TIDMOSB

Directors' Remuneration Report

Annual Statement by the Chair of the Group Remuneration Committee

2019 was a transformational year for OSB following the Combination with

CCFS.

Dear Shareholder,

I am pleased to present the 2019 Directors' Remuneration Report which

sets out details of Directors' remuneration in respect of 2019, our new

Policy for financial years 2020 to 2022 and how

we intend to implement the Policy in 2020.

New Remuneration Policy

The Combination of OSB and CCFS completed with effect from

4 October 2019. This is transformational for OSB, nearly doubling its

size and enhancing its ability to compete in its core markets. As a

result, the Board and Group Remuneration Committee have considered the

Remuneration Policy for the newly formed Group Executive team, which

comprises both legacy CCFS and OSB Executives.

The current Directors' Remuneration Policy was approved at the AGM in

May 2018 and we had planned to operate it for the full three years;

however, the Combination will accelerate the Bank becoming a FCA Level 2

Firm under the regulations applicable to the financial services sector.

Accordingly, we will be seeking shareholder approval for a new Policy in

line with the more

stringent regulatory requirements applicable to FCA Level 2 Firms at the

May 2020 AGM, a year earlier than planned.

We are also taking the opportunity to incorporate into the Policy, the

recommendations in the 2018 UK Corporate Governance Code and latest

investor guidance on matters such as executive pension and executive

shareholdings.

The key change to the Policy as a FCA Level 2 Firm is that the value of

variable pay (annual bonus and performance shares) is limited to one

times the value of fixed pay (base salary, benefits and pension). This

limit may be increased under the FCA regulations from one times to two

times fixed pay, with

shareholder approval. Accordingly, alongside seeking shareholder

approval for the new Policy, we will also be seeking shareholder

approval to increase this regulatory limit imposed on variable pay to

two times fixed pay. In order to retain the competitiveness of the

overall total remuneration package, a direct consequence of this

regulatory requirement means that the package had to be

re-weighted so that the annual bonus and performance shares are reduced

from 150% of salary each, to 110% of salary each with a corresponding

increase to base salaries.

We will also be required to comply with the FCA regulations on deferral

and holding requirements for variable pay, as follows:

-- At least 60% of variable remuneration will be deferred over a seven year

period, with no vesting earlier than three years after the award is

granted, and pro-rated for the remaining years.

-- When each tranche of deferred remuneration vests, shares will be required

to be held for a further year.

In practice this means that:

-- In most instances annual bonus will be paid at least 50% in shares and

the remainder in cash following the publication of the audited results,

with the shares subject to a holding period. Whilst under the FCA

regulations the shares are only required to be held for a minimum of one

year, to enhance the shareholder alignment of Directors' pay further,

this has been extended to three years (in line with the current bonus

deferral horizons).

-- Performance Share Plan ('PSP') awards will continue to be subject to a

three-year performance period, with vesting pro-rated between years three

and seven. Shares delivered

on each vesting date will also be subject to a one year holding period,

taking the overall time horizon for each PSP award to eight years.

The structure of the deferral and holding requirements is set out in the

diagram below.

There will be enhanced clawback and malus for up to seven years after

the grant of an award (ten years in exceptional circumstances).

Other structural changes to ensure compliance with the Code and investor

guidelines are as follows:

- The pension provision for the Executive Directors has been reduced

from 13% of salary to 8% of salary, which is at the same percentage

level as the majority of the workforce.

For any new Executive Directors, the Policy will be the same.

- The minimum required shareholding level will remain at 250% and 200%

of salary respectively, for the CEO and CFO. Added to this will be a new

requirement so that after ceasing employment, Executive Directors will

be required to retain

a shareholding at the lower of the in-service shareholding requirement

and the actual level of shareholding on cessation, for a two year

period.

Operation of the Policy for 2020

As well as restructuring the packages as a consequence of becoming a

Level 2 Firm, which of itself would result in a re- weighting of the

package from variable pay to fixed pay; subject to shareholder approval,

we are increasing the overall level of remuneration in light of the

increased scope of the roles and increased legal and fiduciary

responsibility entailed in managing and overseeing a significantly

larger business. In particular,

this includes leading a series of long-term strategic initiatives to

ensure that the full anticipated benefits of the Combination are

actually realised.

The Board considers that Andy Golding and April Talintyre, our CEO and

CFO respectively, have been instrumental in the

exceptional performance delivered to shareholders since OSB's Initial

Public Offering ('IPO') and will be critical in relation to the

successful integration of CCFS and delivering the longer-term strategy

for the combined business. Since the IPO in 2013, the CEO and CFO have

overseen continued growth in underlying earnings of OSB, with an

attractive net interest margin and loan

book growth achieved whilst providing ongoing investment in the business

and controlling costs. Significant shareholder value

has also been delivered since listing, well above the FTSE All Share

Index despite uncertain economic times and Brexit headwinds specifically

affecting our market.

The Committee has carefully considered the appropriate pay levels for

the roles of CEO and CFO of the combined Group that will be appropriate

for the scope of the roles following the integration of the two

businesses. As a consequence of becoming a FCA

Level 2 Firm, even if the value of the total package was to remain

unchanged, there would still need to be a significant increase

to base salary to offset the required reduction in bonus and PSP

opportunity, from 150% of salary each, to 110% of base salary. On top of

this adjustment, the salary will be increased further, to deliver the

targeted overall level of remuneration, recognising that the value of

the salary increase flows through to the other elements of the package.

For the CEO, rather than moving to the targeted package immediately from

1 January 2020, following investor feedback during the consultation, we

are proposing a two-stage increase, with the first stage representing

50% of the increase. On this basis, from 1 January 2020 his overall

package will increase by just over 12%. The Committee will validate the

second stage increase, which will be effective from 1 January 2021,

taking into account (i) the performance against the integration plan,

(ii) the level of cost savings against published guidance, (iii) whether

the desired culture and customer focus has been delivered across the

whole organisation and (iv) the performance against the compliance plan.

For the CFO, where the increase to the overall package is lower, we

propose to increase the package in one step, by just over 13%.

On this basis, subject to shareholder and regulatory approval, we

propose that the remuneration packages would change as summarised below:

Maximum Maximum

Annual PSP Increase

Salary Pension Bonus Award to total

GBP'000s (% salary) (% salary) (% salary) remuneration

--------------- ------------------

Chief

Executive

Officer

Current

package GBP520 13% 150% 150%

With

effect

from 1

January

2020 GBP735 8% 110% 110% 12.1%

With

effect

from 1

January

2021 GBP815 8% 110% 110% 24.2%

Chief

Financial

Officer

Current

package GBP350 13% 150% 150%

With

effect

from 1

January

2020 GBP500 8% 110% 110% 13.2%

Proposed changes to Directors' remuneration packages

The Committee recognises the stakeholder sensitivity in increasing

Executive Directors' pay and has debated this issue at length and

consulted with significant shareholders. We believe that the proposed

new packages are commensurate with the additional complexity of each

role and greater responsibility for managing a significantly larger and

more complex business and, as part of this, delivering the successful

integration of the two businesses. Following the Combination, the

combined business will have total assets of GBP21.4bn (GBP10.5bn

previously), total headcount of around 1,800 employees (around 1,000

previously), an increase in the number of products offered, an increase

in the number of customers served and a near doubling of shareholders'

funds for which we are responsible. The combined business will also be

subject to materially higher regulatory scrutiny, including being a FCA

Level 2 Firm.

The proposed remuneration levels also ensure that there are appropriate

relativities compared to other Executives within the combined Group and

the rest of the workforce where, within prudent cost constraints, other

employees' packages are being adjusted, as appropriate, for increased

role complexity and responsibility.

We have also considered carefully pay levels within the limited number

of peers in the financial services sector and the FTSE more generally

and we are comfortable that the proposed packages would deliver a total

remuneration equivalent to

a broadly mid-market position.

In summary, we believe that this level of pay is appropriate

remuneration for the task in hand and will be appropriately competitive

to ensure that their services are retained.

Overview of 2019 performance

2019 was a transformational year for OSB following the Combination with

CCFS, which completed on 4 October 2019. The business maintained

momentum during the extended transaction process and has made strong

progress in the period since the Combination. Statutory pre-tax profit

was up 14% to

GBP209.1m, although statutory basic EPS decreased 5% as a result of the

increased share count post Combination. During 2019, OSB also returned

to the securitisation market through the Canterbury Finance programme,

and the Combination with CCFS strengthened our expertise in the area.

Financial results were delivered whilst maintaining a focus on customers

(customer NPS of +66 at OSB and +72 at CCFS) and we were included in

The Sunday Times 100 Best Companies to Work For list.

Incentive outcomes for 2019

The 2019 Executive Bonus Scheme was based 90% on the Business Balanced

Scorecard, which measures corporate performance against financial,

customer, quality and staff metrics and 10% on personal objectives.

Targets for each measure were set and assessed by the Committee

following the end of the financial year. As the Combination completed

late in the year, performance was based on OSB alone, with the Committee

having the ability to adjust the outcome to reflect the overall combined

Group performance for the remainder of the year, if appropriate.

The Executive team delivered strong performance across the Business

Balanced Scorecard with above-target levels of

performance in all categories other than the cost to income ratio and

broker satisfaction. In particular, underlying profit before tax of

GBP199.1m was achieved against a target of GBP196.9m (an increase of

c.3% versus 2018), with an improved customer satisfaction score and low

levels of complaints. There were also no 'high severity' operational

incidents in the year and a low number

of overdue management actions and staff metrics for diversity and

employee engagement were both achieved in full. As such, the Executive

Directors earned 65.89% out of the 90% of bonus assessed against the

scorecard.

As previously noted, given the Combination with CCFS completed late in

the year, the scorecard was assessed based on OSB's performance as a

standalone entity. The Committee maintained discretion to adjust the

outcome based on performance of the Group as a whole; however, having

considered this, confirmed that the outcome did not require adjusting

and was reflective of Group performance over the period. In combination

with strong

performance against individual targets, the Committee determined that

75.89% of the bonus was earned by each of the CEO and CFO. Full details

are provided on page 137. As in previous years, 50% of the bonus will be

deferred into shares for three years.

The 2017 Award under the PSP will vest in March 2020 at 75.1% of maximum

based on performance over the three-year performance period ending on 31

December 2019. As most of the three year performance period relates to

the performance of OSB before the Combination, the earnings per share

('EPS') performance relates to OSB alone. The total shareholder return

('TSR') performance will naturally include the share price impact

of the transaction over the final three months of the performance

period. Performance against the EPS targets exceeded the maximum

threshold and so 100% of the EPS part of the award vested. The TSR of

37.4% placed OSB between the median and upper quartile of the FTSE 250

peer group and 50.2% of the TSR part of the award vested. Overall, the

Committee is comfortable that there has been a clear and strong link

between reward and performance and that discretion should not be

exercised to adjust the incentive outcome.

Implementation of Policy in 2020

As explained above, the CEO's salary will be increased from

GBP520,000 to GBP735,000, as the first stage of a planned increase; and

the CFO's salary will be increased from GBP350,300 to GBP500,000.

The pension contribution has been reduced from 13% to 8% of base salary

under the new Policy, aligning the rate with the majority of the

workforce.

The 2020 annual bonus will be subject to a maximum limit of 110% of

salary and will be based on 90% of performance against the Business

Balanced Scorecard and 10% on personal objectives. Across all measures

there will be a strong focus on the successful integration of the two

businesses. 50% of any bonus will be delivered in shares, which may not

be sold for at least three years.

PSP awards of 110% of salary will be made to the Executive Directors

with performance being measured over the period to 31 December 2022

based on TSR (35% weighting), EPS growth (35% weighting), return on

equity ('ROE') (15% weighting), and as required by the regulations

applicable to a Level 2 Firm, a newly- introduced risk-based measure

(15% weighting). Furthermore,

at the time of vesting the Committee will assess whether the formulaic

vesting outcome is aligned with the underlying

performance, risk appetite and individual conduct over the period.

The targets for each measure are set out in this report and the

Committee is satisfied that these provide the appropriate

stretch, taking into account the business plan, external operating

environment and market expectations.

Awards will vest 20% each year between three and seven years after grant,

with each vested tranche subject to a one year holding period.

Chairman and Non-Executive Director fees

The Committee also reviewed and agreed the fees payable to the Chairman

and Deputy Chairman following the Combination and these are set out on

page 144 along with the details of the NEDs' fees, which were agreed by

the Board.

Consideration of shareholder views and response to the new UK Corporate

Governance Code

The Committee undertook extensive engagement with shareholders during

the review of the Policy and made several changes to the Policy

following investor feedback.

The Committee has also considered the updated UK Corporate Governance

Code (the 'Code') and updates to shareholder

and proxy advisor guidelines and we believe that the new Policy is fully

in line with the Code requirements and the latest investor guidelines.

Consideration of employee policies and views

I am pleased to have been appointed as the NED representing the

workforce on the Board. As a result, I regularly meet with employees,

individually and through forums such as the Primary Talent Group, the

Women's Networking Forum and the newly established Workforce Advisory

Forum, known as OneVoice, to understand their views and report those to

the Board. Further details on the activities of OneVoice can be found on

pages 146 and 147.

As part of the Policy review connected with the Combination, the

Committee oversaw a review of pay and benefits across the Group to

ensure coherence with the Executive Directors' Policy and FCA Level 2

regulatory compliance.

Concluding remarks

I would like to welcome new members to the Committee; Noël Harwerth

and Rajan Kapoor who have joined since completion of the Combination;

and Sarah Hedger who joined in March 2020. Rod Duke has stepped down

from the Committee and I would like to thank him for the significant

contribution he made to the formulation of these Policy proposals.

I look forward to your support for the binding resolutions to approve

the new Remuneration Policy; the increase of the limit to variable pay

to two times fixed pay and the advisory resolution to approve the Annual

Report on Remuneration at the 2020 AGM.

Mary McNamara

Chair of the Group Remuneration Committee

19 March 2020

Remuneration Policy

This section describes our Directors' Remuneration Policy, for which

shareholder approval will be sought at the AGM on

7 May 2020 and will formally come into effect from that date. It is

intended that this Policy will last the three financial years, 2020 to

2022.

Changes to the Policy

The following changes have been made to the Remuneration Policy.

Base salary

The salary review date will be changed from 1 April to 1 January, to

align Executive Directors' pay with the financial year.

Pension

The pension contribution rate (for incumbent and new Directors) has been

reduced to 8% of base salary, in line with the rate applicable for the

majority of the workforce.

Annual bonus

The maximum limit has been reduced from 150% to 110% of salary.

In line with the regulations applicable to a Level 2 Firm, the policy on

deferral will be changed so that instead of 50% of any bonus being

deferred in the form of an award over shares, which vest after three

years, the shares will be subject only to a holding period for the same

length of time. In the event of a

near maximum bonus there could be an additional requirement that part of

this bonus would need to be deferred in line with the deferral

arrangements for the PSP described below in order to comply with the FCA

requirement that 60% of total variable pay must be deferred over a seven

year period.

Performance Share Plan

The maximum value of PSP awards has been reduced from 200% to 110% of

base salary.

Instead of PSP awards vesting after three years and then being subject

to a two year holding period, awards will vest from the third

anniversary of grant and in tranches of 20% over years three to seven. A

one year holding period will apply following the vesting of each

tranche.

Share ownership guidelines

A requirement has been added so that the CEO and CFO must retain shares

equivalent to the in-service shareholding guideline requirement (250% of

salary for the CEO and 200% for the CFO) or, if lower, the actual

shareholding on cessation of employment, for two years after cessation

of employment (other than in exceptional circumstances).

Clawback and malus

Enhanced provisions ensure that incentive payments may be recovered for

up to seven years (ten years in exceptional circumstances).

Policy overview

This Policy has been prepared in accordance with the Large and

Medium-sized Companies and Groups (Accounts and Reports) Regulations

2008, as amended in 2013. The Policy has been developed taking into

account a number of regulatory and governance principles, including:

- The 2018 UK Corporate Governance Code

-- The regulatory framework applying to the Financial Services Sector

(including the Dual-regulated firms Remuneration Code and provisions of

CRD IV)

-- The executive remuneration guidelines of the main institutional investors

and their representative bodies

Approach to designing the Remuneration Policy

The Committee is responsible for the development, implementation and

review of the Directors' Remuneration Policy. In addressing this

responsibility the Committee works with management and external advisers

to develop proposals and recommendations. The Committee considers the

source of information presented to it, takes care to understand the

detail and ensures that independent judgement is exercised when making

decisions. The Group Risk Committee considers whether the Remuneration

Policy and practices are in line with the risk appetite and the Group

Audit Committee confirms incentive plan performance results, where

appropriate.

The Code sets out principles against which the Committee should

determine the Remuneration Policy for Executives. These are shown in the

first column of the table below, together with the Committee's approach,

in the second column:

Principle Committee approach

Clarity -- remuneration

arrangements should be -- We aim to set out our approach to remuneration in

transparent and promote this report as transparently as possible.

effective engagement with

shareholders and the workforce. -- We will engage with our Workforce Advisory Forum

(OneVoice) to explain the alignment of the Executive

Director Remuneration Policy with that of the

workforce.

Simplicity -- remuneration -- Within the required regulatory framework and in line

structures should avoid with investor guidance, we have structured the

complexity and their rationale Remuneration Policy to be as simple as possible.

and operation should be -- We have a simple policy offering pension at the same

easy to understand. rate as employees, an annual bonus plan which

cascades to most employees and, for senior employees,

performance shares to provide alignment with

longer-term performance.

-- There is however, a degree of complexity required for

Executive Director packages to ensure a robust link

to performance and to avoid reward for failure and to

comply with investor and Code requirements.

Risk -- remuneration arrangements } We have mitigated these risks through careful

should ensure reputational policy design, including long-term performance

and other risks from excessive measurement, the use of specific risk-based measures,

rewards, and behavioural deferral and shareholding requirements (including

risks that can arise from post cessation of employment) and discretion and

target-based incentive clawback provisions if incentive payment levels

plans, are identified are inappropriate.

and mitigated.

Predictability -- the } We look carefully each year at the range of likely

range of possible values performance outcomes for incentive plans when setting

of rewards to individual performance target ranges for threshold, target

directors and any other and maximum payouts and would use discretion where

limits or discretions necessary where this leads to an inappropriate

should be identified and pay outcome.

explained at the time

of approving the Policy.

Proportionality -- the -- Incentive plans are determined based on a proportion

link between individual of base salary so there is a sensible balance between

awards, the delivery of fixed pay and performance-linked elements.

strategy and the long-term -- There are provisions to override the formula-driven

performance of the Company outcome of incentive plans deferral and clawbacks to

should be clear. Outcomes ensure that poor performance is not rewarded or if

should not reward poor incentive payments are too high for the performance

performance. delivered, in the view of the Committee.

-- As illustrated by the chart showing our TSR

performance and historic CEO remuneration on page

140, we believe that there has been a strong link

between Directors' pay

and

performance.

Alignment to culture -- } The Business Balanced Scorecard used for the

incentive schemes should annual bonus is based on a wide range of measures

drive behaviours consistent linked to financial performance, customer, quality

with company purpose, and employees,

values and strategy. to ensure that payments are aligned to Company

culture and values.

} Bonus plans operate widely throughout the Company

and are approved by the Committee to ensure consistency

with Company purpose, values and strategy.

How the views of employees and shareholders are taken into account

The Committee does not formally consult directly with employees on

Executive pay but receives updates in relation to the remuneration

structure throughout the Group and salary and bonus reviews each year.

As set out in the policy table, in setting remuneration for the

Executive Directors, the Committee takes note of the overall approach to

reward for employees in the Company and salary increases will ordinarily

be in line (in percentage of salary terms) with those of the wider

workforce. Thus, the Committee is satisfied that the decisions made in

relation to Executive Directors' pay are made with an appropriate

understanding of the

wider workforce.

The Committee undertook extensive engagement with shareholders during

the review of the Policy. The Committee will seek to engage with major

shareholders and the main shareholder representative bodies and proxy

advisory firms when it is proposed that any material changes are to be

made to the Remuneration Policy or its implementation. In addition, we

will consider any shareholder feedback received in relation to the AGM.

The Remuneration Policy for Executive Directors

The table below and accompanying notes describe the Policy for Executive

Directors.

Purpose and link Operation and performance

Element to strategy conditions Maximum

Salary To reward Executives Paid monthly. Increases will generally

for the role and Base salaries are usually be broadly in line with

duties required. reviewed annually, with the average of the workforce.

Recognises individual's any changes usually effective Higher increases may

experience, responsibility from 1 January. be awarded in exceptional

and performance. No performance conditions circumstances such as

apply to the payment of a material increase in

salary. However, when setting the scope of the role,

salaries, account is taken following the appointment

of an individual's specific of a new Executive (which

role, duties, experience could also include internal

and contribution to the promotions) to bring

organisation. an initially below-market

As part of the salary review package

process, the Committee takes in line with the market

account of individual and over time or in response

corporate performance, increases to market factors.

provided to the wider workforce

and the external market

for UK listed companies

both in the financial services

sector and across all sectors.

Benefits To provide market The Company currently provides: There is no maximum cap

competitive benefits -- car allowance on benefits,

to ensure the -- life assurance as the cost of benefits

well-being of employees. -- income protection may vary according to

-- private medical insurance the external market.

-- other benefits as appropriate for the role

Pension To provide a contribution Directors may participate In line with the rate

to retirement planning. in a defined contribution receivable by the majority

plan, or, if they are in of the workforce, which

excess of the HM Revenue is currently 8% of salary.

& Customs ('HMRC') annual

or lifetime allowances for

contributions, may elect

to receive cash in lieu

of all or some of such benefit.

Annual To incentivise and The annual bonus targets The maximum bonus opportunity

bonus reward individuals will have a 90% weighting is 110% of salary per

for the achievement based on performance under annum.

of pre-defined, an agreed balanced scorecard The threshold level for

Committee-approved, which includes an element payment is up to 25%

annual financial, of risk appraisal. Within of maximum for any measure.

operational and the scorecard, at least

individual objectives 50% of the bonus will be

which are closely based on financial performance.

linked to the corporate 10% of the bonus will be

strategy. based on personal performance

targets.

The objectives in the scorecard,

and the weightings on each

element will be set annually,

and may be flexed according

to role. Each element will

be assessed independently,

but with Committee discretion

to flex the payout (including

to zero) to ensure there

is a strong

link between payout and

performance. On top of this,

there is a general discretion

to adjust the outturn to

reflect other exceptional

factors at the discretion

of the Committee.

50% of any bonus earned

will be delivered in shares,

subject to a three year

holding period.

In exceptional circumstances

of high bonus payments there

may be a requirement to

defer a proportion of bonus

with vesting staggered over

three to seven years, in

line with the deferral arrangements

for the PSP described below.

Updated clawback/malus provisions

apply, as described in note

1 overleaf.

Remuneration Policy

Purpose and link Operation and performance

Element to strategy conditions Maximum

---------------------------

Performance To incentivise and PSP awards will typically The maximum PSP grant

Share Plan recognise execution be made annually at the limit is 110% of salary

of the business discretion of the Committee, in respect of grants

strategy over the usually following the announcement in any financial year.

longer term. of full year results. The threshold level for

Rewards strong financial Usually, awards will be payment is 25% for any

performance over based on a mixture of internal measure.

a sustained period. financial performance targets,

risk- based measures and

relative TSR. At least 50%

of the PSP award will ordinarily

be based on financial and

relative TSR metrics.

The performance targets

will usually be measured

over three years.

Any vesting will be subject

to an underpin, whereby

the Committee must be satisfied;

(i) that the vesting reflects

the underlying performance

of the Company; (ii) that

the business has operated

within the Board's risk

appetite framework; and

(iii) that individual conduct

has been satisfactory. On

top of this, there is a

general discretion to adjust

the outturn to reflect other

exceptional factors at the

discretion of the Committee.

Awards granted after 1 January

2020 will vest in five equal

tranches of 20%, following

the Committee's determination

of performance and annually

thereafter. At the time

each tranche vests, a one

year holding period will

apply. (Awards granted before

this date will vest

in accordance with the terms

of the previous Policy).

Clawback and malus provisions

apply as described in note

1 below.

---------------------------

All-employee All employees, including Tax-favoured plan under Maximum permitted savings

share plan Executive Directors, which regular monthly savings based on HMRC limits.

(Sharesave are encouraged to may be made over a three

Plan) become shareholders or five year period and

through the operation can be used to fund the

of an all-employee exercise of an option, where

share plan. the exercise price is discounted

by up to 20%.

---------------------------

Share ownership To increase alignment Executive Directors are At least 250% of salary

guidelines between Executives expected to build and maintain for the CEO and at least

and shareholders. a minimum holding of shares. 200% of salary for the

Executive Directors must CFO or such higher level

retain at least 50% of the as the Committee may

shares acquired on vesting determine from time to

of any share awards (net time.

of tax) until the required The net of tax value

holding is attained. of any unvested deferred

On cessation of employment, awards (which are not

Executive Directors must subject to any future

retain the lower of the performance condition)

in-service shareholding may count towards the

requirement, or the Executive definition of a shareholding

Directors' actual shareholding, for this purpose.

for two years.

---------------------------

1. Clawback and malus provisions apply to both the annual bonus,

including amounts deferred into shares, and PSP awards. These provide

for the recovery of incentive payments within seven years in the event

of; (i) a material misstatement of results, (ii) an error, (iii) a

significant failure of risk management, (iv) regulatory censure, (v) in

instances of individual gross misconduct, (vi) corporate failure, (vii)

reputational damage or (viii) any other exceptional circumstance as

determined by the Board. A further three years may be applied following

such a discovery, in order to allow for the investigation of any such

event. In order to effect any such clawback, the Committee may use a

variety of methods: withhold deferred bonus shares, future PSP awards or

cash bonuses, or seek to recoup cash or shares already paid.

Choice of performance measures for Executive Directors' awards

The use of a balanced scorecard for the annual bonus reflects the

balance of financial and non-financial business drivers across the

Company. The combination of performance measures ties the bonus plan to

both the delivery of corporate targets, risk measures and

strategic/personal objectives. This ensures there is an appropriate

focus on the balance between financial and non-financial targets and

risk, with the scorecard composition being set by the Committee from

year to year depending on

the corporate plan.

The PSP is based on a mixture of financial and risk measures and

relative TSR, in line with our key objectives of sustained growth in

earnings leading to the creation of shareholder value over the long term

within an appropriate risk framework. TSR provides

a close alignment between the relative returns experienced by our

shareholders and the rewards to executives.

There is an underpin in place on the PSP to ensure that the payouts are

aligned with underlying performance, financial and non-financial risk

and individual conduct.

Annual bonus and PSP targets are set taking into account the business

plans, shareholder expectations, the external market and regulatory

requirements.

In line with HMRC regulations for such schemes, the Sharesave Plan does

not operate performance conditions.

How the Group Remuneration Committee operates the variable pay policy

The Committee operates the share plans in accordance with their

respective rules, the Listing Rules and HMRC requirements where

relevant. The Committee, consistent with market practice, retains

discretion over a number of areas relating to the operation and

administration of certain plans, including:

- Who participates in the plans.

-- The form of the award (for example, conditional share award or nil cost

option).

-- When to make awards and payments; how to determine the size of an award;

a payment; and when and how much of an award should vest.

-- Whether share awards will be eligible to receive dividend equivalents and

the method of calculation.

-- The testing of a performance condition over a shortened performance

period.

-- How to deal with a change of control or restructuring of the Group.

-- Whether a participant is a good/bad leaver for incentive plan purposes;

what proportion of an award vests at the original vesting date or whether

and what proportion of an award may vest at the time of leaving.

-- How and whether an award may be adjusted in certain circumstances (e.g.

for a rights issue, a corporate restructuring or for special dividends).

-- What the weighting, measures and targets should be for the annual bonus

plan and PSP from year to year.

The Committee also retains the discretion within the Policy to adjust

existing targets and/or set different measures for the annual bonus. For

the PSP, if events happen that cause it to determine that the targets

are no longer appropriate, an

amendment could be made so they can achieve their original intended

purpose and ensure the new targets are not materially less difficult to

satisfy.

Any use of the above discretions would, where relevant, be explained in

the Annual Report on Remuneration and may, as appropriate, be the

subject of consultation with the Company's major shareholders.

OSB operates in a heavily regulated sector, the rules of which are

subject to frequent evolution. The Committee therefore also retains the

discretion to make adjustments to payments under this Policy as required

by financial services regulations.

Conflicts of interest

The Committee ensures that no Director is present when their

remuneration is being discussed and considers any potential conflicts

prior to meeting materials being distributed and at the beginning at

each meeting.

Awards granted prior to the effective date

Any commitments entered into with Directors prior to the effective date

of this Policy will be honoured. Details of any such payments will be

set out in the Annual Report on Remuneration as they arise.

Remuneration Policy for other employees

The Committee has regard to pay structures across the wider Group when

setting the Remuneration Policy for Executive Directors and ensures that

policies at and below the executive level are coherent. There are no

significant differences in the overall remuneration philosophy, although

pay is generally more variable and linked more to the long term for

those at more senior levels. The Committee's primary reference point for

the salary reviews for the Executive Directors is the average salary

increase for the broader workforce.

A highly collegiate approach is followed in the assessment of the annual

bonus, with our corporate scorecard being used to assess bonus outcomes

throughout the Group, with measures weighted according to role, where

relevant.

Overall, the Remuneration Policy for the Executive Directors is more

heavily weighted towards performance-related pay than

for other employees. In particular, performance-related long-term

incentives are not provided outside of the most senior executive

population as they are reserved for those considered to have the

greatest potential to influence overall levels of performance.

Although PSPs are awarded only to the most senior managers in the Group,

the Company is committed to widespread equity ownership and a Sharesave

Plan is available to all employees. Executive Directors are eligible to

participate in this plan on the same basis as other employees.

Illustrations of application of Remuneration Policy

The chart below illustrates how the composition of the Executive

Directors' remuneration packages (as it is intended the Policy will be

implemented in 2020) would vary under various performance scenarios.

1. Minimum performance assumes no award is earned under the annual bonus

plan and no vesting is achieved under the PSP -- only fixed pay (salary,

benefits and pension are payable).

2. At on-target, half of the annual bonus is earned (i.e. 55% of salary) and

25% of maximum is achieved under the PSP (i.e. 27.5% of salary).

3. At maximum, full vesting is achieved under both plans (i.e. 110% of

salary under the bonus and PSP).

4. As at maximum, but illustrating the effect of a 50% increase in the share

price on PSP awards.

Other than as noted above, share price growth and all-employee share

plan participation are not considered in these scenarios.

The terms and provisions that relate to remuneration in the Executive

Directors' service agreements are set out below. Service contracts are

available for inspection at the Company's registered office.

Provision Policy

------------------------------------------------------------------------

Notice period 12 months on either side.

------------------------------------------------------------------------

Termination A payment in lieu of notice may be made on termination

payments to the value of the Executive Director's basic salary at

the time of termination. Such payments may be made in instalments

and in such circumstances can be reduced to the extent

that the Executive Directors mitigate their loss. Rights

to DSBP and PSP awards on termination are shown below.

The employment of each Executive Director is terminable

with immediate effect without notice in certain circumstances,

including gross misconduct, fraud or financial dishonesty,

bankruptcy or material breach of obligations under their

service agreements.

------------------------------------------------------------------------

Remuneration Salary, pension and core benefits are specified in the

agreements. There is no contractual right to participate

in the annual bonus plan or to receive long-term incentive

awards.

------------------------------------------------------------------------

Post-termination These include six months post termination restrictive covenants

against competing with the Company; nine months restrictive

covenants against dealing with clients or suppliers of

the Company; and nine months restrictive covenants against

soliciting clients, suppliers and key employees.

------------------------------------------------------------------------

Contract date Andy Golding 12 February 2020, April Talintyre 12 February

2020.

------------------------------------------------------------------------

Unexpired term Rolling contracts.

------------------------------------------------------------------------

Payments for loss of office

On termination, other than for gross misconduct, the Executive Directors

will be contractually entitled to salary, pension and contractual

benefits (car allowance, private medical cover,

life assurance and income protection) over their notice period. The

Company may make a payment in lieu of notice equivalent to the salary

for the remaining notice period. Payments in lieu of notice would

normally be phased and subject to mitigation, by offsetting the payments

against earnings elsewhere.

The Company may also pay reasonable legal costs in respect of any

compromise settlement.

Annual bonus on termination

There is no automatic/contractual right to bonus payments and the

default position is that the individual will not receive a payment. The

Committee may determine that an individual is a 'good leaver' and may

elect to pay a pro-rated bonus for the period of employment at its

discretion and based on full year performance.

Deferred bonus awards on termination

In respect of outstanding awards made under the previous policy,

deferred bonus awards normally lapse on termination of employment.

However, in certain good leaver situations, awards may instead vest on

the normal vesting date (or on cessation of

employment in exceptional circumstances). Good leaver scenarios include;

(i) death; (ii) injury, ill-health or disability; (iii) retirement with

the agreement of the Company; (iv) redundancy; (v) the employing company

ceasing to be a member of the Group; or (vi) any other circumstance the

Committee determines good leaver treatment is appropriate. Shares which

are subject to a holding period will ordinarily be released at the

normal time. Where a portion of the annual bonus is required to be

deferred in line with FCA regulations, the treatment on cessation will

be in line with deferred awards made under the previous policy (as

above).

Performance Share Plan awards on termination

Awards normally lapse on termination of employment. However, in certain

good leaver situations, awards may vest on the normal vesting date and

to the extent that the performance conditions are met. The Committee is,

however, permitted under the PSP rules and FCA regulations to allow

early vesting

of the award to the extent it considers appropriate, taking into account

performance to date. Unless the Committee determines otherwise, awards

vesting in good leaver situations will be pro- rated for time employed

during the performance period. Shares which are subject to a post

vesting holding period will ordinarily be released at the normal time.

Approach to recruitment and promotions

The ongoing remuneration package for a new Executive Director would be

set in accordance with the terms of the Company's approved Remuneration

Policy.

On recruitment, the salary may (but need not necessarily) be set at a

lower rate, with phased increases (which may be above

the average for the wider employee population) as the Executive Director

gains experience. The salary would in all cases be set

to reflect the individual's experience and skills and the scope of the

role. Annual bonus and PSP award levels would be in line with the

Policy.

The Company may take into account and compensate for remuneration

foregone upon leaving a previous employer using cash awards, the

Company's share plans or awards under Listing Rule 9.4.2 as may be

required. This would include taking into account the quantum foregone;

the extent to which performance conditions apply; the form of award; and

the time left to

vesting. These would be structured in line with any regulatory

requirements (such as the PRA Rulebook).

For all appointments, the Committee may agree that the Company will meet

certain appropriate relocation costs.

For an internal appointment, including the situation where an Executive

Director is appointed following corporate activity, any variable pay

element awarded in respect of their prior role would be allowed to pay

out broadly according to its terms.

Should an individual be appointed to a role (Executive or

Non-Executive) on an interim basis, the Company may provide additional

remuneration, in line with the Policy for the specific role, for the

duration the individual holds the interim role.

For the appointment of a new Chairman or NED, the fee arrangement would

be in accordance with the approved Remuneration Policy in force at that

time.

External appointments

Executive Directors may accept one directorship of another company with

the consent of the Board, which will consider the time commitment

required. The Executive Director would normally be able to retain any

fees from such an appointment.

The Remuneration Policy for the Chairman and Non-Executive Directors

Element Purpose and link Operation Maximum opportunity

to strategy

------------------------------

Fees To attract and retain The Chairman and NEDs There is no prescribed

a high-calibre Chairman are entitled to an annual maximum annual increase.

and NEDs by offering fee, with supplementary The Committee is guided

a market competitive fees payable for additional by the general increase

fee. responsibilities including in the non-executive market

the Chair of the Group but on occasion may need

Audit, Group Nomination to recognise, for example,

and Governance, Group change in responsibility

Remuneration and Group and/or time commitments.

Risk Committees and for

acting as

the SID.

Fees are reviewed periodically.

The Chairman and NEDs

are entitled to reimbursement

of travel and other reasonable

expenses incurred in the

performance of their duties.

------------------------------

Letters of appointment

The NEDs are appointed appointment that set out their duties and responsibilities.

by letters of The key terms are:

Provision Policy

Period of appointment Initial three year term, subject to annual re-election

by shareholders. On expiry of the initial term and

subject to the needs of the Board, NEDs may be invited

to serve a further three years. NEDs appointed beyond

nine years will be at the discretion of the Group

Nomination and Governance Committee.

-------------------------------------------------------------

Notice periods Three months on either side.

The appointments are also terminable with immediate

effect and without compensation or payment in lieu

of notice if the Chairman or NEDs are not elected

or re-elected to their position as a Director of the

Company by shareholders.

-------------------------------------------------------------

Payment in lieu of The Company is entitled to make a payment in lieu

notice of notice on termination.

-------------------------------------------------------------

Letters of appointment are available for inspection at the Company's

registered office. The effective dates of the current NEDs' appointments

are shown in the table below.

Non-Executive Date of appointment

Director

--------------------------------------------------------------

Graham Allatt 6 May 2014

--------------------------------------------------------------

Noël 4 October 2019 (appointed to the CCFS Board in June

Harwerth 2017)

--------------------------------------------------------------

Sarah Hedger 1 February 2019

--------------------------------------------------------------

Rajan Kapoor 4 October 2019 (appointed to the CCFS Board in September

2016)

--------------------------------------------------------------

Mary McNamara 6 May 2014

--------------------------------------------------------------

David Weymouth 1 September 2017

--------------------------------------------------------------

2019 Annual Report on Remuneration

Introduction

This section sets out details of the remuneration received by Executive

Directors and NEDs in respect of the financial year ended 31 December

2019. This Annual Report on Remuneration will, in conjunction with the

Annual Statement of the Committee Chair on pages 122 to 126, be proposed

for an advisory vote by shareholders at the forthcoming AGM to be held

on 7 May 2020. Where required, data has been audited by Deloitte and

this is indicated where applicable.

Membership

The Committee met seven times during the year. Mary McNamara (Chair),

Rod Duke and David Weymouth were members of the Committee throughout the

year. Sir Malcolm Williamson, Noël Harwerth and Rajan Kapoor joined

the Committee on 4 October 2019 following completion of the Combination.

Sarah Hedger joined the Committee in March 2020. Rod Duke and Sir

Malcolm Williamson ceased to be Directors from 4 February 2020. The

attendance of individual Committee members is set out in the Corporate

Governance Report.

The Board considers each of the members of the Committee to be

independent in accordance with the UK Corporate Governance Code.

Responsibilities

The Committee's responsibilities are set out in its terms of reference,

which are available on the Company's website. In summary, the

responsibilities of the Committee include:

- Pay for employees under the Committee's scope:

-- Setting the Remuneration Policy.

-- Determining total individual remuneration (including salary increases,

bonus opportunities and outcomes and LTIP awards).

-- Ensuring that contractual terms on termination, and any payments made,

are fair to the individual, and the Company, that failure is not rewarded

and that the duty to mitigate loss is fully recognised.

-- Approving the design of, and determining targets for, any

performance-related pay schemes operated by the Company and approving

total payments made under such schemes.

Employees under the Committee's scope include Executive Directors, the

Chairman of the Board, the Company Secretary and all employees that are

identified as Material Risk Takers for the purposes of the PRA and FCA's

Dual Regulated Remuneration Code ('Code Staff').

Key matters considered by the Committee

Key issues reviewed and discussed by the Committee during the year

included:

- Significant review of the Remuneration Policy

- Extensive consultation with major investors

- Combination-related remuneration matters

- Leaving arrangements for senior employees

-- All business as usual matters for employees under the Committee's scope:

-- Review and approve salary increases

-- Review and approve bonus awards

-- Determine the grants under the PSP

- Consider and approve the Directors' Remuneration Report.

Advisers to the Committee

Korn Ferry provided independent advice to the Committee during 2019,

having been appointed following a competitive tender process in 2017.

The total fees paid to Korn Ferry in 2019 were

GBP238,632 and were charged on a time and materials basis. This figure

includes a significant amount in respect of support for the Committee

and management in relation to the Combination.

Korn Ferry has no other connection with the Group and therefore the

Committee is satisfied that it provides objective and independent

advice. Korn Ferry is a member of the Remuneration Consultants Group and

abides by the voluntary code of conduct of that body, which is designed

to ensure objective and independent advice is given to remuneration

committees.

The Committee consults with the CEO, as appropriate, and seeks input

from the Group Risk Committee to ensure that any

remuneration or pay scheme reflects the Company's risk appetite and

profile and considers current and potential future risks.

The Committee also receives input on senior executive remuneration from

the CFO and Group HR Director. The Group General Counsel and Company

Secretary acts as Secretary to the Committee and advises on regulatory

and technical matters, ensuring that the Committee fulfils its duties

under its terms

of reference.

No individual is present in discussions directly relating to their own

pay.

Directors' pay outcomes for 2019

Remuneration and fees payable for 2019 -- (audited)

The table below sets out a single figure for the total remuneration

received by each Executive Director and NED for the years ending 31

December 2019 and 31 December 2018.

Annual Amount

Basic Taxable bonus bonus

salary benefits1 Pension paid2 deferred2 LTIP3 Total

Executive Directors Year GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------

Andy Golding 2019 516 21 67 296 296 413 1,609

2018 501 21 65 347 347 321 1,602

---------

April Talintyre 2019 347 16 45 199 199 219 1,025

2018 336 16 44 232 232 227 1,087

---------

1 Taxable benefits received include car allowance (CEO GBP20,000; CFO

GBP15,000) and private medical cover.

1. 50% of bonus is payable in cash and 50% in shares deferred for three

years.

2. The LTIP figure for the year ended 2018 has been restated based on the

share price on vesting of GBP3.9652 for the 2016 PSP.

Total fees GBP'000 2018 2019

Chairman

Sir Malcolm Williamson -- 631

David Weymouth 250 2501

Non-Executive Directors

Graham Allatt 89 91

Eric Anstee 83 88

Rod Duke 78 89

Margaret Hassall 63 71

Sarah Hedger -- 672

Mary McNamara 78 90

Directors appointed from CCFS

-- 263

Tim Brooke Noël Harwerth -- 313

Rajan Kapoor -- 293

Ian Ward -- 283

Former Directors

Andrew Doman 22 --4

Total 663 9235

NEDs cannot participate in any of the Company's share schemes and are

not eligible to join the Company pension scheme.

1. David Weymouth served as Chairman until 4 October 2019, his fee remained

unchanged due to additional responsibilities; Sir Malcolm Williamson

became Chairman from that date.

2. Appointed to the Board on 1 February 2019.

3. From completion on 4 October 2019.

4. Ceased to be a Director on 10 May 2018.

5. An additional amount of GBP5,000 was payable to each NED for significant

extra time spent on matters relating to the Combination.

Executive bonus scheme:

As noted in the Statement from the Committee Chair, given that the

Combination with CCFS completed late in the year, the Committee

determined that the Business Balanced Scorecard should be assessed based

on OSB's performance as a standalone entity. The Committee however,

retained the discretion to adjust the outcome based on performance of

the Group as a whole. The performance is set out below. The Committee

agreed that no adjustments were required and that the outcome was

reflective of underlying performance.

2019 performance against the Business Balanced Scorecard

Targets1

-----------

Threshold Budget Max Actual Outcome Outcome

Category Key performance indicator (25%) (50%) (100%) result CEO CFO

----------- ------------ ------------- ---------- ----------

Financial

(50%) Underlying PBT GBP192.9m GBP196.9m GBP204.9m GBP199.1m 33.44% 33.44%

All-in ROE 21.4% 22.4% 24.4% 23.2%

Cost to income ratio 31.0% 30.0% 28.0% 30.4%

Net loan book growth 16.2% 17.2% 19.2% 20.1%

Customer

(15%) Customer satisfaction 45 50 60 67 11% 11%

Broker satisfaction 27.5 30 35 26.6

Complaints 0.8% 0.5% 0.1% 0.1%

Quality

(15%) Overdue actions 3 2 0 1 11.45% 11.45%

Arrears 1.25% 1.0% 0.5% 0.96%

High-severity incidents 4 3 1 0

Staff (10%) Diversity2 27.0% 28.0% 30.0% 30.9% 10% 10%

Employee engagement3 3 4 6 7

Personal Vary by executive -- see

(10%) section below 10% 10%

Total 75.89% 75.89%

1. Targets -- based on a sliding scale between threshold, target and

maximum.

2. Diversity -- based on the gender diversity of the senior leadership team.

3. Employee engagement -- the employee engagement score represents the

number of categories which showed improvement versus the prior year.

2019 personal performance:

The Executive Directors were allocated up to a maximum of 10% of their

bonus based on their personal performance against agreed objectives.

The priorities for 2019 were identified in our 2018 Annual Report and

objectives built around these. Performance against the objectives for

both Executive Directors was outstanding, as was their overall

leadership of the Bank.

The objectives set at the start of the year and the Committee's

assessment of performance against them are set out below:

Objectives Key achievements

CEO Oversee the progression of Outstanding leadership in relation to the

all established 2019 strategic successful completion of the Charter Court

objectives in line with the transaction, whilst still also delivering

operating plan against BAU objectives

Maintain strong relationships Open and honest relationship with regulators

with all regulators maintained throughout 2019. This was a year

of exceptional regulator interactions in

the context of the Combination transaction

Continue to embed the OSB Outstanding leadership during a significant

Mission, Vision and Values corporate transaction. Externally measured

and the associated activities employee engagement increased

to positively impact on employee

survey results.

Establish and maintain strong Outstanding performance in relation to investor

relationships with key investors, roadshows and securing investor support

brokers and analysts for the transaction, including with new

shareholders following the completion of

the Combination

Undertake all prescribed All responsibilities delivered positively

and additional responsibilities and proactively

allocated under the Senior

Managers Regime

Consistently act as a positive Outstanding leadership in year of significant

ambassador for OSB at all change

times, demonstrating role

model behaviours.

CFO Deliver all Board-approved Outstanding leadership in relation to the

BAU and strategic projects, successful completion of the Charter Court

with a particular personal transaction, which became the single most

focus on Data and MI and important strategic project of the year

People-related initiatives

Complete feasibility assessment Feasibility and project plan completed

and project plan for Bankline

Direct

Continued automation of regulatory Significant progress on automation of regulatory

process and successful go-live process including use of new template during

with new PRA templates a year when resources were otherwise diverted

to the Combination transaction

Delivery of a new procurement Delivered on time and on budget with new

system to facilitate enhanced system operational by year end

Opex reporting and efficiencies

Continue to strengthen relationships Outstanding performance in relation to investor

with shareholders and other roadshows and securing investor support

stakeholders, including regulator for the transaction. Open and honest relationship

with regulators maintained throughout 2019

Effective oversight of the Step change in the Bank's capital and funding

management of the Bank's forecasting and planning capabilities during

capital and funding covering 2019

accurate forecasting, maintenance

of the capital and funding

plans

Successful 2018 year end Smooth delivery of OSB and pro forma combined

and 2019 first half close Group accounts

and delivery to the market.

Includes early finalisation

of subsidiary statutory accounts

Consistently act as a positive Outstanding leadership in year of significant

ambassador for OSB at all change

times, demonstrating role

model behaviours.

Based on this performance, the Committee determined that 10% of a

possible 10% for the individual element of the bonus should be paid to

the each of the CEO and CFO. The CEO and CFO therefore each earned

75.89% of maximum (114% of salary). Half of the bonus will be deferred

into shares for three years.

Long-term incentive plan (audited)

The 2017 LTIP award was granted on 16 March 2017 and measured

performance over the three financial years to 31 December 2019. Awards

will vest after publication of this report, based on the EPS and TSR

performance, at 75.1% of maximum, as set out below.

Given that the Combination with CCFS only completed approximately 33

months into a 36 month performance period, the Committee determined that

the EPS should be assessed against OSB's performance as if the

transaction had not occurred (the adjustments to EPS were agreed by the

Committee and the Chair of the Group Audit Committee).

TSR Vesting

Percentage performance of TSR

of that part EPS element Vesting TSR (50% versus part (50%

Performance of the award (50% of total EPS of EPS of FTSE 250 of total

level vesting award) performance part total award) constituents award)

Below Less than 6% 74 out

'threshold' 0% CAGR 13.6% CAGR 100% Below median of 50.2%

'Threshold' 25% 6% CAGR Median 176

'Stretch' 100% 12% CAGR Upper quartile

The 2017 PSP awards will therefore vest as follows:

Number

of Number Value Total

shares of from share value

Number of due to shares price vesting

Executive Directors shares granted vest lapsed increase1 GBP'0002

--------- -------------

Andy Golding 143,544 107,801 35,743 GBP77,832 GBP413,093

April Talintyre 76,066 57,125 18,941 GBP41,244 GBP218,903

---------

1. Value of share price increase based on a GBP3.11 share price at the time

of grant of the award, to the three-month average share price of

GBP3.8320 to 31 December 2019.

2. Value of shares based on a three-month average share price of GBP3.8320

to 31 December 2019. This value will be restated next year based on the

actual share price on the date of vesting. Dividend equivalents are not

paid under the Performance Share Plan.

The Committee is comfortable that the level of vesting is in line with

underlying performance and shareholder experience over the performance

period.

Executive pay outcomes in context

Percentage change in the remuneration of the CEO (audited)

The table below sets out the percentage change in base salary, value of

taxable benefits and bonus for the CEO compared with the average

percentage change for employees. For these purposes, UK employees who

have been employed for over a year (and therefore eligible for a salary

increase) have been used as a comparator group as they are the analogous

population (based on service and location).

Average percentage change 2018--2019

Taxable Annual

Salary benefits bonus

-------- ------------ ----------

CEO 3.02% 0% (14.7)%

UK employees 6.26% 0% 9.9%

Comparison of Company performance and CEO remuneration (audited)

The following table summarises the CEO single figure for total

remuneration, annual bonus and LTIP pay-out as a percentage of maximum

opportunity for the period between 2013 and 2019:

2013 2014 2015 2016 2017 2018 2019

--------

Andy Golding

Annual bonus (as a percentage

of maximum opportunity) 92.5% 92.63% 93.00% 88.75% 85% 91.75% 75.89%

LTIP vesting (as a percentage

of maximum opportunity) -- -- -- -- 100% 50% 75.1%

CEO single figure of remuneration

(GBP'000) 518 777 848 910 1,614 1,602 1,609

--------

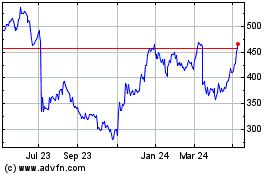

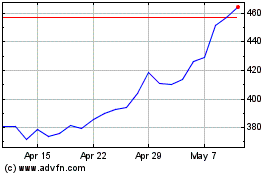

Total shareholder return

The chart below shows the TSR performance of the Company over the period

from listing to 31 December 2019 compared to the performance of the FTSE

All Share Index. This index is considered to be the most appropriate

index against which to measure performance as the Company is a member of

this index.

This graph shows the value, at 31 December 2019, of GBP100 invested in

OneSavings Bank plc on admission (5 June 2014) compared with the value

of GBP100 invested in the FTSE All Share Index on the same date. The

other points plotted are the values at intervening financial year ends.

Source: Datastream (Thomson Reuters)

CEO pay ratios

The ratio of the CEO's single figure of total pay to median employee pay

is set out in the table below. The ratio has been calculated in

accordance with methodology B as it is the same pay data for employees

as is used for the Gender Pay Gap analysis. Full time equivalent pay for

individuals that do not work full time has been calculated by increasing

their pay pro rata to that of a full time individual. The median ratio

has decreased between 2018 and 2019 as a result of a combination of

factors, which result in the total

pay for the median individual within the workforce increasing, including

positive changes to the Group's pay policy and changes in the employee

population between 2018 and 2019. There has been no change to the

Company's employment models between the two years. The decrease in the

ratio between 2017 and 2018 was as a result of the above factors.

Additionally, the total pay for the CEO decreased between 2017 and 2018.

The median ratio is consistent with the pay, reward and progression

policies within the Company.

CEO pay ratio 2017 2018 2019

Method B B B

CEO single figure 1,614 1,574 1,609

Upper quartile 62.1 58.4 63.5

Median 46.1 39.4 37.2

Lower quartile 24.8 21.9 26.2

Basic salary Total

2019 (GBP'000) pay (GBP'000)

-----------------

CEO 516.2 1,609

Lower quartile -- Employee A 22.6 24.6

Median -- Employee B 34.7 41.8

Upper quartile -- Employee C 50.3 61.5

Relative importance of the spend on employee pay (audited)

The table below shows the Company's total employee remuneration

(including the Directors) compared to distributions to shareholders and

operating profit before tax for the year under review and the prior

year. In order to provide context for these figures, underlying

operating profit as a key financial metric used for remuneration

purposes has been shown.

2018 2019

Total employee costs GBP43.6m GBP60.5m

Distributions to shareholders GBP35.7m GBP61.8m

Underlying profit before tax (PBT) GBP193.6m GBP199.1m

Total employee costs vs PBT 22.5% 30.4%

Average headcount 989 1,278

Average PBT per employee GBP195,753 GBP155,790

Other disclosures relating to 2019 executive remuneration

Scheme interests awarded during the financial year (audited)

The table below shows the conditional share awards made to Executive

Directors in 2019 under the PSP and the performance conditions attached

to these awards:

Face value of award Percentage

Executive (percentage of Face value Number of awards End of performance Performance

salary) of of shares1 released period conditions

award for achieving (weighting)

threshold

targets

------------------------- -----------------

Andy Golding 150% GBP780,000 199,959 EPS (40%)

April Talintyre 150% GBP525,450 134,703 25% 31 December TSR (40%)

2021 ROE (20%)

------------- ------------ -------------

1. The number of shares awarded was calculated using a share price of

GBP3.9008 (the average mid-market quotation for the preceding five days

before grant on 14 March 2019).

2. Performance conditions are; (i) 40% TSR versus the FTSE 250 (25% vesting

for median performance increasing to maximum vesting for upper quartile

performance); (ii) 40% EPS (25% vesting for growth in EPS of 5% per annum

increasing to maximum vesting for 10% per annum); and (iii) 20% ROE (25%

vesting for average ROE of 20% increasing to maximum vesting for an

average of 25%). Financial performance conditions have been adjusted as a

result of the Combination to ensure that they are no harder or easier to

achieve than was originally intended when the targets were set. This is

also the case for the 2018 awards. Full details will be provided in the

relevant report at the end of the performance period.

All-employee share plans (audited)

Number

Market of options

price Number as at

Exercise 31 December Exercisable Exercisable of options 31 December

Executive Date of grant price 2019 from to granted 2019

---------------

1 December 1 June

Andy Golding 1 November 2019 GBP2.65496 GBP4.3340 2022 2023 6,779 6,779

April 1 December 1 June

Talintyre 1 November 2019 GBP2.65496 GBP4.3340 2022 2023 6,779 6,779

-------------

Statement of Directors' shareholdings and share interests (audited)

Total shares owned by Directors: Interest in share

Interest in shares awards Shareholding requirements

Subject

Beneficially Without to performance Shareholding Current

Beneficially owned performance conditions requirement shareholding

owned at at conditions as at (percentage (percentage

1 January 31 December at 31 December 31 December of basic of

2019 2019 2019 2019 salary) basic salary)1

-------------- -------------- --------------------- ---------------------

Executive

Andy Golding 680,429 512,941 194,916 523,942 250% 428% (Met)

April

Talintyre 263,001 220,346 132,554 331,774 200% 273% (Met)

Non-Executive

Eric Anstee 4,960 4,960

Rod Duke 80,000 80,000

Rajan Kapoor -- 8,970

Mary McNamara 22,350 22,350

Ian Ward -- 35,882

David Weymouth 13,178 13,178

Sir Malcolm

Williamson -- 71,764

1. Shareholding based on the closing share price on 31 December 2019

(GBP4.3340) and year end salaries.

External appointments

Andy Golding is a Director/Trustee of the Building Societies Trust

Limited. He receives no remuneration for this position. Andy Golding was

a member of the Financial Conduct Authority's Small Business

Practitioners Panel until his resignation on 17 October 2019.

Payments to departing Directors (audited)

During the year, the Company did not make any payments to past

Directors; neither has it made any payments to Directors for loss of

office.

How we will implement the Remuneration Policy for Directors in 2020

As set out in the Statement from the Group Remuneration Committee Chair,

there will be significant changes in the Directors' remuneration,

largely driven by increased regulatory requirements as a Level 2 Firm

under the PRA/FCA remuneration rules.

In particular, there has been a rebalancing of the package to comply

with the regulations capping variable pay (i.e. bonus + PSP award) at

two times fixed pay (salary + pension + benefits). As such, the CEO's

salary has been increased from GBP520,000 to GBP735,000, as the first

stage of a planned increase and the CFO's salary has been increased from

GBP350,300 to GBP500,000. The pension contribution has been reduced from

13% to 8% of base salary, in line with the rate for the wider employee

population. The opportunity under the annual bonus and the PSP has been

reduced from 150% of salary to 110% of salary to ensure that variable

pay is in line with the cap.

Annual bonus

The 2020 annual bonus will be subject to a maximum limit of 110% of

salary. The performance measures have been set in line with the Business

Balanced Scorecard. Accordingly, the balance of the metrics are as

follows:

Financial Customer Quality Staff Personal objectives