Petra Diamonds Announcement of Final Tender Results

October 12 2022 - 3:30AM

UK Regulatory

TIDMPDL

12 October 2022 LSE: PDL

Petra Diamonds Limited

("Petra")

Petra's wholly owned subsidiary, Petra Diamonds US$ Treasury Plc, has today

made the following announcement on the Irish Stock Exchange:

FOR IMMEDIATE RELEASE

This announcement and any materials relating to the Offer do not constitute,

and may not be used in connection with, any form of offer or solicitation in

any place where such offers or solicitations are not permitted by law.

The distribution of this announcement in certain jurisdictions may be

restricted by law. Persons into whose possession this announcement comes are

required to inform themselves about, and to observe, any such restrictions.

THIS DOCUMENT IS IMPORTANT AND REQUIRES YOUR IMMEDIATE ATTENTION. IF YOU ARE IN

DOUBT ABOUT THE ACTION YOU SHOULD TAKE, YOU SHOULD CONSULT IMMEDIATELY YOUR

STOCKBROKER, BANK MANAGER, SOLICITOR, ACCOUNTANT OR APPROPRIATELY AUTHORISED

INDEPENT FINANCIAL ADVISER.

Petra Diamonds US$ Treasury Plc

Company Number: 09518557

(the "Offeror")

Announcement of Final Tender Results

$336,656,000 in aggregate notional principal amount of Senior Secured Second

Lien Notes due 2026

(ISIN No. XS2289899242, Common Code 228989924 (Private Placement))

(ISIN No. XS2289895927, Common Code 228989592 (Regulation S))

12 October 2022

On September 13, 2022, Petra Diamonds US$ Treasury Plc (the "Offeror")

announced its invitation to offer (the "Offer") to holders (the "Noteholders")

to submit tenders to sell to the Offeror for cash the $336,656,000 in aggregate

notional principal amount of the Senior Secured Second Lien Notes due 2026 (the

"Notes") up to a maximum consideration of $150,000,000 (the "Acceptance

Consideration"), subject to the offer and distribution restrictions, upon the

terms and subject to the conditions set forth in a tender offer memorandum

dated September 13, 2022 (as it may be amended or supplemented from time to

time, the "Tender Offer Memorandum") in accordance with a modified Dutch

auction procedure (the "Launch Announcement"). On September 27, 2022, the

Offeror announced the early tender results and the two following amendments to

the Tender Offer Memorandum (the "Early Results Announcement" and, together

with the Tender Offer Announcement, the "Tender Offer Announcements"):

i. the Acceptance Consideration was increased from $150,000,000 to

$175,000,000; and

ii. all Noteholders who validly tendered their Notes after the Early

Participation Deadline but prior to the Expiration Deadline would be

eligible to receive the Total Consideration of $1,010 per $1,000 principal

amount of Notes validly tendered (to be multiplied by the Pool Factor of

1.14362).

Capitalised terms used in this announcement but not otherwise defined have the

meanings given to them in the Tender Offer Memorandum and the Tender Offer

Announcements.

Following the Expiration Deadline of the Offer at 5.00 p.m. London time on

October 11, 2022, the Offeror hereby announces that:

a. all conditions to the Offer as of the Expiration Deadline, including,

without limitation, the Transaction Conditions, have been satisfied or

waived by the Offeror;

b. it will accept for purchase valid tenders of Notes pursuant to the Offer

after the Early Participation Deadline but at or prior to the Expiration

Deadline;

c. the notional principal amount of Notes that have been validly tendered by

Noteholders after the Early Participation Deadline but at or prior to the

Expiration Deadline and are accepted for payment by the Offeror is $875,000

(corresponding to an actual principal amount after application of the Pool

Factor of $1,000,667.50);

d. the Total Consideration for Notes tendered after the Early Participation

Deadline but at or prior to the Expiration Deadline will be $1,010 per

$1,000 in principal amount of Notes;

e. the total cash purchase price to be paid by the Offeror on the Final

Settlement Date (that is, the Total Consideration for all Notes validly

tendered multiplied by the Pool Factor) is $1,010,674.18; and

f. the principal amount of Notes outstanding after the Final Settlement Date

will be $210,190,662.

The following table summarizes the final results as of the Expiration Deadline

and the aggregate principal amount of Notes that the Offeror has accepted for

purchase.

Principal

Amount

Validly

Tendered Total Principal

after the Principal Amount of

Description Outstanding Early Early Total Amount of Notes

of ISIN / Notional Participation Tender Consideration Notes Validly outstanding

the Notes Common Code Principal Deadline but Premium(2) (2)(3) Tendered and after Final

Amount(1) at or Prior (3) Accepted for Settlement

to the Purchase Date

Expiration

Deadline and

Accepted For

Purchase

Private $336,656,000 $875,000 $50 $1,010 $1,010,674.18 $210,190,662

$336,656,000 Placement:

in aggregate ISIN:

notional XS2289899242

principal Common code:

amount of 228989924

Senior

Secured Regulation

Second Lien S:

Notes due ISIN:

2026 (the " XS2289895927

Notes") Common code:

228989592

(1) Represents the notional outstanding principal amount. The actual principal

amount after application of a pool factor of 1.14362 is $385,006,534.72. Unless

stated otherwise, all references to outstanding principal in this announcement

are to the notional outstanding principal amount prior to the application of

the pool factor.

(2) Per $1,000 of principal amount of Notes.

(3) Total Consideration per $1,000 of principal amount of Notes includes the

Early Tender Premium and will be multiplied by the pool factor of 1.14362.

Total Consideration has been determined pursuant to a modified Dutch auction

procedure.

The expected Final Settlement Date in respect of the tenders received after the

Early Participation Deadline but at or prior to the Expiration Deadline is

October 13, 2022. Full details concerning the Offer are set out in the Tender

Offer Memorandum. No accrued interest will be payable in addition to the Total

Consideration.

Noteholders who have tendered their Notes for purchase pursuant to the Offer

are advised to check with the bank, securities broker, custodian, trust

company, direct participant or other intermediary through which they hold their

Notes to determine whether their tendered Notes have been accepted for purchase

by the Offeror.

Any Notes purchased pursuant to the Offer will be cancelled by the Offeror in

accordance with the Indenture. Notes that have been tendered but not accepted

by the Offeror for purchase pursuant to the Offers shall be unblocked in the

relevant Noteholder's account in the relevant Clearing System. Notes that are

not tendered and accepted for purchase pursuant to the Offer will remain

outstanding.

The Offer has now expired and no further Notes can be tendered for purchase.

Absa Bank Limited and Merrill Lynch International are acting as Dealer Managers

for the Offer (the "Dealer Managers") and Kroll Issuer Services Limited is

acting as the Information and Tender Agent for the Offers (the "Information and

Tender Agent").

Any questions and requests for assistance concerning the terms of the Offer may

be directed to the Dealer Managers and the Information and Tender Agent at the

telephone numbers and locations listed below:

Absa Bank Limited

15 Alice Lane

Sandton

Johannesburg 2196

South Africa

Telephone: +44 203 961 6067, +44 738 411 8926

Attention: Simon Rankin

Email: Simon.Rankin@absa.africa

Merrill Lynch International

2 King Edward Street

London EC1A 1HQ

United Kingdom

United Kingdom Telephone (Europe): +44 207 996 5420

Telephone (U.S. Toll Free): +1 (888) 292-0070

Telephone (U.S.): +1 (980) 388-3646

Attention: Liability Management Group

Email: DG.LM-EMEA@bofa.com

Kroll Issuer Services Limited

The Shard

32 London Bridge Street

London SE1 9SG

United Kingdom

Telephone: +44 20 7704 0880

Attention: Thomas Choquet

Email: petradiamonds@is.kroll.com

Offer Website: https://deals.is.kroll.com/petradiamonds

DISCLAIMER

This announcement must be read in conjunction with the Tender Offer Memorandum

and the Tender Offer Announcement. This announcement and the Tender Offer

Memorandum contain important information which should be read carefully. If any

Noteholder is in any doubt as to the action it should take, it is recommended

to seek its own financial and legal advice, including as to any tax

consequences, from its stockbroker, bank manager, solicitor, accountant or

other independent financial or legal adviser. None of the Offeror, the

Information and Tender Agent or the Trustee is providing Noteholders with any

legal, business, tax, investment or other advice in the Tender Offer

Memorandum.

Subject to applicable law, the Offeror reserves the right, in its sole

discretion, to extend, re-open, withdraw or terminate the Offer and to amend or

waive any of the terms and conditions of the Offer at any time after the

announcement of the Offer as described under "Amendment and Termination" in the

Tender Offer Memorandum, including with respect to any Tender Instructions

already submitted as of the time of any such extension, re-opening, withdrawal,

termination, amendment or waiver.

Forward-Looking Statements

This announcement contains certain forward-looking statements, which are based

on current intentions, beliefs, assumptions and estimates by the management of

the Offeror concerning, among other things, results of operations, financial

condition, liquidity, prospects, growth, strategies of Petra Diamonds Limited

("PDL") and its subsidiaries (the "Group") and the industries in which the

Group operates. By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on circumstances that

may or may not occur in the future. Readers are cautioned that forward-looking

statements are not guarantees of future performance and that the Group's actual

results of operations, financial condition and liquidity, and the development

of the industries in which it operates, may differ materially from those made

in or suggested by the forward-looking statements contained in this

announcement. In addition, even if the Group's or its affiliates' results of

operations, financial condition and liquidity and the development of the

industries in which it operates are consistent with the forward-looking

statements contained in this announcement, those results or developments may

not be indicative of results or developments in subsequent periods. The Offeror

undertakes no obligation to update these forward-looking statements and will

not publicly release any revisions that may be made to these forward-looking

statements which may result from events or circumstances arising after the date

of this announcement.

Ends

For further information, please contact:

Petra Diamonds, London Telephone: +44 20 7494 8203

Patrick Pittaway

investorrelations@petradiamonds.com

Jill Sherratt

Julia Stone

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Group's portfolio

incorporates interests in three underground producing mines in South Africa

(Finsch, Cullinan Mine and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

of ca. 226.6 million carats, which supports the potential for long-life

operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Group aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Group's US$336.7 million notes due in 2026

are listed on the Irish Stock Exchange and admitted to trading on the Global

Exchange Market. For more information, visit www.petradiamonds.com.

END

(END) Dow Jones Newswires

October 12, 2022 03:30 ET (07:30 GMT)

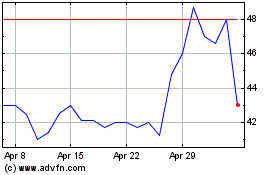

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jul 2023 to Jul 2024