

Tonnes treated Tonnes 1,025,056 1,120,282 -9% 1,053,631 3,256,249 3,360,618 -3%

------- --------- --------- ------ --------- --------- --------- ------

Diamonds produced Carats 322,724 328,137 -2% 404,473 1,019,657 1,247,675 -18%

------- --------- --------- ------ --------- --------- --------- ------

Grade(1) Cpht 31.5 29.3 7% 38.4 31.3 37.1 -16%

------- --------- --------- ------ --------- --------- --------- ------

Tailings Production

------- --------- --------- ------ --------- --------- --------- ------

Tonnes treated Tonnes 110,431 62,178 78% 112,414 250,182 350,706 -29%

------- --------- --------- ------ --------- --------- --------- ------

Diamonds produced Carats 60,009 28,211 113% 49,560 115,010 176,995 -35%

------- --------- --------- ------ --------- --------- --------- ------

Grade(1) Cpht 54.3 45.4 20% 44.1 46.0 50.5 -9%

------- --------- --------- ------ --------- --------- --------- ------

Total Production

------- --------- --------- ------ --------- --------- --------- ------

Tonnes treated Tonnes 1,135,487 1,182,460 -4% 1,166,045 3,506,431 3,711,324 -6%

------- --------- --------- ------ --------- --------- --------- ------

Diamonds produced Carats 382,732 356,348 7% 454,033 1,134,667 1,424,670 -20%

------- --------- --------- ------ --------- --------- --------- ------

Note: 1. Petra is not able to precisely measure the ROM /

tailings grade split because ore from both sources is processed

through the same plant; the Company therefore back-calculates the

grade with reference to resource grades.

Finsch - South Africa

Three months Nine months YTD

Q3 Q2 Q3

Unit FY 2023 FY 2023 Var. FY 2022 FY 2023 FY 2022 Var.

-------- -------- ------ -------- --------- --------- ------

Sales

------- -------- -------- ------ -------- --------- --------- ------

Revenue US$m 19.0 32.0 -40% 39.2 74 .4 104.9 -29%

------- -------- -------- ------ -------- --------- --------- ------

Diamonds sold Carats 152,924 283,833 -46% 259,164 614,041 935,459 -34%

------- -------- -------- ------ -------- --------- --------- ------

Average price

per carat US$ 124 113 10% 151 121 112 8%

------- -------- -------- ------ -------- --------- --------- ------

ROM Production

------- -------- -------- ------ -------- --------- --------- ------

Tonnes treated Tonnes 629,211 522,578 20% 656,408 1,724,765 2,079,527 -17%

------- -------- -------- ------ -------- --------- --------- ------

Diamonds produced Carats 270,396 234,150 15% 303,591 764,763 1,005,134 -24%

------- -------- -------- ------ -------- --------- --------- ------

Grade(1) Cpht 43.0 44.8 -4% 46.3 44.3 48.3 -8%

------- -------- -------- ------ -------- --------- --------- ------

Tailings Production

------- -------- -------- ------ -------- --------- --------- ------

Tonnes treated Tonnes - 30,197 - - 47,502 - -

------- -------- -------- ------ -------- --------- --------- ------

Diamonds produced Carats - 3,402 - - 6,562 - -

------- -------- -------- ------ -------- --------- --------- ------

Grade(1) Cpht - 11.3 - - 13.8 - -

------- -------- -------- ------ -------- --------- --------- ------

Total Production

------- -------- -------- ------ -------- --------- --------- ------

Tonnes treated Tonnes 629 211 552,775 14% 656,408 1,772,267 2,079,527 -15%

------- -------- -------- ------ -------- --------- --------- ------

Diamonds produced Carats 270 396 237,552 14% 303,591 771,325 1,005,134 -23%

------- -------- -------- ------ -------- --------- --------- ------

Note: 1. Petra is not able to precisely measure the ROM /

tailings grade split because ore from both sources is processed

through the same plant; the Company therefore back-calculates the

grade with reference to resource grades.

Williamson - Tanzania

Three months Nine months YTD

Q3 Q2 Q3

Unit FY 2023 FY 2023 Var. FY 2022 FY 2023 FY 2022 Var.

-------- -------- ------ --------- --------- --------- ------

Sales

------- -------- -------- ------ --------- --------- --------- ------

Revenue US$m - 27.9 - 22.4 49 .1 42.6 15%

------- -------- -------- ------ --------- --------- --------- ------

Diamonds sold Carats - 103,829 - 60,759 175,124 87,370 100%

------- -------- -------- ------ --------- --------- --------- ------

Average price

per carat US$ - 269 - 369 280 488 -43%

------- -------- -------- ------ --------- --------- --------- ------

ROM Production

------- -------- -------- ------ --------- --------- --------- ------

Tonnes treated Tonnes - 520,017 - 1,005,901 1,829,376 2,360,017 -22%

------- -------- -------- ------ --------- --------- --------- ------

Diamonds produced Carats - 39,766 - 65,003 140,516 147,876 -5%

------- -------- -------- ------ --------- --------- --------- ------

Grade(1) Cpht - 7.6 - 6.5 7.7 6.3 23%

------- -------- -------- ------ --------- --------- --------- ------

Total Production

------- -------- -------- ------ --------- --------- --------- ------

Tonnes treated Tonnes - 520,017 - 1,005,901 1,829,376 2,360,017 -22%

------- -------- -------- ------ --------- --------- --------- ------

Diamonds produced Carats - 39,766 - 65,003 140,516 147,876 -5%

------- -------- -------- ------ --------- --------- --------- ------

Koffiefontein - South Africa

Three months Nine months YTD

Q3 Q2 Q3

Unit FY 2023 FY 2023 Var. FY 2022 FY 2023 FY 2022 Var.

-------- -------- ------ -------- --------- --------- ------

Sales

------- -------- -------- ------ -------- --------- --------- ------

Revenue US$m 0.8 2.2 -64% 5.4 4.5 16.5 -73%

------- -------- -------- ------ -------- --------- --------- ------

Diamonds sold Carats 1,927 4,228 -54% 6,269 9,859 26,907 -63%

------- -------- -------- ------ -------- --------- --------- ------

Average price

per carat US$ 461 508 -9% 856 452 612 -26%

------- -------- -------- ------ -------- --------- --------- ------

ROM Production

------- -------- -------- ------ -------- --------- --------- ------

Tonnes treated Tonnes - 36,099 - 76,453 84,869 393,763 -78%

------- -------- -------- ------ -------- --------- --------- ------

Diamonds produced Carats - 2,862 - 7,829 6,687 30,200 -78%

------- -------- -------- ------ -------- --------- --------- ------

Grade(1) Cpht - 7.9 - 10.2 7.9 7.7 3%

------- -------- -------- ------ -------- --------- --------- ------

Tailings Production

------- -------- -------- ------ -------- --------- --------- ------

Tonnes treated Tonnes - - - - -

------- -------- -------- ------ -------- --------- --------- ------

Diamonds produced Carats - - - - -

------- -------- -------- ------ -------- --------- --------- ------

Grade(1) Cpht - - - - -

------- -------- -------- ------ -------- --------- --------- ------

Total Production

------- -------- -------- ------ -------- --------- --------- ------

Tonnes treated Tonnes - 36,099 - 76,453 84,869 393,763 -78%

------- -------- -------- ------ -------- --------- --------- ------

Diamonds produced Carats - 2,862 - 7,829 6,687 30,200 -78%

------- -------- -------- ------ -------- --------- --------- ------

Note: 1. Petra is not able to precisely measure the ROM /

tailings grade split because ore from both sources is processed

through the same plant; the Company therefore back-calculates the

grade with reference to resource grades.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTBLGDSCUBDGXR

(END) Dow Jones Newswires

April 18, 2023 02:00 ET (06:00 GMT)

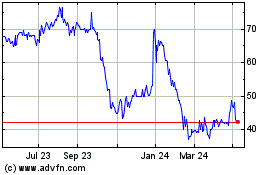

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jun 2024 to Jul 2024

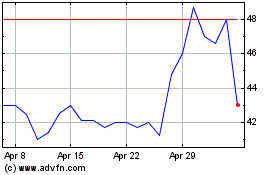

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jul 2023 to Jul 2024