Petra Diamonds Sales results for Tender 5 of FY 2022

May 03 2022 - 3:11AM

UK Regulatory

TIDMPDL

3 May 2022 LSE: PDL

Petra Diamonds Limited

Sales results for Tender 5 of FY 2022

Petra Diamonds Limited ("Petra" or the "Company") announces the results of

Tender 5 of FY 2022, at which 635,806 carats were sold for a total of US$86.1

million.

FY 2022 FY 2022 FY 2022 FY 2022

Tender 5 FY 2022 Tender 5 Tender 4 Tender 3 Year to Date

Results

Diamonds sold (carats) 635,806 735,222 885,136 2,966,875

Sales (US$ million) 86.1 140.6 128.4 491.4

Like-for-like rough diamond prices decreased by 23.7% on Tender 4 (March 2022),

but were up 3.2% on Tender 3 (December 2021), with the balance of price

movement attributable to product mix. Strong demand was again evident across

all size and quality categories. The reduction in prices compared to the highs

seen in March was in line with other market commentary and as anticipated in

our Q3 FY 2022 Trading Updated earlier this month.

The fifth tender cycle included one Exceptional Stone from the Cullinan mine, a

13.74ct blue stone. This was sold for US$5.7 million into a partnership with

Stargems (Pty) Ltd ("Stargems"), with Petra retaining a 50% interest in the

profits of the resultant polished stone(s), net of costs. Petra classifies an

'Exceptional Stone as a rough diamond that sells for US$5 million or more.

Mine by mine prices for Tender 4, H1 FY 2022 and Year-to-Date FY 2022 are set

out in the table below:

Tender 5 Tender 4 H1 FY 2022 YTD

Mine FY 2022 FY 2022 6 months to FY 2022

31-Dec-21

(US$/ct) (US$/ct) (US$/ct) (US$/ct)

Cullinan1 111 180 192 172

Finsch 122 151 97 114

Koffiefontein 431 856 538 578

Williamson1 341 369 760 437

Note 1: Prices for both Cullinan and Williamson mines include proceeds from the

sale of Exceptional Stones. At Cullinan the product mix was negatively

impacted by fewer Type IIa (white) stones in this sales cycle over the

preceding FY2022 tenders. We expect this to improve back towards the average in

future tenders.

Petra intends to hold one further tender during FY 2022, in June.

Richard Duffy, Chief Executive of Petra, commented:

"As anticipated, these prices were below the significant increase we saw in our

March sales, reflecting the seasonally quieter period and the ongoing

uncertainty around the impact of the conflict in Ukraine. Prices nevertheless

remain above our December tender levels, providing for some consolidation in a

diamond market that continues to be supportive.

"We are pleased to have entered into a third partnership arrangement with

Stargems for this financial year on the 13.74ct blue diamond from Cullinan. We

previously announced partnership arrangements, also with Stargems, on the

342.92 carat Type IIa white diamond (that sold for US$10 million and an 18.30

carat Type IIb blue diamond (that sold for US$3.5 million), both from Cullinan.

Further details on the sale of the resultant polished diamonds will be provided

as this process evolves."

Ends

For further information, please contact:

Petra Diamonds, London Telephone: +44 20 7494 8203

Jill Sherratt

investorrelations@petradiamonds.com

Julia Stone

About Petra Diamonds Limited

Petra Diamonds is a leading independent diamond mining group and a supplier of

gem quality rough diamonds to the international market. The Company's portfolio

incorporates interests in three underground producing mines in South Africa

(Finsch, Cullinan and Koffiefontein) and one open pit mine in Tanzania

(Williamson).

Petra's strategy is to focus on value rather than volume production by

optimising recoveries from its high-quality asset base in order to maximise

their efficiency and profitability. The Group has a significant resource base

of ca. 230 million carats, which supports the potential for long-life

operations.

Petra strives to conduct all operations according to the highest ethical

standards and only operates in countries which are members of the Kimberley

Process. The Company aims to generate tangible value for each of its

stakeholders, thereby contributing to the socio-economic development of its

host countries and supporting long-term sustainable operations to the benefit

of its employees, partners and communities.

Petra is quoted with a premium listing on the Main Market of the London Stock

Exchange under the ticker 'PDL'. The Company's US$336.7 million notes due in

2026 are listed (subject to temporary suspension) on the Irish Stock Exchange

and admitted to trading on the Global Exchange Market. For more information,

visit www.petradiamonds.com.

END

(END) Dow Jones Newswires

May 03, 2022 03:11 ET (07:11 GMT)

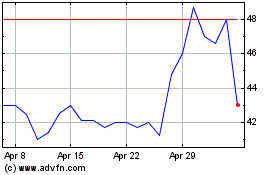

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jun 2024 to Jul 2024

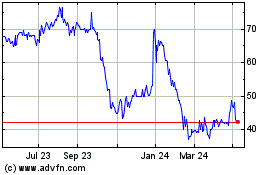

Petra Diamonds (LSE:PDL)

Historical Stock Chart

From Jul 2023 to Jul 2024