ONESAVINGS BANK PLC Combination Update -- Competition Clearance

July 30 2019 - 2:08AM

UK Regulatory

TIDMOSB

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART,

DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO

WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF THAT JURISDICTION

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION

FOR IMMEDIATE RELEASE

LEI: 213800WTQKOQI8ELD692

30 July 2019

Recommended all-share combination

of

OneSavings Bank plc

and

Charter Court Financial Services Group plc

Combination Update -- Competition Clearance

On 14 March 2019, the Boards of OneSavings Bank plc ("OSB") and Charter

Court Financial Services Group plc ("Charter Court") announced that they

had reached agreement on the terms of a recommended all-share

combination for the entire issued and to be issued share capital of

Charter Court (the "Combination"). The full terms and conditions of the

Combination are set out in the scheme document which was published on 15

May 2019 (the "Scheme Document").

In particular, the Combination remained subject to the conditions set

out in Part III of the Scheme Document, which stated that the

Combination was conditional (amongst other things) on the Competition

and Markets Authority (the "CMA") confirming, in terms reasonably

satisfactory to OSB, that the Combination or any matter arising

therefrom or related thereto or any part of it will not be subject to a

reference under sections 22 or 33 of the Enterprise Act 2002 (the "CMA

Condition").

OSB and Charter Court are pleased to confirm that, on 30 July 2019, the

CMA announced that it does not intend to refer the Combination under the

provisions of the Enterprise Act 2002 and that the CMA's clearance was

unconditional.

The CMA Condition has therefore been satisfied.

Completion of the Combination remains subject to other outstanding

conditions, including receipt of regulatory approvals from the FCA and

PRA. Further announcements will be made as necessary in due course.

Terms used but not defined in this announcement have the meanings given

in the Scheme Document unless the context requires otherwise.

The person responsible for arranging the release of this announcement on

behalf of OSB is Jason Elphick, Company Secretary and the person

responsible for arranging the release of this announcement of behalf of

Charter Court is Sebastien Maloney, Chief Financial Officer.

Further information

Enquiries:

OneSavings Bank plc

Alastair Pate, Group Head of Investor Relations:

Tel: +44 (0) 16 3483 8973

Rothschild & Co (Financial Adviser and Sponsor to OSB)

Stephen Fox Tel: +44 (0) 20 7280 5000

Toby Ross

Guy Luff

James Ford

Barclays (Financial Adviser and Corporate Broker to OSB)

Kunal Gandhi Tel: +44 (0) 20 7623 2323

Francesco Ceccato

Derek Shakespeare

Brunswick (Financial PR Adviser to OSB)

Robin Wrench Tel: +44 (0) 20 7404 5959

Simone Selzer

Charter Court Financial Services Group plc

Sebastien Maloney Tel: +44 (0) 19 0262 5929

RBC Capital Markets (Joint Financial Adviser and Corporate Broker to

Charter Court)

Oliver Hearsey Tel: +44 (0) 20 7653 4000

Kevin J. Smith

Daniel Werchola

Steve Winter

Credit Suisse (Joint Financial Adviser to Charter Court)

George Maddison Tel: +44 (0) 20 7888 8888

Gaurav Parkash

Joe Hannon

Max Mesny

Citigate Dewe Rogerson (Financial PR Adviser to Charter Court)

Andrew Hey Tel: +44 (0) 20 7638 9571

Caroline Merrell

Important Notices

N. M. Rothschild & Sons Limited, which is authorised and regulated by

the Financial Conduct Authority in the United Kingdom, is acting

exclusively for OSB and no one else in relation to the contents of this

Announcement, the Combination, Admission or any other matters referred

to in this Announcement and will not regard any other person (whether or

not a recipient of this Announcement) as a client in relation to the

Combination, Admission or any other matters referred to in this

Announcement and will not be responsible to anyone other than OSB for

providing the protections afforded to clients of Rothschild & Co nor for

providing advice in relation to the contents of this Announcement, the

Combination, Admission or any other matters referred to in this

Announcement. Apart from the responsibilities and liabilities, if any,

which may be imposed on Rothschild & Co under FSMA or the regulatory

regime established thereunder, neither Rothschild & Co nor any of its

affiliates accept any responsibility or liability whatsoever for, nor

make any representation or warranty, express or implied, concerning the

contents of this Announcement, including its accuracy, completeness or

verification, or for any other statement made or purported to be made by

OSB or on OSB's behalf, or by Rothschild & Co, or on Rothschild & Co's

behalf in connection with the Combination, the New OSB Shares or

Admission and nothing in this Announcement is, or shall be relied upon

as, a promise or representation in this respect, whether as to the past

or future. To the fullest extent permitted by law, Rothschild & Co and

its affiliates disclaim all and any duty, liability or responsibility

whatsoever (whether direct or indirect and whether in contract, in tort,

under statute or otherwise) which it might otherwise have in respect of

this Announcement or any such statement.

Barclays Bank PLC, acting through its Investment Bank, ("Barclays")

which is authorised by the Prudential Regulation Authority and regulated

in the United Kingdom by the Financial Conduct Authority and the

Prudential Regulation Authority, is acting exclusively for OSB and no

one else in relation to the Combination and will not be responsible to

anyone other than OSB for providing the protections afforded to its

clients nor for providing advice in connection with the Combination or

any other matter referred to in this Announcement.

RBC Europe Limited (trading as RBC Capital Markets) ("RBC Capital

Markets"), which is authorised by the Prudential Regulation Authority

and regulated in the UK by the Financial Conduct Authority and the

Prudential Regulation Authority, is acting as financial adviser

exclusively for Charter Court and no one else in connection with the

Combination and will not be responsible to anyone other than Charter

Court for providing the protections afforded to clients of RBC Capital

Markets, nor for providing advice in connection with the Combination or

any matter referred to herein.

Credit Suisse International ("Credit Suisse"), which is authorised by

the Prudential Regulation Authority and regulated in the UK by the

Financial Conduct Authority and the Prudential Regulation Authority, is

acting as financial adviser exclusively for Charter Court and no one

else in connection with the Combination and will not be responsible to

anyone other than Charter Court for providing the protections afforded

to clients of Credit Suisse, nor for providing advice in relation to the

content of this announcement or any matter referred to herein. Neither

Credit Suisse nor any of its subsidiaries, branches or affiliates owes

or accepts any duty, liability or responsibility whatsoever (whether

direct or indirect, whether in contract, in tort, under statute or

otherwise) to any person who is not a client of Credit Suisse in

connection with the Combination.

This announcement is for information purposes only and does not

constitute an offer to sell or an invitation to purchase any securities

or the solicitation of an offer to buy any securities, pursuant to the

Combination or otherwise. The Combination will be made solely by means

of the Scheme Document or any document by which the Combination is made

which will contain the full terms and conditions of the Combination,

including details of how to vote in respect of the Combination.

This announcement has been prepared for the purpose of complying with

English law and the Takeover Code and the information disclosed may not

be the same as that which would have been disclosed if this announcement

had been prepared in accordance with the laws of jurisdictions outside

England and Wales.

Overseas Shareholders

The release, publication or distribution of this Announcement in

jurisdictions other than the United Kingdom may be restricted by law and

therefore any persons who are subject to the laws of any jurisdiction

other than the United Kingdom should inform themselves about, and

observe any applicable requirements. Any failure to comply with such

requirements may constitute a violation of the securities laws of any

such jurisdiction. To the fullest extent permitted by applicable law,

the companies and other persons involved in the Combination disclaim any

responsibility or liability for any violation of such restrictions by

any person. This Announcement has been prepared for the purpose of

complying with English law and the City Code and the information

disclosed may not be the same as that which would have been disclosed if

this Announcement had been prepared in accordance with the laws of

jurisdictions outside the United Kingdom.

Copies of this Announcement and any documentation relating to the

Combination are not being, and must not be, directly or indirectly,

mailed, transmitted or otherwise forwarded, distributed or sent in or

into or from any Restricted Jurisdiction and persons receiving such

documents (including custodians, nominees and trustees) must not mail or

otherwise forward, distribute or send it in or into or from any

Restricted Jurisdiction where to do so would violate the laws in that

jurisdiction, and persons receiving this Announcement and any documents

relating to the Combination (including custodians, nominees and

trustees) must not mail or otherwise distribute or send them in, into or

from such jurisdictions where to do so would violate the laws in that

jurisdiction.

Publication on Website

A copy of this announcement will be made available on Charter Court's

and OSB's websites at www.chartercourtfs.co.uk and www.osb.com

respectively by no later than 12 noon (London time) on 31 July 2019. For

the avoidance of doubt, the contents of those websites are not

incorporated and do not form part of this announcement.

Other

The International Securities Identification Number for OSB is

GB00BM7S7K96 and the International Securities Identification Number for

Charter Court Shares is GB00BD822578.

(END) Dow Jones Newswires

July 30, 2019 02:08 ET (06:08 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

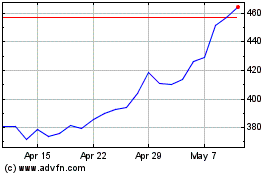

Osb (LSE:OSB)

Historical Stock Chart

From Jun 2024 to Jul 2024

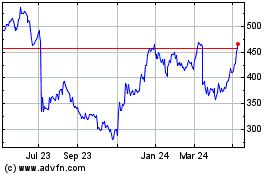

Osb (LSE:OSB)

Historical Stock Chart

From Jul 2023 to Jul 2024